Deck 13: The Statement of Cash Flows

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/68

Play

Full screen (f)

Deck 13: The Statement of Cash Flows

1

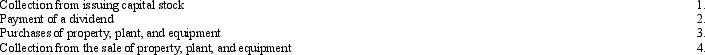

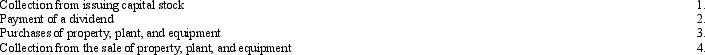

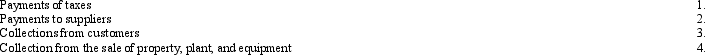

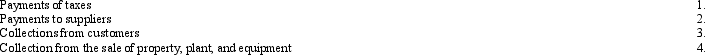

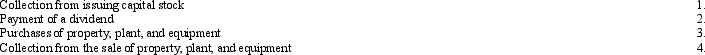

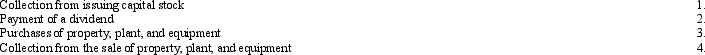

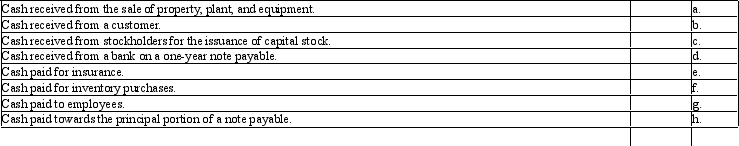

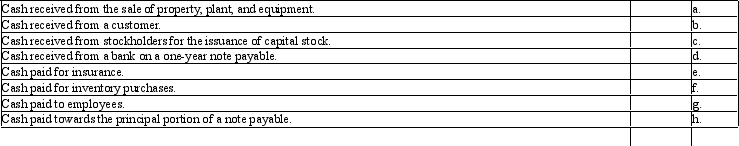

Given the following events, which ones affect cash flows from investing activities?

A) 1 and 2

B) 3 and 4

C) 2 and 4

D) 1, 2, 3, and 4

A) 1 and 2

B) 3 and 4

C) 2 and 4

D) 1, 2, 3, and 4

B

2

Which of the following is not one of the types of activities that is summarized on the statement of cash flows?

A) Organizing

B) Financing

C) Investing

D) Operating

A) Organizing

B) Financing

C) Investing

D) Operating

A

3

Cash paid to stockholders as a dividend is classified in which section of the statement of cash flows?

A) Operating

B) Investing

C) Financing

D) Noncash

A) Operating

B) Investing

C) Financing

D) Noncash

C

4

Which of the following is not a required external financial statement?

A) Balance sheet

B) Budgeted income statement

C) Statement of cash flows

D) Statement of changes in stockholders' equity

A) Balance sheet

B) Budgeted income statement

C) Statement of cash flows

D) Statement of changes in stockholders' equity

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

5

Cash paid towards salaries is classified in which section of the statement of cash flows?

A) Operating

B) Investing

C) Financing

D) Noncash

A) Operating

B) Investing

C) Financing

D) Noncash

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

6

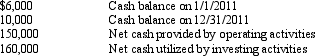

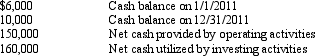

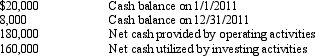

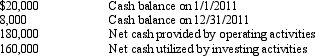

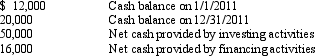

Nelson Corporation has the following information available for 2011:  The financing activity section of Nelson's statement of cash flows would show:

The financing activity section of Nelson's statement of cash flows would show:

A) net cash provided by financing activities of $10,000.

B) net cash utilized by financing activities of $4,000.

C) net cash utilized by financing activities of $6,000.

D) net cash provided by financing activities of $14,000.

The financing activity section of Nelson's statement of cash flows would show:

The financing activity section of Nelson's statement of cash flows would show:A) net cash provided by financing activities of $10,000.

B) net cash utilized by financing activities of $4,000.

C) net cash utilized by financing activities of $6,000.

D) net cash provided by financing activities of $14,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

7

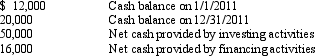

BTE Corporation has the following information available for 2011:  The financing activity section of BTE's statement of cash flows would show:

The financing activity section of BTE's statement of cash flows would show:

A) net cash provided by financing activities of $32,000.

B) net cash utilized by financing activities of $32,000.

C) net cash utilized by financing activities of $8,000.

D) net cash provided by financing activities of $8,000.

The financing activity section of BTE's statement of cash flows would show:

The financing activity section of BTE's statement of cash flows would show:A) net cash provided by financing activities of $32,000.

B) net cash utilized by financing activities of $32,000.

C) net cash utilized by financing activities of $8,000.

D) net cash provided by financing activities of $8,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

8

Which type of transactions are required by generally accepted accounting principles to be disclosed either in a separate schedule at the bottom of the statement of cash flows or in a footnote to the financial statements?

A) Significant cash transactions that are classified as operating activities.

B) Significant cash transactions that are classified as investing activities.

C) Significant cash transactions that are classified as financing activities.

D) Significant noncash transactions.

A) Significant cash transactions that are classified as operating activities.

B) Significant cash transactions that are classified as investing activities.

C) Significant cash transactions that are classified as financing activities.

D) Significant noncash transactions.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

9

Cash received from customers is classified in which section of the statement of cash flows?

A) Operating

B) Investing

C) Financing

D) Noncash

A) Operating

B) Investing

C) Financing

D) Noncash

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is not true regarding the statement of cash flows?

A) It reports the impact of a firm's operating, investing, and financing activities on cash flows during the accounting period.

B) It discloses items that affect the balance sheet, but do not show up on the income statement, such as issuance of stock.

C) It is not a required component of a company's external financial statements.

D) It explains how cash changed from the end of the previous year to the end of the current year.

A) It reports the impact of a firm's operating, investing, and financing activities on cash flows during the accounting period.

B) It discloses items that affect the balance sheet, but do not show up on the income statement, such as issuance of stock.

C) It is not a required component of a company's external financial statements.

D) It explains how cash changed from the end of the previous year to the end of the current year.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

11

Given the following events, which ones affect cash flows from operating activities?

A) 2 and 3

B) 3 and 4

C) 1, 2, and 3

D) 1, 2, 3, and 4

A) 2 and 3

B) 3 and 4

C) 1, 2, and 3

D) 1, 2, 3, and 4

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

12

Justine Inc. has the following information available for 2011:  The operating activity section of Justine's statement of cash flows would show:

The operating activity section of Justine's statement of cash flows would show:

A) net cash provided by operating activities of $58,000.

B) net cash utilized by operating activities of $58,000.

C) net cash utilized by operating activities of $98,000.

D) net cash provided by operating activities of $98,000.

The operating activity section of Justine's statement of cash flows would show:

The operating activity section of Justine's statement of cash flows would show:A) net cash provided by operating activities of $58,000.

B) net cash utilized by operating activities of $58,000.

C) net cash utilized by operating activities of $98,000.

D) net cash provided by operating activities of $98,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

13

Cash received from the issuance of capital stock is classified in which section of the statement of cash flows?

A) Operating

B) Investing

C) Financing

D) Noncash

A) Operating

B) Investing

C) Financing

D) Noncash

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

14

Cash paid to purchase equipment is classified in which section of the statement of cash flows?

A) Operating

B) Investing

C) Financing

D) Noncash

A) Operating

B) Investing

C) Financing

D) Noncash

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

15

Cash received from the borrowing on a note payable is classified in which section of the statement of cash flows?

A) Operating

B) Investing

C) Financing

D) Noncash

A) Operating

B) Investing

C) Financing

D) Noncash

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

16

Cash received from the sale of property is classified in which section of the statement of cash flows?

A) Operating

B) Investing

C) Financing

D) Noncash

A) Operating

B) Investing

C) Financing

D) Noncash

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

17

Cash received from the sale of long-term investments is classified in which section of the statement of cash flows?

A) Operating

B) Investing

C) Financing

D) Noncash

A) Operating

B) Investing

C) Financing

D) Noncash

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

18

The main purpose of the statement of cash flows is to provide information about:

A) a company's revenues and expenses for a period of time.

B) a company's assets, liabilities, and stockholders' equity at a point in time.

C) the changes in stockholders' equity of a company for a period of time.

D) a company's cash inflows and outflows for a period of time.

A) a company's revenues and expenses for a period of time.

B) a company's assets, liabilities, and stockholders' equity at a point in time.

C) the changes in stockholders' equity of a company for a period of time.

D) a company's cash inflows and outflows for a period of time.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following items would not be classified as either cash or a cash equivalent for purposes of the statement of cash flows?

A) Money market account funds.

B) Treasury bill that matures in three months.

C) Treasury bill that matures in three years.

D) Checking account funds.

A) Money market account funds.

B) Treasury bill that matures in three months.

C) Treasury bill that matures in three years.

D) Checking account funds.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

20

Cash received from the sale of property, plant, and equipment is classified in which section of the statement of cash flows?

A) Operating

B) Investing

C) Financing

D) Noncash

A) Operating

B) Investing

C) Financing

D) Noncash

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

21

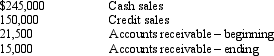

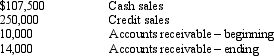

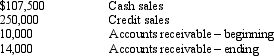

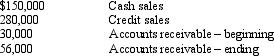

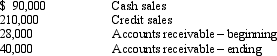

Culpepper Inc. had the following information related to last year's sales:  What amount would be reported as "cash collections from customers" on the statement of cash flows using the direct method?

What amount would be reported as "cash collections from customers" on the statement of cash flows using the direct method?

A) $238,500

B) $431,500

C) $401,500

D) $143,500

What amount would be reported as "cash collections from customers" on the statement of cash flows using the direct method?

What amount would be reported as "cash collections from customers" on the statement of cash flows using the direct method?A) $238,500

B) $431,500

C) $401,500

D) $143,500

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

22

Generally accepted accounting principles allows which of the following methods of preparing the statement of cash flows?

A) The operating, investing, and financing methods.

B) The accrual basis and cash basis of accounting methods.

C) The direct and indirect methods.

D) The cash flows and noncash flows methods.

A) The operating, investing, and financing methods.

B) The accrual basis and cash basis of accounting methods.

C) The direct and indirect methods.

D) The cash flows and noncash flows methods.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

23

Burke Inc.'s accounts receivable balance increased during the year from $300,000 to $360,000. Based on this information, which of the following statements is true?

A) Cash received from customers was greater than sales revenue recorded during the year.

B) Cash received from customers was less than sales revenue recorded during the year.

C) Cash received from customers was exactly equal to sales revenue recorded during the year.

D) Cash received from customers was higher than cash paid to suppliers during the year.

A) Cash received from customers was greater than sales revenue recorded during the year.

B) Cash received from customers was less than sales revenue recorded during the year.

C) Cash received from customers was exactly equal to sales revenue recorded during the year.

D) Cash received from customers was higher than cash paid to suppliers during the year.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

24

When using the indirect method of preparing a statement of cash flows, which of the following items would need to be added to net income in order to reconcile to cash provided by operating activities?

A) Increase in accounts receivable

B) Decrease in liabilities

C) Depreciation expense

D) Increase in long-term loan

A) Increase in accounts receivable

B) Decrease in liabilities

C) Depreciation expense

D) Increase in long-term loan

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

25

When using the indirect method of preparing a statement of cash flows, which of the following items would need to be deducted from net income in order to reconcile to cash provided by operating activities?

A) Increase in accounts payable

B) Increase in accounts receivable

C) Depreciation expense

D) Increase in property, plant, and equipment

A) Increase in accounts payable

B) Increase in accounts receivable

C) Depreciation expense

D) Increase in property, plant, and equipment

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

26

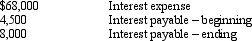

Lineberger Corporation had the following information available from its 2011 balance sheet and income statement:  What amount would be reported as cash outflows for interest on the statement of cash flows for 2011 using the direct method?

What amount would be reported as cash outflows for interest on the statement of cash flows for 2011 using the direct method?

A) $71,500

B) $80,500

C) $64,500

D) $55,500

What amount would be reported as cash outflows for interest on the statement of cash flows for 2011 using the direct method?

What amount would be reported as cash outflows for interest on the statement of cash flows for 2011 using the direct method?A) $71,500

B) $80,500

C) $64,500

D) $55,500

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

27

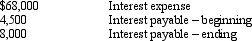

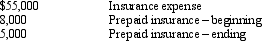

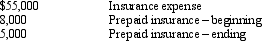

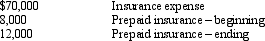

McClintock Inc. had the following information available from its 2011 balance sheet and income statement:  What amount would be reported as cash outflows for insurance on the statement of cash flows for 2011 using the direct method?

What amount would be reported as cash outflows for insurance on the statement of cash flows for 2011 using the direct method?

A) $70,000

B) $10,000

C) $20,000

D) $25,000

What amount would be reported as cash outflows for insurance on the statement of cash flows for 2011 using the direct method?

What amount would be reported as cash outflows for insurance on the statement of cash flows for 2011 using the direct method?A) $70,000

B) $10,000

C) $20,000

D) $25,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

28

Jazzy Inc. reported sales revenue of $550,000 on their income statement for 2011. From the beginning until the end of 2011, accounts receivables increased by a net amount of $35,000. How much "cash collections from customers" should Jazzy report for 2011 on their statement of cash flows?

A) $550,000

B) $585,000

C) $515,000

D) $ 35,000

A) $550,000

B) $585,000

C) $515,000

D) $ 35,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

29

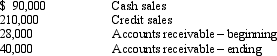

Pomander Inc. had the following information related to last year's sales:  What amount would be reported as "cash collections from customers" on the statement of cash flows using the direct method?

What amount would be reported as "cash collections from customers" on the statement of cash flows using the direct method?

A) $254,000

B) $381,500

C) $111,500

D) $353,500

What amount would be reported as "cash collections from customers" on the statement of cash flows using the direct method?

What amount would be reported as "cash collections from customers" on the statement of cash flows using the direct method?A) $254,000

B) $381,500

C) $111,500

D) $353,500

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

30

Chatham Corp. reported sales revenue of $98,000 on their income statement for 2011. From the beginning until the end of 2011, accounts receivables decreased by a net amount of $9,000. How much "cash collections from customers" should Chatham report for 2011 on their statement of cash flows?

A) $ 98,000

B) $ 89,000

C) $ 9,000

D) $107,000

A) $ 98,000

B) $ 89,000

C) $ 9,000

D) $107,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

31

Simmon Incorporation's cost of goods purchased amounted to $20,000. From the beginning until the end of 2011, accounts payable increased by a net amount of $7,000. How much "cash outflows for purchases" should Simmons report for 2011 on their statement of cash flows?

A) $ 7,000

B) $13,000

C) $20,000

D) $27,000

A) $ 7,000

B) $13,000

C) $20,000

D) $27,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

32

Given the following events, which ones affect cash flows from financing activities?

A) 1 and 2

B) 3 and 4

C) 2 and 4

D) 1, 2, 3, and 4

A) 1 and 2

B) 3 and 4

C) 2 and 4

D) 1, 2, 3, and 4

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

33

The collection of interest revenue will be depicted on the statement of cash flows as a:

A) cash inflow from an operating activity.

B) cash inflow from an investing activity.

C) cash outflow for a financing activity.

D) cash inflow from a financing activity.

A) cash inflow from an operating activity.

B) cash inflow from an investing activity.

C) cash outflow for a financing activity.

D) cash inflow from a financing activity.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

34

Peter Piper Inc. had the following information available from its 2011 balance sheet and income statement:  What amount would be reported as cash outflows for insurance on the statement of cash flows for 2011 using the direct method?

What amount would be reported as cash outflows for insurance on the statement of cash flows for 2011 using the direct method?

A) $68,000

B) $58,000

C) $42,000

D) $52,000

What amount would be reported as cash outflows for insurance on the statement of cash flows for 2011 using the direct method?

What amount would be reported as cash outflows for insurance on the statement of cash flows for 2011 using the direct method?A) $68,000

B) $58,000

C) $42,000

D) $52,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

35

The difference between the direct method and the indirect methods of preparing the statement of cash flows is primarily visible in which of the following sections?

A) Operating activities section only

B) Investing activities section only

C) Both operating and investing activities

D) Both investing and financing activities

A) Operating activities section only

B) Investing activities section only

C) Both operating and investing activities

D) Both investing and financing activities

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

36

When using the indirect method of preparing a statement of cash flows, which of the following items would need to be deducted from net income in order to reconcile to cash provided by operating activities?

A) Gain on sale of property, plant, and equipment

B) Decrease in prepaid insurance

C) Depreciation expense

D) Increase in salaries payable

A) Gain on sale of property, plant, and equipment

B) Decrease in prepaid insurance

C) Depreciation expense

D) Increase in salaries payable

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

37

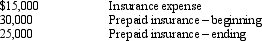

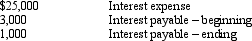

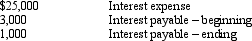

Tuffet Corporation had the following information available from its 2011 balance sheet and income statement:  What amount would be reported as cash outflows for interest on the statement of cash flows for 2011 using the direct method?

What amount would be reported as cash outflows for interest on the statement of cash flows for 2011 using the direct method?

A) $27,000

B) $29,000

C) $21,000

D) $23,000

What amount would be reported as cash outflows for interest on the statement of cash flows for 2011 using the direct method?

What amount would be reported as cash outflows for interest on the statement of cash flows for 2011 using the direct method?A) $27,000

B) $29,000

C) $21,000

D) $23,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following statements is true about the indirect method of preparing the operating activities section on a statement of cash flows?

A) It adjusts cash basis net income to accrual basis net income.

B) It adjusts accrual basis net income to cash provided by operating activities.

C) It adjusts accrual basis net income to budgeted net income.

D) It adjusts cash basis net income to budgeted net income.

A) It adjusts cash basis net income to accrual basis net income.

B) It adjusts accrual basis net income to cash provided by operating activities.

C) It adjusts accrual basis net income to budgeted net income.

D) It adjusts cash basis net income to budgeted net income.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

39

Paxton Inc. had the following information related to last year's sales:  What amount would be reported as "cash collections from customers" on the statement of cash flows using the direct method?

What amount would be reported as "cash collections from customers" on the statement of cash flows using the direct method?

A) $404,000

B) $176,000

C) $516,000

D) $306,000

What amount would be reported as "cash collections from customers" on the statement of cash flows using the direct method?

What amount would be reported as "cash collections from customers" on the statement of cash flows using the direct method?A) $404,000

B) $176,000

C) $516,000

D) $306,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

40

The payment of interest expense will be depicted on the statement of cash flows as a:

A) cash inflow from an operating activity.

B) cash outflow for an investing activity.

C) cash inflow from a financing activity.

D) cash outflow for an operating activity.

A) cash inflow from an operating activity.

B) cash outflow for an investing activity.

C) cash inflow from a financing activity.

D) cash outflow for an operating activity.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

41

Caldwell Corp.'s cost of goods purchased amounts to $900,000 for 2011. From the beginning until the end of 2011, their accounts payable decreased by a net amount of $95,000. How much "cash outflows for purchases" should Caldwell report for 2011 on their statement of cash flows?

A) $ 95,000

B) $900,000

C) $995,000

D) $805,000

A) $ 95,000

B) $900,000

C) $995,000

D) $805,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

42

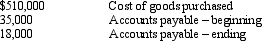

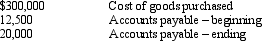

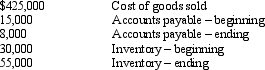

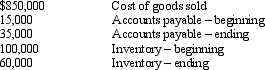

Crenshaw Inc. had the following information related to last year's purchases:  What amount would be reported as "cash outflows for purchases" on the statement of cash flows using the direct method?

What amount would be reported as "cash outflows for purchases" on the statement of cash flows using the direct method?

A) $527,000

B) $493,000

C) $475,000

D) $457,000

What amount would be reported as "cash outflows for purchases" on the statement of cash flows using the direct method?

What amount would be reported as "cash outflows for purchases" on the statement of cash flows using the direct method?A) $527,000

B) $493,000

C) $475,000

D) $457,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

43

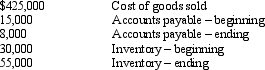

Felton Inc. had the following information related to last year's purchases:  What amount would be reported as "cash outflows for purchases" on the statement of cash flows using the direct method?

What amount would be reported as "cash outflows for purchases" on the statement of cash flows using the direct method?

A) $307,500

B) $292,500

C) $312,500

D) $280,000

What amount would be reported as "cash outflows for purchases" on the statement of cash flows using the direct method?

What amount would be reported as "cash outflows for purchases" on the statement of cash flows using the direct method?A) $307,500

B) $292,500

C) $312,500

D) $280,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

44

What is the purpose of a statement of cash flows?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

45

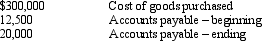

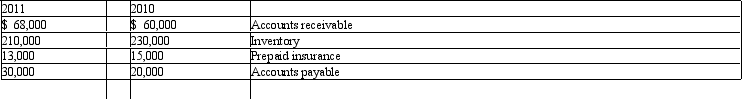

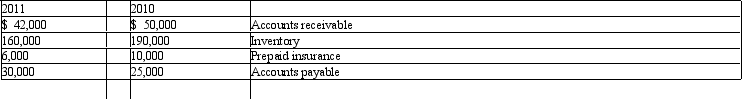

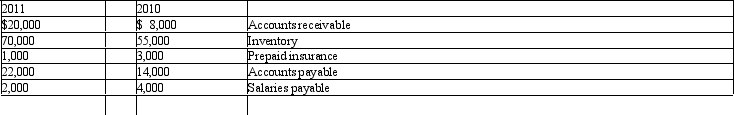

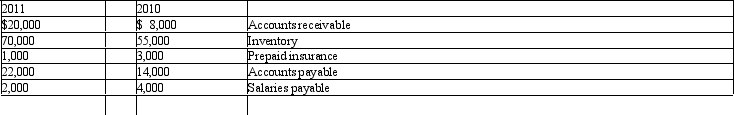

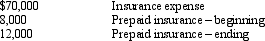

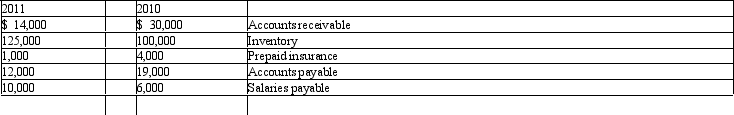

Gregson Company had the following noncash current asset and current liabilities balances at the end of 2010 and 2011:  Net income for 2011 was $750,000 and depreciation expense was $40,000. All sales and all purchases are on account. Gregson uses the indirect method for preparing the statement of cash flows.

Net income for 2011 was $750,000 and depreciation expense was $40,000. All sales and all purchases are on account. Gregson uses the indirect method for preparing the statement of cash flows.

Net cash flows from operating activities for 2011 would be:

A) $814,000

B) $774,000

C) $786,000

D) $766,000

Net income for 2011 was $750,000 and depreciation expense was $40,000. All sales and all purchases are on account. Gregson uses the indirect method for preparing the statement of cash flows.

Net income for 2011 was $750,000 and depreciation expense was $40,000. All sales and all purchases are on account. Gregson uses the indirect method for preparing the statement of cash flows.Net cash flows from operating activities for 2011 would be:

A) $814,000

B) $774,000

C) $786,000

D) $766,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

46

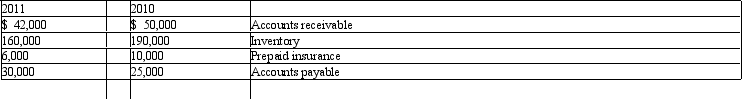

Clyde's Clothing Inc. comparative balance sheets and income statements showed the following information for 2010 and 2011:  Clyde's accounts payable balances are composed solely of amounts due to suppliers for purchases of inventory. What is the amount of cash payments for inventory that Clyde should report on its 2011 statement of cash flows assuming that the direct method is used?

Clyde's accounts payable balances are composed solely of amounts due to suppliers for purchases of inventory. What is the amount of cash payments for inventory that Clyde should report on its 2011 statement of cash flows assuming that the direct method is used?

A) $387,000

B) $413,000

C) $497,000

D) $303,000

Clyde's accounts payable balances are composed solely of amounts due to suppliers for purchases of inventory. What is the amount of cash payments for inventory that Clyde should report on its 2011 statement of cash flows assuming that the direct method is used?

Clyde's accounts payable balances are composed solely of amounts due to suppliers for purchases of inventory. What is the amount of cash payments for inventory that Clyde should report on its 2011 statement of cash flows assuming that the direct method is used?A) $387,000

B) $413,000

C) $497,000

D) $303,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

47

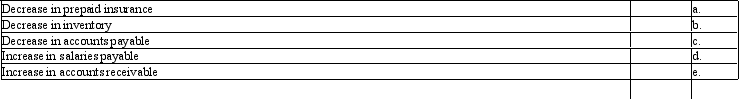

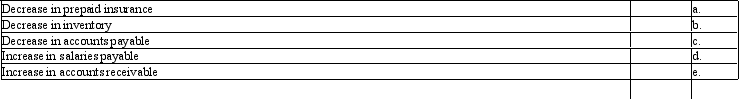

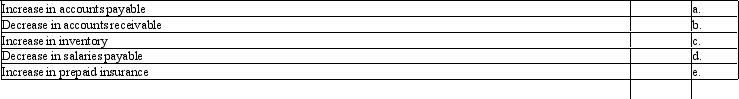

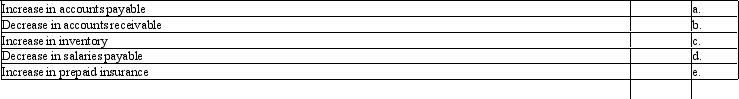

For each of the following asset and liability balance changes from the beginning to the end of the year, indicate whether the change should be added to (+) or subtracted from (-) net income for purposes of preparing the operating activity section of the statement of cash flows using the indirect method.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

48

Burrows Inc. had an outstanding loan at the beginning of 2011 totaling $50,000. During 2011, $16,800 was paid out related to this loan broken down as follows: $15,000 towards principal and $1,800 in interest. Which of the following statements is correct regarding how the $16,800 payment should be depicted on the statement of cash flows?

A) The entire $16,800 should be shown as a cash outflow for financing activities.

B) The entire $16,800 should be shown as a cash outflow for investing activities.

C) The $15,000 principal portion should be shown as a cash outflow for financing activities, and the $1,800 in interest should be shown as a cash outflow for operating activities.

D) The $15,000 principal portion should be shown as a cash outflow for investing activities, and the $1,800 in interest should be shown as a cash outflow for operating activities.

A) The entire $16,800 should be shown as a cash outflow for financing activities.

B) The entire $16,800 should be shown as a cash outflow for investing activities.

C) The $15,000 principal portion should be shown as a cash outflow for financing activities, and the $1,800 in interest should be shown as a cash outflow for operating activities.

D) The $15,000 principal portion should be shown as a cash outflow for investing activities, and the $1,800 in interest should be shown as a cash outflow for operating activities.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

49

Why are noncash transactions included on the statement of cash flows? Provide an example of a noncash transaction that would be reported on the statement of cash flows.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

50

How do the direct and indirect methods of preparing the statement of cash flows differ?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

51

The statement of cash flows divides all transactions that affect a company's cash into three types of activities. List and briefly describe each of these activities.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

52

For each of the following asset and liability balance changes from the beginning to the end of the year, indicate whether the change should be added to (+) or subtracted from (-) net income for purposes of preparing the operating activity section of the statement of cash flows using the indirect method.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

53

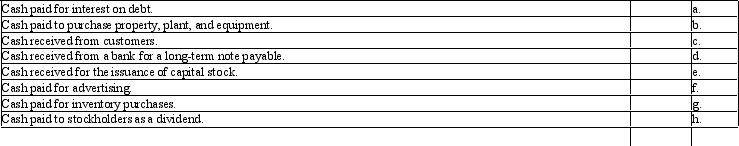

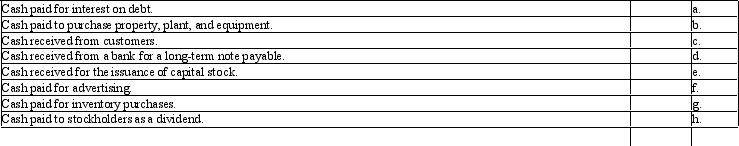

For each of the following activities, indicate whether they would be classified as operating (O), investing (I), or financing (F) activities for purposes of the statement of cash flows:

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

54

Atlantic Inc. had the following noncash current asset and current liabilities balances at the end of 2010 and 2011:  Net income for 2011 was $940,000 and depreciation expense was $25,000. All sales and all purchases are on account. Atlantic uses the indirect method for preparing the statement of cash flows.

Net income for 2011 was $940,000 and depreciation expense was $25,000. All sales and all purchases are on account. Atlantic uses the indirect method for preparing the statement of cash flows.

Net cash flows from operating activities for 2011 would be:

A) $ 918,000

B) $1,012,000

C) $1,002,000

D) $ 987,000

Net income for 2011 was $940,000 and depreciation expense was $25,000. All sales and all purchases are on account. Atlantic uses the indirect method for preparing the statement of cash flows.

Net income for 2011 was $940,000 and depreciation expense was $25,000. All sales and all purchases are on account. Atlantic uses the indirect method for preparing the statement of cash flows.Net cash flows from operating activities for 2011 would be:

A) $ 918,000

B) $1,012,000

C) $1,002,000

D) $ 987,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

55

What is a cash equivalent? Provide one example of a cash equivalent.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

56

Haley Inc. had the following information related to last year's purchases:  What amount would be reported as "cash outflows for purchases" on the statement of cash flows using the direct method?

What amount would be reported as "cash outflows for purchases" on the statement of cash flows using the direct method?

A) $93,000

B) $87,000

C) $77,000

D) $83,000

What amount would be reported as "cash outflows for purchases" on the statement of cash flows using the direct method?

What amount would be reported as "cash outflows for purchases" on the statement of cash flows using the direct method?A) $93,000

B) $87,000

C) $77,000

D) $83,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

57

For each of the following activities, indicate whether they would be classified as operating (O), investing (I), or financing (F) activities for purposes of the statement of cash flows:

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

58

The payment of a cash dividend will be depicted on the statement of cash flows as a:

A) cash inflow from an operating activity.

B) cash outflow for an investing activity.

C) cash outflow for a financing activity.

D) cash outflow for an operating activity.

A) cash inflow from an operating activity.

B) cash outflow for an investing activity.

C) cash outflow for a financing activity.

D) cash outflow for an operating activity.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

59

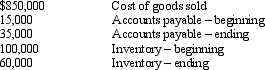

Skipper's Souvenir Shop had comparative balance sheets and income statements that showed the following information for 2010 and 2011:  Skipper's accounts payable balances are composed solely of amounts due to suppliers for purchases of inventory. What is the amount of cash payments for inventory that Skipper should report on its 2011 statement of cash flows assuming that the direct method is used?

Skipper's accounts payable balances are composed solely of amounts due to suppliers for purchases of inventory. What is the amount of cash payments for inventory that Skipper should report on its 2011 statement of cash flows assuming that the direct method is used?

A) $690,000

B) $710,000

C) $850,000

D) $550,000

Skipper's accounts payable balances are composed solely of amounts due to suppliers for purchases of inventory. What is the amount of cash payments for inventory that Skipper should report on its 2011 statement of cash flows assuming that the direct method is used?

Skipper's accounts payable balances are composed solely of amounts due to suppliers for purchases of inventory. What is the amount of cash payments for inventory that Skipper should report on its 2011 statement of cash flows assuming that the direct method is used?A) $690,000

B) $710,000

C) $850,000

D) $550,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

60

Why can't a decision-maker use sales revenue and expense information provided on the income statement as a measure of cash inflows and outflows from operating activities?

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

61

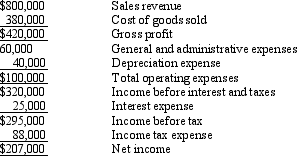

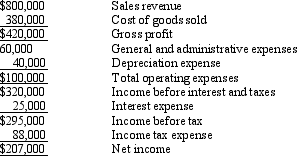

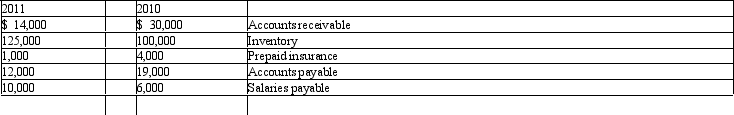

The following account balances are for the noncash current assets and current liabilities of Sam's Surfboard Shop for 2010 and 2011:

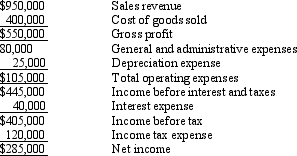

In addition, the income statement for 2011 is as follows:

In addition, the income statement for 2011 is as follows:

Required: Prepare the operating activities section of the statement of cash flows using the indirect method.

Required: Prepare the operating activities section of the statement of cash flows using the indirect method.

In addition, the income statement for 2011 is as follows:

In addition, the income statement for 2011 is as follows: Required: Prepare the operating activities section of the statement of cash flows using the indirect method.

Required: Prepare the operating activities section of the statement of cash flows using the indirect method.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

62

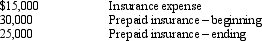

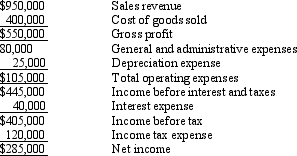

MTM Inc. had the following information available from its 2011 balance sheet and income statement:

Required: Compute the amount that would be reported as "cash paid for insurance" on the statement of cash flows using the direct method.

Required: Compute the amount that would be reported as "cash paid for insurance" on the statement of cash flows using the direct method.

Required: Compute the amount that would be reported as "cash paid for insurance" on the statement of cash flows using the direct method.

Required: Compute the amount that would be reported as "cash paid for insurance" on the statement of cash flows using the direct method.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

63

The following account balances are for the noncash current assets and current liabilities of Eloise's Furniture Shop for 2010 and 2011:

In addition, the income statement for 2011 is as follows:

In addition, the income statement for 2011 is as follows:

Required: Prepare the operating activities section of the statement of cash flows using the indirect method.

Required: Prepare the operating activities section of the statement of cash flows using the indirect method.

In addition, the income statement for 2011 is as follows:

In addition, the income statement for 2011 is as follows: Required: Prepare the operating activities section of the statement of cash flows using the indirect method.

Required: Prepare the operating activities section of the statement of cash flows using the indirect method.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

64

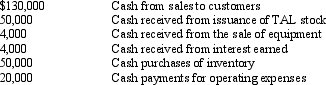

You are given the following transaction information for the TAL Corporation for 2011:

Required: Prepare a statement of cash flows using the direct method for TAL Corporation for 2011.

Required: Prepare a statement of cash flows using the direct method for TAL Corporation for 2011.

Required: Prepare a statement of cash flows using the direct method for TAL Corporation for 2011.

Required: Prepare a statement of cash flows using the direct method for TAL Corporation for 2011.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

65

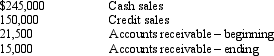

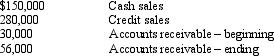

Vargas Inc. had the following information related to last year's sales:

Required: Compute the amount that would be reported as "cash collections from customers" on the statement of cash flows using the direct method.

Required: Compute the amount that would be reported as "cash collections from customers" on the statement of cash flows using the direct method.

Required: Compute the amount that would be reported as "cash collections from customers" on the statement of cash flows using the direct method.

Required: Compute the amount that would be reported as "cash collections from customers" on the statement of cash flows using the direct method.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

66

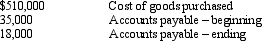

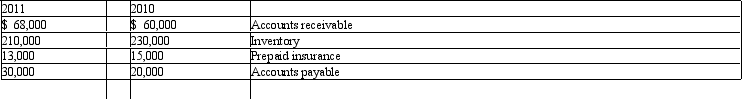

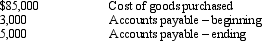

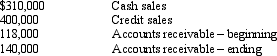

The following information relates O'Hara Products Inc.:

O'Hara's accounts payable balances are composed solely of amounts due to suppliers for inventory purchases.

O'Hara's accounts payable balances are composed solely of amounts due to suppliers for inventory purchases.

Required: Compute the amount that would be reported as "cash paid for purchases" on the statement of cash flows using the direct method.

O'Hara's accounts payable balances are composed solely of amounts due to suppliers for inventory purchases.

O'Hara's accounts payable balances are composed solely of amounts due to suppliers for inventory purchases.Required: Compute the amount that would be reported as "cash paid for purchases" on the statement of cash flows using the direct method.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

67

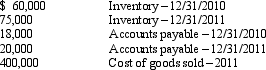

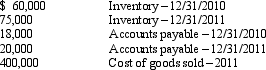

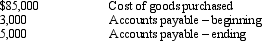

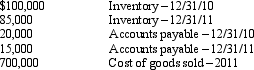

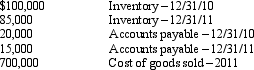

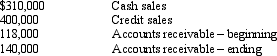

The following information relates to Finnegan Inc.:

Finnegan's accounts payable balances are composed solely of amounts due to suppliers for inventory purchases.

Finnegan's accounts payable balances are composed solely of amounts due to suppliers for inventory purchases.

Required: Compute the amount that would be reported as "cash paid for purchases" on the statement of cash flows using the direct method.

Finnegan's accounts payable balances are composed solely of amounts due to suppliers for inventory purchases.

Finnegan's accounts payable balances are composed solely of amounts due to suppliers for inventory purchases.Required: Compute the amount that would be reported as "cash paid for purchases" on the statement of cash flows using the direct method.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

68

Poindexter Inc. had the following information related to last year's sales:

Required: Compute the amount that would be reported as "cash collections from customers" on the statement of cash flows using the direct method.

Required: Compute the amount that would be reported as "cash collections from customers" on the statement of cash flows using the direct method.

Required: Compute the amount that would be reported as "cash collections from customers" on the statement of cash flows using the direct method.

Required: Compute the amount that would be reported as "cash collections from customers" on the statement of cash flows using the direct method.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck