Deck 11: Impairment of Assets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/25

Play

Full screen (f)

Deck 11: Impairment of Assets

1

Under AASB 136 Impairment of Assets,the following assets are subject to impairment testing:

I II III IV

Inventory Yes Yes No No

Assets arising from construction contracts Yes Yes No No

Assets arising from employee benefits No Yes No Yes

Property,plant and equipment No Yes Yes No

A)I

B)II

C)III

D)IV.

I II III IV

Inventory Yes Yes No No

Assets arising from construction contracts Yes Yes No No

Assets arising from employee benefits No Yes No Yes

Property,plant and equipment No Yes Yes No

A)I

B)II

C)III

D)IV.

C

2

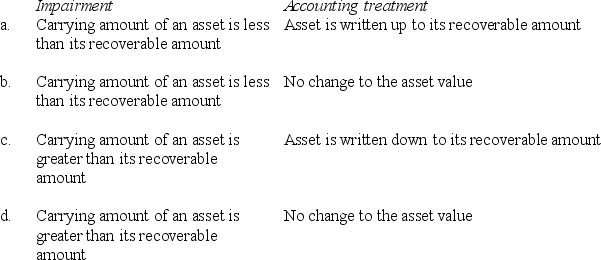

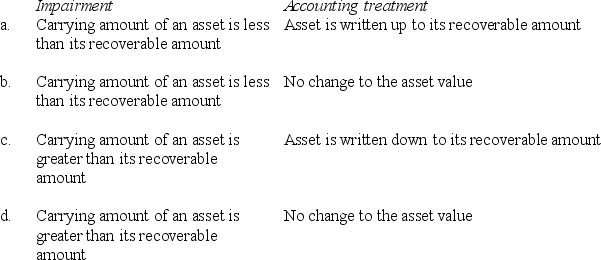

Under AASB 136 Impairment of Assets,impairment of an asset,and the accounting treatment using the cost model,are as follows:

C

3

When an asset is measured using the revaluation model,any impairment loss is treated as:

A)a revaluation decrement

B)a revaluation increment

C)a set-off against depreciation expense

D)an addition to depreciation expense.

A)a revaluation decrement

B)a revaluation increment

C)a set-off against depreciation expense

D)an addition to depreciation expense.

A

4

Jam Pty Ltd has two cash generating units.CGU A had a carrying amount of $700 and value in use of $750.CGU B has a carrying amount of $900 and a value in use of $800.The carrying amount of the head office assets is $400.CGU A & B utilise the head office services equally.The impairment loss for CGU A is:

A)$0

B)$50

C)$150

D)$350

A)$0

B)$50

C)$150

D)$350

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following assets need to be tested for impairment every year?

I intangible assets with indefinite useful lives

II intangible assets not yet available for use

III intangible assets accounted for under the revaluation method

IV goodwill acquired in a business combination

A)I,II and III only

B)II,III and IV only

C)I,II and IV only

D)I,III and IV only

I intangible assets with indefinite useful lives

II intangible assets not yet available for use

III intangible assets accounted for under the revaluation method

IV goodwill acquired in a business combination

A)I,II and III only

B)II,III and IV only

C)I,II and IV only

D)I,III and IV only

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

6

When goodwill is acquired under a business combination it is subject to an impairment test every:

A)year

B)two years

C)three years

D)five years.

A)year

B)two years

C)three years

D)five years.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

7

Where an asset is measured using the cost model,any impairment loss is:

A)accumulated in a separate 'accumulated impairment losses' account

B)set off against the balance of revenue

C)taken directly to equity

D)added to the balance of the accumulated depreciation account.

A)accumulated in a separate 'accumulated impairment losses' account

B)set off against the balance of revenue

C)taken directly to equity

D)added to the balance of the accumulated depreciation account.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

8

According to AASB 136 Impairment of Assets,the recoverable amount test requires an entity to compare the fair value an asset less costs to sell,with:

A)the amount obtainable from the sale of the asset

B)the costs directly attributable to the liquidation of the asset

C)its disposal value

D)its value in use.

A)the amount obtainable from the sale of the asset

B)the costs directly attributable to the liquidation of the asset

C)its disposal value

D)its value in use.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

9

Nguyen Limited estimated that it would receive future cash flows from the use of equipment:

-End of Year 1 $10 000

-End of Year 2 $50 000

-End of Year 3 $20 000

The discount rate was determined as 8%.The 'value in use' of the equipment is:

A)$80 000

B)$73 600

C)$68 000

D)$63 500.

-End of Year 1 $10 000

-End of Year 2 $50 000

-End of Year 3 $20 000

The discount rate was determined as 8%.The 'value in use' of the equipment is:

A)$80 000

B)$73 600

C)$68 000

D)$63 500.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

10

When assessing the recoverable of assets that have previously been subject to an impairment loss,which of the following indicators assist in providing external evidence that an impairment loss has reversed:

A)the asset's market value has decreased significantly during the period

B)significant changes with an adverse effect on the entity have taken place

C)market interest rates have decreased during the period

D)internal reporting sources indicate that the economic performance of the asset will not be as good as expected.

A)the asset's market value has decreased significantly during the period

B)significant changes with an adverse effect on the entity have taken place

C)market interest rates have decreased during the period

D)internal reporting sources indicate that the economic performance of the asset will not be as good as expected.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

11

At reporting date Guilder Limited estimated an impairment loss of $50 000 against its single cash-generating unit.The company had the following assets: Headquarters Building $100 000; Plant $60 000; Equipment $40 000.The net carrying amount of the Plant after allocation of the impairment loss is:

A)$60 000

B)$45 000

C)$35 000

D)$10 000.

A)$60 000

B)$45 000

C)$35 000

D)$10 000.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

12

At reporting date,the carrying amount of a cash-generating unit was considered to be have been impaired by $800.The unit included the following assets: Land $4000; Plant $3000; Goodwill $1000.The carrying amount of Goodwill after the impairment loss is allocated is:

A)$0

B)$200

C)$900

D)$1000.

A)$0

B)$200

C)$900

D)$1000.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

13

Hayfield Limited recognised an impairment loss of $200 against a cash-generating unit containing the following assets: Buildings $500; Roads $300; Equipment $600.The net carrying amount of the Roads after allocation of the impairment loss is:

A)$100

B)$235

C)$257.

D)$300

A)$100

B)$235

C)$257.

D)$300

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

14

During 20X7 Sacco Limited,estimated that the carrying amount of goodwill was impaired and wrote it down by $50 000.In 20X8,the company reassessed goodwill was decided that the old acquired goodwill still existed.The appropriate accounting treatment in 20X8 is:

A)reverse the previous goodwill impairment loss

B)recognise the revalued amount of goodwill by an adjustment against the asset revaluation surplus account

C)ignore the reversal as it is prohibited by AASB 136 Impairment of Assets

D)increase goodwill by an adjustment to retained earnings.

A)reverse the previous goodwill impairment loss

B)recognise the revalued amount of goodwill by an adjustment against the asset revaluation surplus account

C)ignore the reversal as it is prohibited by AASB 136 Impairment of Assets

D)increase goodwill by an adjustment to retained earnings.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

15

An appropriate journal entry to recognise an impairment loss under the cost model is:

A)DR Accumulated impairment losses CR Impairment loss

B)DR Accumulated impairment losses CR Asset revaluation (Equity)

C)DR Impairment loss CR Accumulated depreciation & impairment losses

D)DR Revenue CR Impairment loss

A)DR Accumulated impairment losses CR Impairment loss

B)DR Accumulated impairment losses CR Asset revaluation (Equity)

C)DR Impairment loss CR Accumulated depreciation & impairment losses

D)DR Revenue CR Impairment loss

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

16

In relation to the impairment of assets,AASB 136 Impairment of Assets,requires the following disclosures for each class of assets:

I The line of the income statement in which impairment losses are included.

II The amount of reversals of impairment losses during the period.

III The amount of impairment losses recognised directly in equity.

IV The beginning and ending balances of any 'provision for impairment' account.

A)I,II,III and IV

B)I,II and III only

C)II and IV only

D)IV only.

I The line of the income statement in which impairment losses are included.

II The amount of reversals of impairment losses during the period.

III The amount of impairment losses recognised directly in equity.

IV The beginning and ending balances of any 'provision for impairment' account.

A)I,II,III and IV

B)I,II and III only

C)II and IV only

D)IV only.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

17

At reporting date,the carrying amount of a cash-generating unit was considered to be have been impaired by $900.The unit included the following assets: Land $4000; Plant $3000; Goodwill $500.The amount of impairment allocated to the land is:

A)$200

B)$229

C)$300

D)$514

A)$200

B)$229

C)$300

D)$514

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

18

Candy Limited expected future cash flows from the use of Equipment as follows: End of Year 1 $4000; End of Year 2 $5000; End of Year 3 $2000.The discount rate was determined as 5%.The value in use of the equipment is:

A)$10 073

B)$10 576

C)$11 000

D)$11 550.

A)$10 073

B)$10 576

C)$11 000

D)$11 550.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

19

In allocating an impairment loss,an entity shall not reduce the carrying amount of an asset below the highest of:

A)value in use and zero

B)present value and value in use

C)cost and market value

D)initial cost and fair value.

A)value in use and zero

B)present value and value in use

C)cost and market value

D)initial cost and fair value.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

20

An impairment loss occurs when:

A)the recoverable amount of an asset exceeds the carrying amount

B)the carrying amount of an asset exceeds the recoverable amount

C)the asset has a zero residual value

D)the recoverable amount of an asset exceeds its initial cost.

A)the recoverable amount of an asset exceeds the carrying amount

B)the carrying amount of an asset exceeds the recoverable amount

C)the asset has a zero residual value

D)the recoverable amount of an asset exceeds its initial cost.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

21

Explain how the fair value of an asset might be determined.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

22

Explain how an entity can recover the value of an asset.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

23

Outline the circumstances under which it would be acceptable to reverse a previously recognised impairment loss.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

24

Explain how the impairment test protects the carrying amount of goodwill.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

25

Identify the disclosures for each class of asset in respect to impairment losses.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck