Deck 16: Income Taxes

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/68

Play

Full screen (f)

Deck 16: Income Taxes

1

An example of a "deductible temporary difference" occurs when

A) the installment sales method is used for tax purposes,but the accrual method of recognizing sales revenue is used for financial reporting purposes.

B) warranty expenses are recognized on the accrual basis for financial reporting purposes but recognized as the warranty conditions are met for tax purposes.

C) accelerated depreciation is used for tax purposes but straight-line depreciation is used for accounting purposes.

D) the completed-contract method of recognizing construction revenue is used for tax purposes,but the percentage-of-completion method is used for financial reporting purposes.

A) the installment sales method is used for tax purposes,but the accrual method of recognizing sales revenue is used for financial reporting purposes.

B) warranty expenses are recognized on the accrual basis for financial reporting purposes but recognized as the warranty conditions are met for tax purposes.

C) accelerated depreciation is used for tax purposes but straight-line depreciation is used for accounting purposes.

D) the completed-contract method of recognizing construction revenue is used for tax purposes,but the percentage-of-completion method is used for financial reporting purposes.

B

2

Which of the following creates a permanent difference between financial income and taxable income?

A) Interest received on municipal bonds

B) Completed contract method of recognizing construction revenue

C) Unearned rent revenue

D) Accelerated cost recovery on plant and equipment

A) Interest received on municipal bonds

B) Completed contract method of recognizing construction revenue

C) Unearned rent revenue

D) Accelerated cost recovery on plant and equipment

A

3

Which of the following temporary differences ordinarily results in a deferred tax liability?

A) Accrued warranty costs

B) Unrealized losses on marketable securities

C) Depreciation

D) Subscription revenue received in advance

A) Accrued warranty costs

B) Unrealized losses on marketable securities

C) Depreciation

D) Subscription revenue received in advance

C

4

The result of interperiod income tax allocation is that

A) wide fluctuations in a company's tax liability payments are eliminated.

B) tax expense shown in the income statement is equal to the deferred taxes shown on the balance sheet.

C) tax liability shown in the balance sheet is equal to the deferred taxes shown on the previous year's balance sheet plus the income tax expense shown on the income statement.

D) tax expense shown on the income statement is equal to income taxes payable for the current year plus or minus the change in the deferred tax asset or liability balances for the year.

A) wide fluctuations in a company's tax liability payments are eliminated.

B) tax expense shown in the income statement is equal to the deferred taxes shown on the balance sheet.

C) tax liability shown in the balance sheet is equal to the deferred taxes shown on the previous year's balance sheet plus the income tax expense shown on the income statement.

D) tax expense shown on the income statement is equal to income taxes payable for the current year plus or minus the change in the deferred tax asset or liability balances for the year.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following statements is NOT correct?

A) All current deferred tax liabilities and assets shall be offset and presented as a single amount on the balance sheet.

B) Deferred tax assets related to carryforwards shall be classified as current or noncurrent on the balance sheet based on their expected date of reversal.

C) All current and noncurrent deferred tax assets shall be offset and presented as a single amount on the balance sheet.

D) Deferred tax liabilities and assets shall be classified as current or noncurrent on the balance sheet based on the classification of the asset or liability giving rise to the deferred tax item.

A) All current deferred tax liabilities and assets shall be offset and presented as a single amount on the balance sheet.

B) Deferred tax assets related to carryforwards shall be classified as current or noncurrent on the balance sheet based on their expected date of reversal.

C) All current and noncurrent deferred tax assets shall be offset and presented as a single amount on the balance sheet.

D) Deferred tax liabilities and assets shall be classified as current or noncurrent on the balance sheet based on the classification of the asset or liability giving rise to the deferred tax item.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following creates a temporary difference between financial and taxable income?

A) Fines from violation of law

B) Interest on municipal bonds

C) Accelerated cost recovery on plant and equipment

D) Premiums paid for officer's life insurance (company is beneficiary)

A) Fines from violation of law

B) Interest on municipal bonds

C) Accelerated cost recovery on plant and equipment

D) Premiums paid for officer's life insurance (company is beneficiary)

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following items results in a temporary difference deductible amount for a given year?

A) Premiums on officer's life insurance (company is beneficiary)

B) Premiums on officer's life insurance (officer is beneficiary)

C) Vacation pay accrual

D) Accelerated depreciation for tax purposes;straight-line for financial reporting purposes

A) Premiums on officer's life insurance (company is beneficiary)

B) Premiums on officer's life insurance (officer is beneficiary)

C) Vacation pay accrual

D) Accelerated depreciation for tax purposes;straight-line for financial reporting purposes

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following situations would require interperiod income tax allocation procedures?

A) A temporary difference exists because the tax basis of capital equipment is less than its reported amount in the financial statements.

B) Proceeds from an insurance policy on capital equipment lost in a fire exceed the book value of the equipment.

C) Last period's ending inventory was understated causing both net income and income tax expense to be understated.

D) Nontaxable interest payments are received on municipal bonds.

A) A temporary difference exists because the tax basis of capital equipment is less than its reported amount in the financial statements.

B) Proceeds from an insurance policy on capital equipment lost in a fire exceed the book value of the equipment.

C) Last period's ending inventory was understated causing both net income and income tax expense to be understated.

D) Nontaxable interest payments are received on municipal bonds.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

9

In 2014,Ryan Corporation reported $85,000 net income before income taxes.The income tax rate for 2014 was 30 percent.Ryan had an unused $65,000 net operating loss carryforward arising in 2013 when the tax rate was 35 percent.The income tax expense Ryan would report for 2014 would be

A) $7,000.

B) $6,000.

C) $24,600.

D) $32,000.

A) $7,000.

B) $6,000.

C) $24,600.

D) $32,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

10

The purpose of an interperiod income tax allocation is to

A) allow reporting entities to fully utilize tax losses carried forward from a previous year.

B) allow reporting entities whose tax liabilities vary significantly from year to year to smooth payments to taxing agencies.

C) recognize an asset or liability for the tax consequences of temporary differences that exist at the balance sheet date.

D) amortize the deferred tax liability shown on the balance sheet.

A) allow reporting entities to fully utilize tax losses carried forward from a previous year.

B) allow reporting entities whose tax liabilities vary significantly from year to year to smooth payments to taxing agencies.

C) recognize an asset or liability for the tax consequences of temporary differences that exist at the balance sheet date.

D) amortize the deferred tax liability shown on the balance sheet.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

11

Omega Company reported net incomes in 2013 and 2014 before sustaining a significant operating loss in 2015.All of the 2015 loss can be carried back against the income of 2013 and 2014 for purposes of determining the company's 2015 income tax liability.How should the carryback be presented in the company's 2015 financial statements?

A) As an extraordinary item in the income statement

B) As a revenue from operations in the income statement

C) As the correction of an error in the retained earnings statement

D) As a reduction in the operating loss on the income statement for the year 2015

A) As an extraordinary item in the income statement

B) As a revenue from operations in the income statement

C) As the correction of an error in the retained earnings statement

D) As a reduction in the operating loss on the income statement for the year 2015

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

12

An item that would create a permanent difference in pretax financial and taxable incomes would be

A) using accelerated depreciation for tax purposes and straight-line depreciation for book purposes.

B) purchasing equipment previously leased with an operating lease in prior years.

C) using the percentage-of-completion method on long-term construction contracts.

D) paying fines for violation of laws.

A) using accelerated depreciation for tax purposes and straight-line depreciation for book purposes.

B) purchasing equipment previously leased with an operating lease in prior years.

C) using the percentage-of-completion method on long-term construction contracts.

D) paying fines for violation of laws.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

13

When enacted tax rates change,the asset and liability method of interperiod tax allocation recognizes the rate change as

A) a cumulative effect adjustment.

B) an adjustment to be netted against the current income tax expense.

C) a separate charge to the current year's net income.

D) a separate charge or benefit to income tax expense.

A) a cumulative effect adjustment.

B) an adjustment to be netted against the current income tax expense.

C) a separate charge to the current year's net income.

D) a separate charge or benefit to income tax expense.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

14

A company would most likely choose the carryforward option for a net operating loss if the company expected

A) higher tax rates in the future compared to the past.

B) lower tax rates in the future compared to the past.

C) lower earnings in the future compared to the past.

D) higher earnings in the future compared to the past.

A) higher tax rates in the future compared to the past.

B) lower tax rates in the future compared to the past.

C) lower earnings in the future compared to the past.

D) higher earnings in the future compared to the past.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following temporary differences ordinarily creates a deferred tax asset?

A) Accrued warranty costs

B) Depreciation

C) Installment sales

D) Prepaid insurance

A) Accrued warranty costs

B) Depreciation

C) Installment sales

D) Prepaid insurance

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is the most likely item to result in a deferred tax asset?

A) Using accelerated depreciation for tax purposes but straight-line depreciation for accounting purposes

B) Using the completed-contract method of recognizing construction revenue tax purposes,but using percentage-of-completion method for financial reporting purposes

C) Prepaid expenses

D) Unearned revenues

A) Using accelerated depreciation for tax purposes but straight-line depreciation for accounting purposes

B) Using the completed-contract method of recognizing construction revenue tax purposes,but using percentage-of-completion method for financial reporting purposes

C) Prepaid expenses

D) Unearned revenues

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

17

Recognizing tax benefits in a loss year due to a loss carryforward requires

A) only a footnote disclosure.

B) creating a new carryforward for the next year.

C) creating a deferred tax asset.

D) creating a deferred tax liability.

A) only a footnote disclosure.

B) creating a new carryforward for the next year.

C) creating a deferred tax asset.

D) creating a deferred tax liability.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

18

All of the following can result in a temporary difference between pretax financial income and taxable income except

A) payment of premiums for life insurance.

B) depreciation expense.

C) contingent liabilities.

D) product warranty costs.

A) payment of premiums for life insurance.

B) depreciation expense.

C) contingent liabilities.

D) product warranty costs.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following arguments is supportive of allocation of income taxes?

A) Future predictions of net income are enhanced when income taxes are allocated.

B) Income tax expense computed under interperiod tax allocation is a better predictor of future cash flows than income taxes actually paid.

C) Income tax is not an expense;it is a sharing of profits with government.

D) Income tax expense based on actual payments is more understandable to users than allocated income taxes.

A) Future predictions of net income are enhanced when income taxes are allocated.

B) Income tax expense computed under interperiod tax allocation is a better predictor of future cash flows than income taxes actually paid.

C) Income tax is not an expense;it is a sharing of profits with government.

D) Income tax expense based on actual payments is more understandable to users than allocated income taxes.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following items results in a temporary difference taxable amount for a given year?

A) Premiums on officer's life insurance (company is beneficiary)

B) Premiums on officer's life insurance (officer is beneficiary)

C) Vacation pay accrual

D) Accelerated depreciation for tax purposes;straight-line for financial reporting purposes

A) Premiums on officer's life insurance (company is beneficiary)

B) Premiums on officer's life insurance (officer is beneficiary)

C) Vacation pay accrual

D) Accelerated depreciation for tax purposes;straight-line for financial reporting purposes

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

21

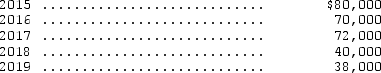

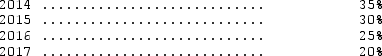

For three consecutive years,2012-2014,Siamese Corporation has reported income before taxes of $200,000 for both financial reporting purposes and tax reporting purposes.During this time,Siamese income tax rates were as follows:  In 2015,Siamese' tax rate changed to 35 percent.Also in 2015,the company reported a loss for both financial reporting and tax reporting purposes of $200,000.Assuming the company uses the carryback provisions,the amount Siamese' should report as an income tax refund receivable in 2015 is

In 2015,Siamese' tax rate changed to 35 percent.Also in 2015,the company reported a loss for both financial reporting and tax reporting purposes of $200,000.Assuming the company uses the carryback provisions,the amount Siamese' should report as an income tax refund receivable in 2015 is

A) $45,000.

B) $50,000.

C) $60,000.

D) $67,500.

In 2015,Siamese' tax rate changed to 35 percent.Also in 2015,the company reported a loss for both financial reporting and tax reporting purposes of $200,000.Assuming the company uses the carryback provisions,the amount Siamese' should report as an income tax refund receivable in 2015 is

In 2015,Siamese' tax rate changed to 35 percent.Also in 2015,the company reported a loss for both financial reporting and tax reporting purposes of $200,000.Assuming the company uses the carryback provisions,the amount Siamese' should report as an income tax refund receivable in 2015 isA) $45,000.

B) $50,000.

C) $60,000.

D) $67,500.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

22

In 2014,The Xavier Company,reported pretax financial income of $400,000.Included in that pretax financial income was $90,000 of nontaxable life insurance proceeds received as a result of the death of an officer;$120,000 of warranty expenses accrued but unpaid as of December 31,2014;and $30,000 of life insurance premiums for a policy for an officer.Assuming that no income taxes were previously paid during the year and assuming an income tax rate of 40 percent,the amount of income taxes payable on December 31,2014,would be

A) $120,000.

B) $150,000.

C) $182,000.

D) $184,000.

A) $120,000.

B) $150,000.

C) $182,000.

D) $184,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

23

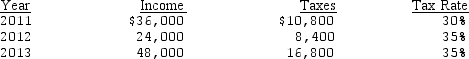

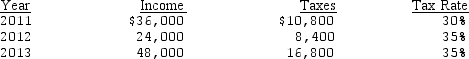

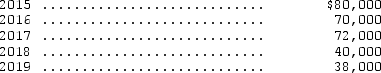

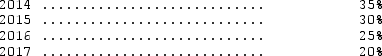

The Morris Corporation reported a $59,000 operating loss in 2014.In the preceding three years,Morris reported the following income before taxes and paid the indicated income taxes:  The amount of tax benefit to be reported in 2014 arising from the tax carryback provisions of the current tax code would be

The amount of tax benefit to be reported in 2014 arising from the tax carryback provisions of the current tax code would be

A) $20,650

B) $22,500.

C) $21,300.

D) $20,100

The amount of tax benefit to be reported in 2014 arising from the tax carryback provisions of the current tax code would be

The amount of tax benefit to be reported in 2014 arising from the tax carryback provisions of the current tax code would beA) $20,650

B) $22,500.

C) $21,300.

D) $20,100

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

24

A deferred tax liability arising from the use of an accelerated method of depreciation for tax purposes and the straight-line method for financial reporting purposes would be classified on the balance sheet as

A) a current liability.

B) a noncurrent liability.

C) a current liability for the portion of the temporary difference reversing within a year and a noncurrent liability for the remainder.

D) an offset to the accumulated depreciation reported on the balance sheet.

A) a current liability.

B) a noncurrent liability.

C) a current liability for the portion of the temporary difference reversing within a year and a noncurrent liability for the remainder.

D) an offset to the accumulated depreciation reported on the balance sheet.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

25

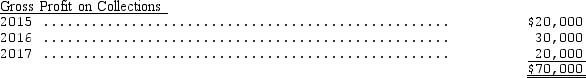

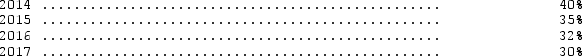

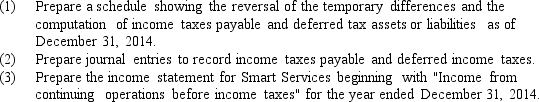

The following information is taken from Glenville Corporation's 2014 financial records:  Assume the taxable temporary difference was created entirely in 2014 and will reverse in equal net taxable amounts in each of the next three years.If tax rates are 40 percent in 2014,35 percent in 2015,35 percent in 2016,and 30 percent in 2017,then the total deferred tax liability Glenville should report on its December 31,2014,balance sheet is

Assume the taxable temporary difference was created entirely in 2014 and will reverse in equal net taxable amounts in each of the next three years.If tax rates are 40 percent in 2014,35 percent in 2015,35 percent in 2016,and 30 percent in 2017,then the total deferred tax liability Glenville should report on its December 31,2014,balance sheet is

A) $13,500.

B) $15,000.

C) $15,750.

D) $18,000.

Assume the taxable temporary difference was created entirely in 2014 and will reverse in equal net taxable amounts in each of the next three years.If tax rates are 40 percent in 2014,35 percent in 2015,35 percent in 2016,and 30 percent in 2017,then the total deferred tax liability Glenville should report on its December 31,2014,balance sheet is

Assume the taxable temporary difference was created entirely in 2014 and will reverse in equal net taxable amounts in each of the next three years.If tax rates are 40 percent in 2014,35 percent in 2015,35 percent in 2016,and 30 percent in 2017,then the total deferred tax liability Glenville should report on its December 31,2014,balance sheet isA) $13,500.

B) $15,000.

C) $15,750.

D) $18,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

26

The Racing Company had taxable income of $12,000 during 2014.Racing used accelerated depreciation for tax purposes ($3,400)and straight-line depreciation for accounting purposes ($2,000).Assuming Racing had no other temporary differences,what would the company's pretax accounting income be for 2014?

A) $1,400

B) $6,600

C) $13,400

D) $17,400

A) $1,400

B) $6,600

C) $13,400

D) $17,400

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

27

On the statement of cash flows using the indirect method,an increase in the deferred tax liability would be shown as

A) an addition to net income.

B) a deduction from net income.

C) an increase in investing activities.

D) an increase in financing activities.

A) an addition to net income.

B) a deduction from net income.

C) an increase in investing activities.

D) an increase in financing activities.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

28

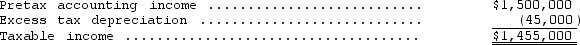

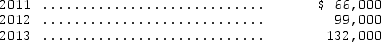

Longhorn Corporation reported a loss for both financial reporting purposes and tax reporting purposes of $231,000 in 2014.For financial reporting purposes,Longhorn reported income before taxes for years 2011-2013 as listed below:  Assuming Longhorn's tax rate is 30 percent in all periods,and that the company uses the carryback provisions,what amount should appear in Longhorn's statements for financial reporting purposes as a net loss in 2014?

Assuming Longhorn's tax rate is 30 percent in all periods,and that the company uses the carryback provisions,what amount should appear in Longhorn's statements for financial reporting purposes as a net loss in 2014?

A) $0

B) $69,300

C) $161,700

D) $234,300

Assuming Longhorn's tax rate is 30 percent in all periods,and that the company uses the carryback provisions,what amount should appear in Longhorn's statements for financial reporting purposes as a net loss in 2014?

Assuming Longhorn's tax rate is 30 percent in all periods,and that the company uses the carryback provisions,what amount should appear in Longhorn's statements for financial reporting purposes as a net loss in 2014?A) $0

B) $69,300

C) $161,700

D) $234,300

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

29

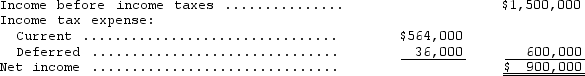

Analysis of the assets and liabilities of Baxter Corp.on December 31,2014,disclosed assets with a tax basis of $1,000,000 and a book basis of $1,300,000.There was no difference in the liability basis.The difference in asset basis arose from temporary differences that would reverse in the following years:  The enacted tax rates are 30 percent for the years 2014-2017 and 35 percent for 2018-2019.The total deferred tax liability on December 31,2014,should be

The enacted tax rates are 30 percent for the years 2014-2017 and 35 percent for 2018-2019.The total deferred tax liability on December 31,2014,should be

A) $105,000.

B) $93,900.

C) $90,000.

D) $69,000.

The enacted tax rates are 30 percent for the years 2014-2017 and 35 percent for 2018-2019.The total deferred tax liability on December 31,2014,should be

The enacted tax rates are 30 percent for the years 2014-2017 and 35 percent for 2018-2019.The total deferred tax liability on December 31,2014,should beA) $105,000.

B) $93,900.

C) $90,000.

D) $69,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

30

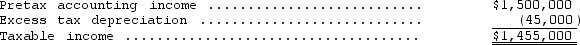

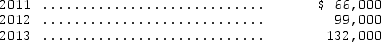

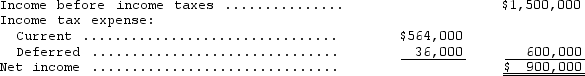

The following information was taken from Caribbean Corporation's 2014 income statement:  Caribbeans' first year of operations was 2014.The company has a 30 percent tax rate.Management decided to use accelerated depreciation for tax purpose and the straight-line method of depreciation for financial reporting purposes.The amount charged to depreciation expense in 2014 was $600,000.Assuming no other differences existed between book income and taxable income,what amount did Caribbean deduct for depreciation on its tax return for 2014?

Caribbeans' first year of operations was 2014.The company has a 30 percent tax rate.Management decided to use accelerated depreciation for tax purpose and the straight-line method of depreciation for financial reporting purposes.The amount charged to depreciation expense in 2014 was $600,000.Assuming no other differences existed between book income and taxable income,what amount did Caribbean deduct for depreciation on its tax return for 2014?

A) $480,000

B) $570,000

C) $600,000

D) $720,000

Caribbeans' first year of operations was 2014.The company has a 30 percent tax rate.Management decided to use accelerated depreciation for tax purpose and the straight-line method of depreciation for financial reporting purposes.The amount charged to depreciation expense in 2014 was $600,000.Assuming no other differences existed between book income and taxable income,what amount did Caribbean deduct for depreciation on its tax return for 2014?

Caribbeans' first year of operations was 2014.The company has a 30 percent tax rate.Management decided to use accelerated depreciation for tax purpose and the straight-line method of depreciation for financial reporting purposes.The amount charged to depreciation expense in 2014 was $600,000.Assuming no other differences existed between book income and taxable income,what amount did Caribbean deduct for depreciation on its tax return for 2014?A) $480,000

B) $570,000

C) $600,000

D) $720,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

31

Ballantine Products,Inc. ,reported an excess of warranty expense over warranty deductions of $72,000 for the year ended December 31,2014.This temporary difference will reverse in equal amounts over the years 2015 to 2017.The enacted tax rates are as follows:  The reporting for this temporary difference at December 31,2014,would be a

The reporting for this temporary difference at December 31,2014,would be a

A) deferred tax liability of $23,400.

B) deferred tax asset of $23,400.

C) current deferred tax liability of $7,200 and a noncurrent deferred tax liability of $16,200.

D) current deferred tax asset of $7,200 and a noncurrent deferred tax asset of $16,200.

The reporting for this temporary difference at December 31,2014,would be a

The reporting for this temporary difference at December 31,2014,would be aA) deferred tax liability of $23,400.

B) deferred tax asset of $23,400.

C) current deferred tax liability of $7,200 and a noncurrent deferred tax liability of $16,200.

D) current deferred tax asset of $7,200 and a noncurrent deferred tax asset of $16,200.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

32

Historically,the United Kingdom has recognized only those deferred tax liabilities expected to "crystallize." The term "crystallize" is most nearly synonymous with the term

A) amortized.

B) realized.

C) recognized.

D) liquidated.

A) amortized.

B) realized.

C) recognized.

D) liquidated.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

33

If all temporary differences entering into the determination of pretax accounting income are considered in the computation of deferred taxes and income tax expense,then the

A) no-deferral approach is being applied.

B) comprehensive recognition approach is being applied.

C) partial recognition approach is being applied.

D) net-of-tax method is being applied.

A) no-deferral approach is being applied.

B) comprehensive recognition approach is being applied.

C) partial recognition approach is being applied.

D) net-of-tax method is being applied.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

34

International accounting standards currently are moving toward the

A) comprehensive recognition approach.

B) partial recognition approach.

C) no-deferral approach.

D) discounted comprehensive recognition approach.

A) comprehensive recognition approach.

B) partial recognition approach.

C) no-deferral approach.

D) discounted comprehensive recognition approach.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

35

Hagar Corporation reported depreciation of $250,000 on its 2014 tax return.However,in its 2014 income statement,Hagar reported depreciation of $100,000.The difference in depreciation is a temporary difference that will reverse over time.Assuming Hagar's tax rate is constant at 30 percent,what amount should be added to the deferred income tax liability in Hagar's December 31,2014,balance sheet?

A) $30,000

B) $37,500

C) $45,000

D) $75,000

A) $30,000

B) $37,500

C) $45,000

D) $75,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

36

Concourse Corporation paid $20,000 in January of 2014 for premiums on a two- year life insurance policy which names the company as the beneficiary.Additionally,Concourse Corporation's financial statements for the year ended December 31,2014,revealed the company paid $105,000 in taxes during the year and also accrued estimated litigation losses of $200,000.Assuming the lawsuit was resolved in February of 2015 (at which time a $200,000 loss was recognized for tax purposes)and that Concourse's tax rate is 30 percent for both 2014 and 2015,what amount should Concourse report as asset for net deferred income taxes on its 2014 balance sheet?

A) $54,000

B) $57,000

C) $60,000

D) $66,000

A) $54,000

B) $57,000

C) $60,000

D) $66,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

37

Amengual Corporation began operations in 2011 and had operating losses of $400,000 in 2012 and $300,000 in 2013.For the year ended December 31,2014,Amengual had a pretax financial income of $600,000.For 2012 and 2013,assume an enacted tax rate of 30 percent,and for 2014 a 35 percent tax rate.There were no temporary differences in any of the years.In Amengual's 2014 income statement,how much should be reported as income tax expense?

A) $0

B) $30,000

C) $180,000

D) $210,000

A) $0

B) $30,000

C) $180,000

D) $210,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

38

On December 31,2013,Breezeway,Inc. ,reported a current deferred tax liability of $140,000 and a noncurrent deferred tax asset of $40,000.At the end of 2014,Breezeway reported a current deferred tax liability of $100,000,and a noncurrent deferred tax liability of $44,000.The deferred tax expense for 2014 is

A) $144,000.

B) $44,000.

C) $36,000.

D) $4,000.

A) $144,000.

B) $44,000.

C) $36,000.

D) $4,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

39

Garden Company had pretax accounting income of $24,000 during 2014.Garden's only temporary difference for 2011 relates to a sale made in 2012 and recognized for accounting purposes at that time.However,Garden uses the installment sales method of revenue recognition for tax purposes.During 2014 Garden collected a receivable from the 2012 sale which resulted in $6,000 of income under the installment sales method.Garden's taxable income for 2014 would be

A) $6,000.

B) $18,000.

C) $24,000.

D) $30,000.

A) $6,000.

B) $18,000.

C) $24,000.

D) $30,000.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

40

The asset-liability method of interperiod tax allocation currently required by U.S.GAAP is an example of the

A) discounted comprehensive recognition approach.

B) no-deferral approach.

C) partial recognition approach.

D) comprehensive recognition approach.

A) discounted comprehensive recognition approach.

B) no-deferral approach.

C) partial recognition approach.

D) comprehensive recognition approach.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

41

Which factor would most likely cause a firm to choose the carryforward option for an NOL?

A) Expectations of lower earnings in the future relative to the past

B) Expectations of higher earnings in the future relative to the past

C) Expectations of lower tax rates in the future relative to the past

D) Expectations of higher tax rates in the future relative to the past

A) Expectations of lower earnings in the future relative to the past

B) Expectations of higher earnings in the future relative to the past

C) Expectations of lower tax rates in the future relative to the past

D) Expectations of higher tax rates in the future relative to the past

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

42

During a year,Awesome Company reported income tax expense of $300,000.The amount of taxes currently payable remained unchanged from the beginning to the end of the year.The deferred tax liability classified as noncurrent that resulted from the use of MACRS for tax purposes and straight-line depreciation for financial reporting purposes,increased from $40,000 at the beginning of the year to $44,000 at the end of the year.How much cash was paid for income taxes during for the year?

A) $256,000

B) $260,000

C) $296,000

D) $206,000

A) $256,000

B) $260,000

C) $296,000

D) $206,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following does NOT help explain why income tax expense is different from the product of pretax income times the current tax rate?

A) Permanent differences

B) Temporary differences

C) The fact that future and current tax rates are different

D) A change in the valuation allowance account for the deferred tax asset.

A) Permanent differences

B) Temporary differences

C) The fact that future and current tax rates are different

D) A change in the valuation allowance account for the deferred tax asset.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following is an example of a temporary difference that would result in a deferred tax liability?

A) Use of straight-line depreciation for accounting purposes and an accelerated rate for income tax purposes

B) Rent revenue collected in advance when included in taxable income before it is included in pretax accounting income

C) Use of a shorter depreciation period for accounting purposes than is used for income tax purposes

D) Investment losses recognized earlier for accounting purposes than for tax purposes

A) Use of straight-line depreciation for accounting purposes and an accelerated rate for income tax purposes

B) Rent revenue collected in advance when included in taxable income before it is included in pretax accounting income

C) Use of a shorter depreciation period for accounting purposes than is used for income tax purposes

D) Investment losses recognized earlier for accounting purposes than for tax purposes

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

45

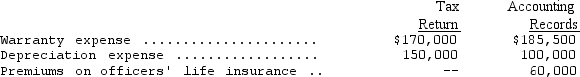

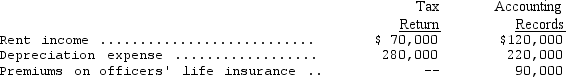

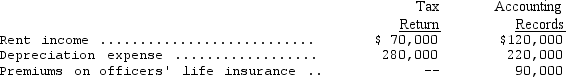

Creative Corporation's income statement for the year ended December 31,2014,shows pretax income of $300,000.The following items are treated differently on the tax return and in the accounting records:  Assume that Creative's tax rate for 2014 is 40 percent.What is the current portion of Creative's total income tax expense for 2014?

Assume that Creative's tax rate for 2014 is 40 percent.What is the current portion of Creative's total income tax expense for 2014?

A) $106,200

B) $120,200

C) $130,200

D) $144,200

Assume that Creative's tax rate for 2014 is 40 percent.What is the current portion of Creative's total income tax expense for 2014?

Assume that Creative's tax rate for 2014 is 40 percent.What is the current portion of Creative's total income tax expense for 2014?A) $106,200

B) $120,200

C) $130,200

D) $144,200

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

46

For the current year,Phoenix Company reported income tax expense of $195,000.Income taxes payable at the end of the prior year were $125,000 and at the end of the current year were $130,000.The deferred tax liability classified as noncurrent that resulted from the use of MACRS for tax purposes and straight-line depreciation for financial reporting purposes increased from $120,000 at the beginning of the current year to $123,000 at the end of the current year.How much cash was paid for income taxes during the year?

A) $187,000

B) $197,000

C) $195,000

D) $190,000

A) $187,000

B) $197,000

C) $195,000

D) $190,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

47

Tongass had pretax accounting income of $1,400 during 2014.Tongass used accelerated depreciation for tax purposes ($1,000)and straight-line depreciation for financial reporting purposes ($200).During 2014,Tongass accrued warranty expenses of $900 and paid cash to honor warranties of $500.Tongass's taxable income for 2014 would be

A) $200.

B) $1,000.

C) $1,800.

D) $2,600.

A) $200.

B) $1,000.

C) $1,800.

D) $2,600.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

48

During 2014,Epsilon Company had pretax accounting income of $620.Epsilon's only temporary difference for 2014 was the collection of a receivable that resulted in $220 of income under the installment sales method of revenue recognition that Epsilon uses for tax purposes.The sale was originally made in 2012 and recognized for accounting purposes at that time.Epsilon's taxable income for 2014 would be

A) $400.

B) $640.

C) $660.

D) $840.

A) $400.

B) $640.

C) $660.

D) $840.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

49

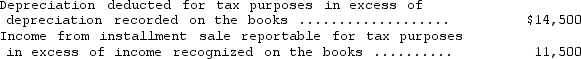

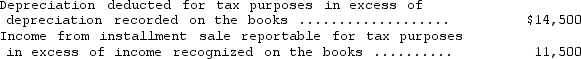

The books of the Speedster Company for the year ended December 31,2014,showed pretax income of $295,000.In computing the taxable income for federal income tax purposes,the following timing differences were taken into account:  What should Speedster record as its current federal income tax liability at December 31,2014,assuming a corporate income tax rate of 30 percent?

What should Speedster record as its current federal income tax liability at December 31,2014,assuming a corporate income tax rate of 30 percent?

A) $80,700

B) $84,700

C) $87,600

D) $89,400

What should Speedster record as its current federal income tax liability at December 31,2014,assuming a corporate income tax rate of 30 percent?

What should Speedster record as its current federal income tax liability at December 31,2014,assuming a corporate income tax rate of 30 percent?A) $80,700

B) $84,700

C) $87,600

D) $89,400

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

50

Intraperiod tax allocation

A) involves the allocation of income taxes between current and future periods.

B) associates tax effect with different items in the income statement.

C) arises because certain revenues and expenses appear in the financial statements either before or after they are included in the income tax return.

D) arises because different income statement items are taxed at different rates.

A) involves the allocation of income taxes between current and future periods.

B) associates tax effect with different items in the income statement.

C) arises because certain revenues and expenses appear in the financial statements either before or after they are included in the income tax return.

D) arises because different income statement items are taxed at different rates.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

51

For the current year,Eastern Atlantic Company reported income tax expense of $21,000.Income taxes payable at the end of the prior year were $19,000 and at the end of the current year were $20,000.The deferred tax liability classified as noncurrent that resulted from the use of MACRS for tax purposes and straight-line depreciation for financial reporting purposes increased from $21,000 at the beginning of the current year to $23,000 at the end of the current year.How much cash was paid for income taxes during the year?

A) $18,000

B) $20,000

C) $21,000

D) $19,000

A) $18,000

B) $20,000

C) $21,000

D) $19,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following is an example of a temporary difference that could result in a deferred tax asset?

A) Gain on disposal of an asset when included in taxable income before it is included in pretax accounting income

B) Use of straight-line depreciation for accounting purposes and an accelerated rate for income tax purposes

C) Gross margin on installment sales is recognized for accounting purposes before it is included in taxable income in the income tax return

D) Prepayments of expenses in year of payment;recognition of expense for accounting purposes occurs in a later year

A) Gain on disposal of an asset when included in taxable income before it is included in pretax accounting income

B) Use of straight-line depreciation for accounting purposes and an accelerated rate for income tax purposes

C) Gross margin on installment sales is recognized for accounting purposes before it is included in taxable income in the income tax return

D) Prepayments of expenses in year of payment;recognition of expense for accounting purposes occurs in a later year

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

53

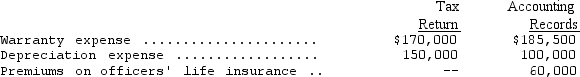

Bodner Corporation's income statement for the year ended December 31,2014,shows pretax income of $1,000,000.The following items are treated differently on the tax return and in the accounting records:  Assume that Bodner's tax rate for 2014 is 30 percent.What is the amount of income tax payable for 2014?

Assume that Bodner's tax rate for 2014 is 30 percent.What is the amount of income tax payable for 2014?

A) $360,000

B) $320,000

C) $294,000

D) $267,000

Assume that Bodner's tax rate for 2014 is 30 percent.What is the amount of income tax payable for 2014?

Assume that Bodner's tax rate for 2014 is 30 percent.What is the amount of income tax payable for 2014?A) $360,000

B) $320,000

C) $294,000

D) $267,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following is NOT a source of support for the realization of a deferred tax asset?

A) Future taxable temporary differences

B) Future deductible temporary differences

C) Past taxable income within the carryback period

D) Future taxable income

A) Future taxable temporary differences

B) Future deductible temporary differences

C) Past taxable income within the carryback period

D) Future taxable income

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

55

Alpha had taxable income of $1,500 during 2014.Alpha used accelerated depreciation for tax purposes ($2,000)and straight-line depreciation for financial reporting purposes ($800).On December 30,2014,Alpha collected the January 2015 rent of $600 on a lot it rents on a month-by-month basis to Zenith.Alpha's pretax accounting income for 2014 would be

A) $900.

B) $2,100.

C) $3,300.

D) $3,700.

A) $900.

B) $2,100.

C) $3,300.

D) $3,700.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following represents a permanent difference?

A) Point-of-sale revenue recognition for financial reporting purposes,installment method for tax purposes

B) Goodwill amortization deducted on the tax return but not amortized for financial reporting purposes

C) Straight-line depreciation for financial reporting purposes,accelerated depreciation for tax purposes

D) Carryback,carryforward option for taxes,no such option for financial reporting purposes

A) Point-of-sale revenue recognition for financial reporting purposes,installment method for tax purposes

B) Goodwill amortization deducted on the tax return but not amortized for financial reporting purposes

C) Straight-line depreciation for financial reporting purposes,accelerated depreciation for tax purposes

D) Carryback,carryforward option for taxes,no such option for financial reporting purposes

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

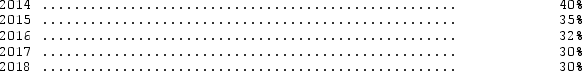

57

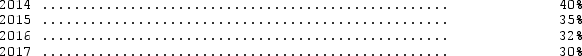

Rodeo Corporation reported depreciation of $450,000 on its 2014 tax return.However,in its 2014 income statement,Rodeo reported depreciation of $300,000,as well as $30,000 interest revenue on tax-free bonds.The difference in depreciation is only a temporary difference,and it will reverse equally over the next three years.Rodeo's enacted income tax rates are as follows:  What amount should be included in the deferred income tax liability in Rodeo's December 31,2014,balance sheet?

What amount should be included in the deferred income tax liability in Rodeo's December 31,2014,balance sheet?

A) $52,500

B) $45,000

C) $30,000

D) $37,500

What amount should be included in the deferred income tax liability in Rodeo's December 31,2014,balance sheet?

What amount should be included in the deferred income tax liability in Rodeo's December 31,2014,balance sheet?A) $52,500

B) $45,000

C) $30,000

D) $37,500

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

58

For the current year,Southern Cross Company reported income tax expense of $45,000.Income taxes payable at the end of the prior year were $20,000 and at the end of the current year were $27,000.The deferred tax liability classified as noncurrent that resulted from the use of MACRS for tax purposes and straight-line depreciation for financial reporting purposes increased from $18,000 at the beginning of the current year to $23,000 at the end of the current year.How much cash was paid for income taxes during the year?

A) $33,000

B) $45,000

C) $38,000

D) $47,000

A) $33,000

B) $45,000

C) $38,000

D) $47,000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

59

In computing the change in deferred tax accounts,which of the following tax rates is used?

A) Current tax rate

B) Estimated future tax rates

C) Enacted future tax rates

D) Past years' tax rates

A) Current tax rate

B) Estimated future tax rates

C) Enacted future tax rates

D) Past years' tax rates

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following could never be subject to interperiod tax allocation?

A) Interest revenue on municipal bonds

B) Depreciation expense on operational assets

C) Estimated warranty expense

D) Rent revenue

A) Interest revenue on municipal bonds

B) Depreciation expense on operational assets

C) Estimated warranty expense

D) Rent revenue

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

61

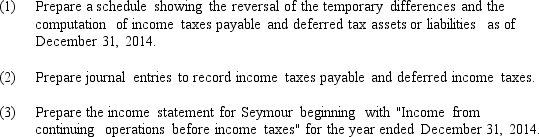

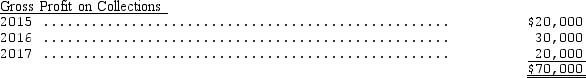

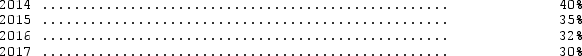

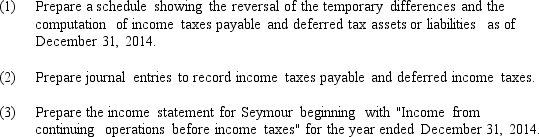

Seymour Associates computed a pretax financial income of $280,000 for the first year of its operations ended December 31,2014.Included in financial income was $20,000 of nondeductible expense and $70,000 gross profit on installment sales that was deferred for tax purposes until the installments were collected.

The temporary differences are expected to reverse in the following pattern.

The enacted tax rates for this year and the next three years are as follows:

The enacted tax rates for this year and the next three years are as follows:

The temporary differences are expected to reverse in the following pattern.

The enacted tax rates for this year and the next three years are as follows:

The enacted tax rates for this year and the next three years are as follows:

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

62

Pretax accounting income is $100,000 and the tax rate is 40%.Included in income is a $20,000 fine levied for pollution violations and other infractions during the year.In the reconciliation of the statutory and effective rate (beginning with the statutory rate),which one of the following amounts would appear?

A) (.08)

B) .08

C) (.20)

D) (.04)

A) (.08)

B) .08

C) (.20)

D) (.04)

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

63

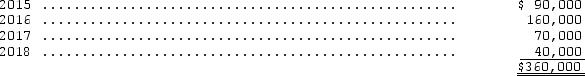

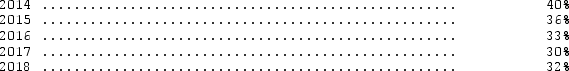

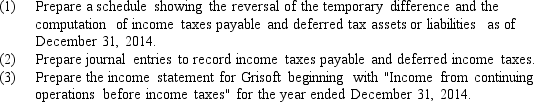

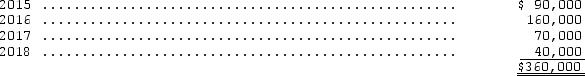

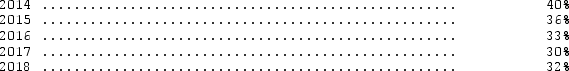

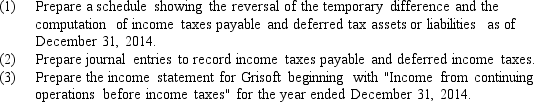

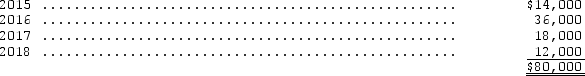

Grisoft Inc.computed a pretax financial income of $40,000 for the first year of its operations ended December 31,2014.Analysis of the tax and book basis of its liabilities disclosed $360,000 in unearned rent revenue on the books that had been recognized as taxable income in 2014 when the cash was received.

The unearned rent is expected to be recognized on the books in the following pattern:

The enacted tax rates for this year and the next four years are as follows:

The enacted tax rates for this year and the next four years are as follows:

Use the provisions of FASB Statement No.109.

Use the provisions of FASB Statement No.109.

The unearned rent is expected to be recognized on the books in the following pattern:

The enacted tax rates for this year and the next four years are as follows:

The enacted tax rates for this year and the next four years are as follows: Use the provisions of FASB Statement No.109.

Use the provisions of FASB Statement No.109.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

64

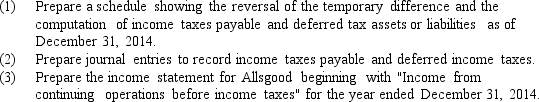

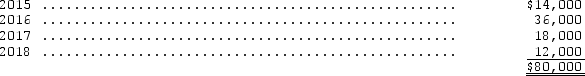

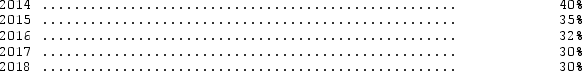

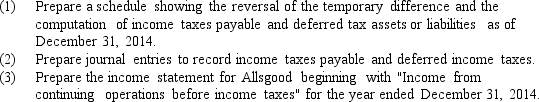

Allsgood Appliances computed a pretax financial loss of $60,000 for the first year of its operations ended December 31,2014.Analysis of the tax and book basis of its liabilities disclosed $80,000 in accrued warranty expenses on the books that had not been deductible from taxable income in 2014,but would be deductible in future years when the warranty expenses were paid.

The future warranty payments are expected to occur in the following pattern:

The enacted tax rates for this year and the next four years are as follows:

The enacted tax rates for this year and the next four years are as follows:

Use the provisions of FASB Statement No.109.

Use the provisions of FASB Statement No.109.

The future warranty payments are expected to occur in the following pattern:

The enacted tax rates for this year and the next four years are as follows:

The enacted tax rates for this year and the next four years are as follows: Use the provisions of FASB Statement No.109.

Use the provisions of FASB Statement No.109.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

65

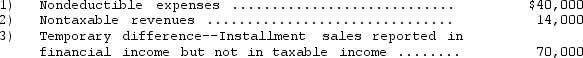

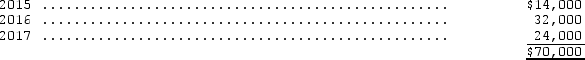

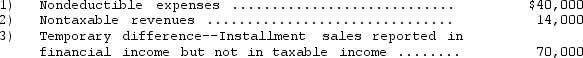

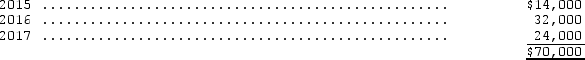

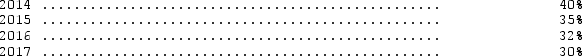

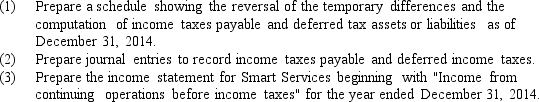

Smart Services computed pretax financial income of $220,000 for its first year of operations ended December 31,2014.In preparing the income tax return for the year,the tax accountant determined the following differences between 2014 financial income and taxable income:

The temporary difference is expected to reverse in the following pattern:

The temporary difference is expected to reverse in the following pattern:

The enacted tax rates for this year and the next three years are as follows:

The enacted tax rates for this year and the next three years are as follows:

Use the provisions of FASB Statement No.109.

Use the provisions of FASB Statement No.109.

The temporary difference is expected to reverse in the following pattern:

The temporary difference is expected to reverse in the following pattern: The enacted tax rates for this year and the next three years are as follows:

The enacted tax rates for this year and the next three years are as follows: Use the provisions of FASB Statement No.109.

Use the provisions of FASB Statement No.109.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

66

The following differences between financial and taxable income were reported by Angostura Corporation for the current year:

![The following differences between financial and taxable income were reported by Angostura Corporation for the current year: Assume that Angostura Corporation had pretax accounting income [before considering items (a)through (h)] of $900,000 for the current year.Compute the taxable income for the current year.](https://d2lvgg3v3hfg70.cloudfront.net/TB2121/11eaafb9_292f_084b_892c_412bd909b764_TB2121_00.jpg) Assume that Angostura Corporation had pretax accounting income [before considering items (a)through (h)] of $900,000 for the current year.Compute the taxable income for the current year.

Assume that Angostura Corporation had pretax accounting income [before considering items (a)through (h)] of $900,000 for the current year.Compute the taxable income for the current year.

![The following differences between financial and taxable income were reported by Angostura Corporation for the current year: Assume that Angostura Corporation had pretax accounting income [before considering items (a)through (h)] of $900,000 for the current year.Compute the taxable income for the current year.](https://d2lvgg3v3hfg70.cloudfront.net/TB2121/11eaafb9_292f_084b_892c_412bd909b764_TB2121_00.jpg) Assume that Angostura Corporation had pretax accounting income [before considering items (a)through (h)] of $900,000 for the current year.Compute the taxable income for the current year.

Assume that Angostura Corporation had pretax accounting income [before considering items (a)through (h)] of $900,000 for the current year.Compute the taxable income for the current year.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

67

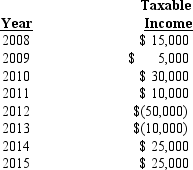

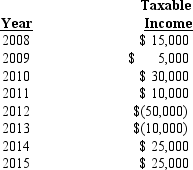

The data shown below represent the complete taxable income history for Confederacy Corporation.The tax rate was 35% throughout the entire period 2008 through 2015:  If the company always chooses the carryback,carryforward option,what is the tax liability for 2014?

If the company always chooses the carryback,carryforward option,what is the tax liability for 2014?

A) $1,750

B) $8,750

C) $5,250

D) $0

If the company always chooses the carryback,carryforward option,what is the tax liability for 2014?

If the company always chooses the carryback,carryforward option,what is the tax liability for 2014?A) $1,750

B) $8,750

C) $5,250

D) $0

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

68

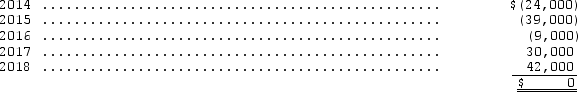

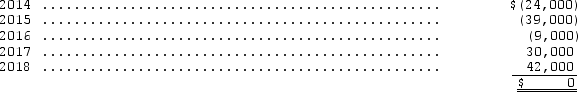

Oriole Industries computed a pretax financial income of $118,500 for the first year of its operations ended December 31,2014.Oriole uses an accelerated cost recovery method on its tax return,and straight-line depreciation on its books.

The difference between the tax and book deduction for depreciation over the five-year life of the assets acquired in 2014 are as follows:

The enacted tax rates for this year and the next four years are as follows:

The enacted tax rates for this year and the next four years are as follows:

Use the provisions of FASB Statement No.109 and assume that it is more likely than not that income will be sufficient in all future years to realize any deductible amounts.

Use the provisions of FASB Statement No.109 and assume that it is more likely than not that income will be sufficient in all future years to realize any deductible amounts.

The difference between the tax and book deduction for depreciation over the five-year life of the assets acquired in 2014 are as follows:

The enacted tax rates for this year and the next four years are as follows:

The enacted tax rates for this year and the next four years are as follows: Use the provisions of FASB Statement No.109 and assume that it is more likely than not that income will be sufficient in all future years to realize any deductible amounts.

Use the provisions of FASB Statement No.109 and assume that it is more likely than not that income will be sufficient in all future years to realize any deductible amounts.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck