Deck 10: Planning for Retirement

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/41

Play

Full screen (f)

Deck 10: Planning for Retirement

1

Natalie's employer uses a final-average formula to calculate pensions.This type of pension is based on a fixed percentage of the average earnings of the employee's last several years.

True

2

An insurance company sells a 20-year term life insurance policy with a face value of $200,000 to a 45-year -old woman.Her annual premium is $990.If the woman dies after paying premiums for 6 years,what is the insurance company's gain or loss?

A) Loss of $194,060

B) Gain of $199,010

C) Loss of $200,990

D) Gain of $205,940

A) Loss of $194,060

B) Gain of $199,010

C) Loss of $200,990

D) Gain of $205,940

Loss of $194,060

3

In 2016,the maximum taxable income for Social Security was $118,500,and the rate was 6.2%.The rate for Medicare tax was 1.45%.If Jessica's taxable income as an attorney was $152,000 that year,how much did she pay in FICA taxes?

A) $2,204

B) $9,551

C) $9,424

D) $11,628

A) $2,204

B) $9,551

C) $9,424

D) $11,628

$9,551

4

Nancy bought a 20-year term life insurance policy with a face value of $200,000.Her monthly premium is $66.She dies after 2 years.Her beneficiaries will receive $200,000 ÷ 2 or $100,000.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

5

A Roth IRA is tax-deferred,so taxes are deferred until the money is withdrawn from the account.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

6

Social Security benefits are need-based and are not based on your earnings over your working lifetime.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

7

The mortality rate for a certain male category is 0.005657.This means there is a 56% chance of a 50-year old man dying before his next birthday.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

8

Jack's full Social Security retirement benefit is $1,890.He started collecting Social Security benefits at age 65,so his benefits are reduced by about 13.3%.What will his monthly benefit be?

A) $1,638.63

B) $1,683.80

C) $1,784.60

D) $1,864,86

A) $1,638.63

B) $1,683.80

C) $1,784.60

D) $1,864,86

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

9

A COLA is based on the Consumer Price Index.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

10

Don opened a retirement account with an APR of 3.25% compounded monthly.He is planning to retire in 15 years.About how much will he have in the account when he retires if he deposits $750 a month?

A) $173,677.27

B) $165,812.50

C) $73,677.21

D) $65,812.50

A) $173,677.27

B) $165,812.50

C) $73,677.21

D) $65,812.50

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

11

Maria's employer of 19 years offers a pension plan that is the product of the three -year average of her most current salaries,the number of years of service,and a 2% multiplier.Her last three salaries are: $63,500,$65,000,and $66,500.What is her annual pension benefit?

A) $23,940

B) $24,700

C) $65,000

D) $247,000

A) $23,940

B) $24,700

C) $65,000

D) $247,000

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

12

Lauri worked full-time at a health club last year earning $23,000.Last year,$1,090 in earnings was needed for one Social Security credit.Lauri earned 4 credits for the year.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

13

Tyrone has an annual salary of $48,000.His employer offers a 401k plan;the company matches 25% of Tyrone's 401k contributions up to 5% of his salary.The maximum allowable contribution to any 401k is $16,500.To maximize his employer's contribution,Tyrone should deposit $200 a month into his account and his employer will deposit $50.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

14

It is advisable to lock in a term life insurance policy rate at a young age because the cost of life insurance increases as a person ages.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

15

This type of life insurance has an investment portion and an insurance portion.The investment portion has a cash value and the insurance portion pays a death benefit.If the policyholder wants to change the death benefit,he or she must apply for a new policy.

A) Term life insurance

B) Decreasing term insurance

C) Whole life insurance

D) Universal life insurance

A) Term life insurance

B) Decreasing term insurance

C) Whole life insurance

D) Universal life insurance

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

16

Mrs.Chambers is 62 years old and plans to retire.Over her life she earned an average of $2,500 per month after adjusting for inflation.The formula for calculating the full monthly Social Security benefits is 90% of the first $856 earned,then 32% of the earnings over $856.What will her monthly benefit be if her full retirement benefit is reduced by approximately 30% for retiring before the age of 67?

A) $1,296.48

B) $1,096.40

C) $836.08

D) $388.94

A) $1,296.48

B) $1,096.40

C) $836.08

D) $388.94

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

17

Cecile is 23 years old and wants to retire when she is 55.She opens up a retirement account and makes a $400 deposit each month.If the account pays 2.75% interest compounded monthly,she will have about $245,842.67 in her account when she is 55.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

18

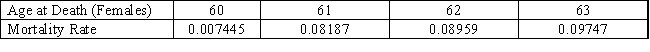

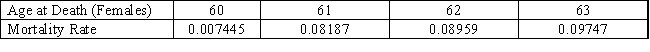

An insurance company uses the mortality table below to calculate its risk when writing life insurance policies.  Based on the table,what is the probability as a percent that a 63-year -old woman will live to see her 64th birthday?

Based on the table,what is the probability as a percent that a 63-year -old woman will live to see her 64th birthday?

A) 97.47%

B) 92.53%

C) 90.53%

D) 90.253%

Based on the table,what is the probability as a percent that a 63-year -old woman will live to see her 64th birthday?

Based on the table,what is the probability as a percent that a 63-year -old woman will live to see her 64th birthday?

A) 97.47%

B) 92.53%

C) 90.53%

D) 90.253%

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

19

The probability that a 42-year -old man will die before his 43rd birthday is about 0.29%.If an insurance company insures 30,000 42-year -old men,how many are expected to die before their 43rd birthdays?

A) 9

B) 87

C) 870

D) 8,700

A) 9

B) 87

C) 870

D) 8,700

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

20

What is a mortality table?

A) A table that lists the premiums that a person pays each month for life insurance.

B) A table that lists the probability of a person of a particular sex and age dying before his or her next birthday.

C) A table that lists the probability of a person of a particular sex and age discontinuing insurance due to illness.

D) A table that lists the probable causes of death of a person based on his or her sex and age.

A) A table that lists the premiums that a person pays each month for life insurance.

B) A table that lists the probability of a person of a particular sex and age dying before his or her next birthday.

C) A table that lists the probability of a person of a particular sex and age discontinuing insurance due to illness.

D) A table that lists the probable causes of death of a person based on his or her sex and age.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

21

Juan changed jobs in 2016.He earned $67,233 working at an insurance company for the first 7 months of the year.When he switched jobs to a textbook company,he was able to negotiate a higher salary and earned $76,144 for the remainder of the year.How much can Juan expect his tax refund to increase in 2016 due to overpaying Social Security taxes?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

22

Fulton has been paying $150 per month for a $200,000 whole life insurance policy for the past 29 years.It has a cash value of $128,000.He recently heard that the S&P 500 has averaged an 8.7% annual return over the past 35 years.If he had invested the premiums in stock funds instead,would his balance be enough to offset the death benefit if he died tomorrow?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

23

Carolyn has been contributing $350 per month to a pre-tax retirement account since she graduated college at the age of 22.This account has been earning 7% compounded monthly.When she is 48,her youngest child is ready to start college,and Carolyn wants to withdraw 20% of the money in the account for tuition.Carolyn's tax bracket this year is 25%,and she knows she will have to pay a 10% early withdrawal penalty.How much money will she realize to pay for her child's tuition?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

24

What is the number of Social Security credits a worker needs to earn over his or her working lifetime to collect Social Security benefits?

A) 1

B) 4

C) 40

D) 67

A) 1

B) 4

C) 40

D) 67

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

25

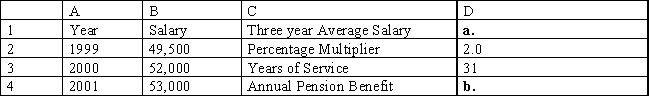

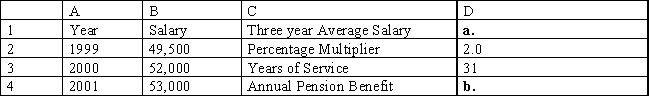

Mr.Casem is preparing to retire after 31 years with his company.He set up this spreadsheet to calculate his pension,which is based on his most recent three -year average salary,number of years of service,and a 2% multiplier.What are the formulas for cells D1 and D4? What are the resulting values?

What are the formulas for cells D1 and D4? What are the resulting values?

What are the formulas for cells D1 and D4? What are the resulting values?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

26

What is the full retirement age,the age at which a person receives full Social Security benefits,of a person born after 1962?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

27

What is the difference between an IRA and a 401k?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

28

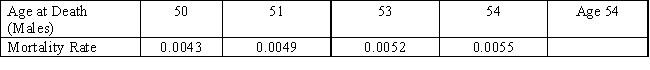

New York Life sells a five-year term insurance policy with a face value of $250,000 to a 50-year old man for a monthly premium of $75.00.Using the mortality table below,determine the probability that the customer lives until he is at least 55.

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

29

Mr.Watkins,born in 1956,is almost 61 years old and is hoping to retire at the age of 62.Over his life,he earned an average of $75,000 per year after adjusting for inflation.The formula for calculating monthly Social Security benefits is 90% of the first $856 earned each month,plus 32% of the monthly earnings over $856 but less than or equal to $5,157 plus 10% of the monthly earning over $5,157.Mr.Watkins has been informed that his full retirement benefit will be reduced by 5/9% for every month he retires before the age of 66 years and 4 months.What will Mr.Watkins' monthly benefit be?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

30

Nina's employer offers a pension plan that is the product of the career average of her salaries while working there,the number of years of service,and a 1.75% multiplier.She calculates the average of her 17 years of salaries to be $54,000.What is her monthly pension?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

31

Where does the money come from to pay Social Security benefits today to those who are receiving them? Why is this a concern for the baby boomer generation?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

32

Isaiah's employer has a pension plan that pays 2.2% of the average of his highest three-year salary for every year worked.Isaiah has been with this company for 15 years,and his last three years' salaries were $77,500;$81,000;and $81,500.What will his monthly pension amount be after three years in retirement if the cost-of-living adjustment is 2.5% per year?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

33

Jackson inherited $50,000 at the age of 42 and had a decision to make.He could deposit the money in a tax -deferred account that pays 3.375% compounded quarterly or he could deposit the money in a taxable account with the same interest rate and compounding period.Jackson's current tax bracket is 25%,which means he will have to pay taxes on the interest earned each year in the taxable account.How much money could Jackson have saved after 25 years if his decision was to deposit the inheritance into the taxable account?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

34

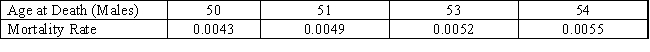

An insurance company uses the mortality table below to calculate its risk when writing life insurance policies.

If this company insures 12,000 54-year -old men,how many are expected to die before they reach their 55th birthday?

If this company insures 12,000 54-year -old men,how many are expected to die before they reach their 55th birthday?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

35

Marianne opened a retirement account that has an annual yield of 5.5%.She is planning to retire in 25 years.How much should she put into the account each month so that she will have $500,000 when she retires?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

36

Mr.Jenkins is almost 67 years old and is preparing to retire.Over his life,he earned an average of $3,750 per month after adjusting for inflation.The formula for calculating monthly Social Security benefits is 90% of the first $856 earned,then 32% of the earnings over $856.What will Mr.Jenkins' monthly benefit be?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

37

Constance arranged for a universal life insurance policy with a face value of $450,000,when she was married.The current cash value of the policy is $12,132.Her premium is $1,500 per year.She wants to buy a new car and is looking for items in her budget that can be put towards the car payment.How many years and months could she suspend her premium payment so that the cash value could be used to pay the premium?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

38

Sherlock invested a $100,000 reward for making sure an embezzler was caught and sent to prison into various types of investments.He invested 20% in corporate bonds,25% in income stocks,15% in growth stocks,10% in penny stocks,and the remainder in a 10-year certificate of deposit.During the next year,the corporate bonds earned 7%,the income stocks earned 13%,the growth stocks earned 21%,the penny stocks lost 67%,and the CD earned 2%.At the end of the year,what percent change did Sherlock see in his portfolio?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

39

Last year,Mrs.Washington had a taxable income of $48,000 and paid about 20% in taxes.This year she contributed $3,000 to a traditional IRA.About how much could her tax liability be reduced?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

40

Caleb's annual salary is $45,000 per year.His employer matches 75% of his 401k contributions up to 10% of his annual salary.Caleb contributes $250 from each biweekly paycheck to his 401k account.What is the combined total of his annual contribution and his employer's contribution?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck

41

Cameron started contributing $400 per month to a retirement account when he was married at the age of 26.The account earned 8.7% compounded monthly until Cameron's finances changed when he was 48.His first child started college that year.Cameron didn't want to pay taxes or a penalty on an early withdrawal,but he did stop his monthly contributions to help pay for college.He moved the money in the account to a more conservative investment paying 4.9% compounded monthly until he was 60 and could begin withdrawing funds without penalty.Now Cameron wants to withdraw $2,500 per month to supplement his pension.How old will Cameron be when the money in this account runs out?

Unlock Deck

Unlock for access to all 41 flashcards in this deck.

Unlock Deck

k this deck