Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 9

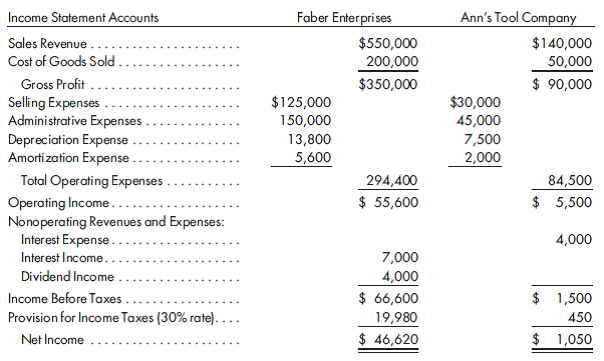

Income statements after acquisition. On July 1, 2011, Faber Enterprises acquired Ann's Tool Company. Prior to the merger of the two companies, each company calculated its income for the entire year ended December 31, 2011. (It may be assumed that all Ann amounts occurred evenly over the year.) These estimates are as follows:

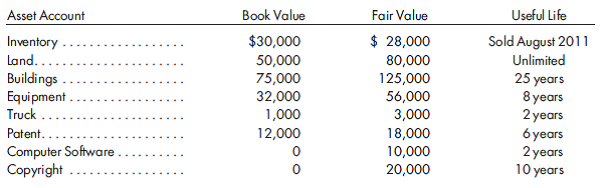

An analysis of the merger agreement revealed that the purchase price exceeded the fair value of all assets by $40,000. The book and fair values of Ann's Tool Company on July 1, 2011, are given in the table below along with an estimate of the useful lives of each of these asset categories.

Management believes the company will be in a combined tax bracket of 30%. The company uses the straight-line method of computing depreciation and amortization and assigns a zero salvage value.

1. Using the above information, prepare the Faber Enterprises income statement for the year ending December 31, 2011. Provide supporting calculations.

2. Prepare the required summarized disclosure of 2011 results if the acquisition occurs at the start of the year.

An analysis of the merger agreement revealed that the purchase price exceeded the fair value of all assets by $40,000. The book and fair values of Ann's Tool Company on July 1, 2011, are given in the table below along with an estimate of the useful lives of each of these asset categories.

Management believes the company will be in a combined tax bracket of 30%. The company uses the straight-line method of computing depreciation and amortization and assigns a zero salvage value.

1. Using the above information, prepare the Faber Enterprises income statement for the year ending December 31, 2011. Provide supporting calculations.

2. Prepare the required summarized disclosure of 2011 results if the acquisition occurs at the start of the year.

Explanation

Calculate adjustment in inventory.

It is...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255