Deck 13: Corporate Taxes and the Impact of Financing on Real Asset Valuation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/19

Play

Full screen (f)

Deck 13: Corporate Taxes and the Impact of Financing on Real Asset Valuation

1

Explain how the certainty equivalent method be combined with APV method in the valuation of projects.

Combined with the APV method,the certainty equivalent method provides perhaps the simplest method for evaluating risky projects,at least in cases where the debt tax shields are certain.When the debt tax shields are certain,one simply adds the debt tax shields to the certainty equivalent cash flows of the project and discounts the sum at the risk-free rate.When the tax shields are uncertain,the financial analyst also must calculate their certainty equivalents.The certainty equivalent tax savings should be somewhat less than the tax savings achieved from debt interest when the firm is highly profitable,to account for the firm's inability to use all of the debt interest expense as a tax deduction in different situations.However,it not recommended using the risk-free scenario method for computing the certainty equivalent of an uncertain tax shield.This method assumes that the distribution of outcomes is symmetrical,but the distribution of tax savings is rarely so,because,for a given amount of debt,tax savings pay-offs are capped at a maximum value.

2

When debt interest is tax deductible:

A)the firm's cost of equity will increase.

B)the WACC of a firm is independent of how it is financed.

C)the WACC will decline as the firm's leverage ratio increases.

D)the capital structure is irrelevant for valuation.

A)the firm's cost of equity will increase.

B)the WACC of a firm is independent of how it is financed.

C)the WACC will decline as the firm's leverage ratio increases.

D)the capital structure is irrelevant for valuation.

C

3

Distinguish the unlevered cost of capital from the WACC.

For an all-equity-financed,or 'unlevered',firm,the appropriate risk-adjusted discount rate for a project's future cash flow when the cash flow has the same risk as the overall firm is the firm's cost of capital.The unlevered cost of capital is the expected return on the equity of the firm if the firm is financed entirely with equity.Because there is no debt tax shield for a firm that is financed entirely with equity,and because the two sides of the balance sheet 'balance',the unlevered cost of capital is also the required rate of return on the firm's unlevered assets.The weighted average cost of capital or WACC is a weighted average of the after-tax expected return paid by the firm on its debt and equity.In the absence of a debt tax shield,debt subsidy or other market frictions that favour one form of financing over another,the WACC is the expected return of the firm's assets.In this case,the WACC and the unlevered cost of capital are the same.The expected return paid by the firm to its equity holders is the same as the expected return received by the equity holders.When a third party,such as the government taxing authority,favours one form of financing over another,the cost of the favoured form of financing will differ from the expected return to investors.For example,the tax deductibility of interest implies that the cost of debt financing to a corporation (as measured by the after-tax return paid by the corporation)may be less than the rate of return on a firm's debt received by the firm's debt holders.Because of this,the WACC differs from the unlevered cost of capital when there is a debt tax shield.

4

The debt tax shield is:

A)the present value of the unlevered cash flows.

B)the sum of the present value of the tax savings from the interest payments and the present value of unlevered cash flows.

C)the sum of the present value of the tax savings from the interest payments and depreciation.

D)the present value of the debt interest deduction for all corporate profits taxes.

A)the present value of the unlevered cash flows.

B)the sum of the present value of the tax savings from the interest payments and the present value of unlevered cash flows.

C)the sum of the present value of the tax savings from the interest payments and depreciation.

D)the present value of the debt interest deduction for all corporate profits taxes.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

5

Explain how NPV of projects is calculated using the adjusted present value (APV)method and the weighted average cost of capital (WACC)method.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

6

Explain the debt capacity of a firm.Differentiate between dynamic and static debt capacity.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

7

If a company funds a new investment with equity:

A)the marginal cost of capital is the appropriate WACC to value the firm.

B)the marginal cost of capital for the project reflects the risk of the project.

C)the marginal cost of capital for the project reflects the total risk of the firm.

D)the marginal cost of capital for the project reflects the systematic risk of the firm.

A)the marginal cost of capital is the appropriate WACC to value the firm.

B)the marginal cost of capital for the project reflects the risk of the project.

C)the marginal cost of capital for the project reflects the total risk of the firm.

D)the marginal cost of capital for the project reflects the systematic risk of the firm.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

8

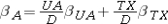

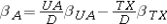

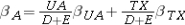

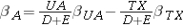

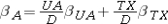

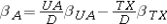

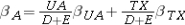

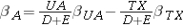

If the assets of the firm with value A as a portfolio of unlevered assets with value UA and debt tax shields with value TX,then the beta of the assets is represented by:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is the correct algebraic expression of WACC when there is a debt shield tax?

A)WACC = wErE + wDTCrD

B)WACC = wErE + wD(1 - TC)rD

C)WACC = wErE + wDrD

D)WACC = wErE + wD(1 + TC)rD

A)WACC = wErE + wDTCrD

B)WACC = wErE + wD(1 - TC)rD

C)WACC = wErE + wDrD

D)WACC = wErE + wD(1 + TC)rD

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

10

The adjusted present value method:

A)calculates the NPV of the all-equity-financed project and adds the value of the tax benefits of debt.

B)accounts for any benefits of debt by adjusting the discount rate.

C)calculates the NPV of the all-equity-financed project and discounts by the cost of capital.

D)discounts only one set of cash flows.

A)calculates the NPV of the all-equity-financed project and adds the value of the tax benefits of debt.

B)accounts for any benefits of debt by adjusting the discount rate.

C)calculates the NPV of the all-equity-financed project and discounts by the cost of capital.

D)discounts only one set of cash flows.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

11

The unlevered cost of capital is the:

A)expected return on the equity of the firm if the firm is financed equally with equity and debt.

B)expected return on the equity of the firm if the firm is financed entirely with equity or debt.

C)expected return on the equity of the firm if the firm is financed entirely with debt.

D)expected return on the equity of the firm if the firm is financed entirely with equity.

A)expected return on the equity of the firm if the firm is financed equally with equity and debt.

B)expected return on the equity of the firm if the firm is financed entirely with equity or debt.

C)expected return on the equity of the firm if the firm is financed entirely with debt.

D)expected return on the equity of the firm if the firm is financed entirely with equity.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

12

A firm's marginal cost of capital:

A)is the amount by which the firm's total cost of financing will increase if it raises an additional amount of capital to finance a project.

B)is the amount by which the firm's total cost of equity will decrease if it raises an additional amount of debt to acquire a firm.

C)is the amount by which a project's profit will increase if it raises an additional amount of capital to finance the project.

D)is the ratio of the percentage change of cost of equity to the percentage change in the debt-to-equity ratio.

A)is the amount by which the firm's total cost of financing will increase if it raises an additional amount of capital to finance a project.

B)is the amount by which the firm's total cost of equity will decrease if it raises an additional amount of debt to acquire a firm.

C)is the amount by which a project's profit will increase if it raises an additional amount of capital to finance the project.

D)is the ratio of the percentage change of cost of equity to the percentage change in the debt-to-equity ratio.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

13

A company has a debt-to-equity ratio of 1:3.The firm is able to borrow at the risk-free rate of 6% per year.The interest expense is tax deductible,and the corporate tax rate is 35%.Assuming that the CAPM holds,the expected return of the market portfolio is 12%,and the beta of the firm's equity is 1.5,what is the firm's WACC?

A)3.9%

B)15%

C)12.23%

D)18.9%

A)3.9%

B)15%

C)12.23%

D)18.9%

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is true of the APV method and the WACC method?

A)The APV method discounts only one set of cash flows,whereas the WACC method discounts separately the cash flows of the project and the cash flows of the tax savings or other debt subsidies.

B)The WACC method would treat the cash flows from the tax breaks in a similar manner to the incremental cash flows generated by subsidized loans,whereas the APV method draws a distinction between subsidies related to project?s financing and those not related to financing.

C)Both methods use the unlevered cash flows generated by the project as their starting point,assuming that the project is financed entirely by equity.

D)Both methods account for benefits from debt financing by adjusting the discount rate.

A)The APV method discounts only one set of cash flows,whereas the WACC method discounts separately the cash flows of the project and the cash flows of the tax savings or other debt subsidies.

B)The WACC method would treat the cash flows from the tax breaks in a similar manner to the incremental cash flows generated by subsidized loans,whereas the APV method draws a distinction between subsidies related to project?s financing and those not related to financing.

C)Both methods use the unlevered cash flows generated by the project as their starting point,assuming that the project is financed entirely by equity.

D)Both methods account for benefits from debt financing by adjusting the discount rate.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

15

BM Corporation has a debt-to-equity ratio of 1:4,a WACC of 16% and a corporate tax rate of 30%.In a financial restructuring designed to raise the proportion of the firm financed with debt to 40%,it issues debt and buys back its equity with the proceeds.Find the firm's new WACC given the assumptions of the Hamada model.

A)22.08%

B)16%

C)17.02%

D)14.98%

A)22.08%

B)16%

C)17.02%

D)14.98%

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is an assumption of the Hamada model?

A)The face value of the debt changes over time.

B)The tax rate is a constant.

C)All cash flows are unlevered.

D)The debt is not perpetual.

A)The face value of the debt changes over time.

B)The tax rate is a constant.

C)All cash flows are unlevered.

D)The debt is not perpetual.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is an assumption of the adjusted present value method?

A)The firm's earnings and dividends grow at the same constant rate,forever.

B)The forecasted cash flows of the project are unlevered.

C)The earnings forecasts are unbiased.

D)The firm has equal weightage on debt and equity.

A)The firm's earnings and dividends grow at the same constant rate,forever.

B)The forecasted cash flows of the project are unlevered.

C)The earnings forecasts are unbiased.

D)The firm has equal weightage on debt and equity.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

18

In the absence of default:

A)the present value of a project's future unlevered cash flows,discounted at the cost of equity,is identical to the present value of cash flows discounted at the cost of debt.

B)the present value of a project's future unlevered cash flows,discounted at the WACC,is identical to the present value of cash flows to debt holders discounted at the cost of debt.

C)the present value of a project's future levered cash flows,discounted at the WACC,is identical to the present value of cash flows discounted at the cost of equity.

D)the present value of a project's future unlevered cash flows,discounted at the WACC,is identical to the present value of cash flows discounted at the cost of equity.

A)the present value of a project's future unlevered cash flows,discounted at the cost of equity,is identical to the present value of cash flows discounted at the cost of debt.

B)the present value of a project's future unlevered cash flows,discounted at the WACC,is identical to the present value of cash flows to debt holders discounted at the cost of debt.

C)the present value of a project's future levered cash flows,discounted at the WACC,is identical to the present value of cash flows discounted at the cost of equity.

D)the present value of a project's future unlevered cash flows,discounted at the WACC,is identical to the present value of cash flows discounted at the cost of equity.

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following can offset the tax benefits of debt financing for a firm?

A)Increase in the probability of bankruptcy

B)Decrease in the tax structure

C)Increase in the cost of equity

D)Increase in the value of marketable securities

A)Increase in the probability of bankruptcy

B)Decrease in the tax structure

C)Increase in the cost of equity

D)Increase in the value of marketable securities

Unlock Deck

Unlock for access to all 19 flashcards in this deck.

Unlock Deck

k this deck