Deck 12: Capital Budgeting Decisions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/144

Play

Full screen (f)

Deck 12: Capital Budgeting Decisions

1

Projects with shorter payback periods are always more profitable than projects with longer payback periods.

False

2

If new equipment is replacing old equipment,any salvage received from sale of the old equipment should not be considered in computing the payback period of the new equipment.

False

3

If a company has computed the project profitability index of an investment project as 0.15,then:

A)the project's internal rate of return is less than the discount rate.

B)the project's internal rate of return is greater than the discount rate.

C)the project's internal rate of return is equal to the discount rate.

D)the relation between the rate of return and the discount rate is impossible to determine from the given data.

A)the project's internal rate of return is less than the discount rate.

B)the project's internal rate of return is greater than the discount rate.

C)the project's internal rate of return is equal to the discount rate.

D)the relation between the rate of return and the discount rate is impossible to determine from the given data.

B

4

In comparing two investment alternatives,the difference between the net present values of the two alternatives obtained using the total cost approach will be the same as the net present value obtained using the incremental cost approach.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

5

A very useful guide for making investment decisions is: The shorter the payback period,the more profitable the project.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

6

The capital budgeting method that recognizes the time value of money by discounting cash flows over the life of the project,using the company's required rate of return as the discount rate is called the:

A)simple rate of return method.

B)the net present value method.

C)the internal rate of return method.

D)the payback method.

A)simple rate of return method.

B)the net present value method.

C)the internal rate of return method.

D)the payback method.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

7

The simple rate of return is the same as the internal rate of return.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

8

An investment project for which the net present value is $300 would result in which of the following conclusions?

A)The net present value is too small;the project should be rejected.

B)The rate of return of the investment project is greater than the required rate of return.

C)The net present value method is not suitable for evaluating this project;the internal rate of return method should be used.

D)The investment project should only be accepted if net present value is zero;a positive net present value indicates an error in the estimates associated with the analysis of this investment.

A)The net present value is too small;the project should be rejected.

B)The rate of return of the investment project is greater than the required rate of return.

C)The net present value method is not suitable for evaluating this project;the internal rate of return method should be used.

D)The investment project should only be accepted if net present value is zero;a positive net present value indicates an error in the estimates associated with the analysis of this investment.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

9

Preference decisions attempt to determine which of many alternative investment projects would be the best for the company to accept.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

10

The simple rate of return focuses on accounting net operating income rather than on cash flows.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

11

If the internal rate of return is used as the discount rate in computing net present value,the net present value will be:

A)positive.

B)negative.

C)zero.

D)unknown.

A)positive.

B)negative.

C)zero.

D)unknown.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

12

The internal rate of return for a project is the discount rate that makes the net present value of the project equal to zero.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

13

In preference decisions,the profitability index and internal rate of return methods may produce conflicting rankings of projects.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

14

Spring Company has invested $20,000 in a project.Spring's discount rate is 12% and the project profitability index on the project is zero.Which of the following statements would be true? I.The net present value of the project is $20,000.

II)The project's internal rate of return is equal to 12%.

A)Only I.

B)Only II.

C)Both I and II.

D)Neither I nor II.

II)The project's internal rate of return is equal to 12%.

A)Only I.

B)Only II.

C)Both I and II.

D)Neither I nor II.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

15

The project profitability index is used to compare the internal rates of return of two companies with different investment amounts.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

16

One criticism of the payback method is that it ignores cash flows that occur after the payback point has been reached.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

17

If the internal rate of return exceeds the required rate of return for a project,then the net present value of that project is positive.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

18

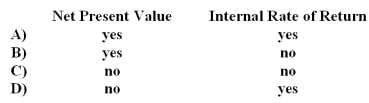

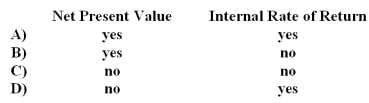

The discount rate must be specified in advance for which of the following methods?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

19

The simple rate of return method places its focus on cash flows instead of on accounting net operating income.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

20

If two projects require the same amount of investment,then the preference ranking computed using either the project profitability index or the net present value will be the same.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

21

(Ignore income taxes in this problem. )An investment of P dollars now will yield cash inflows of $3,000 at the end of the first year and $2,000 at the end of the fourth year.If the internal rate of return for this investment is 20%,then the value of P is:

A)$3,463

B)$2,499

C)$964

D)$4,185

A)$3,463

B)$2,499

C)$964

D)$4,185

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

22

Which one of the following statements about the payback method of capital budgeting is correct?

A)The payback method does not consider the time value of money.

B)The payback method considers cash flows after the payback has been reached.

C)The payback method uses discounted cash flow techniques.

D)The payback method will lead to the same decision as other methods of capital budgeting.

A)The payback method does not consider the time value of money.

B)The payback method considers cash flows after the payback has been reached.

C)The payback method uses discounted cash flow techniques.

D)The payback method will lead to the same decision as other methods of capital budgeting.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

23

(Ignore income taxes in this problem. )A piece of equipment has a cost of $20,000.The equipment will provide cost savings of $3,500 each year for ten years,after which time it will have a salvage value of $2,500.If the company's discount rate is 12%,the equipment's net present value is:

A)$580

B)$(225)

C)$17,500

D)$2,275

A)$580

B)$(225)

C)$17,500

D)$2,275

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

24

The length of time required to recover the initial cash outlay for a project is determined by using the:

A)discounted cash flow method.

B)the payback method.

C)the net present value method.

D)the simple rate of return method.

A)discounted cash flow method.

B)the payback method.

C)the net present value method.

D)the simple rate of return method.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

25

(Ignore income taxes in this problem)The management of Serpas Corporation is considering the purchase of a machine that would cost $180,000,would last for 5 years,and would have no salvage value.The machine would reduce labor and other costs by $46,000 per year.The company requires a minimum pretax return of 13% on all investment projects.The net present value of the proposed project is closest to:

A)$27,138

B)$50,000

C)-$18,218

D)-$33,565

A)$27,138

B)$50,000

C)-$18,218

D)-$33,565

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

26

If an investment has a project profitability index of 0.15,then the:

A)project's internal rate of return is 15%.

B)discount rate is greater than the project's internal rate of return.

C)net present value of the project is positive.

D)the discount rate is 15%.

A)project's internal rate of return is 15%.

B)discount rate is greater than the project's internal rate of return.

C)net present value of the project is positive.

D)the discount rate is 15%.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

27

(Ignore income taxes in this problem. )Mcclam,Inc. ,is considering the purchase of a machine that would cost $100,000 and would last for 9 years.At the end of 9 years,the machine would have a salvage value of $23,000.The machine would reduce labor and other costs by $19,000 per year.Additional working capital of $2,000 would be needed immediately.All of this working capital would be recovered at the end of the life of the machine.The company requires a minimum pretax return of 13% on all investment projects.The net present value of the proposed project is closest to:

A)$3,833

B)$5,167

C)-$2,492

D)$11,514

A)$3,833

B)$5,167

C)-$2,492

D)$11,514

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

28

(Ignore income taxes in this problem. )Mercredi,Inc. ,is considering investing in automated equipment with a ten-year useful life.Managers at Highpoint have estimated the cash flows associated with the tangible costs and benefits of automation,but have been unable to estimate the cash flows associated with the intangible benefits.Using the company's 14% required rate of return,the net present value of the cash flows associated with just the tangible costs and benefits is a negative $182,560.How large would the annual net cash inflows from the intangible benefits have to be to make this a financially acceptable investment?

A)$18,256

B)$26,667

C)$35,000

D)$38,000

A)$18,256

B)$26,667

C)$35,000

D)$38,000

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

29

(Ignore income taxes in this problem. )The Gage Company purchased a machine which will be depreciated by the straight-line method over its estimated 6 year life.The machine will have no salvage value.It will generate cash inflows of $7,000 each year over the next 6 years.Gage Company's required rate of return is 14%.If the net present value of this investment is $12,016,the purchase price of the machine was:

A)$30,016

B)$15,207

C)$17,916

D)$18,000

A)$30,016

B)$15,207

C)$17,916

D)$18,000

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

30

(Ignore income taxes in this problem. )A piece of new equipment will cost $70,000.The equipment will provide a cost savings of $15,000 per year for ten years,after which it will have a $3,000 salvage value.If the required rate of return is 14%,the equipment's net present value is:

A)$8,240

B)$(8,240)

C)$23,888

D)$9,050

A)$8,240

B)$(8,240)

C)$23,888

D)$9,050

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

31

(Ignore income taxes in this problem. )Sibble Corporation is considering the purchase of a machine that would cost $330,000 and would last for 5 years.At the end of 5 years,the machine would have a salvage value of $50,000.By reducing labor and other operating costs,the machine would provide annual cost savings of $76,000.The company requires a minimum pretax return of 12% on all investment projects.The net present value of the proposed project is closest to:

A)-$56,020

B)-$6,020

C)-$48,764

D)-$27,670

A)-$56,020

B)-$6,020

C)-$48,764

D)-$27,670

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

32

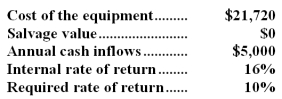

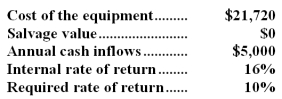

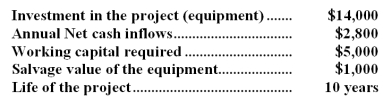

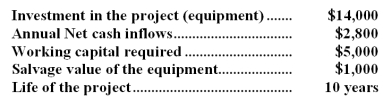

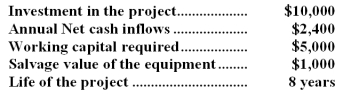

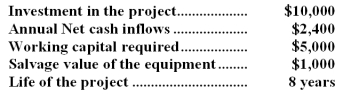

(Ignore income taxes in this problem. )The following data pertain to an investment proposal:  The net present value of the proposed investment is:

The net present value of the proposed investment is:

A)$1,720

B)$6,064

C)$2,154

D)$2,025

The net present value of the proposed investment is:

The net present value of the proposed investment is:A)$1,720

B)$6,064

C)$2,154

D)$2,025

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

33

(Ignore income taxes in this problem. )Benz Company is considering the purchase of a machine that costs $100,000,has a useful life of 18 years,and no salvage value.The company's discount rate is 12%.If the machine's net present value is $5,850,then the annual cash inflows associated with the machine must be (round to the nearest whole dollar):

A)$42,413

B)$14,600

C)$13,760

D)It is impossible to determine from the data given.

A)$42,413

B)$14,600

C)$13,760

D)It is impossible to determine from the data given.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

34

(Ignore income taxes in this problem. )The Yates Company purchased a piece of equipment which is expected to have a useful life of 7 years with no salvage value at the end of the 7-year period.This equipment is expected to generate a cash inflow of $32,000 each year of its useful life.If this investment has a internal rate of return of 14%,then the initial cost of the equipment is:

A)$150,000

B)$137,216

C)$12,800

D)$343,360

A)$150,000

B)$137,216

C)$12,800

D)$343,360

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

35

(Ignore income taxes in this problem. )Sam Weller is thinking of investing $70,000 to start a bookstore.Sam plans to withdraw $15,000 from the business at the end of each year for the next five years.At the end of the fifth year,Sam plans to sell the business for $110,000 cash.At a 12% discount rate,what is the net present value of the investment?

A)$54,075

B)$62,370

C)$46,445

D)$70,000

A)$54,075

B)$62,370

C)$46,445

D)$70,000

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

36

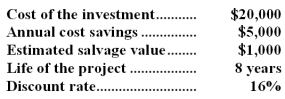

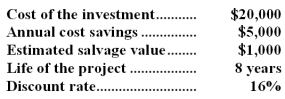

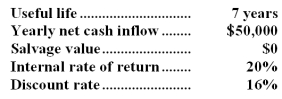

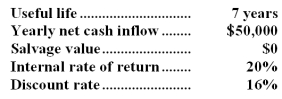

(Ignore income taxes in this problem. )The following information is available on a new piece of equipment:  The life of the equipment is approximately:

The life of the equipment is approximately:

A)6 years

B)4.3 years

C)8 years

D)It is impossible to determine from the data given.

The life of the equipment is approximately:

The life of the equipment is approximately:A)6 years

B)4.3 years

C)8 years

D)It is impossible to determine from the data given.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

37

(Ignore income taxes in this problem. )Stutz Company purchased a machine with an estimated useful life of seven years.The machine will generate cash inflows of $8,000 each year over the next seven years.If the machine has no salvage value at the end of seven years,if Stutz's discount rate is 12%,and if the net present value of this investment is $15,000,then the purchase price of the machine was:

A)$17,888

B)$36,512

C)$15,000

D)$21,512

A)$17,888

B)$36,512

C)$15,000

D)$21,512

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

38

(Ignore income taxes in this problem. )The Baker Company purchased a piece of equipment with the following expected results:  The initial cost of the equipment was:

The initial cost of the equipment was:

A)$300,100

B)$180,250

C)$190,600

D)Cannot be determined from the given information.

The initial cost of the equipment was:

The initial cost of the equipment was:A)$300,100

B)$180,250

C)$190,600

D)Cannot be determined from the given information.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

39

The internal rate of return of an investment project is the:

A)discount rate that results in a zero net present value for the project.

B)minimum acceptable rate of return.

C)weighted average rate of return generated by internal funds.

D)company's cost of capital.

A)discount rate that results in a zero net present value for the project.

B)minimum acceptable rate of return.

C)weighted average rate of return generated by internal funds.

D)company's cost of capital.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

40

(Ignore income taxes in this problem. )Charley has a typing service.He estimates that a new computer will result in increased cash inflow $1,600 in Year 1,$2,000 in Year 2 and $3,000 in Year 3.If Charley's required rate of return is 12%,the most that Charley would be willing to pay for the new computer would be:

A)$4,623

B)$5,159

C)$3,294

D)$4,804

A)$4,623

B)$5,159

C)$3,294

D)$4,804

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

41

(Ignore income taxes in this problem. )The Valentine Company has decided to buy a machine costing $14,750.Estimated cash savings from using the new machine amount to $4,500 per year.The machine will have no salvage value at the end of its useful life of five years.If Valentine's required rate of return is 10%,the machine's internal rate of return is closest to:

A)10%

B)12%

C)14%

D)16%

A)10%

B)12%

C)14%

D)16%

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

42

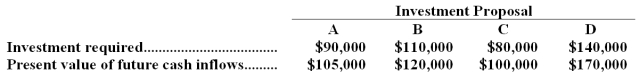

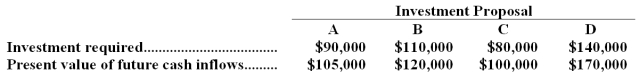

Blanding Company is considering several investment proposals,as shown below:  Using the project profitability index,the ranking would be:

Using the project profitability index,the ranking would be:

A)D,B,A,C

B)D,C,A,B

C)C,D,A,B

D)C,A,D,B

Using the project profitability index,the ranking would be:

Using the project profitability index,the ranking would be:A)D,B,A,C

B)D,C,A,B

C)C,D,A,B

D)C,A,D,B

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

43

(Ignore income taxes in this problem)The management of Londo Corporation is investigating buying a small used aircraft to use in making airborne inspections of its above-ground pipelines.The aircraft would have a useful life of 6 years.The company uses a discount rate of 15% in its capital budgeting.The net present value of the investment,excluding the intangible benefits,is -$474,060.To the nearest whole dollar how large would the annual intangible benefit have to be to make the investment in the aircraft financially attractive?

A)$474,060

B)$125,280

C)$79,010

D)$71,109

A)$474,060

B)$125,280

C)$79,010

D)$71,109

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

44

(Ignore income taxes in this problem. )The following data pertain to an investment proposal:  The working capital would be released for use elsewhere when the project is completed.What is the net present value of the project,using a discount rate of 8 percent?

The working capital would be released for use elsewhere when the project is completed.What is the net present value of the project,using a discount rate of 8 percent?

A)$2,566

B)$(251)

C)$251

D)$5,251

The working capital would be released for use elsewhere when the project is completed.What is the net present value of the project,using a discount rate of 8 percent?

The working capital would be released for use elsewhere when the project is completed.What is the net present value of the project,using a discount rate of 8 percent?A)$2,566

B)$(251)

C)$251

D)$5,251

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

45

(Ignore income taxes in this problem. )The Jackson Company has invested in a machine that cost $70,000,that has a useful life of seven years,and that has no salvage value at the end of its useful life.The machine is being depreciated by the straight-line method,based on its useful life.It will have a payback period of four years.Given these data,the simple rate of return on the machine is closest to:

A)7.1%

B)8.2%

C)10.7%

D)39.3%

A)7.1%

B)8.2%

C)10.7%

D)39.3%

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

46

(Ignore income taxes in this problem)The management of Hirsh Corporation is investigating an investment in equipment that would have a useful life of 9 years.The company uses a discount rate of 13% in its capital budgeting.The net present value of the investment,excluding the annual cash inflow,is -$666,493.To the nearest whole dollar how large would the annual cash inflow have to be to make the investment in the equipment financially attractive?

A)$86,644

B)$666,493

C)$74,055

D)$129,870

A)$86,644

B)$666,493

C)$74,055

D)$129,870

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

47

(Ignore income taxes in this problem. )If an investment of $14,760 now will yield $18,000 at the end of one year,then the internal rate of return for this investment to the nearest whole percentage is:

A)14%

B)18%

C)22%

D)28%

A)14%

B)18%

C)22%

D)28%

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

48

(Ignore income taxes in this problem. )The following data pertain to an investment in equipment:  At the completion of the project,the working capital will be released for use elsewhere.Compute the net present value of the project,using a discount rate of 10%:

At the completion of the project,the working capital will be released for use elsewhere.Compute the net present value of the project,using a discount rate of 10%:

A)$606

B)$8,271

C)$(1,729)

D)$1,729

At the completion of the project,the working capital will be released for use elsewhere.Compute the net present value of the project,using a discount rate of 10%:

At the completion of the project,the working capital will be released for use elsewhere.Compute the net present value of the project,using a discount rate of 10%:A)$606

B)$8,271

C)$(1,729)

D)$1,729

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

49

(Ignore income taxes in this problem)The management of Mazor Corporation is considering the purchase of a machine that would cost $144,144 and would have a useful life of 5 years.The machine would have no salvage value.The machine would reduce labor and other operating costs by $39,000 per year.The internal rate of return on the investment in the new machine is closest to:

A)14%

B)13%

C)12%

D)11%

A)14%

B)13%

C)12%

D)11%

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

50

(Ignore income taxes in this problem. )Czaplinski Corporation is considering a project that would require an investment of $323,000 and would last for 7 years.The incremental annual revenues and expenses generated by the project during those 7 years would be as follows:  The scrap value of the project's assets at the end of the project would be $22,000.The payback period of the project is closest to:

The scrap value of the project's assets at the end of the project would be $22,000.The payback period of the project is closest to:

A)9.7 years

B)4.4 years

C)4.1 years

D)10.4 years

The scrap value of the project's assets at the end of the project would be $22,000.The payback period of the project is closest to:

The scrap value of the project's assets at the end of the project would be $22,000.The payback period of the project is closest to:A)9.7 years

B)4.4 years

C)4.1 years

D)10.4 years

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

51

(Ignore income taxes in this problem. )Cottrell,Inc. ,is investigating an investment in equipment that would have a useful life of 9 years.The company uses a discount rate of 15% in its capital budgeting.The net present value of the investment,excluding the salvage value,is -$230,392.To the nearest whole dollar how large would the salvage value of the equipment have to be to make the investment in the equipment financially attractive?

A)$1,535,947

B)$34,559

C)$811,239

D)$230,392

A)$1,535,947

B)$34,559

C)$811,239

D)$230,392

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

52

(Ignore income taxes in this problem)Lett Corporation is investigating buying a small used aircraft for the use of its executives.The aircraft would have a useful life of 7 years.The company uses a discount rate of 15% in its capital budgeting.The net present value of the investment,excluding the salvage value of the aircraft,is -$578,739.Management is having difficulty estimating the salvage value of the aircraft.To the nearest whole dollar how large would the salvage value of the aircraft have to be to make the investment in the aircraft financially attractive?

A)$578,739

B)$86,811

C)$3,858,260

D)$1,539,199

A)$578,739

B)$86,811

C)$3,858,260

D)$1,539,199

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

53

(Ignore income taxes in this problem. )Duhl Long-Haul,Inc. ,is considering the purchase of a tractor-trailer that would cost $126,175,would have a useful life of 5 years,and would have no salvage value.The tractor-trailer would be used in the company's hauling business,resulting in additional net cash inflows of $35,000 per year.The internal rate of return on the investment in the tractor-trailer is closest to:

A)10%

B)15%

C)13%

D)12%

A)10%

B)15%

C)13%

D)12%

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

54

(Ignore income taxes in this problem. )Girman Corporation is considering three investment projects: K,L,and M.Project K would require an investment of $27,000,Project L of $59,000,and Project M of $88,000.No other cash outflows would be involved.The present value of the cash inflows would be $31,860 for Project K,$66,080 for Project L,and $95,040 for Project M.Rank the projects according to the profitability index,from most profitable to least profitable.

A)K,M,L

B)K,L,M

C)L,M,K

D)L,K,M

A)K,M,L

B)K,L,M

C)L,M,K

D)L,K,M

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

55

A project requires an initial investment of $60,000 and has a project profitability index of 0.329.The present value of the future cash inflows from this investment is:

A)$79,740

B)$45,147

C)$60,000

D)Cannot be determined with available data.

A)$79,740

B)$45,147

C)$60,000

D)Cannot be determined with available data.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

56

(Ignore income taxes in this problem. )Deibel Corporation is considering a project that would require an investment of $59,000.No other cash outflows would be involved.The present value of the cash inflows would be $66,080.The profitability index of the project is closest to:

A)0.88

B)0.12

C)1.12

D)0.11

A)0.88

B)0.12

C)1.12

D)0.11

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

57

Perkins Company is considering several investment proposals,as shown below:  Rank the proposals in terms of preference using the project profitability index:

Rank the proposals in terms of preference using the project profitability index:

A)D,B,C,A

B)B,D,C,A

C)B,D,A,C

D)A,C,B,D

Rank the proposals in terms of preference using the project profitability index:

Rank the proposals in terms of preference using the project profitability index:A)D,B,C,A

B)B,D,C,A

C)B,D,A,C

D)A,C,B,D

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

58

(Ignore income taxes in this problem. )Mongon Roofing is considering the purchase of a crane that would cost $40,224,would have a useful life of 5 years,and would have no salvage value.The use of the crane would result in labor savings of $12,000 per year.The internal rate of return on the investment in the crane is closest to:

A)17%

B)14%

C)15%

D)18%

A)17%

B)14%

C)15%

D)18%

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

59

(Ignore income taxes in this problem. )The management of Dewitz Corporation is considering a project that would require an initial investment of $65,000.No other cash outflows would be required.The present value of the cash inflows would be $72,800.The profitability index of the project is closest to:

A)0.12

B)1.12

C)0.88

D)0.11

A)0.12

B)1.12

C)0.88

D)0.11

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

60

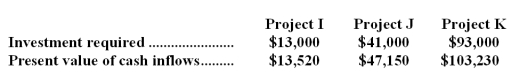

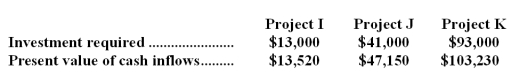

(Ignore income taxes in this problem. )The management of Dittrick Corporation is considering the following three investment projects:  Rank the projects according to the profitability index,from most profitable to least profitable.

Rank the projects according to the profitability index,from most profitable to least profitable.

A)I,J,K

B)K,J,I

C)J,K,I

D)I,K,J

Rank the projects according to the profitability index,from most profitable to least profitable.

Rank the projects according to the profitability index,from most profitable to least profitable.A)I,J,K

B)K,J,I

C)J,K,I

D)I,K,J

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

61

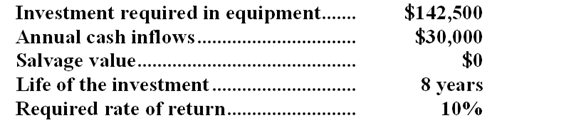

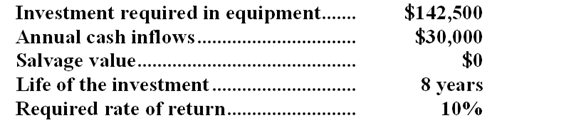

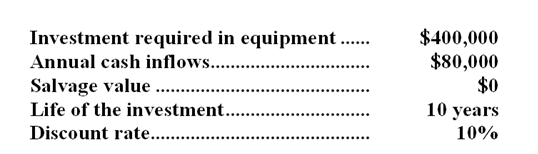

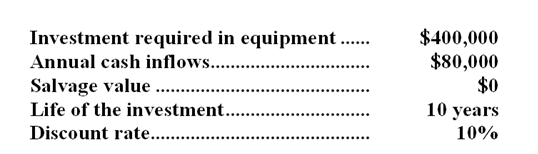

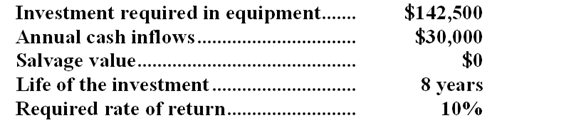

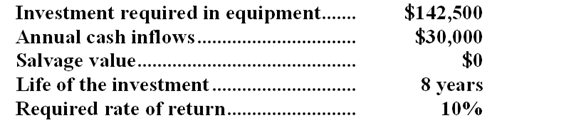

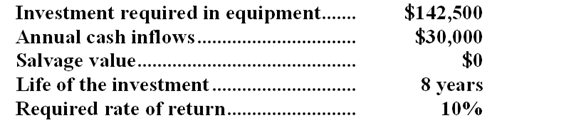

(Ignore income taxes in this problem.) Chow Company has gathered the following data on a proposed investment project:

-The net present value on this investment is closest to:

A)$30,000

B)$76,024

C)$58,800

D)$17,550

-The net present value on this investment is closest to:

A)$30,000

B)$76,024

C)$58,800

D)$17,550

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

62

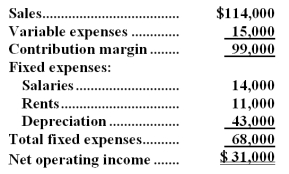

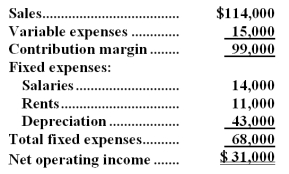

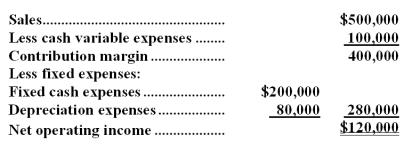

(Ignore income taxes in this problem. )Rogers Company is studying a project that would have a ten-year life and would require an $800,000 investment in equipment which has no salvage value.The project would provide net operating income each year as follows for the life of the project:  The company's required rate of return is 8%.What is the payback period for this project?

The company's required rate of return is 8%.What is the payback period for this project?

A)3 years

B)6.67 years

C)2 years

D)4 years

The company's required rate of return is 8%.What is the payback period for this project?

The company's required rate of return is 8%.What is the payback period for this project?A)3 years

B)6.67 years

C)2 years

D)4 years

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

63

(Ignore income taxes in this problem. )Buy-Rite Pharmacy has purchased a small auto for delivering prescriptions.The auto was purchased for $9,000 and will have a 6-year useful life and a $3,000 salvage value.Delivering prescriptions (which the pharmacy has never done before)should increase gross revenues by at least $5,000 per year.The cost of these prescriptions to the pharmacy will be about $2,000 per year.The pharmacy depreciates all assets using the straight-line method.The payback period for the auto is:

A)3.0 years

B)1.8 years

C)2.0 years

D)1.2 years

A)3.0 years

B)1.8 years

C)2.0 years

D)1.2 years

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

64

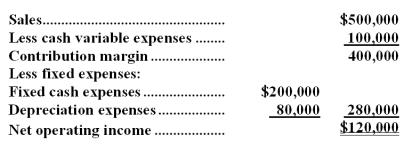

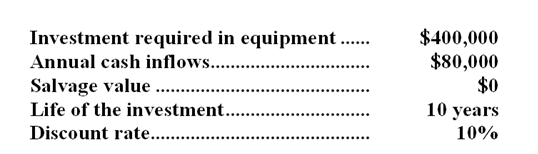

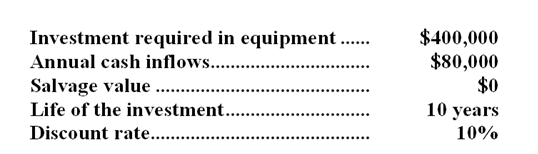

(Ignore income taxes in this problem.) Shields Company has gathered the following data on a proposed investment project:

-The simple rate of return on the investment is closest to:

A)5%

B)10%

C)15%

D)20%

-The simple rate of return on the investment is closest to:

A)5%

B)10%

C)15%

D)20%

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

65

(Ignore income taxes in this problem.) Bugle's Bagel Bakery is investigating the purchase of a new bagel making machine. This machine would provide an annual operating cost savings of $3,650 for each of the next 4 years. In addition, this new machine would allow the production of one new type of bagel which would result in selling 1,500 dozen more bagels each year. The company earns a contribution margin of $0.90 on each dozen bagels sold. The purchase price of this machine is $13,450 and it will have a 4 year useful life. Bugle's discount rate is 14%.

-The total annual cash inflow from this machine for capital budgeting purposes is:

A)$3,650

B)$5,150

C)$4,750

D)$5,000

-The total annual cash inflow from this machine for capital budgeting purposes is:

A)$3,650

B)$5,150

C)$4,750

D)$5,000

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

66

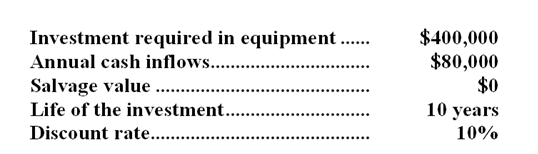

(Ignore income taxes in this problem.) Shields Company has gathered the following data on a proposed investment project:

-The payback period for the investment is closest to:

A)0.2 years

B)1.0 years

C)3.0 years

D)5.0 years

-The payback period for the investment is closest to:

A)0.2 years

B)1.0 years

C)3.0 years

D)5.0 years

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

67

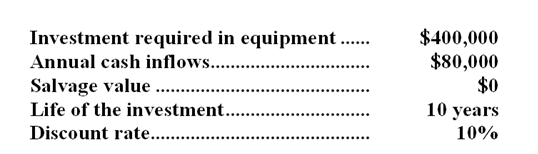

(Ignore income taxes in this problem.) Shields Company has gathered the following data on a proposed investment project:

-The internal rate of return on the investment is closest to:

A)11%

B)13%

C)15%

D)17%

-The internal rate of return on the investment is closest to:

A)11%

B)13%

C)15%

D)17%

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

68

(Ignore income taxes in this problem. )The Jason Company is considering the purchase of a machine that will increase revenues by $32,000 each year.Cash outflows for operating this machine will be $6,000 each year.The cost of the machine is $65,000.It is expected to have a useful life of five years with no salvage value.For this machine,the simple rate of return is:

A)20%

B)40%

C)49.2%

D)9.2%

A)20%

B)40%

C)49.2%

D)9.2%

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

69

(Ignore income taxes in this problem. )Blaine Corporation is considering replacing a technologically obsolete machine with a new state-of-the-art numerically controlled machine.The new machine would cost $180,000 and would have a ten-year useful life.Unfortunately,the new machine would have no salvage value.The new machine would cost $12,000 per year to operate and maintain,but would save $48,000 per year in labor and other costs.The old machine can be sold now for scrap for $20,000.What is the simple rate of return on the new machine (round off your answer to the nearest one-hundredth of a percent)?

A)10.00%

B)26.67%

C)22.50%

D)11.25%

A)10.00%

B)26.67%

C)22.50%

D)11.25%

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

70

(Ignore income taxes in this problem. )The Higgins Company has just purchased a piece of equipment at a cost of $120,000.This equipment will reduce operating costs by $40,000 each year for the next eight years.This equipment replaces old equipment which was sold for $8,000 cash.The new equipment has a payback period of:

A)8.0 years

B)2.8 years

C)10.0 years

D)3.0 years

A)8.0 years

B)2.8 years

C)10.0 years

D)3.0 years

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

71

(Ignore income taxes in this problem. )Hartong Corporation is contemplating purchasing equipment that would increase sales revenues by $185,000 per year and cash operating expenses by $89,000 per year.The equipment would cost $416,000 and have a 8 year life with no salvage value.The annual depreciation would be $52,000.The simple rate of return on the investment is closest to:

A)23.8%

B)12.5%

C)10.6%

D)23.1%

A)23.8%

B)12.5%

C)10.6%

D)23.1%

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

72

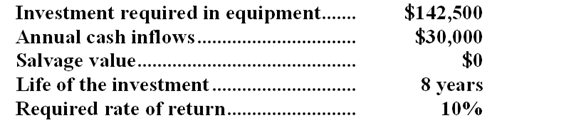

(Ignore income taxes in this problem.) Chow Company has gathered the following data on a proposed investment project:

-The payback period for the investment is closest to:

A)8.00 years

B)1.42 years

C)4.75 years

D)0.21 years

-The payback period for the investment is closest to:

A)8.00 years

B)1.42 years

C)4.75 years

D)0.21 years

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

73

(Ignore income taxes in this problem. )Tu Corporation is investigating automating a process by purchasing a machine for $423,000 that would have a 9 year useful life and no salvage value.By automating the process,the company would save $112,000 per year in cash operating costs.The new machine would replace some old equipment that would be sold for scrap now,yielding $27,000.The annual depreciation on the new machine would be $47,000.The simple rate of return on the investment is closest to:

A)15.4%

B)16.4%

C)26.5%

D)11.1%

A)15.4%

B)16.4%

C)26.5%

D)11.1%

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

74

(Ignore income taxes in this problem. )The management of Rouleau Corporation is investigating automating a process.Old equipment,with a current salvage value of $10,000,would be replaced by a new machine.The new machine would be purchased for $240,000 and would have a 6 year useful life and no salvage value.By automating the process,the company would save $64,000 per year in cash operating costs.The simple rate of return on the investment is closest to:

A)10.0%

B)26.7%

C)10.4%

D)16.7%

A)10.0%

B)26.7%

C)10.4%

D)16.7%

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

75

(Ignore income taxes in this problem. )The management of Rusell Corporation is considering a project that would require an investment of $282,000 and would last for 6 years.The annual net operating income from the project would be $107,000,which includes depreciation of $43,000.The scrap value of the project's assets at the end of the project would be $24,000.The payback period of the project is closest to:

A)1.9 years

B)2.4 years

C)1.7 years

D)2.6 years

A)1.9 years

B)2.4 years

C)1.7 years

D)2.6 years

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

76

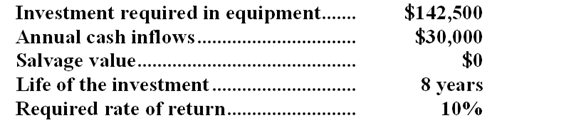

(Ignore income taxes in this problem.) Chow Company has gathered the following data on a proposed investment project:

-The simple rate of return on the investment is closest to:

A)8.55%

B)10.00%

C)21.05%

D)33.55%

-The simple rate of return on the investment is closest to:

A)8.55%

B)10.00%

C)21.05%

D)33.55%

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

77

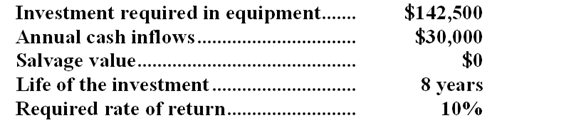

(Ignore income taxes in this problem.) Chow Company has gathered the following data on a proposed investment project:

-The internal rate of return on the investment is closest to:

A)13%

B)15%

C)14%

D)12%

-The internal rate of return on the investment is closest to:

A)13%

B)15%

C)14%

D)12%

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

78

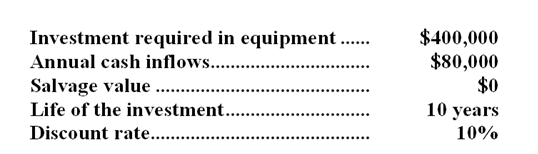

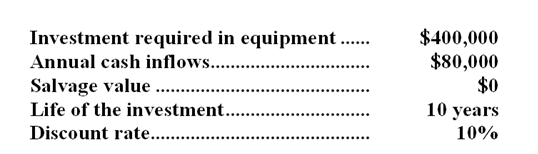

(Ignore income taxes in this problem.) Shields Company has gathered the following data on a proposed investment project:

-The net present value on this investment is closest to:

A)$400,000

B)$80,000

C)$91,600

D)$76,750

-The net present value on this investment is closest to:

A)$400,000

B)$80,000

C)$91,600

D)$76,750

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

79

(Ignore income taxes in this problem. )The management of Burney Corporation is investigating purchasing equipment that would increase sales revenues by $74,000 per year and cash operating expenses by $32,000 per year.The equipment would cost $115,000 and have a 5 year life with no salvage value.The simple rate of return on the investment is closest to:

A)36.5%

B)25.7%

C)20.0%

D)16.5%

A)36.5%

B)25.7%

C)20.0%

D)16.5%

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

80

(Ignore income taxes in this problem. )An expansion at Fenstermacher,Inc. ,would increase sales revenues by $315,000 per year and cash operating expenses by $186,000 per year.The initial investment would be for equipment that would cost $405,000 and have a 5 year life with no salvage value.The annual depreciation on the equipment would be $81,000.The simple rate of return on the investment is closest to:

A)31.9%

B)15.2%

C)20.0%

D)11.9%

A)31.9%

B)15.2%

C)20.0%

D)11.9%

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck