Deck 7: Financial Assets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/206

Play

Full screen (f)

Deck 7: Financial Assets

1

Deposits in transit would not appear on a company's bank reconciliation but would appear on the company's bank statement.

False

2

Restricted cash may be available to meet the normal operating needs of a company.

False

3

A line of credit is an advance agreement by a bank to lend a company any amount of money up to a specified limit.

True

4

Charges for depositing NSF checks are an example of a transaction that has been recorded by the depositor but may not have been recorded by the bank.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

5

If the account Cash Over and Short has a debit balance,it is reported in the balance sheet as a current asset.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

6

A compensating balance is often required by a bank as a condition for granting a loan.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

7

The term "financial asset" is synonymous with the term "cash equivalent."

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

8

Cash equivalents are the most liquid of all assets.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

9

An example of good internal control over cash is to have the person responsible for physically handling all cash perform the bank statement reconciliations.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

10

Service charges are an example of a transaction that appears in the bank statement but which may not yet have been recorded by the company.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

11

A line of credit creates a liability for the borrower when it is granted by the bank.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

12

Entries made in the general journal after preparing a bank reconciliation are called closing entries.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

13

Financial assets describe not just cash,but all assets that are easily and directly convertible into known amounts of cash,except marketable securities.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

14

Internal control is strengthened by a policy of making payments by check,from cash receipts,or from a petty cash fund.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

15

Financial assets may be current or long-term assets.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

16

The first step in a bank reconciliation is to update the depositor's accounting records for any deposits in transit.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

17

U.S.Treasury bills that mature within a period of four to six months are cash equivalents.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

18

Compensating balances are not included in the amount of cash listed on a balance sheet.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

19

Cash equivalents include money market funds,U.S.Treasury bills,and high-grade commercial paper that mature within 90 days of acquisition.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

20

Internal control will aid in achieving accurate accounting for cash transactions.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

21

Short-term investments in marketable securities may not be reported in the balance sheet at values higher than original cost.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

22

Gains (or losses)on sales of marketable securities,as well as any unrealized holding gains (or losses)on investments in available for sale securities,are reported in the income statement.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

23

An account receivable that arose from normal sales activity has a 16-month credit term.This receivable will be classified as a noncurrent asset.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

24

The Allowance for Doubtful Accounts is called a valuation account,or contra-asset account,and normally has a credit balance.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

25

To "write-off" an account receivable is to reduce the balance of the customer's account to zero.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

26

One of the major steps in achieving internal control over accounts receivable is that the Billing department reviews the sales order,the customer's credit file,and decides whether and how much credit should be extended.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

27

The income statement approach used to estimate uncollectible receivables uses a percentage of net sales without considering the current balance in the Allowance account.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

28

The balance shown on a bank statement is always less than the month-end balance of a company's cash account in the general ledger.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

29

An unrealized holding loss on available-for-sale securities will reduce net income.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

30

Effective internal control over receivables is designed to ensure that customers' payments are promptly deposited.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

31

The direct write-off method is more conservative than the allowance method for valuation of receivables.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

32

In order to maximize sales and profits,effective internal control over receivables ensures that credit is extended to all customers who request credit.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

33

In order for a company's accounting records to be up-to-date and accurate after a bank reconciliation has been completed,journal entries should be made for any service charges by the bank and for deposits in transit.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

34

In the bank reconciliation,every adjustment to the balance per depositor's records requires a journal entry.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

35

If the allowance method is used,the recovery of an account receivable previously written-off results in a gain being recorded on the income statement.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

36

Marketable securities include investments in bonds and in the capital stocks of publicly traded corporations.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

37

An unrealized holding gain on available for sale securities will increase shareholders' equity.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

38

When doing a bank reconciliation,an NSF check will reduce the bank's balance.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

39

A basic characteristic of all marketable securities is that they can be purchased or sold quickly and easily at quoted market prices.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

40

Dividend revenue and interest revenue are reported in the income statement as a component of a company's net income.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

41

When the direct write-off method is used to recognize uncollectible accounts expense,an Allowance for Doubtful Accounts is not required.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

42

If the note receivable bears interest,the amount debited to Notes Receivable is for the maturity amount of the note.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

43

When interest is collected,it is debited to the Interest Revenue account and credited to the Notes Receivable account.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

44

When an Allowance for Doubtful Accounts is used,accounts receivable are valued in the balance sheet at their estimated net realizable value.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

45

Each of these categories of assets is normally shown in the balance sheet at current value,except:

A)Inventories.

B)Accounts receivable.

C)Short-term investments in marketable securities.

D)Cash.

A)Inventories.

B)Accounts receivable.

C)Short-term investments in marketable securities.

D)Cash.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

46

The maker of a note is the party to whom payment is to be made.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

47

Factoring allows a business to obtain immediate cash instead of waiting to collect the account receivable.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

48

A major purpose of using an Allowance for Doubtful Accounts is to recognize uncollectible accounts expense in the same accounting period as the related sales that caused the expense.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

49

Industries with relatively high accounts receivable turnover rates include restaurants and hotels.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

50

The lower the accounts receivable turnover rate,the longer a company must wait to collect from its credit customers.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

51

The Allowance for Doubtful Accounts should be listed on the balance sheet as a current liability.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

52

The Allowance for Doubtful Accounts is a contra-asset account and appears on the balance sheet.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

53

The higher a company's accounts receivable turnover rate,the more liquid the company's receivables.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

54

When a company makes a sale by accepting a bank-issued credit card from the customer,the sale is recorded as a cash sale.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

55

In general,the longer an account receivable is outstanding,the greater the likelihood it will be collected.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

56

If the maker of a note defaults,an entry is made to debit Accounts Receivable and credit Notes Receivable.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following is not considered a cash equivalent?

A)U.S.Treasury bills

B)Money market funds

C)Accounts receivable

D)High-grade commercial paper

A)U.S.Treasury bills

B)Money market funds

C)Accounts receivable

D)High-grade commercial paper

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

58

The term cash equivalent refers to:

A)An item such as a money order,travelers' check,or check from a customer.

B)An account receivable from a reliable customer who has always paid bills within the discount period.

C)A guaranteed line of credit at the company's bank.

D)Very liquid short-term investments such as U.S.Treasury Bills and commercial paper.

A)An item such as a money order,travelers' check,or check from a customer.

B)An account receivable from a reliable customer who has always paid bills within the discount period.

C)A guaranteed line of credit at the company's bank.

D)Very liquid short-term investments such as U.S.Treasury Bills and commercial paper.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

59

Financial assets:

A)Only consist of cash and cash equivalents.

B)Are reported at cost in the balance sheet.

C)Include short-term investments in marketable securities and receivables,as well as cash.

D)Are not very productive assets and should be kept to a minimum in a well-managed company.

A)Only consist of cash and cash equivalents.

B)Are reported at cost in the balance sheet.

C)Include short-term investments in marketable securities and receivables,as well as cash.

D)Are not very productive assets and should be kept to a minimum in a well-managed company.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

60

Financial assets include all of the following except:

A)Cash.

B)Marketable securities.

C)Inventories.

D)Accounts receivable.

A)Cash.

B)Marketable securities.

C)Inventories.

D)Accounts receivable.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

61

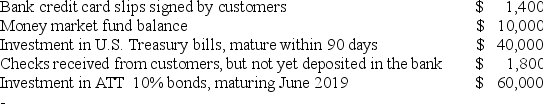

As of December 31,2018,Valley Company has $16,920 cash in its checking account,as well as several other items listed below:  What amount should be shown in Valley's December 31,2018,balance sheet as "Cash and cash equivalents"?

What amount should be shown in Valley's December 31,2018,balance sheet as "Cash and cash equivalents"?

A)$53,200

B)$70,120

C)$130,120

D)$113,200

What amount should be shown in Valley's December 31,2018,balance sheet as "Cash and cash equivalents"?

What amount should be shown in Valley's December 31,2018,balance sheet as "Cash and cash equivalents"?A)$53,200

B)$70,120

C)$130,120

D)$113,200

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

62

The unused portion of a line of credit:

A)Is reported as a current liability in the balance sheet.

B)Decreases a company's liquidity.

C)Can be used at any time by drawing a check on a special bank account.

D)Requires a compensating balance in order to keep the line of credit open.

A)Is reported as a current liability in the balance sheet.

B)Decreases a company's liquidity.

C)Can be used at any time by drawing a check on a special bank account.

D)Requires a compensating balance in order to keep the line of credit open.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following practices best illustrates efficient management of cash?

A)The accountant records all cash receipts and payments when reconciling the bank account at the end of each month.

B)Management arranges for a loan to cover projected cash shortages during the production phase of the business cycle each year.

C)Cash budgets (forecasts)are prepared only one month in advance in order to avoid the need for constant revision.

D)All cash resources are held in the checking account to maximize liquidity.

A)The accountant records all cash receipts and payments when reconciling the bank account at the end of each month.

B)Management arranges for a loan to cover projected cash shortages during the production phase of the business cycle each year.

C)Cash budgets (forecasts)are prepared only one month in advance in order to avoid the need for constant revision.

D)All cash resources are held in the checking account to maximize liquidity.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

64

The bookkeeper prepared a check for $68 but accidentally recorded it as $86.When preparing the bank reconciliation,this should be corrected by:

A)Adding $18 to the bank balance.

B)Subtracting $18 from the bank balance.

C)Adding $18 to the book balance.

D)Subtracting $18 from the book balance.

A)Adding $18 to the bank balance.

B)Subtracting $18 from the bank balance.

C)Adding $18 to the book balance.

D)Subtracting $18 from the book balance.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

65

When preparing a bank reconciliation,outstanding checks will:

A)Increase the balance per depositor's records.

B)Decrease the balance per depositor's records.

C)Increase the balance per the bank statement.

D)Decrease the balance per the bank statement.

A)Increase the balance per depositor's records.

B)Decrease the balance per depositor's records.

C)Increase the balance per the bank statement.

D)Decrease the balance per the bank statement.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

66

In handling of daily cash transactions,a few minor errors inevitably will occur.Which of the following is used to adjust the accounting records for these small errors?

A)The bank reconciliation

B)The Petty Cash account

C)The Cash Over and Short account

D)The cash budget

A)The bank reconciliation

B)The Petty Cash account

C)The Cash Over and Short account

D)The cash budget

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

67

With a line of credit,a liability arises:

A)As soon as the line is created.

B)As soon as any money is borrowed.

C)Upon repayment of the debt.

D)At the maturity date.

A)As soon as the line is created.

B)As soon as any money is borrowed.

C)Upon repayment of the debt.

D)At the maturity date.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following items on a bank reconciliation would have been known to the depositor before the bank statement arrived?

A)Bank service charges

B)An NSF check

C)A credit for interest earned

D)A deposit in transit

A)Bank service charges

B)An NSF check

C)A credit for interest earned

D)A deposit in transit

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

69

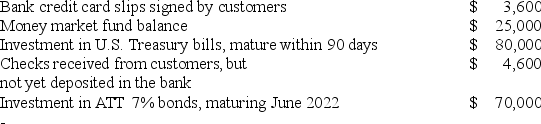

As of December 31,2018,Chippewa Company has $26,440 cash in its checking account,as well as several other items listed below:  What amount should be shown in Chippewa's December 31,2018,balance sheet as "Cash and cash equivalents"?

What amount should be shown in Chippewa's December 31,2018,balance sheet as "Cash and cash equivalents"?

A)$30,040

B)$139,640

C)$209,640

D)$59,640

What amount should be shown in Chippewa's December 31,2018,balance sheet as "Cash and cash equivalents"?

What amount should be shown in Chippewa's December 31,2018,balance sheet as "Cash and cash equivalents"?A)$30,040

B)$139,640

C)$209,640

D)$59,640

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

70

After preparing a bank reconciliation,a journal entry would be required for which of the following:

A)A deposit in transit.

B)A check for $48 given to a supplier but not yet recorded by the company's bank.

C)Interest earned on the company's checking account.

D)A deposit made by a company with a similar name and credited to your account.

A)A deposit in transit.

B)A check for $48 given to a supplier but not yet recorded by the company's bank.

C)Interest earned on the company's checking account.

D)A deposit made by a company with a similar name and credited to your account.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

71

When short-term investments appear in the balance sheet at their current market values,it is an exception to the ________ principle.

A)Revenue recognition

B)Matching

C)Cost

D)Relevance

A)Revenue recognition

B)Matching

C)Cost

D)Relevance

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

72

A bank reconciliation explains the differences between:

A)Cash receipts and cash disbursements for the period.

B)The balance of cash in the bank and the budgeted expenditures for the upcoming accounting period.

C)The balance per bank statement and the cash balance per the accounting records of the depositor.

D)The balance per bank statement and cash expected to be on hand according to the cash forecast.

A)Cash receipts and cash disbursements for the period.

B)The balance of cash in the bank and the budgeted expenditures for the upcoming accounting period.

C)The balance per bank statement and the cash balance per the accounting records of the depositor.

D)The balance per bank statement and cash expected to be on hand according to the cash forecast.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

73

Efficient management of cash includes which of the following concepts?

A)Pay each bill as soon as the invoice is received.

B)Deposit all cash receipts and make all cash disbursements at the end of each week.

C)Prepare a control listing of cash receipts at the time and place the money is received.

D)Pay suppliers in cash out of cash sales receipts before depositing them in the bank.

A)Pay each bill as soon as the invoice is received.

B)Deposit all cash receipts and make all cash disbursements at the end of each week.

C)Prepare a control listing of cash receipts at the time and place the money is received.

D)Pay suppliers in cash out of cash sales receipts before depositing them in the bank.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following is not a basic means of achieving internal control over cash receipts?

A)Separate the functions of cash handling and maintenance of accounting records.

B)Prepare a daily listing of cash received through the mail.

C)Deposit all cash receipts daily in the petty cash fund.

D)Promptly reconcile bank statements with the accounting records.

A)Separate the functions of cash handling and maintenance of accounting records.

B)Prepare a daily listing of cash received through the mail.

C)Deposit all cash receipts daily in the petty cash fund.

D)Promptly reconcile bank statements with the accounting records.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

75

In reconciling a bank statement,which of the following items could cause the cash per the bank statement to be greater than the balance of cash shown in the depositor's accounting records?

A)An outstanding check

B)A check returned to the depositor marked NSF

C)Check 457 written for $643 was recorded by the depositor as $463

D)A bank service charge

A)An outstanding check

B)A check returned to the depositor marked NSF

C)Check 457 written for $643 was recorded by the depositor as $463

D)A bank service charge

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

76

The purpose of establishing a petty cash fund is to:

A)Achieve internal control over small cash disbursements not made by check.

B)Keep track of expenditures paid out of cash receipts from customers prior to deposit.

C)Ensure that the amount of cash in the bank does not become excessive.

D)Keep enough cash on hand in the office to cover all normal operating expenses of the business for a period of time.

A)Achieve internal control over small cash disbursements not made by check.

B)Keep track of expenditures paid out of cash receipts from customers prior to deposit.

C)Ensure that the amount of cash in the bank does not become excessive.

D)Keep enough cash on hand in the office to cover all normal operating expenses of the business for a period of time.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following does not contribute toward achieving internal control over cash?

A)The practice of making small cash disbursements directly from the current day's cash receipts

B)The preparation of cash budgets

C)The use of a petty cash fund

D)The practice of approving every expenditure before the cash disbursement is made

A)The practice of making small cash disbursements directly from the current day's cash receipts

B)The preparation of cash budgets

C)The use of a petty cash fund

D)The practice of approving every expenditure before the cash disbursement is made

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

78

When preparing a bank reconciliation,an NSF check will:

A)Increase the balance per depositor's records.

B)Decrease the balance per depositor's records.

C)Increase the balance per the bank statement.

D)Decrease the balance per the bank statement.

A)Increase the balance per depositor's records.

B)Decrease the balance per depositor's records.

C)Increase the balance per the bank statement.

D)Decrease the balance per the bank statement.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

79

A good system of internal control will include all of the following except:

A)Preparing a pro-forma financial statement on a monthly basis.

B)Separating the handling of cash from the maintenance of accounting records.

C)Making all major payments by check.

D)Reconciling bank statements with accounting records.

A)Preparing a pro-forma financial statement on a monthly basis.

B)Separating the handling of cash from the maintenance of accounting records.

C)Making all major payments by check.

D)Reconciling bank statements with accounting records.

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following is not an example of internal control over cash?

A)Preparation of a cash budget

B)Daily deposits of cash receipts at the bank

C)Combining the functions of signing checks with the approval of expenditures

D)Preparation of bank reconciliation

A)Preparation of a cash budget

B)Daily deposits of cash receipts at the bank

C)Combining the functions of signing checks with the approval of expenditures

D)Preparation of bank reconciliation

Unlock Deck

Unlock for access to all 206 flashcards in this deck.

Unlock Deck

k this deck