Deck 4: Parity Conditions in International Finance and Currency Forecasting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/37

Play

Full screen (f)

Deck 4: Parity Conditions in International Finance and Currency Forecasting

1

A currency is said to be at a forward _________ if the forward rate is below the spot rate.

A) discount

B) premium

C) position

D) forward

A) discount

B) premium

C) position

D) forward

B

2

If the expected inflation rate is 5% and the real required return is 6%, then the Fisher effect says that the nominal interest rate should be

A) 1%

B) 11.3%

C) 11%

D) 6%

A) 1%

B) 11.3%

C) 11%

D) 6%

B

3

Suppose the price indexes in Mexico and the U.S., which both began the year at 100, are at 160 and 103, respectively, by the end of the year. If the exchange rate began the year at Mex$= $1 and ended the year at Mex$5.9 = $1, then the change in the real value of the peso (a "?" indicates a real devaluation) during the year is

A) 0%

B) ?5.0%

C) 18.5%

D) ?8.2%

A) 0%

B) ?5.0%

C) 18.5%

D) ?8.2%

C

4

If a country's freely floating currency is undervalued in terms of purchasing power parity, its capital account is likely to be

A) Subsidized by the International Monetary Fund

A) in deficit or tending toward a deficit

B) in surplus or tending toward a surplus

D) a candidate for loans from the World Bank

A) Subsidized by the International Monetary Fund

A) in deficit or tending toward a deficit

B) in surplus or tending toward a surplus

D) a candidate for loans from the World Bank

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

5

A rise in the inflation rate in one nation relative to others will be associated with a fall in the first nation's exchange rate and with a rise of its interest rate relative to foreign interest rates. The two conditions combined result in the _________ Effect.

A) Fisher

A) Herstatt

B) Unbiased forward rate

C) International Fisher

A) Fisher

A) Herstatt

B) Unbiased forward rate

C) International Fisher

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

6

Suppose five?year deposit rates on Eurodollars and Euromarks are 12% and 8%, respectively. If the current spot rate for the mark is $0.50, then the spot rate for the mark five years from now implied by these interest rates is

A) .5997

B) .4169

C) .5185

D) .4821

A) .5997

B) .4169

C) .5185

D) .4821

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

7

If expected inflation is 20% and the real required return is 10%, then the Fisher effect says that the nominal interest rate should be exactly

A) 30%

B) 32%

C) 22%

D) 12%

A) 30%

B) 32%

C) 22%

D) 12%

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

8

The direct spot quote for the Canadian dollar is $.76 and the 180?day forward rate is $.7The difference between the two rates is likely to mean that

A) inflation in the U.S. during the past year was lower than in Canada

B) interest rates are rising faster in Canada than in the U.S.

C) prices in Canada are expected to rise more rapidly than in the U.S.

D) the Canadian dollar's spot rate is expected to rise in terms of the U.S. dollar

A) inflation in the U.S. during the past year was lower than in Canada

B) interest rates are rising faster in Canada than in the U.S.

C) prices in Canada are expected to rise more rapidly than in the U.S.

D) the Canadian dollar's spot rate is expected to rise in terms of the U.S. dollar

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

9

A 150% real return in Brazil is higher than a 15% dollar return in the U.S.

A) because arbitrage opportunities exist

B) when the inflation controls are suspended in Brazil

C) it depends on whether these are nominal or real returns

D) regardless of nominal or real returns

A) because arbitrage opportunities exist

B) when the inflation controls are suspended in Brazil

C) it depends on whether these are nominal or real returns

D) regardless of nominal or real returns

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

10

Annual inflation rates in the U.S. and Italy are expected to be 4% and 7%, respectively. If the current spot rate is $1 = L2,000, then the expected spot rate for the lira in three years is

A) $.0004591

B) $.0011590

C) $.0009892

D) $.0005471

A) $.0004591

B) $.0011590

C) $.0009892

D) $.0005471

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

11

If inflation in the U.S. is projected at 5% annually for the next 5 years and at 12% annually in Italy for the same time period, and the lira/$ spot rate is currently at L2400 = $1, then the PPP estimate of the spot rate five years from now is

A) 1738

B) 3314

C) 2560

D) 2250

A) 1738

B) 3314

C) 2560

D) 2250

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

12

The inflation rates in the U.S. and France are expected to be 4% per annum and 7% per annum, respectively. If the current spot rate is $.1050, then the expected spot rate in three years is

A) $.1150

B) $.1112

C) $.0964

D) $.0992

A) $.1150

B) $.1112

C) $.0964

D) $.0992

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

13

Annual inflation rates in the U.S. and France are expected to be 4% and 6%, respectively. If the current spot rate is $.1250/FF, then the expected spot rate in two years is

A) $.1299

B) $.1150

C) $.1203

D) $.1335

A) $.1299

B) $.1150

C) $.1203

D) $.1335

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

14

The spot rate on the Dutch guilder is $0.39 and the 180?day forward rate is $0.40. The difference between the spot and forward rates means that

A) interest rates are higher in the U.S. than in the Netherlands

B) the guilder has risen in relation to the dollar

C) the inflation rate in the Netherlands is declining

D) the guilder is expected to fall in value relative to the dollar there is a high inflation rate in the U.S.

A) interest rates are higher in the U.S. than in the Netherlands

B) the guilder has risen in relation to the dollar

C) the inflation rate in the Netherlands is declining

D) the guilder is expected to fall in value relative to the dollar there is a high inflation rate in the U.S.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

15

The current five?year Euroyen rate is 6% per annum (compounded annually). The five?year Eurodollar rate is 8.5%. What is the implied forward premium or discount of the yen (over the current spot rate) for a five?year forward contract?

A) 4.17% premium

B) 18.46% discount

C) 11.00% discount

D) 12.36% premium

A) 4.17% premium

B) 18.46% discount

C) 11.00% discount

D) 12.36% premium

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

16

If the average rate of inflation in the world rises from 5% to 7%, this will tend to make forward exchange rates move toward

A) smaller premiums or larger discounts in relation to the dollar

B) larger premiums or smaller discounts in relation to the dollar

C) no change on average

D) can't tell what will happen

A) smaller premiums or larger discounts in relation to the dollar

B) larger premiums or smaller discounts in relation to the dollar

C) no change on average

D) can't tell what will happen

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

17

The Fisher effect states that the _________ rate is made up of a real required rate of return and an inflation premium.

A) nominal exchange

A) real exchange

B) nominal interest rate

C) adjusted dividend

A) nominal exchange

A) real exchange

B) nominal interest rate

C) adjusted dividend

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

18

Suppose the spot rates for the pound, mark, and Swiss franc are $1.20, $.32, and $.40, respectively. The associated 90?day interest rates (annualized) are 16%, 8%, and 4%, while the U.S. 90?day interest rate is 12%. What is the 90?day forward rate (to the nearest cent) on a TCU (TCU 1 = £1 + DM1 + SFr1) if interest parity holds? a $1.92

B $1.98

C $1.94

D $1.87

B $1.98

C $1.94

D $1.87

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

19

Annual inflation rates in the U.S. and Greece are expected to be 3% and 8%, respectively. If the current spot rate for the drachma is $.007, then the expected spot rate in three years is

A) $.00607

B) $.00823

C) $.00751

D) $.00694

A) $.00607

B) $.00823

C) $.00751

D) $.00694

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

20

Suppose annual inflation rates in the U.S. and Mexico are expected to be 6% and 80%, respectively, over the next several years. If the current spot rate for the Mexican peso is $.005, then the best estimate of the peso's spot value in 3 years is

A) $.00276

B) $.01190

C) $.00321

D) $.00102

A) $.00276

B) $.01190

C) $.00321

D) $.00102

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

21

If annualized interest rates in the U.S. and Switzerland are 10% and 4%, respectively, and the 90?day forward rate for the Swiss franc is $.3864, at what current spot rate will interest rate parity hold?

A) $.3902

B) $.3874

C) $.3807

D) $.3792

A) $.3902

B) $.3874

C) $.3807

D) $.3792

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

22

If annualized interest rates in the U.S. and France are 9% and 13%, respectively, and the spot value of the franc is $.1109, then at what 180?day forward rate will interest rate parity hold?

A) $.1070

B) $.1150

C) $.1088

D) $.1130

A) $.1070

B) $.1150

C) $.1088

D) $.1130

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

23

If the U.S. trade balance with Japan is expected to go from a deficit this year to a surplus next year, the forward rate on yen would

A) be less than the spot rate

B) be higher than the spot rate

C) equal the spot rate

D) could be either above or below the spot rate

A) be less than the spot rate

B) be higher than the spot rate

C) equal the spot rate

D) could be either above or below the spot rate

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

24

Suppose the Swiss franc revalues from $0.40 at the beginning of the year to $0.44 at the end of the year. U.S. inflation is 5% and Swiss inflation is 3% during the year. What is the real devaluation (?) or real revaluation (+) of the Swiss franc during the year?

A) + 7.9%

B) ? 5.3%

C) + 8.1%

D) ? 1.6%

A) + 7.9%

B) ? 5.3%

C) + 8.1%

D) ? 1.6%

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

25

The 90?day interest rates (annualized) in the U.S. and Japan are, respectively, 10% and 7%, while the direct spot quote for the yen in New York is $.004300. At what 90?day forward rate would interest rate parity hold?

A) .004430

B) .004271

C) .004332

D) .004176

A) .004430

B) .004271

C) .004332

D) .004176

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

26

Suppose the spot rates for the pound, mark, and Swiss franc are $1.50, $.42, and $.48, respectively. The associated 90?day interest rates (annualized) are 12%, 6%, and 4%, while the U.S. 90?day interest rate (annualized) is 8%. What is the 90?day forward rate on a DCU (DCU 1 = £1 + DM1 + SFr1) if interest parity holds?

A) $2.4027

B) $2.3923

C) $2.4196

D) $2.3738

A) $2.4027

B) $2.3923

C) $2.4196

D) $2.3738

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

27

Suppose that spot pounds are selling at $1.7342, while 90?day forward pounds are selling at $1.7156. At the same time, DM spot and 90?day forward rates are $0.6138 and $0.6014, respectively. According to these quotes the

A) pound is selling at a 3.87% forward discount relative to the DM

B) pound is selling at a 2.37% forward premium relative to the DM

C) DM is selling at a 0.97% forward discount relative to the pound

D) DM is selling at a 1.54% forward premium relative to the pound

A) pound is selling at a 3.87% forward discount relative to the DM

B) pound is selling at a 2.37% forward premium relative to the DM

C) DM is selling at a 0.97% forward discount relative to the pound

D) DM is selling at a 1.54% forward premium relative to the pound

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

28

The spot rate on the euro is $1.40 and the 180?day forward rate is $1.50. The difference between the two rates means

A) interest rates are higher in the U.S. than in the European Union

B) the mark has risen in relation to the dollar

C) the inflation rate in Germany is declining

D) the euro is expected to fall in value relative to the dollar

A) interest rates are higher in the U.S. than in the European Union

B) the mark has risen in relation to the dollar

C) the inflation rate in Germany is declining

D) the euro is expected to fall in value relative to the dollar

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

29

Suppose the value of the Polish zloty moves from Z 1000 = $1 at the start of the year to Z 1,800 at the end of the year. At the same time, the Polish price level changes from an index of 100 on January 1 to 134 on December 31. U.S. inflation during the year was If the one-year interest rate on the zloty is 44%, what was the real dollar cost of borrowing the zloty during the year?

A) 17.53%

B) 27.81%

C) -23.44%

D) -8.76%

A) 17.53%

B) 27.81%

C) -23.44%

D) -8.76%

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

30

The current five?year Euroyen and Eurodollar rates are 8% and 12.5% per annum, respectively. What is the implied forward premium or discount of the yen (over the current spot rate for a five?year forward contract)?

A) 4.17% premium

B) 18.46% discount

C) 17.74% discount

D) 22.64% premium

A) 4.17% premium

B) 18.46% discount

C) 17.74% discount

D) 22.64% premium

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

31

Suppose the price indexes in Spain and the U.S., which both began the year at 100, are at 117 and 105, respectively, by the end of the year. If the beginning and ending exchange rates, respectively, for the peseta are $.1320 and $.1125, then the change in the real value of the peseta (a "?" indicates a real devaluation) during the year is

A) 0%

B) ?5.0%

C) 2.4%

D) ?8.2%

A) 0%

B) ?5.0%

C) 2.4%

D) ?8.2%

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

32

Suppose the Deutsche mark revalues from $.30 at the beginning of the year to $.33 at the end of the year. Inflation during the year is 5% in the U.S. and 3% in Germany. What is the real devaluation (?) or real revaluation (+) of the Deutsche mark during the year?

A) + 7.9%

B) ? 5.3%

C) + 8.1%

D) ? 1.6%

A) + 7.9%

B) ? 5.3%

C) + 8.1%

D) ? 1.6%

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

33

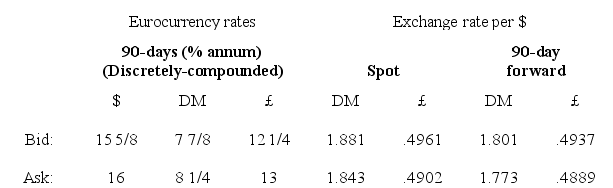

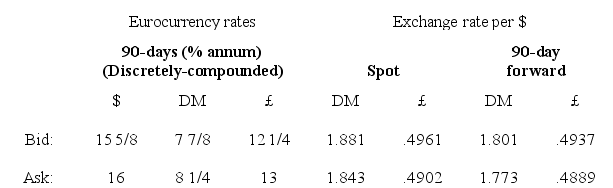

The following exchange and interest rate quotations were recently observed:  An arbitrage profit can be obtained by

An arbitrage profit can be obtained by

A) borrowing pounds and lending dollars

B) borrowing dollars and lending DM

C) borrowing DM and lending pounds

D) there are no arbitrage opportunities

An arbitrage profit can be obtained by

An arbitrage profit can be obtained byA) borrowing pounds and lending dollars

B) borrowing dollars and lending DM

C) borrowing DM and lending pounds

D) there are no arbitrage opportunities

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

34

Suppose inflation rates in the U.S. and France are expected to be 4% and 9%, respectively, next year and 6% and 7%, respectively, in the following year. If the current spot rate is $.1050, then the expected spot value of the franc in two years is

A) $.1111

B) $.1024

C) $.0992

D) $.1074

A) $.1111

B) $.1024

C) $.0992

D) $.1074

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

35

Suppose the spot rates for the pound, mark, and Swiss franc are $1.30, $.35, and $.40, respectively. The associated 90?day interest rates (annualized) are 16%, 8%, and 4%, while the U.S. 90?day interest rate (annualized) is 12%. What is the 90?day forward rate on an ACU (ACU 1 = £1 + DM1 + SFr1) if interest parity holds?

A) $2.0512

B) $2.1134

C) $2.0397

D) $2.0489

A) $2.0512

B) $2.1134

C) $2.0397

D) $2.0489

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

36

Suppose the pound devalues from $1.25 at the start of the year to $1.00 at the end of the year. Inflation during the year is 15% in England and 5% in the U.S. What is the real devaluation (?) or real revaluation (+) of the pound during the year?

A) ? 12.38%

B) ? 20.71%

C) + 2.39%

D) + 1.46%

A) ? 12.38%

B) ? 20.71%

C) + 2.39%

D) + 1.46%

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

37

If annualized interest rates in the U.S. and France are 9% and 13%, respectively, and the spot value of the franc is $.1109, then at what 180?day forward rate will interest rate parity hold?

A) $.1070

B) $.1150

C) $.1088

D) $.1130

A) $.1070

B) $.1150

C) $.1088

D) $.1130

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck