Deck 22: Nature and Form of Commercial Paper

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

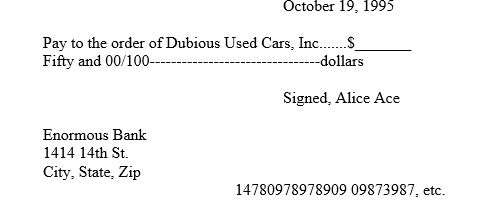

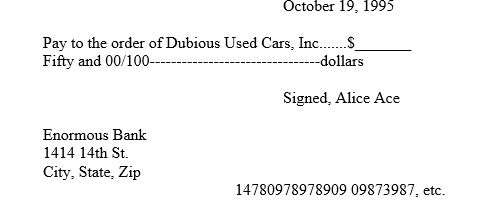

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/52

Play

Full screen (f)

Deck 22: Nature and Form of Commercial Paper

1

A drawer is an unconditional written order by one person directing another person to pay a certain sum of money on demand or at a definite time to a named third person or to bearer.

False

2

The drawee is the person or entity that a draft is directed to and that is ordered to pay the amount stated on it.

True

3

Negotiability is determined by the mere form of the instrument.

True

4

A missing due date on an instrument renders it incomplete.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

5

State law governing commercial paper is vulnerable to federal preemption.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

6

Able made a note payable to Baker; Baker negotiated the note to Carr. Carr has the same standing as an assignee of a contract.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

7

"Negotiability" means that the paper is freely and unconditionally transferable from one person to another by delivery or by delivery and indorsement.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

8

If an instrument has no stated time for payment it is payable on demand.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

9

If an instrument contains a promise to pay out of a particular fund it is not negotiable.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

10

Unless the date of an instrument is required to determine when it is payable, an undated instrument can still be negotiable

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

11

A time draft calls for payment "on sight"; that is, when presented.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

12

The Promissory Notes Act prohibits an assignee from suing the note's maker.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

13

A check is a draft payable on demand.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

14

The indorser is one who transfers ownership of a negotiable instrument by signing it.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

15

Bank acceptance of a check is called a promissory note.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

16

A promissory note does not effectively gain value by reason of its assignability.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

17

A negotiable instrument not payable to a particular person cannot be paid to anyone.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

18

An instrument payable to order is one that will be paid to a particular person or organization identifiable in advance.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

19

A draft is an unconditional order by one person (the drawer) directing another person (drawee or payor) to pay money to a named third person or to bearer.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

20

Banker's acceptance is a short-term credit investment created by a non-financial firm and guaranteed by a bank.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is not necessary for an instrument to be negotiable? It must . . .

A) be signed

B) contain a promise or an order to pay

C) must be for a certain amount

D) must be payable on demand

E) have been acquired for consideration

A) be signed

B) contain a promise or an order to pay

C) must be for a certain amount

D) must be payable on demand

E) have been acquired for consideration

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

22

The Uniform Commercial Code defines a _____ as a draft drawn on a bank and payable on demand.

A) promissory note

B) certificate of delivery

C) certificate of deposit

D) bill of exchange

E) check

A) promissory note

B) certificate of delivery

C) certificate of deposit

D) bill of exchange

E) check

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

23

A _____ calls for payment on a date specified in the written order.

A) bill of exchange

B) check

C) time draft

D) banker's acceptance

E) promissory note

A) bill of exchange

B) check

C) time draft

D) banker's acceptance

E) promissory note

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

24

Of the following, who can become an acceptor?

A) The person to whom a note or bill is indorsed

B) A drawer who directs the bank to pay a sum of money

C) The person who is to receive payment on a draft or note

D) A drawee who signs the draft

E) One who has legal possession of a draft

A) The person to whom a note or bill is indorsed

B) A drawer who directs the bank to pay a sum of money

C) The person who is to receive payment on a draft or note

D) A drawee who signs the draft

E) One who has legal possession of a draft

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

25

An "I.O.U." is not a negotiable instrument.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

26

A bill of exchange drawn on another party is called a _____.

A) time draft

B) trade draft

C) sight draft

D) bank draft

E) banker's acceptance

A) time draft

B) trade draft

C) sight draft

D) bank draft

E) banker's acceptance

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

27

The drawee is:

A) one who directs a person or entity, usually a bank, to pay a sum of money stated in an instrument.

B) the person or entity that a draft is directed to and that is ordered to pay the amount stated on it.

C) the one who pledges to honor the draft as written.

D) the party that signs a promissory note.

E) one who has legal possession of a draft, note, or other negotiable instrument and who is entitled to payment.

A) one who directs a person or entity, usually a bank, to pay a sum of money stated in an instrument.

B) the person or entity that a draft is directed to and that is ordered to pay the amount stated on it.

C) the one who pledges to honor the draft as written.

D) the party that signs a promissory note.

E) one who has legal possession of a draft, note, or other negotiable instrument and who is entitled to payment.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

28

A _____ is drawn on the account of the bank itself and signed by an authorized bank representative in return for a cash payment to it from the customer.

A) certified check

B) cashier's check

C) traveler's check

D) money order

E) blank check

A) certified check

B) cashier's check

C) traveler's check

D) money order

E) blank check

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

29

The Holly Hill Acres, Ltd. v. Charter Bank of Gainesville case is about _____.

A) certification

B) checks

C) certificates of deposit

D) indorsement

E) negotiability

A) certification

B) checks

C) certificates of deposit

D) indorsement

E) negotiability

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

30

A banker's acceptance is:

A) a debt instrument issued by a bank and that which usually pays interest.

B) a negotiable instrument drawn against deposited funds, to pay a specified amount of money to a specific person upon demand.

C) the acceptance by a drawee of a check or draft.

D) a short-term credit investment created by a non-financial firm and guaranteed by a bank.

E) a written order by one person to pay a sum of money to a third person.

A) a debt instrument issued by a bank and that which usually pays interest.

B) a negotiable instrument drawn against deposited funds, to pay a specified amount of money to a specific person upon demand.

C) the acceptance by a drawee of a check or draft.

D) a short-term credit investment created by a non-financial firm and guaranteed by a bank.

E) a written order by one person to pay a sum of money to a third person.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

31

The benefit to negotiability is that the holder of the instrument takes free of most of the obligor's possible defenses.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

32

A certificate of deposit is not negotiable.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

33

The _____ is one who directs a person or entity, usually a bank, to pay a sum of money stated in an instrument.

A) warehouser

B) shipper

C) bailee

D) holder

E) drawer

A) warehouser

B) shipper

C) bailee

D) holder

E) drawer

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

34

The Newman v. Manufacturers Nat. Bank of Detroit case is about _____.

A) negotiability

B) undated instruments

C) certification

D) non-sufficient funds

E) parties to a draft

A) negotiability

B) undated instruments

C) certification

D) non-sufficient funds

E) parties to a draft

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

35

A post-dated instrument is not negotiable.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

36

The person who signs a check promising to pay is a drawee.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

37

A(n) _____ is a written acknowledgment by a bank that it has received money and agrees to repay it at the specified time.

A) indorsement

B) postdated check

C) certificate of deposit

D) time draft

E) promissory note

A) indorsement

B) postdated check

C) certificate of deposit

D) time draft

E) promissory note

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

38

_____ means that the commercial paper is freely and unconditionally transferable from one person to another by delivery or by delivery and indorsement.

A) Bailment

B) Vertical privity

C) Statute of repose

D) Negotiability

E) Implied warranty

A) Bailment

B) Vertical privity

C) Statute of repose

D) Negotiability

E) Implied warranty

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

39

A(n) _____ is one who signs a negotiable instrument in order to lend her name to another party to the instrument.

A) bearer

B) indorser

C) shipper

D) accommodation party

E) holder in due course

A) bearer

B) indorser

C) shipper

D) accommodation party

E) holder in due course

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

40

A(n) _____ is one who transfers ownership of a negotiable instrument by signing it.

A) indorser

B) holder

C) payee

D) holder

E) drawer

A) indorser

B) holder

C) payee

D) holder

E) drawer

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

41

A check made by a bank employee drawn on the bank itse________________.

A) sight draft

B) time draft

C) cashier's check

D) certified check

E) trade acceptance

A) sight draft

B) time draft

C) cashier's check

D) certified check

E) trade acceptance

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

42

What are checks?

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

43

"We promise to pay Big Transmission Co., or order, $800, payment to be made from our account #2. Signed, Dubious Used Cars, Inc, Dubious, Pres."

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

44

Sally Student to the University for her final tuition payment, a paper including this statement: "to be paid out of my first month's income after graduation."

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

45

A gave B this paper: "I promise to pay to the order of B $350 when B delivers selected dining room furniture to my house. Signed, A."

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

46

By Dubious to Shady: "I owe Shady $250 which I will pay him on demand. Signed, Dubious."

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

47

"October 10, 1995. I promise to pay Dubious Used Cars $6000, thirty days after date. Signed, Betty Baker."

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

48

"On or before January 15, 2020, I promise to pay DUC $13,000 in the form of antique auto parts, quantity and quality approved by both parties."

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

49

The person who signs a note, promising to p_____________.

A) drawee

B) maker

C) payor

D) accommodation party

E) drawer

A) drawee

B) maker

C) payor

D) accommodation party

E) drawer

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

50

To Dubious from a Mexican national, a note in proper form but payable in Mexican pesos.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

51

Say whether each of the following is negotiable or not, and why.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

52

Explain the two types of drafts.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck