Deck 1: The Individual Income Tax Return

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/125

Play

Full screen (f)

Deck 1: The Individual Income Tax Return

1

If your spouse dies during the tax year and you do not remarry, you must file as single for the year of death.

False

2

For taxpayers who do not itemize deductions, the standard deduction amount is subtracted from the taxpayer's adjusted gross income.

True

3

A taxpayer who maintains a household with an unmarried child may qualify to file as head of household even if the child is not the taxpayer's dependent.

False

4

If an unmarried taxpayer paid more than half the cost of keeping a home which is the principal place of residence of a nephew, who is not her dependent, she may use the head of household filing status.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

5

All taxpayers may use the tax rate schedule to determine their tax liability.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

6

An item is not included in gross income unless the tax law specifies that the item is subject to taxation.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

7

A single taxpayer, who is not a dependent on another's return, not blind and under age 65, with income of $8,750 must file a tax return.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

8

Most states are community property states.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

9

Taxpayers who do not qualify for married, head of household, or qualifying widow or widower filing status must file as single.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

10

The maximum official individual income tax rate for 2014 is 39.6 percent, not including the Medicare surtax on net investment income.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

11

A corporation is a reporting entity but not a tax-paying entity.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

12

A taxpayer with self-employment income of $600 must file a tax return.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

13

The head of household tax rates are higher than the rates for a single taxpayer.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

14

If a taxpayer is due a refund, it will be mailed to the taxpayer regardless of whether he or she files a tax return.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

15

A dependent child with earned income in excess of the available standard deduction amount must file a tax return.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

16

If taxpayers are married and living together at the end of the year, they must file a joint tax return.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

17

Taxpayers with self-employment income of $400 or more must file a tax return.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

18

Married taxpayers may double their standard deduction amount by filing separate returns.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

19

A married person with a dependent child may choose to file as head of household if it reduces his or her tax liability.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

20

Partnership capital gains and losses are allocated separately to each of the partners.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following forms may be filed by individual taxpayers?

A)Form 1040

B)Form 1041

C)Form 1065

D)Form 1120

E)None of the above

A)Form 1040

B)Form 1041

C)Form 1065

D)Form 1120

E)None of the above

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

22

A child for whom a dependency exemption is claimed on the parents' tax return may also claim a personal exemption on his or her own tax return.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

23

Partnerships:

A)Are not taxable entities.

B)Are taxed in the same manner as individuals.

C)File tax returns on Form 1120.

D)File tax returns on Form 1041.

A)Are not taxable entities.

B)Are taxed in the same manner as individuals.

C)File tax returns on Form 1120.

D)File tax returns on Form 1041.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

24

For 2014, personal and dependency exemptions are $3,950 each.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is correct?

A)An individual is a reporting entity but not a taxable entity.

B)A partnership is a taxable entity and a reporting entity.

C)A corporation is a reporting entity but not a taxable entity.

D)A partnership is a reporting entity but not a taxable entity.

A)An individual is a reporting entity but not a taxable entity.

B)A partnership is a taxable entity and a reporting entity.

C)A corporation is a reporting entity but not a taxable entity.

D)A partnership is a reporting entity but not a taxable entity.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

26

Most taxpayers may deduct the standard deduction amount or the amount of their itemized deductions, whichever is higher.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

27

The two types of exemptions are the personal exemption and the dependency exemption.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

28

A dependency exemption may be claimed by the supporting taxpayer in the year of death of a dependent.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is not a goal of the tax law?

A)Encouraging certain social goals such as contributions to charity.

B)Encouraging certain economic goals such as a thriving business community.

C)Encouraging smaller families.

D)Raising revenue to operate the government.

E)None of the above are goals of the tax law.

A)Encouraging certain social goals such as contributions to charity.

B)Encouraging certain economic goals such as a thriving business community.

C)Encouraging smaller families.

D)Raising revenue to operate the government.

E)None of the above are goals of the tax law.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

30

If a taxpayer's adjusted gross income exceeds certain threshold amounts, he or she may be required to reduce the amount of the otherwise allowable deductions for itemized deductions and personal and dependency exemptions in 2014.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

31

Which one of the following provisions was passed by Congress to meet a social goal of the tax law?

A)The deduction for job hunting expenses.

B)The charitable deduction.

C)The moving expense deduction for adjusted gross income.

D)The deduction for soil and water conservation costs available to farmers.

E)None of the above.

A)The deduction for job hunting expenses.

B)The charitable deduction.

C)The moving expense deduction for adjusted gross income.

D)The deduction for soil and water conservation costs available to farmers.

E)None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

32

Taxpayers can download tax forms from the IRS Internet site.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

33

Scholarships received by a student may be excluded for purposes of the support test for determining the availability of the dependency exemption.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

34

An individual, age 22, enrolled on a full-time basis at a trade school, is considered a student for purposes of determining whether a dependency exemption is permitted.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

35

Partnership income is reported on:

A)Form 1040PTR

B)Form 1120S

C)Form 1040X

D)Form 1065

A)Form 1040PTR

B)Form 1120S

C)Form 1040X

D)Form 1065

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

36

In 2013, the Affordable Care Act (ACA) added a new Medicare surtax of 3.8 percent on net investment income.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

37

Form 1040 allows a taxpayer to report which of the following items that are not allowed for taxpayers who file Form 1040A:

A)Salary income.

B)Joint return status.

C)Withholding on wages.

D)Self-employment income.

A)Salary income.

B)Joint return status.

C)Withholding on wages.

D)Self-employment income.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

38

A taxpayer who is living alone and is legally separated from his or her spouse under a separate maintenance decree at year-end should file as single.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

39

An individual taxpayer with a net capital loss may deduct up to $3,000 per year against ordinary income.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

40

Wesley owns and operates the Cheshire Chicken Ranch in Turpid, Nevada. The income from this ranch is $49,000. Wesley wishes to use the easiest possible tax form. He may file:

A)Form 1040EZ

B)Form 1040A

C)Form 1040

D)Form 1065

E)None of the above

A)Form 1040EZ

B)Form 1040A

C)Form 1040

D)Form 1065

E)None of the above

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

41

Oscar and Mary have no dependents and file a joint income tax return for 2014. They have adjusted gross income of $140,000 and itemized deductions of $30,000. What is the amount of taxable income that Oscar and Mary must report on their 2014 income tax return?

A)$97,600

B)$102,100

C)$105,200

D)$110,000

E)$127,600

A)$97,600

B)$102,100

C)$105,200

D)$110,000

E)$127,600

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following taxpayers does not have to file a tax return for 2014?

A)A single taxpayer who is under age 65, with income of $10,500.

B)Married taxpayers (ages 45 and 50 years), filing jointly, with income of $21,000.

C)A student, age 22, with unearned income of $1,200 who is claimed as a dependent by her parents.

D)A qualifying widow (age 67) with a dependent child and income of $14,500.

E)All of the above.

A)A single taxpayer who is under age 65, with income of $10,500.

B)Married taxpayers (ages 45 and 50 years), filing jointly, with income of $21,000.

C)A student, age 22, with unearned income of $1,200 who is claimed as a dependent by her parents.

D)A qualifying widow (age 67) with a dependent child and income of $14,500.

E)All of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

43

If an individual wishes to amend his individual tax return, he will make the amendment using what form?

A)Form 1040A

B)Form 1040X

C)Form 1120

D)Schedule K-1

E)None of the above

A)Form 1040A

B)Form 1040X

C)Form 1120

D)Schedule K-1

E)None of the above

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

44

John, age 25, is a full-time student at a state university. John lives with his unmarried sister, Ann, who provides over half of his support. His only income is $4,000 of wages from a part-time job at the college book store. What is Ann's filing status for 2014?

A)Single

B)Head of household

C)Married, filing separately

D)Qualifying widow(er)

E)None of the above

A)Single

B)Head of household

C)Married, filing separately

D)Qualifying widow(er)

E)None of the above

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

45

William is a divorced taxpayer who provides a home for his dependent child, Edward. What filing status should William indicate on his tax return?

A)Head of household

B)Married, filing separately

C)Single

D)Qualifying widow(er)

E)None of the above

A)Head of household

B)Married, filing separately

C)Single

D)Qualifying widow(er)

E)None of the above

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

46

An individual is a head of household. What is her standard deduction?

A)$6,200

B)$9,100

C)$12,400

D)$14,800

E)None of the above

A)$6,200

B)$9,100

C)$12,400

D)$14,800

E)None of the above

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

47

Eugene and Velma are married. For 2014, Eugene earned $25,000 and Velma earned $30,000. They have decided to file separate returns and are each entitled to claim one personal exemption. They have no deductions for adjusted gross income. Eugene's itemized deductions are $11,200 and Velma's are $4,000. Assuming Eugene and Velma do not live in a community property state, what is Velma's taxable income?

A)$19,850

B)$22,050

C)$23,800

D)$26,000

E)None of the above

A)$19,850

B)$22,050

C)$23,800

D)$26,000

E)None of the above

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

48

In which of the following situations is the taxpayer not required to file a 2014 income tax return?

A)When an individual has a current year income tax refund and would like to obtain it.

B)When the taxpayer is a single 67-year-old with wages of $9,800.

C)When the taxpayer is a 35-year-old head of household with wages of $16,800.

D)When the taxpayer is a 79-year-old widow with wages of $16,500.

E)When the taxpayers are a married couple with both spouses under 65 years old with wages of $23,000.

A)When an individual has a current year income tax refund and would like to obtain it.

B)When the taxpayer is a single 67-year-old with wages of $9,800.

C)When the taxpayer is a 35-year-old head of household with wages of $16,800.

D)When the taxpayer is a 79-year-old widow with wages of $16,500.

E)When the taxpayers are a married couple with both spouses under 65 years old with wages of $23,000.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

49

Irma, widowed in 2013, pays all costs related to the home in which she and her unmarried son live. Her son does not qualify as her dependent. What is her filing status for 2014?

A)Single

B)Married, filing separate

C)Head of household

D)Qualifying widow(er)

E)None of the above

A)Single

B)Married, filing separate

C)Head of household

D)Qualifying widow(er)

E)None of the above

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

50

Eugene and Velma are married. For 2014, Eugene earned $25,000 and Velma earned $30,000. They have decided to file separate returns and are each entitled to claim one personal exemption. They have no deductions for adjusted gross income. Eugene's itemized deductions are $11,200 and Velma's are $4,000. Assuming Eugene and Velma do not live in a community property state, what is Eugene's taxable income?

A)$9,850

B)$13,800

C)$14,850

D)$18,800

E)None of the above

A)$9,850

B)$13,800

C)$14,850

D)$18,800

E)None of the above

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

51

Depending on the amounts of income and other tax information, some individuals may report their income on:

A)Form 1040A

B)Form 1065

C)Form 1120

D)Form 1041

A)Form 1040A

B)Form 1065

C)Form 1120

D)Form 1041

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

52

Robert is a single taxpayer who has AGI of $145,000 in 2014; his taxable income is $122,000. What is his federal tax liability for 2014?

A)$9,142

B)$18,194

C)$26,356

D)$27,336

E)$27,453

A)$9,142

B)$18,194

C)$26,356

D)$27,336

E)$27,453

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

53

During 2014, Howard maintained his home in which he and his 16 year-old son resided. The son qualifies as his dependent. Howard's wife died in 2013. What is his filing status for 2014?

A)Single

B)Head of household

C)Married, filing separately

D)Qualifying widow(er)

E)None of the above.

A)Single

B)Head of household

C)Married, filing separately

D)Qualifying widow(er)

E)None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

54

Alan, whose wife died in 2012, filed a joint tax return for 2012. He did not remarry and continues to maintain his home in which his four dependent children live. In the preparation of his tax return for 2014, Alan should file as:

A)Single

B)Qualifying widow(er)

C)Head of household

D)Married, filing separately

E)None of the above

A)Single

B)Qualifying widow(er)

C)Head of household

D)Married, filing separately

E)None of the above

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

55

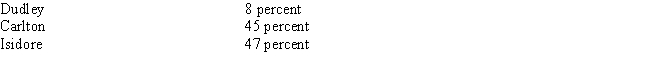

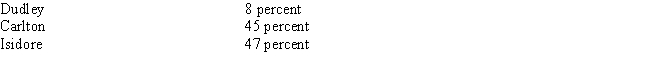

During 2013, Anita was entirely supported by her three sons, Dudley, Carlton, and Isidore, who provided support for her in the following percentages:

Which of the children may be allowed to claim his mother as a dependent, assuming a multiple support agreement exists?

Which of the children may be allowed to claim his mother as a dependent, assuming a multiple support agreement exists?

A)Dudley

B)Dudley or Carlton

C)Carlton or Isidore

D)Dudley, Carlton, or Isidore

E)None of the above

Which of the children may be allowed to claim his mother as a dependent, assuming a multiple support agreement exists?

Which of the children may be allowed to claim his mother as a dependent, assuming a multiple support agreement exists?A)Dudley

B)Dudley or Carlton

C)Carlton or Isidore

D)Dudley, Carlton, or Isidore

E)None of the above

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

56

John, 45 years old and unmarried, contributed $1,000 monthly in 2014 to the support of his parents' household. The parents lived alone and their income for 2014 consisted of $500 from dividends and interest. What is John's filing status and how many exemptions should he claim on his 2014 tax return?

A)Single and 1 exemption

B)Head of household and 1 exemption

C)Single and 3 exemptions

D)Head of household and 3 exemptions

E)None of the above

A)Single and 1 exemption

B)Head of household and 1 exemption

C)Single and 3 exemptions

D)Head of household and 3 exemptions

E)None of the above

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

57

During 2014, Murray, who is 60 years old and unmarried, provided all of the support of his elderly mother. His mother was a resident of a home for the aged for the entire year and had no income. What is Murray's filing status for 2014, and how many exemptions should he claim on his tax return?

A)Head of household and 2 exemptions

B)Single and 2 exemptions

C)Head of household and 1 exemption

D)Single and 1 exemption

E)None of the above

A)Head of household and 2 exemptions

B)Single and 2 exemptions

C)Head of household and 1 exemption

D)Single and 1 exemption

E)None of the above

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

58

Amended individual returns are filed on:

A)Form 1040X

B)Form 1120S

C)Form 1041

D)Form 1040Amend

A)Form 1040X

B)Form 1120S

C)Form 1041

D)Form 1040Amend

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

59

All of the following factors are important in determining whether an individual is required to file an income tax return, except:

A)The taxpayer's filing status.

B)The taxpayer's gross income.

C)The taxpayer's total itemized deductions.

D)The availability of the additional standard deduction for taxpayers who are elderly.

E)None of the above.

A)The taxpayer's filing status.

B)The taxpayer's gross income.

C)The taxpayer's total itemized deductions.

D)The availability of the additional standard deduction for taxpayers who are elderly.

E)None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

60

An unmarried taxpayer who maintains a household for a dependent child and whose spouse died four years ago should file as:

A)Single

B)Head of household

C)Qualifying widow(er)

D)Married, filing separately

E)None of the above

A)Single

B)Head of household

C)Qualifying widow(er)

D)Married, filing separately

E)None of the above

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

61

The 0.9 percent ACA Medicare surtax applies to:

A)Earned income

B)Tax exempt income

C)Gain on the sale of a principal residence

D)IRA distributions

A)Earned income

B)Tax exempt income

C)Gain on the sale of a principal residence

D)IRA distributions

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

62

Your standard deduction will be $6,200 in 2014 if you are:

A)Single and 67 years old.

B)Single and 45 years old.

C)Single, 27 years old and blind.

D)A nonresident alien.

E)A married individual filing a separate return and your spouse itemizes his deductions.

A)Single and 67 years old.

B)Single and 45 years old.

C)Single, 27 years old and blind.

D)A nonresident alien.

E)A married individual filing a separate return and your spouse itemizes his deductions.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

63

Ronald is 92 years old and in poor health. Clever investing earlier in his life has left him with a sizeable income. He is able to support his son Ed. Ed is 67 years old and a bit "confused," so he lives in a nursing home. Ed's income is less than $2,000. How many exemptions should Ronald claim on his tax return?

A)1

B)2

C)3

D)4

E)None of the above

A)1

B)2

C)3

D)4

E)None of the above

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following relatives will not satisfy the relationship test for the dependency exemption?

A)Sister

B)Adopted child

C)Aunt

D)Parent

E)All of the above satisfy the test

A)Sister

B)Adopted child

C)Aunt

D)Parent

E)All of the above satisfy the test

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following is a true statement with respect to the gross income test for the qualifying relative dependency exemption?

A)The relative must receive less than $3,950 of gross income in order to qualify.

B)The gross income test does not have to be met provided the relative is under age 19 at the end of the tax year.

C)The gross income test does not have to be met provided the relative is under age 24 at the end of the tax year.

D)The gross income test does not have to be met provided the relative is a student.

E)All of the above.

A)The relative must receive less than $3,950 of gross income in order to qualify.

B)The gross income test does not have to be met provided the relative is under age 19 at the end of the tax year.

C)The gross income test does not have to be met provided the relative is under age 24 at the end of the tax year.

D)The gross income test does not have to be met provided the relative is a student.

E)All of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

66

Martin, a 50 year-old single taxpayer, paid the full cost of maintaining his dependent mother in a home for the aged for the entire year. What is the amount of Martin's standard deduction for 2014?

A)$6,200

B)$9,100

C)$10,150

D)$12,400

E)None of the above

A)$6,200

B)$9,100

C)$10,150

D)$12,400

E)None of the above

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

67

Taxpayers who are blind get the benefit of:

A)An extra exemption.

B)An additional amount added to their standard deduction.

C)Two standard deductions.

D)None of the above.

A)An extra exemption.

B)An additional amount added to their standard deduction.

C)Two standard deductions.

D)None of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

68

Electronic filing (e-filing):

A)Reduces the chances that the IRS will make mistakes when inputting tax return information.

B)Generally results in a slower refund.

C)Can be done only by telephone.

D)Requires the services of a professional.

A)Reduces the chances that the IRS will make mistakes when inputting tax return information.

B)Generally results in a slower refund.

C)Can be done only by telephone.

D)Requires the services of a professional.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

69

The 3.8 percent ACA Medicare surtax does not apply to:

A)Interest

B)Dividends

C)Capital gains

D)Wages

A)Interest

B)Dividends

C)Capital gains

D)Wages

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

70

Mr. and Mrs. Vonce, both age 62, file a joint return for 2014. They provided all the support for their daughter who is 19 years old, legally blind, and who earns no income. Their son, age 21 and a full-time student at a university, had $4,200 of income and provided 70 percent of his own support during 2014. How many exemptions may Mr. and Mrs. Vonce claim on their 2014 tax return?

A)2

B)3

C)4

D)5

E)None of the above

A)2

B)3

C)4

D)5

E)None of the above

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

71

Albert and Louise, ages 66 and 64, respectively, filed a joint return for 2014. They provided all of the support for their blind 19 year-old son, who had no gross income. They also provided the total support of Louise's father, who is a citizen and life-long resident of Peru. How many exemptions may they claim on their 2014 tax return?

A)2

B)3

C)4

D)5

E)None of the above

A)2

B)3

C)4

D)5

E)None of the above

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following is not a test that must be met for a child to be considered a dependent?

A)Age test

B)Domicile test

C)Citizenship test

D)Relationship test

E)Blood test

A)Age test

B)Domicile test

C)Citizenship test

D)Relationship test

E)Blood test

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

73

Internet users can sign on to http://www.irs.gov/ and:

A)Download tax forms and publications.

B)Find links to other useful IRS pages.

C)Use a search function to find forms and publications.

D)All of the above.

A)Download tax forms and publications.

B)Find links to other useful IRS pages.

C)Use a search function to find forms and publications.

D)All of the above.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

74

The IRS:

A)requires official tax forms be obtained at the local IRS office.

B)links to the H & R Block Web site.

C)provides information on how to choose a stock.

D)has an app for mobile phones.

A)requires official tax forms be obtained at the local IRS office.

B)links to the H & R Block Web site.

C)provides information on how to choose a stock.

D)has an app for mobile phones.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

75

Alexis has a long-term capital loss of $13,000 on the sale of stock in 2014. She has no other capital gains or losses for the year. Her taxable income without this transaction is $57,000. What is her 2014 taxable income considering this capital loss?

A)$44,000

B)$54,000

C)$57,000

D)$70,000

E)Some other amount

A)$44,000

B)$54,000

C)$57,000

D)$70,000

E)Some other amount

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

76

Jill is a 16-year-old child who is claimed as a dependent by her parents. Jill's only income is $1,400 from her bank savings account. What is the amount of Jill's standard deduction for 2014?

A)$1,200

B)$1,000

C)$3,950

D)$6,200

E)None of the above

A)$1,200

B)$1,000

C)$3,950

D)$6,200

E)None of the above

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following is not a capital asset?

A)Inventory

B)Stocks

C)A personal automobile

D)Gold

E)Land

A)Inventory

B)Stocks

C)A personal automobile

D)Gold

E)Land

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

78

Brian is 60 years old, single and legally blind. Brian supports his father, who is 88 years old and blind, by paying the rent and other costs of his father's residence. What is the total standard deduction amount that Brian should claim on his 2014 tax return?

A)$9,100

B)$10,450

C)$10,650

D)$13,050

E)None of the above

A)$9,100

B)$10,450

C)$10,650

D)$13,050

E)None of the above

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

79

Bob owns a rental property that he bought several years ago for $260,000. He has taken depreciation on the house of $35,000 since buying it. He sells it in 2014 for $290,000. His selling expenses were $12,000 for the year. What was Bob's realized gain on the sale?

A)$18,000

B)$53,000

C)$65,000

D)$77,000

E)None of the above

A)$18,000

B)$53,000

C)$65,000

D)$77,000

E)None of the above

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

80

Clay purchased Elm Corporation stock 20 years ago for $10,000. In 2014, he sells the stock for $29,000. What is Clay's gain or loss?

A)$19,000 long-term

B)$19,000 short-term

C)$19,000 ordinary

D)$3,000, with the excess carried forward

E)No gain or loss is recognized on this transaction

A)$19,000 long-term

B)$19,000 short-term

C)$19,000 ordinary

D)$3,000, with the excess carried forward

E)No gain or loss is recognized on this transaction

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck