Deck 21: Building Multiple Regression Models

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/22

Play

Full screen (f)

Deck 21: Building Multiple Regression Models

1

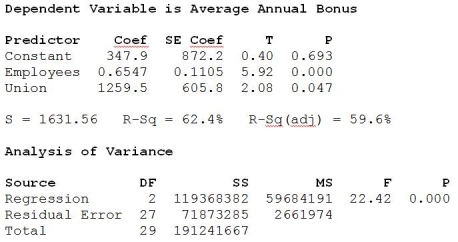

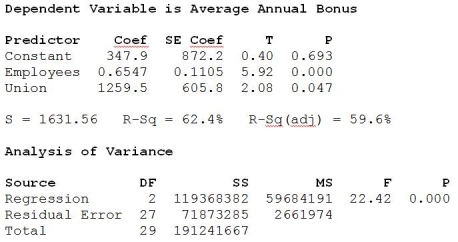

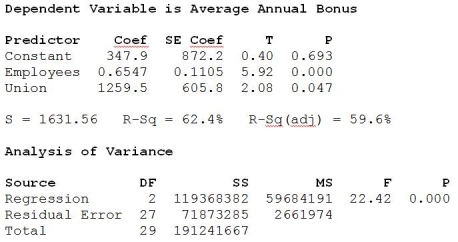

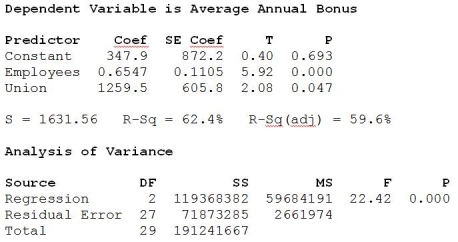

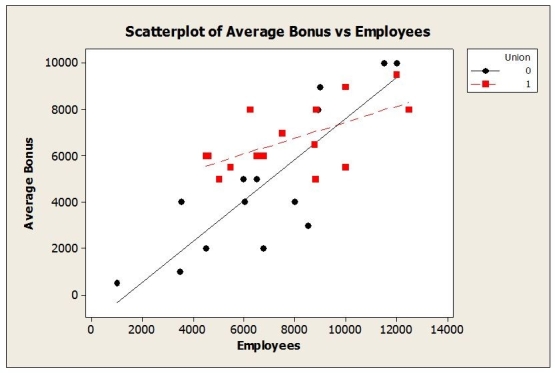

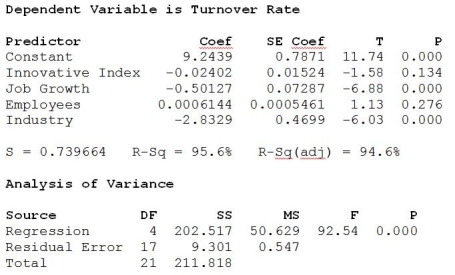

Consider the following to answer the question(s) below:

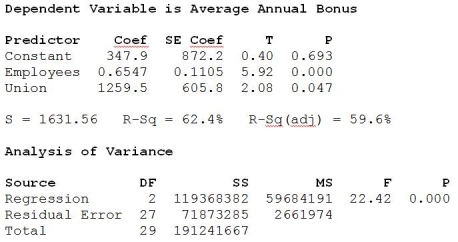

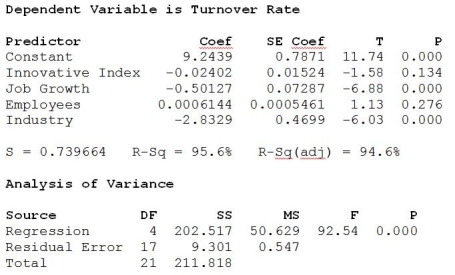

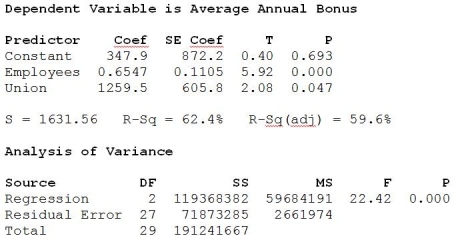

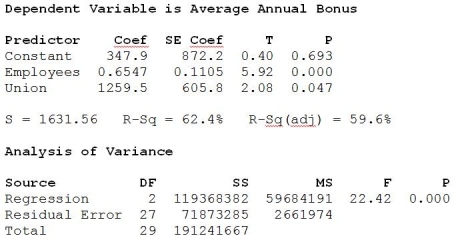

A sample of 30 companies was randomly selected for a study investigating what factors affect the size of company bonuses. Data were collected on the number of employees at the company and whether or not the employees were unionized (1 = yes, 0 = no). The following multiple regression model was fit to the data.

At α = 0.05, we can conclude that

A) The multiple regression model is significant in explaining the size of company bonuses.

B) The number of employees at the company is a significant variable in explaining the size of company bonuses.

C) Whether or not the employees are unionized is a significant variable in explaining the size of company bonuses.

D) The multiple regression model is significant in explaining the size of company bonuses and the number of employees at the company is a significant variable in explaining the size of company bonuses.

E) All of the given possible answers are correct.

A sample of 30 companies was randomly selected for a study investigating what factors affect the size of company bonuses. Data were collected on the number of employees at the company and whether or not the employees were unionized (1 = yes, 0 = no). The following multiple regression model was fit to the data.

At α = 0.05, we can conclude that

A) The multiple regression model is significant in explaining the size of company bonuses.

B) The number of employees at the company is a significant variable in explaining the size of company bonuses.

C) Whether or not the employees are unionized is a significant variable in explaining the size of company bonuses.

D) The multiple regression model is significant in explaining the size of company bonuses and the number of employees at the company is a significant variable in explaining the size of company bonuses.

E) All of the given possible answers are correct.

E

2

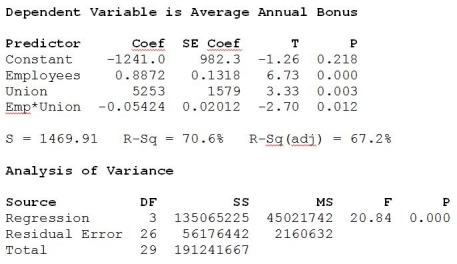

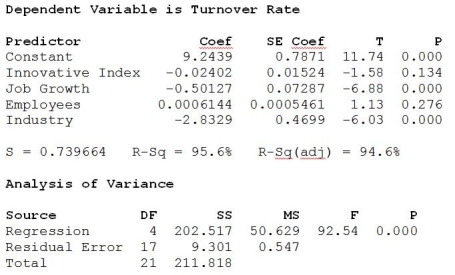

Consider the following to answer the question(s) below:

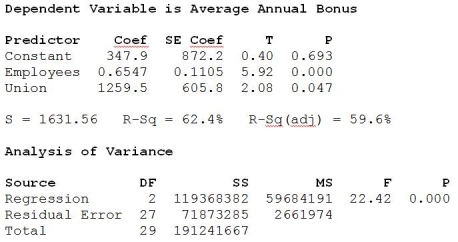

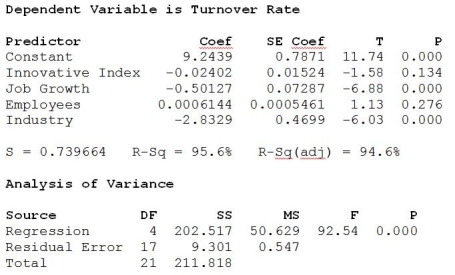

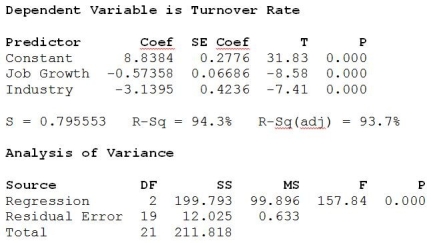

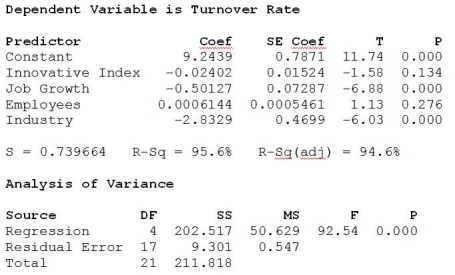

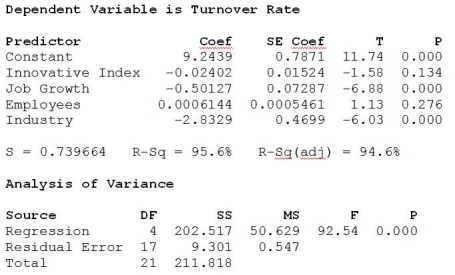

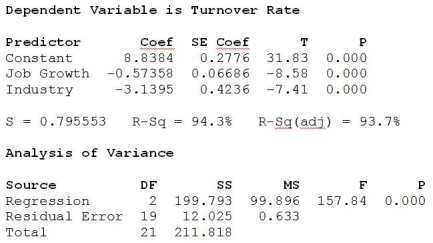

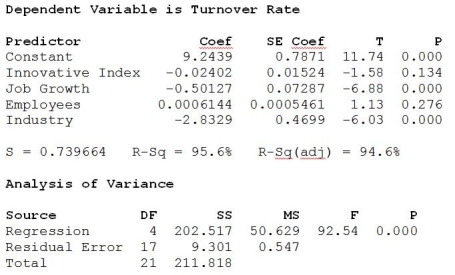

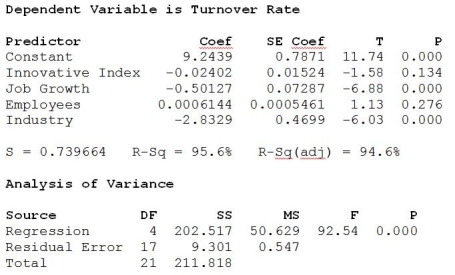

A sample of firms was selected from the high tech industry (Industry = 1) and the financial services sector (Industry = 0). Data were collected on the following variables: turnover rate, job growth, number of employees, and innovative index (higher scores indicate a more innovative and creative organizational culture). Below are the multiple regression results.

Which of the following independent variables are significant in this regression equation at α = 0.05?

A) Innovative Index

B) Employees

C) Both Innovative Index and Employees

D) All four variables

E) Both Job Growth and Industry

A sample of firms was selected from the high tech industry (Industry = 1) and the financial services sector (Industry = 0). Data were collected on the following variables: turnover rate, job growth, number of employees, and innovative index (higher scores indicate a more innovative and creative organizational culture). Below are the multiple regression results.

Which of the following independent variables are significant in this regression equation at α = 0.05?

A) Innovative Index

B) Employees

C) Both Innovative Index and Employees

D) All four variables

E) Both Job Growth and Industry

E

3

Consider the following to answer the question(s) below:

A sample of 30 companies was randomly selected for a study investigating what factors affect the size of company bonuses. Data were collected on the number of employees at the company and whether or not the employees were unionized (1 = yes, 0 = no). The following multiple regression model was fit to the data.

The correct interpretation of the regression coefficient of Union is

A) that the annual average bonus is $605.80 less for unionized companies compared to non-unionized companies of the same size (same number of employees)

B) that the annual average bonus is $605.80 more for unionized companies compared to non-unionized companies of the same size (same number of employees)

C) that the annual average bonus is $1259.50 less for unionized companies compared to non-unionized companies of the same size (same number of employees)

D) that the annual average bonus is $1259.50 more for unionized companies compared to non-unionized companies of the same size (same number of employees)

E) that the annual average bonus is $208 more for unionized companies compared to non-unionized companies of the same size (same number of employees)

A sample of 30 companies was randomly selected for a study investigating what factors affect the size of company bonuses. Data were collected on the number of employees at the company and whether or not the employees were unionized (1 = yes, 0 = no). The following multiple regression model was fit to the data.

The correct interpretation of the regression coefficient of Union is

A) that the annual average bonus is $605.80 less for unionized companies compared to non-unionized companies of the same size (same number of employees)

B) that the annual average bonus is $605.80 more for unionized companies compared to non-unionized companies of the same size (same number of employees)

C) that the annual average bonus is $1259.50 less for unionized companies compared to non-unionized companies of the same size (same number of employees)

D) that the annual average bonus is $1259.50 more for unionized companies compared to non-unionized companies of the same size (same number of employees)

E) that the annual average bonus is $208 more for unionized companies compared to non-unionized companies of the same size (same number of employees)

D

4

Which of the following statements about multiple regression model building methods is true?

A) There is no simple definition of the "best" model in regression analysis.

B) Stepwise selection will always find the best regression model.

C) Both stepwise and best subsets methods check assumptions and conditions.

D) The best subsets method will involve trying fewer different regression models than stepwise regression.

E) All of the above are correct.

A) There is no simple definition of the "best" model in regression analysis.

B) Stepwise selection will always find the best regression model.

C) Both stepwise and best subsets methods check assumptions and conditions.

D) The best subsets method will involve trying fewer different regression models than stepwise regression.

E) All of the above are correct.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

5

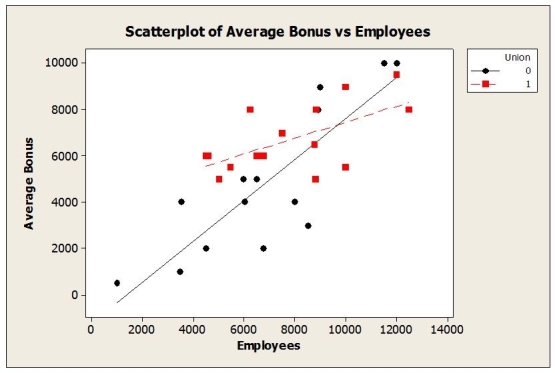

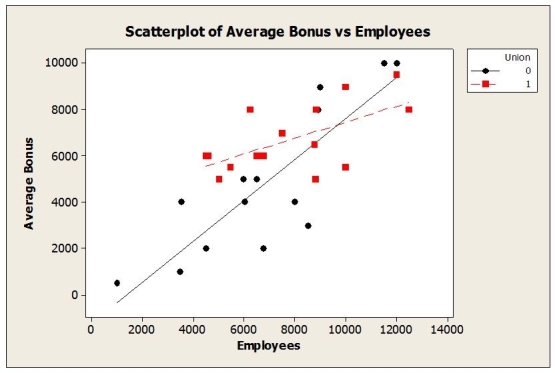

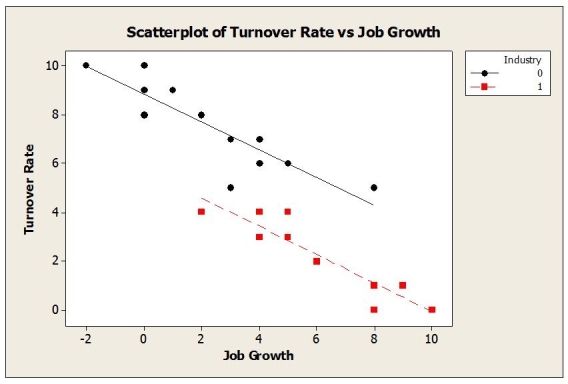

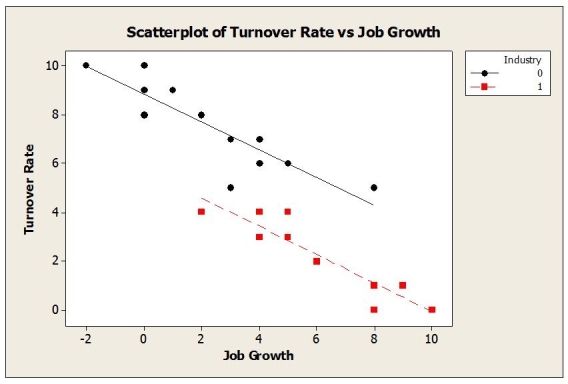

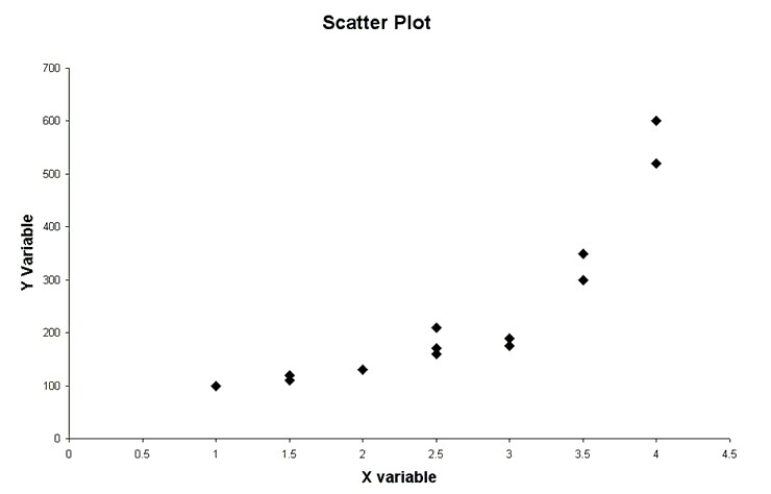

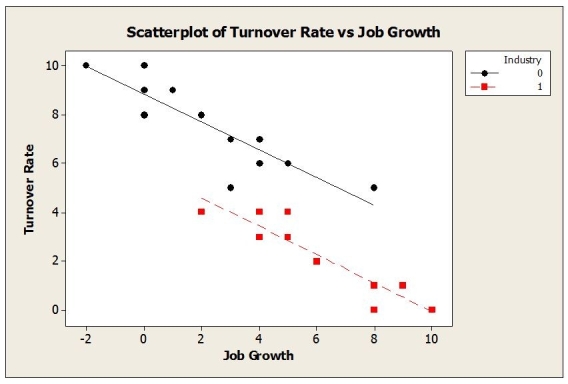

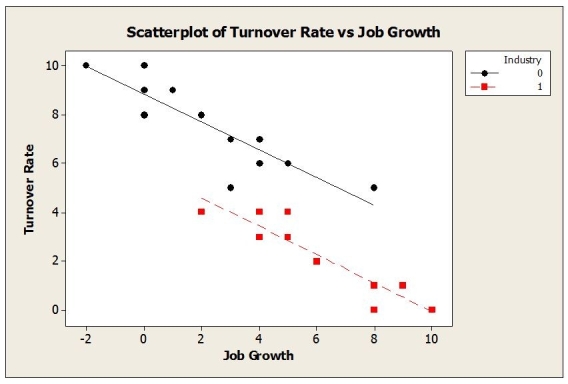

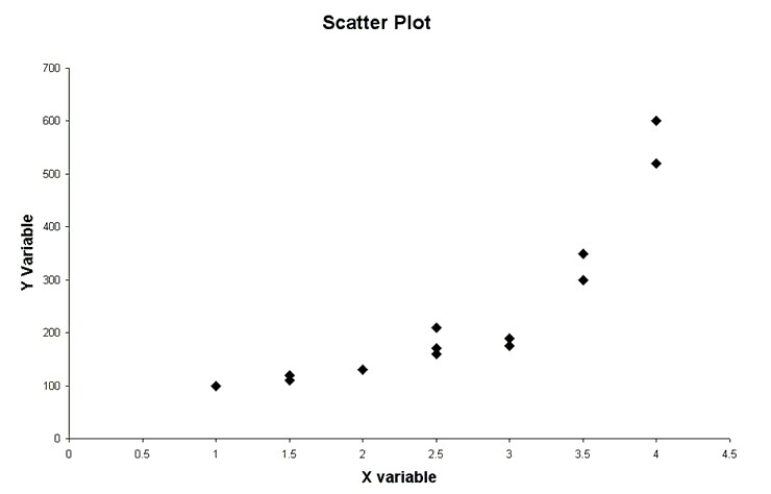

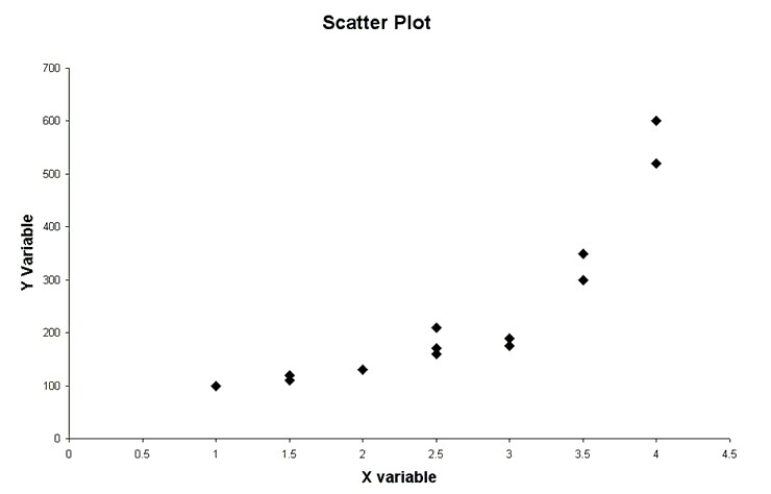

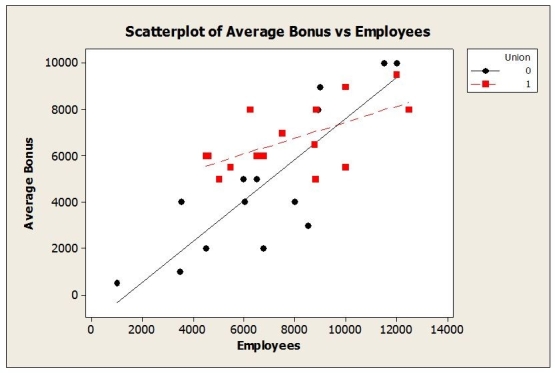

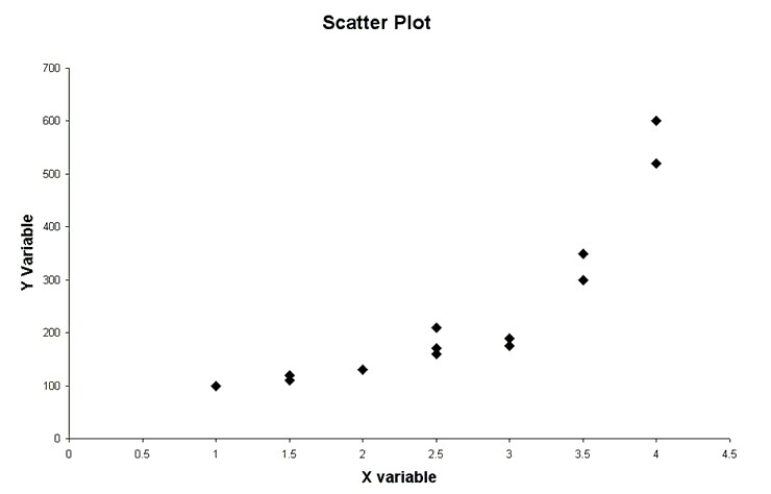

What does the scatterplot of these data (shown below) suggest?

A) Using the interaction term Employees*Union in the model is appropriate.

B) Using Union as an indicator variable in this model is appropriate.

C) Union should not be included in the model as a variable.

D) Employees should not be included in the model as a variable.

E) Using the interaction term Employees*Union in the model is definitely inappropriate.

A) Using the interaction term Employees*Union in the model is appropriate.

B) Using Union as an indicator variable in this model is appropriate.

C) Union should not be included in the model as a variable.

D) Employees should not be included in the model as a variable.

E) Using the interaction term Employees*Union in the model is definitely inappropriate.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

6

Using this model, the predicted turnover rate for a firm in the financial services sector with 1000 employees, an innovativeness index of 50, and 2% job growth rate is

A) 8.25%

B) 7.69%

C) 4.56%

D) 6.19%

E) 37.41%

A) 8.25%

B) 7.69%

C) 4.56%

D) 6.19%

E) 37.41%

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

7

Consider the following to answer the question(s) below:

A sample of 30 companies was randomly selected for a study investigating what factors affect the size of company bonuses. Data were collected on the number of employees at the company and whether or not the employees were unionized (1 = yes, 0 = no). The following multiple regression model was fit to the data.

The estimated regression model is

A) Average Annual Bonus = 347.9 + 0.6547 Employees + 1259.5 Union

B) Average Annual Bonus = 872.2 + 0.1105 Employees + 605.8 Union

C) Average Annual Bonus = 0.40 + 5.92 Employees + 2.08 Union

D) Average Annual Bonus = 0.6547 Employees + 1259.5 Union

E) Average Annual Bonus = 347.9 + 872.2 Employees + 0.40 Union .

A sample of 30 companies was randomly selected for a study investigating what factors affect the size of company bonuses. Data were collected on the number of employees at the company and whether or not the employees were unionized (1 = yes, 0 = no). The following multiple regression model was fit to the data.

The estimated regression model is

A) Average Annual Bonus = 347.9 + 0.6547 Employees + 1259.5 Union

B) Average Annual Bonus = 872.2 + 0.1105 Employees + 605.8 Union

C) Average Annual Bonus = 0.40 + 5.92 Employees + 2.08 Union

D) Average Annual Bonus = 0.6547 Employees + 1259.5 Union

E) Average Annual Bonus = 347.9 + 872.2 Employees + 0.40 Union .

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

8

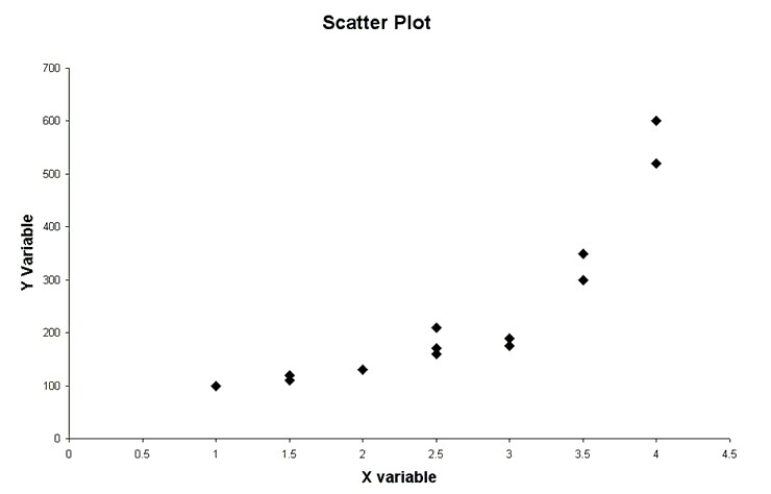

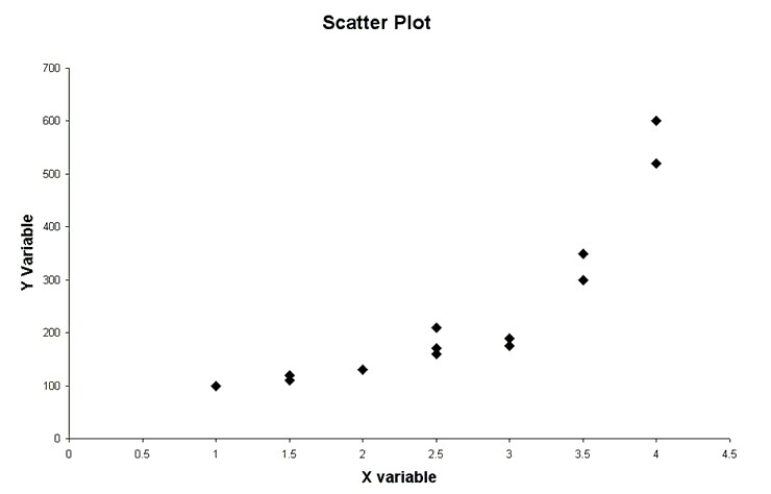

What does the scatterplot of these data (shown below) suggest?

A) Using Job Growth as an indicator variable in this model is appropriate.

B) Using the interaction term Job Growth*Industry in the model is appropriate.

C) Using Industry as an indicator variable in this model is appropriate.

D) Job Growth should not be included in the model as a variable.

E) Using Industry as an indicator variable in this model is definitely not appropriate.

A) Using Job Growth as an indicator variable in this model is appropriate.

B) Using the interaction term Job Growth*Industry in the model is appropriate.

C) Using Industry as an indicator variable in this model is appropriate.

D) Job Growth should not be included in the model as a variable.

E) Using Industry as an indicator variable in this model is definitely not appropriate.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements is true?

A) The method used in regression analysis for incorporating a categorical variable into the model is by organizing the categorical variable into one or more indicator variables.

B) An indicator variable is a dependent variable whose value is set at either zero or one.

C) There are four possible responses listed for marital status. Based on this, four indicator variables will need to be created and incorporated into the regression model.

D) On a survey there is a question that asks whether someone lives in a house, apartment, or condominium. These three responses could be coded in an indicator variable using values of 0, 1, and 2.

E) All of the above are correct.

A) The method used in regression analysis for incorporating a categorical variable into the model is by organizing the categorical variable into one or more indicator variables.

B) An indicator variable is a dependent variable whose value is set at either zero or one.

C) There are four possible responses listed for marital status. Based on this, four indicator variables will need to be created and incorporated into the regression model.

D) On a survey there is a question that asks whether someone lives in a house, apartment, or condominium. These three responses could be coded in an indicator variable using values of 0, 1, and 2.

E) All of the above are correct.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

10

Consider the following to answer the question(s) below:

Consider the following scatter plot:

Which of the following statements best describes a point with high leverage?

A) A point may exert high leverage because it has an unusual combination of predictor values.

B) A point with high leverage is easy to see in a regression of a single predictor and response.

C) A point of high leverage may not influence the regression slope.

D) A point with zero leverage has no effect on the regression slope.

E) All of the above are true.

Consider the following scatter plot:

Which of the following statements best describes a point with high leverage?

A) A point may exert high leverage because it has an unusual combination of predictor values.

B) A point with high leverage is easy to see in a regression of a single predictor and response.

C) A point of high leverage may not influence the regression slope.

D) A point with zero leverage has no effect on the regression slope.

E) All of the above are true.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following statements describes the consequences of collinearity in a model?

A) The value of the Variance Inflation Factor will be high.

B) An estimated coefficient may have an unexpected sign or size.

C) The F-statistic for the model may indicate overall significance, but most or all of the individual coefficients have t-statistics showing insignificance.

D) Collinearity occurs when two or more predictor variables are correlated.

E) All of the above are correct.

A) The value of the Variance Inflation Factor will be high.

B) An estimated coefficient may have an unexpected sign or size.

C) The F-statistic for the model may indicate overall significance, but most or all of the individual coefficients have t-statistics showing insignificance.

D) Collinearity occurs when two or more predictor variables are correlated.

E) All of the above are correct.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

12

Consider the following to answer the question(s) below:

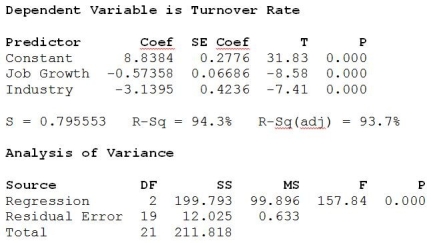

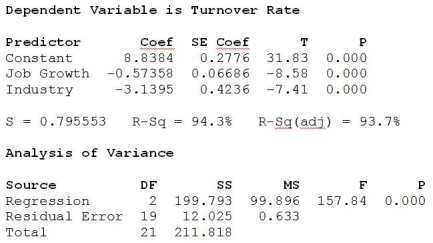

An alternative multiple regression model is fit to the data on the sample of firms selected from the high tech industry (Industry = 1) and the financial services sector (Industry = 0). The results are shown below.

Which of the following statements is true?

A) All of the independent variables in this model are significant.

B) This model is inferior to the first model (see p.238) because it has fewer independent variables.

C) This model does not include an indicator variable.

D) All of the independent variables in this model are significant and this model is inferior to the first model because it has fewer independent variables.

E) All of the given statements are true.

An alternative multiple regression model is fit to the data on the sample of firms selected from the high tech industry (Industry = 1) and the financial services sector (Industry = 0). The results are shown below.

Which of the following statements is true?

A) All of the independent variables in this model are significant.

B) This model is inferior to the first model (see p.238) because it has fewer independent variables.

C) This model does not include an indicator variable.

D) All of the independent variables in this model are significant and this model is inferior to the first model because it has fewer independent variables.

E) All of the given statements are true.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

13

A sample of firms was selected from the high tech industry (Industry = 1) and the financial services sector (Industry = 0). Data were collected on the following variables: turnover rate, job growth, number of employees, and innovative index (higher scores indicate a more innovative and creative organizational culture). Below are the multiple regression results.  a. Write out the estimated regression equation.

a. Write out the estimated regression equation.

b. Are all of the independent variables significant in this regression equation (using α = 0.05)? Explain.

c. Interpret the coefficient of the Industry.

d. An alternative multiple regression model is fit to these data and the results are shown below. Which model is better? Explain. e. Based on the scatterplot below, is it appropriate to use Industry as an indicator variable in this regression model? Explain.

e. Based on the scatterplot below, is it appropriate to use Industry as an indicator variable in this regression model? Explain.  f. Using the better model, predict turnover rate for a firm in the financial services sector with 1000 employees, an innovative index of 50 and 2% job growth rate.

f. Using the better model, predict turnover rate for a firm in the financial services sector with 1000 employees, an innovative index of 50 and 2% job growth rate.

a. Write out the estimated regression equation.

a. Write out the estimated regression equation.b. Are all of the independent variables significant in this regression equation (using α = 0.05)? Explain.

c. Interpret the coefficient of the Industry.

d. An alternative multiple regression model is fit to these data and the results are shown below. Which model is better? Explain.

e. Based on the scatterplot below, is it appropriate to use Industry as an indicator variable in this regression model? Explain.

e. Based on the scatterplot below, is it appropriate to use Industry as an indicator variable in this regression model? Explain.  f. Using the better model, predict turnover rate for a firm in the financial services sector with 1000 employees, an innovative index of 50 and 2% job growth rate.

f. Using the better model, predict turnover rate for a firm in the financial services sector with 1000 employees, an innovative index of 50 and 2% job growth rate.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

14

Consider the following to answer the question(s) below:

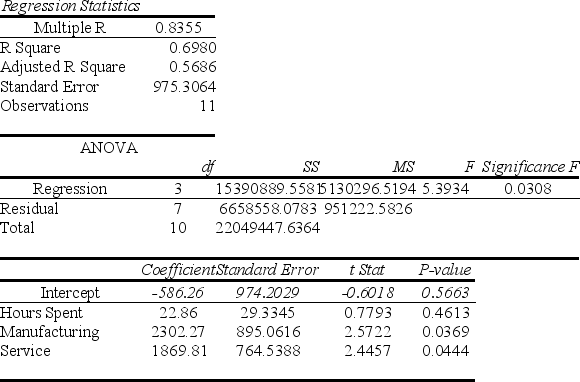

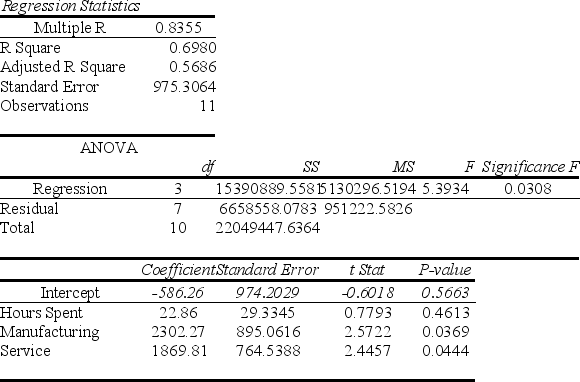

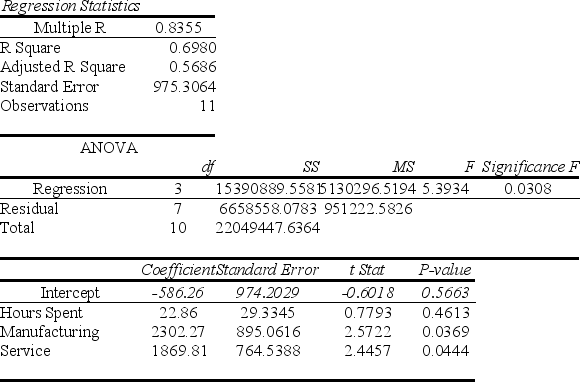

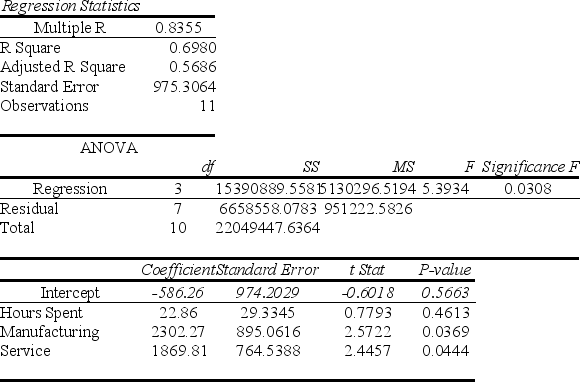

A Toronto accounting firm estimated a model to explain variation in client profitability. The dependent variable is client net profits and the predictor variables include the hours spent working on the client and indicator variables to denote the type of client-manufacturing, service, or government. The indicator variables have a value of one if the client is the type described. The following are the model results.

If the number of hours spent on a client is 100, and the client is in the Service industry,what is the predicted net profit?

A) The predicted net profit is $3,569.66.

B) The predicted net profit is $1,869.81.

C) The predicted net profit is $1,283.55.

D) The predicted net profit is $4,172.08.

E) The predicted net profit is $3,585.82.

A Toronto accounting firm estimated a model to explain variation in client profitability. The dependent variable is client net profits and the predictor variables include the hours spent working on the client and indicator variables to denote the type of client-manufacturing, service, or government. The indicator variables have a value of one if the client is the type described. The following are the model results.

If the number of hours spent on a client is 100, and the client is in the Service industry,what is the predicted net profit?

A) The predicted net profit is $3,569.66.

B) The predicted net profit is $1,869.81.

C) The predicted net profit is $1,283.55.

D) The predicted net profit is $4,172.08.

E) The predicted net profit is $3,585.82.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

15

Consider the following to answer the question(s) below:

A sample of firms was selected from the high tech industry (Industry = 1) and the financial services sector (Industry = 0). Data were collected on the following variables: turnover rate, job growth, number of employees, and innovative index (higher scores indicate a more innovative and creative organizational culture). Below are the multiple regression results.

Which statement is true about the estimated multiple regression model?

A) Turnover rate is the indicator variable.

B) Innovative index is the indicator variable.

C) Test results indicate that the model is significant in explaining Turnover rate.

D) Innovative index is the indicator variable and the F test results indicate that the model is not significant in explaining Turnover rate.

E) All of the given possible statements are true.

A sample of firms was selected from the high tech industry (Industry = 1) and the financial services sector (Industry = 0). Data were collected on the following variables: turnover rate, job growth, number of employees, and innovative index (higher scores indicate a more innovative and creative organizational culture). Below are the multiple regression results.

Which statement is true about the estimated multiple regression model?

A) Turnover rate is the indicator variable.

B) Innovative index is the indicator variable.

C) Test results indicate that the model is significant in explaining Turnover rate.

D) Innovative index is the indicator variable and the F test results indicate that the model is not significant in explaining Turnover rate.

E) All of the given possible statements are true.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

16

Consider the following to answer the question(s) below:

Consider the following scatter plot:

The model of this data would be better fit with the inclusion of

A) a quadratic term

B) a dummy variable

C) an interaction term

D) an indicator variable

E) leverage value

Consider the following scatter plot:

The model of this data would be better fit with the inclusion of

A) a quadratic term

B) a dummy variable

C) an interaction term

D) an indicator variable

E) leverage value

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

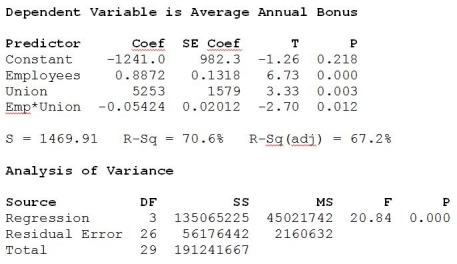

17

A sample of 30 companies was randomly selected for a study investigating what factors affect the size of company bonuses. Data were collected on the number of employees at the company and whether or not the employees were unionized (1 = yes, 0 = no). Below are the multiple regression results.  a. Write out the estimated regression equation.

a. Write out the estimated regression equation.

b. Are all of the independent variables significant in this regression equation (using α = 0 .05)? Explain.

c. Interpret the coefficient of the Union.

d. Based on the scatterplot below, do you think using Union as an indicator variable in this model is appropriate? Explain. e. An alternative multiple regression model is fit to these data and the results are shown below. Which model is better? Explain.

e. An alternative multiple regression model is fit to these data and the results are shown below. Which model is better? Explain.  f. Using the better model, predict the annual average bonus for a company with 7500 employees that are not unionized.

f. Using the better model, predict the annual average bonus for a company with 7500 employees that are not unionized.

a. Write out the estimated regression equation.

a. Write out the estimated regression equation.b. Are all of the independent variables significant in this regression equation (using α = 0 .05)? Explain.

c. Interpret the coefficient of the Union.

d. Based on the scatterplot below, do you think using Union as an indicator variable in this model is appropriate? Explain.

e. An alternative multiple regression model is fit to these data and the results are shown below. Which model is better? Explain.

e. An alternative multiple regression model is fit to these data and the results are shown below. Which model is better? Explain.  f. Using the better model, predict the annual average bonus for a company with 7500 employees that are not unionized.

f. Using the better model, predict the annual average bonus for a company with 7500 employees that are not unionized.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

18

Consider the following to answer the question(s) below:

A sample of firms was selected from the high tech industry (Industry = 1) and the financial services sector (Industry = 0). Data were collected on the following variables: turnover rate, job growth, number of employees, and innovative index (higher scores indicate a more innovative and creative organizational culture). Below are the multiple regression results.

How much of the variability in Turnover Rate is explained by the multiple regression model?

A) 73.9%

B) 95.6%

C) 9.3%

D) 50.62%

E) 91.39%

A sample of firms was selected from the high tech industry (Industry = 1) and the financial services sector (Industry = 0). Data were collected on the following variables: turnover rate, job growth, number of employees, and innovative index (higher scores indicate a more innovative and creative organizational culture). Below are the multiple regression results.

How much of the variability in Turnover Rate is explained by the multiple regression model?

A) 73.9%

B) 95.6%

C) 9.3%

D) 50.62%

E) 91.39%

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

19

Consider the following to answer the question(s) below:

Consider the following scatter plot:

What does the scatter plot suggest?

A) The linearity condition is not satisfied.

B) The equal spread condition is not satisfied.

C) There is an outlier present in the data set.

D) There is a high leverage value present in the data set.

E) The data are not normal.

Consider the following scatter plot:

What does the scatter plot suggest?

A) The linearity condition is not satisfied.

B) The equal spread condition is not satisfied.

C) There is an outlier present in the data set.

D) There is a high leverage value present in the data set.

E) The data are not normal.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

20

A regression equation that predicts the price of homes in thousands of dollars is  t = 24.6 + 0.055x1 - 3.6x2, where x2 is an indicator variable that represents whether the house is on a busy street (1 = yes, 0 = no). Based on this information, which of the following statements is true?

t = 24.6 + 0.055x1 - 3.6x2, where x2 is an indicator variable that represents whether the house is on a busy street (1 = yes, 0 = no). Based on this information, which of the following statements is true?

A) On average, homes that are on busy streets are worth $3600 less than homes that are not on busy streets.

B) On average, homes that are on busy streets are worth $3.60 less than homes that are not on busy streets.

C) On average, homes that are on busy streets are worth $3600 more than homes that are not on busy streets.

D) On average, homes that are on busy streets are worth $3.60 more than homes that are not on busy streets.

E) None of the above is correct.

t = 24.6 + 0.055x1 - 3.6x2, where x2 is an indicator variable that represents whether the house is on a busy street (1 = yes, 0 = no). Based on this information, which of the following statements is true?

t = 24.6 + 0.055x1 - 3.6x2, where x2 is an indicator variable that represents whether the house is on a busy street (1 = yes, 0 = no). Based on this information, which of the following statements is true?A) On average, homes that are on busy streets are worth $3600 less than homes that are not on busy streets.

B) On average, homes that are on busy streets are worth $3.60 less than homes that are not on busy streets.

C) On average, homes that are on busy streets are worth $3600 more than homes that are not on busy streets.

D) On average, homes that are on busy streets are worth $3.60 more than homes that are not on busy streets.

E) None of the above is correct.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

21

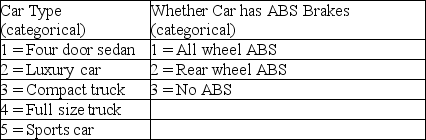

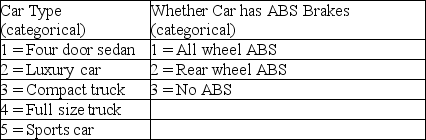

The editors of a national automotive magazine recently studied 30 different automobiles sold in the Canada with the intent of seeing whether they could develop a multiple regression model to explain the variation in highway fuel consumption. A number of different independent variables were collected. Included in these were two variables described as follows:  If these two variables are to be included in a regression model, how many additional indicator variables will be needed?

If these two variables are to be included in a regression model, how many additional indicator variables will be needed?

A) 6

B) 8

C) 2

D) 4

E) 5

If these two variables are to be included in a regression model, how many additional indicator variables will be needed?

If these two variables are to be included in a regression model, how many additional indicator variables will be needed?A) 6

B) 8

C) 2

D) 4

E) 5

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

22

Consider the following to answer the question(s) below:

A Toronto accounting firm estimated a model to explain variation in client profitability. The dependent variable is client net profits and the predictor variables include the hours spent working on the client and indicator variables to denote the type of client-manufacturing, service, or government. The indicator variables have a value of one if the client is the type described. The following are the model results.

At α = 0.05, which of the following statements is correct?

A) The overall regression model is significant in explaining net profits.

B) The number of hours spent on a client is not significant in explaining variation in client profitability.

C) The indicator variables for client type are significant in explaining variation in client profitability.

D) The regression model is significant overall, and the indicator variables for type of client are significant in explaining the variation in client profitability.

E) All of the above statements are correct.

A Toronto accounting firm estimated a model to explain variation in client profitability. The dependent variable is client net profits and the predictor variables include the hours spent working on the client and indicator variables to denote the type of client-manufacturing, service, or government. The indicator variables have a value of one if the client is the type described. The following are the model results.

At α = 0.05, which of the following statements is correct?

A) The overall regression model is significant in explaining net profits.

B) The number of hours spent on a client is not significant in explaining variation in client profitability.

C) The indicator variables for client type are significant in explaining variation in client profitability.

D) The regression model is significant overall, and the indicator variables for type of client are significant in explaining the variation in client profitability.

E) All of the above statements are correct.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck