Deck 25: Capital Budgeting and Managerial Decisions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/150

Play

Full screen (f)

Deck 25: Capital Budgeting and Managerial Decisions

1

Capital budgeting decisions are risky because the outcome is uncertain, large amounts are usually involved, the investment involves a long-term commitment, and the decision could be difficult or impossible to reverse.

True

2

Another name for relevant cost is unavoidable cost.

False

3

An opportunity cost is the potential benefit that is lost by taking a specific action when two or more alternative choices are available.

True

4

In a make or buy decision, management should focus on costs that are constant under the two alternatives.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

5

If a company has the capacity to produce either 10,000 units of Product X or 10,000 units of Product Y; assuming fixed costs remain constant, production restrictions are the same for both products, and the markets for both products are unlimited; the company should commit 100% of its capacity to the product that has the higher contribution margin.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

6

Neither the payback period nor the accounting rate of return methods of evaluating investments considers the time value of money.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

7

An advantage of the break-even time (BET) method over the payback period method is that it recognizes the time value of money.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

8

Incremental costs should be considered in a make or buy decision.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

9

In ranking choices with the break-even time (BET) method, the investment with the highest BET measure gets the highest rank.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

10

An out-of-pocket cost requires a current and/or future outlay of cash.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

11

The decision to accept an additional volume of business should be based on a comparison of the revenue from the additional business with the sunk costs of producing that revenue.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

12

The concept of incremental cost is the same as the concept of differential cost.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

13

Significant sunk costs are relevant to decisions about the future.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

14

A special order of goods or services should always be accepted when the incremental revenue exceeds the incremental costs.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

15

A sunk cost will change with a future course of action.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

16

Capital budgeting is the process of analyzing alternative long-term investments and deciding which assets to acquire or sell.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

17

Relevant benefits refer to the additional or incremental revenue generated by selecting a particular course or action over another.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

18

If the internal rate of return (IRR) of an investment is below the hurdle rate, the project should be accepted.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

19

Part of the decision to accept additional business should be based on a comparison of the incremental (differential) costs of the added production with the additional revenues to be received.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

20

When computing payback period, the year in which a capital investment is made is year 1.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

21

Use of the internal rate of return method cannot be used with uneven cash flows.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

22

The net present value decision rule is: When an asset's expected cash flows are discounted at the required rate and yield a positive net present value, the asset should be acquired.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

23

The calculation of annual net cash flow from a particular investment project should include all of the following except:

A) Income taxes.

B) Revenues generated by the investment.

C) Cost of products generated by the investment.

D) Depreciation expense.

E) General and administrative expenses.

A) Income taxes.

B) Revenues generated by the investment.

C) Cost of products generated by the investment.

D) Depreciation expense.

E) General and administrative expenses.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

24

A minimum acceptable rate of return for an investment decision is called the:

A) Internal rate of return.

B) Average rate of return.

C) Hurdle rate.

D) Maximum rate.

E) Payback rate.

A) Internal rate of return.

B) Average rate of return.

C) Hurdle rate.

D) Maximum rate.

E) Payback rate.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

25

The accounting rate of return uses cash flows in its calculation.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

26

The process of restating future cash flows in today's dollars is known as:

A) Budgeting.

B) Annualization.

C) Discounting.

D) Payback period.

E) Capitalizing.

A) Budgeting.

B) Annualization.

C) Discounting.

D) Payback period.

E) Capitalizing.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

27

Capital budgeting decisions usually involve analysis of:

A) Cash outflows only.

B) Short-term investments.

C) Long-term investments.

D) Investments with certain outcomes only.

E) Operating revenues.

A) Cash outflows only.

B) Short-term investments.

C) Long-term investments.

D) Investments with certain outcomes only.

E) Operating revenues.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

28

Two investments with exactly the same payback periods are always equally valuable to an investor.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

29

The time value of money is considered when calculating the payback period of an investment.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

30

The payback method of evaluating an investment fails to consider how long the investment will generate cash inflows beyond the payback period.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

31

The process of analyzing alternative investments and deciding which assets to acquire or sell is known as:

A) Planning and control.

B) Capital budgeting.

C) Variance analysis.

D) Master budgeting.

E) Managerial accounting.

A) Planning and control.

B) Capital budgeting.

C) Variance analysis.

D) Master budgeting.

E) Managerial accounting.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

32

A disadvantage of an investment with a short payback period is that it will produce revenue for only a short period of time.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

33

If two projects have the same risks, the same payback periods, and the same initial investments, they are equally attractive.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

34

In business decision-making, managers typically examine the two fundamental factors of:

A) Risk and capital investment.

B) Risk and rate of return.

C) Capital investment and rate of return.

D) Risk and payback.

E) Payback and rate of return.

A) Risk and capital investment.

B) Risk and rate of return.

C) Capital investment and rate of return.

D) Risk and payback.

E) Payback and rate of return.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

35

If net present values are used to evaluate two investments that have equal costs and equal total cash flows, the one with more cash flows in the early years has the higher net present value.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

36

Capital budgeting decisions are generally based on:

A) Tentative predictions of future outcomes.

B) Perfect predictions of future outcomes.

C) Results from past outcomes only.

D) Results from current outcomes only.

E) Speculation of interest rates and economic performance only.

A) Tentative predictions of future outcomes.

B) Perfect predictions of future outcomes.

C) Results from past outcomes only.

D) Results from current outcomes only.

E) Speculation of interest rates and economic performance only.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

37

The payback method, unlike the net present value method, does not ignore cash flows after the point of cost recovery.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

38

If the straight-line depreciation method is used, the annual average investment amount used in calculating rate of return is calculated as (beginning book value + ending book value)/2.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

39

The internal rate of return equals the rate that yields a net present value of zero for an investment.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

40

Capital budgeting decisions are risky because:

A) The outcome is uncertain.

B) Large amounts of money are usually involved.

C) The investment involves a long-term commitment.

D) The decision could be difficult or impossible to reverse.

E) All of these are true

A) The outcome is uncertain.

B) Large amounts of money are usually involved.

C) The investment involves a long-term commitment.

D) The decision could be difficult or impossible to reverse.

E) All of these are true

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

41

A company paid $200,000 ten years ago for a specialized machine that has no salvage value and is being depreciated at the rate of $10,000 per year. The company is considering using the machine in a new project that will have incremental revenues of $28,000 per year and annual cash expenses of $20,000. In analyzing the new project, the $10,000 depreciation on the machine is an example of a(n):

A) Incremental cost.

B) Opportunity cost.

C) Variable cost.

D) Sunk cost.

E) Out-of-pocket cost.

A) Incremental cost.

B) Opportunity cost.

C) Variable cost.

D) Sunk cost.

E) Out-of-pocket cost.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

42

An opportunity cost:

A) Is an unavoidable cost.

B) Requires a current outlay of cash.

C) Results from past managerial decisions.

D) Is the lost benefit of choosing an alternative course of action.

E) Is irrelevant in decision making.

A) Is an unavoidable cost.

B) Requires a current outlay of cash.

C) Results from past managerial decisions.

D) Is the lost benefit of choosing an alternative course of action.

E) Is irrelevant in decision making.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

43

The calculation of the payback period for an investment when net cash flow is even (equal) is:

A) Cost of investment/Annual net cash flow

B) Cost of investment/Total net cash flow

C) Annual net cash flow/Cost of investment

D) Total net cash flow/Cost of investment

E) Total net cash flow/Annual net cash flow

A) Cost of investment/Annual net cash flow

B) Cost of investment/Total net cash flow

C) Annual net cash flow/Cost of investment

D) Total net cash flow/Cost of investment

E) Total net cash flow/Annual net cash flow

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

44

Parker Plumbing has received a special one-time order for 1,500 faucets (units) at $5 per unit. Parker currently produces and sells 7,500 units at $6.00 each. This level represents 75% of its capacity. Production costs for these units are $4.50 per unit, which includes $3.00 variable cost and $1.50 fixed cost. To produce the special order, a new machine needs to be purchased at a cost of $1,000 with a zero salvage value. Management expects no other changes in costs as a result of the additional production. Should the company accept the special order?

A) No, because additional production would exceed capacity.

B) No, because incremental costs exceed incremental revenue.

C) Yes, because incremental revenue exceeds incremental costs.

D) Yes, because incremental costs exceed incremental revenues.

E) No, because the incremental revenue is too low.

A) No, because additional production would exceed capacity.

B) No, because incremental costs exceed incremental revenue.

C) Yes, because incremental revenue exceeds incremental costs.

D) Yes, because incremental costs exceed incremental revenues.

E) No, because the incremental revenue is too low.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

45

A company is considering a new project that will cost $19,000. This project would result in additional annual revenues of $6,000 for the next 5 years. The $19,000 cost is an example of a(n):

A) Sunk cost.

B) Fixed cost.

C) Incremental cost.

D) Uncontrollable cost.

E) Opportunity cost.

A) Sunk cost.

B) Fixed cost.

C) Incremental cost.

D) Uncontrollable cost.

E) Opportunity cost.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

46

A cost that cannot be avoided or changed because it arises from a past decision, and is irrelevant to future decisions, is called a(n):

A) Uncontrollable cost.

B) Incremental cost.

C) Opportunity cost.

D) Out-of-pocket cost.

E) Sunk cost.

A) Uncontrollable cost.

B) Incremental cost.

C) Opportunity cost.

D) Out-of-pocket cost.

E) Sunk cost.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

47

A company has the choice of either selling 1,000 defective units as scrap or rebuilding them. The company could sell the defective units as they are for $4.00 per unit. Alternatively, it could rebuild them with incremental costs of $1.00 per unit for materials, $2.00 per unit for labor, and $1.50 per unit for overhead, and then sell the rebuilt units for $8.00 each. What should the company do?

A) Sell the units as scrap.

B) Rebuild the units.

C) It does not matter because both alternatives have the same result.

D) Neither sell nor rebuild because both alternatives produce a loss. Instead, the company should store the units permanently.

E) Throw the units away.

A) Sell the units as scrap.

B) Rebuild the units.

C) It does not matter because both alternatives have the same result.

D) Neither sell nor rebuild because both alternatives produce a loss. Instead, the company should store the units permanently.

E) Throw the units away.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

48

Parker Plumbing has received a special one-time order for 1,500 faucets (units) at $5 per unit. Parker currently produces and sells 7,500 units at $6.00 each. This level represents 75% of its capacity. Production costs for these units are $4.50 per unit, which includes $3.00 variable cost and $1.50 fixed cost. To produce the special order, a new machine needs to be purchased at a cost of $1,000 with a zero salvage value. Management expects no other changes in costs as a result of the additional production. If Parker wishes to earn $1,250 on the special order, the size of the order would need to be:

A) 4,500 units.

B) 2,250 units.

C) 1,125 units.

D) 625 units.

E) 300 units.

A) 4,500 units.

B) 2,250 units.

C) 1,125 units.

D) 625 units.

E) 300 units.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

49

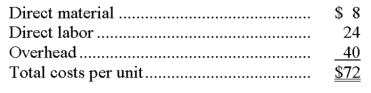

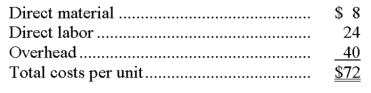

Alpha Co. can produce a unit of Beta for the following costs:  An outside supplier offers to provide Alpha with all the Beta units it needs at $60 per unit. If Alpha buys from the supplier, Alpha will still incur 40% of its overhead. Alpha should:

An outside supplier offers to provide Alpha with all the Beta units it needs at $60 per unit. If Alpha buys from the supplier, Alpha will still incur 40% of its overhead. Alpha should:

A) Buy Beta since the relevant cost to make it is $72.

B) Make Beta since the relevant cost to make it is $56.

C) Buy Beta since the relevant cost to make it is $48.

D) Make Beta since the relevant cost to make it is $48.

E) Buy Beta since the relevant cost to make it is $56.

An outside supplier offers to provide Alpha with all the Beta units it needs at $60 per unit. If Alpha buys from the supplier, Alpha will still incur 40% of its overhead. Alpha should:

An outside supplier offers to provide Alpha with all the Beta units it needs at $60 per unit. If Alpha buys from the supplier, Alpha will still incur 40% of its overhead. Alpha should:A) Buy Beta since the relevant cost to make it is $72.

B) Make Beta since the relevant cost to make it is $56.

C) Buy Beta since the relevant cost to make it is $48.

D) Make Beta since the relevant cost to make it is $48.

E) Buy Beta since the relevant cost to make it is $56.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

50

A limitation of the internal rate of return method is:

A) Failure to measure time value of money.

B) Failure to measure results as a percent.

C) Failure to consider the payback period.

D) Failure to reflect changes in risk levels over project life.

E) Failure to compare dissimilar projects.

A) Failure to measure time value of money.

B) Failure to measure results as a percent.

C) Failure to consider the payback period.

D) Failure to reflect changes in risk levels over project life.

E) Failure to compare dissimilar projects.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

51

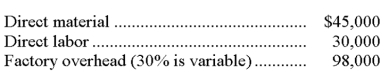

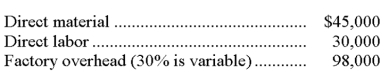

Textel is thinking about having one of its products manufactured by a subcontractor. Currently, the cost of manufacturing 1,000 units follows:  If Textel can buy 1,000 units from a subcontractor for $100,000, it should:

If Textel can buy 1,000 units from a subcontractor for $100,000, it should:

A) Make the product because current factory overhead is less than $100,000.

B) Make the product because the cost of direct material plus direct labor of manufacturing is less than $100,000.

C) Buy the product because the total incremental costs of manufacturing are greater than $100,000.

D) Buy the product because total fixed and variable manufacturing costs are greater than $100,000.

E) Make the product because factory overhead is a sunk cost.

If Textel can buy 1,000 units from a subcontractor for $100,000, it should:

If Textel can buy 1,000 units from a subcontractor for $100,000, it should:A) Make the product because current factory overhead is less than $100,000.

B) Make the product because the cost of direct material plus direct labor of manufacturing is less than $100,000.

C) Buy the product because the total incremental costs of manufacturing are greater than $100,000.

D) Buy the product because total fixed and variable manufacturing costs are greater than $100,000.

E) Make the product because factory overhead is a sunk cost.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

52

Marsden manufactures a cat food product called Special Export. Marsden currently has 10,000 bags of Special Export on hand. The variable production costs per bag are $1.80 and total fixed costs are $10,000. The cat food can be sold as it is for $9.00 per bag or be processed further into Prime Cat Food and Feline Surprise at an additional $2,000 cost. The additional processing will yield 10,000 bags of Prime Cat Food and 3,000 bags of Feline Surprise, which can be sold for $8 and $6 per bag, respectively. The net advantage (incremental income) of processing Special Export further into Prime and Feline Surprise would be:

A) $98,000.

B) $96,000.

C) $8,000.

D) $6,000.

E) $2,000.

A) $98,000.

B) $96,000.

C) $8,000.

D) $6,000.

E) $2,000.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

53

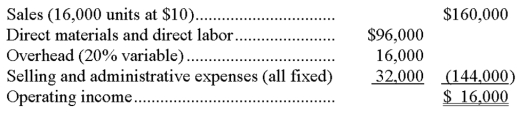

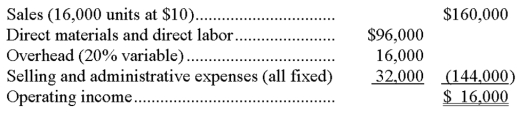

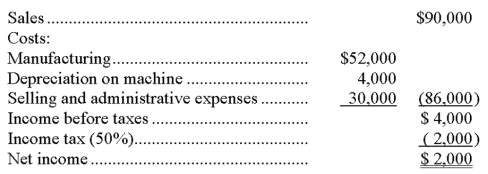

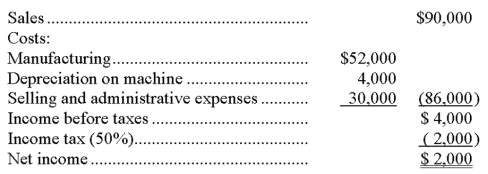

Thompson Company had the following results of operations for the past year:  A foreign company (whose sales will not affect Thompson's market) offers to buy 4,000 units at $7.50 per unit. In addition to variable manufacturing costs, selling these units would increase fixed overhead by $600 and selling and administrative costs by $300. If Thompson accepts the offer, its profits will:

A foreign company (whose sales will not affect Thompson's market) offers to buy 4,000 units at $7.50 per unit. In addition to variable manufacturing costs, selling these units would increase fixed overhead by $600 and selling and administrative costs by $300. If Thompson accepts the offer, its profits will:

A) Increase by $30,000.

B) Increase by $6,000.

C) Decrease by $6,000.

D) Increase by $5,200.

E) Increase by $4,300.

A foreign company (whose sales will not affect Thompson's market) offers to buy 4,000 units at $7.50 per unit. In addition to variable manufacturing costs, selling these units would increase fixed overhead by $600 and selling and administrative costs by $300. If Thompson accepts the offer, its profits will:

A foreign company (whose sales will not affect Thompson's market) offers to buy 4,000 units at $7.50 per unit. In addition to variable manufacturing costs, selling these units would increase fixed overhead by $600 and selling and administrative costs by $300. If Thompson accepts the offer, its profits will:A) Increase by $30,000.

B) Increase by $6,000.

C) Decrease by $6,000.

D) Increase by $5,200.

E) Increase by $4,300.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

54

Patrick Corporation inadvertently produced 10,000 defective personal radios. The radios cost $8 each to produce. A salvage company will purchase the defective units as they are for $3 each. Patrick's production manager reports that the defects can be corrected for $5 per unit, enabling them to be sold at their regular market price of $12.50. Patrick should:

A) Sell the radios for $3 per unit.

B) Correct the defects and sell the radios at the regular price.

C) Sell the radios as they are because repairing them will cause their total cost to exceed their selling price.

D) Sell 5,000 radios to the salvage company and repair the remainder.

E) Throw the radios away.

A) Sell the radios for $3 per unit.

B) Correct the defects and sell the radios at the regular price.

C) Sell the radios as they are because repairing them will cause their total cost to exceed their selling price.

D) Sell 5,000 radios to the salvage company and repair the remainder.

E) Throw the radios away.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

55

An additional cost incurred only if a particular action is taken is a(n):

A) Period cost.

B) Pocket cost.

C) Discount cost.

D) Incremental cost.

E) Sunk cost.

A) Period cost.

B) Pocket cost.

C) Discount cost.

D) Incremental cost.

E) Sunk cost.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

56

The potential benefits of one alternative that are lost by choosing another is known as a(n):

A) Alternative cost.

B) Sunk cost.

C) Out-of-pocket cost.

D) Differential cost.

E) Opportunity cost.

A) Alternative cost.

B) Sunk cost.

C) Out-of-pocket cost.

D) Differential cost.

E) Opportunity cost.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

57

A cost that requires a current and/or future outlay of cash, and is usually an incremental cost, is a(n):

A) Out-of-pocket cost.

B) Sunk cost.

C) Opportunity cost.

D) Operating cost.

E) Uncontrollable cost.

A) Out-of-pocket cost.

B) Sunk cost.

C) Opportunity cost.

D) Operating cost.

E) Uncontrollable cost.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

58

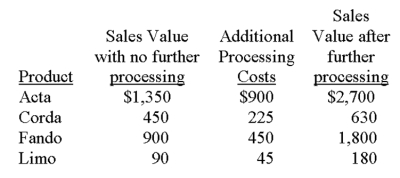

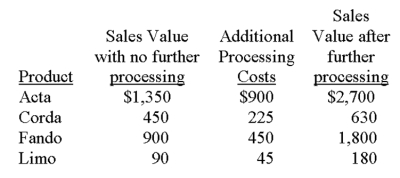

Marcus processes four different products that can either be sold as is or processed further. Listed below are sales and additional cost data:  Which product(s) should not be processed further?

Which product(s) should not be processed further?

A) Acta.

B) Corda.

C) Fando.

D) Limo.

E) None of the products should be processed further.

Which product(s) should not be processed further?

Which product(s) should not be processed further?A) Acta.

B) Corda.

C) Fando.

D) Limo.

E) None of the products should be processed further.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

59

Marsden manufactures a cat food product called Special Export. Marsden currently has 10,000 bags of Special Export on hand. The variable production costs per bag are $1.80 and total fixed costs are $10,000. The cat food can be sold as it is for $9.00 per bag or be processed further into Prime Cat Food and Feline Surprise at an additional $2,000 cost. The additional processing will yield 10,000 bags of Prime Cat Food and 3,000 bags of Feline Surprise, which can be sold for $8 and $6 per bag, respectively. If Special Export is processed further into Prime Cat Food and Feline Surprise, the total gross profit would be:

A) $68,000.

B) $78,000.

C) $96,000.

D) $98,000.

E) $100,000.

A) $68,000.

B) $78,000.

C) $96,000.

D) $98,000.

E) $100,000.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

60

The break-even time (BET) method is a variation of the:

A) Payback method.

B) Internal rate of return method.

C) Accounting rate of return method.

D) Net present value method.

E) Present value method.

A) Payback method.

B) Internal rate of return method.

C) Accounting rate of return method.

D) Net present value method.

E) Present value method.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

61

A company is considering purchasing a machine for $21,000. The machine will generate an after-tax net income of $2,000 per year. Annual depreciation expense would be $1,500. What is the payback period for the new machine?

A) 4 years.

B) 6 years.

C) 10.5 years.

D) 14 years.

E) 42 years.

A) 4 years.

B) 6 years.

C) 10.5 years.

D) 14 years.

E) 42 years.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

62

Monterey Corporation is considering the purchase of a machine costing $36,000 with a 6-year useful life and no salvage value. Monterey uses straight-line depreciation and assumes that the annual cash inflow from the machine will be received uniformly throughout each year. In calculating the accounting rate of return, what is Monterey's average investment?

A) $6,000.

B) $7,000.

C) $18,000.

D) $21,000.

E) $36,000.

A) $6,000.

B) $7,000.

C) $18,000.

D) $21,000.

E) $36,000.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

63

The accounting rate of return is calculated as:

A) The after-tax income divided by the total investment.

B) The after-tax income divided by the annual average investment.

C) The cash flows divided by the annual average investment.

D) The cash flows divided by the total investment.

E) The annual average investment divided by the after-tax income.

A) The after-tax income divided by the total investment.

B) The after-tax income divided by the annual average investment.

C) The cash flows divided by the annual average investment.

D) The cash flows divided by the total investment.

E) The annual average investment divided by the after-tax income.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

64

An estimate of an asset's value to the company, calculated by discounting the future cash flows from the investment at an appropriate rate and then subtracting the initial cost of the investment, is known as:

A) Annual net cash flows.

B) Rate of return on investment.

C) Net present value.

D) Payback period.

E) Unamortized carrying value.

A) Annual net cash flows.

B) Rate of return on investment.

C) Net present value.

D) Payback period.

E) Unamortized carrying value.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

65

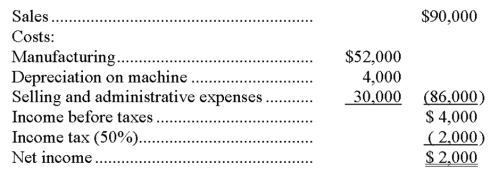

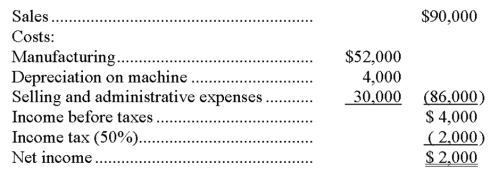

A company is planning to purchase a machine that will cost $24,000, have a six-year life, and be depreciated over a three-year period with no salvage value. The company expects to sell the machine's output of 3,000 units evenly throughout each year. A projected income statement for each year of the asset's life appears below. What is the payback period for this machine?

A) 24 years.

B) 12 years.

C) 6 years.

D) 4 years.

E) 1 year.

A) 24 years.

B) 12 years.

C) 6 years.

D) 4 years.

E) 1 year.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

66

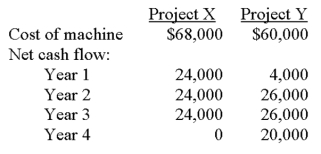

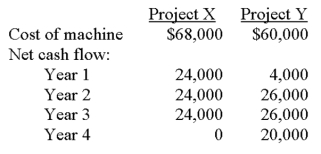

Coffer Co. is analyzing two projects for the future. Assume that only one project can be selected.  If the company is using the payback period method and it requires a payback of three years or less, which project should be selected?

If the company is using the payback period method and it requires a payback of three years or less, which project should be selected?

A) Project Y.

B) Project X.

C) Both X and Y are acceptable projects.

D) Neither X nor Y is an acceptable project.

E) Project Y because it has a lower initial investment.

If the company is using the payback period method and it requires a payback of three years or less, which project should be selected?

If the company is using the payback period method and it requires a payback of three years or less, which project should be selected?A) Project Y.

B) Project X.

C) Both X and Y are acceptable projects.

D) Neither X nor Y is an acceptable project.

E) Project Y because it has a lower initial investment.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

67

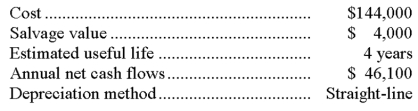

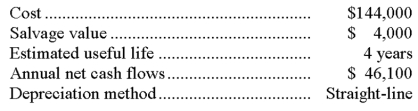

The following data concerns a proposed equipment purchase:  Assuming that net cash flows are received evenly throughout the year, the accounting rate of return is:

Assuming that net cash flows are received evenly throughout the year, the accounting rate of return is:

A) 62.3%.

B) 32.0%.

C) 15.0%.

D) 7.7%.

E) 5.0%.

Assuming that net cash flows are received evenly throughout the year, the accounting rate of return is:

Assuming that net cash flows are received evenly throughout the year, the accounting rate of return is:A) 62.3%.

B) 32.0%.

C) 15.0%.

D) 7.7%.

E) 5.0%.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

68

A company buys a machine for $60,000 that has an expected life of 9 years and no salvage value. The company anticipates a yearly net income of $2,850 after taxes of 30%, with the cash flows to be received evenly throughout each year. What is the accounting rate of return?

A) 2.85%.

B) 4.75%.

C) 6.65%.

D) 9.50%.

E) 42.75%.

A) 2.85%.

B) 4.75%.

C) 6.65%.

D) 9.50%.

E) 42.75%.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following cash flows is not considered when using the net present value method?

A) Future cash inflows.

B) Future cash outflows.

C) Past cash outflows.

D) Non-uniform cash inflows.

E) All of these are considered.

A) Future cash inflows.

B) Future cash outflows.

C) Past cash outflows.

D) Non-uniform cash inflows.

E) All of these are considered.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

70

After-tax net income divided by the annual average investment in an investment, is the:

A) Net present value rate.

B) Payback rate.

C) Accounting rate of return.

D) Earnings from investment.

E) Profit rate.

A) Net present value rate.

B) Payback rate.

C) Accounting rate of return.

D) Earnings from investment.

E) Profit rate.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

71

A company is considering the purchase of a new piece of equipment for $90,000. Predicted annual cash inflows from this investment are $36,000 (year 1), $30,000 (year 2), $18,000 (year 3), $12,000 (year 4) and $6,000 (year 5). The payback period is:

A) 4.50 years.

B) 4.25 years.

C) 3.50 years.

D) 3.00 years.

E) 2.50 years.

A) 4.50 years.

B) 4.25 years.

C) 3.50 years.

D) 3.00 years.

E) 2.50 years.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

72

Beyer Corporation is considering buying a machine for $25,000. Its estimated useful life is 5 years, with no salvage value. Beyer anticipates annual net income after taxes of $1,500 from the new machine. What is the accounting rate of return assuming that Beyer uses straight-line depreciation and that income is earned uniformly throughout each year?

A) 6.0%.

B) 8.0%.

C) 8.5%.

D) 10.0%.

E) 12.0%.

A) 6.0%.

B) 8.0%.

C) 8.5%.

D) 10.0%.

E) 12.0%.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

73

A company is planning to purchase a machine that will cost $24,000, have a six-year life, and be depreciated over a three-year period with no salvage value. The company expects to sell the machine's output of 3,000 units evenly throughout each year. A projected income statement for each year of the asset's life appears below. What is the accounting rate of return for this machine?

A) 33.3%.

B) 16.7%.

C) 50.0%.

D) 8.3%.

E) 4%.

A) 33.3%.

B) 16.7%.

C) 50.0%.

D) 8.3%.

E) 4%.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

74

The time expected to pass before the net cash flows from an investment would return its initial cost is called the:

A) Amortization period.

B) Payback period.

C) Interest period.

D) Budgeting period.

E) Discounted cash flow period.

A) Amortization period.

B) Payback period.

C) Interest period.

D) Budgeting period.

E) Discounted cash flow period.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

75

The hurdle rate is often set at:

A) The rate the company could earn if the investment were placed in the bank.

B) The company's cost of capital.

C) 10% above the IRR of current projects.

D) 10% above the ARR of current projects.

E) The rate at which the company is taxed on income.

A) The rate the company could earn if the investment were placed in the bank.

B) The company's cost of capital.

C) 10% above the IRR of current projects.

D) 10% above the ARR of current projects.

E) The rate at which the company is taxed on income.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

76

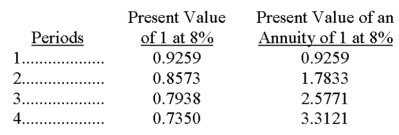

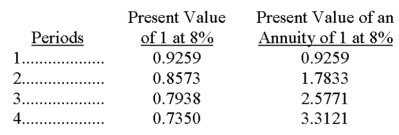

The following present value factors are provided for use in this problem.  Norman Co. wants to purchase a machine for $40,000, but needs to earn an 8% return. The expected year-end net cash flows are $12,000 in each of the first three years, and $16,000 in the fourth year. What is the machine's net present value (round to the nearest whole dollar)?

Norman Co. wants to purchase a machine for $40,000, but needs to earn an 8% return. The expected year-end net cash flows are $12,000 in each of the first three years, and $16,000 in the fourth year. What is the machine's net present value (round to the nearest whole dollar)?

A) $(9,075).

B) $2,685.

C) $42,685.

D) $(28,240).

E) $52,000.

Norman Co. wants to purchase a machine for $40,000, but needs to earn an 8% return. The expected year-end net cash flows are $12,000 in each of the first three years, and $16,000 in the fourth year. What is the machine's net present value (round to the nearest whole dollar)?

Norman Co. wants to purchase a machine for $40,000, but needs to earn an 8% return. The expected year-end net cash flows are $12,000 in each of the first three years, and $16,000 in the fourth year. What is the machine's net present value (round to the nearest whole dollar)?A) $(9,075).

B) $2,685.

C) $42,685.

D) $(28,240).

E) $52,000.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

77

A company is considering the purchase of a new machine for $48,000. Management predicts that the machine can produce sales of $16,000 each year for the next 10 years. Expenses are expected to include direct materials, direct labor, and factory overhead totaling $8,000 per year plus depreciation of $4,000 per year. The company's tax rate is 40%. What is the payback period for the new machine?

A) 3.0 years.

B) 6.0 years.

C) 7.5 years.

D) 12.0 years.

E) 20.0 years.

A) 3.0 years.

B) 6.0 years.

C) 7.5 years.

D) 12.0 years.

E) 20.0 years.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

78

Which one of the following methods considers the time value of money in evaluating alternative capital expenditures?

A) Accounting rate of return.

B) Net present value.

C) Payback period.

D) Cash flow method.

E) Return on average investment.

A) Accounting rate of return.

B) Net present value.

C) Payback period.

D) Cash flow method.

E) Return on average investment.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

79

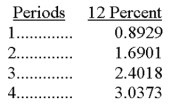

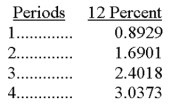

Daniels Corporation is considering the purchase of new equipment costing $30,000. The projected annual after-tax net income from the equipment is $1,200, after deducting $10,000 for depreciation. The revenue is to be received at the end of each year. The machine has a useful life of 3 years and no salvage value. Daniels requires a 12% return on its investments. The present value of an annuity of 1 for different periods follows:  What is the net present value of the machine?

What is the net present value of the machine?

A) $24,018.

B) $(3,100).

C) $30,000.

D) $26,900.

E) $(29,520).

What is the net present value of the machine?

What is the net present value of the machine?A) $24,018.

B) $(3,100).

C) $30,000.

D) $26,900.

E) $(29,520).

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

80

A disadvantage of using the payback period to compare investment alternatives is that:

A) It ignores cash flows beyond the payback period.

B) It includes the time value of money.

C) It cannot be used when cash flows are not uniform.

D) It cannot be used if a company records depreciation.

E) It cannot be used to compare investments with different initial investments.

A) It ignores cash flows beyond the payback period.

B) It includes the time value of money.

C) It cannot be used when cash flows are not uniform.

D) It cannot be used if a company records depreciation.

E) It cannot be used to compare investments with different initial investments.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck