Deck 11: Capital Budgeting and Risk

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

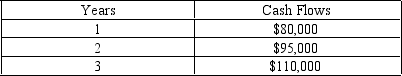

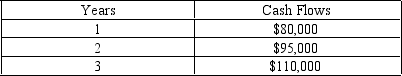

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/78

Play

Full screen (f)

Deck 11: Capital Budgeting and Risk

1

A firm's leveraged beta will always be ____ its unleveraged beta.

A) less than

B) greater than

C) the same as

D) could be all of the above

A) less than

B) greater than

C) the same as

D) could be all of the above

B

2

A major problem with using the risk-adjusted discount rate approach is the determination of

A) the beta value for the firm

B) the firm's weighted cost of capital

C) the firm's required rate of return

D) beta values for individual projects

A) the beta value for the firm

B) the firm's weighted cost of capital

C) the firm's required rate of return

D) beta values for individual projects

D

3

The subjective approach to determining risk-adjusted discount rates

A) uses the risk-free rate for average-risk projects

B) explicitly considers the probability distribution of a project's cash flows

C) always leads to the correct investment decisions

D) groups projects into risk classes and evaluates all projects in a particular risk class at the same risk- adjusted discount rate

A) uses the risk-free rate for average-risk projects

B) explicitly considers the probability distribution of a project's cash flows

C) always leads to the correct investment decisions

D) groups projects into risk classes and evaluates all projects in a particular risk class at the same risk- adjusted discount rate

D

4

The net present value/payback approach is a useful approach when

A) screening projects characterized by rapid technological advances

B) cash flow estimates are known with certainty

C) the more risky cash flows occur during the startup period

D) None of the above

A) screening projects characterized by rapid technological advances

B) cash flow estimates are known with certainty

C) the more risky cash flows occur during the startup period

D) None of the above

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

5

All of the following are advantages of the NPV-payback approach to risk analysis except

A) it is easy and inexpensive to apply

B) it considers a project's liquidity

C) it explicitly considers the variability of a project's return

D) it is consistent with the notion that risk increases with futurity

A) it is easy and inexpensive to apply

B) it considers a project's liquidity

C) it explicitly considers the variability of a project's return

D) it is consistent with the notion that risk increases with futurity

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

6

The certainty equivalent approach adjusts the ____ for risk in the ____ of the net present value equation.

A) net cash flows, numerator

B) risk-free rate, numerator

C) required return, numerator

D) net cash flows, denominator

A) net cash flows, numerator

B) risk-free rate, numerator

C) required return, numerator

D) net cash flows, denominator

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

7

Total project risk is

A) the contribution a project makes to the risk of the firm

B) measured by the correlation coefficient

C) the chance that a project will perform different from expectations

D) measured by the project's beta

A) the contribution a project makes to the risk of the firm

B) measured by the correlation coefficient

C) the chance that a project will perform different from expectations

D) measured by the project's beta

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

8

In a simulation analysis, a model is simulated on a computer program and run through several iterations. The results of these iterations are used to

A) plot a required rate of return value profile

B) compute a mean and a standard deviation of returns

C) provide the decision maker with a measure of beta risk

D) plot the coefficient of variation of the annual net cash flows

A) plot a required rate of return value profile

B) compute a mean and a standard deviation of returns

C) provide the decision maker with a measure of beta risk

D) plot the coefficient of variation of the annual net cash flows

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following techniques can be used to analyze total project risk?

A) net present value/payback approach

B) risk-adjusted discount rate approach

C) simulation analysis

D) all of the above

A) net present value/payback approach

B) risk-adjusted discount rate approach

C) simulation analysis

D) all of the above

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

10

The use of sensitivity analysis requires that

A) a model of a project's cash flows be developed

B) probability distributions of the determinants of a project's cash flows be estimated

C) the firms have access to a very large computer

D) the firm is greatly interested in the portfolio risk reduction characteristics of a project

A) a model of a project's cash flows be developed

B) probability distributions of the determinants of a project's cash flows be estimated

C) the firms have access to a very large computer

D) the firm is greatly interested in the portfolio risk reduction characteristics of a project

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

11

When analyzing a sensitivity curve, the ____ the slope, the more sensitive the net present value is to a change in the computed variable.

A) more negative

B) steeper

C) more general

D) smaller

A) more negative

B) steeper

C) more general

D) smaller

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

12

The discount rate used in calculating the certainty equivalent net present value is the

A) risk-adjusted discount rate

B) cost of capital

C) risk-free rate

D) cost of equity capital

A) risk-adjusted discount rate

B) cost of capital

C) risk-free rate

D) cost of equity capital

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

13

Simulation techniques are

A) cheap to apply

B) widely used

C) mostly beneficial for large projects

D) identical to sensitivity analysis

A) cheap to apply

B) widely used

C) mostly beneficial for large projects

D) identical to sensitivity analysis

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

14

The certainty equivalent factors used to adjust the cash flows for risk can range from

A) -1 to + 1

B) 0 to infinity

C) +.01 to + .99

D) 0 to + 1.0

A) -1 to + 1

B) 0 to infinity

C) +.01 to + .99

D) 0 to + 1.0

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

15

A major disadvantage of the risk-adjusted discount rate approach is that it

A) can lead to selecting only above-average risk projects

B) provides the decision maker with a range of numbers

C) can lead to selecting only below-average risk projects

D) is difficult to estimate the appropriate risk premium for a project

A) can lead to selecting only above-average risk projects

B) provides the decision maker with a range of numbers

C) can lead to selecting only below-average risk projects

D) is difficult to estimate the appropriate risk premium for a project

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

16

The basic capital budgeting decision models, that is, NPV and IRR, handle risk by

A) ignoring it

B) assuming all cash flows are known with certainty

C) assuming all projects are of average risk and evaluating them based on expected values

D) using risk-adjusted discount rates to evaluate projects

A) ignoring it

B) assuming all cash flows are known with certainty

C) assuming all projects are of average risk and evaluating them based on expected values

D) using risk-adjusted discount rates to evaluate projects

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

17

The risk-adjusted discount rate approach is preferable to the weighted cost of capital approach when

A) all projects have the same risk characteristics

B) the risk-free rate is known with certainty

C) the projects under consideration have different risk characteristics

D) the firm is unlevered

A) all projects have the same risk characteristics

B) the risk-free rate is known with certainty

C) the projects under consideration have different risk characteristics

D) the firm is unlevered

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

18

Sensitivity analysis is a procedure that can be used in the capital budgeting process to indicate how sensitive the ____ is to changes in a particular variable.

A) probability

B) return distribution

C) net present value

D) standard deviation

A) probability

B) return distribution

C) net present value

D) standard deviation

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

19

Project C has been classified into risk class II by the analyst of a major firm. The risk premium required for projects in this risk class is 8%. The current risk-free rate measured by the analyst is 10%. If the project has an estimated return of 20%, the analyst would recommend

A) accepting project C

B) rejecting project C

C) reestimating the risk premiums for class II projects

D) none of the above

A) accepting project C

B) rejecting project C

C) reestimating the risk premiums for class II projects

D) none of the above

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

20

The ____ the amount of debt in a firm's capital structure, the ____ will be the firm's beta.

A) larger, larger

B) smaller, larger

C) larger, smaller

D) smaller, smaller

A) larger, larger

B) smaller, larger

C) larger, smaller

D) smaller, smaller

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

21

The risk assessment technique that considers the impact of simultaneous changes in key variables on the desirability of an investment project is ____.

A) sensitivity analysis

B) simultaneous equations

C) scenario analysis

D) RADR analysis

A) sensitivity analysis

B) simultaneous equations

C) scenario analysis

D) RADR analysis

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

22

A project has an expected net present value of $50,000 with a standard deviation of the net present value of $20,000. Assume that NPV is normally distributed. What is the probability that the project will have a negative NPV?

A) 99.38%

B) 0.62%

C) 34.5%

D) 49.38%

A) 99.38%

B) 0.62%

C) 34.5%

D) 49.38%

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

23

A project has an expected NPV of $50,000 with a standard deviation of the NPV of $20,000. Assume that NPV is normally distributed. What is the probability that the project will have a net present value greater than $60,000?

A) 1915%

B) 69.15%

C) 0.13%

D) 30.85%

A) 1915%

B) 69.15%

C) 0.13%

D) 30.85%

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

24

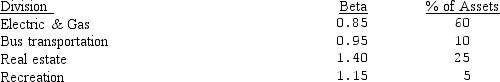

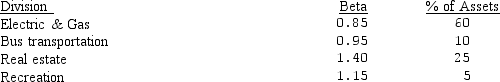

SCAN is a multi-divisional utility company. SCAN has four divisions with the following betas and proportions of the firm's total assets:

What is the firm's weighted average beta?

A) 1.01

B) 1.53

C) 0.93

D) 1.13

What is the firm's weighted average beta?

A) 1.01

B) 1.53

C) 0.93

D) 1.13

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

25

Faris currently has a capital structure of 40 percent debt and 60 percent equity, but is considering a new product that will be produced and marketed by a separate division. The new division will have a capital structure of 70 percent debt and 30 percent equity. Faris has a current beta of 1.1, but is not sure what the beta for the new division will be. AMX is a firm that produces a product similar to the product under consideration by Faris. AMX has a beta of 1.6, a capital structure of 40 percent debt and 60 percent equity and a marginal tax rate of 40 percent. If Faris' tax rate is 40 percent, estimate the levered beta for the new product division?

A) 2.44

B) 1.14

C) 2.74

D) 3.88

A) 2.44

B) 1.14

C) 2.74

D) 3.88

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

26

The ____ approach is widely used by firms that attempt to consider differential project risk in their capital budgeting procedures.

A) net present value

B) internal rate of return

C) risk-adjusted discount rate

D) certainty equivalent

A) net present value

B) internal rate of return

C) risk-adjusted discount rate

D) certainty equivalent

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

27

When evaluating a capital expenditure to be made in a foreign country, the parent firm must be concerned with the

A) exchange rate risk

B) cash flows that can be expected to be received by the parent

C) greater uncertainty associated with tax rates in the host country

D) all the above

A) exchange rate risk

B) cash flows that can be expected to be received by the parent

C) greater uncertainty associated with tax rates in the host country

D) all the above

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

28

The risk-adjusted discount rate approach is used in the analysis of projects for which ____ is the applicable risk measure.

A) total project risk

B) beta (systematic) risk

C) unsystematic risk

D) both total project and beta risk

A) total project risk

B) beta (systematic) risk

C) unsystematic risk

D) both total project and beta risk

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

29

A simulation analysis for a new acquisition has indicated that the expected NPV is $50 million with a standard deviation of $40 million. Assume that NPV is normally distributed. What is the probability that the project will be unacceptable?

A) 89.44%

B) 10.56%

C) 39.44%

D) 21.19%

A) 89.44%

B) 10.56%

C) 39.44%

D) 21.19%

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

30

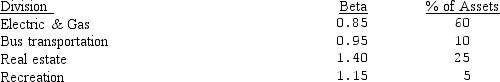

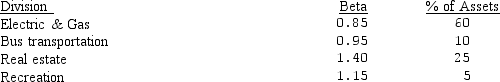

SCAN is a multi-divisional utility company. SCAN has four divisions with the following betas and proportions of the firm's total assets:

The risk-free rate is 8 percent and the market risk premium is 5 percent. If SCAN is considering a residential development, what should the firm use as its cost of equity in evaluating this project?

A) 13.05%

B) 16.20%

C) 12.25%

D) 15.00%

The risk-free rate is 8 percent and the market risk premium is 5 percent. If SCAN is considering a residential development, what should the firm use as its cost of equity in evaluating this project?

A) 13.05%

B) 16.20%

C) 12.25%

D) 15.00%

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

31

With the risk adjusted discount rate approach, in the context of total risk, the discount rates used in evaluating cash flows are determined ____.

A) objectively

B) subjectively

C) using regression analysis

D) objectively and by using regression analysis

A) objectively

B) subjectively

C) using regression analysis

D) objectively and by using regression analysis

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

32

The certainty equivalent factors used in capital budgeting analysis are equal to the ____ divided by ____.

A) certain return; risky return

B) risky return; certain return

C) certain return; beta

D) beta, risky return

A) certain return; risky return

B) risky return; certain return

C) certain return; beta

D) beta, risky return

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

33

Technico plans to start a new product division that will have a capital structure of 70 percent debt and 30 percent equity. The levered beta for this division has been estimated to be 2.02. What will be Technico's weighted cost of capital for this new division if the after-tax cost of debt is 7 percent, the risk-free rate is 8 percent, and the market risk premium is 5 percent?

A) 14.77%

B) 10.33%

C) 18.1%

D) 1.03%

A) 14.77%

B) 10.33%

C) 18.1%

D) 1.03%

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

34

Calco is a multi-divisional firm with a weighted cost of capital of 14 percent and a risk-adjusted discount rate for its can division of 17 percent. A planned expansion in the can division requires a net investment of $170,000 and results in expected cash inflows of $42,000 a year for seven years. Should Calco invest in this expansion?

A) Yes, NPV = $10,096

B) Yes, NPV = $ 9,896

C) No, NPV = -$5,276

D) No, NPV = -$9,896

A) Yes, NPV = $10,096

B) Yes, NPV = $ 9,896

C) No, NPV = -$5,276

D) No, NPV = -$9,896

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

35

The DMT Company is financed entirely with equity. DMT has a beta of 1.20 and the current risk-free rate is 9.5 percent. If the expected market return is 14 percent, what rate of return should DMT require on a project of average risk?

A) 14.9%

B) 15.4%

C) 14.0%

D) 12.0%

A) 14.9%

B) 15.4%

C) 14.0%

D) 12.0%

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

36

The net present value of a project is normally distributed with an expected value of $52,000 and a standard deviation of $31,515. Determine the probability that the project will have a net present value of less than zero.

A) 1.65%

B) 95.1%

C) 4.95%

D) cannot be determined

A) 1.65%

B) 95.1%

C) 4.95%

D) cannot be determined

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

37

The Chris-Kraft Co. is financed entirely with equity and the firm has a beta of 1.6. The current risk-free rate is 9.5 percent and the expected market return is 16 percent. What rate of return should Chris-Kraft require on a project of average risk?

A) 25.6%

B) 14.9%

C) 10.4%

D) 19.9%

A) 25.6%

B) 14.9%

C) 10.4%

D) 19.9%

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

38

The most expensive method of adjusting for total project risk in the evaluation of capital budgeting projects is the

A) sensitivity analysis method

B) simulation approach

C) net present value/payback method

D) risk-adjusted discount rate approach

A) sensitivity analysis method

B) simulation approach

C) net present value/payback method

D) risk-adjusted discount rate approach

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

39

With the ____ approach, the decision maker adjusts separately each period's cash flows to account for the specific risk of those cash flows.

A) risk-adjusted discount rate

B) NPV/payback

C) certainty equivalent

D) economic life

A) risk-adjusted discount rate

B) NPV/payback

C) certainty equivalent

D) economic life

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

40

The ____ of a firm is a weighted average of the ____ of the individual assets in the firm.

A) systematic risk; systematic risk

B) unsystematic risk; unsystematic risk

C) total risk; total risk

D) systematic risk, total risk

A) systematic risk; systematic risk

B) unsystematic risk; unsystematic risk

C) total risk; total risk

D) systematic risk, total risk

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

41

All of the following are correct statements about a project's total risk EXCEPT:

A) Undiversified investors are concerned about the company's future outlook.

B) It becomes the relevant risk when the project's returns are correlated to the returns from the firm as a whole.

C) Total project risk can be measured by calculating standard deviation

D) Total project risk is irrelevant when forecasting a company's chance of bankruptcy.

A) Undiversified investors are concerned about the company's future outlook.

B) It becomes the relevant risk when the project's returns are correlated to the returns from the firm as a whole.

C) Total project risk can be measured by calculating standard deviation

D) Total project risk is irrelevant when forecasting a company's chance of bankruptcy.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

42

The type of analysis that models some event and requires that estimates be made of the probability distribution of each cash flow element is:

A) scenario

B) sensitivity

C) simulation

D) net present value/payback approach

A) scenario

B) sensitivity

C) simulation

D) net present value/payback approach

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

43

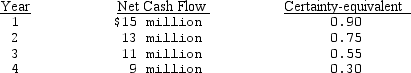

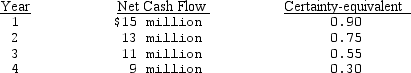

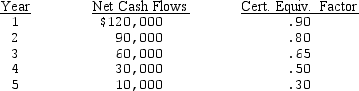

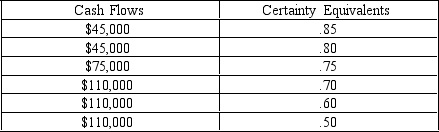

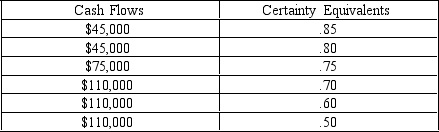

The Bull Company, a lawn mower manufacturer, is considering the introduction of a new model. The initial outlay required is $22 million. Net cash flows over the 4-year life cycle and the corresponding certainty-equivalents of the new model are as follows:

The firm's cost of capital is 14% and the risk-free rate is 6%. Bull uses the certainty-equivalent approach in evaluating above-average risk investments such as this one. What is the project's certainty-equivalent NPV?

A) $20,083,000

B) $ 6,628,400

C) $13,905,000

D) $ 3,019,400

The firm's cost of capital is 14% and the risk-free rate is 6%. Bull uses the certainty-equivalent approach in evaluating above-average risk investments such as this one. What is the project's certainty-equivalent NPV?

A) $20,083,000

B) $ 6,628,400

C) $13,905,000

D) $ 3,019,400

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

44

All of the following techniques are used to measure total project risk EXCEPT:

A) simulation analysis

B) profitability index

C) certainty equivalent approach

D) risk adjusted discount rate

A) simulation analysis

B) profitability index

C) certainty equivalent approach

D) risk adjusted discount rate

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

45

M-tel is financed entirely with equity and the firm's stock has a beta of 0.85. M-tel is considering investing in a project that is expected to have a beta of 1.3. The project requires an initial outlay of $6 million and is expected to generate after-tax net cash flows of $1.3 million each year for 8 years. Calculate the NPV of the project. Assume the risk-free rate is 7% and the expected market return is 14%. (Note: Problem requires either calculator use or interpolation from the tables. The suggested solutions use calculator accuracy.)

A) $249,685

B) -$371,484

C) $238,700

D) -$352,800

A) $249,685

B) -$371,484

C) $238,700

D) -$352,800

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

46

Many firms combine net present value and payback when analyzing project risk. Which of the following statements is/are correct?

I) Both payback and net present value consider the frequency of cash flows.

II) Both payback and net present can be adjusted for risk.

A) I only

B) II only

C) Both I and II

D) Neither I nor II

I) Both payback and net present value consider the frequency of cash flows.

II) Both payback and net present can be adjusted for risk.

A) I only

B) II only

C) Both I and II

D) Neither I nor II

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

47

The Chris-Kraft Co. is financed entirely with equity and the firm has a beta of 1.25. The current risk-free rate is 7 percent and the expected market return is 15 percent. Chris-Kraft is considering an investment project with a risk that matches the firm's average risk, requires a net investment of $70,000, and has net cash flows of $18,000 per year for 8 years. Should Chris-Kraft invest in the project?

A) Yes, NPV = $5,726

B) Yes, NPV = $75,726

C) No, NPV = -$10,934

D) No, NPV = -$5,726

A) Yes, NPV = $5,726

B) Yes, NPV = $75,726

C) No, NPV = -$10,934

D) No, NPV = -$5,726

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

48

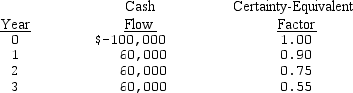

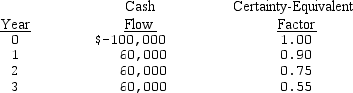

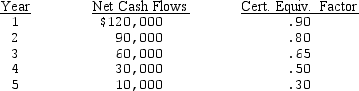

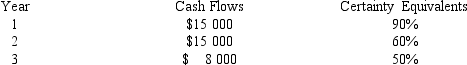

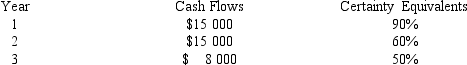

Given the following cash flows and certainty equivalent factors for an investment project, determine the certainty equivalent net present value. The firm's cost of capital is 14% and the risk-free rate is 6%.

A) $32,000

B) $18,692

C) $4,238

D) cannot be determined

A) $32,000

B) $18,692

C) $4,238

D) cannot be determined

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

49

IKON is financed entirely with equity and its beta is 1.31. If the current risk-free rate is 6.25% and the expected market return is 12.8%, what is IKON's required rate of return on a project of average risk?

A) 8.58%

B) 14.83%

C) 17.65%

D) 12.81%

A) 8.58%

B) 14.83%

C) 17.65%

D) 12.81%

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

50

The certainty equivalent approach is a risk evaluation technique. Which of the following statements is/are correct?

I) Certainty equivalents adjust the cash flows in the numerator of the NPV equation.

II) Using the RADR involves adjustments to the denominator of the NPV equation.

A) I only

B) II only

C) Both I and II

D) Neither I nor II

I) Certainty equivalents adjust the cash flows in the numerator of the NPV equation.

II) Using the RADR involves adjustments to the denominator of the NPV equation.

A) I only

B) II only

C) Both I and II

D) Neither I nor II

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

51

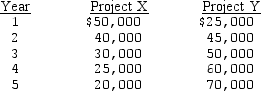

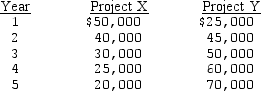

Quick Flick is considering two investments. Both require a net investment of $120,000 and have the following net cash flows:

Quick uses a combination of the net present value approach and the payback approach to evaluate investment alternatives. The firm uses a discount rate of 14 percent and requires that all projects have a payback period no longer than 3 years. Which investment or investments should Quick accept?

A) only Project X

B) only Project Y

C) both projects X and Y

D) reject both projects

Quick uses a combination of the net present value approach and the payback approach to evaluate investment alternatives. The firm uses a discount rate of 14 percent and requires that all projects have a payback period no longer than 3 years. Which investment or investments should Quick accept?

A) only Project X

B) only Project Y

C) both projects X and Y

D) reject both projects

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

52

Portfolio risk is also known as:

A) total project risk

B) beta risk

C) market risk

D) scenario risk

A) total project risk

B) beta risk

C) market risk

D) scenario risk

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following statements is correct about adjusting for beta risk in capital budgeting?

A) It measures unsystematic risk.

B) It is a guaranteed measure of the success of the project.

C) The beta concept can be used to determine RADR.

D) It evaluates the efficiency of the management team.

A) It measures unsystematic risk.

B) It is a guaranteed measure of the success of the project.

C) The beta concept can be used to determine RADR.

D) It evaluates the efficiency of the management team.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

54

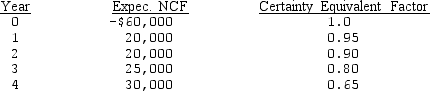

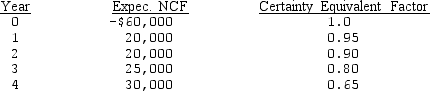

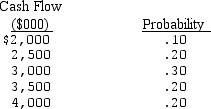

DKA uses the certainty equivalent approach to deal with total project risk and is considering a project with the following:

What is the certainty equivalent NPV for this project if the risk-free rate is 8% and the required return on the market portfolio is 15%?

A) $3,233

B) $17,743

C) - $15,243

D) $13,233

What is the certainty equivalent NPV for this project if the risk-free rate is 8% and the required return on the market portfolio is 15%?

A) $3,233

B) $17,743

C) - $15,243

D) $13,233

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

55

Billy Bob is considering building a water slide park that will require a net investment of $200,000 and yield the following net cash flows:

If the risk-free rate is 8 percent and the market risk premium is 6 percent, what is the certainty equivalent NPV for this project?

A) $12,805

B) $ 5,746

C) $ 3,703

D) $11,025

If the risk-free rate is 8 percent and the market risk premium is 6 percent, what is the certainty equivalent NPV for this project?

A) $12,805

B) $ 5,746

C) $ 3,703

D) $11,025

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

56

MedChem has a capital structure of 60% equity and 40% debt and a current beta of 1.2. MedChem is considering an investment project in a new line of business that has an expected internal rate of return of 16%. The typical firm already in the line of business that MedChem is considering expanding into has a beta of 1.5 and a capital structure that has 55% debt and 45% equity. The marginal tax rate for all these firms, including MedChem, is 40%. If the current risk-free rate is 7% and the expected market risk premium is 8%, should MedChem expand into the new line? Assume that MedChem will retain its current capital structure.

A) expand if after-tax cost of debt is 11.5% or less

B) expand if after-tax cost of debt is 15% or less

C) expand if after-tax cost of debt is 10.4% or less

D) do not expand

A) expand if after-tax cost of debt is 11.5% or less

B) expand if after-tax cost of debt is 15% or less

C) expand if after-tax cost of debt is 10.4% or less

D) do not expand

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

57

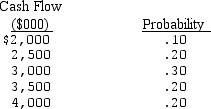

Determine the coefficient of variation for the following annual cash in flows from an investment project:

A) $624.50

B) 125.8

C) 0.201

D) cannot be determined

A) $624.50

B) 125.8

C) 0.201

D) cannot be determined

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

58

Rolling in Dough Cookie Corporation is trying to determine its certainty equivalent NPV. What is the CNPV if the risk free ratel is 2% and the initial investment is $19,000 (rounded)?

A) $2,575.25

B) $6,655.10

C) $5,261.38

D) $4,215.15

A) $2,575.25

B) $6,655.10

C) $5,261.38

D) $4,215.15

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

59

American Biodyne (AB) is considering expanding into a new line of business. The expansion will require an investment of $500,000 in new equipment. This equipment which will cost another $300,000 to install, will be depreciated on a straight-line basis over an 8-year period to an estimated salvage value of zero. If the expansion project is accepted, working capital will increase by $100,000 immediately. Revenues for the first 3 years are forecasted at $650,000 per year and at $800,000 in years 4-8. Operating costs exclusive of depreciation are expected to be $310,000 per year for 3 years and increase to $400,000 per year for the following 5 years. AB has a marginal tax rate of 40% and its required rate of return for the project under consideration is 16%. If AB assumes that the new equipment will have an actual market value of $50,000 at the end of the 8th year, should the expansion be undertaken?

A) Yes, NPV = $275,114

B) Yes, NPV = $265,964

C) Yes, NPV = $302,934

D) Yes, NPV = $272,434

A) Yes, NPV = $275,114

B) Yes, NPV = $265,964

C) Yes, NPV = $302,934

D) Yes, NPV = $272,434

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

60

A weakness of the net present value/payback method is:

A) It is a complicated calculation

B) It is subjective

C) It is directly related to the variability of returns from a project

D) Because it recognizes the riskiness of various projects, it can develop multiple outcomes.

A) It is a complicated calculation

B) It is subjective

C) It is directly related to the variability of returns from a project

D) Because it recognizes the riskiness of various projects, it can develop multiple outcomes.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

61

How can beta, a measure of systematic risk of a portfolio of securities, be used to judge the risk of a firm?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

62

Determine the pure project beta of a project that has 45% debt and 55% equity. The beta for the company is 1.6 and a tax rate of 40%.

A) 1.82

B) 1.82

C) 1.07

D) 2.07

A) 1.82

B) 1.82

C) 1.07

D) 2.07

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

63

List the ways that a company's decision maker can adjust for total project risk in capital budegeting.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

64

Smart Bumpkins wants to increase production by adding new equipment. The cost of the upgrade is $190,000 and expected cash flows from the new upgrade are expected to be as follows over the next 6 years and the risk free rate is 5%. Should the company upgrade?

A) Yes, the CNPV is $195,196.06

B) Yes, the CNPV is $83,775.16

C) No, the CNPV is -$75,522.84

D) No, the CNPV is -$42,175.93

A) Yes, the CNPV is $195,196.06

B) Yes, the CNPV is $83,775.16

C) No, the CNPV is -$75,522.84

D) No, the CNPV is -$42,175.93

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

65

Determine the pure project beta of a project that has 30% debt and 70% equity. The beta for the company is 1.4 and a tax rate of 40%.

