Deck 14: Investments in Debt and Equity Securities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/81

Play

Full screen (f)

Deck 14: Investments in Debt and Equity Securities

1

From the following,select the most appropriate basis for the valuation of a new investment when properties or services are exchanged for stock.

A) The par or stated value of the stock received

B) The book value of the property or services exchanged

C) The fair market value of the stock received

D) Either the book value of the property or services exchange or the fair market value of the stock received,whichever is more clearly determinable

A) The par or stated value of the stock received

B) The book value of the property or services exchanged

C) The fair market value of the stock received

D) Either the book value of the property or services exchange or the fair market value of the stock received,whichever is more clearly determinable

C

2

FASB Statement No.115 generally applies when the level of ownership of another company is at what percentage?

A) More than 50%

B) 20%-30%

C) 30%-50%

D) Less than 20%

A) More than 50%

B) 20%-30%

C) 30%-50%

D) Less than 20%

D

3

If the combined market value of trading securities at the end of the year is less than the market value of the same portfolio of trading securities at the beginning of the year,the difference should be accounted for by

A) a credit to Investment in Trading Securities.

B) reporting an unrealized loss in security investments in the stockholders' equity section of the balance sheet.

C) a footnote to the financial statements.

D) reporting an unrealized loss in security investments in the income statement.

A) a credit to Investment in Trading Securities.

B) reporting an unrealized loss in security investments in the stockholders' equity section of the balance sheet.

C) a footnote to the financial statements.

D) reporting an unrealized loss in security investments in the income statement.

D

4

At the beginning of the year a company had a debit balance in the account Market Adjustment--Trading Securities.During the year the company did not buy or sell any trading securities,but at the end of the year the related market adjustment account had a credit balance.This change indicates that

A) a loss on the income statement was recognized.

B) a gain on the income statement was recognized.

C) the value of the investment account increased.

D) the value of the investment account decreased.

A) a loss on the income statement was recognized.

B) a gain on the income statement was recognized.

C) the value of the investment account increased.

D) the value of the investment account decreased.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

5

If the combined market value of available-for-sale securities at the end of the year is less than the market value of the same portfolio of available-for-sale securities at the beginning of the year,the difference should be accounted for by

A) reporting an unrealized loss in security investments in the stockholders' equity section of the balance sheet.

B) reporting an unrealized loss in security investments in the income statement.

C) a footnote to the financial statements.

D) a credit to Investment in Available-for-Sale Securities.

A) reporting an unrealized loss in security investments in the stockholders' equity section of the balance sheet.

B) reporting an unrealized loss in security investments in the income statement.

C) a footnote to the financial statements.

D) a credit to Investment in Available-for-Sale Securities.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is true?

A) Trading securities can be classified as current or noncurrent depending on management's intent.

B) Held-to-maturity securities should not be classified as current under any circumstance.

C) Available-for-sale securities can be classified as current or noncurrent depending on management's intent.

D) Trading securities should not be classified as current under any circumstance.

A) Trading securities can be classified as current or noncurrent depending on management's intent.

B) Held-to-maturity securities should not be classified as current under any circumstance.

C) Available-for-sale securities can be classified as current or noncurrent depending on management's intent.

D) Trading securities should not be classified as current under any circumstance.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

7

A credit balance in the account Market Adjustment--Trading Securities at the end of a year should be interpreted as the net

A) realized holding loss to date.

B) unrealized holding loss to date.

C) realized holding loss for that year.

D) unrealized holding loss for that year.

A) realized holding loss to date.

B) unrealized holding loss to date.

C) realized holding loss for that year.

D) unrealized holding loss for that year.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

8

The equity method of accounting for an investment in the common stock of another company should be used when the investment

A) is composed of common stock and it is the investor's intent to vote the common stock.

B) ensures a source of supply such as raw materials.

C) enables the investor to exercise significant influence over the investee.

D) gives the investor voting control over the investee.

A) is composed of common stock and it is the investor's intent to vote the common stock.

B) ensures a source of supply such as raw materials.

C) enables the investor to exercise significant influence over the investee.

D) gives the investor voting control over the investee.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

9

When an investor uses the equity method to account for investments in common stock,cash dividends received by the investor from the investee should be recorded as

A) an increase in the investment account.

B) a deduction from the investment account.

C) dividend revenue.

D) a deduction from the investor's share of the investee's profits.

A) an increase in the investment account.

B) a deduction from the investment account.

C) dividend revenue.

D) a deduction from the investor's share of the investee's profits.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

10

Changes in fair value of securities are reported in the stockholders' equity section of the balance sheet for which type of securities?

A) Marketable equity securities

B) Available-for-sale securities

C) Trading securities

D) Held-to-maturity securities

A) Marketable equity securities

B) Available-for-sale securities

C) Trading securities

D) Held-to-maturity securities

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

11

Consolidated financial statements are typically prepared when one company has

A) accounted for its investment in another company by the equity method.

B) significant influence over the operating and financial policies of another company.

C) the controlling financial interest in another company.

D) a substantial equity interest in the net assets of another company.

A) accounted for its investment in another company by the equity method.

B) significant influence over the operating and financial policies of another company.

C) the controlling financial interest in another company.

D) a substantial equity interest in the net assets of another company.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

12

The only significant difference between the provisions of international accounting standards as promulgated by IAS 39 and U.S.accounting standards under FASB ASC Topic 860 (Transfers and Servicing is

A) IAS 39 requires accounting for all investments in debt securities to be on a fair value basis while ASC 860 does not.

B) IAS 39 allows all unrealized gains and losses on securities valued at fair value to be reported in net income for the period while ASC 860 does not.

C) IAS 39 requires trading securities to be reported on a fair value basis but not securities available for sale.

D) IAS 39 does not permit the reporting of unrealized gains and losses on securities other than trading securities to be recorded as part of equity.

A) IAS 39 requires accounting for all investments in debt securities to be on a fair value basis while ASC 860 does not.

B) IAS 39 allows all unrealized gains and losses on securities valued at fair value to be reported in net income for the period while ASC 860 does not.

C) IAS 39 requires trading securities to be reported on a fair value basis but not securities available for sale.

D) IAS 39 does not permit the reporting of unrealized gains and losses on securities other than trading securities to be recorded as part of equity.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

13

Which securities are purchased with the intent of selling them in the near future?

A) Marketable equity securities

B) Available-for-sale securities

C) Trading securities

D) Held-to-maturity securities

A) Marketable equity securities

B) Available-for-sale securities

C) Trading securities

D) Held-to-maturity securities

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

14

When an investor uses the equity method to account for investments in common stock,the investment account will be increased when the investor recognizes

A) a proportionate share of the net income of the investee.

B) a cash dividend received from the investee.

C) periodic amortization of an intangible arising from contractual rights acquired in the purchase.

D) depreciation related to the excess of market value over book value of the investee's depreciable assets at the date of purchase by the investor.

A) a proportionate share of the net income of the investee.

B) a cash dividend received from the investee.

C) periodic amortization of an intangible arising from contractual rights acquired in the purchase.

D) depreciation related to the excess of market value over book value of the investee's depreciable assets at the date of purchase by the investor.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

15

Changes in fair value of securities are reported in the income statement for which type of securities?

A) Marketable equity securities

B) Available-for-sale securities

C) Held-to-maturity securities

D) Trading securities

A) Marketable equity securities

B) Available-for-sale securities

C) Held-to-maturity securities

D) Trading securities

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

16

Under the cost method of accounting for unconsolidated investments in common stock,goodwill amortization

A) reduces the investment account.

B) increases the investment account.

C) reduces both investment income and the investment account.

D) is not recorded.

A) reduces the investment account.

B) increases the investment account.

C) reduces both investment income and the investment account.

D) is not recorded.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

17

When an investor uses the cost method to account for investments in common stock,cash dividends received by the investor from the investee should normally be recorded as

A) a deduction from the investment account.

B) dividend revenue.

C) an addition to the investor's share of the investee's profit.

D) a deduction from the investor's share of the investee's profit.

A) a deduction from the investment account.

B) dividend revenue.

C) an addition to the investor's share of the investee's profit.

D) a deduction from the investor's share of the investee's profit.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

18

Which category includes only debt securities?

A) Held-to-maturity securities

B) Available-for-sale securities

C) Marketable equity securities

D) Trading securities

A) Held-to-maturity securities

B) Available-for-sale securities

C) Marketable equity securities

D) Trading securities

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

19

For which type of investments would unrealized increases and decreases be recorded directly in an owners' equity account?

A) Equity method securities

B) Available-for-sale securities

C) Trading securities

D) Held-to-maturity securities

A) Equity method securities

B) Available-for-sale securities

C) Trading securities

D) Held-to-maturity securities

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

20

A debit balance in the account Market Adjustment--Available-for-Sale Securities at the end of a year should be interpreted as the net

A) unrealized holding gain for that year.

B) realized holding gain for that year.

C) unrealized holding gain to date.

D) realized holding gain to date.

A) unrealized holding gain for that year.

B) realized holding gain for that year.

C) unrealized holding gain to date.

D) realized holding gain to date.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

21

On April 1,2014,Ziba Inc.purchased as a temporary investment $100,000,face amount,10% U.S.Treasury notes;they pay interest semiannually on January 1 and July 1.The notes were purchased at 102.Which of the following entries correctly records this purchase?

A) Trading Securities--10% U.S.Treasury Notes.100,000

Interest Receivable.........................2,500

Premium on Trading Securities...............2,000

Cash.....................................104,500

B) Trading Securities--10% U.S.Treasury Notes.102,000

Interest Receivable.........................2,500

Cash.....................................104,500

C) Trading Securities--10% U.S.Treasury Notes.100,000

Interest Receivable.........................4,500

Cash.....................................104,500

D) Trading Securities--10% U.S.Treasury Notes.102,000

Cash.....................................102,000

A) Trading Securities--10% U.S.Treasury Notes.100,000

Interest Receivable.........................2,500

Premium on Trading Securities...............2,000

Cash.....................................104,500

B) Trading Securities--10% U.S.Treasury Notes.102,000

Interest Receivable.........................2,500

Cash.....................................104,500

C) Trading Securities--10% U.S.Treasury Notes.100,000

Interest Receivable.........................4,500

Cash.....................................104,500

D) Trading Securities--10% U.S.Treasury Notes.102,000

Cash.....................................102,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

22

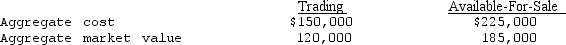

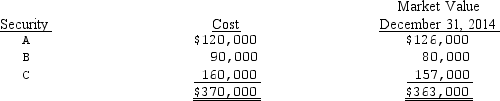

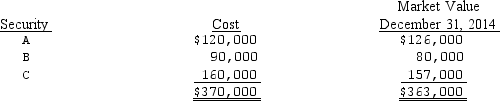

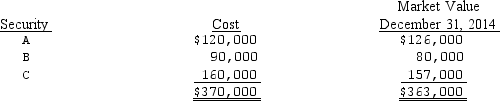

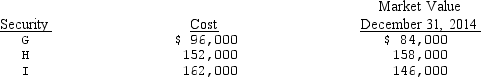

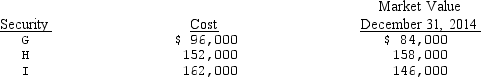

Aronson,Inc.began business on January 1,2014,and at December 31,2014,Aronson had the following investment portfolios of equity securities:  None of the declines is judged to be other than temporary.Unrealized losses at December 31,2014,should be recorded with corresponding charges against

None of the declines is judged to be other than temporary.Unrealized losses at December 31,2014,should be recorded with corresponding charges against

Stockholders'

Income Equity

A) $70,000 $ 0

B) $40,000 $30,000

C) $30,000 $40,000

D) $ 0 $70,000

None of the declines is judged to be other than temporary.Unrealized losses at December 31,2014,should be recorded with corresponding charges against

None of the declines is judged to be other than temporary.Unrealized losses at December 31,2014,should be recorded with corresponding charges againstStockholders'

Income Equity

A) $70,000 $ 0

B) $40,000 $30,000

C) $30,000 $40,000

D) $ 0 $70,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

23

In March of 2013,Mars Corp.bought 45,000 shares of Elite Corp.'s listed stock for $450,000 and classified the shares as available-for-sale securities.The market value of these shares had declined to $300,000 by December 31,2013.Mars changed the classification of these shares to trading securities in June of 2014 when the market value of this investment in Elite's stock had risen to $345,000.How much should Mars include as a loss on transfer of securities in its determination of net income for 2014?

A) $0

B) $45,000

C) $105,000

D) $150,000

A) $0

B) $45,000

C) $105,000

D) $150,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

24

On January 1,2014,Comas Corporation acquired Partly,Inc.as a long-term investment for $250,000 (a 30 percent common stock interest in Partly).On that date,Partly had net assets with a book value and current market value of $800,000.During 2014,Partly reported net income of $85,000 and declared and paid cash dividends of $20,000.What is the maximum amount of income that Comas should report from this investment for 2014?

A) $25,500

B) $21,000

C) $6,000

D) $33,000

A) $25,500

B) $21,000

C) $6,000

D) $33,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

25

Cartel Inc.owns 35 percent of Elliott Corporation.During the calendar year 2014,Elliott had net earnings of $300,000 and paid dividends of $36,000.Cartel mistakenly accounted for the investment in Elliott using the cost method rather than the equity method of accounting.What effect would this have on the investment account and net income,respectively?

A) Understate,overstate

B) Overstate,understate

C) Overstate,overstate

D) Understate,understate

A) Understate,overstate

B) Overstate,understate

C) Overstate,overstate

D) Understate,understate

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

26

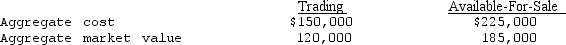

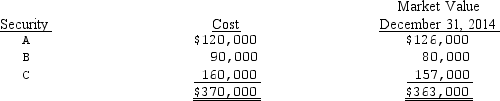

Elio Co.purchased the following portfolio of trading securities during 2014 and reported the following balances at December 31,2014.No sales occurred during 2014.All declines are considered to be temporary.  The carrying value of the portfolio at December 31,2014,on Elio Co.'s balance sheet would be

The carrying value of the portfolio at December 31,2014,on Elio Co.'s balance sheet would be

A) $222,000.

B) $240,000.

C) $242,000.

D) $252,000.

The carrying value of the portfolio at December 31,2014,on Elio Co.'s balance sheet would be

The carrying value of the portfolio at December 31,2014,on Elio Co.'s balance sheet would beA) $222,000.

B) $240,000.

C) $242,000.

D) $252,000.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

27

If an investment in stock is reclassified from available-for-sale securities to trading securities,the stock should be recorded on the date it is reclassified at the

A) market value at the date of acquisition.

B) book value at the date of reclassification.

C) market value at the date of reclassification.

D) lower-of-cost-or-market value at the date of reclassification.

A) market value at the date of acquisition.

B) book value at the date of reclassification.

C) market value at the date of reclassification.

D) lower-of-cost-or-market value at the date of reclassification.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

28

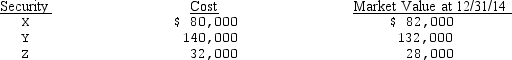

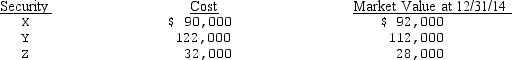

Anson Company began operations in 2013.The company's trading securities portfolio,which did not change in composition during 2014,is as follows:  Ignoring income taxes,what amount should be reported as an unrealized loss on trading securities in Anson's 2014 income statement?

Ignoring income taxes,what amount should be reported as an unrealized loss on trading securities in Anson's 2014 income statement?

A) $0

B) $15,000

C) $25,000

D) $40,000

Ignoring income taxes,what amount should be reported as an unrealized loss on trading securities in Anson's 2014 income statement?

Ignoring income taxes,what amount should be reported as an unrealized loss on trading securities in Anson's 2014 income statement?A) $0

B) $15,000

C) $25,000

D) $40,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

29

On August 1,2013,Abruzzo Corp.acquired 10,000 of the outstanding shares of Tuscany Co.On January 2,2014,Abruzzo acquired an additional 20,000 shares of Tuscany Co. ,which brought the total ownership to 30,000 shares.Using the normal guidelines for percentages of ownership and assuming that Tuscany Co.had 100,000 shares outstanding during 2013 and 2014,Abruzzo Corp.should account for the investment in Tuscany Co.by using the

A) cost method in 2013 and the equity method in 2014.

B) cost method in 2013,retroactively adjusting the investment account to the equity method at the beginning of 2014,and using the equity method in 2014.

C) equity method for 2013 and 2014.

D) cost method in 2013 and 2014 for the 10,000 shares acquired in 2013,and using the equity method in 2014 for the 20,000 shares acquired in 2014.

A) cost method in 2013 and the equity method in 2014.

B) cost method in 2013,retroactively adjusting the investment account to the equity method at the beginning of 2014,and using the equity method in 2014.

C) equity method for 2013 and 2014.

D) cost method in 2013 and 2014 for the 10,000 shares acquired in 2013,and using the equity method in 2014 for the 20,000 shares acquired in 2014.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

30

Angular Co.purchased the following portfolio of available-for-sale securities during 2014 and reported the following balances at December 31,2014.No sales occurred during 2014.All declines are considered to be temporary.  Angular Co.should report what amount related to the securities transactions in its 2014 income statement?

Angular Co.should report what amount related to the securities transactions in its 2014 income statement?

A) $0

B) $2,000 unrealized loss

C) $10,000 unrealized loss

D) $12,000 unrealized loss

Angular Co.should report what amount related to the securities transactions in its 2014 income statement?

Angular Co.should report what amount related to the securities transactions in its 2014 income statement?A) $0

B) $2,000 unrealized loss

C) $10,000 unrealized loss

D) $12,000 unrealized loss

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

31

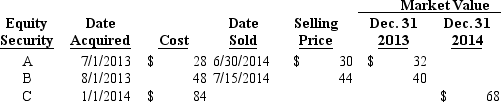

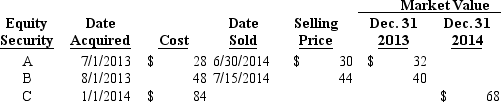

Sanders Company began business in February of 2013.During the year,Sanders purchased the three trading securities listed below.On its December 31,2013,balance sheet,Sanders appropriately reported a $4,000 credit balance in its Market Adjustment--Trading Securities account.There was no change during 2014 in the composition of Sanders' portfolio of trading securities.Pertinent data are as follows:  What amount of loss on these securities should be included in Sanders' income statement for the year ended December 31,2014?

What amount of loss on these securities should be included in Sanders' income statement for the year ended December 31,2014?

A) $0

B) $3,000

C) $7,000

D) $11,000

What amount of loss on these securities should be included in Sanders' income statement for the year ended December 31,2014?

What amount of loss on these securities should be included in Sanders' income statement for the year ended December 31,2014?A) $0

B) $3,000

C) $7,000

D) $11,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

32

On January 2,2013,Bismark Corporation bought 20 percent of Congeal Corporation's capital stock for $60,000 and classified it as available-for-sale securities.Congeal's net incomes for the years ended December 31,2013,and 2014,were $20,000 and $100,000,respectively.During 2014,Congeal declared a dividend of $110,000.No dividends were declared in 2013.On December 31,2014,the fair value of the Congeal stock owned by Bismark had increased to $90,000.How much should Bismark show on its 2014 income statement as income from this investment?

A) $18,000

B) $20,000

C) $22,000

D) $44,000

A) $18,000

B) $20,000

C) $22,000

D) $44,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

33

In January 2014,Albert Corporation acquired 20 percent of the outstanding common stock of Peter Company for $1,120,000.This investment gave Albert the ability to exercise significant influence over Peter.The book value of the acquired shares was $840,000.The excess of cost over book value was attributed to an identifiable intangible asset that was undervalued on Peter's balance sheet and that had a remaining useful life of ten years.For the year ended December 31,2014,Peter reported net income of $252,000 and paid cash dividends of $56,000 on its common stock.What is the proper carrying value of Albert's investment in Peter at December 31,2014?

A) $1,080,800

B) $1,092,000

C) $1,131,200

D) $1,181,600

A) $1,080,800

B) $1,092,000

C) $1,131,200

D) $1,181,600

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

34

Samba Company acquired 10,000 shares of the common stock of Pati Corp.in July 2014.The following January,Pati announced a $100,000 net income for 2014 and declared a cash dividend of $.50 per share on its 100,000 shares of outstanding common stock.The Samba Company dividend revenue from Pati Corp.in January 2014 would be

A) $0.

B) $2,500.

C) $5,000.

D) $10,000.

A) $0.

B) $2,500.

C) $5,000.

D) $10,000.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

35

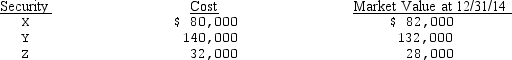

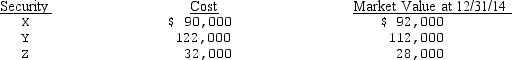

Tarkenton Corporation purchased the following portfolio of trading securities during 2014 and reported the following balances at December 31,2014.No sales occurred during 2014.All declines are considered to be temporary.  The only transaction in 2015 was the sale of security Z for $35,000 on December 31,2015.The market values for the other securities at December 31,2015,were the same as at December 31,2014.Tarkenton's entry to record the sale of security Z would include a

The only transaction in 2015 was the sale of security Z for $35,000 on December 31,2015.The market values for the other securities at December 31,2015,were the same as at December 31,2014.Tarkenton's entry to record the sale of security Z would include a

A) credit of 32,000 to Realized Gain on Sale of Trading Securities.

B) debit of $3,000 to Realized Gain on Sale of Trading Securities.

C) $3,000 debit to Market Adjustment--Trading Securities.

D) $4,000 debit to Market Adjustment--Trading Securities.

The only transaction in 2015 was the sale of security Z for $35,000 on December 31,2015.The market values for the other securities at December 31,2015,were the same as at December 31,2014.Tarkenton's entry to record the sale of security Z would include a

The only transaction in 2015 was the sale of security Z for $35,000 on December 31,2015.The market values for the other securities at December 31,2015,were the same as at December 31,2014.Tarkenton's entry to record the sale of security Z would include aA) credit of 32,000 to Realized Gain on Sale of Trading Securities.

B) debit of $3,000 to Realized Gain on Sale of Trading Securities.

C) $3,000 debit to Market Adjustment--Trading Securities.

D) $4,000 debit to Market Adjustment--Trading Securities.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

36

Antoine Company began business in February 2013.During the year,Antoine purchased the three trading securities listed below.On its December 31,2013,balance sheet,Antoine appropriately reported a $4,000 debit balance in its Market Adjustment--Trading Securities account.There was no change in 2014 in the composition of Antoine's portfolio of marketable equity securities held as a temporary investment.Pertinent data are as follows:  What amount should Antoine credit to the Market Adjustment--Trading Securities account at December 31,2014?

What amount should Antoine credit to the Market Adjustment--Trading Securities account at December 31,2014?

A) $0

B) $3,000

C) $7,000

D) $11,000

What amount should Antoine credit to the Market Adjustment--Trading Securities account at December 31,2014?

What amount should Antoine credit to the Market Adjustment--Trading Securities account at December 31,2014?A) $0

B) $3,000

C) $7,000

D) $11,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

37

On January 1,2014,Stillman Inc.purchased 30 percent of the outstanding common stock of Overrun Corporation for $516,000 cash.Stillman is accounting for this investment using the equity method.On the date of acquisition,the fair value of Overrun' net assets was $1,240,000.Stillman has determined that the excess of the cost of the investment over its share of Overrun' net assets is attributable to goodwill.Overrun' net income for the year ended December 31,2014,was $360,000.During 2014,Overrun declared and paid cash dividends of $40,000.There were no other transactions between the two companies.Ignoring income taxes,Stillman' statement of income for the year ended December 31,2014,should include "Income From Investment in Overrun Corporation Stock" in the amount of

A) $54,600

B) $74,000.

C) $108,000.

D) $126,000.

A) $54,600

B) $74,000.

C) $108,000.

D) $126,000.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

38

On January 1,2014,Kimba Co.paid $500,000 for 20,000 shares of Flathead Co.'s common stock and classified these shares as trading securities.Kimba does not have the ability to exercise significant influence over Flathead.Flathead declared and paid a dividend of $.50 a share to its stockholders during 2014.Flathead reported net income of $260,000 for the year ended December 31,2014.The fair value of Flathead Co.'s stock at December 31,2014,is $27 per share.What is the net asset amount (which includes both investments and any related market adjustments)attributable to the investment in Flathead that will be included on Kimba's balance sheet at December 31,2014?

A) $530,000

B) $540,000

C) $569,000

D) $579,000

A) $530,000

B) $540,000

C) $569,000

D) $579,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

39

On January 2,2014,Nora Co.acquired 2,000 shares of Stonewall Co.common stock for $8,000 and classified these shares as available-for-sale securities.During 2014,Nora received $6,000 of cash dividends.Nora's share of Stonewall's 2014 earnings (net income)was $5,000.The fair value of Stonewall's stock on December 31,2014,was $7 per share.Nora should report what amount in 2014 related to Stonewall Co.?

A) Revenue of $6,000

B) Revenue of $12,000

C) A $1,000 decrease in the investment account

D) A $1,000 increase in the investment account

A) Revenue of $6,000

B) Revenue of $12,000

C) A $1,000 decrease in the investment account

D) A $1,000 increase in the investment account

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

40

On January 1,2014,Amber Inc.purchased 30 percent of the outstanding common stock of Collar Corporation for $516,000 cash.Amber is accounting for this investment using the equity method.On the date of acquisition,the fair value of Collar' net assets was $1,240,000.Amber has determined that the excess of the cost of the investment over its share of Collar' net assets is attributable to goodwill.Collar' net income for the year ended December 31,2014,was $360,000.During 2014,Collar declared and paid cash dividends of $40,000.There were no other transactions between the two companies.On December 31,2014,the investment in Collar should be recorded as

A) $396,000.

B) $468,000.

C) $612,000.

D) $624,000.

A) $396,000.

B) $468,000.

C) $612,000.

D) $624,000.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

41

On January 1,2014,Bijou Company purchased investment securities costing $3,000 and classified them as available-for-sale.During 2014,Bijou Company sold a portion of these available-for-sale securities with a cost of $1,800 for $1,500.The market value of the remainder of these securities available-for-sale at December 31,2014,was $1,300.Bijou prepares its statement of cash flows using the indirect method. Which of the following represents the effect of these transactions on the statement of cash flows for Bijou Company for the year ending December 31,2014?

Operating Activities Investing Activities

A) $200 increase $1,500 decrease

B) $300 decrease $1,400 decrease

C) $300 increase $1,400 decrease

D) $300 increase $1,500 decrease

Operating Activities Investing Activities

A) $200 increase $1,500 decrease

B) $300 decrease $1,400 decrease

C) $300 increase $1,400 decrease

D) $300 increase $1,500 decrease

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

42

When an entity reduces its interest in an investment in equity securities accounted for by the equity method,and changes to the fair value method,what is the initial cost value for purposes of subsequent changes in market value?

A) Original cost

B) Book value at the date of change

C) Market value at the date of the change

D) Market value at the date of acquisition

A) Original cost

B) Book value at the date of change

C) Market value at the date of the change

D) Market value at the date of acquisition

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

43

King Company purchased 30% of Andei Company for $2,500,000 at the beginning of the current year.Andei earned $400,000 and declared and paid $300,000 of dividends during the current year.Which of the following correctly describes the effect of these transactions on the statement of cash flows of King Company prepared under the indirect method? Operating Activities Investing Activities

A) $2,530,000 decrease No effect

B) $2,620,000 decrease No effect

C) $30,000 decrease $2,500,000 decrease

D) $120,000 decrease $2,500,000 decrease

A) $2,530,000 decrease No effect

B) $2,620,000 decrease No effect

C) $30,000 decrease $2,500,000 decrease

D) $120,000 decrease $2,500,000 decrease

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

44

In January of 2014,Bonnie Corporation acquired 20% of the outstanding voting common stock of Clyde Company for $280,000.This investment enabled Bonnie to exercise significant influence over Clyde.The book value of the acquired shares was $210,000.The excess of cost over book value was attributed to an identifiable intangible asset that was undervalued on Clyde's balance sheet and that had a remaining useful life of 10 years. For the year ended December 31,2014,Clyde reported income of $63,000 and paid cash dividends of $14,000 on its common stock.What is the proper carrying value of Bonnie's investment in Clyde at December 31,2014?

A) $270,000

B) $273,000

C) $280,000

D) $282,800

A) $270,000

B) $273,000

C) $280,000

D) $282,800

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

45

On August 31,2014,Steinway Company purchased the following available-for-sale securities:  On December 31,2014,Steinway reclassified its investment in security I from available-for-sale securities to trading securities.What total amount of loss on these securities should be included in Steinway' income statement for the year ended December 31,2014?

On December 31,2014,Steinway reclassified its investment in security I from available-for-sale securities to trading securities.What total amount of loss on these securities should be included in Steinway' income statement for the year ended December 31,2014?

A) $0

B) $16,000

C) $22,000

D) $28,000

On December 31,2014,Steinway reclassified its investment in security I from available-for-sale securities to trading securities.What total amount of loss on these securities should be included in Steinway' income statement for the year ended December 31,2014?

On December 31,2014,Steinway reclassified its investment in security I from available-for-sale securities to trading securities.What total amount of loss on these securities should be included in Steinway' income statement for the year ended December 31,2014?A) $0

B) $16,000

C) $22,000

D) $28,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

46

On October 1,Ryan Company purchased $200,000 face value 12% bonds for 98 plus accrued interest and brokerage fees and classified them as held-to-maturity securities.Interest is paid semiannually on January 1 and July 1.Brokerage fees for this transaction were $700.At what amount should this acquisition of bonds be recorded?

A) $196,000

B) $196,700

C) $202,000

D) $202,700

A) $196,000

B) $196,700

C) $202,000

D) $202,700

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

47

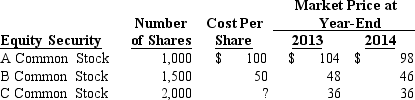

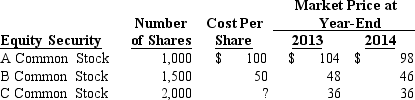

Neutron Corporation held the following short-term investments in equity securities classified as trading securities:  The valuation account is a net credit of $8,000 at the end of 2014.What was the original cost per share of the C common stock?

The valuation account is a net credit of $8,000 at the end of 2014.What was the original cost per share of the C common stock?

A) $22

B) $26

C) $30

D) $36

The valuation account is a net credit of $8,000 at the end of 2014.What was the original cost per share of the C common stock?

The valuation account is a net credit of $8,000 at the end of 2014.What was the original cost per share of the C common stock?A) $22

B) $26

C) $30

D) $36

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

48

Ignoring income taxes,choose the correct response below regarding total stockholders' equity resulting from classifying all investments for a firm either as trading securities or securities available-for-sale.

A) Stockholders' equity is the same regardless of the classification

B) Stockholders' equity is greater if the investments are classified as available-for-sale.

C) .Stockholders' equity is greater if the investments are classified as trading securities.

D) If there have been unrealized gains,classification as trading securities results in higher stockholders' equity.

A) Stockholders' equity is the same regardless of the classification

B) Stockholders' equity is greater if the investments are classified as available-for-sale.

C) .Stockholders' equity is greater if the investments are classified as trading securities.

D) If there have been unrealized gains,classification as trading securities results in higher stockholders' equity.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

49

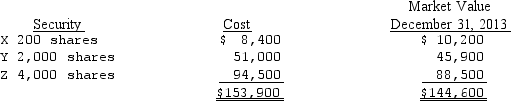

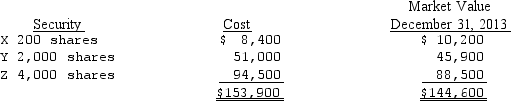

During 2013,Rubble Company purchased marketable equity securities as a short-term investment and classified them as trading securities.The cost and market value at December 31,2013,were as follows:  Rubble sold 1,000 shares of Company Y stock on March 16,2014,for $24 per share,incurring $1,300 in brokerage commissions and taxes.On the sale,Rubble should report a realized loss of

Rubble sold 1,000 shares of Company Y stock on March 16,2014,for $24 per share,incurring $1,300 in brokerage commissions and taxes.On the sale,Rubble should report a realized loss of

A) $0.

B) $1,550

C) $2,300

D) $2,800

Rubble sold 1,000 shares of Company Y stock on March 16,2014,for $24 per share,incurring $1,300 in brokerage commissions and taxes.On the sale,Rubble should report a realized loss of

Rubble sold 1,000 shares of Company Y stock on March 16,2014,for $24 per share,incurring $1,300 in brokerage commissions and taxes.On the sale,Rubble should report a realized loss ofA) $0.

B) $1,550

C) $2,300

D) $2,800

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

50

Eric Company reports its income from its investment in Kate Company under the equity method.Eric recognized income of $150,000 from its investment in Kate during the current year.No dividends were declared or paid by Kate during the year.Eric would show the $150,000 in its statement of cash flows for the current year prepared under the indirect method as

A) cash from investing activities.

B) a reduction of the investment account.

C) a deduction from net income in the operating activities section.

D) a noncash activity.

A) cash from investing activities.

B) a reduction of the investment account.

C) a deduction from net income in the operating activities section.

D) a noncash activity.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

51

Other-than-temporary impairments in the value of equity securities classified as available-for-sale should be made

A) on the individual security level.

B) in the aggregate for each type of security (i.e. ,common or preferred).

C) either on the individual security level or in the aggregate.

D) in none of these approaches.

A) on the individual security level.

B) in the aggregate for each type of security (i.e. ,common or preferred).

C) either on the individual security level or in the aggregate.

D) in none of these approaches.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

52

Aloe Company reports its income from its investment in Palm Company under the equity method.Aloe recognized income of $125,000 from its investment in Palm during the current year.Palm declared and paid dividends of which Aloe's share was $25,000 during the current year.The effect of these activities on the operating section of the statement of cash flows of Aloe Company prepared for the current year under the indirect method would be

A) an increase of $125,000.

B) a deduction of $125,000.

C) a deduction of $100,000.

D) an increase of $100,000.

A) an increase of $125,000.

B) a deduction of $125,000.

C) a deduction of $100,000.

D) an increase of $100,000.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

53

The market rate of interest for a bond issue that sells for more than its par value is

A) less than the rate stated on the bond.

B) equal to the rate stated on the bond.

C) higher than the rate stated on the bond.

D) independent of the rate stated on the bond.

A) less than the rate stated on the bond.

B) equal to the rate stated on the bond.

C) higher than the rate stated on the bond.

D) independent of the rate stated on the bond.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

54

When an investor purchases sufficient common stock to gain significant influence over the investee,what is the proper accounting treatment of any excess of cost over book value acquired?

A) The excess remains in the asset account until the investment is sold.

B) The excess is immediately charged to expense in the period in which the investment is made.

C) The excess is amortized over the period of time that is reasonable in light of the underlying cause of the excess.

D) The excess is charged to retained earnings at the time the investor resells the common stock.

A) The excess remains in the asset account until the investment is sold.

B) The excess is immediately charged to expense in the period in which the investment is made.

C) The excess is amortized over the period of time that is reasonable in light of the underlying cause of the excess.

D) The excess is charged to retained earnings at the time the investor resells the common stock.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

55

When an enterprise increases its interest in an investment in equity securities accounted for by the fair value method,and changes to the equity method,what is the initial carrying value for purposes of subsequent application of the equity method?

A) Book value at the date of the change

B) Original cost plus or minus the net market value change since acquisition

C) Market value at the date of the change

D) The amount that would be reflected in the investment account had the equity method been in use continually since the purchase of the securities

A) Book value at the date of the change

B) Original cost plus or minus the net market value change since acquisition

C) Market value at the date of the change

D) The amount that would be reflected in the investment account had the equity method been in use continually since the purchase of the securities

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

56

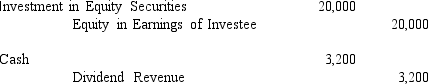

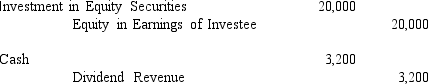

An investor that uses the equity method of accounting for its investment in a 40 percent-owned investee that earned $50,000 and paid $8,000 in dividends,made the following entries:  What effect will these entries have on the parent corporation's statement of financial position?

What effect will these entries have on the parent corporation's statement of financial position?

A) Investment in subsidiary understated,retained earnings understated.

B) Investment in subsidiary overstated,retained earnings overstated.

C) Investment in subsidiary overstated,retained earnings understated.

D) Financial position will be fairly stated.

What effect will these entries have on the parent corporation's statement of financial position?

What effect will these entries have on the parent corporation's statement of financial position?A) Investment in subsidiary understated,retained earnings understated.

B) Investment in subsidiary overstated,retained earnings overstated.

C) Investment in subsidiary overstated,retained earnings understated.

D) Financial position will be fairly stated.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following is true regarding the provisions of IAS 39?

A) IAS 39 does not require unrealized gains and losses on trading securities to be recognized as part of net income.

B) IAS 39 requires gains and losses on available for sale securities to be recognized as part of net income.

C) IAS 39 allows companies to choose between recognizing gains and losses on available-for-sale securities as part of net income or as part of stockholders' equity.

D) IAS 39 allows companies to choose between recognizing gains and losses on trading securities as part of net income or as part of stockholders' equity.

A) IAS 39 does not require unrealized gains and losses on trading securities to be recognized as part of net income.

B) IAS 39 requires gains and losses on available for sale securities to be recognized as part of net income.

C) IAS 39 allows companies to choose between recognizing gains and losses on available-for-sale securities as part of net income or as part of stockholders' equity.

D) IAS 39 allows companies to choose between recognizing gains and losses on trading securities as part of net income or as part of stockholders' equity.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

58

On January 1,2014,Sudan Company purchased investment securities costing $4,000 and classified them as trading securities.During 2014,Sudan Company sold a portion of these trading securities with a cost of $1,800 for $1,500.The market value of the remainder of these trading securities at December 31,2014,was $1,400.Sudan prepares its statement of cash flows using the indirect method. Which of the following represents the effect of these transactions on the statement of cash flows for Sudan Company for the year ending December 31,2014?

Operating Activities Investing Activities

A) $2,200 decrease No effect

B) $1,400 decrease No effect

C) $200 increase $1,500 decrease

D) $300 increase $1,500 decrease

Operating Activities Investing Activities

A) $2,200 decrease No effect

B) $1,400 decrease No effect

C) $200 increase $1,500 decrease

D) $300 increase $1,500 decrease

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

59

A firm purchased bonds to be classified as an investment in securities available-for-sale.The bonds were purchased at a premium.Assume the market price of the bond is volatile.Given these facts,which of the following is correct?

A) Less cash interest is received each year than interest revenue is recognized

B) The ending valuation allowance account balance will depend on ending market value and original cost

C) The ending valuation allowance account balance will depend on ending market value and original cost adjusted for amortization of premium

D) The premium is ignored because the bonds are not classified as held-to-maturity

A) Less cash interest is received each year than interest revenue is recognized

B) The ending valuation allowance account balance will depend on ending market value and original cost

C) The ending valuation allowance account balance will depend on ending market value and original cost adjusted for amortization of premium

D) The premium is ignored because the bonds are not classified as held-to-maturity

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

60

The following information relates to Bower Company's short-term investment in equity securities available for sale at the end of 2013 and 2014 (in 000s):  Bower's net realized and unrealized gains and losses for 2014,respectively,would be

Bower's net realized and unrealized gains and losses for 2014,respectively,would be

A) $2 realized loss;$8 unrealized loss.

B) $2 realized loss;$16 unrealized loss.

C) $2 realized loss;$16 unrealized gain.

D) $2 realized loss;$8 unrealized gain.

Bower's net realized and unrealized gains and losses for 2014,respectively,would be

Bower's net realized and unrealized gains and losses for 2014,respectively,would beA) $2 realized loss;$8 unrealized loss.

B) $2 realized loss;$16 unrealized loss.

C) $2 realized loss;$16 unrealized gain.

D) $2 realized loss;$8 unrealized gain.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

61

Fennel owned 40 percent of Actual's common stock,and as a result,accounted for the investment using the equity method.After the fifth year of owning the stock,the investment account had a credit balance.This could only happen if Fennel

A) recorded net losses that were more than the net income.

B) distributed dividends in excess of the accumulated earnings.

C) had accumulated income that was less than the additional depreciation that Fennel recorded as a result of purchasing the stock when market value of the assets was in excess of book value.

D) experienced any,or a combination,of the conditions described in the three other responses.

A) recorded net losses that were more than the net income.

B) distributed dividends in excess of the accumulated earnings.

C) had accumulated income that was less than the additional depreciation that Fennel recorded as a result of purchasing the stock when market value of the assets was in excess of book value.

D) experienced any,or a combination,of the conditions described in the three other responses.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

62

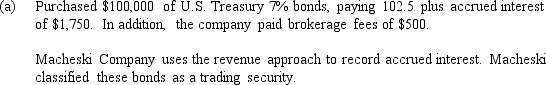

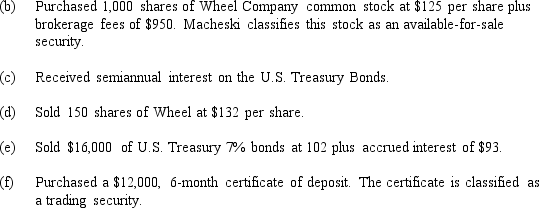

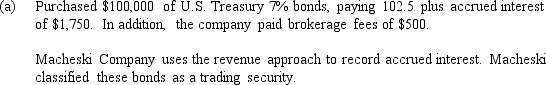

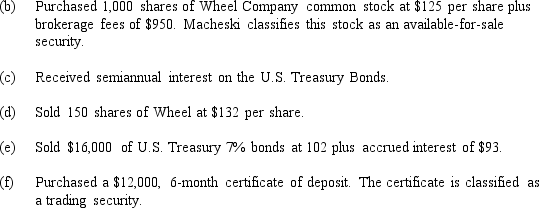

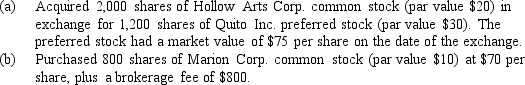

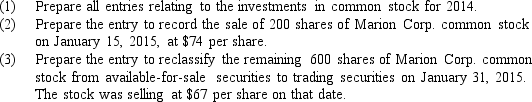

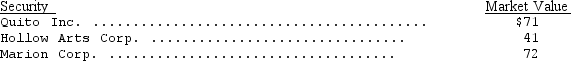

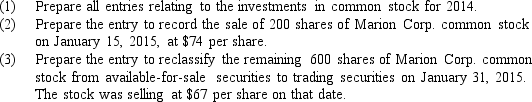

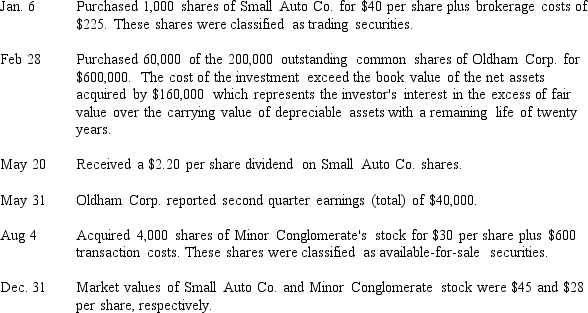

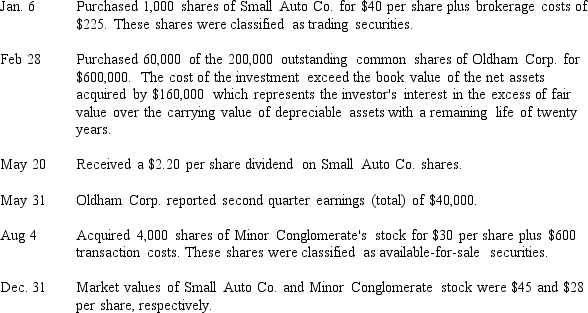

The following transactions of the Macheski Company were completed during the fiscal year just ended:

Prepare the entries necessary to record the above transactions.

Prepare the entries necessary to record the above transactions.

Prepare the entries necessary to record the above transactions.

Prepare the entries necessary to record the above transactions.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

63

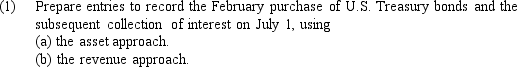

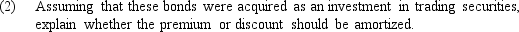

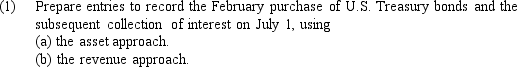

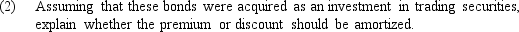

On February 1,2014,Andover Inc.had excess cash on hand.The controller suggested to management that the company buy $300,000 of U.S.Treasury bonds selling at 102 and paying 8 percent interest.Interest payments on these bonds are made semiannually on January 1 and July 1.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

64

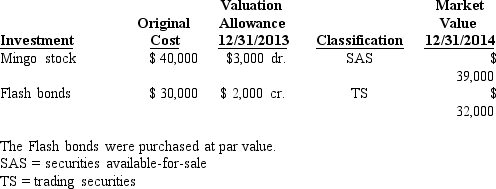

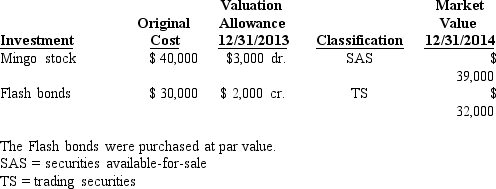

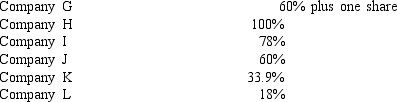

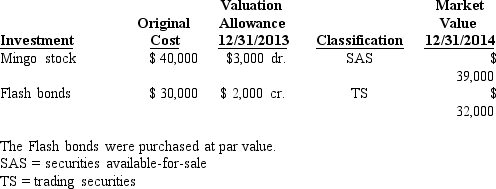

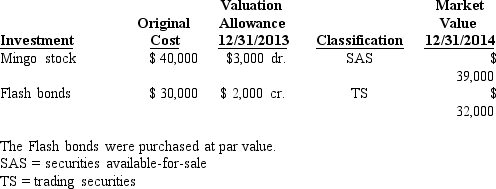

The following information is available for an enterprise's security investments as of December 31,2014:  What is the 2014 holding gain or loss recognized in 2014 earnings and directly to stockholders' equity?

What is the 2014 holding gain or loss recognized in 2014 earnings and directly to stockholders' equity?

A) Earnings: $4,000 loss;Stockholders' Equity: $4,000 loss

B) Earnings: $4,000 gain;Stockholders' Equity: $4,000 gain

C) Earnings: $4,000 loss;Stockholders' Equity: $4,000 gain

D) Earnings: $4,000 gain;Stockholders' Equity: $4,000 loss

What is the 2014 holding gain or loss recognized in 2014 earnings and directly to stockholders' equity?

What is the 2014 holding gain or loss recognized in 2014 earnings and directly to stockholders' equity?A) Earnings: $4,000 loss;Stockholders' Equity: $4,000 loss

B) Earnings: $4,000 gain;Stockholders' Equity: $4,000 gain

C) Earnings: $4,000 loss;Stockholders' Equity: $4,000 gain

D) Earnings: $4,000 gain;Stockholders' Equity: $4,000 loss

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

65

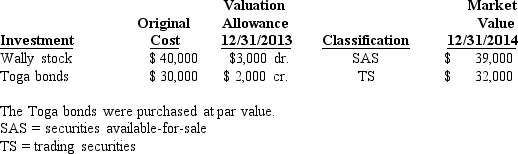

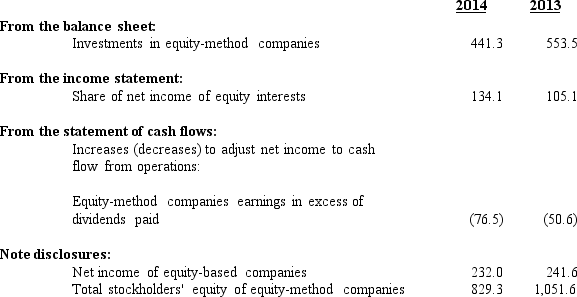

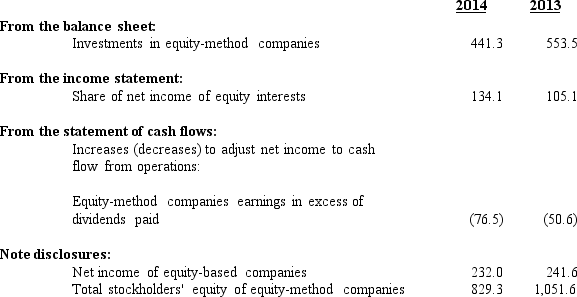

The following selected information is available from the financial statements of a large global company:

Required:

Required:

Use the financial information above to answer the following questions:

Required:

Required:Use the financial information above to answer the following questions:

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

66

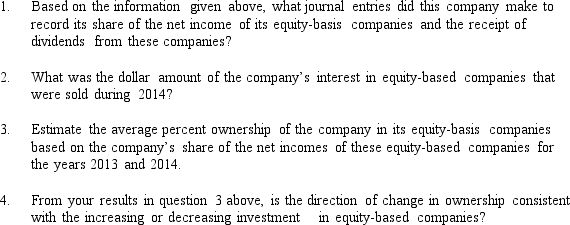

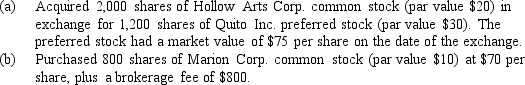

In 2014,Quito Inc.purchased stock as follows:

At December 31,2014,the market values of the securities were as follows:

At December 31,2014,the market values of the securities were as follows:

The investments in common stock are classified by Quito Inc.as available-for-sale securities accounted for by the cost method.The fiscal year of Quito ends on December 31.

The investments in common stock are classified by Quito Inc.as available-for-sale securities accounted for by the cost method.The fiscal year of Quito ends on December 31.

At December 31,2014,the market values of the securities were as follows:

At December 31,2014,the market values of the securities were as follows: The investments in common stock are classified by Quito Inc.as available-for-sale securities accounted for by the cost method.The fiscal year of Quito ends on December 31.

The investments in common stock are classified by Quito Inc.as available-for-sale securities accounted for by the cost method.The fiscal year of Quito ends on December 31.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

67

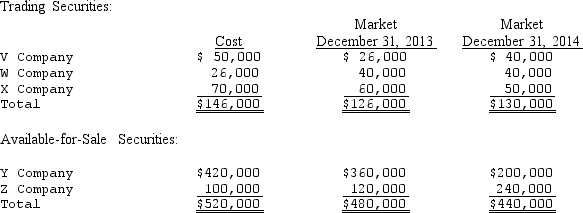

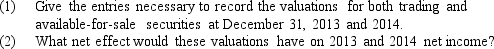

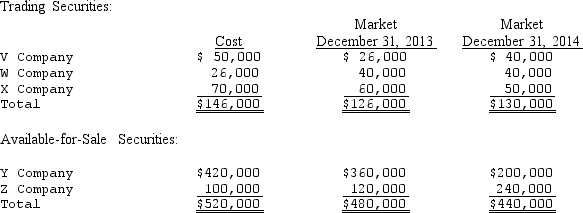

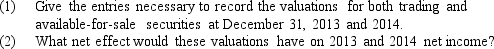

Springer Inc.carries the following marketable equity securities on its books at December 31,2013,and 2014.All securities were purchased during 2013 and there were no beginning balances in any market adjustment accounts.

The cost method is used in accounting for all investments in securities.

The cost method is used in accounting for all investments in securities.

The cost method is used in accounting for all investments in securities.

The cost method is used in accounting for all investments in securities.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

68

On July 1,2014,Hilltop Systems acquired 8,000 shares of Accurate Services' 40,000 outstanding common shares at a cost of $240,000.The book value of Accurate's net assets on that date was $880,000.The following data pertain to Accurate Services for 2014:

Any excess of cost over book value is attributable to depreciable properties the market value of which exceeds the carrying value.The remaining life of the equipment is 10 years.

Any excess of cost over book value is attributable to depreciable properties the market value of which exceeds the carrying value.The remaining life of the equipment is 10 years.

Any excess of cost over book value is attributable to depreciable properties the market value of which exceeds the carrying value.The remaining life of the equipment is 10 years.

Any excess of cost over book value is attributable to depreciable properties the market value of which exceeds the carrying value.The remaining life of the equipment is 10 years.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

69

Gabriel Co.executed the following long-term investment transactions during the current year.

Prepare journal entries with appropriate supporting computations for the year's transactions.

Prepare journal entries with appropriate supporting computations for the year's transactions.

Prepare journal entries with appropriate supporting computations for the year's transactions.

Prepare journal entries with appropriate supporting computations for the year's transactions.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

70

The following information is available for an enterprise's security investments as of December 31,2014:

In June 2015,the enterprise decided to reclassify the Mingo stock as trading securities.The stock had a market value of $41,000 at the time of the reclassification. What amount of holding gain or loss is immediately recognized in 2015 earnings?

A) $2,000 gain

B) $1,000 gain

C) $3,000 gain

D) $1,000 loss

In June 2015,the enterprise decided to reclassify the Mingo stock as trading securities.The stock had a market value of $41,000 at the time of the reclassification. What amount of holding gain or loss is immediately recognized in 2015 earnings?

A) $2,000 gain

B) $1,000 gain

C) $3,000 gain

D) $1,000 loss

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

71

On January 1,2014,Farming Associates purchased 25 percent of the outstanding shares of stock of Anders Corp.for $125,000 cash.The investment will be accounted for by the equity method.On that date,Anders's net assets (book and fair value)were $250,000.Farming has determined that the excess of the cost of its investment in Anders over its share of Anders's net assets is attributable to equipment whose market value exceeds its carrying value by $95,000 and to an operating license whose market value exceeds its carrying value by $95,000.The remaining useful life of the equipment is ten years and the remaining useful life of the operating license is 20 years.

Anders's net income for the year ended December 31,2014,was $55,000.During 2014,Farming received $4,500 cash dividends from Anders.There were no other transactions between the two companies.

Compute the amount that would be reported on Farming Associates' books for the investment in Anders Corp.at December 31,2014.

Anders's net income for the year ended December 31,2014,was $55,000.During 2014,Farming received $4,500 cash dividends from Anders.There were no other transactions between the two companies.

Compute the amount that would be reported on Farming Associates' books for the investment in Anders Corp.at December 31,2014.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

72

At January 1,2014,a company had a net valuation allowance account credit balance for investments in securities available-for-sale of $20,000.At December 31,2014,the total cost of the relevant portfolio was $300,000,and total market value was $275,000.The entry required on December 31,2014,would reflect a

A) $5,000 decrease in net income.

B) $25,000 decrease in net income.

C) credit of $5,000 to the valuation allowance account.

D) debit of $25,000 to the unrealized loss account.

A) $5,000 decrease in net income.

B) $25,000 decrease in net income.

C) credit of $5,000 to the valuation allowance account.

D) debit of $25,000 to the unrealized loss account.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

73

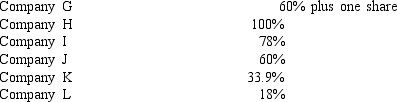

Large,global enterprises typically have an equity interest in other entities throughout the world.Some of the interests represent wholly-owned (100%-owned)subsidiaries,while others represent lesser percentages of ownership.These large global conglomerates provide information on the percentage ownership of their various affiliated companies in the notes to the consolidated financial statements.

The following list of companies represents the ownership percentage of selected companies by a large global company:

Required:

Required:

Explain how you would expect the global company holding the indicated interests to account for each of the companies listed above,based on the percentage ownership reported.

The following list of companies represents the ownership percentage of selected companies by a large global company:

Required:

Required:Explain how you would expect the global company holding the indicated interests to account for each of the companies listed above,based on the percentage ownership reported.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following is true regarding the provisions of International Accounting Standard No.39,"Financial Instruments: Recognition and Measurement (amended 2005)?

A) IAS No.39 applies only to financial assets.

B) IAS No.39 applies only to financial liabilities.

C) IAS No.39 applies only to accounting for derivatives and loans and receivables.

D) IAS No.39 applies to both financial assets and financial liabilities.

A) IAS No.39 applies only to financial assets.

B) IAS No.39 applies only to financial liabilities.

C) IAS No.39 applies only to accounting for derivatives and loans and receivables.

D) IAS No.39 applies to both financial assets and financial liabilities.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

75

The following information is available for an enterprise's security investments as of December 31,2014:

In June 2015,the enterprise decided to reclassify the Flash bonds as securities available-for-sale.The bonds had a market value of $31,000 at the time of the reclassification. What amount of holding gain or loss is immediately recognized in 2015 earnings?

A) $2,000 gain

B) $3,000 gain

C) $1,000 gain

D) $1,000 loss

In June 2015,the enterprise decided to reclassify the Flash bonds as securities available-for-sale.The bonds had a market value of $31,000 at the time of the reclassification. What amount of holding gain or loss is immediately recognized in 2015 earnings?

A) $2,000 gain

B) $3,000 gain

C) $1,000 gain

D) $1,000 loss

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

76

On January 1,2014,Palsoe Corp.acquired 30 percent (13,000 shares)of Nostay Services Inc.common stock for $1,300,000 as a long-term investment.Data from Nostay's 2014 financial statements include the following:

The market value of Nostay Services Inc.common stock on December 31,2014,was $98 per share.Palsoe does not have any other noncurrent investments in securities.

The market value of Nostay Services Inc.common stock on December 31,2014,was $98 per share.Palsoe does not have any other noncurrent investments in securities.

Prepare the necessary journal entries for Palsoe's investment in Nostay Services Inc.common stock under

The market value of Nostay Services Inc.common stock on December 31,2014,was $98 per share.Palsoe does not have any other noncurrent investments in securities.

The market value of Nostay Services Inc.common stock on December 31,2014,was $98 per share.Palsoe does not have any other noncurrent investments in securities.Prepare the necessary journal entries for Palsoe's investment in Nostay Services Inc.common stock under

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

77

On January 1,2013,a company purchased four 5%,$1,000 Esso bonds at 103 as an investment in securities available-for-sale.The bonds pay interest each December 31 and have four years remaining to maturity on the purchase date.The market value of the bonds on December 31,2013,was 107,and on December 31,2014,was 105. The entry to adjust the carrying value of the securities available-for-sale at December 31,2014,will include a

A) debit to accumulated gain on securities available-for-sale in the stockholders' equity section.

B) credit to the investment account of $30.

C) debit to realized loss of $30.

D) debit to unrealized loss of $80.

A) debit to accumulated gain on securities available-for-sale in the stockholders' equity section.

B) credit to the investment account of $30.

C) debit to realized loss of $30.

D) debit to unrealized loss of $80.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

78

Cronie Enterprises purchased 10,000 shares of stock in Vector Corporation for $15 per share.Cronie's broker arranged for Cronie to pay only $4 cash per share at the date of purchase with the remaining balance to be paid in monthly installments. Cronie should record the investment by:

A) debiting the investment account for $40,000.

B) debiting the investment account for $150,000.

C) debiting the investment account for $100,000,and crediting a contra account for $60,000.

D) not making an entry until the cost of the securities is paid in full.

A) debiting the investment account for $40,000.

B) debiting the investment account for $150,000.

C) debiting the investment account for $100,000,and crediting a contra account for $60,000.

D) not making an entry until the cost of the securities is paid in full.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

79

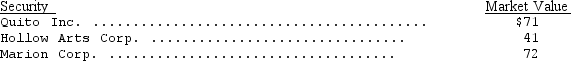

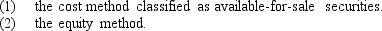

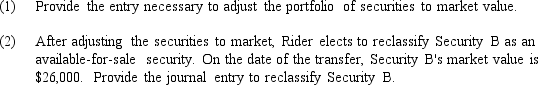

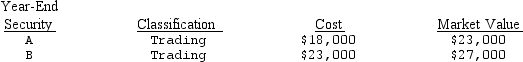

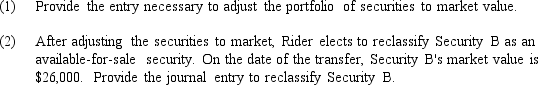

Rider Company had the following portfolio of securities at the end of its first year of operations:

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

80

Under the provisions of FASB ASC Topic 825 (Financial Instruments),

A) the election of the fair value option for investment securities classified as available-for-sale securities would result in unrealized gains and losses on these securities being included in other comprehensive income.

B) the election of the fair value option for investment securities classified as trading securities would result in unrealized gains and losses on these securities being included in other comprehensive income.

C) the election of the fair value option for investment securities classified as held-to-maturity securities would result in unrealized gains and losses on these securities being included in earnings in the income statement.

D) the election of the fair value option for investment securities currently classified as trading,available-for-sale,or held-to-maturity is not available and can only be applied to new securities that an entity purchases.

A) the election of the fair value option for investment securities classified as available-for-sale securities would result in unrealized gains and losses on these securities being included in other comprehensive income.

B) the election of the fair value option for investment securities classified as trading securities would result in unrealized gains and losses on these securities being included in other comprehensive income.

C) the election of the fair value option for investment securities classified as held-to-maturity securities would result in unrealized gains and losses on these securities being included in earnings in the income statement.

D) the election of the fair value option for investment securities currently classified as trading,available-for-sale,or held-to-maturity is not available and can only be applied to new securities that an entity purchases.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck