Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 7

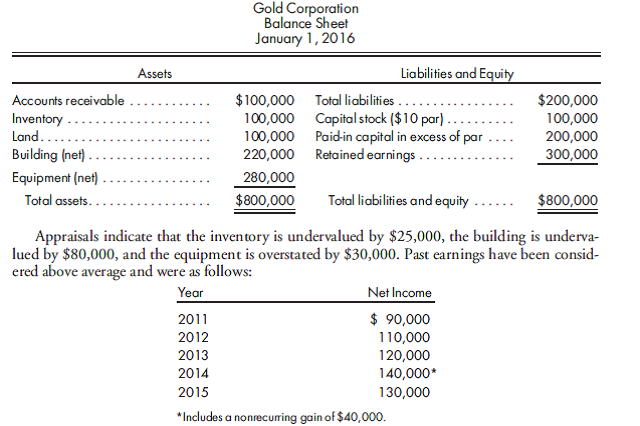

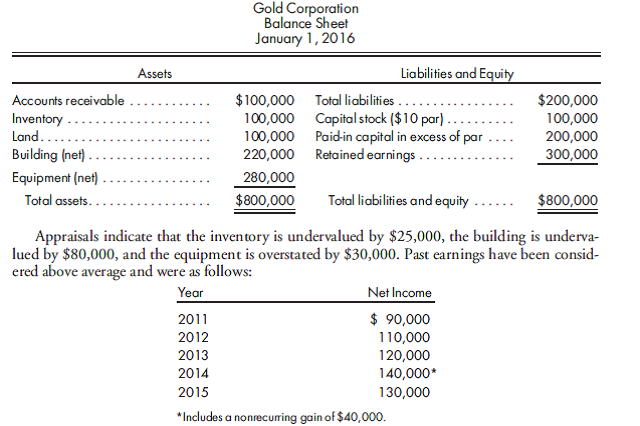

Estimating goodwill. Green Company is considering acquiring the assets of Gold Corporation by assuming Gold's liabilities and by making a cash payment. Gold Corporation has the following balance sheet on the date negotiations occur:

It is assumed that the average operating income of the past five years will continue. In this industry, the average return on assets is 12% on the fair value of the total identifiable assets.

1. Prepare an estimate of goodwill based on each of the following assumptions:

a. The purchasing company paid for five years of excess earnings.

b. Excess earnings will continue indefinitely and are to be capitalized at the industry normal return.

c. Excess earnings will continue for only five years and should be capitalized at a higher rate of 16%, which reflects the risk applicable to goodwill.

2. Determine the actual goodwill recorded if Green pays $690,000 cash for the net assets of Gold Corporation and assumes all existing liabilities.

It is assumed that the average operating income of the past five years will continue. In this industry, the average return on assets is 12% on the fair value of the total identifiable assets.

1. Prepare an estimate of goodwill based on each of the following assumptions:

a. The purchasing company paid for five years of excess earnings.

b. Excess earnings will continue indefinitely and are to be capitalized at the industry normal return.

c. Excess earnings will continue for only five years and should be capitalized at a higher rate of 16%, which reflects the risk applicable to goodwill.

2. Determine the actual goodwill recorded if Green pays $690,000 cash for the net assets of Gold Corporation and assumes all existing liabilities.

Explanation

c)Calculate goodwill.

Present value (exp...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255