Accounting for Decision Making and Control 7th Edition by Jerold Zimmerman

Edition 7ISBN: 978-0078136726

Accounting for Decision Making and Control 7th Edition by Jerold Zimmerman

Edition 7ISBN: 978-0078136726 Exercise 10

LaserFIo

Marti Meyers, vice president of marketing for LaserFlo, was concerned as she reviewed the costs for the AP2000 laser printer she was planning to launch next month. The AP2000 is a new commercial printer that LaserFlo designed for medium-size direct mail businesses. The basic system price was set at $74,500; the unit manufacturing cost of the AP2000 is $46,295, and selling and administrative cost is budgeted at 33 percent of the selling price. The maintenance price she planned to announce was $85 per hour of LaserFlo technician time. While the $74,500 base price is competitive, $85 per hour is a bit higher than the industry average of $82 per hour. However, Meyers believed she could live with the $85 price. She is concerned because she has just received a memo from the Field Service organization stating that it was increasing its projected hourly charge for service from $35.05 to $38.25.

The $85 price Meyers was prepared to charge for service was based on last year's $35.05 service cost. She thought that using last year's cost was conservative since Field Service had been downsizing and she expected the cost to go down, not up. The $35.05 cost still did not yield the 60 percent margin on service that was the standard for other LaserFlo printers, but Meyers had difficulty justifying a higher maintenance price given the competition. With a service cost of $38.25, Meyers knows she cannot raise the price to the customer enough to cover the higher costs without significantly reducing sales. Given the higher cost of the LaserFlo field technicians and the prices charged for maintenance by the competition, she will not be able to make the profit target in her plan.

Background

LaserFlo manufactures, sells, and services its printers throughout the United States using direct sales and service forces. It has been in business for 22 years and is the largest of three manufacturers of high-speed laser printers for direct mailers in the United States. LaserFlo maintains its market leadership by innovating new technology. Direct mail marketing firms produce customized letters of solicitation for bank credit cards, real estate offers, life insurance, colleges and universities, andmagazine giveaway contests. Personalized letters are printed on high-speed printers attached to computers that have the mailing information. The printers print either the entire letter or the address and salutation ("Dear Mrs. Jeremy McConnell") on preprinted forms. Direct mail firms have computer systems to manage their address lists and mailings, and LaserFlo printers are attached to the client's computer system.

Direct mail laser printers process very high volumes; a single printer commonly addresses 75,000 letters a day. Hence, LaserFlo printers for direct mail marketers differ from general-purpose high-speed printers. In particular, they have specialized paper transfer mechanisms to handle the often custom, heavy paper; varying paper sizes; and high-speed paper flows. With such high paper flow rates, these printers require regular adjustments to prevent paper jams and misalignments. LaserFlo's nationwide field service organization of about 500 employees maintains these printers.

The standard LaserFlo sales contract contains two parts: the purchase price of the equipment and a maintenance contract for the equipment. All LaserFlo printers are maintained by LaserFlo field service personnel, and the maintenance contract specifies the price per hour charged for routine and unscheduled maintenance. Most of LaserFlo's profits come from printer maintenance. Printers have about a 5 to 10 percent markup over manufacturing and selling cost, but the markup on maintenance has historically averaged about 60 percent.

LaserFlo printers have a substantial amount of built-in intelligence to control the printing and for self-diagnostics. Each printer has its own microcomputer with memory to hold the data to be printed. These internal microcomputers also keep track of printing statistics and can alert the operator to impending problems (low toner, paper alignment problems, form breaks). When customers change their operating system or computer, this often necessitates a LaserFlo service call to ensure that the new system is compatible with the printer. The standard service contract calls for normal maintenance after a fixed number of impressions (pages); for example, the AP2000 requires service after every 500,000 pages are printed. Its microcomputer is programmed to call LaserFlo's central computer to schedule maintenance whenever the machine has produced 375,000 pages since the last servicing.

LaserFlo organization

LaserFlo is organized into engineering, manufacturing, marketing, field service, and administration divisions. Engineering designs the new printers and provides consulting services to marketing and field service regarding system installation and maintenance. Engineering is evaluated as a cost center.

Manufacturing produces the printers, which are assembled from purchased parts and subassem- blies. LaserFlo's comparative advantage is quality control and design. Manufacturing also provides parts for field service maintenance. Manufacturing is treated as a cost center and evaluated based on meeting cost targets and delivery schedules. Manufacturing's unit cost is charged to marketing for each printer sold.

Marketing, a profit center, is responsible for designing the marketing campaigns, pricing the printers, and managing the field sales staff. LaserFlo sells six different printers; each has a separate marketing program manager. The six marketing program managers report to Marti Meyers, vice president of marketing, who also manages field sales.

Field sales is organized around four regional managers responsible for the sales offices in their region. Each of the 27 sales offices has a direct sales force that contacts potential customers and sells the six programs. Salespeople receive a salary and a commission depending on the printer and options sold. The salesperson continues to receive commissions from ongoing revenues paid by the account for service. Since ongoing maintenance forms a significant amount of a printer's total profit, the salesperson has an incentive to keep the customer with LaserFlo.

Field service contains the technical people who install and maintain the printers. Headed by Phil Hansen, vice president of field service, field service usually shares office space with field sales in the cities where they operate. Field service is a cost center, and its direct and indirect costs are charged to programs when the printers are serviced. The price charged is based on the budgeted rate set at the beginning of the year. Any difference between the actual amount charged to the programs and the total cost incurred by the field service group is charged to a corporate overhead account, not to the marketing programs.

Administration manages human resources, finance, accounting, and field office leases. It handles customer billing and collections, payroll, and negotiating office space for the field sales and field service people. Administration is evaluated as a cost center. While local office space is managed by administration, the cost of the office space is allocated to the field sales and service groups and included in their budgets and monthly operating statements.

Service contracts

Each LaserFlo printer sold requires a service contract. The AP2000's service contract calls for normal maintenance every 500,000 pages at a price of $0.51 per 1,000 pages. Normal maintenance requires three hours. The typical AP2000 prints 12 million pages per year. Besides normal maintenance (sometimes called preventive maintenance), unscheduled maintenance occurs due to improper operator setups, paper jams, system upgrades, and harsh usage of the equipment. Past statistical studies have shown that each normal maintenance hour generates 0.50 unscheduled maintenance hours. Unscheduled maintenance is billed to the customer at the service contract rate of $85 per hour.

When maintenance is performed on a particular machine, the service revenues less field service costs are credited to the marketing manager for that program. All the programs' actual service profits are compared with the plan; they form part of Meyers's performance evaluation. The field salesperson receives a commission based on the total service revenue generated by the account. In evaluating each new printer program, LaserFlo uses the following procedure. Profits from service are expected to create an annuity that will last for five years at 18 percent interest. To evaluate a proposed new printer, the one-year maintenance profits are multiplied by 3.127 to reflect the present value of the future service profits each printer is expected to generate over its life (about five years).

Parts

Any parts used during service are charged directly to the customer and do not flow through field service budgets or operating statements. LaserFlo purchases most of the printers' parts from outside suppliers, and the customer pays only a token markup. Marketing does not receive any revenue, nor is it charged any costs when customers use parts in the service process. The reason for not charging customers a larger markup on parts stems from an antitrust case filed against LaserFlo and other printer companies six years ago. A third-party service company, Servwell, sued the printer manufacturers for restraint of trade, claiming they prevented Servwell from maintaining the printers by only selling replacement parts at very high prices. To prevent other such claims, LaserFlo sells parts at a small markup over costs. Yet Servwell and other third-party service firms have never been able to penetrate LaserFlo's service markets because laser printing technology changes rapidly, and an outside company cannot keep a work force trained to fix the latest products. Besides, each printer usually has at least two engineering modifications each year to fix problems or upgrade the printer or its microcomputer hardware and/or software. An outside service company cannot learn of these changes and provide the same level of service as LaserFlo.

Recent changes in field service

LaserFlo field service had two types of technicians: Tech1 and Tech2. Both were trained to repair electromechanical problems, but Tech2s had more training in electronics and computers to work on the latest, most sophisticated printers.

Field service had been trying to reduce the size of the service force the last few years through voluntary retirements and attrition. As the printers became more sophisticated, they became more reliable. The newer systems had self-diagnosing software that allowed a service technician to call up a customer's printer and run a diagnostic program. Often the problem was solved over the phone line by having a LaserFlo technician make the repair in the software. If a mechanical problem was detected, the technician dispatched a repair person (often a Tech1) with the right part. Also, past customers replaced their older printers with newer ones that required less maintenance. The result was excess capacity in the field staff.

The voluntary retirements over the past few years did not produce the reductions necessary to eliminate the excess capacity. In 2010, field service went through a very large involuntary reduction of its workforce. Through attrition, early retirements, and terminations, LaserFlo reduced the number of technicians by 75, down to 500 budgeted for 2011. The company simultaneously improved the skill level of its remaining field force substantially.

AP2000 sales plan for 2011

Marti Meyers's 2011 sales plan for the AP2000 calls for 120 placements this year and a program profit projection of about $2.5 million based on capitalizing the service income using the 3.127 annuity factor. If she were to raise the service price much above $0.51 per 1,000 pages, LaserFlo would lose sales, which are already ambitious. She called Phil Hansen and raised her concerns with him.

"Phil," she began, "explain to me how you downsized your field personnel, cut some office locations, consolidated inventories, and reduced other fixed costs, yet the price I'm being charged for service increased from $35.05 per hour to $38.25. I thought the whole purpose of the field service reorganization was to streamline and make us more cost competitive. You know that our service costs were out of line with our competitors'. We were planning to charge $85 an hour for the AP2000 service contract. Even at $85 per hour, I would be violating the corporate policy of maintaining a 60 percent markup on service. If I were to follow the 60 percent rule, I would have to charge $87.63 per hour if you had kept your cost to me at $35.05. But with your cost of $38.25 and my price at $85, the margin falls to 55 percent. I already had to get special permission to lower the margin to 59 percent with $35.05."

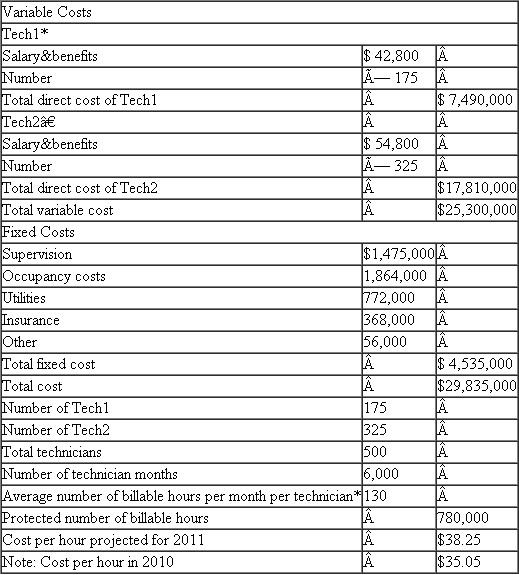

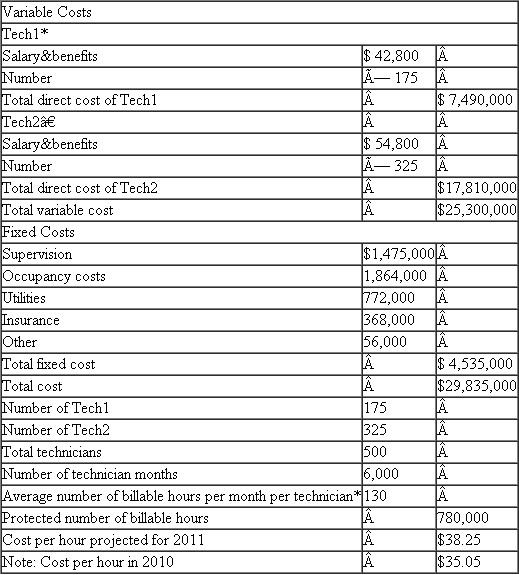

TABLE 1 Field Service Projected Hourly Rate for 2011

*300 Tech1s in 2010 with salary benefits of $40,100.

*300 Tech1s in 2010 with salary benefits of $40,100.

† 275 Tech2s in 2010 with salary benefits of $52,900.

‡ Same in 2010.

Hansen replied, "Well, there are a number of issues that you've just raised. Let me respond to a few over the phone now and suggest we meet to discuss this more fully next week when I'm back in the office. In the meantime, I'll send you our projected budget for next year that derived the $38.25 rate. Regarding the key question as to how our hourly rate could go up after downsizing, it's really quite simple. We had a lot of idle time being built into the numbers. People just pretended to be busy. Had we not downsized, the hourly charge would have gone up even more than it did. For example, on the AP2000 that you mentioned, we would have used 3.25 hours per normal servicing had we kept our labor force mix of Tech1s and 2s the same as in 2010. Had we not downsized, our fixed costs in 2011 would have remained the same as they were in 2010, and our variable costs for Tech1s and 2s would have increased to the 2011 amounts because of wage increases and inflation. Let me get you our numbers so you can see for yourself how much progress we've been making."

That afternoon, Meyers received a fax from Hansen's office (see Table 1). In trying to decide how to proceed, Meyers would like you to address the following questions:

a. Calculate the projected five-year profits of an AP2000 using first the $35.05 and then the $38.25 service cost.

b. Why did the field service hourly cost increase? What caused the hourly rate to go from $35.05 to $38.25?

c. Did the reorganization of field service reduce the cost of servicing the AP2000? Calculate what the total annual service cost of the AP2000 would have been had the reorganization not occurred.

d. Identify the various options Meyers has for dealing with the service cost increase and analyze them.

e. Why does LaserFlo make more money on servicing printers than selling them? Does such a policy make sense?

Marti Meyers, vice president of marketing for LaserFlo, was concerned as she reviewed the costs for the AP2000 laser printer she was planning to launch next month. The AP2000 is a new commercial printer that LaserFlo designed for medium-size direct mail businesses. The basic system price was set at $74,500; the unit manufacturing cost of the AP2000 is $46,295, and selling and administrative cost is budgeted at 33 percent of the selling price. The maintenance price she planned to announce was $85 per hour of LaserFlo technician time. While the $74,500 base price is competitive, $85 per hour is a bit higher than the industry average of $82 per hour. However, Meyers believed she could live with the $85 price. She is concerned because she has just received a memo from the Field Service organization stating that it was increasing its projected hourly charge for service from $35.05 to $38.25.

The $85 price Meyers was prepared to charge for service was based on last year's $35.05 service cost. She thought that using last year's cost was conservative since Field Service had been downsizing and she expected the cost to go down, not up. The $35.05 cost still did not yield the 60 percent margin on service that was the standard for other LaserFlo printers, but Meyers had difficulty justifying a higher maintenance price given the competition. With a service cost of $38.25, Meyers knows she cannot raise the price to the customer enough to cover the higher costs without significantly reducing sales. Given the higher cost of the LaserFlo field technicians and the prices charged for maintenance by the competition, she will not be able to make the profit target in her plan.

Background

LaserFlo manufactures, sells, and services its printers throughout the United States using direct sales and service forces. It has been in business for 22 years and is the largest of three manufacturers of high-speed laser printers for direct mailers in the United States. LaserFlo maintains its market leadership by innovating new technology. Direct mail marketing firms produce customized letters of solicitation for bank credit cards, real estate offers, life insurance, colleges and universities, andmagazine giveaway contests. Personalized letters are printed on high-speed printers attached to computers that have the mailing information. The printers print either the entire letter or the address and salutation ("Dear Mrs. Jeremy McConnell") on preprinted forms. Direct mail firms have computer systems to manage their address lists and mailings, and LaserFlo printers are attached to the client's computer system.

Direct mail laser printers process very high volumes; a single printer commonly addresses 75,000 letters a day. Hence, LaserFlo printers for direct mail marketers differ from general-purpose high-speed printers. In particular, they have specialized paper transfer mechanisms to handle the often custom, heavy paper; varying paper sizes; and high-speed paper flows. With such high paper flow rates, these printers require regular adjustments to prevent paper jams and misalignments. LaserFlo's nationwide field service organization of about 500 employees maintains these printers.

The standard LaserFlo sales contract contains two parts: the purchase price of the equipment and a maintenance contract for the equipment. All LaserFlo printers are maintained by LaserFlo field service personnel, and the maintenance contract specifies the price per hour charged for routine and unscheduled maintenance. Most of LaserFlo's profits come from printer maintenance. Printers have about a 5 to 10 percent markup over manufacturing and selling cost, but the markup on maintenance has historically averaged about 60 percent.

LaserFlo printers have a substantial amount of built-in intelligence to control the printing and for self-diagnostics. Each printer has its own microcomputer with memory to hold the data to be printed. These internal microcomputers also keep track of printing statistics and can alert the operator to impending problems (low toner, paper alignment problems, form breaks). When customers change their operating system or computer, this often necessitates a LaserFlo service call to ensure that the new system is compatible with the printer. The standard service contract calls for normal maintenance after a fixed number of impressions (pages); for example, the AP2000 requires service after every 500,000 pages are printed. Its microcomputer is programmed to call LaserFlo's central computer to schedule maintenance whenever the machine has produced 375,000 pages since the last servicing.

LaserFlo organization

LaserFlo is organized into engineering, manufacturing, marketing, field service, and administration divisions. Engineering designs the new printers and provides consulting services to marketing and field service regarding system installation and maintenance. Engineering is evaluated as a cost center.

Manufacturing produces the printers, which are assembled from purchased parts and subassem- blies. LaserFlo's comparative advantage is quality control and design. Manufacturing also provides parts for field service maintenance. Manufacturing is treated as a cost center and evaluated based on meeting cost targets and delivery schedules. Manufacturing's unit cost is charged to marketing for each printer sold.

Marketing, a profit center, is responsible for designing the marketing campaigns, pricing the printers, and managing the field sales staff. LaserFlo sells six different printers; each has a separate marketing program manager. The six marketing program managers report to Marti Meyers, vice president of marketing, who also manages field sales.

Field sales is organized around four regional managers responsible for the sales offices in their region. Each of the 27 sales offices has a direct sales force that contacts potential customers and sells the six programs. Salespeople receive a salary and a commission depending on the printer and options sold. The salesperson continues to receive commissions from ongoing revenues paid by the account for service. Since ongoing maintenance forms a significant amount of a printer's total profit, the salesperson has an incentive to keep the customer with LaserFlo.

Field service contains the technical people who install and maintain the printers. Headed by Phil Hansen, vice president of field service, field service usually shares office space with field sales in the cities where they operate. Field service is a cost center, and its direct and indirect costs are charged to programs when the printers are serviced. The price charged is based on the budgeted rate set at the beginning of the year. Any difference between the actual amount charged to the programs and the total cost incurred by the field service group is charged to a corporate overhead account, not to the marketing programs.

Administration manages human resources, finance, accounting, and field office leases. It handles customer billing and collections, payroll, and negotiating office space for the field sales and field service people. Administration is evaluated as a cost center. While local office space is managed by administration, the cost of the office space is allocated to the field sales and service groups and included in their budgets and monthly operating statements.

Service contracts

Each LaserFlo printer sold requires a service contract. The AP2000's service contract calls for normal maintenance every 500,000 pages at a price of $0.51 per 1,000 pages. Normal maintenance requires three hours. The typical AP2000 prints 12 million pages per year. Besides normal maintenance (sometimes called preventive maintenance), unscheduled maintenance occurs due to improper operator setups, paper jams, system upgrades, and harsh usage of the equipment. Past statistical studies have shown that each normal maintenance hour generates 0.50 unscheduled maintenance hours. Unscheduled maintenance is billed to the customer at the service contract rate of $85 per hour.

When maintenance is performed on a particular machine, the service revenues less field service costs are credited to the marketing manager for that program. All the programs' actual service profits are compared with the plan; they form part of Meyers's performance evaluation. The field salesperson receives a commission based on the total service revenue generated by the account. In evaluating each new printer program, LaserFlo uses the following procedure. Profits from service are expected to create an annuity that will last for five years at 18 percent interest. To evaluate a proposed new printer, the one-year maintenance profits are multiplied by 3.127 to reflect the present value of the future service profits each printer is expected to generate over its life (about five years).

Parts

Any parts used during service are charged directly to the customer and do not flow through field service budgets or operating statements. LaserFlo purchases most of the printers' parts from outside suppliers, and the customer pays only a token markup. Marketing does not receive any revenue, nor is it charged any costs when customers use parts in the service process. The reason for not charging customers a larger markup on parts stems from an antitrust case filed against LaserFlo and other printer companies six years ago. A third-party service company, Servwell, sued the printer manufacturers for restraint of trade, claiming they prevented Servwell from maintaining the printers by only selling replacement parts at very high prices. To prevent other such claims, LaserFlo sells parts at a small markup over costs. Yet Servwell and other third-party service firms have never been able to penetrate LaserFlo's service markets because laser printing technology changes rapidly, and an outside company cannot keep a work force trained to fix the latest products. Besides, each printer usually has at least two engineering modifications each year to fix problems or upgrade the printer or its microcomputer hardware and/or software. An outside service company cannot learn of these changes and provide the same level of service as LaserFlo.

Recent changes in field service

LaserFlo field service had two types of technicians: Tech1 and Tech2. Both were trained to repair electromechanical problems, but Tech2s had more training in electronics and computers to work on the latest, most sophisticated printers.

Field service had been trying to reduce the size of the service force the last few years through voluntary retirements and attrition. As the printers became more sophisticated, they became more reliable. The newer systems had self-diagnosing software that allowed a service technician to call up a customer's printer and run a diagnostic program. Often the problem was solved over the phone line by having a LaserFlo technician make the repair in the software. If a mechanical problem was detected, the technician dispatched a repair person (often a Tech1) with the right part. Also, past customers replaced their older printers with newer ones that required less maintenance. The result was excess capacity in the field staff.

The voluntary retirements over the past few years did not produce the reductions necessary to eliminate the excess capacity. In 2010, field service went through a very large involuntary reduction of its workforce. Through attrition, early retirements, and terminations, LaserFlo reduced the number of technicians by 75, down to 500 budgeted for 2011. The company simultaneously improved the skill level of its remaining field force substantially.

AP2000 sales plan for 2011

Marti Meyers's 2011 sales plan for the AP2000 calls for 120 placements this year and a program profit projection of about $2.5 million based on capitalizing the service income using the 3.127 annuity factor. If she were to raise the service price much above $0.51 per 1,000 pages, LaserFlo would lose sales, which are already ambitious. She called Phil Hansen and raised her concerns with him.

"Phil," she began, "explain to me how you downsized your field personnel, cut some office locations, consolidated inventories, and reduced other fixed costs, yet the price I'm being charged for service increased from $35.05 per hour to $38.25. I thought the whole purpose of the field service reorganization was to streamline and make us more cost competitive. You know that our service costs were out of line with our competitors'. We were planning to charge $85 an hour for the AP2000 service contract. Even at $85 per hour, I would be violating the corporate policy of maintaining a 60 percent markup on service. If I were to follow the 60 percent rule, I would have to charge $87.63 per hour if you had kept your cost to me at $35.05. But with your cost of $38.25 and my price at $85, the margin falls to 55 percent. I already had to get special permission to lower the margin to 59 percent with $35.05."

TABLE 1 Field Service Projected Hourly Rate for 2011

*300 Tech1s in 2010 with salary benefits of $40,100.

*300 Tech1s in 2010 with salary benefits of $40,100.† 275 Tech2s in 2010 with salary benefits of $52,900.

‡ Same in 2010.

Hansen replied, "Well, there are a number of issues that you've just raised. Let me respond to a few over the phone now and suggest we meet to discuss this more fully next week when I'm back in the office. In the meantime, I'll send you our projected budget for next year that derived the $38.25 rate. Regarding the key question as to how our hourly rate could go up after downsizing, it's really quite simple. We had a lot of idle time being built into the numbers. People just pretended to be busy. Had we not downsized, the hourly charge would have gone up even more than it did. For example, on the AP2000 that you mentioned, we would have used 3.25 hours per normal servicing had we kept our labor force mix of Tech1s and 2s the same as in 2010. Had we not downsized, our fixed costs in 2011 would have remained the same as they were in 2010, and our variable costs for Tech1s and 2s would have increased to the 2011 amounts because of wage increases and inflation. Let me get you our numbers so you can see for yourself how much progress we've been making."

That afternoon, Meyers received a fax from Hansen's office (see Table 1). In trying to decide how to proceed, Meyers would like you to address the following questions:

a. Calculate the projected five-year profits of an AP2000 using first the $35.05 and then the $38.25 service cost.

b. Why did the field service hourly cost increase? What caused the hourly rate to go from $35.05 to $38.25?

c. Did the reorganization of field service reduce the cost of servicing the AP2000? Calculate what the total annual service cost of the AP2000 would have been had the reorganization not occurred.

d. Identify the various options Meyers has for dealing with the service cost increase and analyze them.

e. Why does LaserFlo make more money on servicing printers than selling them? Does such a policy make sense?

Explanation

This case provides the following topics ...

Accounting for Decision Making and Control 7th Edition by Jerold Zimmerman

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255