Deck 19: Corporate Formation, Reorganization, and Liquidation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/100

Play

Full screen (f)

Deck 19: Corporate Formation, Reorganization, and Liquidation

1

Han transferred land to his corporation in a section 351 transaction. Han had held the land for two years prior to the transfer. The corporation will tack Han's holding period for the land.

True

Explanation: The holding period of the land "tacks" under section 351.

Explanation: The holding period of the land "tacks" under section 351.

2

In a tax-deferred transaction, the calculation of a taxpayer's tax basis in property received always begins with its cost to the taxpayer.

False

Explanation: In tax-deferred transactions, the adjusted basis begins with the tax basis of the property exchanged in the transaction.

Explanation: In tax-deferred transactions, the adjusted basis begins with the tax basis of the property exchanged in the transaction.

3

Type A reorganizations involve the transfer of assets of targets corporation via a merger or consolidation.

True

4

A taxpayer must receive voting common stock to be eligible for deferral in a section 351 exchange.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

5

Gain or loss is always recognized when realized for tax purposes.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

6

Mandel transferred property to his new corporation in a section 351 transaction. Among the several properties transferred by Mandel was land with a fair market value of $200,000 and a tax basis of $250,000. In all cases, the corporation will always take a tax basis in the land of $200,000 to prevent the "built-in loss" from being transferred from Mandel to the corporation.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

7

Tax considerations are always the primary reason for structuring an acquisition.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

8

Gain and loss realized in a section 351 transaction will be recognized if the taxpayer receives boot in the exchange.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

9

M Corporation assumes a $200 liability attached to property transferred to it by Jane in a section 351 transaction. In all cases, the assumed liability will be treated as boot received by Jane.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

10

Generally, before gain or loss is realized for tax purposes, the taxpayer must engage in a transaction.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

11

The requirements for tax deferral in a forward triangular merger and a reverse triangular merger are the same.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

12

Maria defers $100 of gain realized in a section 351 transaction. The stock she receives in the exchange has a fair market value of $500. Maria's tax basis in the stock will be $400.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

13

The definition of property as it relates to a section 351 transaction includes money.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

14

A taxpayer always will have a tax basis in boot received in a section 351 transaction equal to its fair market value.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

15

Control as it relates to a section 351 transaction is strictly defined to be 80 percent or more of the voting power of the stock of the corporation to which property is transferred.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

16

The shareholders in the target corporation always receive a tax basis in the stock received from the acquirer equal to the stock's fair market value.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

17

A section 338 transaction is a stock acquisition treated as an asset acquisition based on an election made by the acquirer.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

18

Continuity of interest as it relates to a tax reorganization focuses on the aggregate equity received by the shareholders of the target corporation in the transaction.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

19

A stock-for-stock Type B reorganization will be tax-deferred to a target corporation shareholder as long as at least 80 percent of the consideration received is in the form of stock of the acquirer.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

20

To meet the control test under section 351, taxpayers transferring property to a corporation must in aggregate own 80 percent or more of the corporation's voting stock and 80 percent of each class of nonvoting stock after the transfer.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following statements best describes the tax law approach to recognizing gain or loss realized in an exchange?

A) Gain or loss realized is not recognized unless specifically stated otherwise in the Internal Revenue Code.

B) Gain or loss realized is recognized unless specifically stated otherwise in the Internal Revenue Code.

C) Gain realized is recognized unless specifically stated otherwise in the Internal Revenue Code, but loss realized is not recognized unless specifically stated otherwise in the Internal Revenue Code.

D) Loss realized is recognized unless specifically stated otherwise in the Internal Revenue Code, but gain realized is not recognized unless specifically stated otherwise in the Internal Revenue Code.

A) Gain or loss realized is not recognized unless specifically stated otherwise in the Internal Revenue Code.

B) Gain or loss realized is recognized unless specifically stated otherwise in the Internal Revenue Code.

C) Gain realized is recognized unless specifically stated otherwise in the Internal Revenue Code, but loss realized is not recognized unless specifically stated otherwise in the Internal Revenue Code.

D) Loss realized is recognized unless specifically stated otherwise in the Internal Revenue Code, but gain realized is not recognized unless specifically stated otherwise in the Internal Revenue Code.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

22

A liquidated corporation will always recognize gain in a complete liquidation.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

23

A liquidated corporation will always recognize loss in a complete liquidation where none of the shareholders is a corporation.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

24

Antoine transfers property with a tax basis of $500 and a fair market value of $600 to a corporation in exchange for stock with a fair market value of $550 in a transaction that qualifies for deferral under section 351. The corporation assumed a liability of $50 on the property transferred. What is Antoine's tax basis in the stock received in the exchange?

A) $600

B) $550

C) $500

D) $450

A) $600

B) $550

C) $500

D) $450

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

25

Which statement best describes the concept of realization as it applies to gain or loss?

A) Realization is the recording of gain or loss on a tax return.

B) Realization is the result of an exchange of property rights in a transaction.

C) Realization is the excess of amount realized over adjusted basis.

D) Realization is the excess of adjusted basis over amount realized.

A) Realization is the recording of gain or loss on a tax return.

B) Realization is the result of an exchange of property rights in a transaction.

C) Realization is the excess of amount realized over adjusted basis.

D) Realization is the excess of adjusted basis over amount realized.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

26

Roy transfers property with a tax basis of $800 and a fair market value of $500 to a corporation in exchange for stock with a fair market value of $400 and $50 in cash in a transaction that qualifies for deferral under section 351. The corporation assumed a liability of $50 on the property transferred. What is Roy's tax basis in the stock received in the exchange?

A) $800

B) $750

C) $700

D) $500

A) $800

B) $750

C) $700

D) $500

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

27

Tristan transfers property with a tax basis of $900 and a fair market value of $1,200 to a corporation in exchange for stock with a fair market value of $900 and $200 in cash in a transaction that qualifies for deferral under section 351. The corporation assumed a liability of $100 on the property transferred. What is the corporation's tax basis in the property received in the exchange?

A) $1,200

B) $1,100

C) $1,000

D) $900

A) $1,200

B) $1,100

C) $1,000

D) $900

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

28

Inez transfers property with a tax basis of $200 and a fair market value of $300 to a corporation in exchange for stock with a fair market value of $250 in a transaction that qualifies for deferral under section 351. The corporation assumed a liability of $50 on the property transferred. What is the corporation's tax basis in the property received in the exchange?

A) $150

B) $200

C) $250

D) $300

A) $150

B) $200

C) $250

D) $300

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

29

The tax basis of property received by a noncorporate shareholder in a complete liquidation will be the property's fair market value.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

30

Ashley transfers property with a tax basis of $5,000 and a fair market value of $3,000 to a corporation in exchange for stock with a fair market value of $2,000 and $500 in cash in a transaction that qualifies for deferral under section 351. The corporation assumed a liability of $500 on the property transferred. What is Ashley's tax basis in the stock received in the exchange?

A) $5,000

B) $4,000

C) $3,000

D) $2,000

A) $5,000

B) $4,000

C) $3,000

D) $2,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following amounts is not included in the computation of amount realized in an exchange?

A) Cash received.

B) Fair market value of property received.

C) Selling expenses.

D) Adjusted basis of property transferred.

A) Cash received.

B) Fair market value of property received.

C) Selling expenses.

D) Adjusted basis of property transferred.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

32

Casey transfers property with a tax basis of $2,000 and a fair market value of $5,000 to a corporation in exchange for stock with a fair market value of $4,000 and $400 in cash in a transaction that qualifies for deferral under section 351. The corporation assumed a liability of $600 on the property transferred. Casey also incurred selling expenses of $300. What is the amount realized by Casey in the exchange?

A) $5,000

B) $4,700

C) $4,600

D) $4,200

A) $5,000

B) $4,700

C) $4,600

D) $4,200

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

33

A liquidation of a corporation always is a taxable event for the shareholder(s) of the liquidated corporation.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

34

Carlos transfers property with a tax basis of $500 and a fair market value of $800 to a corporation in exchange for stock with a fair market value of $650 and $50 in cash in a transaction that qualifies for deferral under section 351. The corporation assumed a liability of $100 on the property transferred. What is the corporation's tax basis in the property received in the exchange?

A) $800

B) $600

C) $550

D) $450

A) $800

B) $600

C) $550

D) $450

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

35

Roberta transfers property with a tax basis of $400 and a fair market value of $500 to a corporation in exchange for stock with a fair market value of $350 in a transaction that qualifies for deferral under section 351. The corporation assumed a liability of $150 on the property transferred. What is the amount realized by Roberta in the exchange?

A) $500

B) $400

C) $350

D) $250

A) $500

B) $400

C) $350

D) $250

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

36

Sybil transfers property with a tax basis of $5,000 and a fair market value of $6,000 to a corporation in exchange for stock with a fair market value of $3,000 and $2,000 in cash in a transaction that qualifies for deferral under section 351. The corporation assumed a liability of $1,000 on the property transferred. What is Sybil's tax basis in the stock received in the exchange?

A) $6,000

B) $5,000

C) $4,000

D) $3,000

A) $6,000

B) $5,000

C) $4,000

D) $3,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following requirements do not have to be met in a section 351 transaction?

A) Each transferor of property must receive stock equal to at least 80 percent of the fair market value of the property transferred.

B) In the aggregate, the transferors of property to the corporation must collectively control the corporation immediately after the transfers.

C) Only property transferred to a corporation is eligible for deferral.

D) All transfers of property to a corporation must be made simultaneously to qualify for deferral.

A) Each transferor of property must receive stock equal to at least 80 percent of the fair market value of the property transferred.

B) In the aggregate, the transferors of property to the corporation must collectively control the corporation immediately after the transfers.

C) Only property transferred to a corporation is eligible for deferral.

D) All transfers of property to a corporation must be made simultaneously to qualify for deferral.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

38

A shareholder will own the same percentage of stock in the distributing corporation under both a spin-off and a split-off of a subsidiary.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following amounts is not included in the computation of a property's adjusted basis in an exchange?

A) Selling expenses incurred by the buyer.

B) Acquisition cost of the buyer.

C) Capital improvements made to the property by the buyer.

D) Depreciation of the property by the buyer.

A) Selling expenses incurred by the buyer.

B) Acquisition cost of the buyer.

C) Capital improvements made to the property by the buyer.

D) Depreciation of the property by the buyer.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

40

Camille transfers property with a tax basis of $800 and a fair market value of $1,200 to a corporation in exchange for stock with a fair market value of $850 and $350 in cash in a transaction that qualifies for deferral under section 351. Camille also incurred selling expenses of $100. What is the amount realized by Camille in the exchange?

A) $1,200

B) $1,100

C) $850

D) $750

A) $1,200

B) $1,100

C) $850

D) $750

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following statements best describes the tax benefits that arise from the sale of section 1244 stock?

A) Section 1244 allows an individual shareholder to exempt gain from sale of the stock from tax.

B) Section 1244 allows an individual shareholder to deduct all of the loss from sale of the stock as an ordinary loss in the year of the sale.

C) Section 1244 allows an individual shareholder to deduct up to $50,000 of the loss from sale of the stock as an ordinary loss in the year of the sale.

D) Section 1244 allows a corporate shareholder to deduct up to $50,000 of the loss from sale of the stock as an ordinary loss in the year of the sale.

A) Section 1244 allows an individual shareholder to exempt gain from sale of the stock from tax.

B) Section 1244 allows an individual shareholder to deduct all of the loss from sale of the stock as an ordinary loss in the year of the sale.

C) Section 1244 allows an individual shareholder to deduct up to $50,000 of the loss from sale of the stock as an ordinary loss in the year of the sale.

D) Section 1244 allows a corporate shareholder to deduct up to $50,000 of the loss from sale of the stock as an ordinary loss in the year of the sale.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following statements best describes the impact of receiving boot in a section 351 transaction?

A) Boot received has no impact on the recognition of gain or loss realized in a section 351 transaction.

B) Boot received causes gain realized to be recognized, but not loss realized.

C) Boot received causes loss realized to be recognized, but not gain realized.

D) Boot received causes gain or loss realized to be recognized.

A) Boot received has no impact on the recognition of gain or loss realized in a section 351 transaction.

B) Boot received causes gain realized to be recognized, but not loss realized.

C) Boot received causes loss realized to be recognized, but not gain realized.

D) Boot received causes gain or loss realized to be recognized.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following statements best describes the "built-in loss" rules that apply to property transferred to a corporation under section 351?

A) If the basis of a property transferred to a corporation under section 351 exceeds its fair market value, the corporation will always take a tax basis in the property equal to the property's fair market value.

B) If the basis of a property transferred to a corporation under section 351 exceeds its fair market value, the corporation will always take a tax basis in the property equal to the property's tax basis in the hands of the shareholder.

C) If the aggregate basis of all property transferred to a corporation under section 351 exceeds its aggregate fair market value, the aggregate tax basis of the property in the hands of the corporation cannot exceed the aggregate fair market value of the property.

D) If the aggregate basis of all property transferred to a corporation under section 351 exceeds its aggregate fair market value, the aggregate tax basis of the property in the hands of the corporation cannot exceed the aggregate tax basis of the property.

A) If the basis of a property transferred to a corporation under section 351 exceeds its fair market value, the corporation will always take a tax basis in the property equal to the property's fair market value.

B) If the basis of a property transferred to a corporation under section 351 exceeds its fair market value, the corporation will always take a tax basis in the property equal to the property's tax basis in the hands of the shareholder.

C) If the aggregate basis of all property transferred to a corporation under section 351 exceeds its aggregate fair market value, the aggregate tax basis of the property in the hands of the corporation cannot exceed the aggregate fair market value of the property.

D) If the aggregate basis of all property transferred to a corporation under section 351 exceeds its aggregate fair market value, the aggregate tax basis of the property in the hands of the corporation cannot exceed the aggregate tax basis of the property.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

44

Amy transfers property with a tax basis of $900 and a fair market value of $600 to a corporation in exchange for stock with a fair market value of $450 in a transaction that qualifies for deferral under section 351. The corporation assumed a liability of $150 on the property transferred. What is Amy's tax basis in the stock received in the exchange?

A) $900

B) $750

C) $650

D) $450

A) $900

B) $750

C) $650

D) $450

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

45

Rachelle transfers property with a tax basis of $800 and a fair market value of $900 to a corporation in exchange for stock with a fair market value of $750 and $50 in cash in a transaction that qualifies for deferral under section 351. The corporation assumed a liability of $100 on the property transferred. What is the corporation's tax basis in the property received in the exchange?

A) $900

B) $850

C) $800

D) $750

A) $900

B) $850

C) $800

D) $750

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

46

Sami transferred property with a fair market value of $600 and a tax basis of $300 to a corporation in exchange for stock with a fair market value of $600. In addition, Sami received stock with a fair market value of $50 in exchange for services she provided to the corporation in the incorporation process. Which of the following statements best describes the tax result to Sami because of the exchanges?

A) Sami will recognize $50 of compensation income, but she can count the shares of stock she receives in exchange for services in determining if the control test is met under section 351.

B) Sami will recognize $50 of compensation income, but she cannot count the shares of stock she receives in exchange for services in determining if the control test is met under section 351.

C) Sami will not recognize $50 of compensation income, but she can count the shares of stock she receives in exchange for services in determining if the control test is met under section 351.

D) Sami will not recognize $50 of compensation income, and she cannot count the shares of stock she receives in exchange for services in determining if the control test is met under section 351.

A) Sami will recognize $50 of compensation income, but she can count the shares of stock she receives in exchange for services in determining if the control test is met under section 351.

B) Sami will recognize $50 of compensation income, but she cannot count the shares of stock she receives in exchange for services in determining if the control test is met under section 351.

C) Sami will not recognize $50 of compensation income, but she can count the shares of stock she receives in exchange for services in determining if the control test is met under section 351.

D) Sami will not recognize $50 of compensation income, and she cannot count the shares of stock she receives in exchange for services in determining if the control test is met under section 351.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following statements best describes the tax consequences that arise from a contribution of capital to a corporation by an existing sole-shareholder?

A) The shareholder recognizes a gain or loss on the transfer and the corporation's basis in the property transferred equals its fair market value.

B) The shareholder does not recognize a gain or loss on the transfer and the corporation's basis in the property transferred equals the shareholder's basis in the property transferred.

C) The shareholder recognizes a gain or loss on the transfer and the corporation's basis in the property transferred equals the shareholder's basis in the property transferred.

D) The shareholder does not recognize a gain or loss on the transfer and the corporation's basis in the property transferred equals zero.

A) The shareholder recognizes a gain or loss on the transfer and the corporation's basis in the property transferred equals its fair market value.

B) The shareholder does not recognize a gain or loss on the transfer and the corporation's basis in the property transferred equals the shareholder's basis in the property transferred.

C) The shareholder recognizes a gain or loss on the transfer and the corporation's basis in the property transferred equals the shareholder's basis in the property transferred.

D) The shareholder does not recognize a gain or loss on the transfer and the corporation's basis in the property transferred equals zero.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following statements best describes the tax results to a shareholder in a section 351 transaction when liabilities on property transferred to the corporation are assumed by the corporation?

A) Liabilities assumed by a corporation on a section 351 transfer are always treated as boot.

B) Liabilities assumed by a corporation on a section 351 transfer are never treated as boot.

C) Liabilities assumed by a corporation on a section 351 transfer are treated as boot if the total liabilities assumed exceed the total basis of the assets transferred.

D) Liabilities assumed by a corporation on a section 351 transfer are treated as boot if there is no business purpose for the assumption of the liabilities by the corporation.

A) Liabilities assumed by a corporation on a section 351 transfer are always treated as boot.

B) Liabilities assumed by a corporation on a section 351 transfer are never treated as boot.

C) Liabilities assumed by a corporation on a section 351 transfer are treated as boot if the total liabilities assumed exceed the total basis of the assets transferred.

D) Liabilities assumed by a corporation on a section 351 transfer are treated as boot if there is no business purpose for the assumption of the liabilities by the corporation.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

49

Jamie transferred 100 percent of her stock in Fox Company to Otter Corporation in a Type A merger. In exchange, she received stock in Otter with a fair market value of $400,000 plus $600,000 in cash. Jamie's tax basis in the Fox stock was $600,000. What amount of gain does Jamie recognize in the exchange and what is her basis in the Otter stock she receives?

A) $400,000 gain recognized and a basis in Otter stock of $400,000.

B) $600,000 gain recognized and a basis in Otter stock of $400,000.

C) $400,000 gain recognized and a basis in Otter stock of $600,000.

D) $600,000 gain recognized and a basis in Otter stock of $600,000.

A) $400,000 gain recognized and a basis in Otter stock of $400,000.

B) $600,000 gain recognized and a basis in Otter stock of $400,000.

C) $400,000 gain recognized and a basis in Otter stock of $600,000.

D) $600,000 gain recognized and a basis in Otter stock of $600,000.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

50

Jasmine transferred 100 percent of her stock in Woodward Company to Jefferson Corporation in a Type A merger. In exchange, she received stock in Jefferson with a fair market value of $600,000 plus $400,000 in cash. Jasmine's tax basis in the Woodward stock was $1,500,000. What amount of loss does Jasmine recognize in the exchange and what is her basis in the Jefferson stock she receives?

A) $500,000 loss recognized and a basis in Jefferson stock of $600,000.

B) $500,000 loss recognized and a basis in Jefferson stock of $1,100,000.

C) No loss recognized and a basis in Jefferson stock of $1,500,000.

D) No loss recognized and a basis in Jefferson stock of $1,100,000.

A) $500,000 loss recognized and a basis in Jefferson stock of $600,000.

B) $500,000 loss recognized and a basis in Jefferson stock of $1,100,000.

C) No loss recognized and a basis in Jefferson stock of $1,500,000.

D) No loss recognized and a basis in Jefferson stock of $1,100,000.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following principles does not need to be satisfied for an acquisition to be a tax-deferred reorganization?

A) Continuity of interest.

B) Continuity of purpose.

C) Business purpose.

D) Continuity of business enterprise.

A) Continuity of interest.

B) Continuity of purpose.

C) Business purpose.

D) Continuity of business enterprise.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following statements best describes the concept of control as it applies to a section 351 transaction?

A) Control is defined as the ownership of 80 percent or more of a corporation's voting stock.

B) Control is defined as the ownership of 80 percent or more of the fair market value of a corporation's stock.

C) Control is defined as the ownership of 80 percent or more of a corporation's voting stock and 80 percent or more of the fair market value of a corporation's stock.

D) Control is defined as the ownership of 80 percent or more of a corporation's voting stock and 80 percent or more of the total number of shares of each class of nonvoting stock.

A) Control is defined as the ownership of 80 percent or more of a corporation's voting stock.

B) Control is defined as the ownership of 80 percent or more of the fair market value of a corporation's stock.

C) Control is defined as the ownership of 80 percent or more of a corporation's voting stock and 80 percent or more of the fair market value of a corporation's stock.

D) Control is defined as the ownership of 80 percent or more of a corporation's voting stock and 80 percent or more of the total number of shares of each class of nonvoting stock.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following statements best describes a section 338 transaction?

A) A section 338 transaction is an election made by the buyer to treat a stock acquisition as an asset acquisition.

B) A section 338 transaction is an election made by the buyer to treat an asset acquisition as a stock acquisition.

C) A section 338 transaction is an election made by the seller to treat a stock acquisition as an asset acquisition.

D) A section 338 transaction is an election made by the seller to treat an asset acquisition as a stock acquisition.

A) A section 338 transaction is an election made by the buyer to treat a stock acquisition as an asset acquisition.

B) A section 338 transaction is an election made by the buyer to treat an asset acquisition as a stock acquisition.

C) A section 338 transaction is an election made by the seller to treat a stock acquisition as an asset acquisition.

D) A section 338 transaction is an election made by the seller to treat an asset acquisition as a stock acquisition.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following statements best describes the continuity of interest principle as it applies to a tax-deferred acquisition?

A) Continuity of interest requires each shareholder to receive at least 40 percent of the consideration received in equity of the acquirer.

B) Continuity of interest requires shareholders in the aggregate to receive at least 40 percent of the consideration received in equity of the acquirer.

C) Continuity of interest requires each shareholder to receive at least 80 percent of the consideration received in equity of the acquirer.

D) Continuity of interest requires shareholders in the aggregate to receive at least 80 percent of the consideration received in equity of the acquirer.

A) Continuity of interest requires each shareholder to receive at least 40 percent of the consideration received in equity of the acquirer.

B) Continuity of interest requires shareholders in the aggregate to receive at least 40 percent of the consideration received in equity of the acquirer.

C) Continuity of interest requires each shareholder to receive at least 80 percent of the consideration received in equity of the acquirer.

D) Continuity of interest requires shareholders in the aggregate to receive at least 80 percent of the consideration received in equity of the acquirer.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

55

Rachelle transfers property with a tax basis of $800 and a fair market value of $900 to a corporation in exchange for stock with a fair market value of $750 and $50 in cash in a transaction that qualifies for deferral under section 351. The corporation assumed a liability of $100 on the property transferred. What is Rachelle's tax basis in the stock received in the exchange?

A) $900

B) $850

C) $750

D) $700

A) $900

B) $850

C) $750

D) $700

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following statements best describes the application of the continuity of enterprise principle to a Type A tax-deferred reorganization?

A) The continuity of business enterprise principle must be satisfied for both the acquirer and the target corporation.

B) The continuity of business enterprise principle must be satisfied for only the target corporation.

C) The continuity of business enterprise principle must be satisfied for only the acquirer.

D) The continuity of business enterprise principle does not have to be satisfied as long as the business purpose principle is satisfied.

A) The continuity of business enterprise principle must be satisfied for both the acquirer and the target corporation.

B) The continuity of business enterprise principle must be satisfied for only the target corporation.

C) The continuity of business enterprise principle must be satisfied for only the acquirer.

D) The continuity of business enterprise principle does not have to be satisfied as long as the business purpose principle is satisfied.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following statements does not describe a motivation by the buyer or seller in the acquisition or sale of a company?

A) Buyers generally prefer to buy assets because they can take a tax basis in the assets acquired equal to the assets' fair market value.

B) Buyers generally prefer to buy stock because they can take a tax basis in the underlying assets of the company acquired equal to the assets' fair market value.

C) Sellers generally prefer to sell assets in a tax-deferred reorganization to avoid higher tax rates imposed on gains from the sale of non-capital assets.

D) Sellers generally prefer to sell stock because they can recognize capital gain on the sale taxed at preferential rates.

A) Buyers generally prefer to buy assets because they can take a tax basis in the assets acquired equal to the assets' fair market value.

B) Buyers generally prefer to buy stock because they can take a tax basis in the underlying assets of the company acquired equal to the assets' fair market value.

C) Sellers generally prefer to sell assets in a tax-deferred reorganization to avoid higher tax rates imposed on gains from the sale of non-capital assets.

D) Sellers generally prefer to sell stock because they can recognize capital gain on the sale taxed at preferential rates.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

58

Simone transferred 100 percent of her stock in Purple Company to Plum Corporation in a Type A merger. In exchange, she received stock in Plum with a fair market value of $500,000 plus $500,000 in cash. Simone's tax basis in the Purple stock was $200,000. What amount of gain does Simone recognize in the exchange and what is her basis in the Plum stock she receives?

A) $800,000 gain recognized and a basis in Plum stock of $1,000,000.

B) $800,000 gain recognized and a basis in Plum stock of $500,000.

C) $500,000 gain recognized and a basis in Plum stock of $500,000.

D) $500,000 gain recognized and a basis in Plum stock of $200,000.

A) $800,000 gain recognized and a basis in Plum stock of $1,000,000.

B) $800,000 gain recognized and a basis in Plum stock of $500,000.

C) $500,000 gain recognized and a basis in Plum stock of $500,000.

D) $500,000 gain recognized and a basis in Plum stock of $200,000.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following class of stock is not allowed to be used in a section 351 transaction?

A) Voting common stock.

B) Voting preferred stock.

C) Nonvoting preferred stock.

D) All of these classes of stock can be used in a section 351 transaction.

A) Voting common stock.

B) Voting preferred stock.

C) Nonvoting preferred stock.

D) All of these classes of stock can be used in a section 351 transaction.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following statements best describes the tax consequences of a section 338 election?

A) Gain or loss is recognized by the acquired corporation on the deemed sale of its assets and the buyer gets a stepped-up basis in the assets acquired.

B) Gain or loss is recognized by the acquired corporation on the deemed sale of its assets and the buyer gets a carryover basis in the assets acquired.

C) Gain or loss is not recognized by the acquired corporation on the deemed sale of its assets and the buyer gets a stepped-up basis in the assets acquired.

D) Gain or loss is not recognized by the acquired corporation on the deemed sale of its assets and the buyer gets a carryover basis in the assets acquired.

A) Gain or loss is recognized by the acquired corporation on the deemed sale of its assets and the buyer gets a stepped-up basis in the assets acquired.

B) Gain or loss is recognized by the acquired corporation on the deemed sale of its assets and the buyer gets a carryover basis in the assets acquired.

C) Gain or loss is not recognized by the acquired corporation on the deemed sale of its assets and the buyer gets a stepped-up basis in the assets acquired.

D) Gain or loss is not recognized by the acquired corporation on the deemed sale of its assets and the buyer gets a carryover basis in the assets acquired.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following statements does not describe a requirement that must be met in a tax-deferred forward triangular merger?

A) The 40 percent continuity of interest test must be met with respect to the stock transferred from the acquisition corporation to the target corporation shareholders.

B) The acquirer must hold substantially all of the target corporation's properties after the merger.

C) The continuity of business enterprise test must be met with respect to the target corporation.

D) The target corporation shareholders must receive voting stock in the acquiring corporation.

A) The 40 percent continuity of interest test must be met with respect to the stock transferred from the acquisition corporation to the target corporation shareholders.

B) The acquirer must hold substantially all of the target corporation's properties after the merger.

C) The continuity of business enterprise test must be met with respect to the target corporation.

D) The target corporation shareholders must receive voting stock in the acquiring corporation.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

62

Julian transferred 100 percent of his stock in Lemon Company to Apricot Corporation in a Type B stock-for stock exchange. In exchange, he received stock in Apricot with a fair market value of $200,000. Julian's tax basis in the Lemon stock was $400,000. What amount of loss does Julian recognize in the exchange and what is his basis in the Apricot stock he receives?

A) $200,000 loss recognized and a basis in Apricot stock of $200,000.

B) No loss recognized and a basis in Apricot stock of $400,000.

C) $200,000 loss recognized and a basis in Apricot stock of $400,000.

D) No loss recognized and a basis in Apricot stock of $200,000.

A) $200,000 loss recognized and a basis in Apricot stock of $200,000.

B) No loss recognized and a basis in Apricot stock of $400,000.

C) $200,000 loss recognized and a basis in Apricot stock of $400,000.

D) No loss recognized and a basis in Apricot stock of $200,000.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

63

Katarina transferred her 10 percent interest to Spartan Company as part of a complete liquidation of the company. In the exchange, she received land with a fair market value of $200,000. Katarina's basis in the Spartan stock was $100,000. The land had a basis to Spartan Company of $50,000. What amount of gain does Spartan recognize in the exchange and what is Katarina's basis in the land she receives?

A) $100,000 gain recognized by Spartan and a basis in the land of $200,000 to Katarina.

B) $150,000 gain recognized by Spartan and a basis in the land of $200,000 to Katarina.

C) No gain recognized by Spartan and a basis in the land of $100,000 to Katarina.

D) No gain recognized by Spartan and a basis in the land of $50,000 to Katarina.

A) $100,000 gain recognized by Spartan and a basis in the land of $200,000 to Katarina.

B) $150,000 gain recognized by Spartan and a basis in the land of $200,000 to Katarina.

C) No gain recognized by Spartan and a basis in the land of $100,000 to Katarina.

D) No gain recognized by Spartan and a basis in the land of $50,000 to Katarina.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

64

Jalen transferred his 10 percent interest to Wolverine Company as part of a complete liquidation of the company. In the exchange, he received land with a fair market value of $100,000. Jalen's basis in the Wolverine stock was $50,000. The land had a basis to Wolverine Company of $80,000. What amount of gain does Jalen recognize in the exchange and what is his basis in the land he receives?

A) $50,000 gain recognized and a basis in the land of $100,000.

B) $50,000 gain recognized and a basis in the land of $80,000.

C) No gain recognized and a basis in the land of $80,000.

D) No gain recognized and a basis in the land of $50,000.

A) $50,000 gain recognized and a basis in the land of $100,000.

B) $50,000 gain recognized and a basis in the land of $80,000.

C) No gain recognized and a basis in the land of $80,000.

D) No gain recognized and a basis in the land of $50,000.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following statements best describes the requirement that must be met in a tax-deferred Type B stock-for-stock reorganization?

A) The 40 percent continuity of interest test must be met with respect to the stock transferred from the acquisition corporation to the target shareholders.

B) The acquiring corporation must hold substantially all of the target's properties after the acquisition.

C) The target corporation shareholders must receive "solely" voting stock in the acquiring corporation in the exchange.

D) The target corporation shareholders must receive voting stock in the acquiring corporation in exchange for 60 percent or more of the target corporation stock.

A) The 40 percent continuity of interest test must be met with respect to the stock transferred from the acquisition corporation to the target shareholders.

B) The acquiring corporation must hold substantially all of the target's properties after the acquisition.

C) The target corporation shareholders must receive "solely" voting stock in the acquiring corporation in the exchange.

D) The target corporation shareholders must receive voting stock in the acquiring corporation in exchange for 60 percent or more of the target corporation stock.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

66

Billie transferred her 20 percent interest to Jean Company as part of a complete liquidation of the company. In the exchange, she received land with a fair market value of $200,000. Billie's basis in the Jean stock was $100,000. The land had a basis to Jean Company of $400,000. What amount of loss does Jean recognize in the exchange and what is Billie's basis in the land she receives? Billie is not considered a related party to Jean Company.

A) $200,000 loss recognized by Jean and a basis in the land of $200,000 to Billie.

B) $200,000 loss recognized by Jean and a basis in the land of $400,000 to Billie.

C) No loss recognized by Jean and a basis in the land of $200,000 to Billie.

D) No loss recognized by Jean and a basis in the land of $400,000 to Billie.

A) $200,000 loss recognized by Jean and a basis in the land of $200,000 to Billie.

B) $200,000 loss recognized by Jean and a basis in the land of $400,000 to Billie.

C) No loss recognized by Jean and a basis in the land of $200,000 to Billie.

D) No loss recognized by Jean and a basis in the land of $400,000 to Billie.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following statements does not describe a requirement that must be met in a tax-deferred reverse triangular merger?

A) The 40 percent continuity of interest test must be met with respect to the stock transferred from the acquisition corporation to the target corporation shareholders.

B) The target must hold substantially all of the target corporation's properties and the properties of the acquisition subsidiary after the merger.

C) The continuity of business enterprise test must be met with respect to the target corporation.

D) The target corporation shareholders must receive voting stock in the acquiring corporation.

A) The 40 percent continuity of interest test must be met with respect to the stock transferred from the acquisition corporation to the target corporation shareholders.

B) The target must hold substantially all of the target corporation's properties and the properties of the acquisition subsidiary after the merger.

C) The continuity of business enterprise test must be met with respect to the target corporation.

D) The target corporation shareholders must receive voting stock in the acquiring corporation.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

68

Celeste transferred 100 percent of her stock in Supply Chain Company to Marketing Corporation in a Type A merger. In exchange, she received stock in Marketing with a fair market value of $500,000 plus $500,000 in cash. Celeste's tax basis in the Supply Chain stock was $1,200,000. What amount of loss does Celeste recognize in the exchange and what is her basis in the Marketing stock she receives?

A) $200,000 loss recognized and a basis in Marketing stock of $1,200,000.

B) No loss recognized and a basis in Marketing stock of $1,200,000.

C) $200,000 loss recognized and a basis in Marketing stock of $700,000.

D) No loss recognized and a basis in Marketing stock of $700,000.

A) $200,000 loss recognized and a basis in Marketing stock of $1,200,000.

B) No loss recognized and a basis in Marketing stock of $1,200,000.

C) $200,000 loss recognized and a basis in Marketing stock of $700,000.

D) No loss recognized and a basis in Marketing stock of $700,000.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

69

Packard Corporation transferred its 100 percent interest to State Company as part of a complete liquidation of the company. In the exchange, Packard received land with a fair market value of $300,000. Packard's basis in the State stock was $600,000. The land had a basis to State Company of $500,000. What amount of loss does State recognize in the exchange and what is Packard's basis in the land it receives?

A) $200,000 loss recognized by State and a basis in the land of $300,000 to Packard.

B) $200,000 loss recognized by State and a basis in the land of $500,000 to Packard.

C) No loss recognized by State and a basis in the land of $300,000 to Packard.

D) No loss recognized by State and a basis in the land of $500,000 to Packard.

A) $200,000 loss recognized by State and a basis in the land of $300,000 to Packard.

B) $200,000 loss recognized by State and a basis in the land of $500,000 to Packard.

C) No loss recognized by State and a basis in the land of $300,000 to Packard.

D) No loss recognized by State and a basis in the land of $500,000 to Packard.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

70

Paladin Corporation transferred its 90 percent interest to Furman Company as part of a complete liquidation of the company. In the exchange, Paladin received land with a fair market value of $1,000,000. The corporation's basis in the Furman Company stock was $400,000. The land had a basis to Furman Company of $200,000. What amount of gain does Paladin recognize in the exchange and what is its basis in the land it receives?

A) $600,000 gain recognized and a basis in the land of $1,000,000.

B) $600,000 gain recognized and a basis in the land of $400,000.

C) No gain recognized and a basis in the land of $400,000.

D) No gain recognized and a basis in the land of $200,000.

A) $600,000 gain recognized and a basis in the land of $1,000,000.

B) $600,000 gain recognized and a basis in the land of $400,000.

C) No gain recognized and a basis in the land of $400,000.

D) No gain recognized and a basis in the land of $200,000.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following statements best describes the recognition of loss on property transferred to shareholders in complete liquidation of a corporation?

A) The liquidated corporation always recognizes loss on the distribution of property in complete liquidation of the corporation.

B) The liquidated corporation never recognizes loss on the distribution of property in complete liquidation of the corporation.

C) The liquidated corporation recognizes loss on the distribution of property in complete liquidation of the corporation if the property is distributed to individuals who are not related parties to the corporation.

D) The liquidated corporation recognizes loss on the distribution of property in complete liquidation of the corporation only if the property is distributed to individuals who are related parties to the corporation.

A) The liquidated corporation always recognizes loss on the distribution of property in complete liquidation of the corporation.

B) The liquidated corporation never recognizes loss on the distribution of property in complete liquidation of the corporation.

C) The liquidated corporation recognizes loss on the distribution of property in complete liquidation of the corporation if the property is distributed to individuals who are not related parties to the corporation.

D) The liquidated corporation recognizes loss on the distribution of property in complete liquidation of the corporation only if the property is distributed to individuals who are related parties to the corporation.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

72

Juan transferred 100 percent of his stock in Rosa Company to Azul Corporation in a Type B stock-for stock exchange. In exchange, he received stock in Azul with a fair market value of $1,000,000. Juan's tax basis in the Rosa stock was $400,000. What amount of gain does Juan recognize in the exchange and what is his basis in the Azul stock he receives?

A) $600,000 gain recognized and a basis in Azul stock of $400,000.

B) No gain recognized and a basis in Azul stock of $400,000.

C) $600,000 gain recognized and a basis in Azul stock of $1,000,000.

D) No gain recognized and a basis in Azul stock of $1,000,000.

A) $600,000 gain recognized and a basis in Azul stock of $400,000.

B) No gain recognized and a basis in Azul stock of $400,000.

C) $600,000 gain recognized and a basis in Azul stock of $1,000,000.

D) No gain recognized and a basis in Azul stock of $1,000,000.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

73

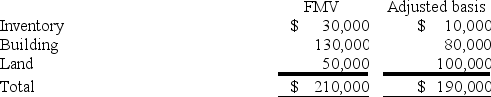

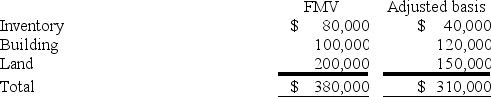

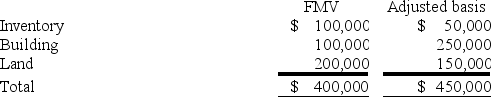

Francine incorporated her sole proprietorship by transferring inventory, a building, and land to the corporation in return for 100 percent of the corporation's stock. The property transferred to the corporation had the following fair market values and tax-adjusted bases.

The corporation also assumed a mortgage of $60,000 attached to the building and land. The fair market value of the corporation's stock received in the exchange was $150,000.

The corporation also assumed a mortgage of $60,000 attached to the building and land. The fair market value of the corporation's stock received in the exchange was $150,000.

a. What amount of gain or loss does Francine realize on the transfer of the property to her corporation?

b. What amount of gain or loss does Francine recognize on the transfer of the property to her corporation?

c. What is Francine's basis in the stock she receives in her corporation?

The corporation also assumed a mortgage of $60,000 attached to the building and land. The fair market value of the corporation's stock received in the exchange was $150,000.

The corporation also assumed a mortgage of $60,000 attached to the building and land. The fair market value of the corporation's stock received in the exchange was $150,000.a. What amount of gain or loss does Francine realize on the transfer of the property to her corporation?

b. What amount of gain or loss does Francine recognize on the transfer of the property to her corporation?

c. What is Francine's basis in the stock she receives in her corporation?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

74

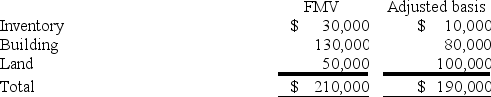

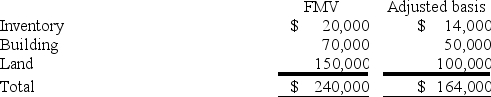

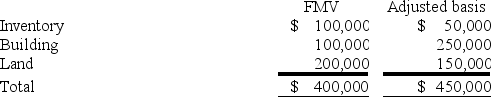

Keegan incorporated his sole proprietorship by transferring inventory, a building, and land to the corporation in return for 100 percent of the corporation's stock. The property transferred to the corporation had the following fair market values and tax-adjusted bases.

The fair market value of the corporation's stock received in the exchange equaled the fair market value of the assets transferred to the corporation by Keegan.

The fair market value of the corporation's stock received in the exchange equaled the fair market value of the assets transferred to the corporation by Keegan.

Assuming the gain or loss realized in this problem is deferred under §351, what is Keegan's basis in the stock he receives in his corporation?

The fair market value of the corporation's stock received in the exchange equaled the fair market value of the assets transferred to the corporation by Keegan.

The fair market value of the corporation's stock received in the exchange equaled the fair market value of the assets transferred to the corporation by Keegan.Assuming the gain or loss realized in this problem is deferred under §351, what is Keegan's basis in the stock he receives in his corporation?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

75

Red Blossom Corporation transferred its 40 percent interest to Tea Company as part of a complete liquidation of the company. In the exchange, Red Blossom received land with a fair market value of $500,000. The corporation's basis in the Tea Company stock was $300,000. The land had a basis to Tea Company of $600,000. What amount of gain does Red Blossom recognize in the exchange and what is its basis in the land it receives?

A) $200,000 gain recognized and a basis in the land of $600,000.

B) $200,000 gain recognized and a basis in the land of $500,000.

C) No gain recognized and a basis in the land of $600,000.

D) No gain recognized and a basis in the land of $300,000.

A) $200,000 gain recognized and a basis in the land of $600,000.

B) $200,000 gain recognized and a basis in the land of $500,000.

C) No gain recognized and a basis in the land of $600,000.

D) No gain recognized and a basis in the land of $300,000.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

76

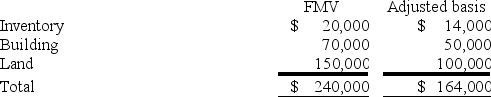

Zhao incorporated her sole proprietorship by transferring inventory, a building, and land to the corporation in return for 100 percent of the corporation's stock. The property transferred to the corporation had the following fair market values and tax-adjusted bases.

The corporation also assumed a mortgage of $50,000 attached to the building and land. The fair market value of the corporation's stock received in the exchange was $330,000. The transaction met the requirements to be tax-deferred under §351.

The corporation also assumed a mortgage of $50,000 attached to the building and land. The fair market value of the corporation's stock received in the exchange was $330,000. The transaction met the requirements to be tax-deferred under §351.

a. What amount of gain or loss does Zhao realize on the transfer of the property to her corporation?

b. What amount of gain or loss does Zhao recognize on the transfer of the property to her corporation?

c. What is the corporation's adjusted basis in each of the assets received in the exchange?

The corporation also assumed a mortgage of $50,000 attached to the building and land. The fair market value of the corporation's stock received in the exchange was $330,000. The transaction met the requirements to be tax-deferred under §351.

The corporation also assumed a mortgage of $50,000 attached to the building and land. The fair market value of the corporation's stock received in the exchange was $330,000. The transaction met the requirements to be tax-deferred under §351.a. What amount of gain or loss does Zhao realize on the transfer of the property to her corporation?

b. What amount of gain or loss does Zhao recognize on the transfer of the property to her corporation?

c. What is the corporation's adjusted basis in each of the assets received in the exchange?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

77

Keegan incorporated his sole proprietorship by transferring inventory, a building, and land to the corporation in return for 100 percent of the corporation's stock. The property transferred to the corporation had the following fair market values and tax-adjusted bases.

The fair market value of the corporation's stock received in the exchange equaled the fair market value of the assets transferred to the corporation by Keegan.

The fair market value of the corporation's stock received in the exchange equaled the fair market value of the assets transferred to the corporation by Keegan.

What amount of gain or loss does Keegan realize on the transfer of the property to his corporation?

The fair market value of the corporation's stock received in the exchange equaled the fair market value of the assets transferred to the corporation by Keegan.

The fair market value of the corporation's stock received in the exchange equaled the fair market value of the assets transferred to the corporation by Keegan.What amount of gain or loss does Keegan realize on the transfer of the property to his corporation?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

78

Robin transferred her 60 percent interest to Cardinal Company as part of a complete liquidation of the company. In the exchange, she received land with a fair market value of $800,000. Robin's basis in the Cardinal stock was $900,000. The land had a basis to Cardinal Company of $1,000,000. What amount of loss does Cardinal recognize in the exchange and what is Robin's basis in the land she receives? The distribution was non pro rata to Robin, a related person.

A) $200,000 loss recognized by Cardinal and a basis in the land of $1,000,000 to Robin.

B) $200,000 loss recognized by Cardinal and a basis in the land of $800,000 to Robin.

C) No loss recognized by Cardinal and a basis in the land of $1,000,000 to Robin.

D) No loss recognized by Cardinal and a basis in the land of $800,000 to Robin.

A) $200,000 loss recognized by Cardinal and a basis in the land of $1,000,000 to Robin.

B) $200,000 loss recognized by Cardinal and a basis in the land of $800,000 to Robin.

C) No loss recognized by Cardinal and a basis in the land of $1,000,000 to Robin.

D) No loss recognized by Cardinal and a basis in the land of $800,000 to Robin.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

79

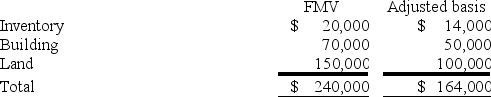

Phillip incorporated his sole proprietorship by transferring inventory, a building, and land to the corporation in return for 100 percent of the corporation's stock. The property transferred to the corporation had the following fair market values and tax-adjusted bases.

The fair market value of the corporation's stock received in the exchange was $400,000. The transaction met the requirements to be tax-deferred under §351.

The fair market value of the corporation's stock received in the exchange was $400,000. The transaction met the requirements to be tax-deferred under §351.

a. What amount of net gain or loss does Phillip realize on the transfer of the property to his corporation?

b. What amount of gain or loss does Phillip recognize on the transfer of the property to his corporation?

c. What is the corporation's adjusted basis in each of the assets received in the exchange?

The fair market value of the corporation's stock received in the exchange was $400,000. The transaction met the requirements to be tax-deferred under §351.

The fair market value of the corporation's stock received in the exchange was $400,000. The transaction met the requirements to be tax-deferred under §351.a. What amount of net gain or loss does Phillip realize on the transfer of the property to his corporation?

b. What amount of gain or loss does Phillip recognize on the transfer of the property to his corporation?

c. What is the corporation's adjusted basis in each of the assets received in the exchange?

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following statements does not describe a tax consequence to shareholders in a complete liquidation?

A) All complete liquidations are taxable to the shareholders.

B) Complete liquidations are taxable to all individual shareholders.

C) Complete liquidations are taxable to all corporate shareholders owning stock of the liquidated corporation representing less than 80 percent or more of voting power and value.

D) Complete liquidations are tax deferred to corporate shareholders owning stock of the liquidated corporation representing 80 percent or more of voting power and value.

A) All complete liquidations are taxable to the shareholders.

B) Complete liquidations are taxable to all individual shareholders.

C) Complete liquidations are taxable to all corporate shareholders owning stock of the liquidated corporation representing less than 80 percent or more of voting power and value.

D) Complete liquidations are tax deferred to corporate shareholders owning stock of the liquidated corporation representing 80 percent or more of voting power and value.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck