Deck 19: International Portfolio Diversification

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/51

Play

Full screen (f)

Deck 19: International Portfolio Diversification

1

As the number of assets held in a portfolio increases, the variance of return on the portfolio becomes more dependent on the covariances between the individual assets and less dependent on the variances of the individual assets.

True

2

In perfect markets, rational investors have equal access to information and to market prices.

True

3

Dividend distributions are subject to withholding taxes in many countries.

True

4

Suppose both goods and financial markets are segmented across national borders but are otherwise efficient. Then, multinational corporations may be able to reduce their cost of capital through foreign direct investment.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

5

Financial contracts in high-inflation countries are seldom pegged to inflation because their value would be eroded at a rapid rate.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

6

A national securities market can be informationally efficient in a domestic context and yet segmented in an international context.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

7

The extent to which risk is reduced through portfolio diversification primarily depends on the expected returns and variances of return in the portfolio.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

8

The variance of foreign bond returns to domestic residents is primarily due to return variance in foreign market returns and to a lesser extent to variance in exchange rates.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

9

The variance of foreign stock returns to domestic residents is primarily due to variance in foreign market returns and to a lesser extent to variance in exchange rates.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

10

The extent to which risk is reduced through portfolio diversification primarily depends on the covariance between individual assets in the portfolio.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

11

Allocational efficiency refers to whether ownership in a state-owned firm is distributed equally among the citizens when the firm is privatized.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

12

American depository receipts pay dividends in dollars and trade on U.S. exchanges just like other domestic U.S. shares.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

13

The Sharpe index is useful for measuring the risk-adjusted performance of a single asset in a well-diversified portfolio.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

14

Solnik ["Why not diversify internationally?" Financial Analysts Journal, 1974] estimates that the systematic risk of a diversified portfolio of U.S. stocks can be reduced by about half by including international stocks in the portfolio.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

15

American shares pay dividends in dollars and trade on U.S. exchanges just like other domestic U.S. shares.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

16

Total risk equals systematic risk plus unsystematic risk plus error.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

17

Solnik ["Why not diversify internationally?" Financial Analysts Journal, 1974] estimates that systematic risk comprises approximately 74% of individual security variance within a portfolio of U.S. stocks.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

18

The risk of an individual asset when held in a portfolio with a large number of assets depends primarily on its return covariance with other assets in the portfolio and not on its return variance.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

19

A foreign stock goes up 10% in price in the foreign currency as the domestic currency depreciates by 10%. The price of the foreign stock in domestic currency stays the same.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

20

Open-end mutual funds often trade at large premiums or discounts to net asset value.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

21

Correlations between national stock markets are fairly stable over time.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

22

The benefits of international diversification are limited by the lack of _______ in foreign markets.

A) adequate information

B) free convertibility of currencies

C) liquidity

D) More than one of the above

E) None of the above

A) adequate information

B) free convertibility of currencies

C) liquidity

D) More than one of the above

E) None of the above

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

23

The correlation between returns on companies in the same industry and domiciled in the same country is usually greater than the correlation between returns on companies in the same industry but in different countries.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

24

The perfect market assumptions include each of the following EXCEPT

A) equal access to registered brokers

B) equal access to market prices

C) frictionless markets

D) no costs of financial distress

E) rational investors

A) equal access to registered brokers

B) equal access to market prices

C) frictionless markets

D) no costs of financial distress

E) rational investors

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

25

The extent to which risk is reduced by portfolio diversification does not depend on the correlations between assets in the portfolio.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

26

You live in London and have invested in shares of Societe Gererale de Belgique at a price of €52.00. By the end of the year you have received dividends of €1.00, share price has risen to €54.50, and the pound has fallen 20% against the euro. Which of the following is closest to your pound sterling return for the year?

A) -15%

B) 0%

C) +7%

D) +28%

E) +33%

A) -15%

B) 0%

C) +7%

D) +28%

E) +33%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

27

Suppose E[rA] = 14.8%, A = 17.9%, E[rB] = 17.1%, and B = 31.9%. Assuming a mean-variance framework, which of the following statements is true?

A) A is preferred to B.

B) B is preferred to A.

C) A and B are equally desirable.

D) Whether A or B is preferred depends on the correlation between the two assets.

E) Which asset is preferred depends on individual preferences.

A) A is preferred to B.

B) B is preferred to A.

C) A and B are equally desirable.

D) Whether A or B is preferred depends on the correlation between the two assets.

E) Which asset is preferred depends on individual preferences.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following conditions is sufficient to ensure an operationally efficient market?

A) frictionless markets

B) perfect competition

C) rational investors

D) More than one of the above

E) None of the above

A) frictionless markets

B) perfect competition

C) rational investors

D) More than one of the above

E) None of the above

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

29

You live in New York and buy a share of Phillips at a price of 166 euros. At the end of the year, you receive a dividend of 4 euros and the stock price is 160 euros. If the euro appreciates by 8% during the year, what was your percentage return in dollars for the year?

A) -10%

B) -1%

C) +7%

D) +9%

E) +11%

A) -10%

B) -1%

C) +7%

D) +9%

E) +11%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

30

The standard deviation of return to the Indian stock market is 24.8% in local currency. The standard deviation of the Indian rupee against the Canadian dollar is 30.2%. Ignoring interactions between the Indian stock market and the value of the Indian rupee, what is the standard deviation of return of the Indian market to a Canadian investor?

A) 0.550

B) 0.153

C) 0.391

D) cannot be determined from the given information

E) None of the above

A) 0.550

B) 0.153

C) 0.391

D) cannot be determined from the given information

E) None of the above

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

31

In an economist's perfect world with no barriers to the free flow of goods and capital, multinational corporations can create value for investors by diversifying internationally.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

32

The future benefits of risk reduction through international portfolio diversification can be estimated fairly precisely using historical data.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

33

A stock in India rises 20% in local terms. The Indian rupee rises 25% against the U.K. pound sterling. What is the return in pound sterling?

A) -5%

B) 0%

C) 5%

D) 45%

E) 50%

A) -5%

B) 0%

C) 5%

D) 45%

E) 50%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

34

Which of a) through c) is FALSE?

A) The risk of an individual asset when held in a portfolio with a large number of assets depends on its covariance with other assets in the portfolio.

B) As the number of assets held in a portfolio increases, the covariance terms begin to dominate the portfolio variance calculation.

C) The extent to which risk is reduced by portfolio diversification depends on how highly the individual assets in the portfolio are correlated.

D) All of the above are true.

E) All of the above are false.

A) The risk of an individual asset when held in a portfolio with a large number of assets depends on its covariance with other assets in the portfolio.

B) As the number of assets held in a portfolio increases, the covariance terms begin to dominate the portfolio variance calculation.

C) The extent to which risk is reduced by portfolio diversification depends on how highly the individual assets in the portfolio are correlated.

D) All of the above are true.

E) All of the above are false.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

35

Frictionless financial markets could have which of the following?

A) agency costs

B) bid-ask spreads

C) brokerage fees

D) government intervention

E) irrational investors

A) agency costs

B) bid-ask spreads

C) brokerage fees

D) government intervention

E) irrational investors

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

36

Return variance on a portfolio with many assets depends more on the variances of the individual assets in the portfolio than on the covariances between the individual assets.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

37

A stock in India rises 20% in local terms. Pound sterling rises 25% against the Indian rupee. What is the return in pound sterling?

A) -4%

B) 0%

C) 4%

D) 45%

E) 50%

A) -4%

B) 0%

C) 4%

D) 45%

E) 50%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

38

The return-risk efficiency of an internationally diversified portfolio of stocks and bonds can be improved by hedging the currency risk of foreign investments.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

39

What is the variance on the Indian (Rp = rupee) stock market to a Canadian investor if Var(rRp) = 0.105, Var(sC£/Rp) = 0.088, and the local Indian stock market is independent of the value of the rupee?

A) -0.017

B) 0.017

C) 0.193

D) cannot be determined from the given information

E) None of the above

A) -0.017

B) 0.017

C) 0.193

D) cannot be determined from the given information

E) None of the above

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

40

Empirical evidence suggests that stock return volatility varies predictably over time.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

41

Which of a) through c) is TRUE?

A) Both domestic and foreign nominal cash flows are exposed to purchasing power risk.

B) The real value of a future foreign currency cash flow in the domestic currency depends on domestic inflation.

C) Hedging foreign currency risk substitutes exposure to domestic purchasing power risk for exposure to currency risk.

D) All of the above are true

E) Two of the above are true

A) Both domestic and foreign nominal cash flows are exposed to purchasing power risk.

B) The real value of a future foreign currency cash flow in the domestic currency depends on domestic inflation.

C) Hedging foreign currency risk substitutes exposure to domestic purchasing power risk for exposure to currency risk.

D) All of the above are true

E) Two of the above are true

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following could account for investors' tendency to favor local assets? A the additional information costs of international diversification

B the ability of a domestic stock portfolio to hedge domestic inflation risk

C the higher returns typically earned on foreign investments

A) A and B

B) B and C

C) A and C

D) All three of the above

E) Only one of the above

B the ability of a domestic stock portfolio to hedge domestic inflation risk

C the higher returns typically earned on foreign investments

A) A and B

B) B and C

C) A and C

D) All three of the above

E) Only one of the above

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

43

Which of a) through d) is FALSE?

A) If an asset's returns are distributed as normal, then its return distribution can be completely described by its mean and variance of return.

B) Returns on foreign stocks are leptokurtic.

C) Correlation and covariance measure how closely two assets move together.

D) The correlation coefficient between two assets is the covariance scaled by the standard deviations of the two assets.

E) All of the above are true

A) If an asset's returns are distributed as normal, then its return distribution can be completely described by its mean and variance of return.

B) Returns on foreign stocks are leptokurtic.

C) Correlation and covariance measure how closely two assets move together.

D) The correlation coefficient between two assets is the covariance scaled by the standard deviations of the two assets.

E) All of the above are true

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

44

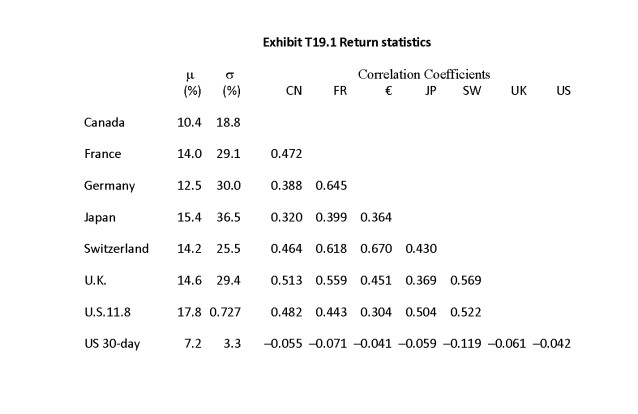

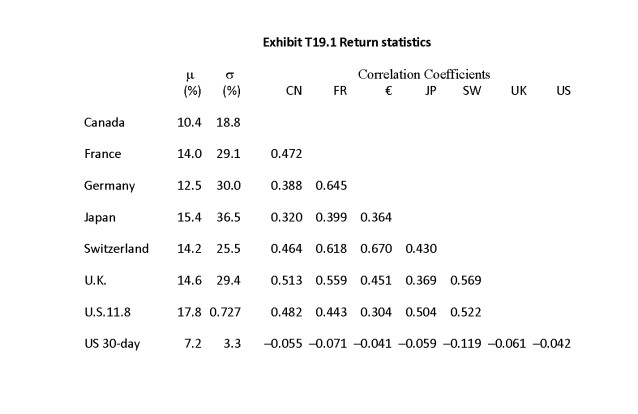

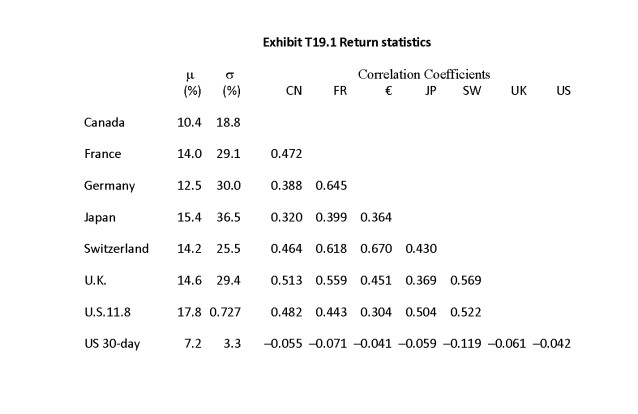

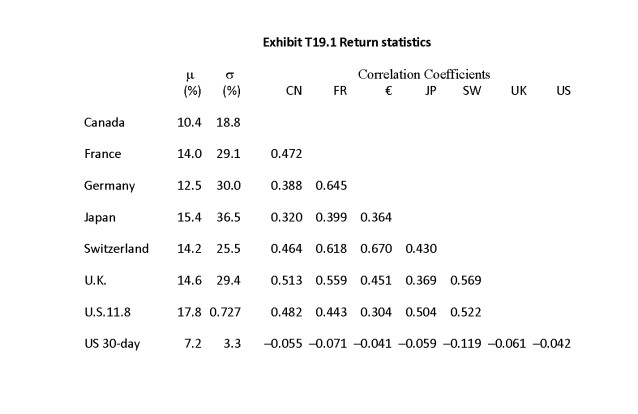

Based on Exhibit T19.1, what is the standard deviation of an equal-weighted portfolio of Canadian and French equities?

A) 4.5%

B) 17.4%

C) 20.7%

D) 24.1%

E) 30.7%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

45

Based on Exhibit T19.1, what is the standard deviation of an equal-weighted portfolio of Japanese and Swiss equities?

A) 16.6%

B) 17.4%

C) 19.3%

D) 26.4%

E) 35.9%

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

46

Which of a) through c) is TRUE?

A) In the CAPM, that portion of an individual asset's risk that cannot be diversified away by holding the asset in a large portfolio is called systematic risk.

B) In the CAPM, that portion of an individual asset's risk that cannot be diversified away by holding the asset in a large portfolio is called market risk.

C) In the CAPM, that portion of an individual asset's risk that cannot be diversified away by holding a portfolio with many securities is called nondiversifiable risk.

D) All of the above are true.

E) None of the above are true.

A) In the CAPM, that portion of an individual asset's risk that cannot be diversified away by holding the asset in a large portfolio is called systematic risk.

B) In the CAPM, that portion of an individual asset's risk that cannot be diversified away by holding the asset in a large portfolio is called market risk.

C) In the CAPM, that portion of an individual asset's risk that cannot be diversified away by holding a portfolio with many securities is called nondiversifiable risk.

D) All of the above are true.

E) None of the above are true.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

47

The risk-reduction benefits of hedging the currency risk in an international investment portfolio are greatest for a portfolio of ______.

A) commodity futures

B) domestic bonds

C) domestic stocks

D) foreign bonds

E) foreign stocks

A) commodity futures

B) domestic bonds

C) domestic stocks

D) foreign bonds

E) foreign stocks

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

48

Which of a) through d) is FALSE?

A) The systematic risk of a portfolio is measured by the standard deviation (or variance) of return on the portfolio.

B) If two assets are perfectly correlated, then the standard deviation of a portfolio of these two assets is a simple weighted average of the standard deviations of the assets.

C) The variance of a portfolio with N securities is calculated as a weighted average of the N2 cells in the variance-covariance matrix.

D) The standard deviation of a portfolio of assets is a simple weighted average of the expected returns of the assets.

E) All of the above (a-c) are false.

A) The systematic risk of a portfolio is measured by the standard deviation (or variance) of return on the portfolio.

B) If two assets are perfectly correlated, then the standard deviation of a portfolio of these two assets is a simple weighted average of the standard deviations of the assets.

C) The variance of a portfolio with N securities is calculated as a weighted average of the N2 cells in the variance-covariance matrix.

D) The standard deviation of a portfolio of assets is a simple weighted average of the expected returns of the assets.

E) All of the above (a-c) are false.

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

49

______ are not an impediment to the free flow of capital across national borders.

A) Foreign exchange controls

B) Capital inflow and outflow controls

C) Stock exchanges

D) Transactions costs

E) Withholding taxes

A) Foreign exchange controls

B) Capital inflow and outflow controls

C) Stock exchanges

D) Transactions costs

E) Withholding taxes

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

50

Based on Exhibit T19.1, what is the Sharpe index of an equal-weighted portfolio of Canadian and French equities?

A) 0.138

B) 0.209

C) 0.236

D) 0.241

E) 0.288

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck

51

Based on Exhibit T19.1, what is the Sharpe index of an equal-weighted portfolio of Japanese and Swiss equities?

A) 0.138

B) 0.209

C) 0.236

D) 0.241

E) 0.288

Unlock Deck

Unlock for access to all 51 flashcards in this deck.

Unlock Deck

k this deck