Deck 19: Accounting for Income Taxes

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/65

Play

Full screen (f)

Deck 19: Accounting for Income Taxes

1

There are two types of temporary differences between the carrying value of assets and liabilities and the tax base - assessable temporary differences and neutral temporary differences:

False

2

When a non-current asset is revalued, the recognition of future tax associated with an asset that has a fair value in excess of cost, acts to reduce the amount of the revaluation reserve:

True

3

The tax base of revenue received in advance is equal to zero where the revenue received is taxed in the reporting period that the revenue is received.

True

4

It is possible for a firm to legally make a large accounting profit but pay little or no tax based on its taxable income:

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

5

Deferred tax assets are the amounts of income taxes recoverable in future periods that arise from assessable temporary differences.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

6

When a non-current asset is revalued the tax base is not affected as depreciation for tax purposes will continue to be based on original cost:

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

7

The difference between the carrying amount of an asset or liability in the balance sheet and its tax base is a temporary difference:

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

8

Since the introduction of the tax consolidation regime entities that have not elected to be part of a 'tax consolidated group' will not be able to transfer tax losses to other entities:

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

9

Profit for taxation purposes is determined in accordance with Australian Accounting Standards, AASB 112:

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

10

Non-deductible expenses results to a deferred tax asset.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

11

The tax-effect of the temporary difference that arises from revaluation of non-current assets is recognised in profit and loss.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

12

When the carrying amount of an asset exceeds its tax base, the amount that will be allowed as a deduction for tax purposes will exceed the amount of assessable economic benefits:

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

13

Deferred tax assets arise as a result of tax losses. In Australia losses incurred in previous years can always be carried forward to offset taxable income derived in future years:

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

14

According to AASB 112, with one exception, the tax base of a liability is to be determined in the following manner,

Carrying amount - Future deductible amount + Future assessable amount:

Carrying amount - Future deductible amount + Future assessable amount:

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

15

AASB 112 uses what term to describe the method for accounting for taxes that it mandates?

A) Net balances method.

B) Financial position method.

C) Asset and liability method.

D) Balance sheet method.

E) None of the given answers.

A) Net balances method.

B) Financial position method.

C) Asset and liability method.

D) Balance sheet method.

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

16

The balance sheet approach to accounting for taxation relies on comparing the historical cost of an item with its appropriate tax base:

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

17

Under AASB 112, where the carrying amount of an asset is less than the amount that is economically recoverable, the deferred tax asset should be adjusted.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

18

In business combinations an entity recognises any deferred tax liability or asset and this affects the amount of goodwill or bargain purchase gain it recognizes.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

19

Deferred tax assets may arise from amounts of income taxes recoverable in future periods that arise from carry forward of unused tax losses.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

20

The tax figure calculated and recorded on the income statement is an accurate reflection of the entity's tax liability for the stated period.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

21

A deductible temporary difference is one that will result in:

A) A decrease in income tax recoverable in future reporting periods when the carrying amount of the asset or liability is recovered or settled.

B) An increase in income tax payable in future reporting periods when the carrying amount of the asset or liability is recovered or settled.

C) A decrease in income tax recoverable in future reporting periods when the carrying amount of the asset or liability is recovered or settled and an increase in income tax payable in future reporting periods when the carrying amount of the asset or liability is recovered or settled.

D) A decrease in income tax payable in future reporting periods when the carrying amount of the asset or liability is recovered or settled.

E) None of the given answers.

A) A decrease in income tax recoverable in future reporting periods when the carrying amount of the asset or liability is recovered or settled.

B) An increase in income tax payable in future reporting periods when the carrying amount of the asset or liability is recovered or settled.

C) A decrease in income tax recoverable in future reporting periods when the carrying amount of the asset or liability is recovered or settled and an increase in income tax payable in future reporting periods when the carrying amount of the asset or liability is recovered or settled.

D) A decrease in income tax payable in future reporting periods when the carrying amount of the asset or liability is recovered or settled.

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

22

Tissues Ltd has a depreciable asset that is estimated for accounting purposes to have a useful life of 8 years. For taxation purposes the useful life is 5 years. The asset was purchased at the beginning of year 1, there is no residual value, and the straight-line method of depreciation is used for both tax and accounting purposes. The tax rate is 30 per cent and the cost of the asset is $100,000. What is the amount of the deferred tax liability account generated by this asset at the end of years 1, 2 and 3?

A) End of year 1: $0; Year 2: $2,250; Year 3: $4,500

B) End of year 1: $7,500; Year 2: $15,000; Year 3: $22,500

C) End of year 1: $6,750; Year 2: $4,500; Year 3: $2,250

D) End of year 1: $2,250; Year 2: $4,500; Year 3: $6,750

E) None of the given answers.

A) End of year 1: $0; Year 2: $2,250; Year 3: $4,500

B) End of year 1: $7,500; Year 2: $15,000; Year 3: $22,500

C) End of year 1: $6,750; Year 2: $4,500; Year 3: $2,250

D) End of year 1: $2,250; Year 2: $4,500; Year 3: $6,750

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

23

The generally accepted (a) accounting rule, and (b) tax rule; for development expenditure, are .....:

A) Capitalise and amortise; (b) A tax deduction when paid for.

B) Expense when paid for; (b) A tax deduction when paid for.

C) Capitalise and amortise; (b) A tax deduction when amortised.

D) Expense when paid for; (b) A tax deduction when amortised.

E) Capitalise and amortise; (b) A tax deduction when impaired.

A) Capitalise and amortise; (b) A tax deduction when paid for.

B) Expense when paid for; (b) A tax deduction when paid for.

C) Capitalise and amortise; (b) A tax deduction when amortised.

D) Expense when paid for; (b) A tax deduction when amortised.

E) Capitalise and amortise; (b) A tax deduction when impaired.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

24

Under AASB 112's approach to accounting for income taxes, a taxable temporary difference creates which account?

A) Provision for tax payable.

B) Deferred tax asset.

C) General reserve.

D) Deferred tax liability.

E) None of the given answers.

A) Provision for tax payable.

B) Deferred tax asset.

C) General reserve.

D) Deferred tax liability.

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

25

A company has a loan with a carrying value of $60,000. The payment of the loan is not deductible for tax purposes. The tax rate is 30 per cent. What is the tax base for this item?

A) $0

B) $60,000

C) $18,000

D) $78,000

E) None of the given answers.

A) $0

B) $60,000

C) $18,000

D) $78,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

26

Some items are typically not allowable tax deductions but are recognised as an expense for accounting purposes. Which of the following items are of that type?

A) Research and development costs.

B) Warranty costs.

C) Sick leave payments.

D) Goodwill amortisation.

E) None of the given answers.

A) Research and development costs.

B) Warranty costs.

C) Sick leave payments.

D) Goodwill amortisation.

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

27

Raging Dragons Ltd has a depreciable asset that is estimated for accounting purposes to have a useful life of 15 years. For taxation purposes the useful life is 10 years. The asset was purchased at the beginning of year 1, there is no residual value, and the straight-line method of depreciation is used for both tax and accounting purposes. The tax rate is 30 per cent and the cost of the asset is $150,000. What adjustment will be required to the deferred tax liability account in years 10 and 11?

A) End of year 10: $1,500; Year 11: $1,500

B) End of year 10: $5,000; Year 11: $(10,000)

C) End of year 10: $1,500; Year 11: $(3,000)

D) End of year 10: $15,000; Year 11: $(3,000)

E) None of the given answers.

A) End of year 10: $1,500; Year 11: $1,500

B) End of year 10: $5,000; Year 11: $(10,000)

C) End of year 10: $1,500; Year 11: $(3,000)

D) End of year 10: $15,000; Year 11: $(3,000)

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

28

The tax base is defined in AASB 112 as:

A) The amount of assessable income for the period.

B) The tax rate applicable to income levels under $60,000.

C) The amount that is attributed to an asset or liability for tax purposes.

D) The head office of the Australian Taxation Office in Canberra.

E) None of the given answers.

A) The amount of assessable income for the period.

B) The tax rate applicable to income levels under $60,000.

C) The amount that is attributed to an asset or liability for tax purposes.

D) The head office of the Australian Taxation Office in Canberra.

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

29

The AASB 112 approach has been adopted because:

A) It matches the revenues earned with tax payable on those revenues.

B) It is conservative.

C) It is considered consistent with the AASB framework.

D) It is considered acceptable by the Tax Office.

E) None of the given answers.

A) It matches the revenues earned with tax payable on those revenues.

B) It is conservative.

C) It is considered consistent with the AASB framework.

D) It is considered acceptable by the Tax Office.

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

30

The amount of tax assessed by the Tax Office based on the entity's operations for the period will be reflected in which account?

A) Income tax expense.

B) Deferred income tax.

C) Deferred tax liability.

D) Income tax payable.

E) None of the given answers.

A) Income tax expense.

B) Deferred income tax.

C) Deferred tax liability.

D) Income tax payable.

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

31

A company has received $40,000 for subscription revenue in advance and recorded a liability account 'revenue received in advance'. Revenue is taxed when it is received. The tax rate is 30 per cent. What is the tax base for this item?

A) $0

B) $40,000

C) $12,000

D) $36,000

E) None of the given answers.

A) $0

B) $40,000

C) $12,000

D) $36,000

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

32

A taxable temporary difference is one that will result in:

A) An increase in income tax payable in future reporting periods when the carrying amount of the asset or liability is recovered or settled.

B) A decrease in income tax payable in future reporting periods when the carrying amount of the asset or liability is recovered or settled.

C) An increase in income tax recoverable in future reporting periods when the carrying amount of the asset or liability is recovered or settled.

D) A decrease in income tax payable in future reporting periods when the carrying amount of the asset or liability is recovered or settled and an increase in income tax recoverable in future reporting periods when the carrying amount of the asset or liability is recovered or settled.

E) None of the given answers.

A) An increase in income tax payable in future reporting periods when the carrying amount of the asset or liability is recovered or settled.

B) A decrease in income tax payable in future reporting periods when the carrying amount of the asset or liability is recovered or settled.

C) An increase in income tax recoverable in future reporting periods when the carrying amount of the asset or liability is recovered or settled.

D) A decrease in income tax payable in future reporting periods when the carrying amount of the asset or liability is recovered or settled and an increase in income tax recoverable in future reporting periods when the carrying amount of the asset or liability is recovered or settled.

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

33

Some items are treated as a deduction for tax purposes when they are paid but are recognised as expenses when they are accrued for accounting purposes. Which of the following items are of that type?

A) Long service leave.

B) Goodwill amortisation.

C) Depreciation.

D) Entertainment.

E) All of the given answers.

A) Long service leave.

B) Goodwill amortisation.

C) Depreciation.

D) Entertainment.

E) All of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

34

A deferred tax asset arises if:

A) The carrying amount of an asset is greater than its tax base.

B) The carrying amount of a liability is greater than its tax base.

C) The carrying amount of a liability is less than its tax base.

D) The carrying amount of an asset is greater than its tax base and the carrying amount of a liability is less than its tax base.

E) None of the given answers.

A) The carrying amount of an asset is greater than its tax base.

B) The carrying amount of a liability is greater than its tax base.

C) The carrying amount of a liability is less than its tax base.

D) The carrying amount of an asset is greater than its tax base and the carrying amount of a liability is less than its tax base.

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

35

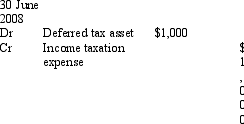

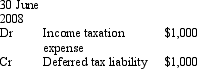

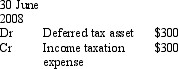

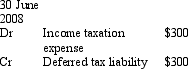

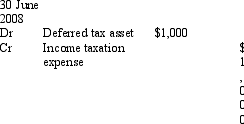

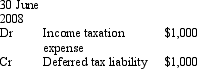

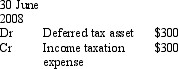

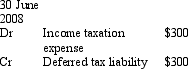

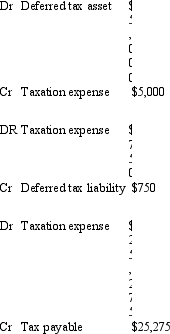

Digitor Industries Ltd accrues long service leave as employees work towards their entitlement. For tax purposes, long service leave is not deductible until it is paid. During the current period Digitor has accrued $50,000 in long service leave expense and paid none. The tax rate is 30 per cent. What is the journal entry to record the deferral?

A)

B)

C)

D)

E) None of the given answers.

A)

B)

C)

D)

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

36

Under AASB 112's approach to accounting for income taxes, a deductible temporary difference creates which account?

A) Deferred tax revenue.

B) Deferred tax liability.

C) Deferred tax asset.

D) Provision for tax payable.

E) None of the given answers.

A) Deferred tax revenue.

B) Deferred tax liability.

C) Deferred tax asset.

D) Provision for tax payable.

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

37

Sinfonia Ltd made credit sales for this period of $100,000. The allowance for doubtful debts for these sales is $3,000. For taxation purposes the amount provided for doubtful debts is not tax-deductible and the taxation office has included the $100,000 in taxable income. The tax rate is 30 per cent. What is the deferral arising from this situation?

A) None.

B) Deferred tax liability of $900

C) Deferred tax asset of $900

D) Deferred tax liability of $3,000

E) Deferred tax asset of $3,000.

A) None.

B) Deferred tax liability of $900

C) Deferred tax asset of $900

D) Deferred tax liability of $3,000

E) Deferred tax asset of $3,000.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

38

Snifful Industries has a depreciable asset that is estimated for accounting purposes to have a useful life of 7 years. For taxation purposes the useful life is 3 years. The asset was purchased at the beginning of year 1, there is no residual value, and the straight-line method of depreciation is used for both tax and accounting purposes. The tax rate is 30 per cent and the cost of the asset is $210,000. What is the amount of the deferred tax liability account generated by this asset at the end of years 2, 3 and 4?

A) End of year 2: $24,000; Year 3: $36,000; Year 4: $27,000

B) End of year 2: $80,000; Year 3: $120,000; Year 4: $90,000

C) End of year 2: $12,000; Year 3: $24,000; Year 4: $36,000

D) End of year 2: $12,000; Year 3: $12,000; Year 4: $(9,000)

E) None of the given answers.

A) End of year 2: $24,000; Year 3: $36,000; Year 4: $27,000

B) End of year 2: $80,000; Year 3: $120,000; Year 4: $90,000

C) End of year 2: $12,000; Year 3: $24,000; Year 4: $36,000

D) End of year 2: $12,000; Year 3: $12,000; Year 4: $(9,000)

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

39

Bulldog Supplies Ltd has an item of equipment that has a carrying value of $80,000. For taxation purposes the asset's net value is $60,000 and deferred tax liabilities of $3,000 had previously been recorded. Bulldog also has accrued interest revenue of $5,000 that will not be taxed until it is received in cash. The tax rate is 30 per cent. What is the journal entry to record the tax effect?

A)

B)

C)

D)

E) None of the given answers.

A)

B)

C)

D)

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

40

The correct method for calculating the amount of a deferred tax liability or asset may be expressed as a formula as follows:

A) (Carrying amount of assets or liabilities - tax bases of assets or liabilities) tax rate.

B) Carrying amount of assets or liabilities - (tax bases of assets or liabilities tax rate).

C) Carrying amount of assets or liabilities - tax bases of assets or liabilities tax rate.

D) Carrying amount of assets or liabilities - tax bases of assets or liabilities.

E) None of the given answers.

A) (Carrying amount of assets or liabilities - tax bases of assets or liabilities) tax rate.

B) Carrying amount of assets or liabilities - (tax bases of assets or liabilities tax rate).

C) Carrying amount of assets or liabilities - tax bases of assets or liabilities tax rate.

D) Carrying amount of assets or liabilities - tax bases of assets or liabilities.

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

41

The carrying amount of deferred tax assets and deferred tax liabilities can change:

A) With a change in the amount of the related temporary differences.

B) Even if there is no change in the amount of the related temporary differences.

C) A re-assessment of the recoverability of deferred tax liabilities.

D) With a change in the amount of the related temporary differences and even if there is no change in the amount of the related temporary differences.

E) All of the given answers.

A) With a change in the amount of the related temporary differences.

B) Even if there is no change in the amount of the related temporary differences.

C) A re-assessment of the recoverability of deferred tax liabilities.

D) With a change in the amount of the related temporary differences and even if there is no change in the amount of the related temporary differences.

E) All of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

42

Recognising deferred tax assets and deferred tax liabilities as per AASB 112 creates some conflict with the definition of assets and liabilities in the AASB Framework. Key issues in this regard are:

A) It is questionable whether or not the company controls the benefits from the deferred tax asset, and there is not a present obligation to transfer the funds represented in the deferred tax liability to the government.

B) The company really has no claim against the government for the amount of the deferred tax asset and it is not probable that the company will have to pay the deferred tax liability.

C) Setting off the deferred tax asset and deferred tax liability does not meet the requirements of the AASB Framework and there is a contingent element involved in the recognition of the deferred tax asset.

D) The AASB Framework does not permit the recognition of the rights to future revenues implicit in assets to trigger obligations to future expenses implicit in liabilities and the extent to which a deferred tax liability is recognised should not depend on management's intention to sell a revalued asset.

E) None of the given answers.

A) It is questionable whether or not the company controls the benefits from the deferred tax asset, and there is not a present obligation to transfer the funds represented in the deferred tax liability to the government.

B) The company really has no claim against the government for the amount of the deferred tax asset and it is not probable that the company will have to pay the deferred tax liability.

C) Setting off the deferred tax asset and deferred tax liability does not meet the requirements of the AASB Framework and there is a contingent element involved in the recognition of the deferred tax asset.

D) The AASB Framework does not permit the recognition of the rights to future revenues implicit in assets to trigger obligations to future expenses implicit in liabilities and the extent to which a deferred tax liability is recognised should not depend on management's intention to sell a revalued asset.

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

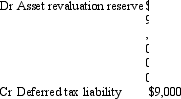

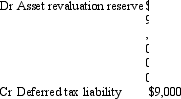

43

Shopping Malls Ltd has some land it purchased several years ago for $300,000. It has revalued the land this period to $480,000 and management intends to sell it in the near future. When the land was acquired the index for capital gains tax was 110 and at reporting date it is 132. The tax rate is 30 per cent. What is the entry to record the tax implications of the revaluation?

A)

B)

C)

D)

E) None of the given answers.

A)

B)

C)

D)

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

44

As at 30 June 2007, Net Accounts Receivables was $57,000, and the Allowance for Doubtful Debts was $3,000. On 30 June 2008, the respective balances were $64,000 and $4,000. Assuming there were no other temporary differences, what s the journal entry to adjust for the changes in these balances as at 30 June 2008? The corporate tax rate is 30 per cent.

A)

B)

C)

D)

E) None of the given answers

A)

B)

C)

D)

E) None of the given answers

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following statements is not correct in relation to tax rate changes?

A) An increase in tax rates will create an expense where an entity has deferred tax liabilities.

B) Across time it is likely that governments will change tax rates.

C) A decrease in tax rates will create an income where an entity has deferred tax assets.

D) Changes tax rates will have implications for the value attributed to pre-existing deferred tax assets

E) Deferred tax arising from changes to tax rates is recognised in either the income statement or to equity (if they had been previously charged to equity).

A) An increase in tax rates will create an expense where an entity has deferred tax liabilities.

B) Across time it is likely that governments will change tax rates.

C) A decrease in tax rates will create an income where an entity has deferred tax assets.

D) Changes tax rates will have implications for the value attributed to pre-existing deferred tax assets

E) Deferred tax arising from changes to tax rates is recognised in either the income statement or to equity (if they had been previously charged to equity).

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

46

To be a member of a "tax consolidated group":

A) Associates must be Australian residents

B) Subsidiaries must be Australian residents

C) Subsidiaries must be majority owned by the parent company.

D) Subsidiaries must be Australian residents and subsidiaries must be majority owned by the parent company.

E) None of the given answers.

A) Associates must be Australian residents

B) Subsidiaries must be Australian residents

C) Subsidiaries must be majority owned by the parent company.

D) Subsidiaries must be Australian residents and subsidiaries must be majority owned by the parent company.

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

47

The criteria for recognising a deferred tax asset is:

A) That it should be fully recognised if it is probable that future taxable amounts within the entity will be available against which the deductible temporary differences can be utilised.

B) That it should be recognised if it is possible that future taxable amounts within the entity will be available against which the deductible temporary differences can be utilised.

C) That it should be recognised to the extent, and only to the extent, that it is possible that future taxable amounts within the entity will be available against which the deductible temporary differences can be utilised.

D) That it should be recognised to the extent, and only to the extent, that it is probable that future taxable amounts within the entity will be available against which the deductible temporary differences can be utilised.

E) None of the given answers.

A) That it should be fully recognised if it is probable that future taxable amounts within the entity will be available against which the deductible temporary differences can be utilised.

B) That it should be recognised if it is possible that future taxable amounts within the entity will be available against which the deductible temporary differences can be utilised.

C) That it should be recognised to the extent, and only to the extent, that it is possible that future taxable amounts within the entity will be available against which the deductible temporary differences can be utilised.

D) That it should be recognised to the extent, and only to the extent, that it is probable that future taxable amounts within the entity will be available against which the deductible temporary differences can be utilised.

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

48

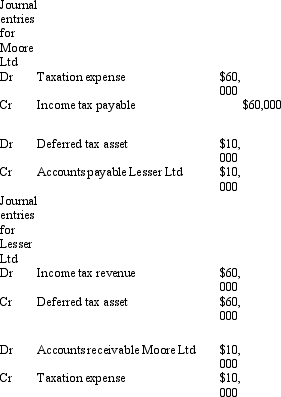

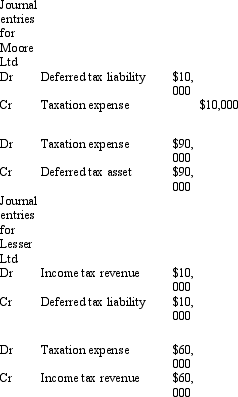

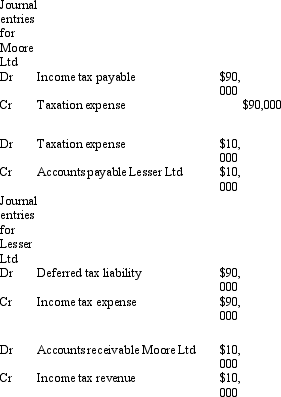

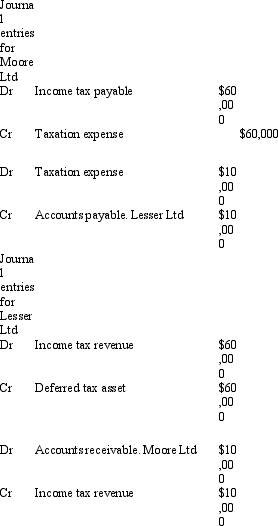

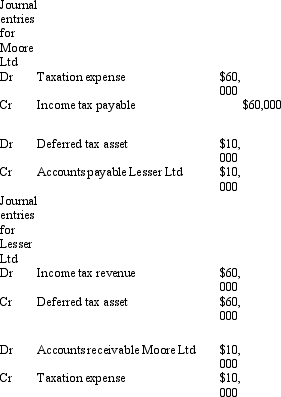

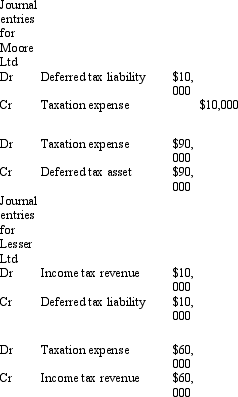

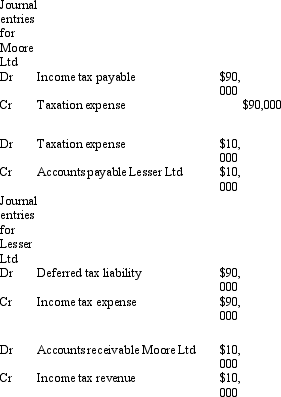

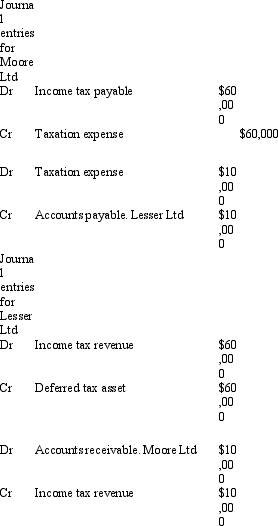

Lesser Ltd is wholly owned by Moore Ltd. In the current year Lesser Ltd has made a tax loss of $200,000 and Moore Ltd has made a profit of $300,000. It is expected that Lesser Ltd will make sufficient profits in the future to utilise the benefits of the tax loss, so Lesser has recorded a deferral for the loss. Moore pays Lesser $10,000 consideration for the transfer of the tax loss. Neither Moore nor Lesser have elected to be part of a tax consolidated group. The taxation rate is 30 per cent. What are the appropriate entries to record the transfer (only)?

A)

B)

C)

D)

E) None of the given answers.

A)

B)

C)

D)

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

49

The transfer of tax losses to other entities within a group:

A) Is no longer permitted in Australia under the new tax consolidation regime.

B) Is not addressed in AASB 112.

C) Can only be performed by entities within a tax consolidated group.

D) Is not addressed in AASB 112 and can only be performed by entities within a tax consolidated group.

E) None of the given answers.

A) Is no longer permitted in Australia under the new tax consolidation regime.

B) Is not addressed in AASB 112.

C) Can only be performed by entities within a tax consolidated group.

D) Is not addressed in AASB 112 and can only be performed by entities within a tax consolidated group.

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

50

The balance sheet approach adopted in AASB 112:

A) Will continue to be used as the alternatives are too simplistic.

B) Will only be understood by the very sophisticated financial readers.

C) Uses existing balance sheet data thus reducing record keeping costs.

D) Will only be understood by the very sophisticated financial readers and uses existing balance sheet data thus reducing record keeping costs.

E) None of the given answers.

A) Will continue to be used as the alternatives are too simplistic.

B) Will only be understood by the very sophisticated financial readers.

C) Uses existing balance sheet data thus reducing record keeping costs.

D) Will only be understood by the very sophisticated financial readers and uses existing balance sheet data thus reducing record keeping costs.

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

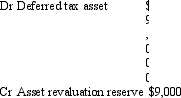

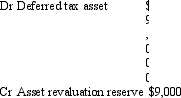

51

Spring Day Ltd has a piece of equipment that it has revalued to its fair value of $90,000 this period. It originally cost $80,000 and the accumulated depreciation for both accounting and tax purposes is $20,000. There is no intention to sell the equipment in the near future. The tax rate is 30 per cent. What is the journal entry to reflect the revaluation's tax implications?

A)

B)

C)

D)

E) None of the given answers.

A)

B)

C)

D)

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

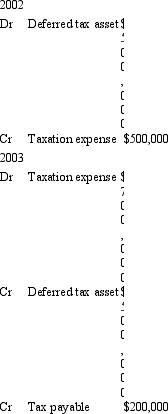

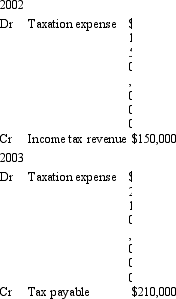

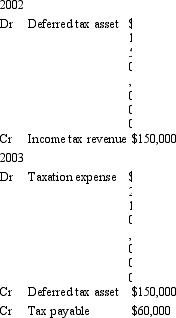

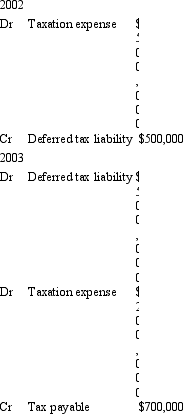

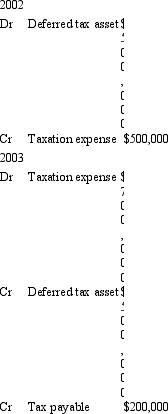

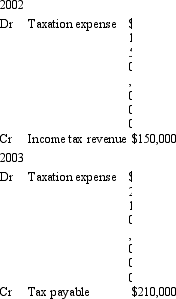

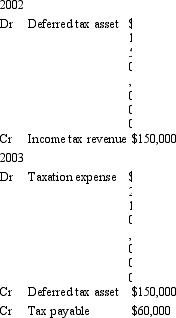

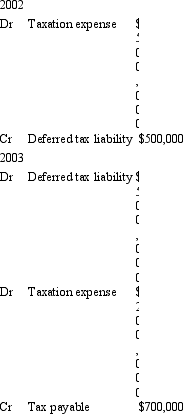

52

Casper Ltd incurred a loss of $500,000 for tax purposes in 2002. This was due to one-off circumstances and it is expected that Casper will make profits again in 2003 and subsequent years. There are no temporary differences in either year. In 2003 Casper makes a profit of $700,000. The tax rate is 30 per cent. What are the journal entries for 2002 and 2003?

A)

B)

C)

D)

E) None of the given answers.

A)

B)

C)

D)

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

53

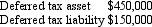

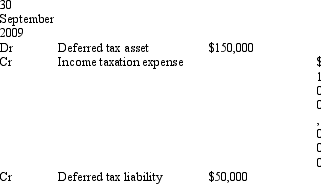

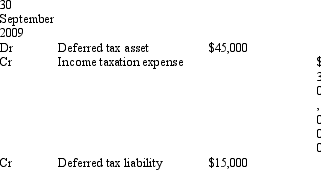

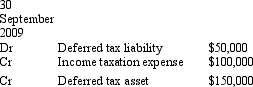

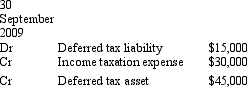

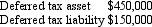

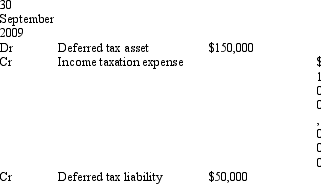

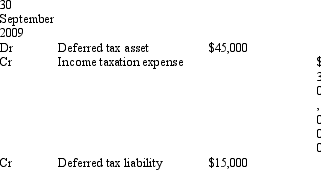

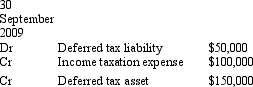

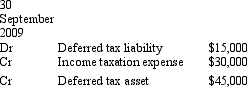

Bogart Ltd has the following tax balances as at 30 June 2009

The balances were calculated when the tax rate was 30 per cent. On 30 September 2009, the Government announced a change to the company tax rate to 40 per cent, effective immediately. What is the journal entry to adjust the carry-forward balances of the deferred tax asset and deferred tax liability?

A)

B)

C)

D)

E) None of the given answers

The balances were calculated when the tax rate was 30 per cent. On 30 September 2009, the Government announced a change to the company tax rate to 40 per cent, effective immediately. What is the journal entry to adjust the carry-forward balances of the deferred tax asset and deferred tax liability?

A)

B)

C)

D)

E) None of the given answers

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

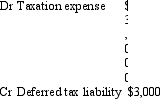

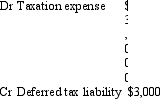

54

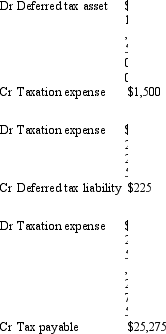

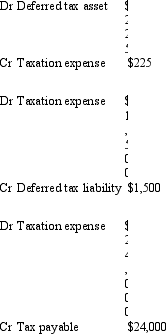

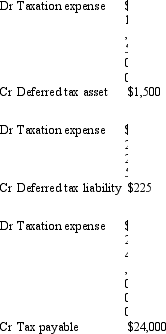

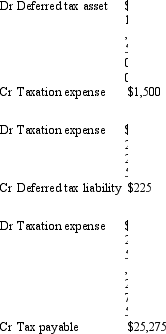

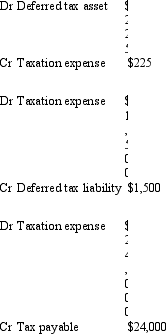

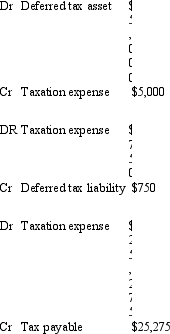

Mighty Motors Ltd offers a warranty on all the spare parts it sells. This period the accrued warranty is $5,000. For tax purposes there is no deduction for the warranty until payments are made. Mighty Motors also has equipment that has a useful life for accounting purposes of 4 years and for tax purposes 3 years. The equipment was purchased at the beginning of the current period, cost $9,000, and has no residual value. The straight-line method of depreciation is used for both accounting and tax purposes. The accounting profit before tax this period is $80,000. The tax rate is 30 per cent. What are the journal entries to record the tax expense and tax payable?

A)

B)

C)

D)

E) None of the given answers.

A)

B)

C)

D)

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

55

Criteria used by an entity to assess the probability that taxable profit will be available against which unused tax losses can be utilised include:

A) Whether the unused tax losses result from identifiable causes which are unlikely to recur.

B) Whether it is probable that the entity will have taxable profits before the unused tax losses expire.

C) Whether permission has been received from the Australian Taxation Office to carry forward tax losses.

D) All of the given answers

E) Whether the unused tax losses result from identifiable causes which are unlikely to recur and whether it is probable that the entity will have taxable profits before the unused tax losses expire.

A) Whether the unused tax losses result from identifiable causes which are unlikely to recur.

B) Whether it is probable that the entity will have taxable profits before the unused tax losses expire.

C) Whether permission has been received from the Australian Taxation Office to carry forward tax losses.

D) All of the given answers

E) Whether the unused tax losses result from identifiable causes which are unlikely to recur and whether it is probable that the entity will have taxable profits before the unused tax losses expire.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

56

The tax base of a liability must be calculated as the liability's carrying amount as at the reporting date, less any future deductible amounts and plus any future assessable amounts that are expected to arise from settling the liability's carrying amount as at the reporting date. The exception to this rule is that:

A) In the case of revenue received in advance, the tax base must be calculated as the liability's carrying amount less any amount of the revenue received in advance that has been included in taxable amounts in the current or a previous reporting period.

B) In the case of carry forward tax losses, the tax base must be adjusted for any consideration paid by a company within the group that is receiving the transferred tax loss.

C) In the case of a downward revaluation of a non-current asset, the tax base must be calculated as the decrease in the asset plus any amount expected to be received in the future inflated by the index for capital gains tax.

D) In the case of a warranty liability, the tax base must be calculated as the liability's carrying amount less any amounts paid out this period that have not been included in taxable amounts in the current period.

E) None of the given answers.

A) In the case of revenue received in advance, the tax base must be calculated as the liability's carrying amount less any amount of the revenue received in advance that has been included in taxable amounts in the current or a previous reporting period.

B) In the case of carry forward tax losses, the tax base must be adjusted for any consideration paid by a company within the group that is receiving the transferred tax loss.

C) In the case of a downward revaluation of a non-current asset, the tax base must be calculated as the decrease in the asset plus any amount expected to be received in the future inflated by the index for capital gains tax.

D) In the case of a warranty liability, the tax base must be calculated as the liability's carrying amount less any amounts paid out this period that have not been included in taxable amounts in the current period.

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

57

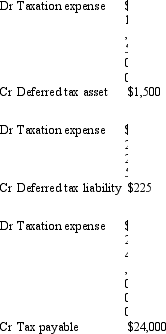

As at 30 June 2007, the Provision for Long Service Leave balance was $125,000. During 2006/07 $54,000 was charged to the provision account, and leave to the value of $34,000 was taken by staff. The balance on 30 June 2008 was $135,000, following the charging of long service leave expense of the same amount as in 2006/07 - i.e., $54,000. Assuming there were no other temporary differences, what s the journal entry to adjust for the changes in these balances as at 30 June 2008? The corporate tax rate is 30 per cent.

A)

B)

C)

D)

E) None of the given answers

A)

B)

C)

D)

E) None of the given answers

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

58

When the carrying amount of an asset exceeds the tax base, there will be a deferred tax ..... (a) ......; because the taxation payments have effectively been ...... (b):

A) (a) Asset; (b) made in advance of recognising the expense.

B) (a) Asset; (b) deferred to future periods.

C) (a) Liability; (b) made in advance of recognising the expense.

D) (a) Liability; (b) deferred to future periods.

E) (a) Reserve; (b) deferred to future periods.

A) (a) Asset; (b) made in advance of recognising the expense.

B) (a) Asset; (b) deferred to future periods.

C) (a) Liability; (b) made in advance of recognising the expense.

D) (a) Liability; (b) deferred to future periods.

E) (a) Reserve; (b) deferred to future periods.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

59

Permanent differences:

A) arise due to differences between income tax legislation and accounting rules, in a particular period, and are reversed in subsequent periods.

B) are accounted for by creating and/or passing entries through to "Deferred Tax Assets" and "Deferred Tax Liabilities" accounts.

C) must be considered, and accounted for, by the creation of deferred tax asset and liabilities for all balance sheet items (e.g., including asset revaluations), rather than just income statement items, which is a major change created by the new standard.

D) arise due to differences between income tax legislation and accounting rules, in a particular period, and are reversed in subsequent periods; are accounted for by creating and/or passing entries through to "Deferred Tax Assets" and "Deferred Tax Liabilities" accounts; must be considered, and accounted for, by the creation of deferred tax asset and liabilities for all balance sheet items (e.g., including asset revaluations), rather than just income statement items, which is a major change created by the new standard

E) None of the given answers.

A) arise due to differences between income tax legislation and accounting rules, in a particular period, and are reversed in subsequent periods.

B) are accounted for by creating and/or passing entries through to "Deferred Tax Assets" and "Deferred Tax Liabilities" accounts.

C) must be considered, and accounted for, by the creation of deferred tax asset and liabilities for all balance sheet items (e.g., including asset revaluations), rather than just income statement items, which is a major change created by the new standard.

D) arise due to differences between income tax legislation and accounting rules, in a particular period, and are reversed in subsequent periods; are accounted for by creating and/or passing entries through to "Deferred Tax Assets" and "Deferred Tax Liabilities" accounts; must be considered, and accounted for, by the creation of deferred tax asset and liabilities for all balance sheet items (e.g., including asset revaluations), rather than just income statement items, which is a major change created by the new standard

E) None of the given answers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

60

If a tax rate changes from 30 per cent to 25 per cent results in an adjustment to the Deferred Tax Liability account of $50,000, what is (a) the amount of the temporary differences; and (b) the type of temporary differences?

A) (a) $ 1,000,000; (b) Taxable temporary differences.

B) (a) $ 1,000,000; (b) Deductible temporary differences.

C) (a) $ 50,000; (b) Taxable temporary differences.

D) (a) $ 50,000; (b) Deductible temporary differences.

E) Cannot determine from the information given.

A) (a) $ 1,000,000; (b) Taxable temporary differences.

B) (a) $ 1,000,000; (b) Deductible temporary differences.

C) (a) $ 50,000; (b) Taxable temporary differences.

D) (a) $ 50,000; (b) Deductible temporary differences.

E) Cannot determine from the information given.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following statements is correct with respect to AASB 112 "Income Taxes" when the government increase tax rates?

A) The entity applies a prospective application to deferred tax assets and deferred tax liabilities initially recognized subsequent to the announcement of the tax change.

B) Expense is recognised if the entity has deferred tax liabilities only.

C) Income is recognised if the entity has deferred tax liabilities only.

D) Expense is recognised if the entity has deferred tax assets only.

E) None of the given answers

A) The entity applies a prospective application to deferred tax assets and deferred tax liabilities initially recognized subsequent to the announcement of the tax change.

B) Expense is recognised if the entity has deferred tax liabilities only.

C) Income is recognised if the entity has deferred tax liabilities only.

D) Expense is recognised if the entity has deferred tax assets only.

E) None of the given answers

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following statements is correct with respect to AASB 112 "Income Taxes" when a non-current asset is revalued?

A) On revaluation date, the revaluation reserve is increased by the product of the temporary difference and the tax rate.

B) On revaluation date, the revaluation reserve is decreased by the product of the temporary difference and the tax rate.

C) On revaluation date, a deferred tax liability is created equal to the amount of the temporary difference.

D) On revaluation date, a deferred tax asset is created equal to the amount of the temporary difference.

E) None of the given answers

A) On revaluation date, the revaluation reserve is increased by the product of the temporary difference and the tax rate.

B) On revaluation date, the revaluation reserve is decreased by the product of the temporary difference and the tax rate.

C) On revaluation date, a deferred tax liability is created equal to the amount of the temporary difference.

D) On revaluation date, a deferred tax asset is created equal to the amount of the temporary difference.

E) None of the given answers

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

63

On 1 January 2012, William Bay Ltd purchased a machine for $100,000. The entity adopts a straight-line depreciation method and uses 10% and 15% as depreciation rate and tax rate, respectively. The salvage value is zero and the tax rate is 30%.

At 31 December 2012, which of the following statements is correct with respect to this transaction only that is in accordance with AASB 112 "Income Taxes"?

A) There is a deductible temporary difference of $5,000.

B) There is a deductible temporary difference of $1,500.

C) There is a taxable temporary difference of $5,000.

D) There is a taxable temporary difference of $1,500.

E) The deferred tax liability is $5,000.

At 31 December 2012, which of the following statements is correct with respect to this transaction only that is in accordance with AASB 112 "Income Taxes"?

A) There is a deductible temporary difference of $5,000.

B) There is a deductible temporary difference of $1,500.

C) There is a taxable temporary difference of $5,000.

D) There is a taxable temporary difference of $1,500.

E) The deferred tax liability is $5,000.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

64

What is the accounting treatment for goodwill that is consistent with AASB 112 "Income Taxes"?

A) Treated as a deductible expense in the year of recognition.

B) Treated as a non-deductible expense in the year of recognition and subsequent periods.

C) The difference between the carrying amount and the tax base results to a taxable temporary difference.

D) The difference between the carrying amount and the tax base results to a deductible temporary difference.

E) The deductible temporary difference results to a deferred tax asset.

A) Treated as a deductible expense in the year of recognition.

B) Treated as a non-deductible expense in the year of recognition and subsequent periods.

C) The difference between the carrying amount and the tax base results to a taxable temporary difference.

D) The difference between the carrying amount and the tax base results to a deductible temporary difference.

E) The deductible temporary difference results to a deferred tax asset.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

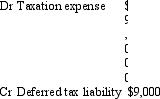

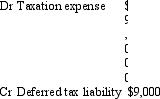

65

On 1 January 2012, William Bay Ltd purchased a machine for $100,000. The entity adopts a straight-line depreciation method and uses 10% and 15% as depreciation rate and tax rate, respectively. The salvage value is zero and the tax rate is 30%.

At 31 December 2012, which of the journal entries is correct with respect to this transaction only that is in accordance with AASB 112 "Income Taxes"?

A) Dr There is a deductible temporary difference of $5,000.

B) There is a deductible temporary difference of $1,500.

C) There is a taxable temporary difference of $5,000.

D) There is a taxable temporary difference of $1,500.

E) The deferred tax liability is $5,000.

At 31 December 2012, which of the journal entries is correct with respect to this transaction only that is in accordance with AASB 112 "Income Taxes"?

A) Dr There is a deductible temporary difference of $5,000.

B) There is a deductible temporary difference of $1,500.

C) There is a taxable temporary difference of $5,000.

D) There is a taxable temporary difference of $1,500.

E) The deferred tax liability is $5,000.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck