Deck 22: Topics in International Macroeconomics

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/148

Play

Full screen (f)

Deck 22: Topics in International Macroeconomics

1

A recent study concluded that trade costs for advanced countries represent about a ______ markup over the pre-shipment price of the goods.

A) 10%

B) 25%

C) 50%

D) 75%

A) 10%

B) 25%

C) 50%

D) 75%

D

2

When measuring real purchasing power parity (PPP) between China and the United States, prices of goods measured in dollars at the exchange rate in both nations resulted in:

A) higher prices for goods in China compared with the United States.

B) lower prices for goods in China compared with the United States.

C) prices of goods that were roughly equal.

D) Chinese customers having higher incomes in terms of purchasing power.

A) higher prices for goods in China compared with the United States.

B) lower prices for goods in China compared with the United States.

C) prices of goods that were roughly equal.

D) Chinese customers having higher incomes in terms of purchasing power.

B

3

Arbitrage may not achieve purchasing power parity due to:

A) trade costs.

B) dealer markups that vary between nations.

C) taxes on income.

D) high interest rates.

A) trade costs.

B) dealer markups that vary between nations.

C) taxes on income.

D) high interest rates.

A

4

The Big Mac index illustrates that in lower-income nations:

A) Big Mac prices, converted to a common currency, were cheaper.

B) PPP cannot be computed in this manner because diets in lower-income nations do not include fast food.

C) Big Mac prices, converted to a common currency, were more expensive.

D) lower-income workers could not afford to purchase fast food.

A) Big Mac prices, converted to a common currency, were cheaper.

B) PPP cannot be computed in this manner because diets in lower-income nations do not include fast food.

C) Big Mac prices, converted to a common currency, were more expensive.

D) lower-income workers could not afford to purchase fast food.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

5

The United States and Mexico can each produce automobiles for $20,000 and 230,000 pesos (P), respectively. Suppose that Mexican auto producers decide to lower their price to begin selling in the U.S. market. Given trade costs of 10%, what is the maximum price they can establish (net of trade costs) that will allow them to sell Mexican autos at the same price as U.S. autos?

A) P200,000

B) P220,000

C) P180,000

D) P181,818

A) P200,000

B) P220,000

C) P180,000

D) P181,818

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

6

Consider the following information about prices, P = $150; EP*= $180. If the cost of transporting the product is $15, the no-arbitrage band is within the limits of:

A) 0.91-1.2.

B) 0.99-1.01.

C) 0.91-1.1.

D) 1-1.5.

A) 0.91-1.2.

B) 0.99-1.01.

C) 0.91-1.1.

D) 1-1.5.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

7

International trade costs consist of:

A) transport costs.

B) costs at the border.

C) labor costs.

D) transport costs and costs at the border.

A) transport costs.

B) costs at the border.

C) labor costs.

D) transport costs and costs at the border.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

8

The United States and Mexico can each produce automobiles for $20,000 and 230,000 pesos (P), respectively. Based on the information provided, will the United States be able to export automobiles to Mexico if the exchange rate is P10 = $US1, and trade costs are 10%?

A) Yes, its price advantage more than offsets trade costs.

B) No, its price advantage does not offset trade costs.

C) No, its price advantage equals trade costs.

D) Yes, because trade costs are only a very small share of the price.

A) Yes, its price advantage more than offsets trade costs.

B) No, its price advantage does not offset trade costs.

C) No, its price advantage equals trade costs.

D) Yes, because trade costs are only a very small share of the price.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

9

The United States and Mexico can each produce automobiles for $20,000 and 230,000 pesos (P), respectively. Suppose that U.S. auto producers decide to raise prices to take advantage of their comparative advantage. What is the maximum price that they can establish (net of trade costs) that will just allow them to sell U.S. autos at the same price as Mexican-produced autos?

A) $20,000

B) $18,000

C) $21,000

D) $20,909

A) $20,000

B) $18,000

C) $21,000

D) $20,909

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

10

In general, if the trade costs are higher, the existence of PPP and the LOOP are:

A) more likely.

B) impossible.

C) less likely.

D) irrelevant.

A) more likely.

B) impossible.

C) less likely.

D) irrelevant.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

11

Purchasing power parity (PPP) in the goods markets would hold if all goods were:

A) manufactured domestically.

B) inspected at the ports.

C) freely tradable.

D) traded only domestically.

A) manufactured domestically.

B) inspected at the ports.

C) freely tradable.

D) traded only domestically.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

12

Consider the following information about prices: P = $150; EP*= $180. If the cost of transporting the product is $15, based on this information:

A) it is possible to engage in arbitrage.

B) it is not possible to engage in arbitrage.

C) it is inconclusive whether arbitrage is possible.

D) arbitrage is possible only if transportation cost is $1.

A) it is possible to engage in arbitrage.

B) it is not possible to engage in arbitrage.

C) it is inconclusive whether arbitrage is possible.

D) arbitrage is possible only if transportation cost is $1.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

13

Consider the following information about prices, P = $150; EP* = $180. If the cost of transporting the product is $30, then the LOOP suggests that:

A) there is no room for arbitrage.

B) the arbitrage band is between 0.91 and 1.1

C) there is significant profits to be made from arbitrage.

D) the arbitrage band is between 0.2 and 1.8.

A) there is no room for arbitrage.

B) the arbitrage band is between 0.91 and 1.1

C) there is significant profits to be made from arbitrage.

D) the arbitrage band is between 0.2 and 1.8.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

14

Trade costs can vary from one nation to another. All of the following tend to increase trade costs, EXCEPT:

A) reduction of quota limits on imports.

B) increased regulatory barriers.

C) higher transportation costs.

D) more liberalized trade.

A) reduction of quota limits on imports.

B) increased regulatory barriers.

C) higher transportation costs.

D) more liberalized trade.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

15

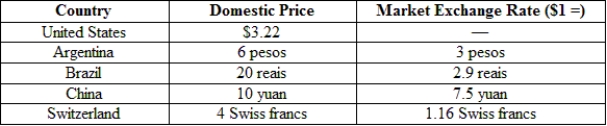

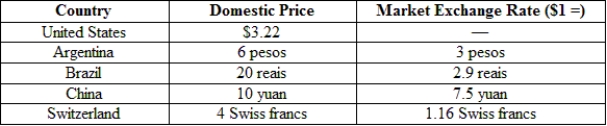

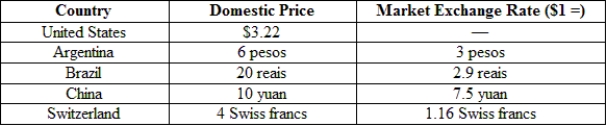

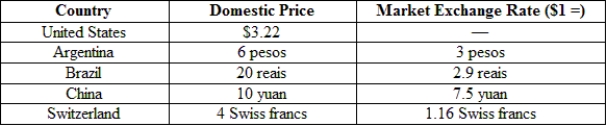

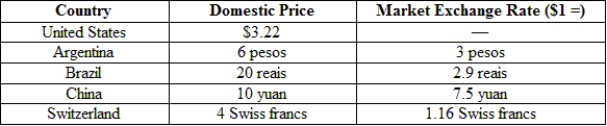

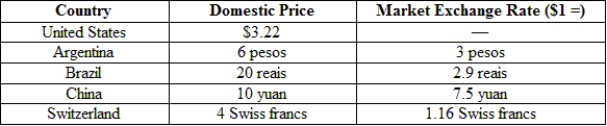

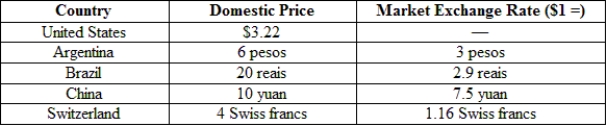

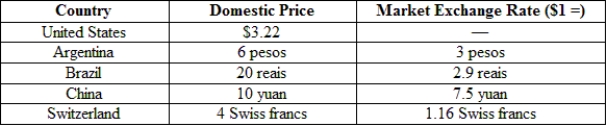

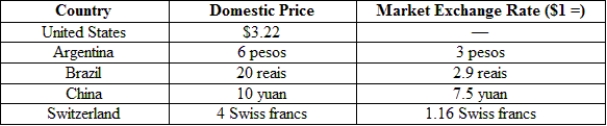

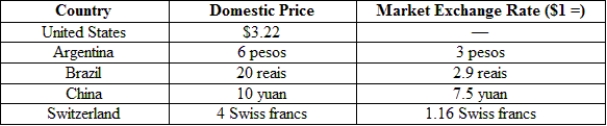

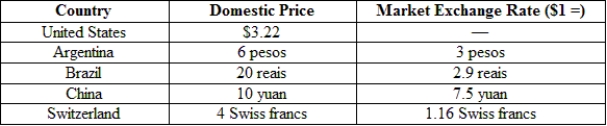

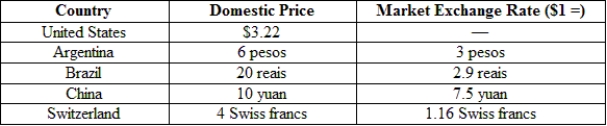

(Table: The Big Mac Index) The price of a hamburger in dollar terms is _____ in China and _____ in Brazil.

A) $2; $9.

B) $1.33; $6.89

C) $1.25; $6

D) $6.89; $1.33

A) $2; $9.

B) $1.33; $6.89

C) $1.25; $6

D) $6.89; $1.33

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

16

The no-arbitrage band delimits the:

A) range in which profitable trading can occur.

B) deviation from 1 that the real exchange rate may exhibit.

C) additional fees charged to exchange currency.

D) propensity of governments to impose trade restrictions.

A) range in which profitable trading can occur.

B) deviation from 1 that the real exchange rate may exhibit.

C) additional fees charged to exchange currency.

D) propensity of governments to impose trade restrictions.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following will increase trade costs?

A) an increase in tariff rates in the importing country

B) a reduction in quotas in the importing country

C) a decrease in transportation costs

D) a decrease in the importing country's exchange rate

A) an increase in tariff rates in the importing country

B) a reduction in quotas in the importing country

C) a decrease in transportation costs

D) a decrease in the importing country's exchange rate

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

18

Arbitrage occurs when an entity purchases a good in the lower-priced market and sells it at the same time in the higher-priced market. The existence of trade costs would ____ opportunities for arbitrage.

A) lower

B) not affect

C) increase

D) completely eliminate

A) lower

B) not affect

C) increase

D) completely eliminate

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

19

When there are no trade costs, which of the following conditions exist? I. There is no arbitrage.

II) The law of one price (LOOP) is operational.

III) The real exchange rate is equal to one.

A) I

B) II

C) I and II

D) II and III

II) The law of one price (LOOP) is operational.

III) The real exchange rate is equal to one.

A) I

B) II

C) I and II

D) II and III

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

20

Increasing trade costs:

A) result in a narrower arbitrage band.

B) exist in advanced countries.

C) result in a wider arbitrage band.

D) promote increased volume of trade.

A) result in a narrower arbitrage band.

B) exist in advanced countries.

C) result in a wider arbitrage band.

D) promote increased volume of trade.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

21

The United States and China can produce TVs at $200 and 2000 yuan each. One day of labor is needed to produce a TV in the United States and 10 days of labor are needed to produce a TV in China. Each country also produces the nontraded good, car washing. In each country, one car can be washed in one day. The exchange rate is 10 yuan = $1. What is the ratio of U.S. to Chinese daily wages, with both expressed in dollars at the 10 yuan = $1 exchange rate?

A) 10

B) 20

C) 5

D) 1

A) 10

B) 20

C) 5

D) 1

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

22

We can calculate the changes in the real exchange rate necessary for purchasing power parity by:

A) the share of nontraded goods divided by the share of traded goods.

B) the share of nontraded goods multiplied by the change in foreign traded productivity level relative to home.

C) nontraded goods minus domestic worker productivity.

D) wages earned in nontraded goods industries divided by wages earned in traded goods industries.

A) the share of nontraded goods divided by the share of traded goods.

B) the share of nontraded goods multiplied by the change in foreign traded productivity level relative to home.

C) nontraded goods minus domestic worker productivity.

D) wages earned in nontraded goods industries divided by wages earned in traded goods industries.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

23

The United States and China can produce TVs at $200 and 2000 yuan each. One day of labor is needed to produce a TV in the United States and 10 days of labor are needed to produce a TV in China. Each country also produces the nontraded good, car washing. In each country, one car can be washed in one day. The exchange rate is 10 yuan = $1. What is the price of a car wash in China?

A) 2,000 yuan

B) 1,000 yuan

C) 600 yuan

D) 200 yuan

A) 2,000 yuan

B) 1,000 yuan

C) 600 yuan

D) 200 yuan

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

24

The United States and China can produce TVs at $200 and 2000 yuan each. One day of labor is needed to produce a TV in the United States and 10 days of labor are needed to produce a TV in China. Each country also produces the nontraded good, car washing. In each country, one car can be washed in one day. The exchange rate is 10 yuan = $1. What is the price of a car wash in the United States?

A) $200

B) $100

C) $50

D) $10

A) $200

B) $100

C) $50

D) $10

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

25

The United States and China can produce TVs at $200 and 2000 yuan each. One day of labor is needed to produce a TV in the United States and 10 days of labor are needed to produce a TV in China. Each country also produces the nontraded good, car washing. In each country, one car can be washed in one day. The exchange rate is 10 yuan = $1. Assume people in each country spend half their income on TVs and half on car washes. Compute the consumer price index (CPI) for each country given by the square root of the TV price times the car wash price. Convert the Chinese CPI to dollars at the 10 yuan = $1 exchange rate. What is the ratio of the U.S. to Chinese CPI?

A) 10

B) 3.16

C) 5

D) 20

A) 10

B) 3.16

C) 5

D) 20

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

26

Deviations from purchasing power parity can be explained by the Balassa-Samuelson model, which assumes:

A) government regulation is absent.

B) traded goods have the same prices, productivity in traded goods determines wages, and wages determine prices of nontraded goods.

C) worker productivity is rising, returns to capital equal the real rate of interest, and there is no money illusion.

D) competitive markets, full information, and full employment of resources.

A) government regulation is absent.

B) traded goods have the same prices, productivity in traded goods determines wages, and wages determine prices of nontraded goods.

C) worker productivity is rising, returns to capital equal the real rate of interest, and there is no money illusion.

D) competitive markets, full information, and full employment of resources.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

27

(Table: The Big Mac Index) The cheapest burger can be found in:

A) Switzerland.

B) Brazil.

C) China.

D) Argentina.

A) Switzerland.

B) Brazil.

C) China.

D) Argentina.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

28

(Table: The Big Mac Index) The most expensive burger is sold in:

A) the United States.

B) Brazil.

C) China.

D) Switzerland.

A) the United States.

B) Brazil.

C) China.

D) Switzerland.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

29

The Balassa-Samuelson model says that wages and prices in general are higher in higher-income nations because:

A) they have more effective laws protecting their workers.

B) the workers have a higher productivity level, which is reflected in prices of nontraded goods.

C) there is less competition in these economies.

D) taxes on business and for entitlement programs raise labor and other costs, making prices much higher.

A) they have more effective laws protecting their workers.

B) the workers have a higher productivity level, which is reflected in prices of nontraded goods.

C) there is less competition in these economies.

D) taxes on business and for entitlement programs raise labor and other costs, making prices much higher.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

30

(Table: The Big Mac Index) The PPP exchange rate for Brazil is ______ reais and Switzerland is ______ Swiss francs.

A) 8; 1.24

B) 6.2; 1.24

C) 2.9; 1.16

D) 3.1; 2

A) 8; 1.24

B) 6.2; 1.24

C) 2.9; 1.16

D) 3.1; 2

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

31

For a product that is traded internationally, with low trade costs, such as a DVD player, competition dictates that workers involved in manufacturing that good will:

A) probably not get the full value of their marginal products.

B) earn higher wages if trade does not force them to compete with low-cost foreign workers.

C) earn wages that are determined by their productivity.

D) lose their jobs if there are higher international product standards.

A) probably not get the full value of their marginal products.

B) earn higher wages if trade does not force them to compete with low-cost foreign workers.

C) earn wages that are determined by their productivity.

D) lose their jobs if there are higher international product standards.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

32

The Balassa-Samuelson effect states that when a nation's productivity rises relative to its trading partners, its wages and prices rise and its real exchange rate:

A) depreciates.

B) converges to 1.

C) appreciates.

D) exhibits instability over a short period.

A) depreciates.

B) converges to 1.

C) appreciates.

D) exhibits instability over a short period.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

33

(Table: The Big Mac Index) The price of a hamburger in dollar terms is ______ in Argentina and _______ in Switzerland.

A) $2; $3.45

B) $3.45; $2

C) $1.33; $2

D) $2; $1.33

A) $2; $3.45

B) $3.45; $2

C) $1.33; $2

D) $2; $1.33

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

34

An interesting conclusion from many studies of international price differences is that:

A) prices tend in general to be higher in low-income nations, causing steep declines in their standards of living.

B) on average, prices of traded goods in low-income nations are lower and, therefore, their overall price levels are lower.

C) on average, prices of nontraded goods in low-income nations are lower, but the prices on traded goods are higher and, therefore, their overall price level is not affected.

D) price differences tend to be larger, depending on whether the central bank pegs the nation's currency to the U.S. dollar or the Japanese yen.

A) prices tend in general to be higher in low-income nations, causing steep declines in their standards of living.

B) on average, prices of traded goods in low-income nations are lower and, therefore, their overall price levels are lower.

C) on average, prices of nontraded goods in low-income nations are lower, but the prices on traded goods are higher and, therefore, their overall price level is not affected.

D) price differences tend to be larger, depending on whether the central bank pegs the nation's currency to the U.S. dollar or the Japanese yen.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

35

Country A is experiencing productivity growth. When compared with other countries with lower productivity growth, we expect to see wages and incomes _______ and its exchange rate _______.

A) fall; appreciate

B) rise, appreciate

C) fall; depreciate

D) rise; depreciate

A) fall; appreciate

B) rise, appreciate

C) fall; depreciate

D) rise; depreciate

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

36

Country A has higher productivity in traded goods production than country B. The difference between country A's and country B's overall price levels will widen as the share of:

A) nontraded goods in country A's consumption falls.

B) traded goods in country A's consumption rises.

C) nontraded goods in country A's consumption rises.

D) nontraded goods in country B's consumption falls.

A) nontraded goods in country A's consumption falls.

B) traded goods in country A's consumption rises.

C) nontraded goods in country A's consumption rises.

D) nontraded goods in country B's consumption falls.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

37

The United States and China can produce TVs at $200 and 2000 yuan each. One day of labor is needed to produce a TV in the United States and 10 days of labor are needed to produce a TV in China. Each country also produces the nontraded good, car washing. In each country, one car can be washed in one day. The exchange rate is 10 yuan = $1. If trade costs are zero, what is the Chinese daily wage?

A) 2000 yuan

B) 667 yuan

C) 200 yuan

D) 25 yuan

A) 2000 yuan

B) 667 yuan

C) 200 yuan

D) 25 yuan

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

38

(Table: The Big Mac Index) The PPP exchange rate for China should be _____ yuan.

A) 4

B) 3.1

C) 5

D) 32.2

A) 4

B) 3.1

C) 5

D) 32.2

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

39

The percentage change in the real exchange rate between two nations is equal to the:

A) product of home worker productivity and foreign productivity divided by the share of traded goods in production.

B) difference between home and foreign worker productivity.

C) difference in the relative wage of foreign and home workers times the price level in the nation.

D) change in the difference between foreign worker productivity and home worker productivity multiplied by the share of nontraded goods in total production.

A) product of home worker productivity and foreign productivity divided by the share of traded goods in production.

B) difference between home and foreign worker productivity.

C) difference in the relative wage of foreign and home workers times the price level in the nation.

D) change in the difference between foreign worker productivity and home worker productivity multiplied by the share of nontraded goods in total production.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

40

The United States and China can produce TVs at $200 and 2000 yuan each. One day of labor is needed to produce a TV in the United States and 10 days of labor are needed to produce a TV in China. Each country also produces the nontraded good, car washing. In each country, one car can be washed in one day. The exchange rate is 10 yuan = $1. If trade costs are zero, what is the daily wage in the United States?

A) $2000

B) $200

C) $100

D) $150

A) $2000

B) $200

C) $100

D) $150

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

41

The Balassa-Samuelson forecast predicted that Argentina's overvalued exchange rate would have to be offset by:

A) maintaining a more credible peg to the U.S. dollar.

B) a combination of more intense price deflation in Argentina relative to the United States and an exchange rate depreciation.

C) intervention by the IMF to stabilize the peso.

D) a trade embargo coupled with capital controls.

A) maintaining a more credible peg to the U.S. dollar.

B) a combination of more intense price deflation in Argentina relative to the United States and an exchange rate depreciation.

C) intervention by the IMF to stabilize the peso.

D) a trade embargo coupled with capital controls.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

42

When a nation's currency is different from equilibrium, it is either overvalued or undervalued. To restore equilibrium, either a ____ or ____ must occur.

A) return to a balanced budget; more government belt-tightening

B) nominal exchange rate change; a change in the nation's price level

C) national cut of imports; a national increase of exports

D) national cut of exports; a national increase of imports

A) return to a balanced budget; more government belt-tightening

B) nominal exchange rate change; a change in the nation's price level

C) national cut of imports; a national increase of exports

D) national cut of exports; a national increase of imports

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

43

If the real exchange rate is higher (FX costs more) than the equilibrium exchange rate (calculated according to the Balassa-Samuelson effect), the nation's currency is said to be:

A) undervalued.

B) overvalued.

C) at the proper level.

D) at greater risk for a currency crisis.

A) undervalued.

B) overvalued.

C) at the proper level.

D) at greater risk for a currency crisis.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

44

If UIP holds, then returns on foreign investments (the carry trade) would be:

A) greater than 10%.

B) equal to the return from investment plus the appreciation of the home currency.

C) equal to the return from investment minus appreciation of the home currency.

D) equal to the reciprocal of the appreciation of the home currency.

A) greater than 10%.

B) equal to the return from investment plus the appreciation of the home currency.

C) equal to the return from investment minus appreciation of the home currency.

D) equal to the reciprocal of the appreciation of the home currency.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

45

The Balassa-Samuelson forecast can be used to predict changes in _____ over time and, therefore, can be used to predict ______ by adding in inflation changes.

A) income levels; real GDP growth rates

B) expectations; technology improvements

C) real GDP; unemployment rates

D) real exchange rates; nominal exchange rates

A) income levels; real GDP growth rates

B) expectations; technology improvements

C) real GDP; unemployment rates

D) real exchange rates; nominal exchange rates

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

46

If a country's currency is overvalued in real terms, what combination of exchange rate and price changes will cause its exchange rate to move toward its real equilibrium value?

A) currency depreciation and deflation

B) currency depreciation and inflation

C) currency appreciation and deflation

D) currency appreciation and inflation

A) currency depreciation and deflation

B) currency depreciation and inflation

C) currency appreciation and deflation

D) currency appreciation and inflation

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

47

The Balassa-Samuelson forecast applied to China during 2000-04:

A) failed to predict the slow rise in the exchange rate that actually occurred.

B) failed to predict the Chinese inflation that actually occurred.

C) failed to predict the rise in Chinese real GDP that actually occurred.

D) predicted correctly that the slow appreciation of the Chinese exchange rate would result in higher inflation of the Chinese yuan.

A) failed to predict the slow rise in the exchange rate that actually occurred.

B) failed to predict the Chinese inflation that actually occurred.

C) failed to predict the rise in Chinese real GDP that actually occurred.

D) predicted correctly that the slow appreciation of the Chinese exchange rate would result in higher inflation of the Chinese yuan.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

48

When PPP holds, the Balassa-Samuelson forecast is:

A) very useful in predicting real and nominal exchange rate changes.

B) somewhat useful except that traders are often unpredictable.

C) not useful because when PPP holds, the real exchange rate is equal to 1.

D) used only for comparisons between low-income nations.

A) very useful in predicting real and nominal exchange rate changes.

B) somewhat useful except that traders are often unpredictable.

C) not useful because when PPP holds, the real exchange rate is equal to 1.

D) used only for comparisons between low-income nations.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

49

The Balassa-Samuelson model about exchange rates suggests that if the Brazilian real is undervalued by 44%, it would take ____ years for the real to appreciate by half of the original amount of undervaluation at the rate of ___ per year.

A) 5; 4.4

B) 4; 5.5

C) 1; 22

D) 3; 7

A) 5; 4.4

B) 4; 5.5

C) 1; 22

D) 3; 7

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

50

Suppose that the half-life of deviations from PPP is five years (it takes five years for the difference between the actual and equilibrium real exchange rate to narrow by half) and the nontraded share of consumption is 0.50. What will be the annual rate of change of the real exchange rate if a country initially has a 20% gap between its actual and equilibrium real exchange rates and its GDP is growing 5% faster than GDP in the rest of the world?

A) 70%

B) 22%

C) 4.5%

D) 2.0%

A) 70%

B) 22%

C) 4.5%

D) 2.0%

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

51

For the time period between 1992 and 2001, an investor who borrowed Japanese yen at low interest rates and invested in Australian dollar assets at higher interest rates:

A) enjoyed an overall profit because the interest differential was higher than the net exchange appreciation of the yen.

B) suffered substantial losses because the interest differential was lower than the net exchange appreciation of the yen.

C) experienced offsetting positive and negative returns because of long-run swings in the exchange rate.

D) did not realize that, as a result of transactions costs and taxes, any net return would be zero.

A) enjoyed an overall profit because the interest differential was higher than the net exchange appreciation of the yen.

B) suffered substantial losses because the interest differential was lower than the net exchange appreciation of the yen.

C) experienced offsetting positive and negative returns because of long-run swings in the exchange rate.

D) did not realize that, as a result of transactions costs and taxes, any net return would be zero.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

52

Between 1992 and 2001, the carry trade strategy of borrowing yen and investing in Australian dollars produced roughly offsetting profits and losses because:

A) the yen appreciated whenever the Australian-Japanese interest rate differential widened.

B) the yen depreciated whenever the Australian-Japanese interest rate differential widened.

C) the yen appreciated whenever the Australian-Japanese interest rate differential narrowed.

D) the value of the yen against the Australian dollar remained constant.

A) the yen appreciated whenever the Australian-Japanese interest rate differential widened.

B) the yen depreciated whenever the Australian-Japanese interest rate differential widened.

C) the yen appreciated whenever the Australian-Japanese interest rate differential narrowed.

D) the value of the yen against the Australian dollar remained constant.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

53

Slovakia experienced rapid productivity growth and an undervalued exchange rate during 1992-2004, which presented a dilemma because:

A) its performance put it below the standards for European Union membership.

B) its government did not understand how to inflate Slovakia's own currency.

C) real GDP growth suffered as predicted by Balassa-Samuelson.

D) to keep its nominal exchange rate from appreciating against the euro (required for Eurozone membership), Slovakia would have had to experience higher inflation as per the Balassa-Samuelson effect.

A) its performance put it below the standards for European Union membership.

B) its government did not understand how to inflate Slovakia's own currency.

C) real GDP growth suffered as predicted by Balassa-Samuelson.

D) to keep its nominal exchange rate from appreciating against the euro (required for Eurozone membership), Slovakia would have had to experience higher inflation as per the Balassa-Samuelson effect.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

54

According to the text, the carry trade strategy of borrowing yen and investing in Australian dollars:

A) never resulted in positive profits between 1982 and 2001.

B) produced roughly offsetting profits and losses between 1992 and 2001.

C) produced large profits between 1992 and 2001.

D) produced large losses between 1992 and 2001

A) never resulted in positive profits between 1982 and 2001.

B) produced roughly offsetting profits and losses between 1992 and 2001.

C) produced large profits between 1992 and 2001.

D) produced large losses between 1992 and 2001

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

55

By stabilizing their exchange rates to join the Eurozone, the Baltic states have seen:

A) lower inflation.

B) faster price growth.

C) massive budget deficits.

D) faster price growth and massive budget deficits.

A) lower inflation.

B) faster price growth.

C) massive budget deficits.

D) faster price growth and massive budget deficits.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

56

The formula for predicting changes in the nominal exchange rate, when PPP doesn't hold, is the rate of real depreciation:

A) multiplied by the nominal wage.

B) multiplied by the interest rate differential.

C) added to the inflation differential.

D) multiplied by inflation in the home nation.

A) multiplied by the nominal wage.

B) multiplied by the interest rate differential.

C) added to the inflation differential.

D) multiplied by inflation in the home nation.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

57

The Balassa-Samuelson effect can be used to forecast changes in real exchange rates by considering the speed of ______ and ______.

A) convergence to equilibrium; trend changes in the equilibrium value

B) adjustment to trade imbalances; budget deficit reduction

C) innovation and productivity; the deterioration of the peg

D) adjustment to imbalances in income levels; educational attainment

A) convergence to equilibrium; trend changes in the equilibrium value

B) adjustment to trade imbalances; budget deficit reduction

C) innovation and productivity; the deterioration of the peg

D) adjustment to imbalances in income levels; educational attainment

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

58

If the interest rate is 1% in Japan and 9% in Australia, then:

A) we can expect the interest rates to equalize.

B) investors will buy Japanese bonds.

C) the yen will depreciate by 8%.

D) the yen will appreciate by 8%.

A) we can expect the interest rates to equalize.

B) investors will buy Japanese bonds.

C) the yen will depreciate by 8%.

D) the yen will appreciate by 8%.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

59

Many analysts believe that China's currency (the yuan) is undervalued in real terms. China has been experiencing a high rate of productivity growth. What would you expect to happen to Chinese GDP and Chinese prices relative to U.S. prices if this pattern continues over time?

A) Chinese GDP will rise and Chinese prices will fall relative to U.S. prices.

B) Chinese GDP will rise and Chinese prices will rise relative to U.S. prices.

C) Chinese GDP will fall and Chinese prices will fall relative to U.S. prices.

D) Chinese GDP will fall and Chinese prices will rise relative to U.S. prices.

A) Chinese GDP will rise and Chinese prices will fall relative to U.S. prices.

B) Chinese GDP will rise and Chinese prices will rise relative to U.S. prices.

C) Chinese GDP will fall and Chinese prices will fall relative to U.S. prices.

D) Chinese GDP will fall and Chinese prices will rise relative to U.S. prices.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

60

In equilibrium, according to the Balassa-Samuelson effect, the real exchange rate is:

A) always equal to 1.

B) never equal to 1.

C) often equal to 1.

D) not necessarily equal to 1.

A) always equal to 1.

B) never equal to 1.

C) often equal to 1.

D) not necessarily equal to 1.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

61

When carry trade speculation grows to high levels, it can affect the economy. How?

A) It is a stabilizing factor.

B) It can be a destabilizing factor, causing large swings in exchange rates.

C) It creates large differentials in income distribution in emerging markets.

D) Inflation is always a problem when carry trade activity increases.

A) It is a stabilizing factor.

B) It can be a destabilizing factor, causing large swings in exchange rates.

C) It creates large differentials in income distribution in emerging markets.

D) Inflation is always a problem when carry trade activity increases.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

62

Uncovered interest parity implies that interest arbitrage will:

A) earn a premium.

B) earn less than a normal return.

C) not be possible.

D) end up raising real rates of interest.

A) earn a premium.

B) earn less than a normal return.

C) not be possible.

D) end up raising real rates of interest.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

63

Why did investors not believe that Argentina's peg to the U.S. dollar during the 1990s was credible?

A) Over most of this period, Argentine interest rates were higher than U.S. interest rates.

B) Over most of this period, Argentine interest rates were lower than U.S. interest rates.

C) Over most of this period, Argentine interest rates were equal to U.S. interest rates.

D) Over most of this period, Argentine interest rates had no relationship to U.S. interest rates.

A) Over most of this period, Argentine interest rates were higher than U.S. interest rates.

B) Over most of this period, Argentine interest rates were lower than U.S. interest rates.

C) Over most of this period, Argentine interest rates were equal to U.S. interest rates.

D) Over most of this period, Argentine interest rates had no relationship to U.S. interest rates.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

64

A foreign exchange trader indicates that he or she can make a predictable return of 10% per year in carry trade between Japanese yen and Australian dollars with a standard deviation of 50%. What is the Sharpe ratio for this carry trade?

A) 500%

B) 50%

C) 20%

D) 10%

A) 500%

B) 50%

C) 20%

D) 10%

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

65

The existence of profits from the carry trade seems to negate the notion of uncovered interest parity (UIP), but:

A) UIP has never really been proved to exist.

B) UIP occurs over longer periods (perhaps two years) as a result of long and volatile movements in the exchange rate.

C) if uncovered interest parity exist, carry trade profits would be higher still.

D) carry trade profits are not related to changes in the nominal rate of interest.

A) UIP has never really been proved to exist.

B) UIP occurs over longer periods (perhaps two years) as a result of long and volatile movements in the exchange rate.

C) if uncovered interest parity exist, carry trade profits would be higher still.

D) carry trade profits are not related to changes in the nominal rate of interest.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

66

The existence of systematic profits in the carry trade seems to violate which of the following?

A) the principle of reason

B) the efficient markets hypothesis combined with UIP and rational expectations

C) the principle of second best

D) the principle of "two out of three"

A) the principle of reason

B) the efficient markets hypothesis combined with UIP and rational expectations

C) the principle of second best

D) the principle of "two out of three"

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

67

If a nation maintains fixed exchange rates, it may be a haven for foreign investment if:

A) investors (irrationally fearing the peg will not hold) demand higher interest rates (risk premium) on investments denominated in the currency.

B) investors make more money when they go against conventional wisdom and put money in riskier investments.

C) there is more certainty over the real return on investments.

D) its government taxes returns from those investments.

A) investors (irrationally fearing the peg will not hold) demand higher interest rates (risk premium) on investments denominated in the currency.

B) investors make more money when they go against conventional wisdom and put money in riskier investments.

C) there is more certainty over the real return on investments.

D) its government taxes returns from those investments.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

68

An analysis of profits in the carry trade revealed a predictable profit (+)/loss (-) of:

A) +25%.

B) +0.08%.

C) -0.02%.

D) -0.2%.

A) +25%.

B) +0.08%.

C) -0.02%.

D) -0.2%.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

69

Many ordinary Japanese workers are investing any extra funds in U.S. dollar and other investments. Why?

A) They fear a decline in the Japanese economy and that they will lose their jobs.

B) They experience higher interest rates not offset by yen appreciation.

C) Many desire to emigrate to the United States and want to establish a financial presence.

D) They have access by computer to U.S. investment houses that do not exist in Japan.

A) They fear a decline in the Japanese economy and that they will lose their jobs.

B) They experience higher interest rates not offset by yen appreciation.

C) Many desire to emigrate to the United States and want to establish a financial presence.

D) They have access by computer to U.S. investment houses that do not exist in Japan.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

70

Analysts have puzzled over why carry trade profits persist. They have rejected all the following explanations, EXCEPT:

A) trade costs in financial markets are sufficiently high enough to make arbitrage impossible.

B) when traders buy or sell an asset in large volumes, it may move the price sufficiently to cause independent changes in the exchange rate.

C) risk of exchange rate movements is so large that many traders prefer not to engage in arbitrage in these markets for fear of excessive losses.

D) there may be a substantial difference in the bid-ask prices of currency that make arbitrage less profitable.

A) trade costs in financial markets are sufficiently high enough to make arbitrage impossible.

B) when traders buy or sell an asset in large volumes, it may move the price sufficiently to cause independent changes in the exchange rate.

C) risk of exchange rate movements is so large that many traders prefer not to engage in arbitrage in these markets for fear of excessive losses.

D) there may be a substantial difference in the bid-ask prices of currency that make arbitrage less profitable.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

71

Argentina's 2001 currency crisis illustrates that:

A) a peg cannot survive major domestic default and banking crises.

B) a peg can be relied on as long as it is tied to a major world currency, such as the U.S. dollar.

C) a peg is the best choice for many emerging market economies.

D) even if a peg breaks, foreign investors can recoup losses from the government.

A) a peg cannot survive major domestic default and banking crises.

B) a peg can be relied on as long as it is tied to a major world currency, such as the U.S. dollar.

C) a peg is the best choice for many emerging market economies.

D) even if a peg breaks, foreign investors can recoup losses from the government.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

72

What is the "peso problem"?

A) Expectations are realized on average, and returns from interest arbitrage are zero.

B) Even when exchange rates are fixed, investors often demand a premium for interest arbitrage, so the return from arbitrage can be positive or negative.

C) Pegged currencies are less stressful for investors because there is no room for speculation.

D) Returns from interest arbitrage are always positive, even when the peg breaks.

A) Expectations are realized on average, and returns from interest arbitrage are zero.

B) Even when exchange rates are fixed, investors often demand a premium for interest arbitrage, so the return from arbitrage can be positive or negative.

C) Pegged currencies are less stressful for investors because there is no room for speculation.

D) Returns from interest arbitrage are always positive, even when the peg breaks.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

73

If a country has a credible peg with no risk of a depreciation or of other risks (e.g., default risk), then UIP implies that:

A) its interest rate should equal foreign interest rates.

B) its interest rate should be greater than foreign interest rates.

C) its interest rate should be less than foreign interest rates.

D) there should be no relationship between its interest rate and foreign interest rates.

A) its interest rate should equal foreign interest rates.

B) its interest rate should be greater than foreign interest rates.

C) its interest rate should be less than foreign interest rates.

D) there should be no relationship between its interest rate and foreign interest rates.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

74

When trade costs are small, the effect on trades in financial markets:

A) is usually quite substantial.

B) is usually quite small and would not interfere with interest arbitrage.

C) might cause investors to delay their reaction to a profitable opportunity.

D) causes a bias toward trades in higher-income nations with more developed financial markets.

A) is usually quite substantial.

B) is usually quite small and would not interfere with interest arbitrage.

C) might cause investors to delay their reaction to a profitable opportunity.

D) causes a bias toward trades in higher-income nations with more developed financial markets.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

75

Actual carry trade profits which are based on actual expected depreciation indicate that:

A) uncovered interest parity does not hold systematically, and on average the carry trade is profitable.

B) uncovered interest parity holds, and there is no possibility of profitable interest arbitrage.

C) purchasing power parity is the best indicator of future currency depreciation.

D) profits in the carry trade are not taxed, which is a burden for emerging market economies.

A) uncovered interest parity does not hold systematically, and on average the carry trade is profitable.

B) uncovered interest parity holds, and there is no possibility of profitable interest arbitrage.

C) purchasing power parity is the best indicator of future currency depreciation.

D) profits in the carry trade are not taxed, which is a burden for emerging market economies.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

76

A forecast error is caused by a:

A) real exchange rate depreciation.

B) nominal exchange rate depreciation.

C) difference between expected nominal exchange rate depreciation and actual depreciation.

D) nation's movement fixed to floating exchange rates.

A) real exchange rate depreciation.

B) nominal exchange rate depreciation.

C) difference between expected nominal exchange rate depreciation and actual depreciation.

D) nation's movement fixed to floating exchange rates.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

77

The ratio of the returns on an asset to the risks taken on by investors is known as:

A) the Marshall-Leamer theorem.

B) the price-to-earnings ratio.

C) the Sharpe ratio.

D) the standard deviation from zero.

A) the Marshall-Leamer theorem.

B) the price-to-earnings ratio.

C) the Sharpe ratio.

D) the standard deviation from zero.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

78

Even though UIP is shown to hold within a small range on average, some deviations allow systematic profits to be made. This violates all of the following principles, EXCEPT:

A) rational expectations with no systematic bias.

B) efficient markets hypothesis, which postulates that all traders are operating with the same information.

C) random deviations in exchange rates around their mean.

D) rational expectations with systematic bias.

A) rational expectations with no systematic bias.

B) efficient markets hypothesis, which postulates that all traders are operating with the same information.

C) random deviations in exchange rates around their mean.

D) rational expectations with systematic bias.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

79

Investors' decisions to invest in a risky asset can be analyzed by using the Sharpe ratio, which measures the:

A) home interest rate plus the inflation differential minus home exchange rate depreciation.

B) difference in nominal interest rates divided by the change in the foreign nominal interest rate.

C) mean of the difference in returns divided by the standard deviation of the differences.

D) ratio of exchange rate depreciation between home and foreign.

A) home interest rate plus the inflation differential minus home exchange rate depreciation.

B) difference in nominal interest rates divided by the change in the foreign nominal interest rate.

C) mean of the difference in returns divided by the standard deviation of the differences.

D) ratio of exchange rate depreciation between home and foreign.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck

80

Because interest returns are known ex ante, the only unknown factor in the carry trade (international investments) is:

A) government tax policy.

B) default risk.

C) exchange rate risk (forecast error).

D) climate change risk.

A) government tax policy.

B) default risk.

C) exchange rate risk (forecast error).

D) climate change risk.

Unlock Deck

Unlock for access to all 148 flashcards in this deck.

Unlock Deck

k this deck