Accounting for Decision Making and Control 7th Edition by Jerold Zimmerman

Edition 7ISBN: 978-0078136726

Accounting for Decision Making and Control 7th Edition by Jerold Zimmerman

Edition 7ISBN: 978-0078136726 Exercise 9

Candice Company

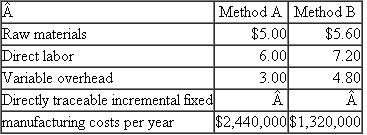

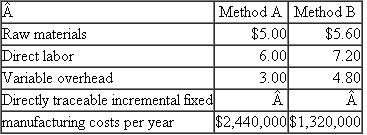

Candice Company has decided to introduce a new product that can be manufactured by either of two methods. The manufacturing method will not affect the quality of the product. The estimated manufacturing costs of the two methods are as follows: Candice's market research department has recommended an introductory unit sales price of $30. The incremental selling expenses are estimated to be $500,000 annually plus $2 for each unit sold, regardless of manufacturing method.

Candice's market research department has recommended an introductory unit sales price of $30. The incremental selling expenses are estimated to be $500,000 annually plus $2 for each unit sold, regardless of manufacturing method.

Required:

a. Calculate the estimated break-even point in annual unit sales of the new product if Candice Co. uses

(i) Manufacturing method A.

(ii) Manufacturing method B.

b. Which production technology should the firm use and why? Source: CMA adapted.

Candice Company has decided to introduce a new product that can be manufactured by either of two methods. The manufacturing method will not affect the quality of the product. The estimated manufacturing costs of the two methods are as follows:

Candice's market research department has recommended an introductory unit sales price of $30. The incremental selling expenses are estimated to be $500,000 annually plus $2 for each unit sold, regardless of manufacturing method.

Candice's market research department has recommended an introductory unit sales price of $30. The incremental selling expenses are estimated to be $500,000 annually plus $2 for each unit sold, regardless of manufacturing method.Required:

a. Calculate the estimated break-even point in annual unit sales of the new product if Candice Co. uses

(i) Manufacturing method A.

(ii) Manufacturing method B.

b. Which production technology should the firm use and why? Source: CMA adapted.

Explanation

Candice Company

Conceptual Framework

W...

Accounting for Decision Making and Control 7th Edition by Jerold Zimmerman

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255