Deck 23: Performance Measurement, Compensation, and Multinational Considerations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/150

Play

Full screen (f)

Deck 23: Performance Measurement, Compensation, and Multinational Considerations

1

Make a list of steps of designing an accounting based performance measure. Give an example of decisions taken under each step.

1.Choose performance measures that align with top management's goals.

Does operating income, return on assets, or revenues best measure a subunit's financial goals?

2.Choose the Details of Each Performance Measure.

Once a firm has chosen a specific performance measure, it must make a variety of decisions about the precise way in which various components of the measure are to be calculated. For example, if the chosen performance measure is return on assets, should it be calculated for one year or for a multiyear period? Should assets be defined as total assets or net assets (total assets

minus total liabilities)? Should assets be measured at historical cost or current cost?

3.Choose a Target Level of Performance and Feedback Mechanism for Each Performance Measure

For example, should all subunits have identical targets, such as the same required rate of return on assets? Should performance reports be sent to top managers daily, weekly, or monthly?

Does operating income, return on assets, or revenues best measure a subunit's financial goals?

2.Choose the Details of Each Performance Measure.

Once a firm has chosen a specific performance measure, it must make a variety of decisions about the precise way in which various components of the measure are to be calculated. For example, if the chosen performance measure is return on assets, should it be calculated for one year or for a multiyear period? Should assets be defined as total assets or net assets (total assets

minus total liabilities)? Should assets be measured at historical cost or current cost?

3.Choose a Target Level of Performance and Feedback Mechanism for Each Performance Measure

For example, should all subunits have identical targets, such as the same required rate of return on assets? Should performance reports be sent to top managers daily, weekly, or monthly?

2

A report that measures financial and nonfinancial performance measures for various organization units in a single report is called a(n) ________.

A) balanced scorecard

B) financial report scorecard

C) goal-congruence report

D) investment success report

A) balanced scorecard

B) financial report scorecard

C) goal-congruence report

D) investment success report

balanced scorecard

3

The first step in designing accounting based performance measures is to choose a target level of performance and feedback mechanism.

False

4

Return on investment can be increased by ________.

A) increasing current assets

B) increasing return on sales

C) decreasing revenues

D) increasing the debt portion of the capital

A) increasing current assets

B) increasing return on sales

C) decreasing revenues

D) increasing the debt portion of the capital

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

5

Average number of repeat visits in a spa unit is a ________ measure on a balanced scorecard.

A) customer perspective

B) financial perspective

C) learning-and-growth perspective

D) internal-business-process perspective

A) customer perspective

B) financial perspective

C) learning-and-growth perspective

D) internal-business-process perspective

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

6

An example of a performance measure with a long time horizon is ________.

A) direct materials efficiency variances

B) overhead spending variances

C) number of new patents developed

D) quality of room service

A) direct materials efficiency variances

B) overhead spending variances

C) number of new patents developed

D) quality of room service

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

7

The balanced scorecard in most organizations is broken down into the following categories: commercial perspective, supplier perspective, external business-process perspective, and productivity perspective.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

8

Some companies present financial and nonfinancial performance measures for various organization units in a single report called the balanced scorecard.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is true about designing an accounting-based performance measure?

A) The decisions made in steps are followed in a hierarchial order.

B) The issues considered in each step are independent.

C) Management's beliefs are not required during the analyses.

D) Behavioral criteria are important when evaluating the steps.

A) The decisions made in steps are followed in a hierarchial order.

B) The issues considered in each step are independent.

C) Management's beliefs are not required during the analyses.

D) Behavioral criteria are important when evaluating the steps.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following steps in designing an accounting-based performance measure includes decisions of selecting net income as a measure of financial performance?

A) choosing performance measures that align with the firm's financial goals

B) choosing the time horizon of each performance measure

C) choosing the details for each performance measure

D) choosing a target level of performance

A) choosing performance measures that align with the firm's financial goals

B) choosing the time horizon of each performance measure

C) choosing the details for each performance measure

D) choosing a target level of performance

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

11

Customer-satisfaction measures are an example of the ________.

A) goal-congruence approach

B) balanced scorecard approach

C) financial report scorecard approach

D) investment success approach

A) goal-congruence approach

B) balanced scorecard approach

C) financial report scorecard approach

D) investment success approach

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

12

Aaron Corp's net income is $25,000. What is the amount of the investment if the return on investment is 30%?

A) $50,000

B) $58,333

C) $83,333

D) $108,333

A) $50,000

B) $58,333

C) $83,333

D) $108,333

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

13

Many common performance measures, such as customer satisfaction, rely on internal financial accounting information.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

14

All of the following are ways to calculate different versions of ROI except ________.

A) Revenues/Total Assets

B) Return on sales x investment turnover

C) Income/Investments

D) Operating Income/Revenues x Revenues/Total Assets

A) Revenues/Total Assets

B) Return on sales x investment turnover

C) Income/Investments

D) Operating Income/Revenues x Revenues/Total Assets

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

15

When designing the steps in accounting-based performance measures, should the decisions in these steps be sequential?

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

16

Companies are increasingly using nonfinancial measures to evaluate performance. Why? Since these numbers do not come from the company's financial records, why are they used?

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following steps in designing an accounting-based performance measure includes decisions such as defining assets as total assets or net assets in the calculation of return on assets?

A) choosing performance measures that align with top management's financial goals

B) choosing the time horizon of each performance measure

C) choosing the details for each performance measure

D) choosing a target level of performance

A) choosing performance measures that align with top management's financial goals

B) choosing the time horizon of each performance measure

C) choosing the details for each performance measure

D) choosing a target level of performance

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

18

The ________ method of profitability analysis recognizes the two basic ingredients in profit-making: increasing income per dollar of revenues and using assets to generate more revenues.

A) Balanced Scorecard

B) Residual-Income

C) DuPont

D) Economic Value Added

A) Balanced Scorecard

B) Residual-Income

C) DuPont

D) Economic Value Added

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

19

The return on investment is usually considered the most popular approach to measure performance because ________.

A) it blends all the ingredients of profitability into a single percentage

B) once determined, there is no need to use it with other measures of performance

C) it throws light on the company's working capital

D) it measures the cash balance of the company in the most efficient manner

A) it blends all the ingredients of profitability into a single percentage

B) once determined, there is no need to use it with other measures of performance

C) it throws light on the company's working capital

D) it measures the cash balance of the company in the most efficient manner

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

20

The Cybertronics Corporation reported the following information for its Cyclotron Division:

Income is defined as operating income.

What is the Cyclotron Division's return on investment?

A) 35.3%

B) 70.6%

C) 27.3%

D) 54.5%

Income is defined as operating income.

What is the Cyclotron Division's return on investment?

A) 35.3%

B) 70.6%

C) 27.3%

D) 54.5%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

21

The Cybertronics Corporation reported the following information for its Cyclotron Division:

Income is defined as operating income.

What is the Cyclotron Division's investment turnover ratio?

A) 1.92

B) 1.56

C) 0.81

D) 1.23

Income is defined as operating income.

What is the Cyclotron Division's investment turnover ratio?

A) 1.92

B) 1.56

C) 0.81

D) 1.23

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

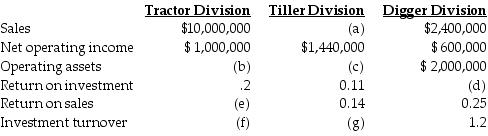

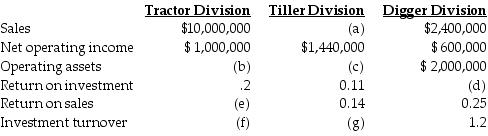

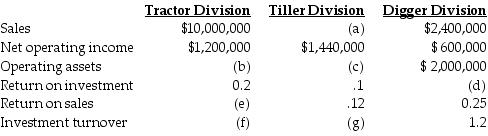

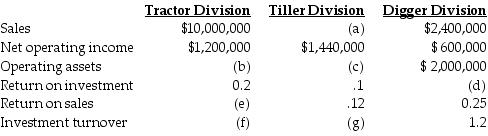

22

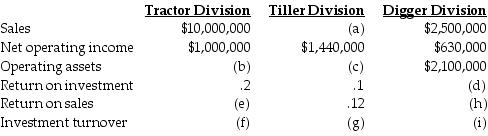

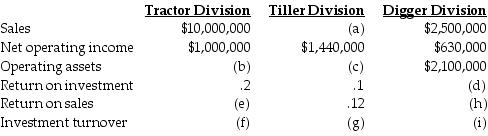

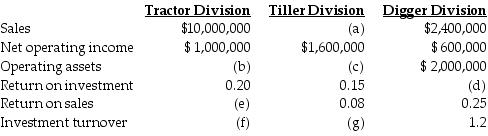

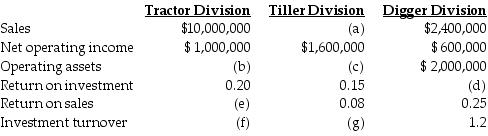

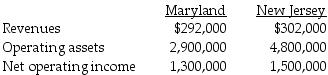

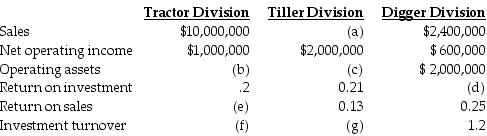

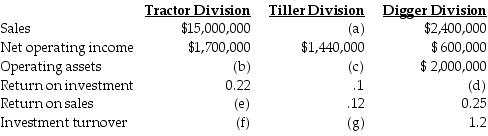

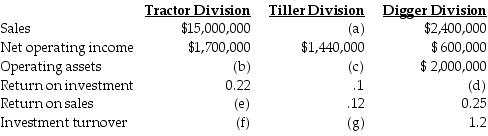

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the Digger Division's return on investment?

A) 0.25

B) 0.30

C) 0.34

D) 0.43

What is the Digger Division's return on investment?

A) 0.25

B) 0.30

C) 0.34

D) 0.43

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

23

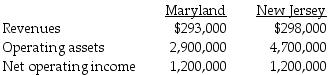

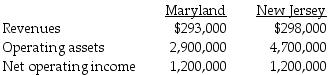

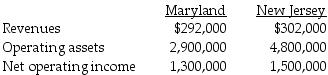

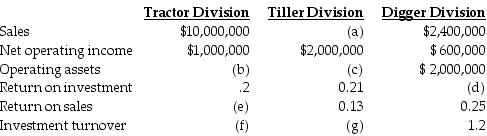

Bouvous Corp has two regional offices. The data for each are as follows:

What is the return on investment for the New Jersey Division?

A) 6.3%

B) 25.5%

C) 41.4%

D) 19.2%

What is the return on investment for the New Jersey Division?

A) 6.3%

B) 25.5%

C) 41.4%

D) 19.2%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

24

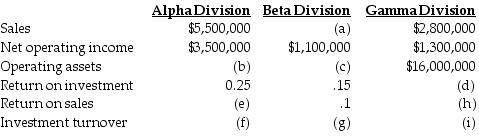

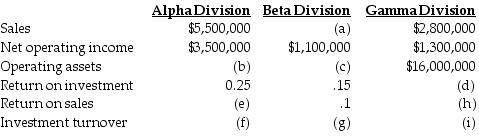

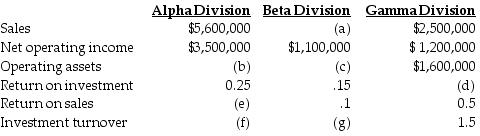

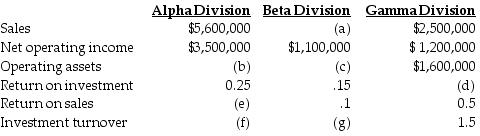

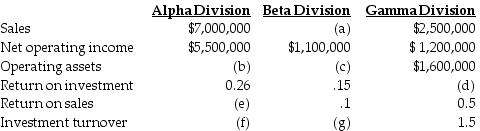

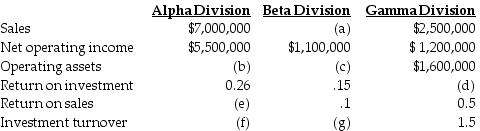

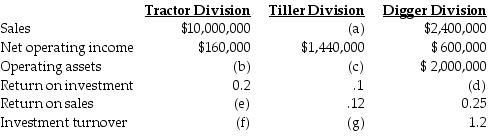

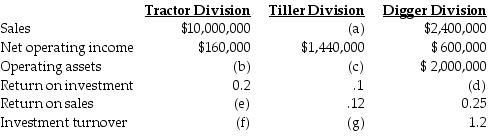

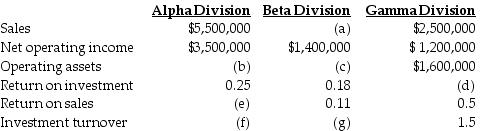

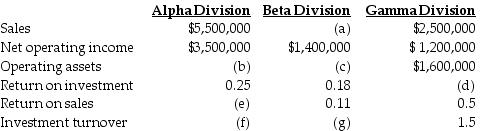

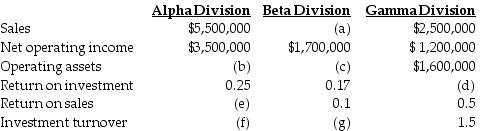

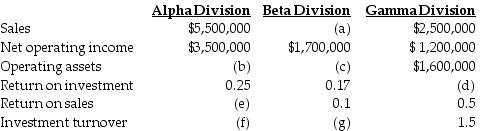

The top management at Amore Corp, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the Gamma Division's return on investment (d)?

A) 5.71

B) 2.15

C) 0.46

D) 0.08

What is the Gamma Division's return on investment (d)?

A) 5.71

B) 2.15

C) 0.46

D) 0.08

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

25

The top management at Amore Corp, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the Alpha Division's return on sales (e)?

A) 38.5%

B) 160.0%

C) 62.5%

D) 37.5%

What is the Alpha Division's return on sales (e)?

A) 38.5%

B) 160.0%

C) 62.5%

D) 37.5%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

26

The top management at Amore Corp, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the value of the operating assets belonging to the Alpha Division (b)?

A) $12,500,000

B) $21,153,846

C) $26,923,077

D) $1,820,000

What is the value of the operating assets belonging to the Alpha Division (b)?

A) $12,500,000

B) $21,153,846

C) $26,923,077

D) $1,820,000

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

27

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the Tiller Division's investment turnover?

A) 1.27

B) 0.79

C) 0.02

D) 0.25

What is the Tiller Division's investment turnover?

A) 1.27

B) 0.79

C) 0.02

D) 0.25

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

28

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What were the sales for the Tiller Division? (Round the final answer to the nearest whole dollar.)

A) $10,666,667

B) $20,000,000

C) $3,000,000

D) $853,333

What were the sales for the Tiller Division? (Round the final answer to the nearest whole dollar.)

A) $10,666,667

B) $20,000,000

C) $3,000,000

D) $853,333

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

29

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the Tractor Division's return on sales?

A) 0.02

B) 12.50

C) 0.22

D) 0.20

What is the Tractor Division's return on sales?

A) 0.02

B) 12.50

C) 0.22

D) 0.20

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

30

Aeralia Inc., has two regional offices. The data for each are as follows:

What is the Maryland Division's return on investment?

A) 44.8%

B) 10.1%

C) 31.3%

D) 22.5%

What is the Maryland Division's return on investment?

A) 44.8%

B) 10.1%

C) 31.3%

D) 22.5%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

31

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the value of the operating assets belonging to the Tiller Division?

A) $10,000,000

B) $15,384,615

C) $9,523,810

D) $260,000

What is the value of the operating assets belonging to the Tiller Division?

A) $10,000,000

B) $15,384,615

C) $9,523,810

D) $260,000

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

32

The Cybertronics Corporation reported the following information for its Cyclotron Division:

Income is defined as operating income.

What is the Cyclotron Division's return on sales?

A) 91.7%

B) 45.8%

C) 50.0%

D) 92.3%

Income is defined as operating income.

What is the Cyclotron Division's return on sales?

A) 91.7%

B) 45.8%

C) 50.0%

D) 92.3%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

33

The weighted-average cost of capital (WACC) equals ________.

A) the after-tax average cost of all the long-term and short-term sources of funds

B) the after-tax average cost of all the long-term source of funds

C) the pre-tax average cost of all the short-term sources of funds

D) the pre-tax average cost of all the long-term and short-term sources of funds

A) the after-tax average cost of all the long-term and short-term sources of funds

B) the after-tax average cost of all the long-term source of funds

C) the pre-tax average cost of all the short-term sources of funds

D) the pre-tax average cost of all the long-term and short-term sources of funds

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

34

The top management at Amore Corp, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What were the sales for the Beta Division (a)?

A) $7,777,778

B) $154,000

C) $12,727,273

D) $252,000

What were the sales for the Beta Division (a)?

A) $7,777,778

B) $154,000

C) $12,727,273

D) $252,000

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

35

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the Tractor Division's investment turnover?

A) 5.0

B) 8.3

C) 1.7

D) 1.0

What is the Tractor Division's investment turnover?

A) 5.0

B) 8.3

C) 1.7

D) 1.0

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

36

The top management at Amore Corp, a manufacturer of computer games, is attempting to recover from a flood that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the value of the operating assets belonging to the Beta Division (c)?

A) $10,000,000

B) $17,000,000

C) $289,000

D) $170,000

What is the value of the operating assets belonging to the Beta Division (c)?

A) $10,000,000

B) $17,000,000

C) $289,000

D) $170,000

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

37

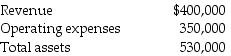

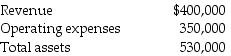

Bouvous Corporation had the following information for 2015:

What is the return on investment?

A) 9.4%

B) 75.5%

C) 8.6%

D) 10.4%

What is the return on investment?

A) 9.4%

B) 75.5%

C) 8.6%

D) 10.4%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

38

The top management at Groundsource Company, a manufacturer of lawn and garden equipment, is attempting to recover from a fire that destroyed some of their accounting records. The main computer system was also severely damaged. The following information was salvaged:

What is the value of the operating assets belonging to the Tractor Division?

A) $15,000,000

B) $2,179,487

C) $13,300,000

D) $7,727,273

What is the value of the operating assets belonging to the Tractor Division?

A) $15,000,000

B) $2,179,487

C) $13,300,000

D) $7,727,273

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

39

Zenith Corporation's net income is $80,000. What is the return on investment if the amount of the investment is $510,000?

A) 18.60%

B) 13.56%

C) 15.69%

D) 27.12%

A) 18.60%

B) 13.56%

C) 15.69%

D) 27.12%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

40

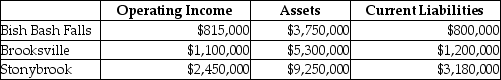

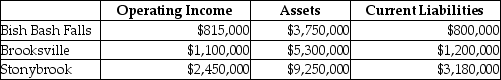

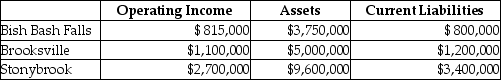

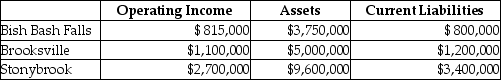

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $19,000,000 issued at an interest rate of 11%, and equity capital that has a market value of $7,000,000 (book value of $5,000,000). Coldbrook Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 16%, while the tax rate is 35%.

What is the EVA® for Brooksville? (Round intermediary calculations to four decimal places.)

A) $715,000

B) $390,730

C) $166,179

D) $324,270

What is the EVA® for Brooksville? (Round intermediary calculations to four decimal places.)

A) $715,000

B) $390,730

C) $166,179

D) $324,270

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

41

Springfield Corporation, whose tax rate is 34%, has two sources of funds: long-term debt with a market value of $6,000,000 and an interest rate of 9%, and equity capital with a market value of $16,000,000 and a cost of equity of 14%. What is Springfield's weighted average cost of capital (WACC)?

A) 14.00%

B) 9.97%

C) 11.80%

D) 12.64%

A) 14.00%

B) 9.97%

C) 11.80%

D) 12.64%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

42

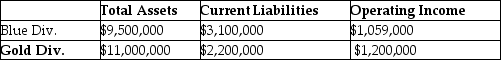

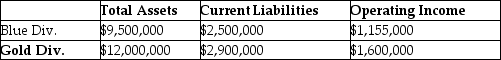

Springfield Corporation, whose tax rate is 30%, has two sources of funds: long-term debt with a market value of $8,400,000 and an interest rate of 8%, and equity capital with a market value of $14,000,000 and a cost of equity of 13%. Springfield has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year:

What is Economic Value Added (EVA®) for the Blue Division? (Round intermediary calculations to four decimal places.)

A) -$86,580

B) $86,580

C) $404,280

D) -$230,550

What is Economic Value Added (EVA®) for the Blue Division? (Round intermediary calculations to four decimal places.)

A) -$86,580

B) $86,580

C) $404,280

D) -$230,550

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

43

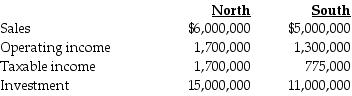

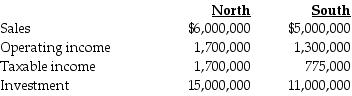

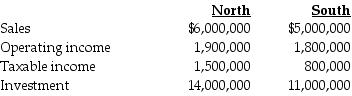

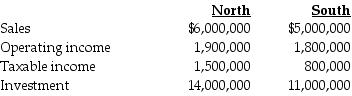

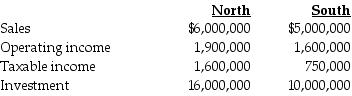

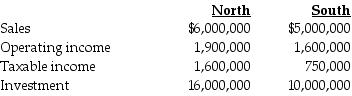

Care Inc., has two divisions that operate independently of one another. The financial data for the year 2015 reported the following results:

The company's desired rate of return is 10%. Income is defined as operating income.

Which division has the best return on investment and which division has the best residual income figure, respectively?

A) North, North

B) South, South

C) North, South

D) South, North

The company's desired rate of return is 10%. Income is defined as operating income.

Which division has the best return on investment and which division has the best residual income figure, respectively?

A) North, North

B) South, South

C) North, South

D) South, North

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

44

Times Corporation, whose tax rate is 30%, has two sources of funds: long-term debt with a market value of $6,500,000 and an interest rate of 7%, and equity capital with a market value of $18,000,000 and a cost of equity of 11%. Times Corporation's after-tax cost of debt is ________.

A) 9.38%

B) 4.90%

C) 7.00%

D) 11.00%

A) 9.38%

B) 4.90%

C) 7.00%

D) 11.00%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

45

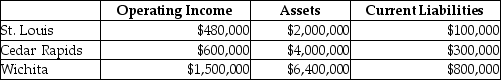

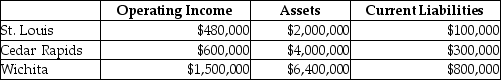

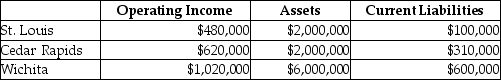

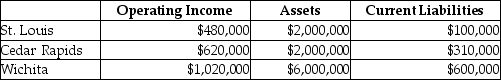

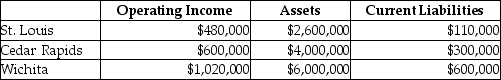

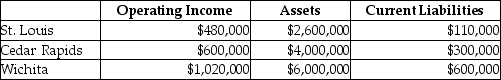

Waldorf Company has two sources of funds: long-term debt with a market and book value of $5,400,000 issued at an interest rate of 12%, and equity capital that has a market value of $4,300,000 (book value of $2,100,000). Waldorf Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 12%, while the tax rate is 35%.

What is the EVA® for Wichita? (Round intermediary calculations to four decimal places.)

A) $975,000

B) $959,040

C) $434,040

D) $356,760

What is the EVA® for Wichita? (Round intermediary calculations to four decimal places.)

A) $975,000

B) $959,040

C) $434,040

D) $356,760

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

46

A company which favors the residual income approach to financial performance evaluation wants managers to ________.

A) concentrate on maximizing an absolute amount of dollars of residual income as opposed to a percentage yield as is the case with ROI

B) concentrate on maximizing a percentage return in excess of the cost of capital

C) maximize the investment turnover ratio

D) maximize return on sales

A) concentrate on maximizing an absolute amount of dollars of residual income as opposed to a percentage yield as is the case with ROI

B) concentrate on maximizing a percentage return in excess of the cost of capital

C) maximize the investment turnover ratio

D) maximize return on sales

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

47

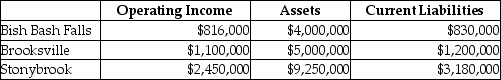

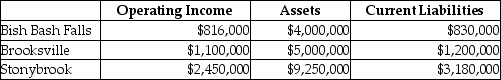

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $17,000,000 issued at an interest rate of 11%, and equity capital that has a market value of $3,000,000 (book value of $4,000,000). Coldbrook Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 35%.

What is the EVA® for Bish Bash Falls? (Round intermediary calculations to four decimal places.)

A) $530,400

B) $264,061

C) $266,339

D) $159,638

What is the EVA® for Bish Bash Falls? (Round intermediary calculations to four decimal places.)

A) $530,400

B) $264,061

C) $266,339

D) $159,638

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following is the required rate of return used in the economic value added (EVA) calculation?

A) The ROI of the division or company being evaluated

B) After-tax weighted-average cost of capital

C) The residual income/total assets

D) The after-tax operating income/(Total assets - current liabilities)

A) The ROI of the division or company being evaluated

B) After-tax weighted-average cost of capital

C) The residual income/total assets

D) The after-tax operating income/(Total assets - current liabilities)

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

49

The required rate of return multiplied by the investment is the ________.

A) sunk cost of the investment

B) historical cost of the investment

C) imputed cost of the investment

D) return on sales

A) sunk cost of the investment

B) historical cost of the investment

C) imputed cost of the investment

D) return on sales

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

50

Waldorf Company has two sources of funds: long-term debt with a market and book value of $5,200,000 issued at an interest rate of 13%, and equity capital that has a market value of $4,200,000 (book value of $2,400,000). Waldorf Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 13%, while the tax rate is 25%.

What is the EVA® for Cedar Rapids? (Round intermediary calculations to four decimal places.)

A) $275,720

B) $465,000

C) $430,720

D) $241,000

What is the EVA® for Cedar Rapids? (Round intermediary calculations to four decimal places.)

A) $275,720

B) $465,000

C) $430,720

D) $241,000

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

51

Care Inc., has two divisions that operate independently of one another. The financial data for the year 2015 reported the following results:

The company's desired rate of return is 10%. Income is defined as operating income.

What are the respective residual incomes for the North and South Divisions?

A) $60,000 and $100,000

B) $300,000 and $60,000

C) $300,000 and $100,000

D) $500,000 and $700,000

The company's desired rate of return is 10%. Income is defined as operating income.

What are the respective residual incomes for the North and South Divisions?

A) $60,000 and $100,000

B) $300,000 and $60,000

C) $300,000 and $100,000

D) $500,000 and $700,000

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following is a performance measure?

A) retained earnings

B) market value

C) present value of cash flows

D) economic value added

A) retained earnings

B) market value

C) present value of cash flows

D) economic value added

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

53

Care Inc., has two divisions that operate independently of one another. The financial data for the year 2015 reported the following results:

The company's desired rate of return is 10%. Income is defined as operating income.

What are the respective return-on-investment ratios for the North and South Divisions?

A) 16.00% and 11.88%

B) 10.00% and 7.50%

C) 11.88% and 16.00%

D) 7.50% and 10.00%

The company's desired rate of return is 10%. Income is defined as operating income.

What are the respective return-on-investment ratios for the North and South Divisions?

A) 16.00% and 11.88%

B) 10.00% and 7.50%

C) 11.88% and 16.00%

D) 7.50% and 10.00%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

54

Waldorf Company has two sources of funds: long-term debt with a market and book value of $5,200,000 issued at an interest rate of 13%, and equity capital that has a market value of $4,200,000 (book value of $2,400,000). Waldorf Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 13%, while the tax rate is 35%.

What is the EVA® for St. Louis? (Round intermediary calculations to four decimal places.)

A) $65,739

B) $51,048

C) $312,000

D) $260,952

What is the EVA® for St. Louis? (Round intermediary calculations to four decimal places.)

A) $65,739

B) $51,048

C) $312,000

D) $260,952

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

55

Using residual income as a measure of performance rather than return on investment promotes goal congruence because residual income ________.

A) places importance on the reduction of underperforming assets

B) calculates a percentage return rather than an absolute return

C) concentrates on maximizing an absolute amount of dollars

D) concentrates on maximizing the return on sales

A) places importance on the reduction of underperforming assets

B) calculates a percentage return rather than an absolute return

C) concentrates on maximizing an absolute amount of dollars

D) concentrates on maximizing the return on sales

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

56

A company has operating income of $300,000, revenues of $1,500,000, total assets of $2,000,000 and an ROI of 15%. To improve the ROI, to increase ROI to 20%, which of the following investment turnovers would need to be achieved?

A) .75

B) 1.5

C) 1

D) 2

A) .75

B) 1.5

C) 1

D) 2

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following is the expression of the DuPont method of profitability analysis?

A) Income / Investment = Income / Total costs + Revenues / Equity

B) Income / Investment = Income / Revenues + Revenues / Investment

C) Income / Investment = Income / Revenues × Revenues / Investment

D) Income / Investment = Income / Total costs × Revenues / Equity

A) Income / Investment = Income / Total costs + Revenues / Equity

B) Income / Investment = Income / Revenues + Revenues / Investment

C) Income / Investment = Income / Revenues × Revenues / Investment

D) Income / Investment = Income / Total costs × Revenues / Equity

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

58

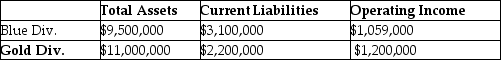

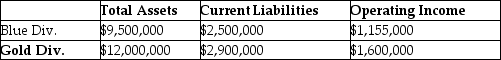

Stonex Corp, whose tax rate is 35%, has two sources of funds: long-term debt with a market value of $6,200,000 and an interest rate of 9%, and equity capital with a market value of $14,000,000 and a cost of equity of 13%. Stonex has two operating divisions, the Blue division and the Gold division, with the following financial measures for the current year:

Calculate EVA for the Gold Division. (Round intermediary calculations to four decimal places.)

A) -$56,290

B) $56,290

C) $1,040,000

D) $983,710

Calculate EVA for the Gold Division. (Round intermediary calculations to four decimal places.)

A) -$56,290

B) $56,290

C) $1,040,000

D) $983,710

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

59

Economic value added is equal to ________.

A) After-tax operating income - [Weighted-average cost of capital + (Total assets - Current liabilities)]

B) Pre-tax operating income - [Weighted-average cost of capital + (Total assets - Current liabilities)]

C) After-tax operating income - [Weighted-average cost of capital × (Total assets - Current liabilities)]

D) Pre-tax operating income - [Weighted-average cost of capital × (Total assets - Current liabilities)]

A) After-tax operating income - [Weighted-average cost of capital + (Total assets - Current liabilities)]

B) Pre-tax operating income - [Weighted-average cost of capital + (Total assets - Current liabilities)]

C) After-tax operating income - [Weighted-average cost of capital × (Total assets - Current liabilities)]

D) Pre-tax operating income - [Weighted-average cost of capital × (Total assets - Current liabilities)]

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

60

A major weakness of comparing two companies using only operating incomes as the basis of comparison is that it ignores the differences in the size of the investment and therefore any concept of yield or return on investment.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

61

Reducing the investment base to improve ROI involves decreasing idle cash, paying down debt, determining proper inventory levels, and spending carefully on long-term assets.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

62

The objective of maximizing return on investment may induce managers of highly profitable divisions to reject projects that from the viewpoint of the overall organization should be accepted.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

63

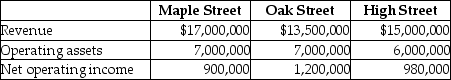

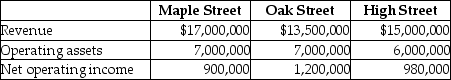

Antique Corp uses the investment center concept for the museums that it manages. Selected operating data for three of its museums for 2015 are as follows:

Required:

a.Compute the return on investment for each division.

b.Which museum manager is doing best based only on ROI? Why?

c.What other factors should be included when evaluating the managers?

Required:

a.Compute the return on investment for each division.

b.Which museum manager is doing best based only on ROI? Why?

c.What other factors should be included when evaluating the managers?

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

64

To evaluate overall performance, return on investment and residual income measures are more appropriate than return on sales.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

65

Return on investment, Residual income, or Economic value added measures are more appropriate than return on sales because they consider only the investment to measure the performance.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

66

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $17,000,000 issued at an interest rate of 11%, and equity capital that has a market value of $6,000,000 (book value of $5,500,000). Coldbrook Company has profit centers in the following locations with the following operating incomes, total assets, and current liabilities. The cost of equity capital is 15%, while the tax rate is 35%.

What is the EVA® for Stonybrook? (Round intermediary calculations to four decimal places.)

A) $1,184,600

B) $1,755,000

C) $570,400

D) $658,693

What is the EVA® for Stonybrook? (Round intermediary calculations to four decimal places.)

A) $1,184,600

B) $1,755,000

C) $570,400

D) $658,693

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

67

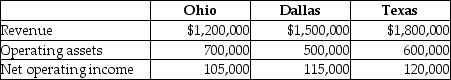

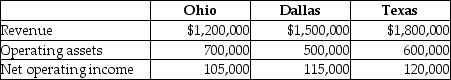

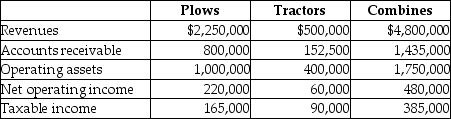

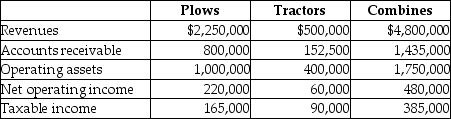

Moto Corp allows its divisions to operate as autonomous units. The operating data for 2015 follow:

Required:

a.Compute the investment turnover for each division.

b.Compute the return on sales for each division.

c.Compute the return on investment for each division.

d.Which division manager is doing best? Why?

e.What other factors should be included when evaluating the managers?

For parts (b) and (c) income is defined as operating income.

Required:

a.Compute the investment turnover for each division.

b.Compute the return on sales for each division.

c.Compute the return on investment for each division.

d.Which division manager is doing best? Why?

e.What other factors should be included when evaluating the managers?

For parts (b) and (c) income is defined as operating income.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

68

In an EVA calculation, the appropriate measure of a division's profit would be that division's pre-tax operating income.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

69

Return on sales can provide how effectively costs are managed and is part of the DuPont method of profitability analysis.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

70

Gas Supply Corporation uses the investment center concept for the gasoline stations that it manages in the city. Consolidated has a 15% required rate of return on investment in order for a branch station to be viable. Select operating data for three of its stations for 2015 are as follows:

Required:

a.Compute the return on investment for each station.

b.Which station manager is doing best based only on ROI? Why?

c.Are any of the stations in danger of being closed due to lack of performance?

d.What other factors should be included when evaluating the managers?

Required:

a.Compute the return on investment for each station.

b.Which station manager is doing best based only on ROI? Why?

c.Are any of the stations in danger of being closed due to lack of performance?

d.What other factors should be included when evaluating the managers?

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

71

All other things held constant, increase in assets such as receivables or decrease in operating income results in an increase in return on investment.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

72

Historical costs are costs recognized in particular situations that are not usually recognized by accrual accounting procedures.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

73

In an EVA calculation, the measure of the invested capital for a division would be that division's assets minus that division's long-term liabilities.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

74

In an EVA calculation, the corporate charge for a division's investment is based on a weighted average of the after-tax interest rate on the firm's debt and the cost of the firm's equity.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

75

Companies that adopt the EVA concept define investment as total assets employed minus current liabilities.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

76

Economic value added, unlike residual income, charges managers for the costs of their investments in long-term assets and working capital.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

77

Return on investment can be calculated by multiplying return on assets by investment turnover.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

78

The DuPont method recognizes the two basic ingredients in profit making: increasing the income per dollar of revenues and using assets to generate more revenues.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

79

Required rate of return multiplied by the investment is the weighted average cost of the investment.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

80

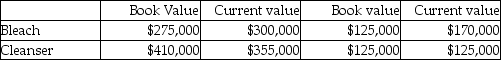

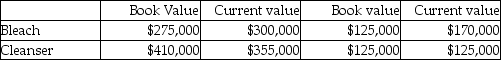

Home Decor Inc., manufactures home cleaning products. The company has two divisions, Bleach and Cleanser. Because of different accounting methods and inflation rates, the company is considering multiple evaluation measures. The following information is provided for 2018:

ASSETSINCOME

The company is currently using a 15% required rate of return.

What are Bleach's and Cleanser's residual incomes based on book values, respectively?

A) $83,750; $63,500

B) $125,000; $71,750

C) $63,500; $83,750

D) $71,750; $125,000

ASSETSINCOME

The company is currently using a 15% required rate of return.

What are Bleach's and Cleanser's residual incomes based on book values, respectively?

A) $83,750; $63,500

B) $125,000; $71,750

C) $63,500; $83,750

D) $71,750; $125,000

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck