Deck 13: Regulation of Commercial Banks

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/60

Play

Full screen (f)

Deck 13: Regulation of Commercial Banks

1

A financial intermediary that can engage in a broad range of financial service activities is termed a universal FI.

True

2

The FDIC insures bank deposits and the OTS insures thrift deposits.

False

3

A securities subsidiary of a bank holding company that engages in investment banking is called a Riegle-Neal affiliate.

False

4

The 1993 Basel Agreement explicitly incorporated the different credit risks of assets into capital adequacy measures.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

5

FBSEA Act of 1991 extended federal regulatory authority over foreign banking organizations in the United States.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

6

The Investment Company Act of 1940 and the Securities Acts of 1933 and 1934 are examples of investor protection regulations.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

7

Unit banking states are states that do not allow interstate branch banking but allow the creation of intrastate branch banks.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

8

A bank holding company that only has one bank is termed a unit bank.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

9

There were a greater number of bank failures from 1980 to 1990 inclusive than from 1934 to 1979.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

10

The quantity of notes and coin in the economy is called inside money but the bulk of the money supply is outside money.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

11

The Financial Services Modernization Act allowed bank holding companies to open insurance underwriting affiliates and allowed insurance companies to open banks.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

12

Periods of high interest rates create the disintermediation phenomena in commercial banks.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

13

In United States,commercial banks are among the least regulated financial institutions.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

14

Banks are generally prohibited from making loans exceeding more than 15 percent of their own equity capital to any one company or borrower.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

15

The difference between the private costs of regulations and the private benefits for the producers of financial services is called the net regulatory burden.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

16

The Glass-Steagall Act came about due to concerns about excessive risk taking at banks and conflicts of interest between commercial and investment banking activities.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

17

The CRA of 1977 and the HMDA of 1975 are examples of consumer protection regulations.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

18

The Financial Services Modernization Act first allowed Section 20 affiliates.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

19

Management of liquidity risk is the major reason why commercial banks are subject to reserve requirements.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

20

The layers of regulation imposed on banks to protect depositors against bank failure are termed credit allocation regulations.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

21

FDIC deposit insurance is generally limited to ________ per depositor per bank.

A)$50,000

B)$100,000

C)$150,000

D)$200,000

E)$250,000

A)$50,000

B)$100,000

C)$150,000

D)$200,000

E)$250,000

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

22

The FDIC may require an undercapitalized bank to

I. provide the FDIC with a capital restoration plan.

II. cease acquiring brokered deposits.

III. obtain FDIC approval for all acquisitions.

IV. suspend dividends and management fees.

V. suspend payments on subordinated debt.

A)I and II only

B)III only

C)I,II,III,and IV only

D)I,II,III,IV,and V

E)I,II,III,and V only

I. provide the FDIC with a capital restoration plan.

II. cease acquiring brokered deposits.

III. obtain FDIC approval for all acquisitions.

IV. suspend dividends and management fees.

V. suspend payments on subordinated debt.

A)I and II only

B)III only

C)I,II,III,and IV only

D)I,II,III,IV,and V

E)I,II,III,and V only

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

23

In the post-Depression era the largest number of bank failures occurred in which time period?

A)1955-1965

B)1965-1975

C)1975-1985

D)1985-1995

E)1995-2005

A)1955-1965

B)1965-1975

C)1975-1985

D)1985-1995

E)1995-2005

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

24

A bank that has an equity to asset ratio equal to 12 percent can normally lend no more than ________ of its assets to any one borrower.

A)1.20 percent

B)1.50 percent

C)1.80 percent

D)12.00 percent

E)15.00 percent

A)1.20 percent

B)1.50 percent

C)1.80 percent

D)12.00 percent

E)15.00 percent

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

25

All banks located in the European Union offer deposits that are insured for ________ euros,although depositors are subject to a ________ in the event of loss.

A)100,000; 2.5 percent insurance premium

B)50,000; 95 percent recovery rate

C)50,000; 10 percent deductible

D)45,000; 5 percent fine

E)75,000; 90 percent recovery rate

A)100,000; 2.5 percent insurance premium

B)50,000; 95 percent recovery rate

C)50,000; 10 percent deductible

D)45,000; 5 percent fine

E)75,000; 90 percent recovery rate

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

26

Tier I (core)capital includes at least some part of which of the following?

I. Common stockholders' equity

II. Retained earnings

III. Subordinated debt

IV. Allowance for loan and lease losses

A)I only

B)I and II only

C)I and IV only

D)II and III only

E)I,II,III,and IV

I. Common stockholders' equity

II. Retained earnings

III. Subordinated debt

IV. Allowance for loan and lease losses

A)I only

B)I and II only

C)I and IV only

D)II and III only

E)I,II,III,and IV

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

27

Recent regulation such as the Riegle-Neal Act of 1994 has removed some of the federal banking laws that formerly constrained profitable opportunities for commercial banks. The Riegle-Neal Act removes the major restrictions on banks' ability to ________.

A)diversify geographically

B)diversify their product line

C)engage in securities underwriting

D)engage in insurance underwriting

E)engage in loan brokerage

A)diversify geographically

B)diversify their product line

C)engage in securities underwriting

D)engage in insurance underwriting

E)engage in loan brokerage

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

28

A bank has Tier I capital of $90 million and Tier II capital of $70 million. The bank has total assets of $2,522 million and risk-weighted assets of 2,017.6 million. This bank is

A)critically undercapitalized.

B)significantly undercapitalized.

C)undercapitalized.

D)adequately capitalized.

E)well-capitalized.

A)critically undercapitalized.

B)significantly undercapitalized.

C)undercapitalized.

D)adequately capitalized.

E)well-capitalized.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

29

Major provisions of the Financial Services Modernization Act of 1999 include all of the following except

A)allowing bank holding companies to open insurance underwriting affiliates and vice versa.

B)allowing bank holding companies to open or merge with investment banks.

C)creating one regulator to oversee all activities of financial service firms.

D)All of these choices are correct.

E)None of these options are correct.

A)allowing bank holding companies to open insurance underwriting affiliates and vice versa.

B)allowing bank holding companies to open or merge with investment banks.

C)creating one regulator to oversee all activities of financial service firms.

D)All of these choices are correct.

E)None of these options are correct.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following would increase the value of a bank charter?

I. Tightening restrictions on new charters

II. Broadening the activities banks can engage in

III. Increasing reserve requirements

IV. Doubling capital adequacy requirements

A)I and II only

B)II only

C)III and IV only

D)I and IV only

E)II and III only

I. Tightening restrictions on new charters

II. Broadening the activities banks can engage in

III. Increasing reserve requirements

IV. Doubling capital adequacy requirements

A)I and II only

B)II only

C)III and IV only

D)I and IV only

E)II and III only

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

31

U.S. depository institutions may be subject to as many as ________ separate regulators.

A)four

B)five

C)six

D)seven

E)eight

A)four

B)five

C)six

D)seven

E)eight

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

32

The reduction in deposit funds cost to an individual bank brought about by government insurance is an example of the

A)social benefit of regulation.

B)private cost of regulation to DIs.

C)private benefits of regulation to DIs.

D)net regulatory burden.

E)None of these options are correct.

A)social benefit of regulation.

B)private cost of regulation to DIs.

C)private benefits of regulation to DIs.

D)net regulatory burden.

E)None of these options are correct.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

33

Which act led to interstate banking in the United States?

A)Glass-Steagall Act

B)DIDMCA

C)McFadden Act

D)Riegle-Neal Act

E)Financial Services Modernization Act

A)Glass-Steagall Act

B)DIDMCA

C)McFadden Act

D)Riegle-Neal Act

E)Financial Services Modernization Act

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

34

Areas of commercial bank regulation dealing with preventing banks from discriminating unfairly in lending are termed ________ regulations.

A)safety and soundness

B)consumer protection

C)investor protection

D)credit allocation

E)monetary policy

A)safety and soundness

B)consumer protection

C)investor protection

D)credit allocation

E)monetary policy

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

35

Areas of commercial bank regulation designed to encourage banks to lend to socially important sectors such as housing and farming are termed ________ regulations.

A)safety and soundness

B)consumer protection

C)investor protection

D)credit allocation

E)monetary policy

A)safety and soundness

B)consumer protection

C)investor protection

D)credit allocation

E)monetary policy

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

36

To be well-capitalized,a bank must have a leverage ratio of at least ________ percent,Tier I capital to credit risk-adjusted asset ratio of at least ________ percent,and a total risk-based capital ratio of at least ________ percent.

A)4; 4; 8

B)5; 8; 10

C)3; 3; 8

D)4; 8; 4

E)4; 6; 10

A)4; 4; 8

B)5; 8; 10

C)3; 3; 8

D)4; 8; 4

E)4; 6; 10

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

37

Among other things,the Financial Institutions Reform,Recovery,and Enforcement Act stipulated the creation of the

A)FDIC.

B)OTS.

C)OCC.

D)Warren Commission.

E)CRA.

A)FDIC.

B)OTS.

C)OCC.

D)Warren Commission.

E)CRA.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

38

The term disintermediation refers to

A)the policy of not closing insolvent institutions in hopes that they can eventually turn around their performance.

B)the withdrawal of deposits from depository institutions that are reinvested in other types of intermediaries.

C)the policy of regulating the minimum rate of return institutions can pay on deposits.

D)chartering restrictions that limit the ability of new banks to enter into a local market.

E)the policy of not allowing banks to grow by creating a de novo branch outside their traditional market area.

A)the policy of not closing insolvent institutions in hopes that they can eventually turn around their performance.

B)the withdrawal of deposits from depository institutions that are reinvested in other types of intermediaries.

C)the policy of regulating the minimum rate of return institutions can pay on deposits.

D)chartering restrictions that limit the ability of new banks to enter into a local market.

E)the policy of not allowing banks to grow by creating a de novo branch outside their traditional market area.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

39

The law that largely repealed the Depression era banking laws was the

A)Depository Institution Deregulation and Monetary Control Act of 1980.

B)Financial Services Modernization Act.

C)FIRREA.

D)International Banking Act.

E)None of these options are correct.

A)Depository Institution Deregulation and Monetary Control Act of 1980.

B)Financial Services Modernization Act.

C)FIRREA.

D)International Banking Act.

E)None of these options are correct.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

40

To be classified as an adequately capitalized bank,the bank must have a leverage ratio of at least ________ percent,Tier I capital to credit risk-adjusted asset ratio of at least ________ percent and a total capital to credit risk-adjusted assets ratio of at least ________ percent,and does not meet the definition of a well-capitalized bank.

A)4; 6; 8

B)5; 6; 10

C)3; 3; 8

D)4; 8; 4

E)4; 6; 10

A)4; 6; 8

B)5; 6; 10

C)3; 3; 8

D)4; 8; 4

E)4; 6; 10

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

41

(a)What are the mandatory Prompt Corrective Action (PCA)Provisions for an undercapitalized bank? Explain why these provisions are required.

(b)Why does one of the mandatory PCA Provisions for a critically undercapitalized bank include appointing a receiver/conservator within 90 days?

(b)Why does one of the mandatory PCA Provisions for a critically undercapitalized bank include appointing a receiver/conservator within 90 days?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

42

Cite one law or regulation per each of the following categories:

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

43

The average daily net transaction accounts of a local bank during the most recent reserve computation period is $687 million. The amount of average daily reserves at the Fed during the reserve maintenance period is $35.23 million,and the average daily vault cash corresponding to the maintenance period is $12.74 million. Is this bank in compliance with reserve requirements?

A)Yes,the bank has excess daily reserves of $2.45 million.

B)Yes,the bank has excess daily reserves of $11.71 million.

C)No,the bank is short on daily reserves by $12.56 million.

D)No,the bank is short on daily reserves by $4.36 million.

E)No,the bank is short on daily reserves by $9.17 million.

A)Yes,the bank has excess daily reserves of $2.45 million.

B)Yes,the bank has excess daily reserves of $11.71 million.

C)No,the bank is short on daily reserves by $12.56 million.

D)No,the bank is short on daily reserves by $4.36 million.

E)No,the bank is short on daily reserves by $9.17 million.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

44

A financial service holding company operates a nationally chartered bank,an insurance firm,a securities firm,and a federal savings bank. Who is the primary regulator for this company? Explain.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

45

The FDIC is required to establish a plan to restore the DIF if the reserve ratio falls below ________ of insured deposits.

A)1.00 percent

B)1.15 percent

C)1.50 percent

D)1.75 percent

E)2.00 percent

A)1.00 percent

B)1.15 percent

C)1.50 percent

D)1.75 percent

E)2.00 percent

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

46

Discuss the four layers of regulation designed to preserve the safety and soundness of DIs.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

47

Requiring foreign banks to operate under the same rules as domestic banks is termed

A)favored status.

B)IBA clause.

C)national treatment.

D)NAFTA.

E)post-patriotism requirement.

A)favored status.

B)IBA clause.

C)national treatment.

D)NAFTA.

E)post-patriotism requirement.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

48

Why were the FIRREA of 1989 and the FDICIA of 1991 passed? What were their major provisions? How did these laws differ from earlier acts of the 1980s?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

49

Why have some states placed restrictions on intrastate and interstate branches? What historical laws gave this right to states? What law changed these restrictions?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

50

The average daily net transaction accounts of a local bank during the most recent reserve computation period is $687 million. The amount of average daily reserves at the Fed during the reserve maintenance period is $35.23 million,and the average daily vault cash corresponding to the maintenance period is $12.74 million. What is the average daily reserve balance required to be held by the bank during the maintenance period?

A)$40.12 million

B)$47.79 million

C)$54.64 million

D)$60.53 million

E)$62.34 million

A)$40.12 million

B)$47.79 million

C)$54.64 million

D)$60.53 million

E)$62.34 million

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

51

Which act allowed the establishment of full-service financial institutions in the United States?

A)Riegle-Neal Act

B)Financial Services Modernization Act

C)USA Patriot Act

D)Foreign Bank Supervision Enhancement Act

E)Foreign Banking Activity Powers Enforcement Act

A)Riegle-Neal Act

B)Financial Services Modernization Act

C)USA Patriot Act

D)Foreign Bank Supervision Enhancement Act

E)Foreign Banking Activity Powers Enforcement Act

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

52

Tier II (supplementary)capital includes which of the following?

I. Allowance for loan and lease losses,up to 1.25 percent of risk-weighted assets

II. Subordinated debt with original maturity of at least 5 years

III. Common stock and retained earnings

IV. Nontransaction deposits

A)II and III only

B)I and IV only

C)I and II only

D)I,II,and III only

E)I,III,and IV only

I. Allowance for loan and lease losses,up to 1.25 percent of risk-weighted assets

II. Subordinated debt with original maturity of at least 5 years

III. Common stock and retained earnings

IV. Nontransaction deposits

A)II and III only

B)I and IV only

C)I and II only

D)I,II,and III only

E)I,III,and IV only

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

53

The average daily net transaction accounts of a local bank during the most recent reserve computation period is $589 million. The amount of average daily reserves at the Fed during the reserve maintenance period is $73.31 million,and the average daily vault cash corresponding to the maintenance period is $8.36 million. What is the average daily reserve balance required to be held by the bank during the maintenance period and is this bank in compliance with reserve requirements?

A)$42.37 million; yes

B)$46.79 million; yes

C)$55.14 million; no

D)$60.83 million; no

E)$62.11 million; no

A)$42.37 million; yes

B)$46.79 million; yes

C)$55.14 million; no

D)$60.83 million; no

E)$62.11 million; no

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

54

What changes to foreign bank operations in the United States have been brought about by the Foreign Bank Supervision and Enhancement Act of 1991?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

55

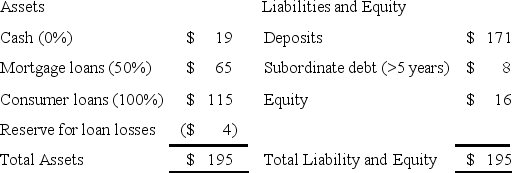

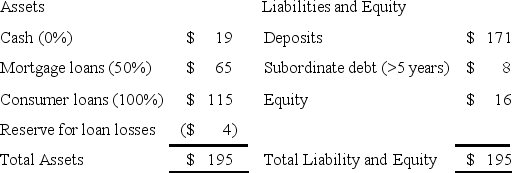

A Bank has the following balance sheet (in millions),with the risk weights in parentheses.

In addition,the bank has $30 million in commercial direct-credit substitute standby letters of credit to a public corporation and $30 million in 10-year FX forward contracts that are in the money by $2 million.

a. What are the risk-adjusted on-balance-sheet assets of the bank as defined under the Basel III?

b. What are the common equity Tier I (CET1)risk-based capital ratio,Tier I risk-based capital ratio,and the total risk-based capital ratio?

c. Disregarding the capital conservation buffer,does the bank have sufficient capital to meet the Basel requirements?

In addition,the bank has $30 million in commercial direct-credit substitute standby letters of credit to a public corporation and $30 million in 10-year FX forward contracts that are in the money by $2 million.

a. What are the risk-adjusted on-balance-sheet assets of the bank as defined under the Basel III?

b. What are the common equity Tier I (CET1)risk-based capital ratio,Tier I risk-based capital ratio,and the total risk-based capital ratio?

c. Disregarding the capital conservation buffer,does the bank have sufficient capital to meet the Basel requirements?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

56

How do risk-based deposit insurance premiums and risk-based capital requirements help reduce the moral hazard problem of deposit insurance? (Hint: Moral hazard means that because of deposit insurance,banks may take on excessive amounts of risk.)

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

57

Among other things,the ________ prohibits U.S. banks from providing banking services to foreign shell banks.

A)International Banking Act

B)Financial Services Modernization Act

C)USA Patriot Act

D)Foreign Bank Supervision Enhancement Act

E)Foreign Banking Activity Powers Enforcement Act

A)International Banking Act

B)Financial Services Modernization Act

C)USA Patriot Act

D)Foreign Bank Supervision Enhancement Act

E)Foreign Banking Activity Powers Enforcement Act

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

58

(a)A bank has risk-weighted assets of $175 and equity of $12.5. If regulators require a minimum risk-weighted capital ratio of 5 percent given the current level of equity,how many new assets with a 100 percent risk weight can the bank add? How many with a 50 percent risk weight?

(b)If the bank had 20 percent more equity,how many new assets with a 100 percent risk weight could the bank add? How many with a 50 percent risk weight? How does having more equity affect a bank's ability to grow? How is this growth affected by the riskiness of the bank's assets?

(b)If the bank had 20 percent more equity,how many new assets with a 100 percent risk weight could the bank add? How many with a 50 percent risk weight? How does having more equity affect a bank's ability to grow? How is this growth affected by the riskiness of the bank's assets?

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

59

In the United States,regulators currently use a ________ to calculate required reserve balances.

A)lagged reserve accounting system

B)contemporaneous reserve system

C)homoscedastic reserve system

D)two-day computation period

E)accrual accounting period

A)lagged reserve accounting system

B)contemporaneous reserve system

C)homoscedastic reserve system

D)two-day computation period

E)accrual accounting period

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

60

The ________ introduced the prompt corrective action policy that requires federal intervention when a bank's capital falls below certain minimums.

A)Federal Deposit Insurance Corporation Improvement Act

B)Financial Services Modernization Act

C)USA Patriot Act

D)Foreign Bank Supervision Enhancement Act

E)Foreign Banking Activity Powers Enforcement Act

A)Federal Deposit Insurance Corporation Improvement Act

B)Financial Services Modernization Act

C)USA Patriot Act

D)Foreign Bank Supervision Enhancement Act

E)Foreign Banking Activity Powers Enforcement Act

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck