Deck 11: The Corporate Income Tax

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/78

Play

Full screen (f)

Deck 11: The Corporate Income Tax

1

For the current year,the Beech Corporation has net income on its books of $60,000,including the following items: Federal tax depreciation exceeds the depreciation deducted on the books by $5,000.What is the corporation's taxable income?

A)$66,000

B)$90,000

C)$95,000

D)$103,000

E)None of the above

A)$66,000

B)$90,000

C)$95,000

D)$103,000

E)None of the above

C

2

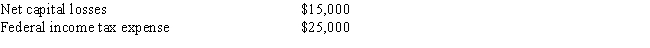

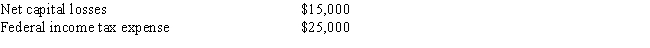

For the year ended June 30,2017,the Rosaceae Corporation,a regular C corporation,has a long-term capital loss of $25,000.

a.Assuming that in addition to the capital loss,the corporation has taxable income,before capital gains and losses,of $25,000 for 2017,calculate the corporation's tax liability before any credits.

b.Assuming that in addition to the long-term capital loss of $25,000 the corporation has taxable income,before capital gains and losses,of $90,000 and a short-term capital gain of $10,000 for 2017,calculate the corporation's tax liability before any credits.

a.Assuming that in addition to the capital loss,the corporation has taxable income,before capital gains and losses,of $25,000 for 2017,calculate the corporation's tax liability before any credits.

b.Assuming that in addition to the long-term capital loss of $25,000 the corporation has taxable income,before capital gains and losses,of $90,000 and a short-term capital gain of $10,000 for 2017,calculate the corporation's tax liability before any credits.

3

If a corporation is unable to deduct a capital loss against capital gains for a particular tax year,it loses the tax benefit since the loss may not be carried to other tax years.

False

4

Corporations are not allowed to amortize the costs of organizing the corporation.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following companies is taxed at a flat rate of 35 percent?

A)An auto parts manufacturing corporation with taxable income of $73,000.

B)A consulting corporation of owner-employee CPAs with taxable income of $1,000,000.

C)A family-owned shoe store with earnings of $224,000 in 2017.

D)All of the above are taxed at a flat rate of 35 percent.

A)An auto parts manufacturing corporation with taxable income of $73,000.

B)A consulting corporation of owner-employee CPAs with taxable income of $1,000,000.

C)A family-owned shoe store with earnings of $224,000 in 2017.

D)All of the above are taxed at a flat rate of 35 percent.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

6

Is it correct to state that the maximum corporate tax rate is 35 percent? Please describe the structure of the corporate tax rate schedule in your answer.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

7

A corporation may carry forward capital losses for an indefinite period.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is true with respect to capital gains and losses of a corporation?

A)A corporation can offset ordinary income with capital losses.

B)A corporation pays 15 percent long-term capital gains rate,just like an individual.

C)A corporation can carry a capital loss back 5 years.

D)A corporation can carry a capital loss forward 5 years.

A)A corporation can offset ordinary income with capital losses.

B)A corporation pays 15 percent long-term capital gains rate,just like an individual.

C)A corporation can carry a capital loss back 5 years.

D)A corporation can carry a capital loss forward 5 years.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

9

Corporations are granted favorable tax treatment for short-term capital losses.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

10

Calculate the corporate tax liability in each of the following circumstances:

a.X Corporation has taxable income of $250,000 for its current calendar tax year.

b.Y Corporation has $1,600,000 in taxable income for the current tax year.

c.Z Corporation has taxable income of $100,000,before capital gains and losses,a short-term capital loss of $30,000,and a long-term capital gain of $10,000 in the current tax year.

a.X Corporation has taxable income of $250,000 for its current calendar tax year.

b.Y Corporation has $1,600,000 in taxable income for the current tax year.

c.Z Corporation has taxable income of $100,000,before capital gains and losses,a short-term capital loss of $30,000,and a long-term capital gain of $10,000 in the current tax year.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

11

Corporations pay a flat 30 percent federal income tax.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

12

A corporation may elect to take a credit for dividends paid in lieu of claiming a dividends received deduction.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

13

Corporations may deduct without limitation any amount of charitable contributions providing the amounts are paid to qualified organizations.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following statements is true of corporations?

A)Income of all corporations is taxed in the same way that income of partnerships is taxed.

B)A corporation's charitable contribution deduction is limited to 25 percent of the corporation's taxable income.

C)Capital losses of a corporation may be deducted from ordinary income,subject to an annual limitation.

D)If a corporation has a long-term capital loss that is carried back,it is treated as a short-term capital loss.

E)A corporation may deduct organizational expenditures as they are incurred.

A)Income of all corporations is taxed in the same way that income of partnerships is taxed.

B)A corporation's charitable contribution deduction is limited to 25 percent of the corporation's taxable income.

C)Capital losses of a corporation may be deducted from ordinary income,subject to an annual limitation.

D)If a corporation has a long-term capital loss that is carried back,it is treated as a short-term capital loss.

E)A corporation may deduct organizational expenditures as they are incurred.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

15

During the current year,the Squamata Corporation,a regular C corporation,has $30,000 in ordinary income,a long-term capital loss of $20,000,and a short-term capital gain of $10,000.

a.Calculate the Squamata Corporation's tax liability for the current year.

b.Explain the nature and amount of any carrybacks or carryforwards that the corporation is entitled to use.

a.Calculate the Squamata Corporation's tax liability for the current year.

b.Explain the nature and amount of any carrybacks or carryforwards that the corporation is entitled to use.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

16

In 2017,Apricot Corporation had taxable income of $120,000.Included in taxable income was a $10,000 capital gain.The $120,000 of taxable income does not include a $15,000 capital loss carryforward available from the previous year.What is Apricot Corporation's 2017 income tax liability before any tax credits?

A)$24,200

B)$26,150

C)$28,550

D)$30,050

E)None of the above

A)$24,200

B)$26,150

C)$28,550

D)$30,050

E)None of the above

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

17

For 2017,what is the maximum tax rate for personal service corporations?

A)25 percent

B)28 percent

C)34 percent

D)35 percent

E)None of the above

A)25 percent

B)28 percent

C)34 percent

D)35 percent

E)None of the above

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

18

A corporation owning 80 percent or more of the stock of another corporation has a dividends received deduction of 100 percent.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

19

The corporate tax rates favor large corporations.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

20

Capital losses of a corporation must be used to offset capital gains and net capital losses may not be deducted from the ordinary income of a corporation.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

21

Brokers' fees incurred in the issuance of a corporation's stock are considered organizational expenditures.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

22

ABC Company owns 40 percent of JMT Company and 95 percent of DEM Company.JMT pays an $80,000 dividend to ABC and DEM pays a $40,000 dividend to ABC in the current year.Assuming that ABC has $1,000,000 of taxable income,calculate ABC's dividends received deduction for the current year.

A)$96,000

B)$104,000

C)$120,000

D)$140,000

E)None of the above is correct

A)$96,000

B)$104,000

C)$120,000

D)$140,000

E)None of the above is correct

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

23

The Peach Corporation is a regular corporation that contributes $25,000 cash to qualified charitable organizations during the current year.The corporation has net taxable income of $190,000 before deducting the contributions.

a.

What is the amount of Peach Corporation's allowable deduction for charitable contributions for the current year?

b.What may the corporation do with any excess amount of contributions?

a.

What is the amount of Peach Corporation's allowable deduction for charitable contributions for the current year?

b.What may the corporation do with any excess amount of contributions?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following items is not generally a schedule M-1 adjustment?

A)Net capital losses

B)Interest on tax-exempt bonds

C)Federal income tax expense

D)Interest expense on a loan to purchase municipal bonds

E)All of the above are M-1 adjustments

A)Net capital losses

B)Interest on tax-exempt bonds

C)Federal income tax expense

D)Interest expense on a loan to purchase municipal bonds

E)All of the above are M-1 adjustments

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

25

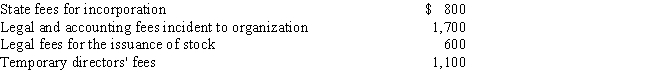

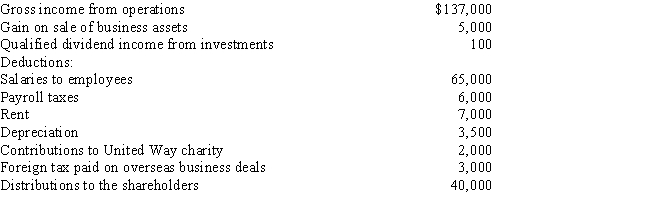

The Lagerstroemia Corporation was formed on January 1,2017.Calculate the Lagerstroemia Corporation's taxable income or loss for 2017 given the following information:

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

26

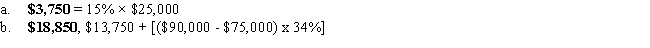

The Nandina Corporation was formed and began operations on July 1,2017,and incurred the following expenses during the year: If the corporation chooses not to expense but rather amortizes organizational costs over 180 months,what is the amount of its amortization expense for 2017?

A)$20

B)$120

C)$240

D)$3,600

E)None of the above

A)$20

B)$120

C)$240

D)$3,600

E)None of the above

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

27

The F.Repens Corporation has taxable income of $250,000 for the current year,including dividends of $60,000 received from 30 percent-owned domestic corporations.How much is the F.Repens Corporation's dividends received deduction for the current year?

A)$0

B)$40,000

C)$48,000

D)$170,000

E)None of the above

A)$0

B)$40,000

C)$48,000

D)$170,000

E)None of the above

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

28

To prevent triple taxation,a corporation is entitled to deduct 50 percent of the dividends received from other domestic corporations.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

29

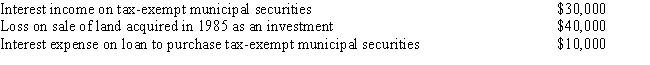

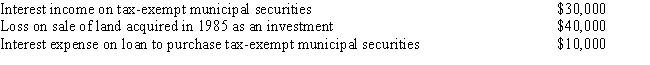

For the year ended December 31,2017,Prunus,Inc. ,reported net income before federal income tax expense of $800,000 per the corporation's books.This figure included the following items: What is the taxable income of Prunus,Inc.for 2017?

A)$800,000

B)$820,000

C)$830,000

D)$870,000

E)None of the above

A)$800,000

B)$820,000

C)$830,000

D)$870,000

E)None of the above

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

30

In the current year,Parvifolia,Inc.had $400,000 of revenue from operations and $160,000 of dividends from non-affiliated 15 percent-owned domestic corporations.The corporation's deductible operating expenses totaled $410,000.What is Parvifolia,Inc.'s dividends received deduction for the current year?

A)$105,000

B)$112,000

C)$120,000

D)$128,000

E)None of the above

A)$105,000

B)$112,000

C)$120,000

D)$128,000

E)None of the above

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

31

The original due date for a tax return of a corporation filing a Form 1120 with a calendar tax year-end falls before the original due date of a return for an individual taxpayer with the same tax year.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

32

During the current year,the Melaleuca Corporation received dividends from 50-percent-owned domestic corporations in the amount of $100,000.

a.Assuming that in addition to the dividend income the corporation has gross income from operations of $250,000 and deductible operating expenses of $210,000,calculate the amount of the corporation's dividends received deduction for the current year.

b.If,instead of $250,000 in gross income from operations,the corporation has $200,000 in gross income from operations and the same amount of dividends and expenses,calculate the amount of the corporation's dividends received deduction for the current year.

a.Assuming that in addition to the dividend income the corporation has gross income from operations of $250,000 and deductible operating expenses of $210,000,calculate the amount of the corporation's dividends received deduction for the current year.

b.If,instead of $250,000 in gross income from operations,the corporation has $200,000 in gross income from operations and the same amount of dividends and expenses,calculate the amount of the corporation's dividends received deduction for the current year.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

33

The Bay Fig Corporation has $350,000 of taxable income from operations for the current year,and dividends of $50,000 received from 10 percent-owned domestic corporations.How much is the Bay Fig Corporation's dividends received deduction for the current year?

A)$35,000

B)$40,000

C)$70,000

D)$80,000

E)None of the above

A)$35,000

B)$40,000

C)$70,000

D)$80,000

E)None of the above

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

34

What is the purpose of Schedule M-1?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

35

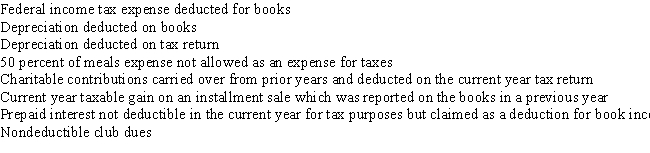

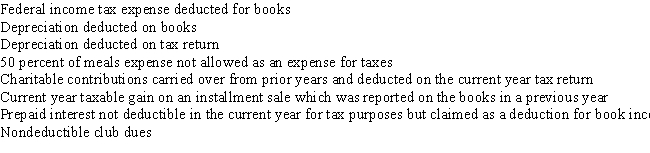

The Cat Corporation had $20,000 of book income in the current year.The following is a list of differences between federal and book income and expenses:

Based on the above information,calculate the Cat Corporation's federal taxable income for the year.Show your calculations.

Based on the above information,calculate the Cat Corporation's federal taxable income for the year.Show your calculations.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

36

A regular corporation with excess charitable contributions may carry the excess forward to the 5 succeeding tax years.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

37

Corporations can elect to deduct up to $5,000 of organizational costs in the year they begin business,assuming their total organizational expenses do not exceed $50,000.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

38

Schedule M-1 on Form 1120 shows the reconciliation of a corporation's tax liability to the tax expense on the corporation's books.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

39

A corporation must reconcile,to the IRS's satisfaction,the differences between net income as shown on the company's books and taxable income (before special deductions and net operating losses)as shown on the tax return.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

40

Ficus,Inc.began business on March 1,2017,and elected to file its income tax return on a calendar-year basis.The corporation incurred $800 in organizational expenditures.Assuming the corporation does not elect to expense but chooses to amortize the costs over 180 months,the maximum allowable deduction for amortization of organizational expenditures in 2017 is:

A)$4.44

B)$44.44

C)$53.28

D)$800.00

E)None of the above

A)$4.44

B)$44.44

C)$53.28

D)$800.00

E)None of the above

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

41

If the shareholders of an S corporation voluntarily revoke the corporation's S corporation status in the sixth month of the tax year and the revocation does not specify a prospective revocation date,the corporation is a regular corporation for that tax year.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following is false in regards to filing requirements?

A)Corporations file their tax returns on Form 1120.

B)An automatic 6-month extension can be obtained by a corporation that files Form 1120.

C)Filing an extension for a corporate tax return also provides an extension for paying the corporation's tax due.A corporation can wait to pay its tax liability without penalty when the return is filed.

D)None of the above is false.

A)Corporations file their tax returns on Form 1120.

B)An automatic 6-month extension can be obtained by a corporation that files Form 1120.

C)Filing an extension for a corporate tax return also provides an extension for paying the corporation's tax due.A corporation can wait to pay its tax liability without penalty when the return is filed.

D)None of the above is false.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

43

Rob,Bill,and Steve form Big Company.Rob performs $45,000 of services for his 45 shares of the company.Bill transferred property with a basis of $5,000 for $75,000 of stock (75 shares).Steve contributes cash of $100,000 for his 100 shares.Which of the three must recognize income in the year of the formation?

A)Rob

B)Rob,Bill

C)Bill

D)Steve,Bill

E)Steve,Rob

A)Rob

B)Rob,Bill

C)Bill

D)Steve,Bill

E)Steve,Rob

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

44

Avocado Corporation paid $3,000 in estimated tax payments for the calendar year ended December 31,2017.The corporation has an actual tax liability of $4,000 for the year.

a.If no extension is requested,when is the tax return due?

b.If an extension of time to file is requested and approved,when is the tax return due?

c.If an extension of time to file is requested and approved,when is the additional $1,000 of the 2017 tax due?

a.If no extension is requested,when is the tax return due?

b.If an extension of time to file is requested and approved,when is the tax return due?

c.If an extension of time to file is requested and approved,when is the additional $1,000 of the 2017 tax due?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

45

As a general rule,the transfer of property by a taxpayer to a corporation in exchange solely for 100% of the stock does not result in a taxable transaction.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

46

Charitable contributions made by an S corporation are not deductible by the corporation;therefore,the shareholders receive no tax benefit from the contributions as itemized deductions.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following corporations is allowed to make an S corporation election?

A)A U.S.corporation owned and operated by two U.S.citizens (individuals).

B)A U.S.corporation owned by a Brazilian corporation.

C)A U.S.owned and operated corporation with 7,000 separate shareholders.

D)None of the above could be an S corporation.

A)A U.S.corporation owned and operated by two U.S.citizens (individuals).

B)A U.S.corporation owned by a Brazilian corporation.

C)A U.S.owned and operated corporation with 7,000 separate shareholders.

D)None of the above could be an S corporation.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following is not a requirement for qualification as an S corporation?

A)The corporation must be a domestic corporation.

B)The corporation must have 25 or fewer shareholders.

C)The corporation must have only one class of stock outstanding.

D)The shareholders of the corporation must not be nonresident aliens.

E)None of the above.

A)The corporation must be a domestic corporation.

B)The corporation must have 25 or fewer shareholders.

C)The corporation must have only one class of stock outstanding.

D)The shareholders of the corporation must not be nonresident aliens.

E)None of the above.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

49

S corporations pay taxes at a higher rate than do regular corporations.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

50

XYZ Corporation has a December 31 year-end.

a.When is XYZ Corporation's tax return due?

b.When does XYZ Corporation need to make its estimated tax payments?

c.Assuming that XYZ Corporation owes $5,000 on the original tax return due date and it files for an extension and is granted an automatic extension to file tax returns,what is the extended tax return date and when should taxes be paid?

a.When is XYZ Corporation's tax return due?

b.When does XYZ Corporation need to make its estimated tax payments?

c.Assuming that XYZ Corporation owes $5,000 on the original tax return due date and it files for an extension and is granted an automatic extension to file tax returns,what is the extended tax return date and when should taxes be paid?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following statements is not true of S corporations?

A)S corporations are corporations that receive tax treatment similar to that given partnerships.

B)Section 1231 gains and losses pass through separately to stockholders of an S corporation.

C)The amount of S corporation losses that a shareholder of an S corporation may report on his or her tax return is limited to the basis of the stock plus any loans made by the shareholder to the corporation.

D)If a taxpayer purchases stock in an S corporation from another shareholder during the year,the new shareholder may report the entire amount of any loss for the year attributable to the shares purchased.

E)If an otherwise qualifying shareholder acquires 40 percent of the stock of an S corporation,the new shareholder cannot cause the corporation to lose its S corporation election.

A)S corporations are corporations that receive tax treatment similar to that given partnerships.

B)Section 1231 gains and losses pass through separately to stockholders of an S corporation.

C)The amount of S corporation losses that a shareholder of an S corporation may report on his or her tax return is limited to the basis of the stock plus any loans made by the shareholder to the corporation.

D)If a taxpayer purchases stock in an S corporation from another shareholder during the year,the new shareholder may report the entire amount of any loss for the year attributable to the shares purchased.

E)If an otherwise qualifying shareholder acquires 40 percent of the stock of an S corporation,the new shareholder cannot cause the corporation to lose its S corporation election.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

52

If a corporation's status as an S corporation is involuntarily terminated in the middle of the tax year,the corporation must file an S corporation tax return for the first half of the tax year and a regular corporation tax return for the second half of the tax year.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

53

The income of an S corporation is computed in much the same manner as that of a partnership.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

54

Terry forms the Camphor Corporation during the current year.She transfers property with a value of $700,000 to Camphor Corporation in exchange for 100 percent of the stock in the corporation.Terry's basis in the property transferred was $400,000 and the corporation assumed a $275,000 mortgage on the property.If the fair market value of the stock received by Terry is $425,000,what is the corporation's basis in the property received from Terry?

A)$125,000

B)$275,000

C)$400,000

D)$450,000

E)$700,000

A)$125,000

B)$275,000

C)$400,000

D)$450,000

E)$700,000

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

55

On July 1,2017,Grey formed Arucaria Corporation.On that same date,Grey contributed $100,000 cash and transferred property with an adjusted basis of $60,000 to Arucaria in exchange for 3,000 shares of the corporation's common stock.The property transferred had a fair market value of $75,000 on the date of the transfer.Arucaria Corporation had no other shares of common stock outstanding on July 1,2017.As a result of this transaction,Grey's basis in the stock and Arucaria Corporation's basis in the property (other than the cash),respectively,are:

A)$160,000 and $60,000

B)$160,000 and $75,000

C)$175,000 and $60,000

D)$175,000 and $75,000

E)None of the above

A)$160,000 and $60,000

B)$160,000 and $75,000

C)$175,000 and $60,000

D)$175,000 and $75,000

E)None of the above

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

56

An S corporation files a Form 1120S.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

57

For its year ended December 31,2017,Cupressa Corporation,an S corporation,had net income of $216,000 which included $180,000 of ordinary income from operations and a $36,000 net long-term capital gain.During 2017,a total of $90,000 was distributed to the corporation's nine equal shareholders,all of whom are on a calendar-year tax basis.For 2017,each shareholder should report:

A)$10,000 ordinary income

B)$20,000 ordinary income

C)$20,000 ordinary income and $4,000 net long-term capital gain

D)$24,000 ordinary income

E)None of the above

A)$10,000 ordinary income

B)$20,000 ordinary income

C)$20,000 ordinary income and $4,000 net long-term capital gain

D)$24,000 ordinary income

E)None of the above

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

58

Rex and Marsha each own 50 percent of the Grandiflora Corporation,an S corporation with a calendar tax year.At the beginning of the tax year,Marsha and Rex both have a basis in the stock of the corporation of $25,000.On June 30,2017,Rex sells his interest in the corporation to George for $200,000,and for 2017 the Grandiflora Corporation has a loss of $90,000.

a.Calculate the amount of the corporation's loss that may be deducted by Rex on his 2017 tax return.

b.Calculate the amount of the corporation's loss that may be deducted by George on his 2017 tax return.

c.Calculate the amount of the corporation's loss that may be deducted by Marsha on her 2017 tax return.

a.Calculate the amount of the corporation's loss that may be deducted by Rex on his 2017 tax return.

b.Calculate the amount of the corporation's loss that may be deducted by George on his 2017 tax return.

c.Calculate the amount of the corporation's loss that may be deducted by Marsha on her 2017 tax return.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

59

In general,estimated payments for calendar-year corporations are due on:

A)March 15,June 15,September 15,and December 15.

B)March 15,June 15,September 15,and January 15 of the following year.

C)April 15,June 15,September 15,and December 15.

D)April 15,June 15,September 15,and January 15 of the following year.

A)March 15,June 15,September 15,and December 15.

B)March 15,June 15,September 15,and January 15 of the following year.

C)April 15,June 15,September 15,and December 15.

D)April 15,June 15,September 15,and January 15 of the following year.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

60

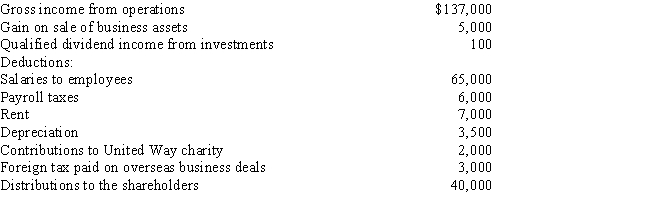

During the current year,The Jupiter Company,which is an S corporation,had the following items of income and expenses:

a.Calculate the net ordinary income.

b.List all the other items which must be separately reported.

c.If the S corporation is on a calendar year,when is the corporation's tax return due?

a.Calculate the net ordinary income.

b.List all the other items which must be separately reported.

c.If the S corporation is on a calendar year,when is the corporation's tax return due?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

61

The Sapote Corporation is a manufacturing corporation.The corporation has accumulated earnings of $450,000 and the corporation cannot establish a reasonable business need for any of that amount.What is the amount of the accumulated earnings tax,if any,that will be imposed on the corporation?

A)$45,000

B)$40,000

C)$50,000

D)$76,000

E)None of the above

A)$45,000

B)$40,000

C)$50,000

D)$76,000

E)None of the above

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

62

The Great Gumball Corporation is a gumball producer.The corporation has accumulated earnings of $425,000 and it can establish a reasonable need for $360,000.Calculate the amount of the accumulated earnings tax,if any,that will be imposed on the corporation.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

63

On July 1,of the current year,Robert forms the Yew Corporation.In exchange for 100 percent of the corporation's stock,Robert contributes land with a fair market value of $100,000.Robert acquired the land 5 years ago at a cost of $30,000.At the date of the contribution,the land is subject to a $10,000 mortgage which the corporation assumes.What is the basis of the land to Yew Corporation?

A)$20,000

B)$30,000

C)$90,000

D)$100,000

E)None of the above

A)$20,000

B)$30,000

C)$90,000

D)$100,000

E)None of the above

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

64

A corporation may be subject to both the accumulated earnings tax and the personal holding company tax in the same year.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

65

Harry forms the Nectarine Corporation during the current tax year.To form the corporation,Harry transfers assets having a fair market value of $650,000 to Nectarine Corporation for 100 percent of the corporation's stock.Harry's adjusted basis in the assets transferred was $375,000 and Nectarine Corporation assumed a $200,000 mortgage on the assets.If the fair market value of the stock received by Harry is $450,000,what is his basis in the stock received from the corporation?

A)$175,000

B)$200,000

C)$375,000

D)$450,000

E)None of the above

A)$175,000

B)$200,000

C)$375,000

D)$450,000

E)None of the above

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

66

Corporations may be subject to the alternative minimum tax.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

67

The Heal Yourself Health Care Corporation,a service corporation,has accumulated earnings of $375,000 and the corporation can establish a reasonable need for $125,000.Calculate the amount of the accumulated earnings tax,if any,that will be imposed on the corporation.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following is not an adjustment or tax preference item for the corporate alternative minimum tax?

A)Certain tax-exempt bond intererest

B)Organization cost amortization

C)Accelerated depreciation on personal property

D)Percentage depletion in excess of the property's adjusted basis

A)Certain tax-exempt bond intererest

B)Organization cost amortization

C)Accelerated depreciation on personal property

D)Percentage depletion in excess of the property's adjusted basis

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

69

Roberta and Sally formed the Alder Corporation on October 1,2017.On the same date,Roberta paid $75,000 cash to Alder Corporation for 1,500 shares of the corporation's common stock.Simultaneously,Sally received 100 shares of Alder Corporation's stock for services rendered.How much should Sally include in her taxable income for 2017,and what will be the basis of her Alder Corporation stock?

Taxable Income Basis of Stock

A)

B)

C)

D)

E)None of the above

Taxable Income Basis of Stock

A)

B)

C)

D)

E)None of the above

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

70

Robert,Kim,Tony,and Sharon decided to form the Cash Cow Corporation.In exchange for 40 percent of the stock,Robert contributed an apartment building with a fair market value of $700,000 and subject to a liability of $300,000.Robert's basis in the apartment building is $225,000.Kim contributed warehouse storage units worth $450,000 in exchange for 40 percent of the stock plus $50,000 in cash from the corporation.Her basis in the warehouse is $125,000.Tony contributed $100,000 cash for 10 percent of the stock.Sharon is performing services worth $100,000 for 10 percent of the stock.

a.What is the recognized gain or recognized income for:

1.Robert

2.Kim

3.Tony

4.Sharon

b.What is the basis in the stock for:

1.Robert

2.Kim

3.Tony

4.Sharon

c.What is the corporation's basis in:

1.The apartment building

2.The warehouse

a.What is the recognized gain or recognized income for:

1.Robert

2.Kim

3.Tony

4.Sharon

b.What is the basis in the stock for:

1.Robert

2.Kim

3.Tony

4.Sharon

c.What is the corporation's basis in:

1.The apartment building

2.The warehouse

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

71

The Birch Corporation has regular taxable income of $85,000 and a regular tax liability of $17,150.The corporation also has $45,000 of tax preference items.Calculate Birch Corporation's alternative minimum tax liability.Assume that the Birch Corporation is not a "small corporation."

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

72

Ashwood Corporation has been in business for 20 years.For the previous 3 years,Ashwood Corporation had annual gross receipts of $3.3 million,$4.2 million and $5.4 million,respectively.For alternative minimum tax purposes,is Ashwood Corporation a small corporation? Give your reasoning and/or the calculation that you based your answer on.Also,why does it matter if they are a small corporation?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

73

Choose the correct statement:

A)The corporate alternative minimum tax applies to all corporations including S corporations.

B)The exemption amount is phased out at a rate of $1.00 for every $1.00 by which the corporation's alternative minimum taxable base exceeds $210,000.

C)The alternative minimum tax is imposed at 26 percent on the alternative minimum tax base up to $150,000 and 28 percent on the AMT base that is greater than $150,000.

D)The alternative minimum tax base is equal to the corporation's regular taxable income increased or decreased for certain adjustments,increased by tax preference items,and decreased by the exemption amount.

A)The corporate alternative minimum tax applies to all corporations including S corporations.

B)The exemption amount is phased out at a rate of $1.00 for every $1.00 by which the corporation's alternative minimum taxable base exceeds $210,000.

C)The alternative minimum tax is imposed at 26 percent on the alternative minimum tax base up to $150,000 and 28 percent on the AMT base that is greater than $150,000.

D)The alternative minimum tax base is equal to the corporation's regular taxable income increased or decreased for certain adjustments,increased by tax preference items,and decreased by the exemption amount.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

74

The accumulated earnings tax is designed to prevent shareholders from avoiding tax at the shareholder level.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

75

The accumulated earnings tax will not be imposed on accumulations that can be shown to be necessary to meet the reasonable needs of the business.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

76

The corporate alternative minimum tax rate is 28 percent.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

77

Fran,George,and Helen form FGH Corporation.In exchange for 300 shares of stock of the corporation,Fran contributes property with a basis of $15,000,fair market value of $50,000 and subject to a liability of $20,000 which the corporation assumed.George contributes property with a basis of $20,000,fair market value of $30,000 in exchange for 250 shares of stock of the corporation with a value of $25,000 plus $5,000 cash.Helen performs services for the corporation and receives $2,000 worth of stock (20 shares)in exchange for the services.

a.What is the amount of Fran's recognized gain or loss on the transaction?

b.What is Fran's basis in the stock of the corporation?

c.What is the corporation's basis in the property received from Fran?

d.What is the amount of George's recognized gain or loss on the transaction?

e.What is George's basis in the stock of the corporation?

a.What is the amount of Fran's recognized gain or loss on the transaction?

b.What is Fran's basis in the stock of the corporation?

c.What is the corporation's basis in the property received from Fran?

d.What is the amount of George's recognized gain or loss on the transaction?

e.What is George's basis in the stock of the corporation?

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

78

What is the maximum amount of accumulated earnings that a corporation is allowed to accumulate,without regard to business needs,before the accumulated earnings tax is imposed?

A)$150,000 for all corporations

B)$150,000 for nonservice corporations only

C)$250,000 for all corporations

D)$250,000 for nonservice corporations only

E)None of the above

A)$150,000 for all corporations

B)$150,000 for nonservice corporations only

C)$250,000 for all corporations

D)$250,000 for nonservice corporations only

E)None of the above

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck