Deck 20: International Business Finance

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/119

Play

Full screen (f)

Deck 20: International Business Finance

1

What keeps foreign exchange quotes in two different countries in line with each other?

A)Cross rates

B)Forward rates

C)Arbitrage

D)Spot rates

A)Cross rates

B)Forward rates

C)Arbitrage

D)Spot rates

C

2

You are on your way to Cancun, Mexico.The current exchange rate is 21 pesos to the dollar.When you arrive, you convert $1000 for how many pesos?

A)21,000 pesos

B)2100 pesos

C)476 pesos

D)4760 pesos

A)21,000 pesos

B)2100 pesos

C)476 pesos

D)4760 pesos

A

3

An investor purchased Canadian dollars at an exchange rate of US $0.756 to the Canadian dollar.The Canadian dollars cost her $1,000,000 (US dollars).How many Canadian dollars did she buy?

A)$132,275

B)$756,000

C)$1,322,751

D)$75,600

A)$132,275

B)$756,000

C)$1,322,751

D)$75,600

C

4

A spot transaction occurs when one currency is

A)deposited in a foreign bank.

B)immediately exchanged for another currency.

C)exchanged for another currency at a specified price.

D)traded for another at an agreed-upon future price.

A)deposited in a foreign bank.

B)immediately exchanged for another currency.

C)exchanged for another currency at a specified price.

D)traded for another at an agreed-upon future price.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

5

Assume that an investor owned 5000 shares of Anheuser-Busch Corporation common stock prior to the acquisition by InBev of Belgium.At the time of the acquisition, the dollar was worth .77 euro.Further assume that the purchase price was equal to 54 euros per share.What was the sales price of Anheuser Busch common stock per share in US dollars?

A)$41.58

B)$54.32

C)$60.67

D)$70.13

A)$41.58

B)$54.32

C)$60.67

D)$70.13

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

6

Trading in foreign exchange markets is dominated by

A)Russian rubles, Indian rupees and Indonesian rupeas.

B)Spanish pesetas, German marks and French francs.

C)Chinese renminbis, Saudi ryals and pesos of various Latin American countries.

D)US dollars, the British pound, the euro and the yen.

A)Russian rubles, Indian rupees and Indonesian rupeas.

B)Spanish pesetas, German marks and French francs.

C)Chinese renminbis, Saudi ryals and pesos of various Latin American countries.

D)US dollars, the British pound, the euro and the yen.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

7

With foreign exchange contracts, currencies are exchanged

A)at the specified future date, but at the rate agreed upon at the date of the contract.

B)immediately, but at the rate agreed upon at the date of the contract.

C)both parties must place the amount of the contract in escrow until the exercise date of the contract.

D)payment is made immediately, but the contracted currency will be delivered at the specified future date.

A)at the specified future date, but at the rate agreed upon at the date of the contract.

B)immediately, but at the rate agreed upon at the date of the contract.

C)both parties must place the amount of the contract in escrow until the exercise date of the contract.

D)payment is made immediately, but the contracted currency will be delivered at the specified future date.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

8

Participants in foreign exchange trading include

A)importers and exporters.

B)investors and portfolio managers.

C)currency traders.

D)all of the above.

A)importers and exporters.

B)investors and portfolio managers.

C)currency traders.

D)all of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements about exchange rates is true?

A)Exchange rates are fixed by international agreements.

B)Exchange rates fluctuate between currencies but are fixed in terms of gold.

C)Exchange rates fluctuate constantly.

D)Are regulated by a special committee of the United Nations.

A)Exchange rates are fixed by international agreements.

B)Exchange rates fluctuate between currencies but are fixed in terms of gold.

C)Exchange rates fluctuate constantly.

D)Are regulated by a special committee of the United Nations.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

10

Forward rates are quoted

A)in direct form.

B)in indirect form.

C)at a premium or discount.

D)All of the above.

A)in direct form.

B)in indirect form.

C)at a premium or discount.

D)All of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

11

An investor purchased 20,000,000 Japanese yen at an exchange rate of 113.25.yen to the dollar.The yen cost her [blank].Round answer to the nearest dollar.

A)$2,265,000,000

B)$17,660,044

C)$197,414

D)$176,600

A)$2,265,000,000

B)$17,660,044

C)$197,414

D)$176,600

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

12

After the US dollar, the most widely traded currency is [blank].

A)the U.K.pound

B)the euro

C)the Swiss franc

D)the Japanese yen

A)the U.K.pound

B)the euro

C)the Swiss franc

D)the Japanese yen

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

13

Buying and selling in more than one market to make a riskless profit is called [blank].

A)profit maximization

B)arbitrage

C)international trading

D)cannot be determined from the above information.

A)profit maximization

B)arbitrage

C)international trading

D)cannot be determined from the above information.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

14

You are leaving Mexico and have 3200 pesos to change into dollars.The exchange rate is 12.5 pesos to the dollar.How many dollars will you receive?

A)$256

B)$400

C)$2560

D)$4000

A)$256

B)$400

C)$2560

D)$4000

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

15

An investor purchased 1,000,000 Canadian dollars at an exchange rate of US $0.756 to the Canadian dollar.

A)$132,275

B)$756,000

C)$1,322,751

D)$75,600

A)$132,275

B)$756,000

C)$1,322,751

D)$75,600

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

16

One US dollar buys 112 yen and 21.5 Mexican pesos.What is price of pesos in yen?

A)5.21 yen

B).0521 yen

C).0465 yen

D)4.65 yen

A)5.21 yen

B).0521 yen

C).0465 yen

D)4.65 yen

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

17

Assume that an investor purchased 200,000,000 Japanese yen in New York at an exchange rate of 113 yen to the dollar and simultaneously sold the yen in Tokyo at an exchange rate of 111 Japanese yen to the dollar.Further assume that there was no cost associated with this transaction.What profit or loss did the investor make? Round your answer to the nearest dollar.

A)($(3189)loss

B)$31,890

C)$(31,890)loss

D)$3189 profit

A)($(3189)loss

B)$31,890

C)$(31,890)loss

D)$3189 profit

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

18

Suppose International Trading Enterprises purchased 25 000 kilograms of Greek olive oil for a price of 100,000 euros.If the current exchange rate is 0.95 euro to the US dollar, what is the purchase price of the oil in dollars?

A)$57,895

B)$26,316

C)$95,000

D)$105,263

A)$57,895

B)$26,316

C)$95,000

D)$105,263

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

19

Assume that an importer were to purchase 5000 cases of premium escargot for 700,000 euro.Further assume that the quoted exchange rates are as follows: spot rate = .9542 euro to the US dollar; 30-day forward rate = .9502 euro to the US dollar; and 90-day forward rate = .9498 euro to the US dollar.If the actual currency exchange rate at the time payment is due in 90 days is equal to the forward rate of .778 euro to the US dollar, how much would the escargot cost the importer in US dollars if payment is made in 90 days? Round to the nearest dollar.

A)$949,800

B)$664,860

C)$105,285

D)$736,997

A)$949,800

B)$664,860

C)$105,285

D)$736,997

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

20

An attempt to profit by converting dollars to yen, yen to euros, and euros back to dollars would be an example of [blank].

A)arbitrage

B)ask rate

C)hedging

D)intervention

A)arbitrage

B)ask rate

C)hedging

D)intervention

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

21

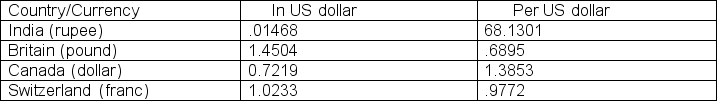

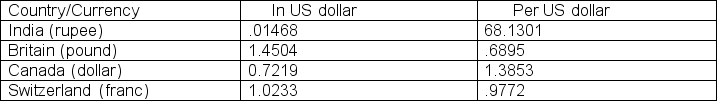

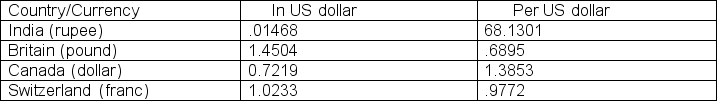

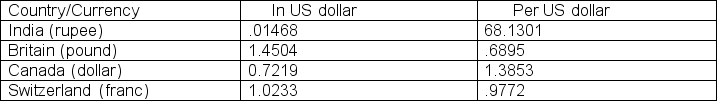

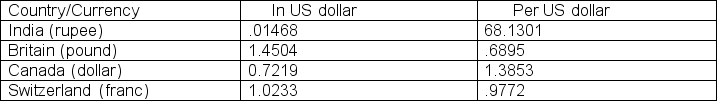

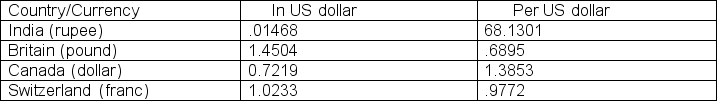

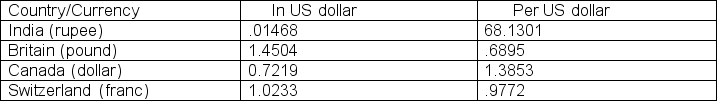

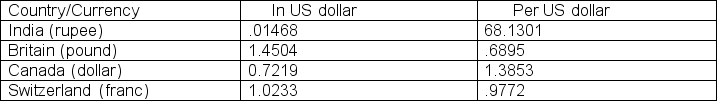

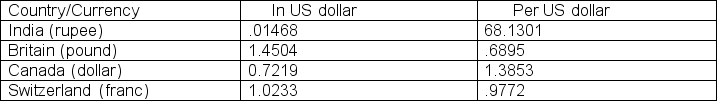

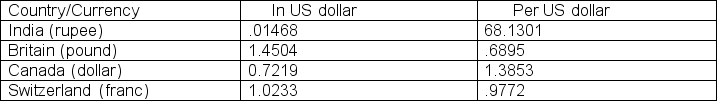

Use the following information to answer the following question(s).

Assume that your firm must pay 10 000,000 rupees to an Indian firm.How much will you have to pay in US dollars?

A)$1 467 780

B)$146 800

C)$681 301

D)$46 130

Assume that your firm must pay 10 000,000 rupees to an Indian firm.How much will you have to pay in US dollars?

A)$1 467 780

B)$146 800

C)$681 301

D)$46 130

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

22

The exchange rate that represents the number of units of a foreign currency that can be purchased with one unit of a home currency is referred to as a(n)[blank] quote.

A)forward

B)cross

C)market

D)indirect

A)forward

B)cross

C)market

D)indirect

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

23

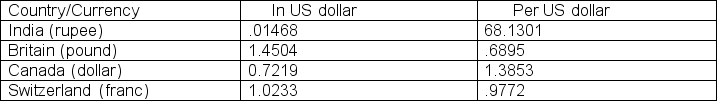

Use the following information to answer the following question(s).

The price of the British pound in Swiss francs rate is

A)1.4173 Swiss francs to the British pound.

B)1.4842 Swiss francs to the British pound.

C).7056 Swiss francs to the British pound.

D).6738 Swiss francs to the British pound.

The price of the British pound in Swiss francs rate is

A)1.4173 Swiss francs to the British pound.

B)1.4842 Swiss francs to the British pound.

C).7056 Swiss francs to the British pound.

D).6738 Swiss francs to the British pound.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

24

The foreign exchange market is similar in form to the New York Stock Exchange.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

25

Use the following information to answer the following question(s).

The price of a Swiss franc in British pounds is

A)1.4842 British pounds to the Swiss franc.

B)1.4173 British pounds to the Swiss franc.

C)0.7056 British pounds to the Swiss franc.

D)0.6738 British pounds to the Swiss franc.

The price of a Swiss franc in British pounds is

A)1.4842 British pounds to the Swiss franc.

B)1.4173 British pounds to the Swiss franc.

C)0.7056 British pounds to the Swiss franc.

D)0.6738 British pounds to the Swiss franc.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

26

Assume that a buyer of Italian coffee saw the following quotes: spot rate of .9505 euros to the US dollar; 30-day forward rate of .9497 euro to the US dollar; 90-day forward rate of .9482 euros to the US dollar.What does this information imply?

A)The forward euro is selling at a premium as compared with the spot euro.

B)The dollar is expected to maintain the same value in the near future relative to the euro.

C)The forward euro is selling at a discount as compared with the spot euro.

D)None of the above.

A)The forward euro is selling at a premium as compared with the spot euro.

B)The dollar is expected to maintain the same value in the near future relative to the euro.

C)The forward euro is selling at a discount as compared with the spot euro.

D)None of the above.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

27

Assume that a firm purchases foreign currency in order to complete the purchase of raw material from an overseas supplier.The currency is purchased today at an exchange rate that is good only for today.This transaction is referred to as a(n)[blank] transaction.

A)forward

B)arbitrage

C)spot

D)exchange

A)forward

B)arbitrage

C)spot

D)exchange

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

28

[blank] is the rate at which the bank buys a unit of the base currency from the customer by paying in the terms currency.

A)Exchange rate

B)Ask rate

C)Bid rate

D)Buying rate

A)Exchange rate

B)Ask rate

C)Bid rate

D)Buying rate

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

29

[blank] is the price of one currency stated in terms of another currency.

A)Exchange rate

B)Ask rate

C)Bid rate

D)Buying rate

A)Exchange rate

B)Ask rate

C)Bid rate

D)Buying rate

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

30

Use the following information to answer the following question(s).

Assume that your firm must pay $4000 to a Swiss firm.In Swiss francs, the Swiss firm will receive

A)391 Swiss francs.

B)49 300 Swiss francs.

C)4903 Swiss francs.

D)3909 Swiss francs.

Assume that your firm must pay $4000 to a Swiss firm.In Swiss francs, the Swiss firm will receive

A)391 Swiss francs.

B)49 300 Swiss francs.

C)4903 Swiss francs.

D)3909 Swiss francs.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

31

Use the following information to answer the following question(s).

The direct three-month forward rate for the U.K.pound is 1.4496; the pound is expected to

A)stay the same against the dollar.

B)weaken against the dollar.

C)fluctuate randomly against the dollar.

D)strengthen against the dollar.

The direct three-month forward rate for the U.K.pound is 1.4496; the pound is expected to

A)stay the same against the dollar.

B)weaken against the dollar.

C)fluctuate randomly against the dollar.

D)strengthen against the dollar.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

32

Use the following information to answer the following question(s).

The following are the prices in the foreign exchange market between the US dollar and a foreign currency (fc).Spot 0.6335US$/fc; three-month forward 0.6375US$/fc.What was the discount or premium on three-month forward for the foreign currency?

A)0.63% premium

B)0.40% premium

C)0.63% discount

D)0.40% discount

The following are the prices in the foreign exchange market between the US dollar and a foreign currency (fc).Spot 0.6335US$/fc; three-month forward 0.6375US$/fc.What was the discount or premium on three-month forward for the foreign currency?

A)0.63% premium

B)0.40% premium

C)0.63% discount

D)0.40% discount

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

33

[blank] is the rate at which the bank buys a unit of the base currency from the customer by paying in the terms currency.

A)Exchange rate

B)Ask rate

C)Bid rate

D)Buying rate

A)Exchange rate

B)Ask rate

C)Bid rate

D)Buying rate

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

34

The ask rate is the price a customer will receive from a foreign currency trader when selling a foreign currency.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

35

Direct quote = 1/Indirect quote

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

36

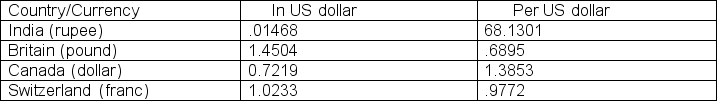

Use the following information to answer the following question(s).

![<strong>Use the following information to answer the following question(s). The number of pounds you can purchase per US dollar is [blank].</strong> A)1.6304 B)6.895 C)0.6895 D)19.51](https://d2lvgg3v3hfg70.cloudfront.net/TB6913/11eaae1e_92db_c6d5_9109_5f58b23d751e_TB6913_00_TB6913_00_TB6913_00_TB6913_00_TB6913_00_TB6913_00_TB6913_00_TB6913_00_TB6913_00.jpg)

The number of pounds you can purchase per US dollar is [blank].

A)1.6304

B)6.895

C)0.6895

D)19.51

![<strong>Use the following information to answer the following question(s). The number of pounds you can purchase per US dollar is [blank].</strong> A)1.6304 B)6.895 C)0.6895 D)19.51](https://d2lvgg3v3hfg70.cloudfront.net/TB6913/11eaae1e_92db_c6d5_9109_5f58b23d751e_TB6913_00_TB6913_00_TB6913_00_TB6913_00_TB6913_00_TB6913_00_TB6913_00_TB6913_00_TB6913_00.jpg)

The number of pounds you can purchase per US dollar is [blank].

A)1.6304

B)6.895

C)0.6895

D)19.51

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

37

[blank] is the rate that a bank wants the customer to pay in the terms currency for one unit of the base currency, when the bank is selling and the customer is buying.

A)Exchange rate

B)Ask rate

C)Bid rate

D)Buying rate

A)Exchange rate

B)Ask rate

C)Bid rate

D)Buying rate

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

38

Use the following information to answer the following question(s).

The direct six-month forward rate for the Japanese yen is 0.008853; the yen is expected to

A)stay the same against the dollar.

B)weaken against the dollar.

C)fluctuate randomly against the dollar.

D)strengthen against the dollar.

The direct six-month forward rate for the Japanese yen is 0.008853; the yen is expected to

A)stay the same against the dollar.

B)weaken against the dollar.

C)fluctuate randomly against the dollar.

D)strengthen against the dollar.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

39

A trader who simultaneously bought Swiss francs in New York for 1.0222 and sold them in Zurich for 1.0233 would be practicing [blank].

A)simple arbitrage

B)inside trading

C)compound arbitrage

D)direct trading

A)simple arbitrage

B)inside trading

C)compound arbitrage

D)direct trading

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

40

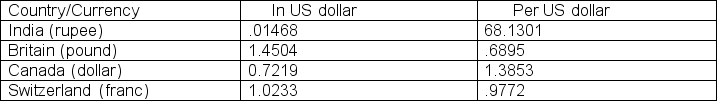

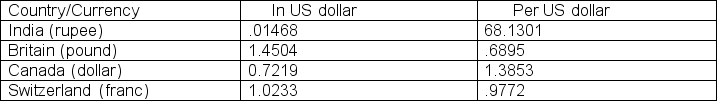

Use the following information to answer the following question(s).

![<strong>Use the following information to answer the following question(s). To buy one Indian rupee you would need [blank].</strong> A)1.468 cents B)68.13 cents C)14.68 cents D)6.813 cents](https://d2lvgg3v3hfg70.cloudfront.net/TB6913/11eaae1e_92db_c6d5_9109_5f58b23d751e_TB6913_00_TB6913_00_TB6913_00_TB6913_00_TB6913_00_TB6913_00_TB6913_00_TB6913_00_TB6913_00.jpg)

To buy one Indian rupee you would need [blank].

A)1.468 cents

B)68.13 cents

C)14.68 cents

D)6.813 cents

![<strong>Use the following information to answer the following question(s). To buy one Indian rupee you would need [blank].</strong> A)1.468 cents B)68.13 cents C)14.68 cents D)6.813 cents](https://d2lvgg3v3hfg70.cloudfront.net/TB6913/11eaae1e_92db_c6d5_9109_5f58b23d751e_TB6913_00_TB6913_00_TB6913_00_TB6913_00_TB6913_00_TB6913_00_TB6913_00_TB6913_00_TB6913_00.jpg)

To buy one Indian rupee you would need [blank].

A)1.468 cents

B)68.13 cents

C)14.68 cents

D)6.813 cents

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

41

The major advantage of the forward market is risk reduction.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

42

The forward rate is the same as the spot rate that will prevail in the future.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

43

The efficiency of foreign currency markets is ensured, in large measure, by the process of arbitrageurs.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

44

Foreign exchange transactions carried out in the spot market entails an agreement today to deliver a specific number of units of currency on a future date in return for a specified number of units of another currency.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

45

A forward exchange contract is a contract that requires delivery on a specified future date of one currency in return for a specified amount of another currency.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

46

A direct quote in Bombay tells one how many British pounds can buy one Indian rupee.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

47

Forward contracts are usually quoted for periods greater than one year.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

48

Spot exchange markets are efficient due to arbitrage forces.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

49

Forward rates, like spot rates, are quoted in both direct and indirect form.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

50

The bid rate (also called the offer rate)is the number of units of home currency paid to a customer in exchange for their foreign currency.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

51

Transactions carried out in the foreign exchange markets can include direct or indirect exchange rate quotes.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

52

The difference between the ask price and the bid price is known as the spread.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

53

Spot transactions are made immediately in the market place at the market price.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

54

Forward contracts benefit only the customer due to a reduction in uncertainty.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

55

Arbitrage is the process of buying and selling in one market in order to make a riskless profit.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

56

The foreign exchange market provides a physical entity that transfers the purchasing-power from one currency to another.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

57

When banks transact in foreign currencies, the direct bid quote is greater than the direct asked quote.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

58

Arbitrage eliminates forward discounts and premiums across the markets of a single currency.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

59

A dealer in Manchester posts an ask rate of .6238 and a bid rate of .6237.How much, in U.K.pounds, would it cost to purchase $100,000.For how much in pounds could you sell $100,000?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

60

Spot exchange markets have the potential for arbitrage opportunities for a long period of time.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

61

One US dollar buys 21.9923 Mexican pesos and .8885 euro.What is the peso/euro exchange rate?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

62

The interplay between interest rate differentials and exchange rates such that both adjust until the foreign exchange market and the money market reach equilibrium is called the

A)purchasing-power parity theory.

B)balance of payments quantum theory.

C)interest rate parity theory.

D)arbitrage markets theory.

A)purchasing-power parity theory.

B)balance of payments quantum theory.

C)interest rate parity theory.

D)arbitrage markets theory.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

63

According to the domestic Fisher effect, if the inflation rate is 3% and the real rate of interest is 2%, the nominal rate of interest will be [blank].

A)5.06%

B)5.00%

C)6%

D)8.15%

A)5.06%

B)5.00%

C)6%

D)8.15%

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

64

In the global portfolio, which of the following is the largest?

A)Australian shares

B)Australian bonds

C)International shares

D)International bonds

A)Australian shares

B)Australian bonds

C)International shares

D)International bonds

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

65

As December 26, 2012, the spot rate for Swiss francs was 1.0917.The three-month forward rate was 1.0939.

Calculate the annualized percentage rate premium or discount for Swiss francs.

Calculate the annualized percentage rate premium or discount for Swiss francs.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

66

The current spot exchange rate between the Japanese yen and the US dollar is 113.25 Y/US$.The yen is expected to appreciate by 4% against the dollar over the next year.What do you expect the spot exchange rate between the yen and the dollar to be one year from now?

A)91.51 Y/US dollar

B)106.72 Y/US dollar

C)108.89 Y/US dollar

D)98.54 Y/US dollar

A)91.51 Y/US dollar

B)106.72 Y/US dollar

C)108.89 Y/US dollar

D)98.54 Y/US dollar

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

67

The six-month interest rate in Australia is 0.6%.The spot exchange rate for Australian dollars is 1.4063 to the US dollar.The six months forward rate is 1.4259 to the US dollar.These prices indicate that the six-month risk-free rate in the United States is [blank].

A)6.00%

B)3.02%

C)3.42%

D)2.00%

A)6.00%

B)3.02%

C)3.42%

D)2.00%

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

68

A barrel of oil currently costs $60 in US dollars.The current exchange rate is $1.1256 U.S.to the euro.If purchasing-power parity prevails what is the price of a barrel of oil in euros?

A)71.43 euro

B)58.36 euro

C)73.16 euro

D)53.30 euro

A)71.43 euro

B)58.36 euro

C)73.16 euro

D)53.30 euro

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following statements is true?

A)Interest rate parity indicates that the forward premium or discount should be greater than the differences in the national interest rates for securities of the same maturity.

B)Purchasing-power parity indicates that, in the long run, exchange rates adjust to reflect international differences in inflation so that the purchasing-power of each currency tends to remain the same.

C)

C)The International Fisher Effect indicates that the nominal interest rate should be the same all over the world at all times if the market is efficient.

D)Both B and

A)Interest rate parity indicates that the forward premium or discount should be greater than the differences in the national interest rates for securities of the same maturity.

B)Purchasing-power parity indicates that, in the long run, exchange rates adjust to reflect international differences in inflation so that the purchasing-power of each currency tends to remain the same.

C)

C)The International Fisher Effect indicates that the nominal interest rate should be the same all over the world at all times if the market is efficient.

D)Both B and

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

70

A theory that relates the ratios of spot and forward exchange to differences in interest rates in two countries or currency zones is known as [blank].

A)interest rate parity

B)purchasing-power parity

C)bid-ask spread

D)forward/spot equivalence hypothesis

A)interest rate parity

B)purchasing-power parity

C)bid-ask spread

D)forward/spot equivalence hypothesis

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

71

According to the domestic Fisher effect, if the inflation rate is 5%, and the nominal rate of interest is 7%, the real rate of interest is [blank].

A)2.00%

B)1.904%

C)4.65%

D)0.5252%

A)2.00%

B)1.904%

C)4.65%

D)0.5252%

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

72

What is the difference between and 'ask' quote and a 'bid' quote?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

73

According to the international Fisher effect, if the nominal interest rate in Russia is 9.5% and the inflation rate is 8%, the real rate of interest is approximately [blank].

A)18.26%

B)6.5%

C)1.5%

D)-1.5%

A)18.26%

B)6.5%

C)1.5%

D)-1.5%

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

74

The purchasing-power parity theory is least likely to apply to the price of

A)oral surgery.

B)smart phones.

C)crude oil.

D)cane sugar.

A)oral surgery.

B)smart phones.

C)crude oil.

D)cane sugar.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

75

What is the difference between forward rates and spot rates? What is the purpose of forward contracts?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

76

What is the role of arbitrage in the foreign exchange markets?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

77

The nominal rate of interest in Russia is 9.5% and the inflation rate is 8%.The nominal rate of interest in Canada is 2.5% and the inflation rate is zero.We would expect

A)the ruble to strengthen against the dollar.

B)the exchange rate between the Canadian dollar and the ruble to stay the same because of interest rate parity.

C)the exchange rate between the Canadian dollar and the ruble to stay the same because of purchasing price parity.

D)the Canadian dollar to strengthen against the ruble.

A)the ruble to strengthen against the dollar.

B)the exchange rate between the Canadian dollar and the ruble to stay the same because of interest rate parity.

C)the exchange rate between the Canadian dollar and the ruble to stay the same because of purchasing price parity.

D)the Canadian dollar to strengthen against the ruble.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

78

10,000 pounds of soybeans currently sells in the United States for $57 300.The current exchange rate is 68.13 rupees to the dollar.If purchasing-power parity prevails, what is the price of 10,000 pounds of soybeans in rupees?

A)3 903 849 rupees

B)8 410 392 rupees

C)68 130 rupees

D)1 467 782 rupees

A)3 903 849 rupees

B)8 410 392 rupees

C)68 130 rupees

D)1 467 782 rupees

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

79

The one year interest rate in the United States is 2%.The spot exchange rate for yen is 113.25 to the dollar.The six months forward rate is 112.96 to the dollar.These prices indicate that the six-month risk-free rate in Japan is [blank].

A)1.04%

B)2.26%

C)4.31%

D)5.99%

A)1.04%

B)2.26%

C)4.31%

D)5.99%

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

80

The nominal rate of interest in Russia is 9.5% and the inflation rate is 8%.The nominal rate of interest in Spain is 3% and the inflation rate is 1%.Which country has the higher real rate of interest?

A)Russia

B)Spain

C)There is no difference.

D)There is not enough information.

A)Russia

B)Spain

C)There is no difference.

D)There is not enough information.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck