Deck 26: Capital Budgeting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/74

Play

Full screen (f)

Deck 26: Capital Budgeting

1

Non-financial factors are relevant in capital budgeting.

True

2

The impact of a capital budgeting decision upon the environment is an example of a nonfinancial consideration.

True

3

The annual net cash flow of an investment

False

4

Nonfinancial considerations are not accounted for in capital budgeting decisions.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

5

The return on average investment computation ignores the timing of an investment's future cash flows.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

6

In capital budgeting,one may use estimates in making decisions.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

7

The present value of a future cash flow is the amount you would pay today for the right to receive that future amount.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

8

In capital budgeting,the investment proposal with the shortest payback period always has the highest rate of return.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

9

Capital budgeting estimates often involve a considerable degree of uncertainty.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

10

Most capital budgeting techniques involve analysis of net operating profits.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

11

Perhaps the most important financial considerations in a capital budgeting decision are its effects upon future cash flow and future profitability.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

12

The payback period considers total profitability over the life of an investment and takes into consideration the timing of an investment's future cash flows.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

13

The present value of money is always less than its future value.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

14

The payback period can be determined by multiplying the amount invested by net cash flows received annually.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

15

The payback period analysis fails to consider the cash flows over the entire life of the investment.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

16

The difference between the present value and future value depends on the rate of interest and the length of time that interest accumulates.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

17

The residual value of an asset should be subtracted from the cost of the asset when determining the average amount invested.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

18

To determine the average investment over the life of an asset,divide the total depreciation of the investment by two.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

19

A failure of the return on average investment method is that no consideration is given to the time value of money.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

20

When straight-line depreciation is used,the average carrying value of an asset with no salvage value is equal to the asset's original cost divided by its estimated useful life.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

21

When the net present value is greater than zero,the investment's rate of return is less than the discount rate.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

22

If an investment costs $140,000 with no residual value,an expected increase in net income of $35,000 and a 5 year useful life,the payback period would be:

A)2.2 years.

B)4 years.

C)5 years.

D)2 years.

A)2.2 years.

B)4 years.

C)5 years.

D)2 years.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

23

Capital investment proposals may not be evaluated by using:

A)The payback period.

B)The return on investment method.

C)The discounted cash flow method.

D)The income statement method.

A)The payback period.

B)The return on investment method.

C)The discounted cash flow method.

D)The income statement method.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

24

A short payback period is preferred so that the investment's costs can be put to other uses.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

25

When management considers an investment,they look for the payback period to be:

A)Short.

B)Long.

C)Profitable.

D)Useful.

A)Short.

B)Long.

C)Profitable.

D)Useful.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

26

The recognition of depreciation expense often causes the annual net income of an investment to be less than the amount of its annual net cash flows.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

27

When an investment fails to provide the desired rate of return,the investment should be rejected.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

28

In considering investment in new plant assets,the payback period is computed without regard to the total useful life of the investment.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is generally not considered a capital budgeting technique?

A)Payback period.

B)Return on average investment.

C)Return on stockholders' equity.

D)Discounted future cash flows.

A)Payback period.

B)Return on average investment.

C)Return on stockholders' equity.

D)Discounted future cash flows.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

30

The selection of an appropriate discount rate for determining net present value of a particular investment proposal does not depend upon:

A)The present value of the proposal's future cash flows.

B)Alternative investment opportunities available.

C)The nature of the investment proposal.

D)The investor's cost of capital.

A)The present value of the proposal's future cash flows.

B)Alternative investment opportunities available.

C)The nature of the investment proposal.

D)The investor's cost of capital.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

31

The payback period:

A)Is the length of time necessary to recover the entire cost of an investment from its resulting annual net cash flow.

B)Is the length of time necessary to recover the entire cost of an investment from its resulting annual net income.

C)Takes into consideration the profitability of an investment over its entire life,but ignores the timing of its future cash flows.

D)Takes into consideration both the profitability of an investment over its entire life and the timing of its future cash flows.

A)Is the length of time necessary to recover the entire cost of an investment from its resulting annual net cash flow.

B)Is the length of time necessary to recover the entire cost of an investment from its resulting annual net income.

C)Takes into consideration the profitability of an investment over its entire life,but ignores the timing of its future cash flows.

D)Takes into consideration both the profitability of an investment over its entire life and the timing of its future cash flows.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

32

The reliability of estimates is a critical factor in capital budget proposals.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

33

Capital budget audits are often undertaken to ensure the accuracy of cash flow estimates.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is not considered a capital investment?

A)The purchase of a large machine.

B)The development of a new product line.

C)The purchase of a large order of raw materials used in the production process.

D)The acquisition of a subsidiary company.

A)The purchase of a large machine.

B)The development of a new product line.

C)The purchase of a large order of raw materials used in the production process.

D)The acquisition of a subsidiary company.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

35

The discount rate used in discounting cash flows from proposed investments is usually the rate of return required by the investor.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

36

Results of capital budgeting processes may have serious implications for employees.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

37

The net present value of an investment proposal is the difference between the total present value of future net cash flows and the cost of the investment.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

38

The higher the required rate of return of an investment,the less an investor will be willing to pay for the investment.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

39

A cost that has been incurred irrevocably by past actions is a (an):

A)Capital expenditure.

B)Incremental cost.

C)Sunk cost.

D)Fixed cost.

A)Capital expenditure.

B)Incremental cost.

C)Sunk cost.

D)Fixed cost.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

40

Capital investments decisions are not affected by:

A)Income taxes.

B)Non-financial considerations.

C)Depreciation methods.

D)Inventory levels.

A)Income taxes.

B)Non-financial considerations.

C)Depreciation methods.

D)Inventory levels.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

41

The average carrying value (or average investment)of an asset with no salvage value is equal to:

A)The original cost of the asset divided by its estimated useful life.

B)The original cost of the asset divided by two.

C)The average annual net cash flow of the asset multiplied by the asset's estimated useful life.

D)The average annual net income of the asset multiplied by the asset's estimated useful life.

A)The original cost of the asset divided by its estimated useful life.

B)The original cost of the asset divided by two.

C)The average annual net cash flow of the asset multiplied by the asset's estimated useful life.

D)The average annual net income of the asset multiplied by the asset's estimated useful life.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

42

The accuracy of capital budget decisions is critically dependent on:

A)The project life span estimates.

B)Currency exchange rates.

C)Employee morale.

D)Supplier availability.

A)The project life span estimates.

B)Currency exchange rates.

C)Employee morale.

D)Supplier availability.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

43

Sterling Corporation has borrowed $75,000 that must be repaid in two years.This $75,000 is to be invested in an eight-year project with an estimated annual net cash flow of $15,000.The payback period for this investment is:

A)Two years.

B)Five years.

C)Eight years.

D)Indeterminable with the given information.

A)Two years.

B)Five years.

C)Eight years.

D)Indeterminable with the given information.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

44

Kenny Company is considering the possibility of investing $1,500,000 in a special project.This venture will return $375,000 per year for 12 years in after tax cash flows.Depreciation on the project will be $187,500 per year using straight-line depreciation.The payback period for the project is:

A)6 years.

B)12 years.

C)4 years.

D)2 years.

A)6 years.

B)12 years.

C)4 years.

D)2 years.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

45

The present value of money is always:

A)Less than its future amount.

B)The same as its future amount.

C)More than its future amount.

D)More or less than its future amount depending upon the discount rate.

A)Less than its future amount.

B)The same as its future amount.

C)More than its future amount.

D)More or less than its future amount depending upon the discount rate.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

46

An investment cost $80,000 with no salvage value,a 5 year useful life,and had an expected annual increase in net income of $7,000.Straight line depreciation is used.What is the expected return on average investment?

A)8.8%.

B)20%.

C)17.5%.

D)10.4%.

A)8.8%.

B)20%.

C)17.5%.

D)10.4%.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

47

A machine cost $46,000 and had a useful life of 4 years and a residual value of $7,000.What is the net present value of the machine if the annual cash flow is $16,000 and the company uses a discount rate of 10%? An annuity table shows the present value of $1 at 10% for 4 years to be 0.683.The present value of an ordinary annuity of $1 discounted at 10% for 4 years is 3.170.

A)$16,501.

B)$33,118.

C)$9,501.

D)$13,000.

A)$16,501.

B)$33,118.

C)$9,501.

D)$13,000.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

48

To compute a future amount from a present value,we need to know:

A)The future value and length of time.

B)The interest rate and length of time.

C)The future annuity amount.

D)The present annuity amount.

A)The future value and length of time.

B)The interest rate and length of time.

C)The future annuity amount.

D)The present annuity amount.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

49

The management of Trylon Farms is considering the purchase of equipment costing $320,000.The equipment has a useful life of eight years,with $20,000 residual value.The use of this equipment will produce positive annual cash flow of $60,000 for eight years,as well as $20,000 from sale of the equipment at the end of the eighth year.Compute the net present value of this investment,discounted at an annual rate of 10%.(Present value of $1 due in eight years,discounted at 10%,is 0.467; present value of $1 received annually for eight years,discounted at 10%,is 5.335.)

A)$9,340.

B)$320,100.

C)$9,440.

D)$329,440.

A)$9,340.

B)$320,100.

C)$9,440.

D)$329,440.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

50

Joseph Company is considering replacing an existing piece of machinery with newer technology.In deciding whether to replace the existing machinery,management should consider which costs as relevant?

A)Future costs which will be classified as fixed rather than variable.

B)Future costs which will be different under the two alternatives.

C)Sunk costs associated with the old machine.

D)Historical costs associated with the old machine.

A)Future costs which will be classified as fixed rather than variable.

B)Future costs which will be different under the two alternatives.

C)Sunk costs associated with the old machine.

D)Historical costs associated with the old machine.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

51

When using the net present value method for evaluating an investment,an increase in the required rate of return will:

A)Make it more difficult to accept the investment.

B)Make it less difficult to accept the investment.

C)Not affect the decision,if the length of the investment's benefits remain constant.

D)Not be a consideration because it is not used in the net present value method.

A)Make it more difficult to accept the investment.

B)Make it less difficult to accept the investment.

C)Not affect the decision,if the length of the investment's benefits remain constant.

D)Not be a consideration because it is not used in the net present value method.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

52

Capital budgeting proposals often require input from all of the following stakeholders except:

A)Managers.

B)Employees.

C)Shareholders.

D)Directors.

A)Managers.

B)Employees.

C)Shareholders.

D)Directors.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

53

Which method of project selection gives consideration to the time value of money in a capital budgeting decision?

A)Payback method.

B)Average rate of return.

C)Discounted cash flows method.

D)Accounting rate of return.

A)Payback method.

B)Average rate of return.

C)Discounted cash flows method.

D)Accounting rate of return.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

54

Of the following techniques of capital budgeting,which one explicitly incorporates an estimate of an interest rate into the basic computation?

A)Payback method.

B)Average rate of return.

C)Discounted cash flows method.

D)Accounting book value method.

A)Payback method.

B)Average rate of return.

C)Discounted cash flows method.

D)Accounting book value method.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

55

Jericho Corporation is considering the purchase of new equipment costing initially $96,000.The equipment has an estimated life of 6 years with no salvage value.Straight-line depreciation is to be used.Net annual after tax cash flow is estimated to be $31,200 for 6 years.The payback period is:

A)1.2300 years.

B)3.0769 years.

C)5.0799 years.

D)6.0000 years.

A)1.2300 years.

B)3.0769 years.

C)5.0799 years.

D)6.0000 years.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following is not an important financial consideration in capital budgeting?

A)The timing of the investment's future cash flows.

B)The investment's future profitability.

C)The sunk costs related to the investment.

D)The initial cost of the investment and its estimated salvage value.

A)The timing of the investment's future cash flows.

B)The investment's future profitability.

C)The sunk costs related to the investment.

D)The initial cost of the investment and its estimated salvage value.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following factors does the payback method consider?

A)Total profitability of an investment.

B)The cash flows over the entire life of an investment.

C)The timing of cash flows.

D)The initial investment.

A)Total profitability of an investment.

B)The cash flows over the entire life of an investment.

C)The timing of cash flows.

D)The initial investment.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

58

In computing the return on average investment of a particular asset,the asset's annual depreciation expense may be viewed as:

A)An increase in the average amount invested over the life of the asset.

B)An increase in the asset's carrying value each year.

C)A recovery of the amount originally invested in the asset.

D)A decrease in the asset's net cash flows.

A)An increase in the average amount invested over the life of the asset.

B)An increase in the asset's carrying value each year.

C)A recovery of the amount originally invested in the asset.

D)A decrease in the asset's net cash flows.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

59

An investment's annual net cash flow will always be equal to its:

A)Annual revenue less its annual expenses.

B)Annual cash receipts less its annual cash disbursements.

C)Annual revenue less its annual cash disbursements.

D)Annual net income plus its annual depreciation expense.

A)Annual revenue less its annual expenses.

B)Annual cash receipts less its annual cash disbursements.

C)Annual revenue less its annual cash disbursements.

D)Annual net income plus its annual depreciation expense.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

60

The minimum rate of return used by an investor to bring future cash flows to their present value is called:

A)The investment rate.

B)The prime rate.

C)The discount rate.

D)The present rate.

A)The investment rate.

B)The prime rate.

C)The discount rate.

D)The present rate.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

61

Appraising rate of return adequacy

What factors should be taken into consideration when appraising the adequacy of the rate of return of a capital investment proposal?

What factors should be taken into consideration when appraising the adequacy of the rate of return of a capital investment proposal?

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

62

Capital budgeting

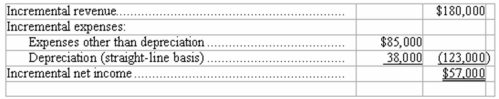

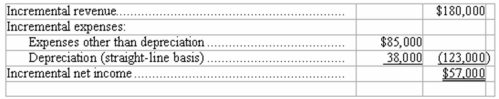

Flynn Corporation is debating whether to purchase a new computerized production system.The system will cost $450,000,and have an estimated 10-year life with a salvage value of $70,000.The estimated operating results from the new production system are as follows: All revenue and expenses other than depreciation will be received and paid in cash.Compute the following for this proposal: (rounded)

All revenue and expenses other than depreciation will be received and paid in cash.Compute the following for this proposal: (rounded)

(a)Annual net cash flow: $__________

(b)Payback period: __________

(c)Return on average investment: __________

(d)Net present value,discounted at an annual rate of 6% (present value of $1 due in 10 years,discounted at 6%,is 0.558; present value of $1 received annually for 10 years,discounted at 6%,is 7.360): $__________

Flynn Corporation is debating whether to purchase a new computerized production system.The system will cost $450,000,and have an estimated 10-year life with a salvage value of $70,000.The estimated operating results from the new production system are as follows:

All revenue and expenses other than depreciation will be received and paid in cash.Compute the following for this proposal: (rounded)

All revenue and expenses other than depreciation will be received and paid in cash.Compute the following for this proposal: (rounded)(a)Annual net cash flow: $__________

(b)Payback period: __________

(c)Return on average investment: __________

(d)Net present value,discounted at an annual rate of 6% (present value of $1 due in 10 years,discounted at 6%,is 0.558; present value of $1 received annually for 10 years,discounted at 6%,is 7.360): $__________

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

63

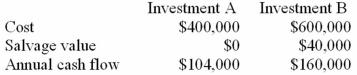

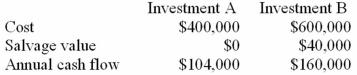

Carter & Co.is trying to decide which of two investments they should consider.The following information is available:  Each investment is expected to have a useful life of 5 years.(Rounded)

Each investment is expected to have a useful life of 5 years.(Rounded)

(a)What is the rate of return on average investment of each investment?

(b)What is the payback period of each investment?

Each investment is expected to have a useful life of 5 years.(Rounded)

Each investment is expected to have a useful life of 5 years.(Rounded)(a)What is the rate of return on average investment of each investment?

(b)What is the payback period of each investment?

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

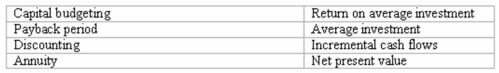

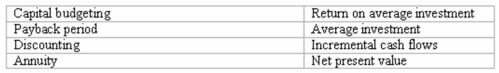

64

Accounting terminology

Listed below are eight technical accounting terms introduced or emphasized in this chapter. Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

____ (a)The process of analyzing investments in plant assets.

____ (b)The number of years required to recover the entire cost of an investment from its net cash flows.

____ (c)A stream of equal cash flows to be received or paid.

____ (d)The estimated average annual income of an investment expressed as a percentage of its average initial cost.

____ (e)The numerator in the return on average investment computation.

____ (f)The amount an investor should be willing to pay today for the right to receive a specified amount of cash at a specified future date.

____ (g)The process of computing the present value of future cash flows.

Listed below are eight technical accounting terms introduced or emphasized in this chapter.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.

Each of the following statements may (or may not)describe one of these technical terms.In the space provided beside each statement,indicate the accounting term described,or answer "None" if the statement does not correctly describe any of the terms.____ (a)The process of analyzing investments in plant assets.

____ (b)The number of years required to recover the entire cost of an investment from its net cash flows.

____ (c)A stream of equal cash flows to be received or paid.

____ (d)The estimated average annual income of an investment expressed as a percentage of its average initial cost.

____ (e)The numerator in the return on average investment computation.

____ (f)The amount an investor should be willing to pay today for the right to receive a specified amount of cash at a specified future date.

____ (g)The process of computing the present value of future cash flows.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

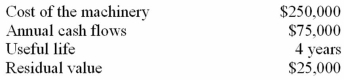

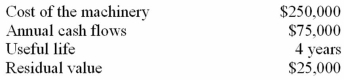

65

Redman Company is considering an investment in new machinery.The details of the investment are as follows:  The company uses straight-line depreciation for its machinery and requires a 12% rate of return.The present value of $1 for 4 years at 12% is 0.636.The present value of an ordinary annuity for $1 for 4 years at 12% is 3.037.

The company uses straight-line depreciation for its machinery and requires a 12% rate of return.The present value of $1 for 4 years at 12% is 0.636.The present value of an ordinary annuity for $1 for 4 years at 12% is 3.037.

(1)What is the payback period? (Round your answer to one decimal place.)

(2)What is the rate of return on average investment? (Round your percentage to one decimal place.)

(3)What is the net present value?

(4)Would you advise the company to invest in this machinery?

The company uses straight-line depreciation for its machinery and requires a 12% rate of return.The present value of $1 for 4 years at 12% is 0.636.The present value of an ordinary annuity for $1 for 4 years at 12% is 3.037.

The company uses straight-line depreciation for its machinery and requires a 12% rate of return.The present value of $1 for 4 years at 12% is 0.636.The present value of an ordinary annuity for $1 for 4 years at 12% is 3.037.(1)What is the payback period? (Round your answer to one decimal place.)

(2)What is the rate of return on average investment? (Round your percentage to one decimal place.)

(3)What is the net present value?

(4)Would you advise the company to invest in this machinery?

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

66

Discounting cash flows

Determine the present value of the following cash flows discounted at an annual rate of 10%:

(a)$96,000 to be received five years from today (the present value of $1 at a 10% compound interest rate for five years is 0.621): $__________

(b)$37,000 to be received annually for five years (the present value of $1 at 10% received annually for five years is 3.791): $__________

(c)$58,000 to be received annually for six years,with an additional $16,000 salvage value to be received at the end of the sixth year (the present value of $1 at 10% received annually for six years is 4.355,and the present value of $1 due six years hence at 10% is 0.564): $__________

Determine the present value of the following cash flows discounted at an annual rate of 10%:

(a)$96,000 to be received five years from today (the present value of $1 at a 10% compound interest rate for five years is 0.621): $__________

(b)$37,000 to be received annually for five years (the present value of $1 at 10% received annually for five years is 3.791): $__________

(c)$58,000 to be received annually for six years,with an additional $16,000 salvage value to be received at the end of the sixth year (the present value of $1 at 10% received annually for six years is 4.355,and the present value of $1 due six years hence at 10% is 0.564): $__________

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

67

Capital budgeting computations

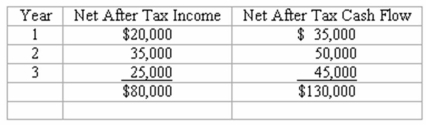

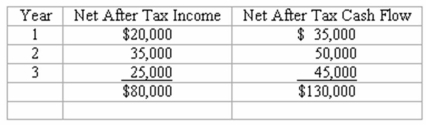

A project costing $80,000 has an estimated life of 3 years and no salvage value.The estimated net income and net after tax cash flows from the project are as follows: The company's minimum desired rate of return for discounted cash flow analysis is 10%.The present value of $1 at compound interest of 10% at 1,2,and 3 years is 0.909,0.826,and 0.751 respectively.The present value of a $1 annuity for three years at 10% is 2.487.The company uses straight-line depreciation.

The company's minimum desired rate of return for discounted cash flow analysis is 10%.The present value of $1 at compound interest of 10% at 1,2,and 3 years is 0.909,0.826,and 0.751 respectively.The present value of a $1 annuity for three years at 10% is 2.487.The company uses straight-line depreciation.

Compute

(a)Net present value of the project _________________________.

(b)The rate of return on average investment __________________.(rounded)

Calculations

A project costing $80,000 has an estimated life of 3 years and no salvage value.The estimated net income and net after tax cash flows from the project are as follows:

The company's minimum desired rate of return for discounted cash flow analysis is 10%.The present value of $1 at compound interest of 10% at 1,2,and 3 years is 0.909,0.826,and 0.751 respectively.The present value of a $1 annuity for three years at 10% is 2.487.The company uses straight-line depreciation.

The company's minimum desired rate of return for discounted cash flow analysis is 10%.The present value of $1 at compound interest of 10% at 1,2,and 3 years is 0.909,0.826,and 0.751 respectively.The present value of a $1 annuity for three years at 10% is 2.487.The company uses straight-line depreciation.Compute

(a)Net present value of the project _________________________.

(b)The rate of return on average investment __________________.(rounded)

Calculations

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

68

Capital budgeting

Zhang Corporation is considering investing $190,000 in equipment to produce a new product.Useful service life of the equipment is estimated to be 5 years,with zero salvage value.Straight-line depreciation is used.The company estimates that production and sale of the new product will increase net income by $65,000 a year.(Round your years and percentage answers to one decimal place.)

(a)The payback period will be __________ years.

(b)The expected rate of return on average investment will be __________.

Zhang Corporation is considering investing $190,000 in equipment to produce a new product.Useful service life of the equipment is estimated to be 5 years,with zero salvage value.Straight-line depreciation is used.The company estimates that production and sale of the new product will increase net income by $65,000 a year.(Round your years and percentage answers to one decimal place.)

(a)The payback period will be __________ years.

(b)The expected rate of return on average investment will be __________.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

69

Capital budgeting

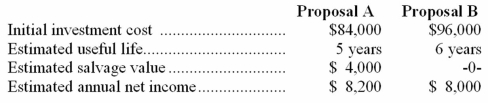

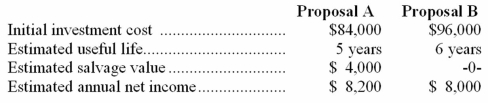

Mason Co.is evaluating two alternative investment proposals.Below are data for each proposal: The following information was taken from present value tables:

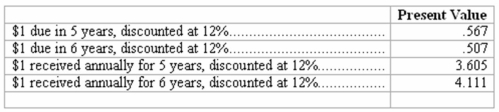

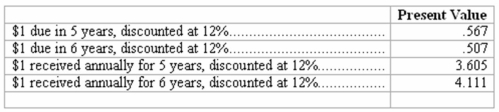

The following information was taken from present value tables:  All revenue and expenses other than depreciation will be received and paid in cash.The company uses a discount rate of 12% in evaluating all capital investments.

All revenue and expenses other than depreciation will be received and paid in cash.The company uses a discount rate of 12% in evaluating all capital investments.

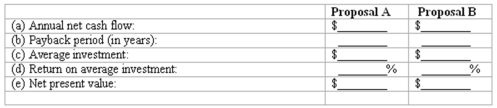

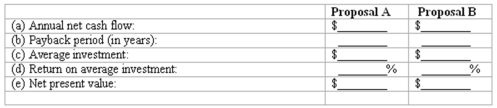

Compute the following for each proposal (round payback period to the nearest tenth of a year and round return on average investment to the nearest tenth of a percent): (f)Based on your analysis,which proposal appears to be the best investment?

(f)Based on your analysis,which proposal appears to be the best investment?

Mason Co.is evaluating two alternative investment proposals.Below are data for each proposal:

The following information was taken from present value tables:

The following information was taken from present value tables:  All revenue and expenses other than depreciation will be received and paid in cash.The company uses a discount rate of 12% in evaluating all capital investments.

All revenue and expenses other than depreciation will be received and paid in cash.The company uses a discount rate of 12% in evaluating all capital investments.Compute the following for each proposal (round payback period to the nearest tenth of a year and round return on average investment to the nearest tenth of a percent):

(f)Based on your analysis,which proposal appears to be the best investment?

(f)Based on your analysis,which proposal appears to be the best investment?

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

70

The shortcomings of the payback method

What are the major shortcomings of relying too heavily upon the payback period in evaluating capital investment decisions?

What are the major shortcomings of relying too heavily upon the payback period in evaluating capital investment decisions?

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

71

Return on average investment vs.discounting cash flows

The computation of return on average investment ignores one characteristic of the earnings stream which is considered in discounting cash flows.What is this characteristic? Why is it important?

The computation of return on average investment ignores one characteristic of the earnings stream which is considered in discounting cash flows.What is this characteristic? Why is it important?

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

72

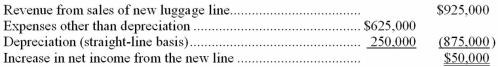

Capital budgeting

Carry-Along is debating whether or not to invest in new equipment to manufacture a line of high-quality luggage.The new equipment would cost $850,000,with an estimated four-year life and no salvage value.The estimated annual operating results with the new equipment are as follows: All revenue from the new luggage line and all expenses (except depreciation)will be received or paid in cash in the same period as recognized for accounting purposes.You are to compute the following for the investment in the new equipment to produce the new luggage line: (rounded)

All revenue from the new luggage line and all expenses (except depreciation)will be received or paid in cash in the same period as recognized for accounting purposes.You are to compute the following for the investment in the new equipment to produce the new luggage line: (rounded)

(a)Annual cash flow: $__________

(b)Payback period: __________

(c)Return on average investment: __________%

(d)Total present value of the expected future annual cash flows,discounted at an annual rate of 12% (an annuity table shows that the present value of $1 received annually for four years discounted at 12% is 3.037): $__________

(e)Net present value of the proposed investment: $__________

Carry-Along is debating whether or not to invest in new equipment to manufacture a line of high-quality luggage.The new equipment would cost $850,000,with an estimated four-year life and no salvage value.The estimated annual operating results with the new equipment are as follows:

All revenue from the new luggage line and all expenses (except depreciation)will be received or paid in cash in the same period as recognized for accounting purposes.You are to compute the following for the investment in the new equipment to produce the new luggage line: (rounded)

All revenue from the new luggage line and all expenses (except depreciation)will be received or paid in cash in the same period as recognized for accounting purposes.You are to compute the following for the investment in the new equipment to produce the new luggage line: (rounded)(a)Annual cash flow: $__________

(b)Payback period: __________

(c)Return on average investment: __________%

(d)Total present value of the expected future annual cash flows,discounted at an annual rate of 12% (an annuity table shows that the present value of $1 received annually for four years discounted at 12% is 3.037): $__________

(e)Net present value of the proposed investment: $__________

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

73

Capital budgeting

Golden Flights,Inc.is considering buying some specialized machinery which would enable the company to obtain a six-year government contract for the design and engineering of a futuristic plane.The machinery costs $975,000 and must be destroyed for security reasons at the end of the six-year contract period.The estimated annual operating results of the project are as follows: All revenue from the contract and all expenses (except depreciation)will be received or paid in cash in the same period as recognized for accounting purposes.You are to compute the following three factors for this project:

All revenue from the contract and all expenses (except depreciation)will be received or paid in cash in the same period as recognized for accounting purposes.You are to compute the following three factors for this project:

(a)Payback period: __________ years

(b)Return on average investment: __________%

(c)Net present value of the investment in this machinery,discounted at an annual rate of 12% (an annuity table shows that the present value of $1 received annually for six years discounted at 12% is 4.111): $__________

Golden Flights,Inc.is considering buying some specialized machinery which would enable the company to obtain a six-year government contract for the design and engineering of a futuristic plane.The machinery costs $975,000 and must be destroyed for security reasons at the end of the six-year contract period.The estimated annual operating results of the project are as follows:

All revenue from the contract and all expenses (except depreciation)will be received or paid in cash in the same period as recognized for accounting purposes.You are to compute the following three factors for this project:

All revenue from the contract and all expenses (except depreciation)will be received or paid in cash in the same period as recognized for accounting purposes.You are to compute the following three factors for this project:(a)Payback period: __________ years

(b)Return on average investment: __________%

(c)Net present value of the investment in this machinery,discounted at an annual rate of 12% (an annuity table shows that the present value of $1 received annually for six years discounted at 12% is 4.111): $__________

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

74

Capital budget audit

Briefly discuss the reasons that a company's management would conduct a regular capital budget audit.

Briefly discuss the reasons that a company's management would conduct a regular capital budget audit.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck