Deck 14: Amortization of Loans,including Residential Mortgages

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/71

Play

Full screen (f)

Deck 14: Amortization of Loans,including Residential Mortgages

1

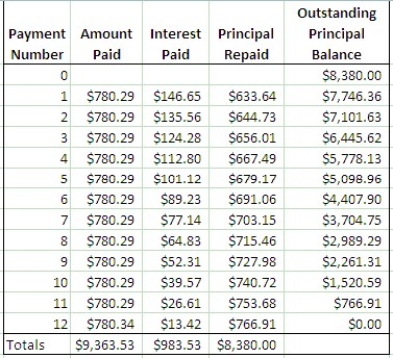

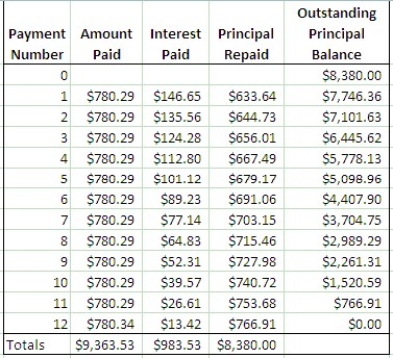

A loan of $8380.00 is repaid by equal payments made at the end of every three months for 3 years.If interest is 7% compounded quarterly,find the size of the quarterly payments and construct an amortization schedule showing the total paid and the total cost of the loan.

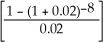

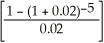

8380.00 = PMT  8380.00 = PMT(10.7395497) $780.29 = PMT Amortization Schedule (done using Excel):

8380.00 = PMT(10.7395497) $780.29 = PMT Amortization Schedule (done using Excel):

8380.00 = PMT(10.7395497) $780.29 = PMT Amortization Schedule (done using Excel):

8380.00 = PMT(10.7395497) $780.29 = PMT Amortization Schedule (done using Excel):

2

A debt of $10 000.00 with interest at 8% compounded quarterly is to be repaid by equal payments at the end of every three months for two years.

a)Calculate the size of the monthly payments.

b)Construct an amortization table.

c)Calculate the outstanding balance after three payments.

a)Calculate the size of the monthly payments.

b)Construct an amortization table.

c)Calculate the outstanding balance after three payments.

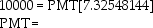

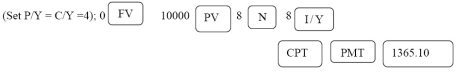

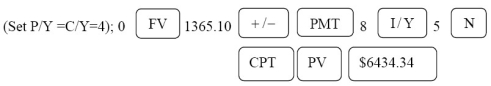

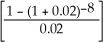

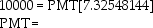

a)PV = 10 000.00; n = 2(4)= 8; i =  = 2% = 0.02; I/Y = 8; P/Y = C/Y = 4;

= 2% = 0.02; I/Y = 8; P/Y = C/Y = 4;

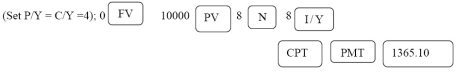

Programmed solution:

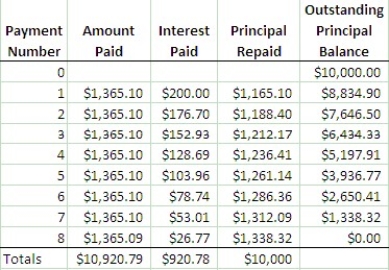

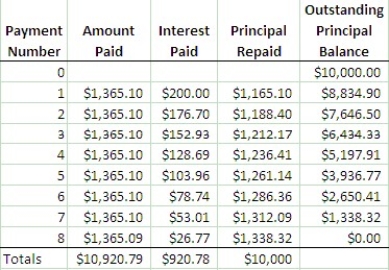

Programmed solution:  b) Amortization Table (done using Excel):

b) Amortization Table (done using Excel):  c)PMT = 1365.10; n = 5(number of payments left); i = 0.02

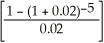

c)PMT = 1365.10; n = 5(number of payments left); i = 0.02

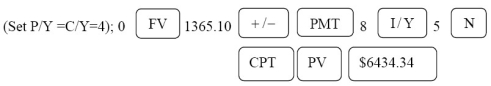

= $6434.34 Programmed solution:

= $6434.34 Programmed solution:  The difference from the chart is due to rounding.

The difference from the chart is due to rounding.

= 2% = 0.02; I/Y = 8; P/Y = C/Y = 4;

= 2% = 0.02; I/Y = 8; P/Y = C/Y = 4;

Programmed solution:

Programmed solution:  b) Amortization Table (done using Excel):

b) Amortization Table (done using Excel):  c)PMT = 1365.10; n = 5(number of payments left); i = 0.02

c)PMT = 1365.10; n = 5(number of payments left); i = 0.02

= $6434.34 Programmed solution:

= $6434.34 Programmed solution:  The difference from the chart is due to rounding.

The difference from the chart is due to rounding. 3

A investor's price for a townhouse was $160 000.00.Sepaba Investments.,the buyers of the rental unit,paid $40 000.00 down and financed the balance by making equal payments at the end of every six months for 25 years.Interest is 6% compounded semi-annually.

a)What is the size of the semi-annual payment?

b)How much will Sepaba Investments.owe after 20 years?

c)What is the total cost of the building for Sepaba Investments?

d)What is the total interest included in the payments?

a)What is the size of the semi-annual payment?

b)How much will Sepaba Investments.owe after 20 years?

c)What is the total cost of the building for Sepaba Investments?

d)What is the total interest included in the payments?

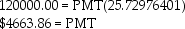

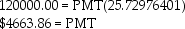

a)120000.00 = PMT

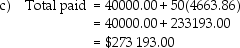

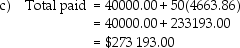

b)An = 4663.86

b)An = 4663.86  = 4663.86(8.530202837)= $39 783.67

= 4663.86(8.530202837)= $39 783.67  d)Total interest = 273193.00 - 160000.00 = $113 193.00

d)Total interest = 273193.00 - 160000.00 = $113 193.00

b)An = 4663.86

b)An = 4663.86  = 4663.86(8.530202837)= $39 783.67

= 4663.86(8.530202837)= $39 783.67  d)Total interest = 273193.00 - 160000.00 = $113 193.00

d)Total interest = 273193.00 - 160000.00 = $113 193.00 4

Vicki receives payments of $3000.00 at the beginning of each month from a pension fund of $150 000.00.Interest earned by the fund is 6% compounded monthly.What is the number of payments Vicki will receive?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

5

Rola Inc.borrowed $42 000.00 at 7% compounded semi-annually.The loan is repaid by payments of $4700.00 due at the end of every six months.

a)How many payments are needed?

b)How much of the principal will be repaid by the 6th payment?

c)Prepare a partial amortization schedule showing the details of the last three payments and totals.

a)How many payments are needed?

b)How much of the principal will be repaid by the 6th payment?

c)Prepare a partial amortization schedule showing the details of the last three payments and totals.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

6

A contractor's price for a new building was $85 100.00.Stampede Inc.,the buyers of the building,paid $14 000.00 down and financed the balance by making equal payments at the end of every six months for 14 years.Interest is 12% compounded semi-annually.

a)What is the size of the semi-annual payment?

b)How much will Stampede Inc.owe after 6 years?

c)What is the total cost of the building for Stampede Inc.?

d)What is the total interest included in the payments?

a)What is the size of the semi-annual payment?

b)How much will Stampede Inc.owe after 6 years?

c)What is the total cost of the building for Stampede Inc.?

d)What is the total interest included in the payments?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

7

Sean and friends bought a property valued at $50 000 for $5000.00 down and a mortgage amortized over 10 years.The group makes equal payments due at the end of every three months.Interest on the mortgage is 6.00% compounded annually and the mortgage is renewable after five years.

a)What is the size of each quarterly payment?

b)What is the outstanding principal at the end of the five-year term?

c)What is the cost of the mortgage for the first five years?

d)If the mortgage is renewed for a further five years at 9% compounded semi-annually,what will be the size of each quarterly payment?

a)What is the size of each quarterly payment?

b)What is the outstanding principal at the end of the five-year term?

c)What is the cost of the mortgage for the first five years?

d)If the mortgage is renewed for a further five years at 9% compounded semi-annually,what will be the size of each quarterly payment?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

8

The owner of the Pink Flamingo Motel borrowed $19 500.00 at 8.11% compounded semi-annually and agreed to repay the loan by making payments of $1110.00 at the end of every three months.

a)How many payments will be needed to repay the loan?

b)How much will be owed at the end of five years?

c)How much of the payments made at the end of five years will be interest?

a)How many payments will be needed to repay the loan?

b)How much will be owed at the end of five years?

c)How much of the payments made at the end of five years will be interest?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

9

Cody borrowed $9100.00 from his credit union.He agreed to repay the loan by making equal monthly payments for 4 years.Interest is 9% compounded monthly.

a)What is the size of the monthly payments?

b)How much will the loan cost him?

c)How much will Cody owe after 16 months?

d)How much interest will he pay in his 26th payment?

e)How much of the principal will be repaid in the 18th payment?

f)Prepare a partial amortization schedule showing details of the first three payments,Payments 24,25,26,the last three payments,and totals.

a)What is the size of the monthly payments?

b)How much will the loan cost him?

c)How much will Cody owe after 16 months?

d)How much interest will he pay in his 26th payment?

e)How much of the principal will be repaid in the 18th payment?

f)Prepare a partial amortization schedule showing details of the first three payments,Payments 24,25,26,the last three payments,and totals.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

10

The Taylors agreed to monthly payments rounded up to the nearest $100.00 on a mortgage of $136 000.00 amortized over 15 years.Interest for the first five years was 8.5% compounded semi-annually.After 30 months,as permitted by the mortgage agreement,the Taylors increased the rounded monthly payment by 10%.

a)Determine the mortgage balance at the end of the five-year term.

b)If the interest rate remains unchanged over the remaining term,how many more of the increased payments will amortize the mortgage balance?

c)How much did the Taylors save by exercising the increase-in-payment option?

a)Determine the mortgage balance at the end of the five-year term.

b)If the interest rate remains unchanged over the remaining term,how many more of the increased payments will amortize the mortgage balance?

c)How much did the Taylors save by exercising the increase-in-payment option?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

11

A debt of $12 500.00 with interest at 5.5% compounded semi-annually is amortized by making payments of $1000.00 at the end of every six months.Calculate the outstanding balance after five years.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

12

A loan of $19 000.00 is repaid by quarterly payments of $900.00 each at 8% compounded quarterly.What is the principal repaid by the 21st payment?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

13

A debt of $12 970.00 with interest at 7.23% compounded semi-annually is repaid by payments of $1880.00 made at the end of every three months.Construct an amortization schedule showing the total paid and the total cost of the debt.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

14

A $30 000.00 mortgage is amortized by monthly payments over twenty years and is renewable after five years.

a)If the interest rate is 8.5% compounded semi-annually,calculate the outstanding balance at the end of the five-year term.

b)If the mortgage is renewed for a further three-year term at 8% compounded semi-annually,calculate the size of the new monthly payment.

c)Calculate the payout figure at the end of the three-year term.

a)If the interest rate is 8.5% compounded semi-annually,calculate the outstanding balance at the end of the five-year term.

b)If the mortgage is renewed for a further three-year term at 8% compounded semi-annually,calculate the size of the new monthly payment.

c)Calculate the payout figure at the end of the three-year term.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

15

Mr.Lamb borrowed $8321.00 at 11.12% compounded monthly.He agreed to repay the loan in equal monthly payments over five years.

a)What is the size of the monthly payment?

b)How much of the 24th payment is interest?

c)What is the principal repaid in the 37th payment?

d)Prepare a partial amortization schedule showing details of the first three payments,the last three payments,and totals.

a)What is the size of the monthly payment?

b)How much of the 24th payment is interest?

c)What is the principal repaid in the 37th payment?

d)Prepare a partial amortization schedule showing details of the first three payments,the last three payments,and totals.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

16

Olfert Inc.is repaying a loan of $52 500.00 by making payments of $4700.00 at the end of every six months.If interest is 7.5% compounded semi-annually,construct an amortization schedule showing the total paid and the total cost of the loan.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

17

A loan of $10 000.00 is repaid by quarterly payments of $1000.00 each at 12% compounded quarterly.What is the principal repaid by the 11th payment?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

18

Barbara borrowed $12 000.00 from the bank at 9% compounded monthly.The loan is amortized with end-of-month payments over five years.

a)Calculate the interest included in the 20th payment.

b)Calculate the principal repaid in the 36th payment.

c)Construct a partial amortization schedule showing the details of the first two payments,the 20th payment,the 36th payment,and the last two payments.

d)Calculate the totals of amount paid,interest paid,and the principal repaid.

a)Calculate the interest included in the 20th payment.

b)Calculate the principal repaid in the 36th payment.

c)Construct a partial amortization schedule showing the details of the first two payments,the 20th payment,the 36th payment,and the last two payments.

d)Calculate the totals of amount paid,interest paid,and the principal repaid.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

19

A loan of $14 100.00 is amortized over 11 years by equal monthly payments at 5.4% compounded monthly.Construct an amortization schedule showing details of the first three payments,the fortieth payment,the last three payments,and totals.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

20

Duguid and Partners bought a property valued at $87 300.00 for $17 000.00 down and a mortgage amortized over 17 years.The firm makes equal payments due at the end of every three months.Interest on the mortgage is 6.85% compounded annually and the mortgage is renewable after five years.

a)What is the size of each quarterly payment?

b)What is the outstanding principal at the end of the five-year term?

c)What is the cost of the mortgage for the first five years?

d)If the mortgage is renewed for a further five years at 7.17% compounded semi-annually,what will be the size of each quarterly payment?

a)What is the size of each quarterly payment?

b)What is the outstanding principal at the end of the five-year term?

c)What is the cost of the mortgage for the first five years?

d)If the mortgage is renewed for a further five years at 7.17% compounded semi-annually,what will be the size of each quarterly payment?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

21

Far East Imports Inc.owes $64 000.00 to be repaid by monthly payments of $2475.00.Interest is 6.12% compounded monthly.

a)How many payments will Far East Imports Inc.have to make?

b)How much interest is included in the 15th payment?

c)How much of the principal will be repaid by the 17th payment?

d)Construct a partial amortization schedule showing details of the first three payments,the last three payments,and totals.

a)How many payments will Far East Imports Inc.have to make?

b)How much interest is included in the 15th payment?

c)How much of the principal will be repaid by the 17th payment?

d)Construct a partial amortization schedule showing details of the first three payments,the last three payments,and totals.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

22

Payments of $1000.00 deferred for nine years are received at the end of each month from a fund of $20 000.00 deposited today at 6% compounded monthly.Calculate the size of the final payment.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

23

Angelina has agreed to purchase her partner's share in the business by making payments of $1720.00 every three months.The agreed transfer value is $19 500.00 and interest is 9.11% compounded annually.If the first payment is due at the date of the agreement,what is the size of the final payment?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

24

Lisa saved $750 000.00.If she withdraws $12 000.00 at the beginning of every month and interest is 12% compounded monthly,what is the size of the last withdrawal?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

25

A $180 000.00 mortgage is to be amortized by making monthly payments for 22.5 years.Interest is 7.2% compounded semi-annually for a four-year term.

a)Compute the size of the monthly payment.

b)Determine the balance at the end of the four-year term.

c)If the mortgage is renewed for a five-year term at 8.66% compounded semi-annually,what is the size of the monthly payment for the renewal term?

a)Compute the size of the monthly payment.

b)Determine the balance at the end of the four-year term.

c)If the mortgage is renewed for a five-year term at 8.66% compounded semi-annually,what is the size of the monthly payment for the renewal term?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

26

A mortgage balance of $137 960.70 is to be repaid over a eleven-year term by equal monthly payments at 8.1% compounded semi-annually.At the request of the mortgagor,the monthly payments were set at $1140.00.

a)How many payments will the mortgagor have to make?

b)What is the size of last payment?

c)Determine the difference between the total actual amount paid and the total amount required to amortize the mortgage by the contractual monthly payments.

a)How many payments will the mortgagor have to make?

b)What is the size of last payment?

c)Determine the difference between the total actual amount paid and the total amount required to amortize the mortgage by the contractual monthly payments.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

27

A debt of $42 500.00 is repaid by payments of $4850.00 made at the end of each year.Interest is 7% compounded semi-annually.

a)How many payments are needed to repay the debt?

b)What is the cost of the debt for the first three years?

c)What is the principal repaid in the 3rd year?

d)Construct an amortization schedule showing details of the first three payments,the last three payments,and totals.

a)How many payments are needed to repay the debt?

b)What is the cost of the debt for the first three years?

c)What is the principal repaid in the 3rd year?

d)Construct an amortization schedule showing details of the first three payments,the last three payments,and totals.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

28

A debt of $41 000.00 is repaid in monthly installments of $660.00.If interest is 8.4% compounded quarterly,what is the size of the final payment?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

29

Karen receives pension payments of $4570.00 at the end of every six months from a retirement fund of $82 000.00.The fund earns 8.06% compounded semi-annually.

a)How many payments will Karen receive?

b)What is the size of the final pension payment?

a)How many payments will Karen receive?

b)What is the size of the final pension payment?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

30

Andre has saved $152 000.00.If he withdraws $1750.00 at the beginning of every month and interest is 7.5% compounded monthly,what is the size of the last withdrawal?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

31

A factory valued at $100 000.00 is purchased for a down payment of 28% and payments of $4000.00 at the end of every three months.If interest is 9% compounded monthly,calculate the size of the final payment.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

32

A contract valued at $47 500.00 requires payments of $6951.00 every six months.The first payment is due in four years and interest is 6.6% compounded semi-annually.

a)How many payments are required?

b)What is the size of the last payment?

c)How much will be paid in total?

d)How much of what is paid is interest?

a)How many payments are required?

b)What is the size of the last payment?

c)How much will be paid in total?

d)How much of what is paid is interest?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

33

A $248 000.00 mortgage amortized by monthly payments over 35 years is renewable after five years.Interest is 8.12% compounded semi-annually.

a)What is the size of the monthly payments?

b)How much interest is paid during the first year?

c)How much of the principal is repaid during the first five-year term?

d)If the mortgage is renewed for a further five-year term at 7.16% compounded semi-annually,what will be the size of the monthly payments?

a)What is the size of the monthly payments?

b)How much interest is paid during the first year?

c)How much of the principal is repaid during the first five-year term?

d)If the mortgage is renewed for a further five-year term at 7.16% compounded semi-annually,what will be the size of the monthly payments?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

34

The owner of the Guelph Inc.borrowed $20 000.00 at 1.2% compounded semi-annually and agreed to repay the loan by making payments of $1000.00 at the end of every three months.

a)How many payments will be needed to repay the loan?

b)How much will be owed at the end of five years?

a)How many payments will be needed to repay the loan?

b)How much will be owed at the end of five years?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

35

Catrina receives payments of $1120.00 at the beginning of each month from a pension fund of $79 500.00.Interest earned by the fund is 11.36% compounded monthly.

a)What is the number of payments Catrina will receive?

b)What is the size of the final payment?

a)What is the number of payments Catrina will receive?

b)What is the size of the final payment?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

36

A debt of $40 000.00 is repaid in monthly installments of $500.00.If interest is 8.0% compounded quarterly,what is the size of the final payment?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

37

John has agreed to purchase his partner's share in real estate by making payments of $5000.00 every three months.The agreed transfer value is $40 000.00 and interest is 10% compounded annually.If the first payment is due at the date of the agreement,what is the size of the final payment?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

38

A contract worth $59 000.00 provides benefits of $21 000.00 at the end of each year.The benefits are deferred for six years and interest is 8.95% compounded quarterly.

a)How many payments are to be made under the contract?

b)What is the size of the last benefit payment?

a)How many payments are to be made under the contract?

b)What is the size of the last benefit payment?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

39

A debt of $43 100.00 is repaid by payments of $3350.00 made at the end of every six months.Interest is 8.4% compounded quarterly.

a)What is the number of payments needed to retire the debt?

b)What is the cost of the debt for the first five years?

c)What is the interest paid in the 11th payment?

d)Construct a partial amortization schedule showing details of the first three payments,the last three payments,and totals.

a)What is the number of payments needed to retire the debt?

b)What is the cost of the debt for the first five years?

c)What is the interest paid in the 11th payment?

d)Construct a partial amortization schedule showing details of the first three payments,the last three payments,and totals.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

40

Tom receives pension payments of $6000.00 at the end of every six months from a retirement fund of $90 000.00.The fund earns 8.00% compounded semi-annually.

a)How many payments will Tom receive?

b)What is the size of the final pension payment?

a)How many payments will Tom receive?

b)What is the size of the final pension payment?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

41

How much principal is repaid in the 74th payment interval on a $142 300 mortgage? The mortgage is amortized over 25 years and the payments are monthly.The interest rate is 7.44% compounded monthly.

A)$257.16

B)$275.16

C)$527.16

D)$572.16

E)$574.16

A)$257.16

B)$275.16

C)$527.16

D)$572.16

E)$574.16

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

42

How much total interest is paid between the 6th and 13th payments on a loan that has monthly payments for 3 years and an original principal of $14 750? The loan rate is 6.6% compounded quarterly.

A)$540

B)$405

C)$450

D)$504

E)$545

A)$540

B)$405

C)$450

D)$504

E)$545

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

43

How much interest is paid in the 53rd monthly payment interval of a loan for $43 200? The loan is amortized at a rate of 9.17% compounded annually over 7 years.

A)$411.11

B)$111.11

C)$144.11

D)$444.11

E)$400.11

A)$411.11

B)$111.11

C)$144.11

D)$444.11

E)$400.11

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

44

How much total principal is repaid between the 1st and 7th payment interval of a 4.5-year loan for $4887 at an interest rate of 7.4% compounded monthly and the payments are also monthly.Round your answer to the nearest dollar.

A)$556

B)$546

C)$456

D)$445

E)$423

A)$556

B)$546

C)$456

D)$445

E)$423

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

45

How much interest is paid in total on a 1-year loan for $5000? The interest rate is 12 % compounded monthly and the payments are monthly.

A)$330.00

B)$333.88

C)$333.00

D)$300.88

E)$330.88

A)$330.00

B)$333.88

C)$333.00

D)$300.88

E)$330.88

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

46

What is the monthly payment size of a 21-year mortgage for $169 600 and an interest rate of 7.2% compounded semi-annually?

A)$1169.11

B)$1296.11

C)$1926.11

D)$1211.96

E)$1222.96

A)$1169.11

B)$1296.11

C)$1926.11

D)$1211.96

E)$1222.96

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

47

A debt of $17 000.00 is repaid by quarterly payments of $1430.00.If interest is 6.12% compounded quarterly,what is the size of the final payment?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

48

The Acme Parts Company is repaying a debt of $15 000.00 by payments of $1410.00 made at the end of every three months.Interest is 7.2% compounded monthly.

a)How many payments are needed to repay the debt?

b)What is the size of the final payment?

a)How many payments are needed to repay the debt?

b)What is the size of the final payment?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

49

What is the size of the final unequal payment of a loan that has 69.47 payments and the equal payment size is $215.64? The interest rate is 3.1% per compounding period.

A)$120.17

B)$210.17

C)$102.17

D)$99.10

E)$99.17

A)$120.17

B)$210.17

C)$102.17

D)$99.10

E)$99.17

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

50

What is the outstanding balance after 23 payments on a 20-year mortgage that has monthly payments of $1062.32 and an interest rate of 6.6% compounded monthly?

A)$143 402.54

B)$144 302.54

C)$134 402.54

D)$134 302.54

E)$134 322.54

A)$143 402.54

B)$144 302.54

C)$134 402.54

D)$134 302.54

E)$134 322.54

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

51

What is the monthly payment size of a 25-year mortgage for $100 000 and an interest rate of 6% compounded semi-annually?

A)$639.81

B)$1639.81

C)$630.81

D)$600.81

E)633.81

A)$639.81

B)$1639.81

C)$630.81

D)$600.81

E)633.81

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

52

A bank has an interest rate of 5% compounded semi annually for a five year closed mortgage.If the mortgage has monthly payments,calculate the effective rate of interest per each term.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

53

A $176 000.00 mortgage is to be repaid over a 21-year period by monthly payments rounded up to the next higher $100.00.Interest is 9.44% compounded semi-annually.

a)Determine the number of rounded payments required to repay the mortgage.

b)Determine the size of the last payment.

a)Determine the number of rounded payments required to repay the mortgage.

b)Determine the size of the last payment.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

54

What is the outstanding balance after the 23rd payment interval of a 16-year loan for $14 734 with semi-annual payments and an interest rate of 5.95% compounded quarterly?

A)$5625.21

B)$5652.21

C)$5562.21

D)$5526.21

E)$5566.21

A)$5625.21

B)$5652.21

C)$5562.21

D)$5526.21

E)$5566.21

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

55

How much interest is paid after the first payment interval on a $100 000 mortgage? The mortgage is amortized over 25 years and the payments are monthly.The interest rate is 6% compounded semi-annually.Round your answer to the nearest dollar.

A)$146

B)$640

C)$527

D)$494

E)$401

A)$146

B)$640

C)$527

D)$494

E)$401

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

56

How much interest is paid in total on a 3-year loan for $28 600 (rounded to the nearest dollar)? The interest rate is 8.7% compounded monthly and the payments are monthly.

A)$3997

B)$3779

C)$3977

D)$3999

E)$4000

A)$3997

B)$3779

C)$3977

D)$3999

E)$4000

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

57

What is the size of the final unequal payment of a loan for $2723.44 if it has quarterly payments of $500? The interest rate is 8.4% compounded quarterly.

A)$432.14

B)$423.14

C)$441.14

D)$414.14

E)$424.14

A)$432.14

B)$423.14

C)$441.14

D)$414.14

E)$424.14

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

58

A demand (variable rate)mortgage of $137 000.00 is amortized over 20 years by equal monthly payments.After 21 months the original interest rate of 6% p.a was raised to 6.6% p.a.Three years after the mortgage was taken out,it was renewed at the request for the mortgagor for a five-year term at a fixed rate of 7.25% p.a.

a)Calculate the mortgage balance after 21 months.

b)Compute the size of the new monthly payment at the 6.6% rate of interest.

c)Determine the mortgage balance at the end of the five-year term.

a)Calculate the mortgage balance after 21 months.

b)Compute the size of the new monthly payment at the 6.6% rate of interest.

c)Determine the mortgage balance at the end of the five-year term.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

59

Munawar is a first time buyer and bought a brand new townhouse in Oshawa for $212 000.He has saved enough to make a 5% down payment and will have to pay mortgage loan insurance at 2.75% of the mortgage balance.Munawar wants the insurance premium added to the maximum allowable loan balance.Determine his maximum initial mortgage balance.

A)$5538.50

B)$201 400

C)$206 938.50

D)$212 000

E)$212 477

A)$5538.50

B)$201 400

C)$206 938.50

D)$212 000

E)$212 477

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

60

A $151 000.00 mortgage is to be repaid over a 17-year period by monthly payments rounded up to the next higher $50.00.Interest is 8.2% compounded semi-annually.

a)Determine the number of rounded payments required to repay the mortgage.

b)Determine the size of the last payment.

c)Calculate the amount of interest saved by rounding the payments up to the next higher $50.00.

a)Determine the number of rounded payments required to repay the mortgage.

b)Determine the size of the last payment.

c)Calculate the amount of interest saved by rounding the payments up to the next higher $50.00.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

61

Rebecca borrowed $20 400 from her local credit union to pay for the upgrades in her kitchen.She wants to pay the loan with monthly payments over the period of 3 years.What is the interest included in the tenth payment,if the rate charged by the credit union is 6% monthly?

A)$78.19

B)$5698.49

C)$21 336.56

D)$15 638.09

E)$75.48

A)$78.19

B)$5698.49

C)$21 336.56

D)$15 638.09

E)$75.48

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

62

Zara bought a 2013 Kia Forte by taking a $19 500 loan from BMO with interest at 5.99% compounded annually and amortized by payments of $378 at the end of every month.She receives an inheritance after making 36 payments and plans to pay the balance in full.What is the payout figure just after the last regular payment made?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

63

Rebecca bought a house in Oshawa and took a $259 000 mortgage amortized by monthly payments over 25 years that is renewable after 5 years.If interest is 4.4% compounded semi-annually,what is the outstanding balance at the end of the five year term?

If the mortgage is renewed for a further 5 year term at 3.7% compounded semi-annually,what is the balance after the second 5 year term?

If the mortgage is renewed for a further 5 year term at 3.7% compounded semi-annually,what is the balance after the second 5 year term?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

64

Honda is selling a 2014 Accord Coupe Ex M for $30 056.90 including freight,PDI and all applicable fees.The lease payment of $382 is due at the beginning of each month.If the interest rate compounded annually is 3.99% and the residual value is $13 200,determine the size of the final lease payment.

A)$240.51

B)$285.95

C)$150.28

D)$214.13

E)$5.92

A)$240.51

B)$285.95

C)$150.28

D)$214.13

E)$5.92

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

65

John makes a monthly mortgage payment of $1940 at the end of every month.On October 31,his loan balance was $145 000 after making a payment of $1940.His financial institute allows him to make one additional payment equal to or less than his monthly payment,once a month.Taking advantage of that,John made a payment of $1500 on November 15 and $1900 on December 20.What is his year-end balance after making monthly payment on December 31? The effective monthly fixed rate is 0.306%.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

66

Shiva transferred his mortgage of $145 981 from CIBC to BMO for the remaining amortization period at 3.59% compounded semi-annually.He has agreed to pay rounded up payment of $2000 every month.How long will it take Shiva to pay-off his mortgage?

A)6 years 11 months

B)6 years 1 months

C)8 years

D)6 years 6 months

E)10 years

A)6 years 11 months

B)6 years 1 months

C)8 years

D)6 years 6 months

E)10 years

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

67

Li bought a house in Whitby for $305 000 5 years ago.He financed the house through Scotia Bank with a mortgage of $259 000 amortized over 25 years.Interest for the first 5 years was 4.4% compounded semi-annually and payments were made monthly.At the end of the 5 year term,Li has renewed the mortgage for another 5 years,at 3.7% compounded semi-annually.What is the monthly payment for the second term?

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

68

The Korean community is planning to buy a place for their community in Markham valued at $1 697 000.They made a down payment of 10% and payments of $400 000 are required at the end of every 3 months.If interest is 9% compounded monthly,what is the size of the final payment

A)$15 685

B)$205 512

C)$131 373

D)$355 547

E)$48 381

A)$15 685

B)$205 512

C)$131 373

D)$355 547

E)$48 381

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

69

Kirk had accumulated $975 000 in his RRSP at the age of 55.He converted the RRSP into an RRIF at that time and started withdrawing $5000 at the beginning of each month.If interest is 4.5% compounded monthly,what is the size of his final withdrawal?

A)$1739.27

B)$1409.28

C)$4947.31

D)$412.07

E)$33.82

A)$1739.27

B)$1409.28

C)$4947.31

D)$412.07

E)$33.82

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

70

Amanda borrowed $57 800 from BMO to buy a 2014 E-Class Mercedes Sedan at 3.9% compounded monthly.Payments of $2056 are required at the end of every month.Construct a complete amortization schedule in MS Excel showing the details of all payments and the total.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck

71

Peter worked for GM for 31 years.On his retirement,he opted a pension buy-out and received $1 467 921.He invested his money in an annuity that provided for payments of $9000 at the end of every month.If interest is 4.4% compounded monthly,determine the size of the final payment.

Unlock Deck

Unlock for access to all 71 flashcards in this deck.

Unlock Deck

k this deck