Deck 12: Commercial Banks Financial Statements and Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

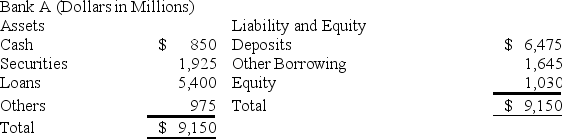

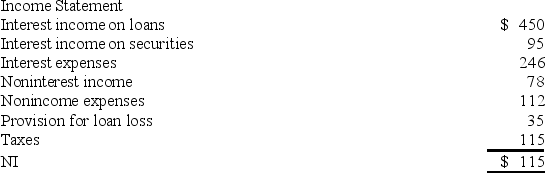

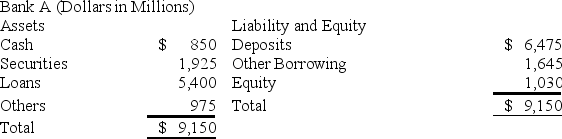

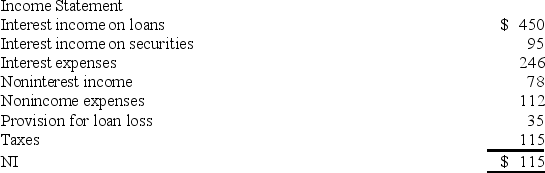

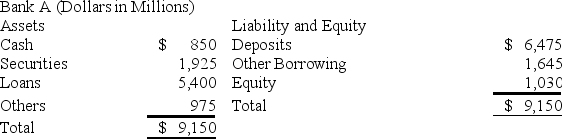

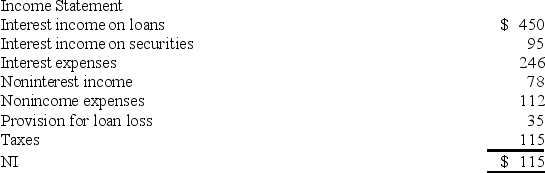

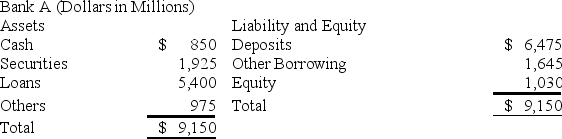

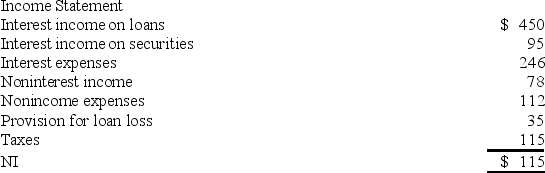

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

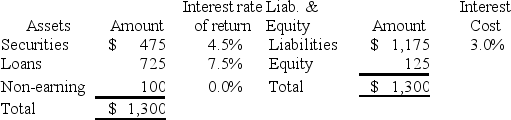

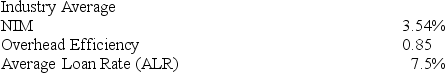

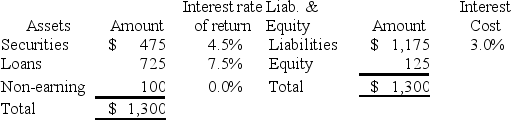

Question

Question

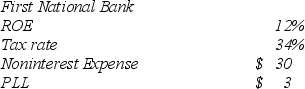

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/59

Play

Full screen (f)

Deck 12: Commercial Banks Financial Statements and Analysis

1

Rate-sensitive funding sources at a bank are termed core deposits.

False

2

C&I loans are loans to businesses used to finance capital needs,equipment purchases,and plant expansions.

True

3

Banks have higher leverage than most manufacturing firms.

True

4

At almost all banks noninterest expense is greater than noninterest income; hence,the overhead efficiency ratio is usually greater than 100 percent.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

5

Core deposits are deposits that are

A)at the bank solely for the interest rate earned.

B)very stable funds sources.

C)typically for larger denominations than hot money sources.

D)very frequently turned over.

A)at the bank solely for the interest rate earned.

B)very stable funds sources.

C)typically for larger denominations than hot money sources.

D)very frequently turned over.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

6

MMDAs are a type of savings account that has some limited checking features. These accounts were designed to help banks compete with MMMFs.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

7

Banks generally pay higher interest rates on NOW accounts than on MMDAs.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

8

Loans are the major asset on a bank's balance sheet,and they generate the largest amount of revenue.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

9

The provision for loan loss account is actual loan losses less loan recoveries in a given time period.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

10

In ratio analysis,the profit margin times the asset utilization ratio equals return on assets.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

11

A wholesale bank is one that focuses its business activities on commercial banking relationships.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

12

Which one of the following is the definition of the NIM?

A)(Net interest income − Net noninterest income)/Earning assets

B)Net interest income/Interest-bearing liabilities

C)(Interest income − Interest expense)/Earning assets

D)(Interest income − Interest expense)/Interest-bearing liabilities

E)(Interest income/Earning assets)− (Interest expense/Interest-bearing liabilities)

A)(Net interest income − Net noninterest income)/Earning assets

B)Net interest income/Interest-bearing liabilities

C)(Interest income − Interest expense)/Earning assets

D)(Interest income − Interest expense)/Interest-bearing liabilities

E)(Interest income/Earning assets)− (Interest expense/Interest-bearing liabilities)

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

13

A construction firm cannot obtain the necessary permits to begin building a shopping mall until it can show it either has or will have the necessary funding to complete the project. The firm may ask a bank for which of the following to allow it to obtain the permits?

I. Commercial letter of credit

II. Loan commitment

III. Credit line

IV. Repurchase agreement

A)I or II

B)II or III

C)II or IV

D)III or IV

E)I or IV

I. Commercial letter of credit

II. Loan commitment

III. Credit line

IV. Repurchase agreement

A)I or II

B)II or III

C)II or IV

D)III or IV

E)I or IV

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

14

Uniform principles,standards,and report forms for depository institutions are prescribed by the

A)FDIC.

B)Federal Reserve.

C)Federal Financial Institutions Examination Council.

D)Office of Comptroller of Currency.

A)FDIC.

B)Federal Reserve.

C)Federal Financial Institutions Examination Council.

D)Office of Comptroller of Currency.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

15

Wholesale CDs obtained from an investment house rather than directly from a customer are referred to as brokered deposits.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

16

The allowance for loan and lease losses is bank management's estimate of the amount of gross loans and leases that will not be repaid to the bank.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

17

Both retail and wholesale CDs are negotiable instruments despite their different denominations.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

18

Composite rating 5 is the rating for the soundest financial institutions.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

19

Bank A has a higher ROA than Bank B. Both banks have similar interest income to asset ratios and noninterest income to asset ratios. We know that

I. Bank A has a higher profit margin than Bank B.

II. Bank A has a higher AU ratio than Bank B.

III. Bank A must have a higher PLL/OI ratio.

A)I only

B)II only

C)I and II only

D)III only

E)I,II,and III

I. Bank A has a higher profit margin than Bank B.

II. Bank A has a higher AU ratio than Bank B.

III. Bank A must have a higher PLL/OI ratio.

A)I only

B)II only

C)I and II only

D)III only

E)I,II,and III

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

20

Loans to consumers and to individuals are jointly termed C&I loans on a bank's balance sheet.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

21

The largest source of income at a typical bank is

A)interest income on securities held for sale.

B)interest income on securities held for investment.

C)interest income on loans and leases.

D)noninterest income.

E)dividends or stock.

A)interest income on securities held for sale.

B)interest income on securities held for investment.

C)interest income on loans and leases.

D)noninterest income.

E)dividends or stock.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

22

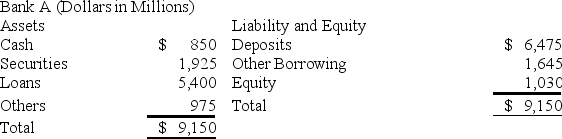

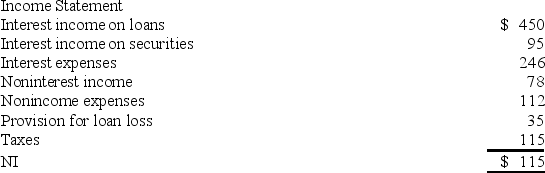

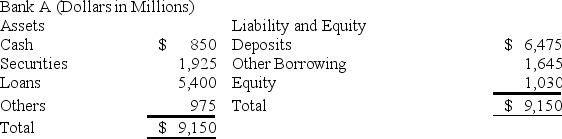

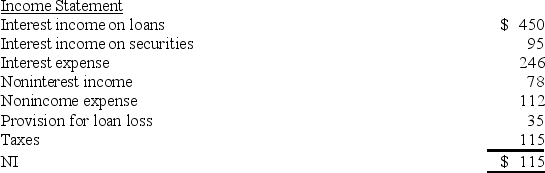

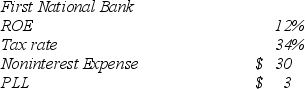

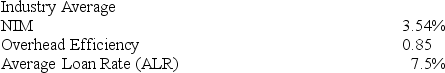

The bank's ROE is

A)15.65 percent.

B)13.21 percent.

C)19.55 percent.

D)11.17 percent.

E)12.67 percent.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

23

Fernando Bank has interest expense of $150 million,earning assets of $1,400 million and a NIM of 5.00 percent. The bank also has interest-bearing liabilities of $1,100 million. Fernando Bank's spread is

A)1.10 percent.

B)1.65 percent.

C)1.94 percent.

D)2.08 percent.

E)2.16 percent.

A)1.10 percent.

B)1.65 percent.

C)1.94 percent.

D)2.08 percent.

E)2.16 percent.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

24

Cash in the process of collection is

A)a deposit at another financial institution.

B)a Fed funds transaction.

C)checks the bank owes other institutions that have not yet been paid.

D)checks that the bank is owed but has not yet collected.

E)equity capital.

A)a deposit at another financial institution.

B)a Fed funds transaction.

C)checks the bank owes other institutions that have not yet been paid.

D)checks that the bank is owed but has not yet collected.

E)equity capital.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

25

A municipal bond is paying a 6 percent annual yield. An equivalent risk corporate bond is paying 7 percent. Investors with a tax rate of ________ or higher would prefer the municipal bond.

A)65.13 percent

B)14.28 percent

C)25.00 percent

D)80.75 percent

E)25.75 percent

A)65.13 percent

B)14.28 percent

C)25.00 percent

D)80.75 percent

E)25.75 percent

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

26

If the average net interest margin for this type of bank is 4.65 percent,then,ceteris paribus,this particular bank is performing

A)the same as average because this bank has a NIM of 4.65 percent.

B)better than average because this bank has a NIM of 6.55 percent.

C)poorer than average because this bank has a NIM of 4.08 percent.

D)better than average because this bank has a NIM of 5.23 percent.

E)One can't determine with the information given.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

27

Plains National Bank has interest income of $250 million and interest expense of $110 million,noninterest income of $40 million and noninterest expense of $65 million on earning assets of $3,900 million. What is Plains' overhead efficiency ratio?

A)61.54 percent

B)44.00 percent

C)9.23 percent

D)42.45 percent

E)37.46 percent

A)61.54 percent

B)44.00 percent

C)9.23 percent

D)42.45 percent

E)37.46 percent

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

28

The bank's asset utilization ratio is

A)58.04 percent.

B)6.12 percent.

C)5.46 percent.

D)4.29 percent.

E)6.81 percent.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

29

The bank's ROA is

A)1.31 percent.

B)1.78 percent.

C)1.26 percent.

D)0.89 percent.

E)None of these choices are correct.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

30

The bank's profit margin is

A)27.27 percent.

B)23.08 percent.

C)21.31 percent.

D)18.46 percent.

E)None of these choices are correct.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

31

Core deposits typically include all except which one of the following?

A)Demand deposits

B)NOW accounts

C)MMDAs

D)Eurodollar deposits

E)Passbook savings accounts

A)Demand deposits

B)NOW accounts

C)MMDAs

D)Eurodollar deposits

E)Passbook savings accounts

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

32

Oceanside Bank converts a dollar of equity into 10 cents of net income and has $9.50 in assets per dollar of equity capital. Oceanside also has a profit margin of 15 percent. What is Oceanside's AU ratio?

A)1.05 percent

B)3.55 percent

C)5.56 percent

D)6.45 percent

E)7.02 percent

A)1.05 percent

B)3.55 percent

C)5.56 percent

D)6.45 percent

E)7.02 percent

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

33

If the typical bank of this type has an overhead efficiency ratio of 0.65,then this particular bank ________ than the typical bank,ceteris paribus.

A)is doing a poorer job generating profitable off-balance-sheet activities

B)is doing a better job time managing noninterest income and expenses

C)is paying higher taxes

D)has fewer loan losses

E)None of these choices are correct.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

34

The lower the interest expense ratio,the provision for loan loss ratio,the noninterest expense ratio,and the tax ratio the ________ the ________.

A)lower; PM

B)higher; PM

C)lower; AU

D)higher; AU

E)lower; EM

A)lower; PM

B)higher; PM

C)lower; AU

D)higher; AU

E)lower; EM

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

35

Purchased funds include all but which one of the following?

A)Brokered deposits

B)Wholesale CDs

C)Fed funds purchased

D)Repurchase agreements

E)Demand deposits

A)Brokered deposits

B)Wholesale CDs

C)Fed funds purchased

D)Repurchase agreements

E)Demand deposits

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

36

The First Bank of the Ozarks generates $0.0155 dollars of net income per dollar of assets and it has a profit margin of 12.25 percent. How much operating income per dollar of total assets does First Bank generate?

A)12.50 percent

B)12.65 percent

C)12.75 percent

D)12.85 percent

E)12.95 percent

A)12.50 percent

B)12.65 percent

C)12.75 percent

D)12.85 percent

E)12.95 percent

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

37

If a bank has more purchased funds than the average bank,you would not be surprised to see a higher than average ________ ratio.

A)provision for loan loss

B)tax

C)noninterest expense

D)interest expense

E)None of these choices are correct.

A)provision for loan loss

B)tax

C)noninterest expense

D)interest expense

E)None of these choices are correct.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

38

Interest-bearing retail accounts with limited checking features designed to compete with money market mutual fund investments are called ________.

A)NOWs

B)retail CDs

C)MMDAs

D)special savings deposits

E)negotiable CDs

A)NOWs

B)retail CDs

C)MMDAs

D)special savings deposits

E)negotiable CDs

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

39

Blue Ridge Bank has a PM of 12 percent,an interest income to total assets ratio of 6.00 percent,and a noninterest income to assets ratio of 1.50 percent. Blue Ridge also has $9 in assets per dollar in equity capital. Blue Ridge's ROE is

A)7.50 percent.

B)9.00 percent.

C)8.10 percent.

D)6.48 percent.

E)5.75 percent.

A)7.50 percent.

B)9.00 percent.

C)8.10 percent.

D)6.48 percent.

E)5.75 percent.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

40

A bank has interest income to total assets ratio of 5.45 percent and has noninterest income of $45 million and total assets of $700 million. What is the bank's asset utilization ratio?

A)5.45 percent

B)6.43 percent

C)9.67 percent

D)15.02 percent

E)11.88 percent

A)5.45 percent

B)6.43 percent

C)9.67 percent

D)15.02 percent

E)11.88 percent

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

41

A bank can raise capital by:

A)Offering long-term CDs

B)Issuing Stock

C)Retaining earnings

D)Both issuing stocks and offering long-term CDs

E)Both issuing stocks and retaining earnings

A)Offering long-term CDs

B)Issuing Stock

C)Retaining earnings

D)Both issuing stocks and offering long-term CDs

E)Both issuing stocks and retaining earnings

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

42

Investment securities plus ________ is equal to a bank's earning assets.

A)net loans and leases

B)gross loans and leases

C)property,plant,and equipment

D)securities held for trading

E)purchased accounts

A)net loans and leases

B)gross loans and leases

C)property,plant,and equipment

D)securities held for trading

E)purchased accounts

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

43

How has the negotiable feature of wholesale CDs improved banks' ability to manage their liquidity?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following assets are used to increase a bank's liquidity position?

A)Commercial loans

B)Treasury securities

C)Personal loans

D)Mortgage loans

E)Corporate bonds

A)Commercial loans

B)Treasury securities

C)Personal loans

D)Mortgage loans

E)Corporate bonds

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

45

If the net noninterest income were to increase to −$16,what would the average loan rate (ALR)have to be to generate a 12 percent ROE? Compared to the industry,does this ALR appear feasible? If not,what options does FNB have?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

46

What are the differences between purchased funds and core deposits?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

47

![What is the bank's NIM? Is the bank performing better or worse than average? In what area is the bank performing better or worse than average? How could the bank improve if necessary? NIM = (Interest revenue − Interest expense)/(Securities + Loans) [(475 × .045)+ (725 × .075)− (1,175 × .03)]/(475 + 725)= 3.383%](https://d2lvgg3v3hfg70.cloudfront.net/TB6854/11eaae25_5e95_7f9f_87fe_23522d67cb28_TB6854_00.jpg)

![What is the bank's NIM? Is the bank performing better or worse than average? In what area is the bank performing better or worse than average? How could the bank improve if necessary? NIM = (Interest revenue − Interest expense)/(Securities + Loans) [(475 × .045)+ (725 × .075)− (1,175 × .03)]/(475 + 725)= 3.383%](https://d2lvgg3v3hfg70.cloudfront.net/TB6854/11eaae25_5e95_a5b0_87fe_c74584d0a942_TB6854_00.jpg)

![What is the bank's NIM? Is the bank performing better or worse than average? In what area is the bank performing better or worse than average? How could the bank improve if necessary? NIM = (Interest revenue − Interest expense)/(Securities + Loans) [(475 × .045)+ (725 × .075)− (1,175 × .03)]/(475 + 725)= 3.383%](https://d2lvgg3v3hfg70.cloudfront.net/TB6854/11eaae25_5e95_a5b1_87fe_131b330fb958_TB6854_00.jpg)

What is the bank's NIM? Is the bank performing better or worse than average? In what area is the bank performing better or worse than average? How could the bank improve if necessary?

NIM = (Interest revenue − Interest expense)/(Securities + Loans)

[(475 × .045)+ (725 × .075)− (1,175 × .03)]/(475 + 725)= 3.383%

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

48

What is the difference between a loan commitment and a letter of credit?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

49

What must net noninterest income (net of noninterest expense)be in order for FNB to have a 12 percent ROE? Based on your answer,must FNB be performing better or worse than the industry average in this area? Explain.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

50

A(n)________ is a contra asset account.

A)loan commitment

B)provision for loan and lease losses

C)allowance for loan and lease losses

D)net charge-off

A)loan commitment

B)provision for loan and lease losses

C)allowance for loan and lease losses

D)net charge-off

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

51

Net loans and leases plus ________ plus ________ equals gross loans and leases.

A)earned income; provision for loan and lease losses

B)unearned income; the allowance for loan and lease losses

C)net charge-offs; provision for loan and lease losses

D)provision for loan and lease losses; allowance for loan and lease losses

E)None of these choices are correct.

A)earned income; provision for loan and lease losses

B)unearned income; the allowance for loan and lease losses

C)net charge-offs; provision for loan and lease losses

D)provision for loan and lease losses; allowance for loan and lease losses

E)None of these choices are correct.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

52

The AU ratio measures the bank's ability to ________ and the PM ratio measures the bank's ability to ________.

A)control expenses; generate income from assets

B)generate income from assets; control expenses

C)maximize interest revenue; minimize interest expense

D)control leverage; minimize physical plant

E)None of these choices are correct.

A)control expenses; generate income from assets

B)generate income from assets; control expenses

C)maximize interest revenue; minimize interest expense

D)control leverage; minimize physical plant

E)None of these choices are correct.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

53

What is the difference between net charge-offs (NCOs,sometimes called write-offs)and the provision for loan loss (PLL)? What is the purpose of the PLL account?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

54

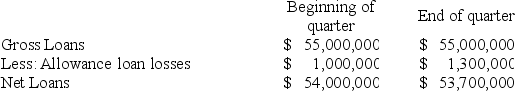

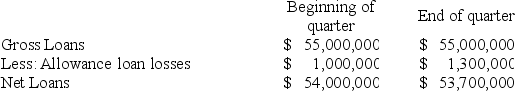

At the start of the quarter a bank has $55 million (gross)in its loan portfolio,and has $1 million in its allowance for loan loss account. During the quarter,loan audits indicate that an additional $300,000 of loans will not be paid as promised. These loans have not yet been written off as uncollectible,however. What are the starting and ending gross and net loan amounts and the provision for loan loss account,and what is the effect on the bank's quarterly earnings?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following is not an off-balance sheet activity?

A)Commercial letter of credit

B)Standby letter of credit

C)Swap transaction

D)Futures contract

E)Consumer loans

A)Commercial letter of credit

B)Standby letter of credit

C)Swap transaction

D)Futures contract

E)Consumer loans

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

56

The largest market available for purchased funds is the ________.

A)wholesale CD market

B)Eurodollar deposit market

C)banker's acceptances market

D)discount window purchases

E)Fed funds market

A)wholesale CD market

B)Eurodollar deposit market

C)banker's acceptances market

D)discount window purchases

E)Fed funds market

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

57

All but which one of the following is an example of noninterest income or noninterest expense?

A)Income from service charges on deposits

B)Income from trust services

C)Gains and losses from trading account assets

D)Earnings on securities held for investment

E)Salaries and benefits paid to employees

A)Income from service charges on deposits

B)Income from trust services

C)Gains and losses from trading account assets

D)Earnings on securities held for investment

E)Salaries and benefits paid to employees

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

58

What are the major sources of purchased funds? Can using purchased funds change a bank's profitability? Its risk level? Explain.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

59

What is the largest operating expense for a bank?

A)Employee salaries

B)Interest paid on loans from Federal Reserve

C)Interest paid on deposits

D)Interest paid on loans borrowed from other banks

E)Employee benefits

A)Employee salaries

B)Interest paid on loans from Federal Reserve

C)Interest paid on deposits

D)Interest paid on loans borrowed from other banks

E)Employee benefits

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck