Deck 18: Earnings Per Share

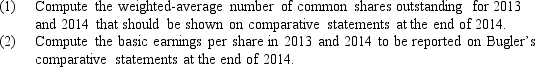

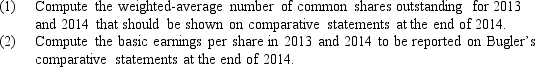

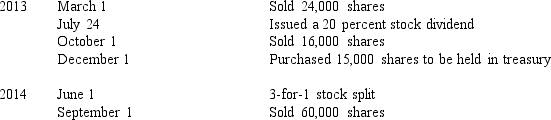

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/77

Play

Full screen (f)

Deck 18: Earnings Per Share

1

The if-converted method of computing EPS data assumes conversion of convertible securities at the

A) beginning of the earliest period reported (or at time of issuance,if later).

B) beginning of the earliest period reported (regardless of time of issuance).

C) middle of the earliest period reported (regardless of time of issuance).

D) ending of the earliest period reported (regardless of time of issuance).

A) beginning of the earliest period reported (or at time of issuance,if later).

B) beginning of the earliest period reported (regardless of time of issuance).

C) middle of the earliest period reported (regardless of time of issuance).

D) ending of the earliest period reported (regardless of time of issuance).

A

2

In calculating diluted earnings per share,which of the following should not be considered?

A) The weighted average number of common shares outstanding

B) The amount of dividends declared on cumulative preferred shares

C) The amount of cash dividends declared on common shares

D) The number of common shares resulting from the assumed conversion of debentures outstanding

A) The weighted average number of common shares outstanding

B) The amount of dividends declared on cumulative preferred shares

C) The amount of cash dividends declared on common shares

D) The number of common shares resulting from the assumed conversion of debentures outstanding

C

3

When computing dilutive EPS,the treasury stock method can be used for all of the following except

A) stock warrants.

B) convertible preferred stock.

C) stock options.

D) stock rights.

A) stock warrants.

B) convertible preferred stock.

C) stock options.

D) stock rights.

B

4

What is the correct treatment of a stock dividend issued in mid-year when computing the weighted-average number of common shares outstanding for earnings per share purposes?

A) The stock dividend should be weighted by the length of time that the additional number of shares are outstanding during the period.

B) The stock dividend should be included in the weighted-average number of common shares outstanding only if the additional shares result in a decrease of 3 percent or more in earnings per share.

C) The stock dividend should be weighted as if the additional shares were issued at the beginning of the year.

D) The stock dividend should be ignored since no additional capital was received.

A) The stock dividend should be weighted by the length of time that the additional number of shares are outstanding during the period.

B) The stock dividend should be included in the weighted-average number of common shares outstanding only if the additional shares result in a decrease of 3 percent or more in earnings per share.

C) The stock dividend should be weighted as if the additional shares were issued at the beginning of the year.

D) The stock dividend should be ignored since no additional capital was received.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

5

When computing earnings per share on common stock,dividends on cumulative,nonconvertible preferred stock should be

A) deducted from net income only if the dividends were declared or paid in the current period.

B) deducted from net income regardless of whether the dividends were not paid or declared in the period.

C) deducted from net income only if net income is greater than the dividends.

D) ignored.

A) deducted from net income only if the dividends were declared or paid in the current period.

B) deducted from net income regardless of whether the dividends were not paid or declared in the period.

C) deducted from net income only if net income is greater than the dividends.

D) ignored.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

6

In applying the treasury stock method of computing diluted earnings per share,when is it appropriate to use the average market price of common stock during the year as the assumed repurchase price?

A) Always

B) Never

C) When the average market price is lower than the exercise price

D) When the average market price is higher than the exercise price

A) Always

B) Never

C) When the average market price is lower than the exercise price

D) When the average market price is higher than the exercise price

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

7

In determining earnings per share,interest expense,net of applicable income taxes,on convertible debt which is dilutive should be

A) ignored for diluted earnings per share.

B) added back to net income for diluted earnings per share.

C) deducted from net income for diluted earnings per share.

D) none of these.

A) ignored for diluted earnings per share.

B) added back to net income for diluted earnings per share.

C) deducted from net income for diluted earnings per share.

D) none of these.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

8

Earnings per share information should be reported for all of the following except

A) continuing operations.

B) extraordinary gain.

C) net income.

D) cash flows from operating activities.

A) continuing operations.

B) extraordinary gain.

C) net income.

D) cash flows from operating activities.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

9

For a company having several different issues of convertible securities and/or stock options and warrants,the FASB requires selection of the combination of securities producing

A) the lowest possible earnings per share.

B) the highest possible earnings per share.

C) the earnings per share figure midway between the lowest possible and the highest possible earnings per share.

D) any earnings per share figure between the lowest possible and the highest possible earnings per share.

A) the lowest possible earnings per share.

B) the highest possible earnings per share.

C) the earnings per share figure midway between the lowest possible and the highest possible earnings per share.

D) any earnings per share figure between the lowest possible and the highest possible earnings per share.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

10

Earnings per share disclosures are required only for

A) companies with complex capital structures.

B) companies that change their capital structures during the reporting period.

C) public companies.

D) private companies.

A) companies with complex capital structures.

B) companies that change their capital structures during the reporting period.

C) public companies.

D) private companies.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

11

Which earnings per share computation should be reported on the face of the income statement? Basic EPS Diluted EPS

A) Yes Yes

B) Yes No

C) No Yes

D) No No

A) Yes Yes

B) Yes No

C) No Yes

D) No No

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

12

Of the following,select the incorrect statement concerning earnings per share.

A) During periods when all income is paid out as dividends,earnings per share and dividends per share under a simple capital structure would be identical.

B) Under a simple capital structure,no adjustment to shares outstanding is necessary for a stock split on the last day of the fiscal period.

C) During a period,changes in stock issued or reacquired by a company may affect earnings per share.

D) During a loss period,the amount of loss attributed to each share of common stock should be computed.

A) During periods when all income is paid out as dividends,earnings per share and dividends per share under a simple capital structure would be identical.

B) Under a simple capital structure,no adjustment to shares outstanding is necessary for a stock split on the last day of the fiscal period.

C) During a period,changes in stock issued or reacquired by a company may affect earnings per share.

D) During a loss period,the amount of loss attributed to each share of common stock should be computed.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

13

The main purpose of reporting diluted earnings per share is to

A) provide a comparison figure for debt holders.

B) indicate earnings shareholders will receive in future periods.

C) distinguish between companies with a complex capital structure and companies with a simple capital structure.

D) show the maximum possible dilution of earnings.

A) provide a comparison figure for debt holders.

B) indicate earnings shareholders will receive in future periods.

C) distinguish between companies with a complex capital structure and companies with a simple capital structure.

D) show the maximum possible dilution of earnings.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

14

For purposes of computing the weighted-average number of shares outstanding during the year,a midyear event that must be treated as occurring at the beginning of the year is the

A) declaration and issuance of a stock dividend.

B) purchase of treasury stock.

C) sale of additional common stock.

D) issuance of stock warrants.

A) declaration and issuance of a stock dividend.

B) purchase of treasury stock.

C) sale of additional common stock.

D) issuance of stock warrants.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

15

When computing diluted earnings per share,stock options are

A) recognized only if they are dilutive.

B) recognized only if they are antidilutive.

C) recognized only if they were exercised.

D) ignored.

A) recognized only if they are dilutive.

B) recognized only if they are antidilutive.

C) recognized only if they were exercised.

D) ignored.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

16

When using the if-converted method to compute diluted earnings per share,convertible securities should be

A) included only if antidilutive.

B) included only if dilutive.

C) included whether dilutive or not.

D) not included.

A) included only if antidilutive.

B) included only if dilutive.

C) included whether dilutive or not.

D) not included.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

17

When computing diluted EPS for a company with a complex capital structure,what is the denominator in the computation?

A) Number of common shares outstanding at year-end

B) Weighted-average number of common shares outstanding

C) Weighted-average number of common shares outstanding plus all other potentially antidilutive securities

D) Weighted-average number of common shares outstanding plus all other potentially dilutive securities

A) Number of common shares outstanding at year-end

B) Weighted-average number of common shares outstanding

C) Weighted-average number of common shares outstanding plus all other potentially antidilutive securities

D) Weighted-average number of common shares outstanding plus all other potentially dilutive securities

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

18

The EPS computation that is forward-looking and based on assumptions about future transactions is

A) basic EPS.

B) diluted EPS.

C) continuing operations EPS.

D) extraordinary EPS.

A) basic EPS.

B) diluted EPS.

C) continuing operations EPS.

D) extraordinary EPS.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

19

Where in the financial statements should basic and complex EPS figures for income from continuing operations be reported?

A) In the accompanying notes

B) In management's discussion and analysis

C) On the income statement

D) On the statement of cash flows

A) In the accompanying notes

B) In management's discussion and analysis

C) On the income statement

D) On the statement of cash flows

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

20

In computing the earnings per share of common stock,noncumulative preferred dividends not declared should be

A) deducted from the net income for the year,net of tax.

B) added to the net income for the year.

C) deducted from the net income for the year.

D) ignored.

A) deducted from the net income for the year,net of tax.

B) added to the net income for the year.

C) deducted from the net income for the year.

D) ignored.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

21

On December 31,2013,Overachiever,Inc.had 500,000 shares of common stock issued and outstanding.Overachiever issued a 10 percent stock dividend on June 1,2014.On November 1,2014,Overachiever reacquired 30,000 shares of its common stock and recorded the purchase using the cost method of accounting for treasury stock.What number of shares should be used in computing basic earnings per share for the year ended December 31,2014?

A) 421,667

B) 470,000

C) 524,167

D) 530,000

A) 421,667

B) 470,000

C) 524,167

D) 530,000

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

22

At December 31,2013,Nightstyle Inc.had 190,000 shares of common stock outstanding.On October 1,2014,an additional 70,000 shares of common stock were issued for cash.Nightstyle also had 2,000,000 of 8 percent convertible bonds outstanding at December 31,2014,which are convertible into 55,000 shares of common stock.The bonds are dilutive in the 2014 earnings per share computation.No bonds were issued or converted into common stock during 2014.What is the number of shares that should be used in computing diluted earnings per share for the year ended December 31,2014?

A) 160,000

B) 175,000

C) 205,000

D) 262,500

A) 160,000

B) 175,000

C) 205,000

D) 262,500

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

23

On January 2,2014,Wondrous Co.issued at par $50,000 of 4 percent bonds convertible,in total,into 5,000 shares of Wondrous's common stock.No bonds were converted during 2014.Throughout 2014 Wondrous had 5,000 shares of common stock outstanding.Wondrous' 2014 net income was $5,000.Wondrous' income tax rate is 40 percent.No potentially dilutive securities other than the convertible bonds were outstanding during 2014.Wondrous' diluted earnings per share for 2014 would be

A) $0.58.

B) $0.62.

C) $0.70.

D) $1.16.

A) $0.58.

B) $0.62.

C) $0.70.

D) $1.16.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

24

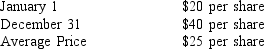

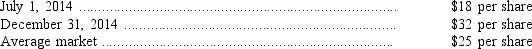

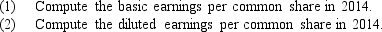

The 2014 net income of Beguile Inc.was $200,000 and 100,000 shares of its common stock were outstanding during the entire year.In addition,there were outstanding options to purchase 10,000 shares of common stock at $10 per share.These options were granted in 2011 and none had been exercised by December 31,2014.Market prices of Beguile's common stock during 2014 were  The amount that should be shown as Beguile's diluted earnings per share for 2014 (rounded to the nearest cent)is

The amount that should be shown as Beguile's diluted earnings per share for 2014 (rounded to the nearest cent)is

A) $2.00.

B) $1.95.

C) $1.89.

D) $1.86.

The amount that should be shown as Beguile's diluted earnings per share for 2014 (rounded to the nearest cent)is

The amount that should be shown as Beguile's diluted earnings per share for 2014 (rounded to the nearest cent)isA) $2.00.

B) $1.95.

C) $1.89.

D) $1.86.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

25

For companies with a complex capital structure,a convertible security is potentially dilutive if its incremental EPS is

A) greater than basic EPS after considering any stock options,rights,and warrants.

B) less than basic EPS after considering any stock options,rights,and warrants.

C) equal to basic EPS after considering any stock options,rights,and warrants.

D) less than 1.00 after considering any stock options,rights,and warrants.

A) greater than basic EPS after considering any stock options,rights,and warrants.

B) less than basic EPS after considering any stock options,rights,and warrants.

C) equal to basic EPS after considering any stock options,rights,and warrants.

D) less than 1.00 after considering any stock options,rights,and warrants.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

26

Warrants exercisable at $15 each to obtain 25,000 shares of common stock were outstanding during a period when the average and year-end market price of the common stock was $30.Application of the treasury stock method for the assumed exercise of these warrants in computing diluted earnings per share will increase the weighted-average number of outstanding common shares by

A) 5,000

B) 10,000

C) 11,000

D) 12,500

A) 5,000

B) 10,000

C) 11,000

D) 12,500

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

27

Azul Incorporated has 3,500,000 shares of common stock outstanding on December 31,2013.An additional 400,000 shares of common stock were issued April 1,2014,and 150,000 more on July 1,2014.On October 1,2014,Azul issued 5,000,$1,000 face value,7 percent convertible bonds.Each bond is convertible into 40 shares of common stock.No bonds were converted into common stock in 2014.What is the number of shares to be used in computing basic earnings per share and diluted earnings per share,respectively?

A) 3,725,000 and 3,750,000

B) 3,725,000 and 3,900,000

C) 3,875,000 and 3,925,000

D) 3,875,000 and 4,125,000

A) 3,725,000 and 3,750,000

B) 3,725,000 and 3,900,000

C) 3,875,000 and 3,925,000

D) 3,875,000 and 4,125,000

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

28

In calculating earning per share,stock options warrants,and rights are

A) always dilutive.

B) never dilutive.

C) dilutive if the exercise price is less than the average market price of the common stock.

D) dilutive if the exercise price is more than the average market price of the common stock.

A) always dilutive.

B) never dilutive.

C) dilutive if the exercise price is less than the average market price of the common stock.

D) dilutive if the exercise price is more than the average market price of the common stock.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

29

At December 31,2014,the Carboneer Company had 150,000 shares of common stock issued and outstanding.On April 1,2015,an additional 30,000 shares of common stock were issued.Carboneer's net income for the year ended December 31,2015,was $517,500.During 2015,Carboneer declared and paid $300,000 in cash dividends on its nonconvertible preferred stock.The basic earnings per common share,rounded to the nearest penny,for the year ended December 31,2015,should be

A) $3.00.

B) $2.00.

C) $1.45.

D) $1.26.

A) $3.00.

B) $2.00.

C) $1.45.

D) $1.26.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

30

The Granger Corporation had 200,000 shares of common stock and 10,000 shares of cumulative,$6 preferred stock outstanding during 2014.The preferred stock is convertible at the rate of three shares of common per share of preferred.For 2014,the company had a $60,000 net loss from operations and declared no dividends.Granger should report 2014 diluted loss per share of (rounded to the nearest cent)

A) $(0.30).

B) $(0.52).

C) $(0.58).

D) $(0.60).

A) $(0.30).

B) $(0.52).

C) $(0.58).

D) $(0.60).

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

31

During its fiscal year,Deerborn Distributing had net income of $100,000 (no extraordinary items)and 50,000 shares of common stock and 10,000 shares of preferred stock outstanding.Deerborn declared and paid dividends of $.50 per share to common and $6.00 per share to preferred.The preferred stock is convertible into common stock on a share-for-share basis.For the year,Deerborn Distributing should report diluted earnings (loss)per share of

A) $(0.80).

B) $1.00.

C) $1.67.

D) $2.67.

A) $(0.80).

B) $1.00.

C) $1.67.

D) $2.67.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

32

Overland,Inc.had 150,000 shares of common stock issued and outstanding at December 31,2013.On July 1,2014,an additional 25,000 shares of common stock were issued for cash.Overland also had unexercised stock options to purchase 20,000 shares of common stock at $15 per share outstanding at the beginning and end of 2014.The market price of Overland's common stock was $20 throughout 2014.What number of shares should be used in computing diluted earnings per share for the year ended December 31,2014?

A) 182,500

B) 180,000

C) 167,500

D) 177,500

A) 182,500

B) 180,000

C) 167,500

D) 177,500

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

33

Under current GAAP,a company with a complex capital structure and potential earnings per share dilution must present

A) basic and diluted earnings per share.

B) primary and fully diluted earnings per share.

C) basic and primary earnings per share.

D) basic earnings per share and cash flow per share.

A) basic and diluted earnings per share.

B) primary and fully diluted earnings per share.

C) basic and primary earnings per share.

D) basic earnings per share and cash flow per share.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

34

Carbondale Enterprises had 200,000 shares of common stock issued and outstanding at December 31,2013.On July 1,2014,Carbondale issued a 10 percent stock dividend.Unexercised stock options to purchase 40,000 shares of common stock (adjusted for the 2014 stock dividend)at $20 per share were outstanding at the beginning and end of 2014.The market price of Carbondale's common stock (which was not affected by the stock dividend)was $25 per share during 2014.Net income for the year ended December 31,2014,was $1,100,000.What should be Carbondale's 2014 diluted earnings per common share,rounded to the nearest penny?

A) $5.00

B) $5.05

C) $4.82

D) $4.23

A) $5.00

B) $5.05

C) $4.82

D) $4.23

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

35

At December 31,2013,the Agricole Company had 600,000 shares of common stock outstanding.On September 1,2014,an additional 400,000 shares of common stock were issued.In addition,Agricole had $20,000,000 of 8 percent convertible bonds outstanding at December 31,2013,which are convertible into 400,000 shares of common stock.No bonds were converted into common stock in 2014.The net income for the year ended December 31,2014,was $7,000,000.Assuming the income tax rate was 40 percent,what should be the diluted earnings per share for the year ended December 31,2014?

A) $5.00

B) $5.53

C) $7.02

D) $10.85

A) $5.00

B) $5.53

C) $7.02

D) $10.85

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

36

Gold Coast Supplies had 80,000 shares of common stock outstanding at January 1.On May 1,Gold Coasts Supplies issued 21,500 shares of common stock.Outstanding all year were 30,000 shares of nonconvertible preferred stock on which a dividend of $3 per share was paid in December.Net income for the year was $300,000.Gold Coast Supplies should report basic earnings per share for the year of

A) $2.07

B) $2.23

C) $3.18

D) $3.26

A) $2.07

B) $2.23

C) $3.18

D) $3.26

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

37

The Neron Company's net income for the year ended December 31 was $30,000.During the year,Neron declared and paid $3,000 in cash dividends on preferred stock and $5,250 in cash dividends on common stock.At December 31,36,000 shares of common stock were outstanding,30,000 of which had been issued and outstanding throughout the year and 6,000 of which were issued on July 1.There were no other common stock transactions during the year,and there is no potential dilution of earnings per share.What should be the year's basic earnings per common share of Neron,rounded to the nearest penny?

A) $0.66

B) $0.75

C) $0.82

D) $0.91

A) $0.66

B) $0.75

C) $0.82

D) $0.91

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

38

At December 31,2014 and 2013,Rollins Corp.had 200,000 shares of common stock and 20,000 shares of 5 percent,$100 par value cumulative preferred stock outstanding.No dividends were declared on either the preferred or common stock in 2013 or 2014.Net income for 2014 was $1,000,000.For 2014,basic earnings per common share amounted to

A) $5.00.

B) $4.75.

C) $4.50.

D) $4.00.

A) $5.00.

B) $4.75.

C) $4.50.

D) $4.00.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

39

Moodrocker Company had 1,000 common shares issued and outstanding at January 1.During the year,Moodrocker also had the common stock transactions listed below.  Given this information,what is the weighted-average number of shares that Moodrocker should use for earnings per share purposes?

Given this information,what is the weighted-average number of shares that Moodrocker should use for earnings per share purposes?

A) 2,880

B) 8,640

C) 8,820

D) 9,720

Given this information,what is the weighted-average number of shares that Moodrocker should use for earnings per share purposes?

Given this information,what is the weighted-average number of shares that Moodrocker should use for earnings per share purposes?A) 2,880

B) 8,640

C) 8,820

D) 9,720

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

40

An entity that reports a discontinued operation or an extraordinary item shall present basic and diluted earnings per share amounts for those line items

A) either on the face of the income statement or in the notes to the financial statements.

B) only in the notes to the financial statements.

C) only on the face of the income statement.

D) only if management chooses to do so as these amounts are not required to be disclosed either in the financial statements or the notes thereto.

A) either on the face of the income statement or in the notes to the financial statements.

B) only in the notes to the financial statements.

C) only on the face of the income statement.

D) only if management chooses to do so as these amounts are not required to be disclosed either in the financial statements or the notes thereto.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

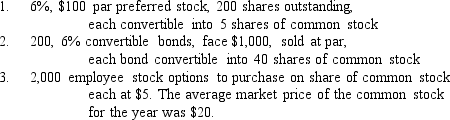

41

The following information relates to the capital structure of Quantico Corp.:  During 2014 Quantico paid $90,000 in dividends on the preferred stock.Quantico's net income for 2014 was $1,960,000 and the income tax rate was 40 percent.For the year ended December 31,2014,the diluted earnings per share is

During 2014 Quantico paid $90,000 in dividends on the preferred stock.Quantico's net income for 2014 was $1,960,000 and the income tax rate was 40 percent.For the year ended December 31,2014,the diluted earnings per share is

A) $7.29.

B) $7.43.

C) $8.17.

D) $8.29.

During 2014 Quantico paid $90,000 in dividends on the preferred stock.Quantico's net income for 2014 was $1,960,000 and the income tax rate was 40 percent.For the year ended December 31,2014,the diluted earnings per share is

During 2014 Quantico paid $90,000 in dividends on the preferred stock.Quantico's net income for 2014 was $1,960,000 and the income tax rate was 40 percent.For the year ended December 31,2014,the diluted earnings per share isA) $7.29.

B) $7.43.

C) $8.17.

D) $8.29.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

42

The following information applies to the next three questions:

Tangier Corporation currently has stock rights outstanding for 2,000 common shares.The exercise price of these shares is $25.The options were issued in January of 2012.The average market price of the related common stock during the year 2012 was $30.The average market price of the related common stock during 2013 was $26 and during 2014 was $21.The company's fiscal year ends on December 31 of each year.

How should these stock rights be treated in the earnings per share calculation for the year ending December 31,2013?

A) The stock options are antidilutive and should not be included either in basic or diluted earnings per share.

B) The stock options are dilutive and should be included in diluted earnings per share in the amount of 77 shares.

C) The stock options are dilutive and should be included in diluted earnings per share in the amount of 2,000 shares.

D) The stock options are dilutive and should be included in diluted earnings per share in the amount of 333 shares.

Tangier Corporation currently has stock rights outstanding for 2,000 common shares.The exercise price of these shares is $25.The options were issued in January of 2012.The average market price of the related common stock during the year 2012 was $30.The average market price of the related common stock during 2013 was $26 and during 2014 was $21.The company's fiscal year ends on December 31 of each year.

How should these stock rights be treated in the earnings per share calculation for the year ending December 31,2013?

A) The stock options are antidilutive and should not be included either in basic or diluted earnings per share.

B) The stock options are dilutive and should be included in diluted earnings per share in the amount of 77 shares.

C) The stock options are dilutive and should be included in diluted earnings per share in the amount of 2,000 shares.

D) The stock options are dilutive and should be included in diluted earnings per share in the amount of 333 shares.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

43

At December 31,2013,Rightoff,Inc.had 600,000 shares of common stock outstanding.On April 1,2014,an additional 180,000 shares of common stock were issued for cash.Rightoff also had $5,000,000 of 8% convertible bonds outstanding at December 31,2013,which are convertible into 150,000 shares of common stock.The bonds are dilutive in the 2014 EPS computation.No bonds were issued or converted into common stock during 2014.

Using the information above,what is the number of shares that should be used in computing basic earnings per share for 2014?

A) 735,000

B) 780,000

C) 885,000

D) 910,000

Using the information above,what is the number of shares that should be used in computing basic earnings per share for 2014?

A) 735,000

B) 780,000

C) 885,000

D) 910,000

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

44

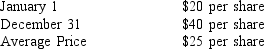

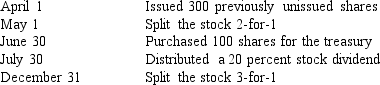

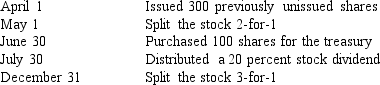

Leshner Corporation began business on January 1,2014.Due to difficulties in beginning operations,the company issued 50 shares of common stock (par $10)on January 1,2014,to the organizers.Twenty additional shares were also sold on that date.The following also occurred during the year 2014:  The weighted average number of shares outstanding for 2014 was

The weighted average number of shares outstanding for 2014 was

A) 77 shares.

B) 175 shares.

C) 350 shares.

D) 385 shares.

The weighted average number of shares outstanding for 2014 was

The weighted average number of shares outstanding for 2014 wasA) 77 shares.

B) 175 shares.

C) 350 shares.

D) 385 shares.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

45

Basic earnings per share represents the amount of earnings attributable to

A) all common stock and dilutive securities.

B) common stock,preferred stock,and all dilutive securities.

C) each share of common stock,and options or warrants which convert to common stock.

D) each share of common stock outstanding,and any non-conditional conversions and exercises.

A) all common stock and dilutive securities.

B) common stock,preferred stock,and all dilutive securities.

C) each share of common stock,and options or warrants which convert to common stock.

D) each share of common stock outstanding,and any non-conditional conversions and exercises.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

46

A company with a 40% tax rate had 50,000 shares of common stock and the following three potentially dilutive issues outstanding for the entire year:  What is the correct ordering (ranking)of the dilutive issues for determining their inclusion into diluted earnings per share?

What is the correct ordering (ranking)of the dilutive issues for determining their inclusion into diluted earnings per share?

A) 1,2,3

B) 3,1,2

C) 3,2,1

D) 2,1,3

What is the correct ordering (ranking)of the dilutive issues for determining their inclusion into diluted earnings per share?

What is the correct ordering (ranking)of the dilutive issues for determining their inclusion into diluted earnings per share?A) 1,2,3

B) 3,1,2

C) 3,2,1

D) 2,1,3

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

47

Pueblo Corporation had 100 shares of common stock issued and outstanding at December 31,2013.On July 1,2014,Pueblo issued a 10 percent stock dividend.Unexercised stock options to purchase 20 shares of common stock (adjusted for the 2014 stock dividend)at $20 per share were outstanding at the beginning and end of 2014.The average market price of Pueblo's common stock (which was not affected by the stock dividend)was $25 per share during 2014.The ending market price was $40.Net income for the year ended December 31,2014,was $2,200. What was Pueblo's 2014 basic earnings per share,rounded to the nearest cent?

A) $19.30

B) $20.00

C) $20.20

D) $20.96

A) $19.30

B) $20.00

C) $20.20

D) $20.96

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

48

The following information applies to the next three questions:

Tangier Corporation currently has stock rights outstanding for 2,000 common shares.The exercise price of these shares is $25.The options were issued in January of 2012.The average market price of the related common stock during the year 2012 was $30.The average market price of the related common stock during 2013 was $26 and during 2014 was $21.The company's fiscal year ends on December 31 of each year.

How should these stock rights be treated in earnings per share calculations for the year ending December 31,2012?

A) The stock options are antidilutive and should not be included either in basic and diluted earnings per share.

B) The stock options are dilutive and should be included both in basic and diluted earnings per share.

C) The stock options are dilutive and should be included both in basic and diluted earnings per share in the amount of 333 shares.

D) The stock options are dilutive and should be included only in diluted earnings per share in the amount of 333 shares.

Tangier Corporation currently has stock rights outstanding for 2,000 common shares.The exercise price of these shares is $25.The options were issued in January of 2012.The average market price of the related common stock during the year 2012 was $30.The average market price of the related common stock during 2013 was $26 and during 2014 was $21.The company's fiscal year ends on December 31 of each year.

How should these stock rights be treated in earnings per share calculations for the year ending December 31,2012?

A) The stock options are antidilutive and should not be included either in basic and diluted earnings per share.

B) The stock options are dilutive and should be included both in basic and diluted earnings per share.

C) The stock options are dilutive and should be included both in basic and diluted earnings per share in the amount of 333 shares.

D) The stock options are dilutive and should be included only in diluted earnings per share in the amount of 333 shares.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

49

Bowie Company had 100 shares of common stock issued and outstanding at December 31,2013.On July 1,2014,Bowie issued a 10 percent stock dividend.Unexercised stock options to purchase 20 shares of common stock (adjusted for the 2014 stock dividend)at $20 per share were outstanding at the beginning and end of 2014.The average market price of Bowie's common stock (which was not affected by the stock dividend)was $25 per share during 2014.The ending market price was $40.Net income for the year ended December 31,2014,was $2,200.What was Bowie's 2014 diluted earnings per share,rounded to the nearest cent?

A) $19.30

B) $20.00

C) $20.20

D) $18.33

A) $19.30

B) $20.00

C) $20.20

D) $18.33

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

50

What would be the effect on book value per share and earnings per share if a corporation purchased its own shares in the open market at a price greater than the book value per share?

A) Increase both book value per share and earnings per share

B) Decrease both book value per share and earnings per share

C) Decrease book value per share and increase earnings per share

D) No effect on book value but increase earnings per share

A) Increase both book value per share and earnings per share

B) Decrease both book value per share and earnings per share

C) Decrease book value per share and increase earnings per share

D) No effect on book value but increase earnings per share

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

51

When a company with a complex capital structure has a loss from continuing operations and potentially dilutive securities,the calculation of earning per share (EPS)results in

A) simple EPS (no potentially dilutive securities are included in the calculation).

B) no EPS being reported.

C) EPS being reported,using the same calculation of dilutive EPS as would be used if net income were positive.

D) EPS being reported,using securities in the calculation of dilutive EPS that would be anti-dilutive if income were positive.

A) simple EPS (no potentially dilutive securities are included in the calculation).

B) no EPS being reported.

C) EPS being reported,using the same calculation of dilutive EPS as would be used if net income were positive.

D) EPS being reported,using securities in the calculation of dilutive EPS that would be anti-dilutive if income were positive.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

52

In computing earnings per share,convertible preferred stock may increase the number of shares outstanding if it is

A) dilutive and nonconvertible.

B) dilutive and convertible.

C) antidilutive and nonconvertible.

D) antidilutive and convertible.

A) dilutive and nonconvertible.

B) dilutive and convertible.

C) antidilutive and nonconvertible.

D) antidilutive and convertible.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

53

The following information applies to the next three questions:

Tangier Corporation currently has stock rights outstanding for 2,000 common shares.The exercise price of these shares is $25.The options were issued in January of 2012.The average market price of the related common stock during the year 2012 was $30.The average market price of the related common stock during 2013 was $26 and during 2014 was $21.The company's fiscal year ends on December 31 of each year.

How should these stock rights be treated in the earnings per share calculation for the year ending December 31,2014?

A) The stock options are antidilutive and should not be included in basic or diluted earnings per share.

B) The stock options are dilutive and should be included in diluted earnings per share in the amount of 381 shares.

C) The stock options are dilutive and should be included in diluted earnings per share in the amount of 2,000 shares.

D) The stock options are dilutive and should be included in diluted earnings per share in the amount of 333 shares.

Tangier Corporation currently has stock rights outstanding for 2,000 common shares.The exercise price of these shares is $25.The options were issued in January of 2012.The average market price of the related common stock during the year 2012 was $30.The average market price of the related common stock during 2013 was $26 and during 2014 was $21.The company's fiscal year ends on December 31 of each year.

How should these stock rights be treated in the earnings per share calculation for the year ending December 31,2014?

A) The stock options are antidilutive and should not be included in basic or diluted earnings per share.

B) The stock options are dilutive and should be included in diluted earnings per share in the amount of 381 shares.

C) The stock options are dilutive and should be included in diluted earnings per share in the amount of 2,000 shares.

D) The stock options are dilutive and should be included in diluted earnings per share in the amount of 333 shares.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

54

On December 31,2013,Freulein Company had 8,000 shares of common stock issued and outstanding.On April 1,2014,an additional 1,500 shares of common stock were issued and on July 1,500 more shares were issued.On October 1,2014,Freulein issued 10,$1,000 maturity value,8% convertible bonds.Each bond is convertible into 40 shares of common stock.No bonds were converted into common stock in 2014.Assuming there are no antidilutive securities,what is the number of shares Freulein should use to compute diluted earnings per share for the year ended December 31,2014?

A) 9,325

B) 9,475

C) 9,525

D) 9,775

A) 9,325

B) 9,475

C) 9,525

D) 9,775

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

55

Digistore,Inc. ,had 400,000 shares of $20 par common stock and 40,000 shares of $100 par,6% cumulative,convertible preferred stock outstanding for the entire year ended December 31,2014.Each share of the preferred stock is convertible into 5 shares of common stock.Digistore's net income for 2014 was $1,680,000.For the year ended December 31,2014,the diluted earnings per share is

A) $2.40.

B) $2.80.

C) $3.60.

D) $4.20.

A) $2.40.

B) $2.80.

C) $3.60.

D) $4.20.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

56

At December 31,2013,Rightoff,Inc.had 600,000 shares of common stock outstanding.On April 1,2014,an additional 180,000 shares of common stock were issued for cash.Rightoff also had $5,000,000 of 8% convertible bonds outstanding at December 31,2013,which are convertible into 150,000 shares of common stock.The bonds are dilutive in the 2014 EPS computation.No bonds were issued or converted into common stock during 2014.

Using the information above,what is the number of shares that should be used in computing diluted earnings per share for 2014?

A) 735,000

B) 780,000

C) 885,000

D) 910,000

Using the information above,what is the number of shares that should be used in computing diluted earnings per share for 2014?

A) 735,000

B) 780,000

C) 885,000

D) 910,000

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

57

At December 31,2013,Joplin Company had 350 shares of common stock outstanding.On October 1,2014,an additional 150 shares of common stock were issued.In addition,Joplin had $40,000 of 8 percent convertible bonds outstanding at December 31,2014,which are convertible in 225 shares of common stock.No bonds were converted into common stock in 2014.Net income for the year ended December 31,2014,was $14,000.Assuming an income tax rate of 50%,the basic earnings per share for the year ended December 31,2014,would be

A) $27.84

B) $36.08

C) $44.32

D) $50.91

A) $27.84

B) $36.08

C) $44.32

D) $50.91

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

58

At December 31,2013,Morrison Company had 700 shares of common stock outstanding.On September 1,2014,an additional 300 shares of common stock were issued.In addition,Morrison had $20,000 of 8 percent convertible bonds outstanding at December 31,2013,which are convertible into 400 shares of common stock.No bonds were converted into common stock in 2014.Net income for the year ended December 31,2014,was $6,000.Assuming an income tax rate of 50 percent what would be the company's diluted earnings per share for the year ended December 31,2014?

A) $7.50

B) $5.67

C) $5.00

D) $4.33

A) $7.50

B) $5.67

C) $5.00

D) $4.33

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following is correct regarding earnings per share (EPS)?

A) If preferred stock is outstanding,dividends declared on the preferred stock are always deducted from net income in calculating EPS.

B) EPS can never be negative.

C) All issues of convertible to common stock must be included in the calculation of diluted EPS.

D) If income from continuing operations is less than zero,potentially dilutive securities are anti-dilutive.

A) If preferred stock is outstanding,dividends declared on the preferred stock are always deducted from net income in calculating EPS.

B) EPS can never be negative.

C) All issues of convertible to common stock must be included in the calculation of diluted EPS.

D) If income from continuing operations is less than zero,potentially dilutive securities are anti-dilutive.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

60

A company already has calculated its basic earnings per share (EPS).In determining diluted earnings per share,the annual dividend on convertible cumulative preferred stock which is dilutive should be

A) added back to the number of basic EPS whether declared or not.

B) deducted from the numerator of basic EPS only if declared.

C) added back to the numerator of basic EPS only if declared.

D) deducted from the numerator of basic EPS whether declared or not.

A) added back to the number of basic EPS whether declared or not.

B) deducted from the numerator of basic EPS only if declared.

C) added back to the numerator of basic EPS only if declared.

D) deducted from the numerator of basic EPS whether declared or not.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

61

Which combination is the correct statement regarding disclosure requirements for earnings per share?

A) Only the EPS figure for net income must be presented and it must appear on the face of the income statement.

B) Income from continuing operations and net income may be presented on the face of the income statement or in the notes.

C) Income from continuing operations and net income are required to be presented on the face of the income statement;presentation of EPS amounts for extraordinary items and discontinued operations is optional.

D) Income from continuing operations and net income are both required to be presented on the face of the income statement;presentation of EPS amounts for extraordinary items and discontinued operations may be presented on the face of the income statement or in the notes.

A) Only the EPS figure for net income must be presented and it must appear on the face of the income statement.

B) Income from continuing operations and net income may be presented on the face of the income statement or in the notes.

C) Income from continuing operations and net income are required to be presented on the face of the income statement;presentation of EPS amounts for extraordinary items and discontinued operations is optional.

D) Income from continuing operations and net income are both required to be presented on the face of the income statement;presentation of EPS amounts for extraordinary items and discontinued operations may be presented on the face of the income statement or in the notes.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

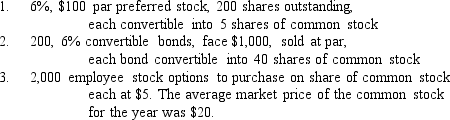

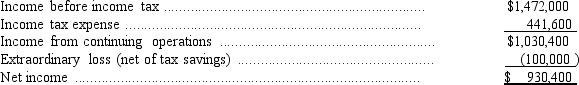

62

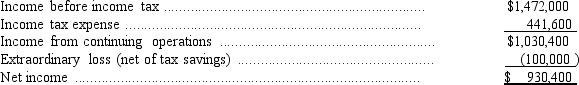

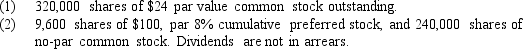

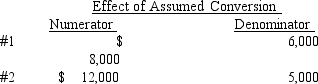

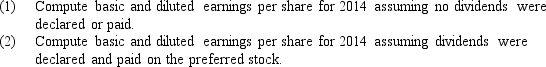

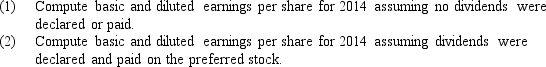

The income statement of Faster Computers,Inc.showed the following information on December 31,2014.

Compute earnings per share figures for common stock under the assumption that Faster Computer Inc.has

Compute earnings per share figures for common stock under the assumption that Faster Computer Inc.has

Note: Assumption (1)is independent of (2).

Note: Assumption (1)is independent of (2).

Compute earnings per share figures for common stock under the assumption that Faster Computer Inc.has

Compute earnings per share figures for common stock under the assumption that Faster Computer Inc.has Note: Assumption (1)is independent of (2).

Note: Assumption (1)is independent of (2).

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

63

Assume a company had net income of $20,000 and 8,000 shares of common stock outstanding the entire year.Also assume there were two potentially dilutive issues outstanding for the entire year:  What is diluted earnings per share for this company for the year?

What is diluted earnings per share for this company for the year?

A) $2.50

B) $2.40

C) $2.11

D) $2.00

What is diluted earnings per share for this company for the year?

What is diluted earnings per share for this company for the year?A) $2.50

B) $2.40

C) $2.11

D) $2.00

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

64

If convertible bonds are dilutive,the interest expense added back to the numerator in calculating diluted earnings per share is

A) net of tax,and includes discount and premium amortization.

B) net of tax,but does not include discount and premium amortization.

C) not net of tax,but includes discount and premium amortization.

D) not net of tax,and does not include discount or premium amortization.

A) net of tax,and includes discount and premium amortization.

B) net of tax,but does not include discount and premium amortization.

C) not net of tax,but includes discount and premium amortization.

D) not net of tax,and does not include discount or premium amortization.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

65

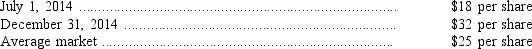

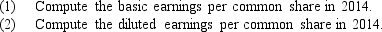

On December 31,2014,Luanne Inc.had outstanding 180,000 shares of common stock.Net income for 2014 was $285,000.Outstanding options (granted July 1,2014)to purchase 15,000 shares of common stock at $20 per share had not been exercised by December 31,2014.During 2014,market prices for Luanne's common stock were:

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

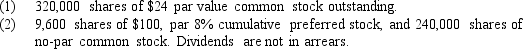

66

The Simonson Corp.provides the following data for 2014:

The net income for 2014 is $2,300,000.The Simonson's tax rate is 30 percent.No conversions or options were exercised during 2014.

The net income for 2014 is $2,300,000.The Simonson's tax rate is 30 percent.No conversions or options were exercised during 2014.

The net income for 2014 is $2,300,000.The Simonson's tax rate is 30 percent.No conversions or options were exercised during 2014.

The net income for 2014 is $2,300,000.The Simonson's tax rate is 30 percent.No conversions or options were exercised during 2014.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

67

During 2014,Belladonna Corp.had outstanding 125,000 shares of common stock and 7,500 shares of noncumulative,8 percent,$50 par preferred stock.Each preferred share is convertible into 8 shares of common stock.In 2014,net income was $231,500.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

68

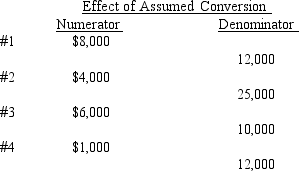

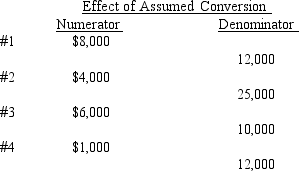

A company earned $20,000 in 2014 and had 20,000 shares of common stock outstanding the entire year.The following four potentially dilutive securities were also outstanding for the entire year.The numerator and denominator effects of the issues are as indicated:  What is diluted EPS?

What is diluted EPS?

A) $0.49

B) $0.32

C) $1.00

D) $0.81

What is diluted EPS?

What is diluted EPS?A) $0.49

B) $0.32

C) $1.00

D) $0.81

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

69

Gabor Company had granted 20,000 options to buy one share of common stock at $10 per share to employees several years ago.The company had net income of $200,000 this year and had 300,000 shares of common stock outstanding the entire year.The average market price per share was $20 and the end of year price was $25.Given only the above information,what are basic and diluted earnings per share respectively for the year?

A) $0.67 $0.67

B) $0.67 $0.65

C) $0.65 $0.64

D) $0.64 $0.64

A) $0.67 $0.67

B) $0.67 $0.65

C) $0.65 $0.64

D) $0.64 $0.64

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

70

During 2014,the Laverne Corporation had 370,000 shares of $20 par common stock outstanding.On January 1,2014,2,000,8 percent bonds were issued with a maturity value of $1,000 each.To enhance the bond sale,the company offered a conversion of 50 shares of common stock for each bond at the option of the purchaser.Net income for 2014 was $464,000.The income tax rate was 30 percent.Compute the diluted earnings per share of common stock.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

71

On December 31,2012,Bugler Travel Inc.had 450,000 shares of no-par common stock issued and outstanding.All shares were sold for $7.50.On June 30,2013,Bugler issued an additional 135,000 shares for $7 per share.The 2013 income was $319,200.On September 1,2012,a 15 percent stock dividend was issued to all common shareholders.On October 1,2014,60,000 shares were reacquired as treasury shares.Net income in 2014 was $278,063.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

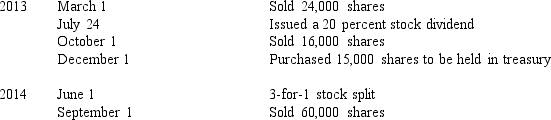

72

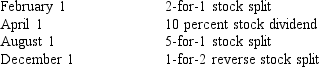

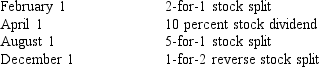

Binary Controls Inc.had 250,000 shares of common stock outstanding at the end of 2012.During 2013 and 2014,the following transactions took place.

Binary Controls Inc.has a simple capital structure.

Binary Controls Inc.has a simple capital structure.

Compute the weighted average number of shares for 2013 and 2014 to be used in the earnings per share computation for comparative financial statements at the end of 2014.

Binary Controls Inc.has a simple capital structure.

Binary Controls Inc.has a simple capital structure.Compute the weighted average number of shares for 2013 and 2014 to be used in the earnings per share computation for comparative financial statements at the end of 2014.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

73

The following information relates to the Tykex Company for 2014:  What is diluted earnings per share?

What is diluted earnings per share?

A) $1.00

B) $0.89

C) $0.81

D) $0.76

What is diluted earnings per share?

What is diluted earnings per share?A) $1.00

B) $0.89

C) $0.81

D) $0.76

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following is correct regarding the effect that dilutive convertible bonds have on the earnings per share computation?

A) The number of shares the bonds would convert to is added to the denominator;interest,net of tax,is subtracted from the numerator.

B) The number of shares the bonds would convert to is added to the denominator;interest net of tax is added to the numerator.

C) The number of shares the bonds would convert to is subtracted from the denominator;interest,net of tax,is subtracted from the numerator.

D) The number of shares the bonds would convert to is subtracted from the denominator;interest,net of tax,is added to the numerator.

A) The number of shares the bonds would convert to is added to the denominator;interest,net of tax,is subtracted from the numerator.

B) The number of shares the bonds would convert to is added to the denominator;interest net of tax is added to the numerator.

C) The number of shares the bonds would convert to is subtracted from the denominator;interest,net of tax,is subtracted from the numerator.

D) The number of shares the bonds would convert to is subtracted from the denominator;interest,net of tax,is added to the numerator.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

75

At December 31,2013,Grandin Corporation had 500 shares of common stock outstanding.On October 1,2014,an additional 200 shares of common stock were issued.In addition,Grandin Corp.had $40,000 of 8 percent convertible bonds outstanding at December 31,2013,which are convertible into 225 shares of common stock.No bonds were converted into common stock in 2014.Net income for the year ending December 31,2014,was $14,000.Assuming the income tax rate was 50 percent,the diluted earnings per share for the year ended December 31,2014,should be

A) $15.67

B) $20.13

C) $25.45

D) $28.36

A) $15.67

B) $20.13

C) $25.45

D) $28.36

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

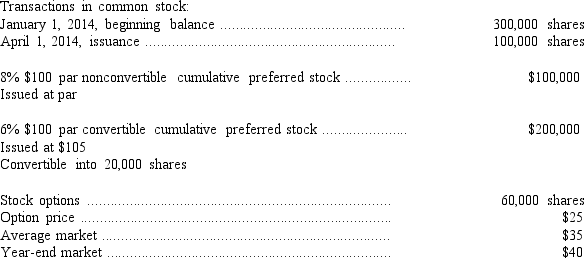

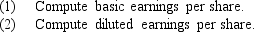

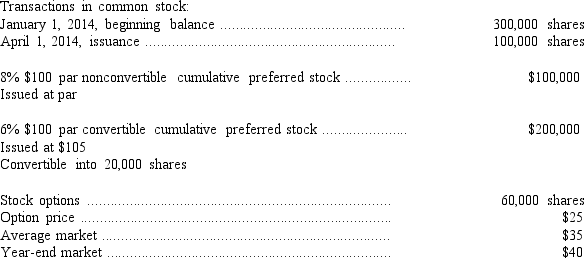

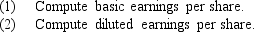

76

During all of 2014 Rambler Manufacturing Company had 950,000 shares of common stock outstanding.On June 30,2014,the company issued 10,000 7 percent convertible bonds at par.The maturity value of each bond is $1,000.Each bond is convertible into 20 shares of common stock.None were converted during 2014.

Rambler also had 60,000 stock warrants outstanding for all of 2014.The option price is $10 per share.The market price of the common stock was $40 on December 31,2014,and the average market price for 2014 was $30.

Rambler reported a net income of $3,650,000 for 2014.Assume the company had a 40 percent income tax rate.

Rambler also had 60,000 stock warrants outstanding for all of 2014.The option price is $10 per share.The market price of the common stock was $40 on December 31,2014,and the average market price for 2014 was $30.

Rambler reported a net income of $3,650,000 for 2014.Assume the company had a 40 percent income tax rate.

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck

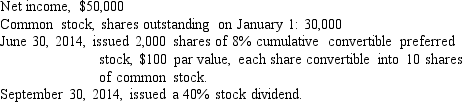

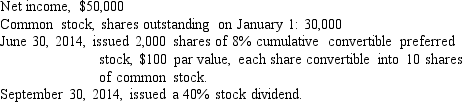

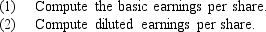

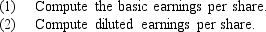

77

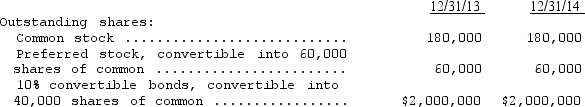

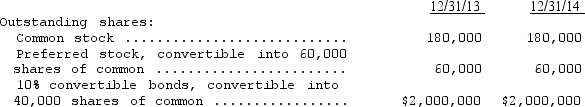

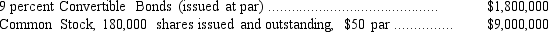

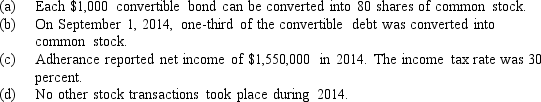

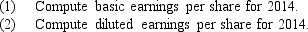

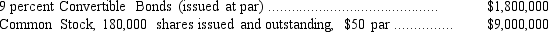

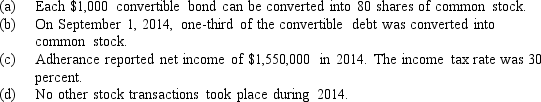

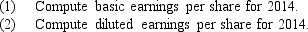

The following is a partial balance sheet for Adherance Corp.for the year ended December 31,2013:

Unlock Deck

Unlock for access to all 77 flashcards in this deck.

Unlock Deck

k this deck