Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 2

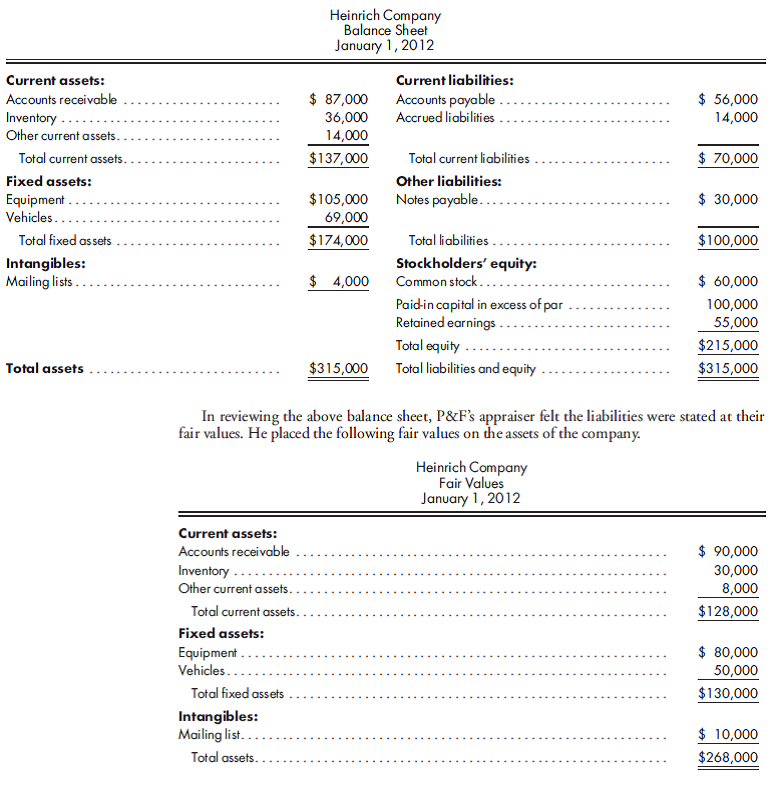

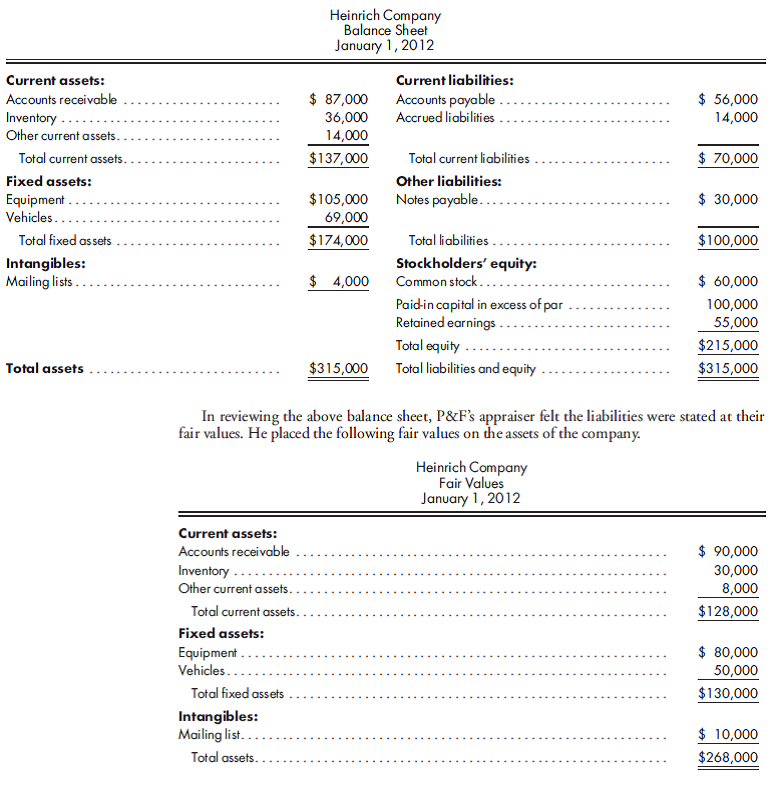

Cash acquisition with a gain. Heinrich Company, owned by Elennor and Al Heinrich, has been experiencing financial difficulty for the past several years. Both Elennor and Al have not been in good health and have decided to find a buyer. P F International, after reviewing the financial statements for the previous three years, has decided to make an offer of $150,000 for the net assets of Heinrich Company on January 1, 2012. The balance sheet as of this date is as follows:

Using this information, do value analysis, and prepare the entry to record the acquisition of the net assets of Heinrich Company on the books of P F International.

Using this information, do value analysis, and prepare the entry to record the acquisition of the net assets of Heinrich Company on the books of P F International.

Explanation

Calculate gain on acquisition:

It is given that the purchase consideration is $150,000 and the calculated value of net identifiable assets acquired is $168,000 [refer to Equation (1)].

Now, calculate excess of total cost over fair value of net assets or goodwill:

![Calculate gain on acquisition: It is given that the purchase consideration is $150,000 and the calculated value of net identifiable assets acquired is $168,000 [refer to Equation (1)]. Now, calculate excess of total cost over fair value of net assets or goodwill: ……(2)The calculated gain on acquisition . Journal entry in the books of P F company • All assets increase the asset value in the balance sheet of company T. Therefore, they are debited. • Take over liabilities and payments of cash increase the liability value and reduce the asset value in the balance sheet, respectively. Therefore, they are credited. • The total asset value is more than the liabilities. Therefore, gain on acquisition is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_5613_5775_bcf8_f3cf6e80fd09_SM1534_00.jpg) ……(2)The calculated gain on acquisition

……(2)The calculated gain on acquisition

![Calculate gain on acquisition: It is given that the purchase consideration is $150,000 and the calculated value of net identifiable assets acquired is $168,000 [refer to Equation (1)]. Now, calculate excess of total cost over fair value of net assets or goodwill: ……(2)The calculated gain on acquisition . Journal entry in the books of P F company • All assets increase the asset value in the balance sheet of company T. Therefore, they are debited. • Take over liabilities and payments of cash increase the liability value and reduce the asset value in the balance sheet, respectively. Therefore, they are credited. • The total asset value is more than the liabilities. Therefore, gain on acquisition is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_5613_5776_bcf8_c17bcf973815_SM1534_00.jpg) .

.

Journal entry in the books of P F company

![Calculate gain on acquisition: It is given that the purchase consideration is $150,000 and the calculated value of net identifiable assets acquired is $168,000 [refer to Equation (1)]. Now, calculate excess of total cost over fair value of net assets or goodwill: ……(2)The calculated gain on acquisition . Journal entry in the books of P F company • All assets increase the asset value in the balance sheet of company T. Therefore, they are debited. • Take over liabilities and payments of cash increase the liability value and reduce the asset value in the balance sheet, respectively. Therefore, they are credited. • The total asset value is more than the liabilities. Therefore, gain on acquisition is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_5613_5777_bcf8_a7c3d807c36e_SM1534_00.jpg) • All assets increase the asset value in the balance sheet of company T. Therefore, they are debited.

• All assets increase the asset value in the balance sheet of company T. Therefore, they are debited.

• Take over liabilities and payments of cash increase the liability value and reduce the asset value in the balance sheet, respectively. Therefore, they are credited.

• The total asset value is more than the liabilities. Therefore, gain on acquisition is debited.

It is given that the purchase consideration is $150,000 and the calculated value of net identifiable assets acquired is $168,000 [refer to Equation (1)].

Now, calculate excess of total cost over fair value of net assets or goodwill:

![Calculate gain on acquisition: It is given that the purchase consideration is $150,000 and the calculated value of net identifiable assets acquired is $168,000 [refer to Equation (1)]. Now, calculate excess of total cost over fair value of net assets or goodwill: ……(2)The calculated gain on acquisition . Journal entry in the books of P F company • All assets increase the asset value in the balance sheet of company T. Therefore, they are debited. • Take over liabilities and payments of cash increase the liability value and reduce the asset value in the balance sheet, respectively. Therefore, they are credited. • The total asset value is more than the liabilities. Therefore, gain on acquisition is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_5613_5775_bcf8_f3cf6e80fd09_SM1534_00.jpg) ……(2)The calculated gain on acquisition

……(2)The calculated gain on acquisition ![Calculate gain on acquisition: It is given that the purchase consideration is $150,000 and the calculated value of net identifiable assets acquired is $168,000 [refer to Equation (1)]. Now, calculate excess of total cost over fair value of net assets or goodwill: ……(2)The calculated gain on acquisition . Journal entry in the books of P F company • All assets increase the asset value in the balance sheet of company T. Therefore, they are debited. • Take over liabilities and payments of cash increase the liability value and reduce the asset value in the balance sheet, respectively. Therefore, they are credited. • The total asset value is more than the liabilities. Therefore, gain on acquisition is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_5613_5776_bcf8_c17bcf973815_SM1534_00.jpg) .

.Journal entry in the books of P F company

![Calculate gain on acquisition: It is given that the purchase consideration is $150,000 and the calculated value of net identifiable assets acquired is $168,000 [refer to Equation (1)]. Now, calculate excess of total cost over fair value of net assets or goodwill: ……(2)The calculated gain on acquisition . Journal entry in the books of P F company • All assets increase the asset value in the balance sheet of company T. Therefore, they are debited. • Take over liabilities and payments of cash increase the liability value and reduce the asset value in the balance sheet, respectively. Therefore, they are credited. • The total asset value is more than the liabilities. Therefore, gain on acquisition is debited.](https://d2lvgg3v3hfg70.cloudfront.net/SM1534/11eb5b63_5613_5777_bcf8_a7c3d807c36e_SM1534_00.jpg) • All assets increase the asset value in the balance sheet of company T. Therefore, they are debited.

• All assets increase the asset value in the balance sheet of company T. Therefore, they are debited.• Take over liabilities and payments of cash increase the liability value and reduce the asset value in the balance sheet, respectively. Therefore, they are credited.

• The total asset value is more than the liabilities. Therefore, gain on acquisition is debited.

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255