A) 1.11

B) 1.56

C) 1.83

D) 1.05

A) 1.11

B) 1.56

C) 1.83

D) 1.05

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

66

All of the following are methods of adjusting a project for total risk EXCEPT:

A) sensitivity analysis

B) carpe diem approach

C) certainty equivalent approach

D) simulation analysis

A) sensitivity analysis

B) carpe diem approach

C) certainty equivalent approach

D) simulation analysis

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

67

____ are needed for sensitivity analysis and have made the application simple and inexpensive.

A) risk tolerance tables

B) financial statements

C) financial calculators

D) computer spreadsheets

A) risk tolerance tables

B) financial statements

C) financial calculators

D) computer spreadsheets

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

68

The hurdle rate approach in determining the acceptability of projects:

A) is an improvement over the risk-adjusted discount rate approach because it provides for an objective basis to determine risk premiums for individual projects.

B) is a modification of the internal rate of return approach.

C) is inconsistent with the principle of project risk balancing.

D) is a method used with the certainty equivalent approach.

A) is an improvement over the risk-adjusted discount rate approach because it provides for an objective basis to determine risk premiums for individual projects.

B) is a modification of the internal rate of return approach.

C) is inconsistent with the principle of project risk balancing.

D) is a method used with the certainty equivalent approach.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

69

What item has made sensitivity analysis simple and inexpensive?

A) computer accounting software

B) computer spreadsheet software

C) computer webinars

D) computer video and presentation software

A) computer accounting software

B) computer spreadsheet software

C) computer webinars

D) computer video and presentation software

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

70

What are the primary advantages and disadvantages of applying simulation to capital budgeting risk analysis?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

71

Haulin'It Towing Company is considering adding more tow trucks to its fleet. The cost of the new trucks is $150,000. The project will utilize the risk adjusted discount, the firm has a beta of 1.3, the risk free rate is 7% and the return in the market is 15%. Should Haulin' It add the additional trucks if the expected increased revenues will be as follows?

A) No, the npv of the project is -$15,175.19

B) Yes, the npv of the project is $75,275.16

C) No, the npv of the project is -$9,765.12

D) Yes, the npv of the project is $55,050.92

A) No, the npv of the project is -$15,175.19

B) Yes, the npv of the project is $75,275.16

C) No, the npv of the project is -$9,765.12

D) Yes, the npv of the project is $55,050.92

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

72

The risk of an investment project is defined in terms of the potential ____ of its returns.

A) certainty

B) size

C) variability

D) timing

A) certainty

B) size

C) variability

D) timing

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

73

What are the weaknesses of the net present value/payback approach?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

74

When is the risk-adjusted discount rate approach considered preferable to the weighted cost of capital approach in determining the net present value of a project?

A) It is preferable when the projects under consideration differ significantly in the number of cash flows generated by the projects.

B) It is preferable when the projects under consideration differ significantly in their total return.

C) It is preferable when the projects under consideration differ significantly in their cash inflows.

D) It is preferable when the projects under consideration differ significantly in their risk characteristics.

A) It is preferable when the projects under consideration differ significantly in the number of cash flows generated by the projects.

B) It is preferable when the projects under consideration differ significantly in their total return.

C) It is preferable when the projects under consideration differ significantly in their cash inflows.

D) It is preferable when the projects under consideration differ significantly in their risk characteristics.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

75

How and when should firms consider employing additional risk analysis techniques in judging the suitability of large projects prior to implementation?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following is/are a risk associated with projects that must be considered when determining the net present value?

I) Financial risk

II) Pure project risk

A) I only

B) II only

C) Both I and II

D) Neither I nor II

I) Financial risk

II) Pure project risk

A) I only

B) II only

C) Both I and II

D) Neither I nor II

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

77

What is the reason companies utilize the certainty equivalent approach in evaluating projects?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

78

The hurdle rate is best described as:

A) the required rate of return.

B) the risk adjusted discount rate.

C) the net present value.

D) the risk free rate.

A) the required rate of return.

B) the risk adjusted discount rate.

C) the net present value.

D) the risk free rate.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck