Deck 11: Investments in Noncurrent Operating Assets-Utilization and Retirement

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/79

Play

Full screen (f)

Deck 11: Investments in Noncurrent Operating Assets-Utilization and Retirement

1

Information needed to compute a depletion charge per unit includes the

A) estimated total amount of resources available for removal.

B) amount of resources removed during the period.

C) cumulative amount of resources removed.

D) amount of resources sold during the period.

A) estimated total amount of resources available for removal.

B) amount of resources removed during the period.

C) cumulative amount of resources removed.

D) amount of resources sold during the period.

A

2

The sum-of-the-years'-digits method of depreciation is being used for a machine with a five-year estimated useful life.What would be the fraction applied to the cost to be depreciated in the fourth year?

A) 2/5

B) 4/5

C) 2/15

D) 4/15

A) 2/5

B) 4/5

C) 2/15

D) 4/15

C

3

Which of the following depreciation methods is computed in the same way as depletion?

A) Straight-line

B) Sum-of-the-years'-digits

C) Double-declining-balance

D) Productive-output

A) Straight-line

B) Sum-of-the-years'-digits

C) Double-declining-balance

D) Productive-output

D

4

Which of the following reasons provides the best theoretical support for accelerated depreciation?

A) Assets are more efficient in early years and initially generate more revenue.

B) Expenses should be allocated in a manner that "smoothes" earnings.

C) Repairs and maintenance costs will probably increase in later periods,so depreciation should decline.

D) Accelerated depreciation provides easier replacement because of the time value of money.

A) Assets are more efficient in early years and initially generate more revenue.

B) Expenses should be allocated in a manner that "smoothes" earnings.

C) Repairs and maintenance costs will probably increase in later periods,so depreciation should decline.

D) Accelerated depreciation provides easier replacement because of the time value of money.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is NOT required to be reported in the financial statements or disclosed in the accompanying notes?

A) Balances of major classes of noncurrent operating assets at the balance sheet date

B) Gross historical cost and accumulated amortization for intangible assets at the balance sheet date

C) Gross historical cost and accumulated depreciation for tangible noncurrent operating assets at the balance sheet date

D) A general description of the cost allocation methods used with respect to major classes of noncurrent operating assets

A) Balances of major classes of noncurrent operating assets at the balance sheet date

B) Gross historical cost and accumulated amortization for intangible assets at the balance sheet date

C) Gross historical cost and accumulated depreciation for tangible noncurrent operating assets at the balance sheet date

D) A general description of the cost allocation methods used with respect to major classes of noncurrent operating assets

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following depreciation methods applies a uniform depreciation rate each period to an asset's book value?

A) Straight-line

B) Declining-balance

C) Units-of-production

D) Sum-of-the-years'-digits

A) Straight-line

B) Declining-balance

C) Units-of-production

D) Sum-of-the-years'-digits

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

7

In order to calculate the third year's depreciation on an asset using the sum-of- the-years'-digits method,which of the following must be known about the asset?

A) Its acquisition cost

B) Its estimated salvage value

C) Its estimated useful life

D) All of these must be known.

A) Its acquisition cost

B) Its estimated salvage value

C) Its estimated useful life

D) All of these must be known.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

8

In accordance with generally accepted accounting principles,which of the following methods of amortization is normally recommended for intangible assets?

A) Sum-of-the-years'-digits

B) Straight-line

C) Group composite

D) Double-declining-balance

A) Sum-of-the-years'-digits

B) Straight-line

C) Group composite

D) Double-declining-balance

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

9

The sale of a depreciable asset resulting in a loss indicates that the proceeds from the sale were

A) less than current market value.

B) greater than cost.

C) greater than book value.

D) less than book value.

A) less than current market value.

B) greater than cost.

C) greater than book value.

D) less than book value.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

10

When an exchange of similar assets involves a gain,

A) the recorded amount of the new asset is the cost of the old asset plus any cash paid.

B) the recorded amount of the new asset is the net book value of the old asset plus any cash paid.

C) the recorded amount of the new asset is its fair market value less any cash paid.

D) None of these are true.

A) the recorded amount of the new asset is the cost of the old asset plus any cash paid.

B) the recorded amount of the new asset is the net book value of the old asset plus any cash paid.

C) the recorded amount of the new asset is its fair market value less any cash paid.

D) None of these are true.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

11

Depreciation of noncurrent operating assets is an accounting process for the purpose of

A) reporting declining asset values on the balance sheet.

B) allocating asset costs over the periods benefited by use of the assets.

C) accounting for costs to reflect the change in general price levels.

D) setting aside funds to replace assets when their economic usefulness expires.

A) reporting declining asset values on the balance sheet.

B) allocating asset costs over the periods benefited by use of the assets.

C) accounting for costs to reflect the change in general price levels.

D) setting aside funds to replace assets when their economic usefulness expires.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

12

On January 1 Murphy Company acquired a machine with a four-year useful life.Murphy estimates the salvage value of the machine will be equal to ten percent of the acquisition cost.The company is debating between using either the double-declining-balance method or the sum-of-the-years'-digits method of depreciation.Comparing the depreciation expense for the first two years computed using these methods,the depreciation expense for the double-declining-balance method (compared to the sum-of-the-years'-digits method)will match which of the patterns shown below? First Second

Year Year

A) Lower Lower

B) Lower Higher

C) Higher Lower

D) Higher Higher

Year Year

A) Lower Lower

B) Lower Higher

C) Higher Lower

D) Higher Higher

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

13

A method that ignores salvage value in the early years of the asset's life in calculating periodic depreciation expense is the

A) productive-output method.

B) group composite method.

C) sum-of-the-years'-digits method.

D) double-declining-balance method.

A) productive-output method.

B) group composite method.

C) sum-of-the-years'-digits method.

D) double-declining-balance method.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following statements is the assumption on which straight-line depreciation is based?

A) The operating efficiency of the asset decreases in later years.

B) Service value declines as a function of obsolescence rather than time.

C) Service value declines as a function of time rather than use.

D) Physical wear and tear are more important than economic obsolescence.

A) The operating efficiency of the asset decreases in later years.

B) Service value declines as a function of obsolescence rather than time.

C) Service value declines as a function of time rather than use.

D) Physical wear and tear are more important than economic obsolescence.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following utilizes the straight-line depreciation method? Composite Group

Depreciation Depreciation

A) Yes Yes

B) Yes No

C) No Yes

D) No No

Depreciation Depreciation

A) Yes Yes

B) Yes No

C) No Yes

D) No No

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

16

The composite depreciation method

A) is applied to a group of homogeneous assets.

B) is an accelerated method of depreciation.

C) does not recognize gain or loss on the retirement of specific assets in the group.

D) excludes salvage value from the base of the depreciation calculation.

A) is applied to a group of homogeneous assets.

B) is an accelerated method of depreciation.

C) does not recognize gain or loss on the retirement of specific assets in the group.

D) excludes salvage value from the base of the depreciation calculation.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

17

Legal fees incurred in successfully defending a patent suit should be capitalized when the patent has been Internally Purchased from

Developed an Inventor

A) Yes No

B) Yes Yes

C) No Yes

D) No No

Developed an Inventor

A) Yes No

B) Yes Yes

C) No Yes

D) No No

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following depreciation methods most closely approximates the method used to deplete the cost of natural resources?

A) Straight-line method

B) Double-declining-balance method

C) Sum-of-the-years'-digits method

D) Units-of-production method

A) Straight-line method

B) Double-declining-balance method

C) Sum-of-the-years'-digits method

D) Units-of-production method

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following principles best describes the conceptual rationale for the methods of matching depreciation expense with revenues?

A) Partial recognition

B) Immediate recognition

C) Systematic and rational allocation

D) Associating cause and effect

A) Partial recognition

B) Immediate recognition

C) Systematic and rational allocation

D) Associating cause and effect

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

20

When the estimate of an asset's useful life is changed,

A) depreciation expense for all past periods must be recalculated.

B) there is no change in the amount of depreciation expense recorded for future years.

C) only the depreciation expense in the remaining years is changed.

D) None of these are true.

A) depreciation expense for all past periods must be recalculated.

B) there is no change in the amount of depreciation expense recorded for future years.

C) only the depreciation expense in the remaining years is changed.

D) None of these are true.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

21

On January 1,2014,Jameson Company purchased equipment at a cost of $420,000.The equipment was estimated to have a useful life of five years and a salvage value of $60,000.Jameson uses the sum-of-the-years'-digits method of depreciation.What should the accumulated depreciation be at December 31,2017?

A) $240,000

B) $288,000

C) $336,000

D) $360,000

A) $240,000

B) $288,000

C) $336,000

D) $360,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

22

A depreciable asset has an estimated 15 percent salvage value.At the end of its estimated useful life,the accumulated depreciation would equal the original cost of the asset under which of the following depreciation methods? Productive- Sum-of-the- Double-

Output Years'-Digits Declining-Balance

A) Yes No No

B) No No No

C) No Yes No

D) Yes Yes Yes

Output Years'-Digits Declining-Balance

A) Yes No No

B) No No No

C) No Yes No

D) Yes Yes Yes

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

23

On June 30,2014,a fire in Walnut Company's plant caused the total loss of a production machine.The machine was being depreciated at $20,000 annually and had a carrying amount of $160,000 at December 31,2013.On the date of the fire,the fair value of the machine was $220,000,and Walnut received insurance proceeds of $200,000 in October 2014.In its income statement for the year ended December 31,2014,what amount should Walnut recognize as a gain or loss on disposition?

A) $0

B) $20,000 loss

C) $40,000 gain

D) $50,000 gain

A) $0

B) $20,000 loss

C) $40,000 gain

D) $50,000 gain

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

24

Zenith Corporation bought a machine on January 1,2014.In purchasing the machine,the company paid $40,000 cash and signed an interest-bearing note for $105,000.The estimated useful life of the machine is five years,after which time the salvage value is expected to be $10,000.Given this information,how much depreciation expense would be recorded for the year ending December 31,2015,if the company uses the sum-of-the-years'-digits depreciation method?

A) $45,000

B) $36,000

C) $40,000

D) $34,000

A) $45,000

B) $36,000

C) $40,000

D) $34,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

25

Winwood Construction purchased a crane on January 1,2013,for $102,750.At the time of purchase,the crane was estimated to have a life of six years and a residual value of $6,750.In 2015,Winwood determined that the crane had a total useful life of seven years and a residual value of $4,500.If Winwood uses the straight-line method of depreciation,what will be the depreciation expense for the crane in 2015?

A) $16,000

B) $13,250

C) $9,464

D) $8,000

A) $16,000

B) $13,250

C) $9,464

D) $8,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

26

Hyde Company traded in an old machine with a book value of $15,000 on a new machine.The exchange did not have commercial substance.The new machine,which had a cash price of $75,000,was purchased for $64,000 cash plus the old machine.Hyde should record the cost of the new machine as

A) $64,000.

B) $71,000.

C) $75,000.

D) $79,000.

A) $64,000.

B) $71,000.

C) $75,000.

D) $79,000.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

27

A company using the group depreciation method for its delivery trucks retired one of the trucks after the average service life of the group was reached.Cash proceeds were received from a salvage company.The net carrying amount of these group asset accounts would be decreased by the

A) original cost of the truck.

B) original cost of the truck less the cash proceeds.

C) cash proceeds received.

D) cash proceeds received and original cost of the truck.

A) original cost of the truck.

B) original cost of the truck less the cash proceeds.

C) cash proceeds received.

D) cash proceeds received and original cost of the truck.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

28

Mantle Company exchanged a used autograph-signing machine with Maris Company for a similar machine with less use.Mantle's old machine originally cost $50,000 and had accumulated depreciation of $40,000,as well as a market value of $40,000,at the time of the exchange.Maris' old machine originally cost $60,000 and at the time of the exchange had a book value of $30,000 and a market value of $32,000.Maris gave Mantle $8,000 cash as part of the exchange.The exchange lacked commercial substance.Mantle should record the cost of the new machine at

A) $8,000.

B) $10,000.

C) $16,000.

D) $32,000.

A) $8,000.

B) $10,000.

C) $16,000.

D) $32,000.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

29

Underwood Company purchased a machine on January 2,2013,for $1,000,000.The machine has an estimated useful life of five years and a salvage value of $100,000.Depreciation was computed by the 150% declining-balance method.The accumulated depreciation balance at December 31,2014,should be

A) $360,000.

B) $459,000.

C) $490,000.

D) $510,000.

A) $360,000.

B) $459,000.

C) $490,000.

D) $510,000.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

30

Stanley Company purchased a machine that was installed and placed in service on January 2,2013,at a total cost of $680,000.Residual value was estimated at $70,000.The machine is being depreciated over ten years by the double-declining-balance method.For the year 2014,Stanley should record depreciation expense of

A) $108,800

B) $97,600

C) $68,000

D) $61,000

A) $108,800

B) $97,600

C) $68,000

D) $61,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

31

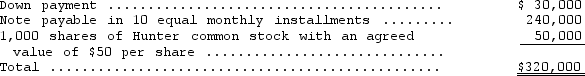

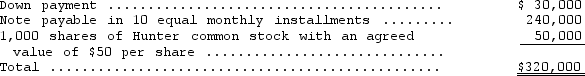

In January,Fanning Corporation entered into a contract to acquire a new machine for its factory.The machine,which had a cash price of $400,000,was paid for as follows:  Prior to the machine's use,installation costs of $10,000 were incurred.The machine has an estimated useful life of ten years and an estimated salvage value of $10,000.What should Hunter record as depreciation expense for the first year under the straight-line method?

Prior to the machine's use,installation costs of $10,000 were incurred.The machine has an estimated useful life of ten years and an estimated salvage value of $10,000.What should Hunter record as depreciation expense for the first year under the straight-line method?

A) $38,100

B) $39,100

C) $40,000

D) $41,000

Prior to the machine's use,installation costs of $10,000 were incurred.The machine has an estimated useful life of ten years and an estimated salvage value of $10,000.What should Hunter record as depreciation expense for the first year under the straight-line method?

Prior to the machine's use,installation costs of $10,000 were incurred.The machine has an estimated useful life of ten years and an estimated salvage value of $10,000.What should Hunter record as depreciation expense for the first year under the straight-line method?A) $38,100

B) $39,100

C) $40,000

D) $41,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

32

Stiller Company owns a machine that was bought on January 2,2011,for $376,000.The machine was estimated to have a useful life of five years and a salvage value of $24,000.Stiller uses the sum-of-the-years'-digits method of depreciation.At the beginning of 2014,Stiller determined that the useful life of the machine should have been four years and the salvage value $35,200.For the year 2014,Stiller should record depreciation expense on this machine of

A) $19,200.

B) $44,400.

C) $59,200.

D) $70,400.

A) $19,200.

B) $44,400.

C) $59,200.

D) $70,400.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

33

Lex Soaps purchased a machine on January 1,2013,for $18,000 cash.The machine has an estimated useful life of four years and a salvage value of $4,700.Lex uses the double-declining-balance method of depreciation for all its assets.What will be the machine's book value as of December 31,2014?

A) $5,100

B) $4,700

C) $4,500

D) $4,300

A) $5,100

B) $4,700

C) $4,500

D) $4,300

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

34

On January 1,2014,Ashton Company purchased equipment at a cost of $570,000.The equipment was estimated to have a useful life of five years and a salvage value of $60,000.Ashton uses the sum-of-the-years'-digits method of depreciation.What should the accumulated depreciation be at December 31,2016?

A) $340,000

B) $408,000

C) $456,000

D) $510,000

A) $340,000

B) $408,000

C) $456,000

D) $510,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

35

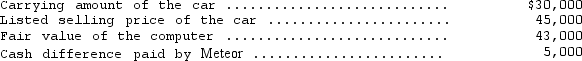

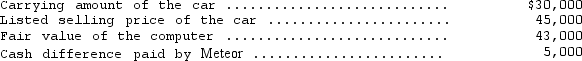

Meteor Motor Sales exchanged a car from its inventory for a computer to be used as a noncurrent operating asset.The following information relates to this exchange that took place on July 31,2014:  The exchange has commercial substance.

The exchange has commercial substance.

On July 31,2014,how much profit should Meteor recognize on this exchange?

A) $0

B) $8,000

C) $10,000

D) $13,000

The exchange has commercial substance.

The exchange has commercial substance.On July 31,2014,how much profit should Meteor recognize on this exchange?

A) $0

B) $8,000

C) $10,000

D) $13,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

36

On January 1,2012,Costas Co.purchased a new machine for $1,250,000.The new machine has an estimated useful life of five years and the salvage value was estimated to be $250,000.Costas uses the sum-of-the-years'-digits method of depreciation.The amount of depreciation expense for 2014 is

A) $200,000.

B) $250,000.

C) $300,000

D) $416,667

A) $200,000.

B) $250,000.

C) $300,000

D) $416,667

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

37

When assets are exchanged at a loss in an exchange lacking commercial substance,the basis of the new asset is usually

A) the list price of the new asset.

B) the book value of the old asset plus any cash paid on the trade-in.

C) the fair market value of the new asset.

D) either the book value of the old asset plus any cash paid on the trade-in or the fair market value of the new asset.

A) the list price of the new asset.

B) the book value of the old asset plus any cash paid on the trade-in.

C) the fair market value of the new asset.

D) either the book value of the old asset plus any cash paid on the trade-in or the fair market value of the new asset.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

38

The Bromley Company purchased a tooling machine in 2004 for $120,000.The machine was being depreciated on the straight-line method over an estimated useful life of 20 years,with no salvage value.At the beginning of 2014,when the machine had been in use for ten years,the company paid $20,000 to overhaul the machine.As a result of this improvement,the company estimated that the useful life of the machine would be extended an additional five years.What would be the depreciation expense recorded for the machine in 2014?

A) $4,000

B) $5,333

C) $6,000

D) $7,333

A) $4,000

B) $5,333

C) $6,000

D) $7,333

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

39

In recording the trade of one asset for another,which of the following accounts is usually debited?

A) Cash

B) Accumulated Depreciation-Old Asset

C) Gain on Exchange of Asset

D) None of these

A) Cash

B) Accumulated Depreciation-Old Asset

C) Gain on Exchange of Asset

D) None of these

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

40

On December 2,2014,Loofa Company,which operates a furniture rental business,traded in a used delivery truck with a carrying amount of $5,400 for a new delivery truck having a list price of $16,000 and paid a cash difference of $7,500 to the dealer.The used truck had a fair value of $6,000 on the date of the exchange.The exchange has commercial substance.At what amount should the new truck be recorded on Loofa's books?

A) $10,600

B) $12,900

C) $13,500

D) $16,000

A) $10,600

B) $12,900

C) $13,500

D) $16,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

41

A company owns a piece of land that originally cost $10,000 and has a fair market value of $8,000.It is exchanged along with $5,000 cash for another piece of land having a fair value of $13,000.The exchange had commercial substance.The proper journal entry to record this transaction is

A) Land (new)........................15,000

Land (old)......................10,000

Cash ...........................5,000

B) Land (new).......................13,000

Loss on Exchange .................2,000

Land ...........................10,000

Cash ...........................5,000

C) Land (new)........................18,000

Land (old).....................10,000

Cash ...........................5,000

Gain on Exchange ...............3,000

D) Land (new)........................13,000

Retained Earnings ................2,000

Land (old)......................10,000

Cash ...........................5,000

A) Land (new)........................15,000

Land (old)......................10,000

Cash ...........................5,000

B) Land (new).......................13,000

Loss on Exchange .................2,000

Land ...........................10,000

Cash ...........................5,000

C) Land (new)........................18,000

Land (old).....................10,000

Cash ...........................5,000

Gain on Exchange ...............3,000

D) Land (new)........................13,000

Retained Earnings ................2,000

Land (old)......................10,000

Cash ...........................5,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

42

The Chisholm Company purchased a machine on November 1,2005,for $148,000.At the time of acquisition,the machine was estimated to have a useful life of ten years and an estimated salvage value of $4,000.Chisholm has recorded monthly depreciation using the straight-line method.On July 1,2014,the machine was sold for $13,000.What should be the loss recognized from the sale of the machine?

A) $4,000

B) $5,000

C) $10,200

D) $13,000

A) $4,000

B) $5,000

C) $10,200

D) $13,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

43

In 2013,Pauley Company paid $1,000,000 to purchase land containing a total estimated 160,000 tons of extractable mineral deposits.The estimated value of the property after the mineral has been removed is $200,000.Extraction activities began in 2014,and by the end of the year,20,000 tons had been recovered and sold.In 2015,geological studies indicated that the total amount of mineral deposits had been underestimated by 25,000 tons.During 2015,30,000 tons were extracted,and 28,000 tons were sold.What is the depletion rate per ton (rounded to the nearest cent)in 2015?

A) $4.24

B) $4.32

C) $4.85

D) $5.19

A) $4.24

B) $4.32

C) $4.85

D) $5.19

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

44

Lovejoy Co.purchased a patent on January 1,2011,for $714,000.The patent was being amortized over its remaining legal life of 15 years expiring on January 1,2026.During 2014,Lovejoy determined that the economic benefits of the patent would not last longer than 10 years from the date of acquisition.What amount should be charged to patent amortization expense for the year ended December 31,2014?

A) $47,600

B) $71,400

C) $81,600

D) $142,800

A) $47,600

B) $71,400

C) $81,600

D) $142,800

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

45

Nielsen Cargo Company recently exchanged an old truck,which cost $108,000 and was one-third depreciated,and paid $70,000 cash for a similar truck having a current fair value of $130,000.The exchange lacked commercial substance.At what amount should the truck be recorded on the books of Nielsen?

A) $70,000

B) $108,000

C) $130,000

D) $142,000

A) $70,000

B) $108,000

C) $130,000

D) $142,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

46

Ibarra Carpet traded cleaning equipment with a cost of $27,000 and accumulated depreciation of $5,250 for new equipment with a fair market value of $14,500.Assuming the exchange lacks commercial substance,Ibarra should record the new equipment at

A) $14,750.

B) $13,750.

C) $14,500.

D) $7,500.

A) $14,750.

B) $13,750.

C) $14,500.

D) $7,500.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

47

A truck that cost $12,000 was originally being depreciated over four years using the straight-line method with no salvage value.If after one year,it was decided that the truck would last an additional four years (or a total of five years),the second year's depreciation would be

A) $1,500

B) $2,250

C) $2,400

D) $3,000

A) $1,500

B) $2,250

C) $2,400

D) $3,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

48

Raptor Company owns a tract of land that it purchased in 2008 for $200,000.The land is held as a future plant site and has a fair market value of $280,000 on July 1,2014.Talon Company also owns a tract of land held as a future plant site.Talon paid $360,000 for the land in 2013 and the land has a fair market value of $380,000 on July 1,2014.On this date,Raptor exchanged its land and paid $100,000 cash for the land owned by Talon.The exchange had commercial substance.At what amount should Raptor record the land acquired in the exchange?

A) $280,000

B) $300,000

C) $320,000

D) $380,000

A) $280,000

B) $300,000

C) $320,000

D) $380,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

49

In January 2014,Router Mining Corporation purchased a mineral mine for $7,200,000 with removable ore estimated by geological surveys at 4,320,000 tons.The property has an estimated value of $720,000 after the ore has been extracted.Router incurred $2,160,000 of development costs preparing the property for the extraction of ore.During 2014,540,000 tons were removed and 480,000 tons were sold.For the year ended December 31,2014,Router should include what amount of depletion in its cost of goods sold?

A) $720,000

B) $810,000

C) $960,000

D) $1,080,000

A) $720,000

B) $810,000

C) $960,000

D) $1,080,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

50

On January 1,2013,Pastel Colors Corporation purchased drilling equipment for $11,500.The equipment has an estimated useful life of four years and a salvage value of $200.Assuming that Pastel Colors uses the straight-line method of depreciation,if it trades the equipment for new equipment with a list price of $15,500 on December 31,2014,and pays $4,050 in the exchange,assuming the exchange lacks commercial substance,the new equipment should be recorded at

A) $15,500.

B) $11,450.

C) $9,850.

D) $9,900.

A) $15,500.

B) $11,450.

C) $9,850.

D) $9,900.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

51

In October 2014,Pollock Company exchanged a used packaging machine having a book value of $240,000 for a new machine and paid a cash difference of $30,000.The market value of the used packaging machine was determined to be $280,000.The exchange had commercial substance.In its income statement for the year ended December 31,2014,how much gain should Pollock recognize on this exchange?

A) $0

B) $10,000

C) $30,000

D) $40,000

A) $0

B) $10,000

C) $30,000

D) $40,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

52

In January 2014,Shone Company exchanged an old machine,with a book value of $156,000 and a fair value of $140,000,and paid $40,000 cash for a similar used machine having a list price of $200,000.The exchange had commercial substance.At what amount should the machine acquired in the exchange be recorded on Shone's books?

A) $200,000

B) $196,000

C) $184,000

D) $180,000

A) $200,000

B) $196,000

C) $184,000

D) $180,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

53

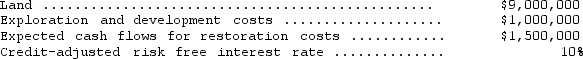

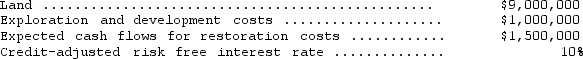

Cavallo Company acquired a tract of land containing an extractable natural resource.Cavallo is required by the purchase contract to restore the land to a condition suitable for recreational use after it has extracted the natural resource.Geological surveys estimate that the recoverable reserves will be 2,500,000 tons and that the extraction will be completed in five years.Relevant cost information follows:  What should be the depletion charge per ton of extracted material?

What should be the depletion charge per ton of extracted material?

A) $4.00

B) $4.37

C) $3.97

D) $3.60

What should be the depletion charge per ton of extracted material?

What should be the depletion charge per ton of extracted material?A) $4.00

B) $4.37

C) $3.97

D) $3.60

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

54

On January 1,2013,Canal Locks Corporation purchased drilling equipment for $11,500.The equipment has an estimated useful life of four years and a salvage value of $200.Given this information,if Canal uses the sum-of-the-years'-digits method of depreciation and then trades the equipment for new equipment with a fair market value of $16,000 on December 31,2014,and pays $8,000 cash in the exchange,assuming the exchange has commercial substance,the new equipment should be recorded at

A) $16,000.

B) $12,475.

C) $11,590.

D) $8,110.

A) $16,000.

B) $12,475.

C) $11,590.

D) $8,110.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

55

Backhoe Construction Company recently exchanged an old truck,which cost $118,000 and was one-third depreciated,and paid $80,000 cash for a used crane having a current fair value of $140,000.Assuming the exchange has commercial substance,at what amount should the crane be recorded on the books of Backhoe?

A) $80,000

B) $118,000

C) $140,000

D) $152,000

A) $80,000

B) $118,000

C) $140,000

D) $152,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

56

In January 2014,Bevis Company exchanged an old machine,with a book value of $256,000 and a fair value of $260,000,and paid $40,000 cash for a similar used machine having a fair value of $300,000.The exchange lacked commercial substance.At what amount should the machine acquired in the exchange be recorded on Bevis' books?

A) $256,000

B) $296,000

C) $300,000

D) $304,000

A) $256,000

B) $296,000

C) $300,000

D) $304,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

57

On January 1,2010,Elaine Company purchased for $600,000,a trademark with an estimated useful life of 16 years.In January 2014,Elaine paid $90,000 for legal fees in a successful defense of the trademark.Trademark amortization expense for the year ended December 31,2014,should be

A) $37,500.

B) $43,125.

C) $45,000.

D) $90,000.

A) $37,500.

B) $43,125.

C) $45,000.

D) $90,000.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

58

During 2009,Cabot Machine Company spent $352,000 on research and development costs for an invention.This invention was patented on January 2,2010,at a nominal cost that was expensed in 2010.The patent has a legal life of 17 years and an estimated useful life of 8 years.In January 2014,Cabot paid $32,000 for legal fees in a successful defense of the patent.Amortization for 2014 should be

A) $2,462.

B) $8,000.

C) $32,000.

D) $52,000.

A) $2,462.

B) $8,000.

C) $32,000.

D) $52,000.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

59

Morgan Trucking traded a used truck with a book value of $1,700 and a fair market value of $2,300 for a new truck with a list price of $17,800.Morgan agreed to pay $13,000 in cash for the exchange in addition to giving up the used truck.Assuming the exchange has commercial substance,at what amount should the new truck be recorded?

A) $17,800

B) $15,300

C) $14,700

D) None of these

A) $17,800

B) $15,300

C) $14,700

D) None of these

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

60

On July 1,Toucan Corporation,a calendar-year company,received a condemnation award of $150,000 as compensation for the forced sale of a plant located on company property that stood in the path of a new highway.On this date,the plant building had a depreciated cost of $75,000 and the land cost was $25,000.On October 1,Toucan purchased a parcel of land for a new plant site at a cost of $62,500.Ignoring income taxes,Toucan should report in its income statement for the year ended December 31 a gain of

A) $0.

B) $12,500.

C) $37,500.

D) $50,000.

A) $0.

B) $12,500.

C) $37,500.

D) $50,000.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

61

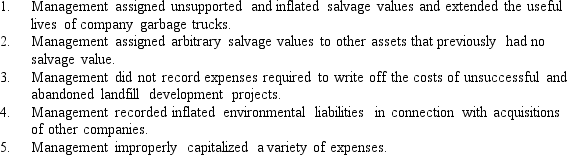

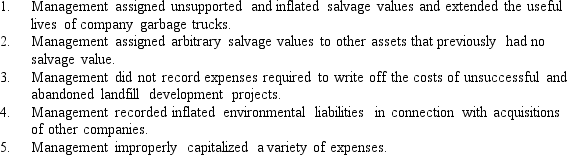

Wastenot is a waste disposal company.Explain the effect the following actions of the management of Wastenot Company might have in managing earnings:

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

62

Five years ago,Monroe,Inc. ,purchased a patent for $110,000.Lower demand for the product produced under this patent necessitates that an impairment test be made.On the date of purchase,the patent had an estimated useful life of eleven years.It currently has a remaining useful life of four years.The current fair value of the patent is $43,000.Company management estimates that the patent will generate future cash flows of $12,000 per year for the next four years. The amount of the impairment loss to be recognized is

A) $50,000.

B) $60,000.

C) $12,000.

D) $17,000.

A) $50,000.

B) $60,000.

C) $12,000.

D) $17,000.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following assets generally is required to be tested at least annually for impairment?

A) Machinery

B) Patent

C) Renewable broadcast license

D) Copyright

A) Machinery

B) Patent

C) Renewable broadcast license

D) Copyright

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

64

Pepitone Inc.exchanged a machine costing $400,000 with accumulated depreciation of $280,000 for a machine from the Berra Company.Berra paid $20,800 cash in addition to its machine (which cost $200,000 with accumulated depreciation of $68,000)for the Pepitone machine.The Berra machine has a fair value of $160,000.

Provide the necessary entries to record the transactions on both companies' books assuming the machine lacks commercial substance.

Provide the necessary entries to record the transactions on both companies' books assuming the machine lacks commercial substance.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

65

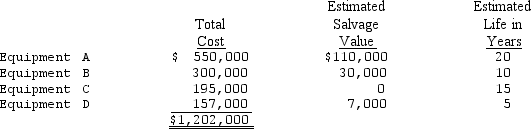

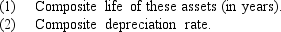

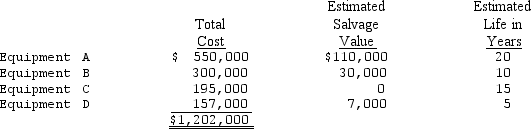

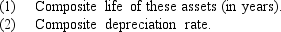

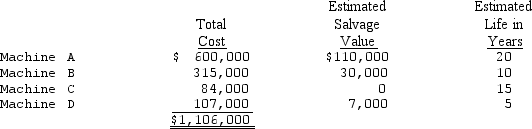

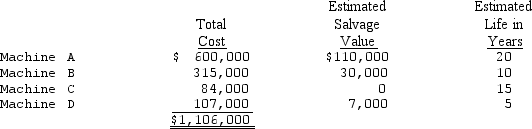

Image Creators,Inc.owns the following equipment and computes their depreciation on the straight-line basis:

Required:

Required:

Required:

Required:

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

66

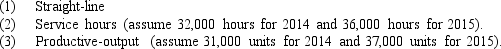

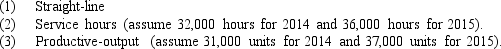

Irvington Manufacturing Inc.purchased a new machine on January 2,2014,that was built to perform one function on its assembly line.Data pertaining to this machine are:

Acquisition cost $330,000

Residual value $30,000

Estimated service life:

Years 5

Service hours 250,000

Production output 300,000

Using each of the following methods,compute the annual depreciation rate and charge for the years ended December 31,2014,and 2015:

Acquisition cost $330,000

Residual value $30,000

Estimated service life:

Years 5

Service hours 250,000

Production output 300,000

Using each of the following methods,compute the annual depreciation rate and charge for the years ended December 31,2014,and 2015:

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

67

The impairment test for an intangible asset with a definite life compares the

A) fair value of the asset to its book value.

B) sum of the undiscounted cash flows expected to be generated by the asset to its book value.

C) sum of the discounted cash flows expected to be generated by the asset to its fair value.

D) sum of the undiscounted cash flows expected to be generated by the asset to its fair value.

A) fair value of the asset to its book value.

B) sum of the undiscounted cash flows expected to be generated by the asset to its book value.

C) sum of the discounted cash flows expected to be generated by the asset to its fair value.

D) sum of the undiscounted cash flows expected to be generated by the asset to its fair value.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

68

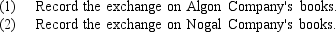

The Corey Company exchanged equipment costing $190,000 with accumulated depreciation of $45,000 for equipment owned by Salvo Corporation.The Salvo equipment cost $305,000 with accumulated depreciation of $105,000.The fair value of both pieces of equipment was $275,000.

Provide the necessary entries to record the transaction on both companies' books assuming:

Provide the necessary entries to record the transaction on both companies' books assuming:

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

69

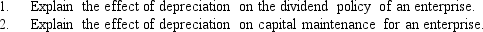

Depreciation is the systematic allocation of historical depreciable cost to periods in which an asset is used.Depreciation is not a cash outflow but does reduce reported income and thus retained earnings by the depreciable cost of the asset less the tax savings associated with depreciation.

Required:

Required:

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following assets generally is required to be tested at least annually for impairment?

A) Machinery

B) Patent

C) Goodwill

D) Copyright

A) Machinery

B) Patent

C) Goodwill

D) Copyright

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

71

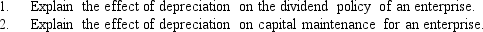

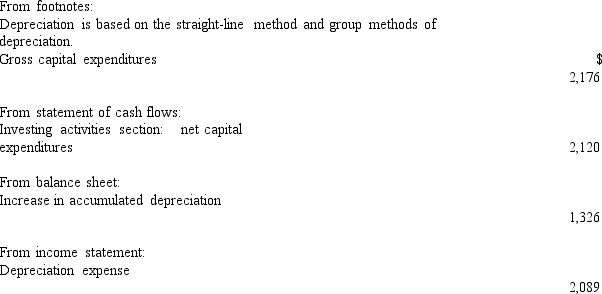

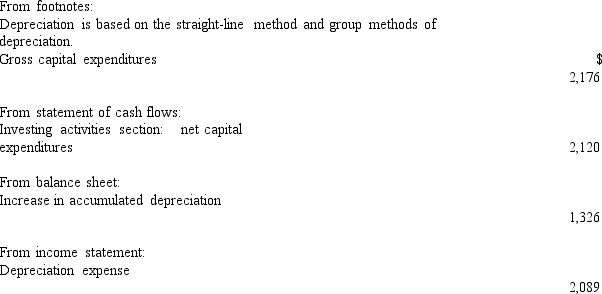

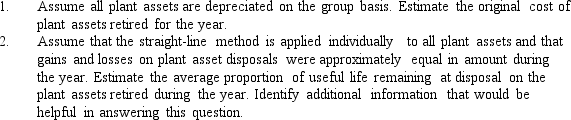

The most recent annual report of the Albondiga Company includes the following information:

(in millions of dollars)

The group method of depreciation treats all assets within a group as having a uniform useful life and applies a depreciation rate based on the total cost of the group.No gain or loss is recognized on disposal under this method.Accumulated depreciation is reduced by the difference between the cost of the assets disposed of and cash proceeds.

The group method of depreciation treats all assets within a group as having a uniform useful life and applies a depreciation rate based on the total cost of the group.No gain or loss is recognized on disposal under this method.Accumulated depreciation is reduced by the difference between the cost of the assets disposed of and cash proceeds.

Required:

(in millions of dollars)

The group method of depreciation treats all assets within a group as having a uniform useful life and applies a depreciation rate based on the total cost of the group.No gain or loss is recognized on disposal under this method.Accumulated depreciation is reduced by the difference between the cost of the assets disposed of and cash proceeds.

The group method of depreciation treats all assets within a group as having a uniform useful life and applies a depreciation rate based on the total cost of the group.No gain or loss is recognized on disposal under this method.Accumulated depreciation is reduced by the difference between the cost of the assets disposed of and cash proceeds.Required:

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

72

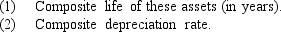

The following is a schedule of machinery owned by Stanton Manufacturing Company.

Stanton computes depreciation on the straight-line basis.Based on the information presented,compute the:

Stanton computes depreciation on the straight-line basis.Based on the information presented,compute the:

Stanton computes depreciation on the straight-line basis.Based on the information presented,compute the:

Stanton computes depreciation on the straight-line basis.Based on the information presented,compute the:

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

73

In 2013,Bootcamp Mining Inc.purchased land for $5,600,000 that had a natural resource supply estimated at 4,000,000 tons.When the natural resources are removed,the land will have an estimated value of $640,000.The present value of the expected cash outflows for the required restoration cost for the property is estimated to be $800,000.

Development and road construction costs on the land were $560,000,and a building was constructed at a cost of $88,000 with an estimated $8,000 salvage value when all the natural resources have been extracted.

During 2014,additional development costs of $272,000 were incurred,but additional resources were not discovered.Production for 2013 and 2014 was 700,000 tons and 900,000 tons,respectively.

Compute the depletion charge for 2013 and 2014.(Include depreciation on the building,if any,as a depletion charge. )Round depletion charge to the nearest cent.

Development and road construction costs on the land were $560,000,and a building was constructed at a cost of $88,000 with an estimated $8,000 salvage value when all the natural resources have been extracted.

During 2014,additional development costs of $272,000 were incurred,but additional resources were not discovered.Production for 2013 and 2014 was 700,000 tons and 900,000 tons,respectively.

Compute the depletion charge for 2013 and 2014.(Include depreciation on the building,if any,as a depletion charge. )Round depletion charge to the nearest cent.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

74

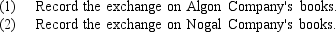

Algon Company owns a machine that cost $560,000,has a book value of $240,000,and an estimated fair value of $480,000.Nogal Company has a machine that cost $720,000,has accumulated depreciation of $400,000,and an estimated fair value of $640,000.Algon pays Nogal cash of $160,000.Assume the trade has commercial substance.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

75

The impairment test for an intangible asset with an indefinite life compares the

A) fair value of the asset to its book value.

B) sum of the undiscounted cash flows expected to be generated by the asset to its book value.

C) sum of the discounted cash flows expected to be generated by the asset to its fair value.

D) sum of the undiscounted cash flows expected to be generated by the asset to its fair value.

A) fair value of the asset to its book value.

B) sum of the undiscounted cash flows expected to be generated by the asset to its book value.

C) sum of the discounted cash flows expected to be generated by the asset to its fair value.

D) sum of the undiscounted cash flows expected to be generated by the asset to its fair value.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

76

The Fanfare Company applied for and received numerous patents at a total cost of $286,500 at the beginning of 2011.It is assumed the patents will be useful evenly during their full legal lives.At the beginning of 2013,the company paid $48,600 in legal fees for successful defense in a patent infringement suit.At the beginning of 2014,information became available that caused the company to reduce the remaining life of the patents to five years.

Calculate the amortization expense for the years 2011,2012,2013,and 2014.Round to the nearest dollar.

Calculate the amortization expense for the years 2011,2012,2013,and 2014.Round to the nearest dollar.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

77

Information concerning Santori Corporation's intangible assets is as follows:

Santori incurred $352,000 of experimental and development costs in its laboratory to develop a patent that was granted on January 2,2014.Legal fees and other costs associated with registration of the patent totaled $65,600.Thomas estimates that the useful life of the patent will be eight years.

A second patent was purchased from Lowman Company for $160,000 on July 1,2011.Expenditures for successful litigation in defense of this patent totaling $40,000 were paid on July 1,2014.Thomas estimates that the useful life of the patent will be 20 years from the date of acquisition.

Prepare a schedule showing the intangible assets section of Santori's balance sheet at December 31,2014.

Santori incurred $352,000 of experimental and development costs in its laboratory to develop a patent that was granted on January 2,2014.Legal fees and other costs associated with registration of the patent totaled $65,600.Thomas estimates that the useful life of the patent will be eight years.

A second patent was purchased from Lowman Company for $160,000 on July 1,2011.Expenditures for successful litigation in defense of this patent totaling $40,000 were paid on July 1,2014.Thomas estimates that the useful life of the patent will be 20 years from the date of acquisition.

Prepare a schedule showing the intangible assets section of Santori's balance sheet at December 31,2014.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following represents the maximum amortization period mandated by current generally accepted accounting principles for amortizable intangible asset?

A) 10 years

B) 20 years

C) 40 years

D) No arbitrary cap on the useful life of amortizable intangible assets has been established.

A) 10 years

B) 20 years

C) 40 years

D) No arbitrary cap on the useful life of amortizable intangible assets has been established.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

79

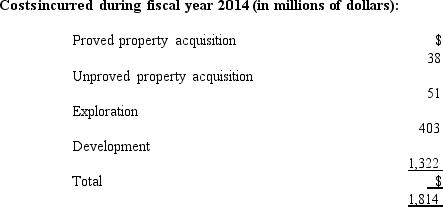

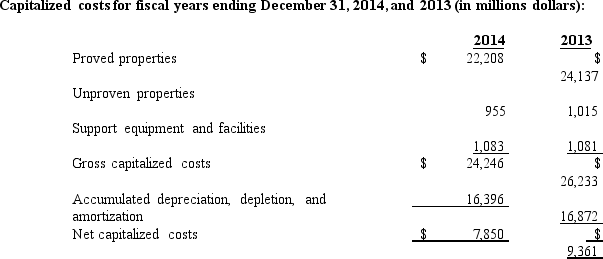

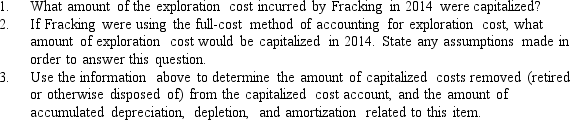

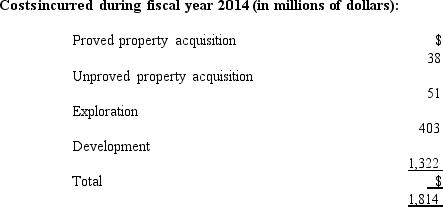

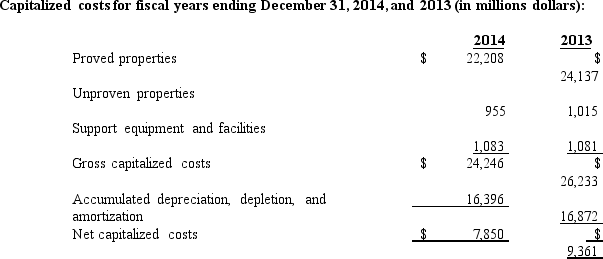

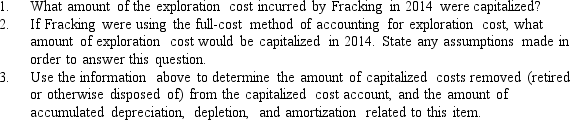

The 2014 annual report of Fracking,Inc. ,provides the following disclosures regarding its oil and gas operations:

During 2014,the company reported exploration expenses totaling $306 million,and depreciation,depletion,and amortization totaling $1,198 million.The amount of capitalized costs for the fiscal years ending December 31,2014,and 2013,were:

During 2014,the company reported exploration expenses totaling $306 million,and depreciation,depletion,and amortization totaling $1,198 million.The amount of capitalized costs for the fiscal years ending December 31,2014,and 2013,were:

Fracking uses the successful-efforts method to account for exploration costs.

Fracking uses the successful-efforts method to account for exploration costs.

Required:

During 2014,the company reported exploration expenses totaling $306 million,and depreciation,depletion,and amortization totaling $1,198 million.The amount of capitalized costs for the fiscal years ending December 31,2014,and 2013,were:

During 2014,the company reported exploration expenses totaling $306 million,and depreciation,depletion,and amortization totaling $1,198 million.The amount of capitalized costs for the fiscal years ending December 31,2014,and 2013,were: Fracking uses the successful-efforts method to account for exploration costs.

Fracking uses the successful-efforts method to account for exploration costs.Required:

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck