Deck 8: Employer Taxes, Payments, and Reports

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/94

Play

Full screen (f)

Deck 8: Employer Taxes, Payments, and Reports

1

To which of the following payroll taxes are employers required to contribute a matching portion for each employee?

A) State unemployment

B) Federal unemployment

C) FICA Medicare

D) FICA Social Security

E) All of these

A) State unemployment

B) Federal unemployment

C) FICA Medicare

D) FICA Social Security

E) All of these

C

2

The entry to record the payroll tax expense includes all of the following except

A) Federal Unemployment Tax Payable.

B) FICA Tax Payable.

C) Employees' Federal Income Tax Payable.

D) State Unemployment Tax Payable.

E) None of these are correct.

A) Federal Unemployment Tax Payable.

B) FICA Tax Payable.

C) Employees' Federal Income Tax Payable.

D) State Unemployment Tax Payable.

E) None of these are correct.

C

3

Wages Payable is used to record:

A) Employee Gross Pay

B) Employee Net Pay

C) Cumulative Employee Earnings

D) Deductions and Taxes

A) Employee Gross Pay

B) Employee Net Pay

C) Cumulative Employee Earnings

D) Deductions and Taxes

B

4

Which of the following payroll taxes has a maximum of earnings subject to the tax?

A) State unemployment tax

B) FICA Social Security

C) FICA Medicare

D) All of these

E) Both state unemployment tax and FICA Social Security

A) State unemployment tax

B) FICA Social Security

C) FICA Medicare

D) All of these

E) Both state unemployment tax and FICA Social Security

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

5

Payroll tax expense represents the amount of taxes contributed by the

A) employee.

B) employer.

C) employee and employer combined.

D) employer plus gross pay.

E) employer plus the employee's net pay.

A) employee.

B) employer.

C) employee and employer combined.

D) employer plus gross pay.

E) employer plus the employee's net pay.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

6

The entry to record the employer's payroll taxes includes a

A) credit to Employees' Federal Income Tax Payable.

B) debit to FICA Tax Expense.

C) debit to Salaries Payable.

D) credit to FICA Tax Payable.

E) debit to Federal Unemployment Tax Payable.

A) credit to Employees' Federal Income Tax Payable.

B) debit to FICA Tax Expense.

C) debit to Salaries Payable.

D) credit to FICA Tax Payable.

E) debit to Federal Unemployment Tax Payable.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

7

Payroll Tax Expense includes all of the following EXCEPT:

A) FICA Taxes Payable

B) SUTA

C) FUTA

D) Federal Income Tax Withheld

A) FICA Taxes Payable

B) SUTA

C) FUTA

D) Federal Income Tax Withheld

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

8

Form 940 is filled by employers to submit:

A) Employer's Annual Federal Unemployment (FUTA) Tax Return.

B) Employer's Annual Federal State Employment (FSTA) Tax Return.

C) Employer's Annual Municipal Employment (META) Tax Return.

D) Employer's Annual State Income (STA) Tax Return.

E) Employer's Annual Federal Unemployment (FUTA) Tax Return.

A) Employer's Annual Federal Unemployment (FUTA) Tax Return.

B) Employer's Annual Federal State Employment (FSTA) Tax Return.

C) Employer's Annual Municipal Employment (META) Tax Return.

D) Employer's Annual State Income (STA) Tax Return.

E) Employer's Annual Federal Unemployment (FUTA) Tax Return.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

9

Mary Jane's cumulative year-to-date earnings are $7,200. On June 30th, Mary Jane earned $600. What is the FUTA tax amount that Mary Jane's employer must record and pay on her most recent earnings?

A) $0

B) $4.80

C) $52.80

D) $56.00

A) $0

B) $4.80

C) $52.80

D) $56.00

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

10

Employer Payroll Tax liability occurs when:

A) The employee comes to work

B) The payroll journal entry is completed

C) When the employee is actually paid

D) When the payroll liability is paid

A) The employee comes to work

B) The payroll journal entry is completed

C) When the employee is actually paid

D) When the payroll liability is paid

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following amounts does Form 941 ask for?

A) Total number of employees during the quarter

B) Total wages and tips subject to federal tax withholding

C) Total federal income tax withheld

D) All of these

E) None of these

A) Total number of employees during the quarter

B) Total wages and tips subject to federal tax withholding

C) Total federal income tax withheld

D) All of these

E) None of these

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is withheld by the employers from the salaries of their employees?

A) Medicare taxes

B) Gift taxes

C) Estate taxes

D) Infrastructure taxes

E) Property taxes

A) Medicare taxes

B) Gift taxes

C) Estate taxes

D) Infrastructure taxes

E) Property taxes

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following payroll taxes do employers pay on employees?

A) SUTA

B) FUTA

C) FICA

D) All of these

E) None of these

A) SUTA

B) FUTA

C) FICA

D) All of these

E) None of these

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

14

Steve has cumulative earnings of $7,250 and earned $700 during the current payroll period. If the state unemployment taxes (SUTA) tax is 5.4 percent, with a ceiling of $7,000, the employer liability for state unemployment taxes is:

A) $40.23.

B) $13.50.

C) $19.45.

D) $20.78.

E) $31.72.

A) $40.23.

B) $13.50.

C) $19.45.

D) $20.78.

E) $31.72.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

15

The employer's counterpart to a Social Security number is the:

A) Employer Identification Number

B) Employer Information Number

C) Employer Item Number

D) Employer Interest Number

A) Employer Identification Number

B) Employer Information Number

C) Employer Item Number

D) Employer Interest Number

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

16

The purpose of Form 941 is to report the tax liability for withholdings of employees':

A) FICA and federal income taxes.

B) FICA and property taxes.

C) State Unemployment tax (SUTA) and gift taxes.

D) Federal Unemployment tax (FUTA) and estate taxes.

E) State Unemployment tax (SUTA) and infrastructure taxes.

A) FICA and federal income taxes.

B) FICA and property taxes.

C) State Unemployment tax (SUTA) and gift taxes.

D) Federal Unemployment tax (FUTA) and estate taxes.

E) State Unemployment tax (SUTA) and infrastructure taxes.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

17

The Sales Wage Expense would be used to record:

A) Net pay for sales personnel

B) A holding account for wages due and payable

C) Gross Pay for Sales Personnel

D) Deductions for Sales Personnel

A) Net pay for sales personnel

B) A holding account for wages due and payable

C) Gross Pay for Sales Personnel

D) Deductions for Sales Personnel

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is debited in the journal entry to record the payment of the taxes shown on the quarterly 941 tax form?

A) Only Cash

B) FICA Social Security Tax Payable, FICA Medicare Tax Payable, and Employee's Federal Income Tax Payable

C) SUTA Tax Receivable (only employee), FICA Medicare Tax Payable, and Federal Income Tax Payable

D) Only Federal Income Tax Payable

E) Federal Unemployment Tax (FUTA) Payable (only employee) and Federal Income Tax Payable

A) Only Cash

B) FICA Social Security Tax Payable, FICA Medicare Tax Payable, and Employee's Federal Income Tax Payable

C) SUTA Tax Receivable (only employee), FICA Medicare Tax Payable, and Federal Income Tax Payable

D) Only Federal Income Tax Payable

E) Federal Unemployment Tax (FUTA) Payable (only employee) and Federal Income Tax Payable

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

19

Lee Loren has cumulative earnings of $6,750 and earned $745 during the current pay period. If the FUTA tax rate is 0.6 percent, with a ceiling of $7,000, the employer payroll tax expense for FUTA is

A) $54.00.

B) $5.96.

C) $0.

D) $1.50.

E) $15.00.

A) $54.00.

B) $5.96.

C) $0.

D) $1.50.

E) $15.00.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following items is considered to be a cost of having an employee?

A) Federal unemployment

B) FICA Medicare

C) FICA Social Security

D) All of these

E) None of these

A) Federal unemployment

B) FICA Medicare

C) FICA Social Security

D) All of these

E) None of these

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

21

If a company is considered to have high employee turnover, what effect does the turnover have on the Payroll Tax expenses for the business?

A) Increases payroll tax expenses

B) Decreases payroll tax expenses

C) Would not have any effect

D) May increase or decrease payroll tax expenses depending on the time of the year.

A) Increases payroll tax expenses

B) Decreases payroll tax expenses

C) Would not have any effect

D) May increase or decrease payroll tax expenses depending on the time of the year.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following statements is false?

A) Employers are required to pay FICA taxes matching the amount withheld from their employees.

B) Employers are responsible for paying FUTA Taxes.

C) Employers are responsible for withholding and remitting Federal Income Taxes.

D) Employers must file form 941 quarterly.

A) Employers are required to pay FICA taxes matching the amount withheld from their employees.

B) Employers are responsible for paying FUTA Taxes.

C) Employers are responsible for withholding and remitting Federal Income Taxes.

D) Employers must file form 941 quarterly.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

23

A debit to the Payroll Tax Expense account means:

A) The employer's payroll taxes have increased

B) The employer's payroll taxes have decreased

C) Both the employer's and the employee's payroll taxes have increased

D) The employer's and employee's payroll taxes have not changed

A) The employer's payroll taxes have increased

B) The employer's payroll taxes have decreased

C) Both the employer's and the employee's payroll taxes have increased

D) The employer's and employee's payroll taxes have not changed

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

24

What is NOT an example of internal control procedures that help prevent payroll fraud?

A) Require mandatory vacations

B) Outsource Payroll Administration

C) Conduct periodic unannounced audits

D) Make sure only one person handles payroll functions

A) Require mandatory vacations

B) Outsource Payroll Administration

C) Conduct periodic unannounced audits

D) Make sure only one person handles payroll functions

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following insurance coverages is provided by the employers for employees killed or injured on the job?

A) Estate Compensation insurance

B) Disability Endurance insurance

C) Workers' Compensation Insurance

D) Property Assurance Insurance

A) Estate Compensation insurance

B) Disability Endurance insurance

C) Workers' Compensation Insurance

D) Property Assurance Insurance

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

26

Extra hours that are added to wage information in order to increase pay is an example of:

A) Ghost Employee Fraud

B) False Wage Claim Fraud

C) False Expense Reimbursement Fraud

D) None of the above

A) Ghost Employee Fraud

B) False Wage Claim Fraud

C) False Expense Reimbursement Fraud

D) None of the above

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

27

Tom James has cumulative earnings of $6,825 and earned $750 during the current payroll period. The FUTA tax is 0.6%, with a ceiling of $7,000. What is the employers federal unemployment tax liability for the current payroll:

A) $10.50

B) $175.00

C) $1.05

D) $105.00

A) $10.50

B) $175.00

C) $1.05

D) $105.00

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

28

The journal entry required to record the employer paying the 941 payroll tax liability is:

A)

Employees' Federal

Income Tax Payable DR

FICA Taxes Payable DR

Cash CR

B)

C)

SUTA Payable DR

Cash CR

D)

A)

Employees' Federal

Income Tax Payable DR

FICA Taxes Payable DR

Cash CR

B)

C)

SUTA Payable DR

Cash CR

D)

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

29

The W-2 form contains all of the following EXCEPT:

A) Wages

B) Employee Social Security Number

C) EIN

D) Number of Allowances

A) Wages

B) Employee Social Security Number

C) EIN

D) Number of Allowances

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

30

The 940 Report is prepared and remitted:

A) Monthly

B) Quarterly

C) Annually

D) As soon as wages reach $7,000

A) Monthly

B) Quarterly

C) Annually

D) As soon as wages reach $7,000

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following entries records an employer's payroll taxes?

A) Debit to Payroll Tax Expense, credit to FICA Social Security Tax Payable, credit to FICA Medicare Tax Payable, credit to Federal Unemployment Tax Payable, and credit to State Unemployment Tax Payable

B) Debit to Federal Unemployment Tax (FUTA) Payable, Debit to State Unemployment Tax (SUTA) Payable, and credit to Payroll Tax Expense

C) Debit to Payroll Tax Payable, credit to Cash, credit to Federal Unemployment Tax Payable, and credit to State Unemployment Tax Payable

D) Debit to Federal Expense, credit to Cash

A) Debit to Payroll Tax Expense, credit to FICA Social Security Tax Payable, credit to FICA Medicare Tax Payable, credit to Federal Unemployment Tax Payable, and credit to State Unemployment Tax Payable

B) Debit to Federal Unemployment Tax (FUTA) Payable, Debit to State Unemployment Tax (SUTA) Payable, and credit to Payroll Tax Expense

C) Debit to Payroll Tax Payable, credit to Cash, credit to Federal Unemployment Tax Payable, and credit to State Unemployment Tax Payable

D) Debit to Federal Expense, credit to Cash

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following frauds refers to recording of someone in the payroll system who does not work for the business?

A) Not hired employee fraud

B) Ghost employee fraud

C) Federal expense fraud

D) Employee expense fraud

A) Not hired employee fraud

B) Ghost employee fraud

C) Federal expense fraud

D) Employee expense fraud

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

33

If a tax payment is made, what is the effect on the FICA Taxes Payable Account?

A) Increase with a, CR

B) Increase with a, DR

C) Decrease with a DR

D) Decrease with a, CR

A) Increase with a, CR

B) Increase with a, DR

C) Decrease with a DR

D) Decrease with a, CR

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following statement is true?

A) Payroll Tax Expense increases on the credit side of the account.

B) FICA Medicare Payable increases with a credit.

C) Federal Income Tax Withholding Payable decreases with a credit.

D) Employee Payroll Taxes withheld are recorded in Payroll Tax Expense.

A) Payroll Tax Expense increases on the credit side of the account.

B) FICA Medicare Payable increases with a credit.

C) Federal Income Tax Withholding Payable decreases with a credit.

D) Employee Payroll Taxes withheld are recorded in Payroll Tax Expense.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following frauds refers to improper claims made for the reimbursement of business expenses?

A) False expense reimbursement fraud

B) Misleading expense reimbursement fraud

C) Fictitious expenses claim fraud

D) False claims fraud

A) False expense reimbursement fraud

B) Misleading expense reimbursement fraud

C) Fictitious expenses claim fraud

D) False claims fraud

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

36

This form is also called the Transmittal of Wage and Tax Statement.

A) W-2

B) 941

C) 940

D) W-3

A) W-2

B) 941

C) 940

D) W-3

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

37

SUTA taxes are normally paid:

A) Annually

B) Quarterly

C) Monthly

D) Weekly

A) Annually

B) Quarterly

C) Monthly

D) Weekly

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

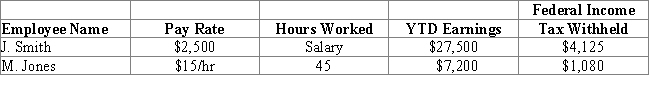

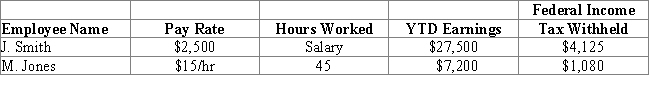

38

Colin Street Body Shop has the following information for the pay period ending March 31st: Assume the Following:

FICA-SS Tax Rate is 6.2%

FICA-Medicare Tax Rate is 1.45%

FUTA Tax Rate is 0.6% on the first $7,000 of wages paid

SUTA Tax Rate is 5% on the first $9,000 of wages paid

From the information provided above, what would be the amount of Wage Expense recorded?

A) $712.50

B) $2,500.00

C) $3,175.00

D) $3,212.50

FICA-SS Tax Rate is 6.2%

FICA-Medicare Tax Rate is 1.45%

FUTA Tax Rate is 0.6% on the first $7,000 of wages paid

SUTA Tax Rate is 5% on the first $9,000 of wages paid

From the information provided above, what would be the amount of Wage Expense recorded?

A) $712.50

B) $2,500.00

C) $3,175.00

D) $3,212.50

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

39

The number assigned to employers by the IRS for use in submitting and reporting tax payments is:

A) EIN

B) TIPN

C) iPay

D) FUTA

A) EIN

B) TIPN

C) iPay

D) FUTA

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following forms is an annual report filed by employers showing total wages paid to employees, total wages subject to federal unemployment tax, total federal unemployment tax, and other information?

A) Form 876

B) Form 940

C) Form W-3

D) Form 941-V

A) Form 876

B) Form 940

C) Form W-3

D) Form 941-V

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

41

Once the employee's income reaches the limit placed on Social Security tax, the amount deducted is reduced based on the number of exemptions claimed.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

42

The W-3 shows all of the following EXCEPT:

A) Employer Name

B) Total Company Wages

C) Employee Social Security Number

D) EIN

A) Employer Name

B) Total Company Wages

C) Employee Social Security Number

D) EIN

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

43

The employer becomes liable for payroll tax expense when the employees are actually paid.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

44

The Payroll Tax Expense account is used to record the employer's state unemployment tax, federal unemployment tax, and federal income tax.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

45

Required employee payroll deductions include income taxes, FICA taxes, union dues, and charitable contributions.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

46

Rounding differences with the employee and employer amounts of FICA taxes are handled on the 941 report by:

A) Any differences are paid in or refunded as appropriate

B) Line 7 accommodates fraction differences, which accommodates rounding

C) When differences occur, the numbers are adjusted before the report to balance

D) None of the above

A) Any differences are paid in or refunded as appropriate

B) Line 7 accommodates fraction differences, which accommodates rounding

C) When differences occur, the numbers are adjusted before the report to balance

D) None of the above

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

47

FUTA is an abbreviation for:

A) Future Unemployment Tax Act

B) Federal Unemployment Tax Act

C) Funding Unemployment Tax Act

D) None of the above

A) Future Unemployment Tax Act

B) Federal Unemployment Tax Act

C) Funding Unemployment Tax Act

D) None of the above

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

48

The FUTA tax is imposed on employees on the first $7,000 of annual earnings per employee.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

49

There is a ceiling on each employee's annual earnings that are subject to federal income taxes.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

50

The FUTA tax must be paid by the employer annually on December 31.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following statements is true?

A) SUTA and FUTA Tax Rates are always the same

B) Payroll Tax Expense involves Federal Income Tax Withholding.

C) The FUTA wage taxable limit is $7,000

D) Withholding Federal Income Taxes is optional for the employer

A) SUTA and FUTA Tax Rates are always the same

B) Payroll Tax Expense involves Federal Income Tax Withholding.

C) The FUTA wage taxable limit is $7,000

D) Withholding Federal Income Taxes is optional for the employer

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

52

Most employers are required to withhold federal unemployment taxes from employees' earnings.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

53

FUTA is an abbreviation for Social Security taxes.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

54

If the limit on unemployment taxes is $7,000, and Bart's accumulated earnings prior to his current earnings of $960 are $6,750, the amount of his check that is taxable for unemployment is

A) $7,000.00.

B) $250.00.

C) $840.00.

D) $6,750.00.

E) $960.00.

A) $7,000.00.

B) $250.00.

C) $840.00.

D) $6,750.00.

E) $960.00.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

55

There is no wage ceiling limit for which of the following:

A) FICA Medicare

B) SUTA

C) FUTA

D) FICA Social Security

A) FICA Medicare

B) SUTA

C) FUTA

D) FICA Social Security

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

56

Employers are required to pay FICA taxes higher in amount to the FICA taxes withheld than their employees.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following statements is NOT true about Workers' Compensation Insurance?

A) Employers generally pay premiums in advance.

B) Most states require employers to provide coverage.

C) Employers normally pass along the cost of coverage to employees.

D) Premium rates vary based on risk and claims.

A) Employers generally pay premiums in advance.

B) Most states require employers to provide coverage.

C) Employers normally pass along the cost of coverage to employees.

D) Premium rates vary based on risk and claims.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

58

The 941 tax return form is reported ___________.

A) Semi-Weekly

B) Monthly

C) Quarterly

D) Annually

A) Semi-Weekly

B) Monthly

C) Quarterly

D) Annually

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

59

FUTA tax liability is generally deposited _________ and reported ___________.

A) Weekly, Monthly

B) Monthly, Quarterly

C) Quarterly, Annually

D) Deposits and Report Dates Vary

A) Weekly, Monthly

B) Monthly, Quarterly

C) Quarterly, Annually

D) Deposits and Report Dates Vary

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

60

The federal unemployment tax is paid only by the employee.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

61

All companies have to pay the federal unemployment insurance quarterly.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

62

The source of information to complete the W-2 form is the employee's individual earnings record.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

63

The rate of the state unemployment tax varies considerably among states.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

64

The employer identification number is the same as the owner's Social Security number.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

65

Explain why employers might not be enthusiastic about employee requests for pay raises, aside from obvious reasons of the cost of the pay raise itself.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

66

A Form W-3 must be submitted to the Social Security Administration by February 28, following the end of the calendar year.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

67

Form 941 is submitted annually.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

68

The rate for the federal unemployment tax is higher than the rate for the state unemployment tax.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

69

Companies furnish their employees with W-2 forms quarterly.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

70

By January 31, an employer must furnish all employees with a Form W-4.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

71

The number of exemptions claimed on a W-4 form helps to determine the federal income tax withholding.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

72

Each employer subject to the federal unemployment tax must file an annual return and pay the unpaid portion of the tax by January 31 of the following year.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

73

Form 941 must be submitted quarterly.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

74

The source of the amounts used to complete the W-2 forms is the payroll register.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

75

Payments for state taxes are submitted to the state agency involved.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

76

Salaries Expense is debited to record the employer's FICA contributions and the FUTA and SUTA taxes.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

77

The details of the current week's earnings for each employee are reported on each employee's W-4 form.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

78

The employer must prepare at least four copies of each W-2 form.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

79

The state unemployment tax is usually paid quarterly.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck

80

Employees, as well as employers, are required to make payments toward federal unemployment insurance.

Unlock Deck

Unlock for access to all 94 flashcards in this deck.

Unlock Deck

k this deck