Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 17

Measurement period. Avery Company acquires the net assets of Iowa Company on July 1, 2011. The net assets acquired include plant assets that are provisionally estimated to have a fair value of $600,000 with a 10-year usable life and no salvage value. Depreciation is recorded based on months in service. The remaining unallocated amount of the price paid is $300,000, which is recorded as goodwill.

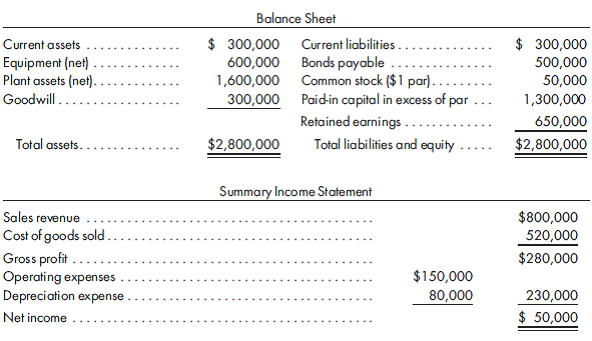

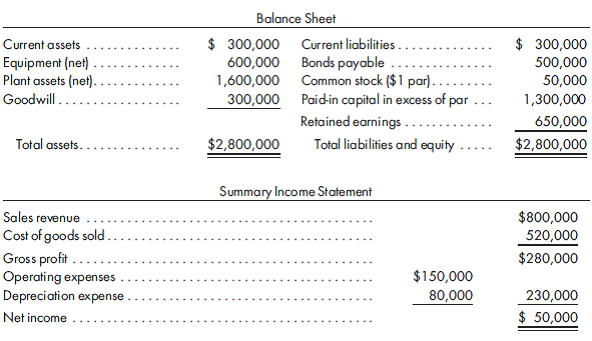

At the end of 2011, Avery prepares the following statements (includes Iowa Company for the last six months):

In March 2012, the final estimated fair value of the acquired plant assets is $700,000 with no change in the estimate of useful life or salvage value.

1. Prepare any journal entries required in March 2012.

2. Prepare the revised balance sheet and income statement for 2011 that will be included in the 2012 comparative statements.

At the end of 2011, Avery prepares the following statements (includes Iowa Company for the last six months):

In March 2012, the final estimated fair value of the acquired plant assets is $700,000 with no change in the estimate of useful life or salvage value.

1. Prepare any journal entries required in March 2012.

2. Prepare the revised balance sheet and income statement for 2011 that will be included in the 2012 comparative statements.

Explanation

Journal entry in the books of company A ...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255