Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 27

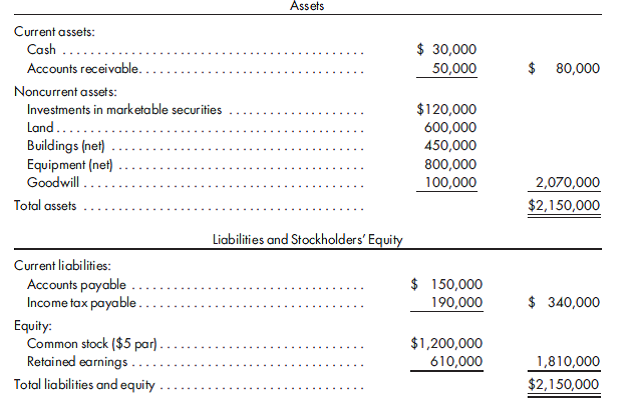

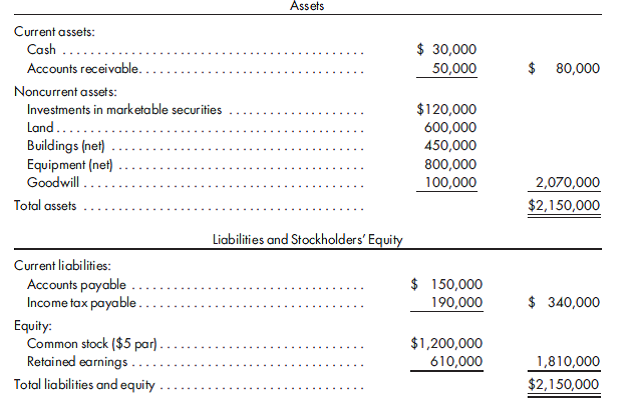

Contingent consideration. Door Corporation acquires the net assets, exclusive of cash, of Walsh Company on January 1, 2011, at which time Walsh Company's balance sheet is as follows:

Door Corporation feels that the following fair values should be used for Walsh's book values:

Cash (no change)............................... $ 30,000

Accounts receivable............................. 60,000

Investment in marketable securities.................. 150,000

Land.......................................... 450,000

Buildings (no change)............................ 450,000

Equipment..................................... 600,000

Accounts payable............................... 120,000

Income tax payable (no change).................... 190,000

Door issues 20,000 shares of its common stock with a $2 par value and a quoted fair value of $60 per share on January 1, 2011, to Walsh Company to acquire the net assets. Door also agrees that two years from now it will issue additional securities to compensate Walsh shareholders for any decline in value below that on the date of issue.

1. Record the acquisition on the books of Door Corporation on January 1, 2011. Include support for calculations used to arrive at the values assigned to the assets and liabilities. Use value analysis to aid your solution.

2. Record payment (if any) of contingent consideration on January 1, 2013, assuming that the quoted value of the stock is $57.50. (Round shares to nearest whole share.)

Door Corporation feels that the following fair values should be used for Walsh's book values:

Cash (no change)............................... $ 30,000

Accounts receivable............................. 60,000

Investment in marketable securities.................. 150,000

Land.......................................... 450,000

Buildings (no change)............................ 450,000

Equipment..................................... 600,000

Accounts payable............................... 120,000

Income tax payable (no change).................... 190,000

Door issues 20,000 shares of its common stock with a $2 par value and a quoted fair value of $60 per share on January 1, 2011, to Walsh Company to acquire the net assets. Door also agrees that two years from now it will issue additional securities to compensate Walsh shareholders for any decline in value below that on the date of issue.

1. Record the acquisition on the books of Door Corporation on January 1, 2011. Include support for calculations used to arrive at the values assigned to the assets and liabilities. Use value analysis to aid your solution.

2. Record payment (if any) of contingent consideration on January 1, 2013, assuming that the quoted value of the stock is $57.50. (Round shares to nearest whole share.)

Explanation

Calculate value of net identifiable asse...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255