Deck 11: Proprietorships, Partnerships, and Corporations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

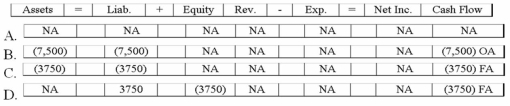

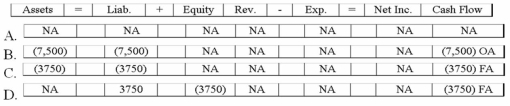

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

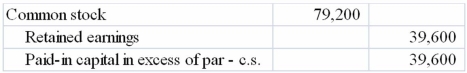

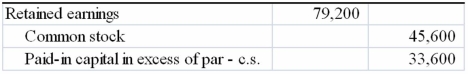

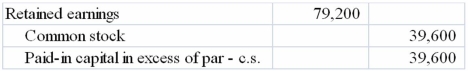

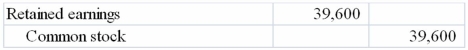

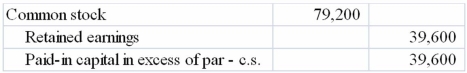

Question

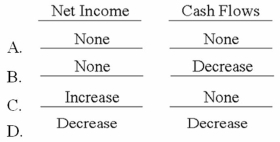

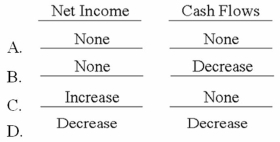

Question

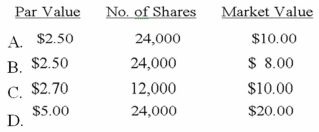

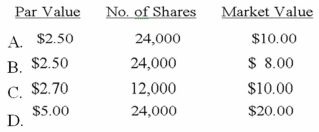

Question

Question

Question

Question

Question

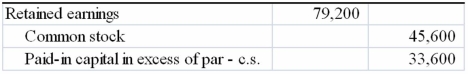

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/153

Play

Full screen (f)

Deck 11: Proprietorships, Partnerships, and Corporations

1

The class or type of stock that every corporation must have is preferred stock.

False

Explanation: All corporations must have common stock.

Explanation: All corporations must have common stock.

2

Preferred stockholders generally have no voting rights in a corporation.

True

Explanation: While preferred stockholders have some preferential treatment over common stockholders, they have no voting rights.

Explanation: While preferred stockholders have some preferential treatment over common stockholders, they have no voting rights.

3

Ease of transferability of ownership is one of the important advantages of the corporate form of business organization.

True

Explanation: Stockholders can sell their stock to others without disturbing the organization structure of the corporation.

Explanation: Stockholders can sell their stock to others without disturbing the organization structure of the corporation.

4

The balance sheet of a sole proprietorship will report two equity accounts: one for amounts contributed by the owner, and one for the business's earnings.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

5

In a closely held corporation, exchanges of stock are limited to transactions between individuals.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

6

Preferred stockholders' claims to a corporation's assets take precedence over the claims of some creditors.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

7

A separate capital account would be maintained for each partner in a partnership.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

8

The book value of a share of stock is equal to the market or selling price of the stock.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

9

A partner is responsible for his/her own actions and also for actions taken by another partner on behalf of the partnership.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

10

Establishing a sole proprietorship generally requires the owner to get a charter from the state government.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

11

A distribution by a sole proprietorship to the owner is called a dividend.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

12

Proprietorships are not separate legal entities; their earnings are taxable to the owners and not to the business itself.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

13

All corporations are subject to extensive government regulation.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

14

Articles of incorporation, prepared by a business that wishes to incorporate, normally include the corporation's name and purpose, its location, and provisions for capital stock.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

15

The number of shares of stock outstanding generally is greater than the number of shares of stock issued.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

16

A benefit of corporations is that they are free from double taxation.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

17

The Securities and Exchange Commission was established in response to the accounting scandals that occurred in 2001 and 2002.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

18

The stock market crash in 1929 led to the beginning of extensive regulation of corporations.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

19

A corporation is a legal entity created by the authority of a state government, separate and distinct from its owners.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

20

Liability is a significant disadvantage of the partnership form of business organization.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

21

Parr Corporation had $10 par stock with a market price of $80, when it declared a 2-for-1 stock split. After the stock split, the number of shares outstanding will double, and the market price of the stock should drop to about $40.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following entities would have the "Paid-in Capital in Excess" account in the equity section of the balance sheet?

A)A sole proprietorship.

B)A municipality.

C)A corporation.

D)A partnership.

A)A sole proprietorship.

B)A municipality.

C)A corporation.

D)A partnership.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following is a disadvantage of a sole proprietorship?

A)Entrenched management.

B)Unlimited liability.

C)Double taxation.

D)Excessive regulation.

A)Entrenched management.

B)Unlimited liability.

C)Double taxation.

D)Excessive regulation.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

24

An appropriation of retained earnings places a limit on the amount of dividends a corporation can declare.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

25

Wu Corporation issued 10,000 shares of no-par common stock for $35 per share. For this transaction, Common Stock should be credited (increased) for $350,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

26

A purchase of treasury stock is an asset exchange transaction.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is not considered an advantage of the corporate form of business organization?

A)Ability to raise capital.

B)Lack of government regulation.

C)Ease of transferability of ownership.

D)Continuity of existence.

A)Ability to raise capital.

B)Lack of government regulation.

C)Ease of transferability of ownership.

D)Continuity of existence.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

28

Treasury Stock is an equity account with a normal credit balance.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

29

When a corporation records a stock dividend, it debits Retained Earnings for the par value of the stock.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

30

A high price-earnings ratio generally means that investors are optimistic about a company's future growth.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

31

The term "double taxation" refers to which of the following?

A)A sole proprietorship must pay income taxes on its net income and the owner is also required to pay income taxes on withdrawals.

B)In a partnership, both partners are required to claim their share of net income on their tax returns.

C)Corporations must pay income taxes on their net income, and their stockholders must pay income taxes on their dividends.

D)A sole proprietorship must pay income taxes to both the state government and the federal government.

A)A sole proprietorship must pay income taxes on its net income and the owner is also required to pay income taxes on withdrawals.

B)In a partnership, both partners are required to claim their share of net income on their tax returns.

C)Corporations must pay income taxes on their net income, and their stockholders must pay income taxes on their dividends.

D)A sole proprietorship must pay income taxes to both the state government and the federal government.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

32

Chiang Corporation issued 10,000 shares of $4 par common stock for $22 per share. As a result of this transaction, Chiang's legal capital increased by $40,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

33

A corporation might buy some of its own stock to help keep the market price from falling.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

34

Jackson Corporation issued 10,000 shares of $6 par common stock for $24 per share. For this transaction, Common Stock should be credited (increased) for $240,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

35

Treasury Stock is reported on the balance sheet between liabilities and equity.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

36

The most frequently reported measure of a company's value is the return on assets ratio.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

37

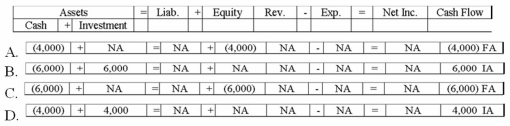

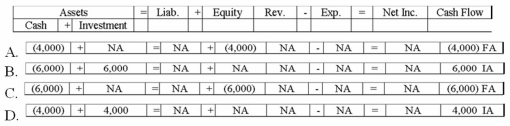

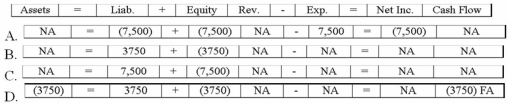

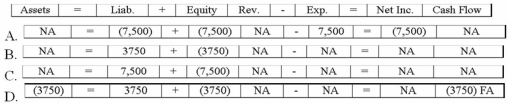

Laverne and Shirley started a partnership. Laverne invested $10,000 in the business and Shirley invested $16,000. The partnership agreement stipulated that profits would be divided as follows. Each partner would receive a 15% return on their invested capital with the remaining income being distributed equally between the two partners. Assuming that the partnership earned $19,000 during an accounting period, the amount of income assigned to the two partners would be:

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

38

Which form of business organization is established as a legal entity separate from its owners?

A)Sole proprietorship

B)Corporation

C)Partnership

D)None of these

A)Sole proprietorship

B)Corporation

C)Partnership

D)None of these

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following entities would report income tax expense on its income statement?

A)A corporation.

B)A sole proprietorship.

C)A partnership.

D)All of the above.

A)A corporation.

B)A sole proprietorship.

C)A partnership.

D)All of the above.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

40

A corporation must record a liability for cash dividends on the date of record.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following statements best describes the term "par value?"

A)An amount used in determining a corporation's legal capital.

B)The amount that must be paid to purchase a share of stock.

C)Determined by dividing total stockholder's equity by the number of shares of stock.

D)The number of shares currently in the hands of stockholders.

A)An amount used in determining a corporation's legal capital.

B)The amount that must be paid to purchase a share of stock.

C)Determined by dividing total stockholder's equity by the number of shares of stock.

D)The number of shares currently in the hands of stockholders.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

42

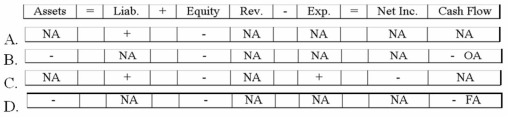

Vernon Company reissued 200 shares of its treasury stock. The stock originally cost $25 per share and was reissued for $35 per share. Select the answer that accurately reflects how the reissue of the treasury stock would affect Vernon's financial statements.

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

43

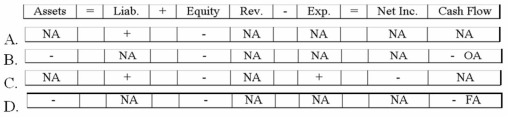

On January 12, 2013, Grove Park Corporation issued 550 shares of $12 par-value common stock for $15 per share. The number of shares authorized is 5,000, and the number of shares outstanding prior to this transaction is 1,200. Which of the following answers describes the effect of the January 12, 2013 transaction?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

44

The par value of a company's stock

A)dictates the initial price of the stock.

B)has little connection to the market value of the stock.

C)is generally greater than market value.

D)may be revised each time a company issues more shares of stock.

A)dictates the initial price of the stock.

B)has little connection to the market value of the stock.

C)is generally greater than market value.

D)may be revised each time a company issues more shares of stock.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following statements is a reason why a company would buy treasury stock?

A)Because management believes the market price of stock is undervalued.

B)To have stock available to issue to employees in stock option plans.

C)To avoid a hostile takeover.

D)All of these are reasons a company would buy treasury stock.

A)Because management believes the market price of stock is undervalued.

B)To have stock available to issue to employees in stock option plans.

C)To avoid a hostile takeover.

D)All of these are reasons a company would buy treasury stock.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

46

Frazier Corporation shows a total of $660,000 in its Common Stock account and $1,600,000 in its Paid-in Capital Excess account. The par value of Frazier's common stock is $4. How many shares of Frazier stock have been issued?

A)165,000.

B)400,000.

C)235,000.

D)It cannot be determined

A)165,000.

B)400,000.

C)235,000.

D)It cannot be determined

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

47

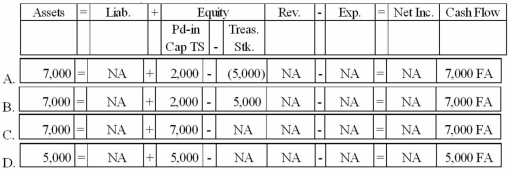

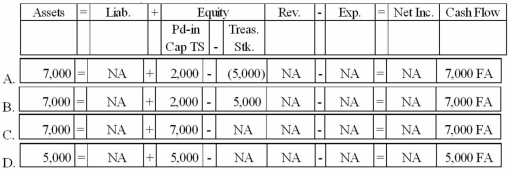

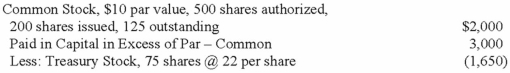

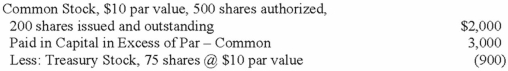

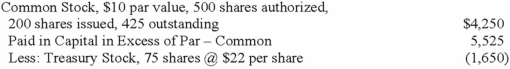

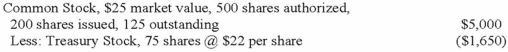

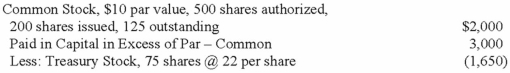

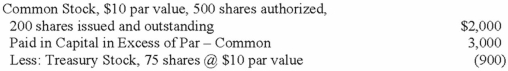

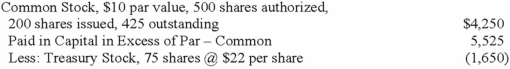

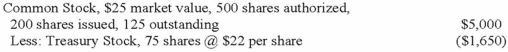

Which answer would represent the financial statement presentation of stockholders' equity after the following transactions? 1) Issued 200 shares of $10 par value common stock for $25 a share. Five hundred shares are authorized.

2) Purchased 75 shares of treasury stock at $22 a share.

A)

B)

C)

D)

2) Purchased 75 shares of treasury stock at $22 a share.

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following terms designates the maximum number of shares of stock that a corporation may issue?

A)Number of shares authorized

B)Number of shares issued

C)Par value

D)Number of shares outstanding

A)Number of shares authorized

B)Number of shares issued

C)Par value

D)Number of shares outstanding

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following statements about types of business entities is true?

A)One advantage of a corporation is ability to raise capital.

B)Ownership in a partnership is represented by having shares of capital stock.

C)For accounting purposes a sole-proprietorship is not a separate entity from its owner.

D)Sole-proprietorships are subject to double-taxation.

A)One advantage of a corporation is ability to raise capital.

B)Ownership in a partnership is represented by having shares of capital stock.

C)For accounting purposes a sole-proprietorship is not a separate entity from its owner.

D)Sole-proprietorships are subject to double-taxation.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

50

At the end of the accounting period, Harris Company had $6,000 of par value common stock issued, additional paid in capital of $5,500, retained earnings of $6,000, and $2,000 of treasury stock. The total amount of stockholders' equity is:

A)$15,500.

B)$19,500.

C)$9,500.

D)$13,500.

A)$15,500.

B)$19,500.

C)$9,500.

D)$13,500.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

51

Jack Grimes started a sole proprietorship by depositing $25,000 cash in a business checking account. During the accounting period the business borrowed $10,000 from a bank, earned $6,000 of net income, and Grimes withdrew $4,000 cash from the business. Based on this information, at the end of the accounting period Grimes' capital account contained a balance of:

A)$31,000.

B)$37,000.

C)$24,000.

D)$27,000.

A)$31,000.

B)$37,000.

C)$24,000.

D)$27,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

52

Hinkle, Inc. purchased 200 shares of its own $20 par value stock for $30 cash per share. Which of the following answers reflects how this purchase of treasury stock would affect Hinkle's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following is not normally a preference given to the holders of preferred stock?

A)The right to vote before the common stockholders at the corporation's annual meeting.

B)The right to receive a specified amount of dividends prior any being paid to common stockholders.

C)The right to receive preference over common stockholders as to the distribution of assets during a liquidation process.

D)All of these are preferences given to preferred stock.

A)The right to vote before the common stockholders at the corporation's annual meeting.

B)The right to receive a specified amount of dividends prior any being paid to common stockholders.

C)The right to receive preference over common stockholders as to the distribution of assets during a liquidation process.

D)All of these are preferences given to preferred stock.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

54

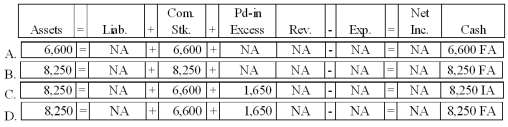

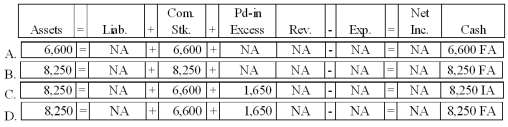

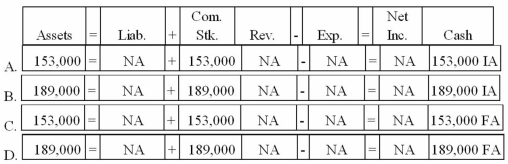

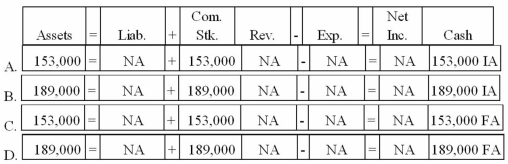

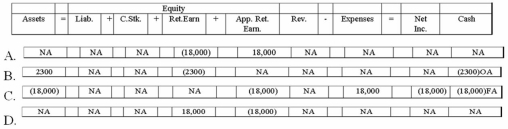

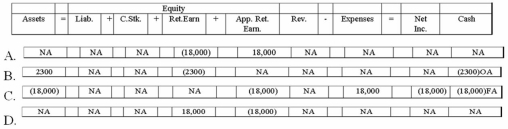

On February 2, 2013, the Metro Art Supply Corporation issued 9,000 shares of no-par stock for $17 per share. Within two hours of the issue, the stock's price jumped on the UMSL stock exchange to $21 per share. Which of the following answers describes the effect of the February 2, 2013 transaction?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

55

When the Common Stock account is disclosed on the balance sheet, it is reported at:

A)current market value

B)average issue price

C)lower of cost or market

D)par or stated value

A)current market value

B)average issue price

C)lower of cost or market

D)par or stated value

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

56

Xi Company issued 20,000 shares of $10 par value common stock at a market price of $16. As a result of this accounting event, the amount of stockholders' equity would

A)increase by $120,000.

B)be unaffected.

C)increase by $320,000.

D)increase by $200,000.

A)increase by $120,000.

B)be unaffected.

C)increase by $320,000.

D)increase by $200,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

57

The term "Retained Earnings" is best explained by which of the following statements?

A)Money set aside for the redemption of bonds.

B)A measure of capital generated through operating activities.

C)Cash retained in a separate bank account designated for emergency uses.

D)The difference between total revenue and total expenses in an accounting perioD.As a corporation generates earnings, equity is increased in the retained earnings account. In a proprietorship or partnership, earnings increase the owner(s)'s capital account.

A)Money set aside for the redemption of bonds.

B)A measure of capital generated through operating activities.

C)Cash retained in a separate bank account designated for emergency uses.

D)The difference between total revenue and total expenses in an accounting perioD.As a corporation generates earnings, equity is increased in the retained earnings account. In a proprietorship or partnership, earnings increase the owner(s)'s capital account.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

58

On January 2, 2013, Terra Corporation issued 20,000 shares of $20 par-value common stock for $22 per share. Which of the following statements is true?

A)The Paid-in Capital in Excess of Par Value account will increase by $40,000.

B)The Cash account will increase by $400,000.

C)Total equity will increase by $400,000.

D)The Common Stock account will increase by $440,000.

A)The Paid-in Capital in Excess of Par Value account will increase by $40,000.

B)The Cash account will increase by $400,000.

C)Total equity will increase by $400,000.

D)The Common Stock account will increase by $440,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following statements about Treasury Stock is correct?

A)The balance in the Treasury Stock account increases paid-in capital.

B)The balance in the Treasury Stock account reduces total Stockholders' Equity.

C)The balance in the Treasury Stock account reduces paid-in capital.

D)The balance in Treasury Stock reduces Retained Earnings.

A)The balance in the Treasury Stock account increases paid-in capital.

B)The balance in the Treasury Stock account reduces total Stockholders' Equity.

C)The balance in the Treasury Stock account reduces paid-in capital.

D)The balance in Treasury Stock reduces Retained Earnings.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

60

Where is treasury stock reported on a corporation's balance sheet?

A)As an addition to total paid-in capital

B)As a deduction from total paid-in capital

C)As a deduction from total stockholders' equity, following Retained Earnings

D)As a deduction from Retained Earnings

A)As an addition to total paid-in capital

B)As a deduction from total paid-in capital

C)As a deduction from total stockholders' equity, following Retained Earnings

D)As a deduction from Retained Earnings

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

61

Church Company declared and paid a cash dividend. Which of the following choices accurately reflects how this event would affect the company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

62

For 2013, the Warner Corporation had beginning and ending Retained Earnings balances of $208,054 and $231,112 respectively. Also during 2013, the corporation declared and paid cash dividends of $29,000 and issued stock dividends valued at $16,000. Total expenses were $32,916. Based on this information, what was the amount of total revenue for 2013?

A)$68,058

B)$100,974

C)$143,054

D)$179,032

A)$68,058

B)$100,974

C)$143,054

D)$179,032

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

63

At the time that Kaplan Company issued a 2-for-1 stock split, the company had 1,000 shares of $6 par value common stock outstanding. Stockholders' equity also contained $15,000 of additional paid in capital and $22,000 of retained earnings. Immediately after the stock split,

A)the balance in the common stock account would amount to $12,000.

B)the amount of paid-in capital would be equal to $15,000.

C)the balance in the retained earnings account would amount to $11,000.

D)the balance in the common stock account would amount to $6,000.

A)the balance in the common stock account would amount to $12,000.

B)the amount of paid-in capital would be equal to $15,000.

C)the balance in the retained earnings account would amount to $11,000.

D)the balance in the common stock account would amount to $6,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

64

What is the correct journal entry to record this transaction?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following reflects the financial statement effects on the May 1, 2013 date of payment?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

66

With respect to the current ratio, the declaration of a cash dividend will:

A)have no effect on the current ratio.

B)have an effect that depends on the market price of the stock at the time the dividend is declared.

C)increase the current ratio.

D)decrease the current ratio.

A)have no effect on the current ratio.

B)have an effect that depends on the market price of the stock at the time the dividend is declared.

C)increase the current ratio.

D)decrease the current ratio.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

67

A reason often given for a corporate stock split is:

A)to protect the interest of creditors.

B)to reduce the market price of the stock.

C)to increase the par value of the stock.

D)to absorb the treasury stock.

A)to protect the interest of creditors.

B)to reduce the market price of the stock.

C)to increase the par value of the stock.

D)to absorb the treasury stock.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following is a negative or contra stockholders' equity account?

A)Treasury Stock

B)Paid-in Capital in Excess of Par

C)Retained Earnings

D)Appropriated Retained Earnings

A)Treasury Stock

B)Paid-in Capital in Excess of Par

C)Retained Earnings

D)Appropriated Retained Earnings

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

69

The entry to record the dividend on March 1 will have which of the following financial statement effects?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

70

On July 1, 2013, Village Bookstore, Inc. appropriated retained earnings in the amount of $18,000 for a future remodeling project in the basement of the bookstore. On June 30, 2013, the balance of Retained Earnings was $41,400 and the Cash balance was $21,600. Which of the following answers shows the effect of the July 1 transaction on the financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

71

Minerva Company was authorized to issue 100,000 shares of common stock. The company had issued 25,000 shares of stock when it purchased 5,000 shares of treasury stock. The number of outstanding shares of common stock was:

A)95,000.

B)30,000.

C)25,000.

D)20,000.

A)95,000.

B)30,000.

C)25,000.

D)20,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

72

The payment of a previously declared cash dividend will

A)decrease assets and equity.

B)increase liabilities and decrease equity.

C)decrease liabilities and increase equity.

D)None of these is correct.

A)decrease assets and equity.

B)increase liabilities and decrease equity.

C)decrease liabilities and increase equity.

D)None of these is correct.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

73

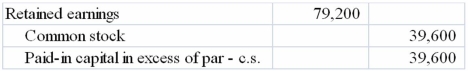

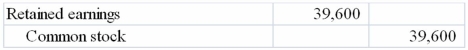

Determine the dollar value of the stock dividend issued by James Corporation.

A)$45,600

B)$79,200

C)$39,600

D)$720,000

A)$45,600

B)$79,200

C)$39,600

D)$720,000

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

74

What effect will the declaration and distribution of a stock dividend have on net income and cash flows?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

75

Sherman Corporation declared a 3-for-1 stock split on 8,000 shares of $7.50 par value common stock. If the market price of the stock had been $30 a share before the split, the par value, number of shares, and approximate market value after the split would be

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

76

Lenworth Company purchased 1,000 shares of its own $5 par value common stock when the market price of the stock was $18 per share. Select the journal entry that correctly records Lenworth's purchase of treasury stock.

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

77

The issuance of a stock dividend will

A)not affect total equity.

B)increase retained earnings.

C)decrease paid-in capital.

D)decrease total assets.

A)not affect total equity.

B)increase retained earnings.

C)decrease paid-in capital.

D)decrease total assets.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

78

Curren Co. paid dividends of $3,000; $6,000; and $10,000 during 2010, 2011 and 2012, respectively. The company had 500 shares of 5%, $200 par value preferred stock outstanding that paid cumulative dividend. The amount of dividends received by the common shareholders during 2012 would be:

A)$5,000.

B)$4,000.

C)$3,000.

D)$2,000.

A)$5,000.

B)$4,000.

C)$3,000.

D)$2,000.

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

79

The declaration and issuance of a stock dividend will

A)have no effect on the current ratio

B)have an effect on the current ratio that depends on the market price of the stock at the time the dividend is declared

C)increase the current ratio

D)decrease the current ratio

A)have no effect on the current ratio

B)have an effect on the current ratio that depends on the market price of the stock at the time the dividend is declared

C)increase the current ratio

D)decrease the current ratio

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck

80

Calculate the number of shares outstanding after the stock dividend is issued.

A)51,700 shares

B)55,000 shares

C)58,300 shares

D)503,300 shares

A)51,700 shares

B)55,000 shares

C)58,300 shares

D)503,300 shares

Unlock Deck

Unlock for access to all 153 flashcards in this deck.

Unlock Deck

k this deck