Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 9

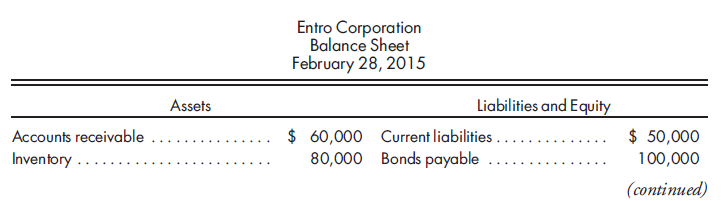

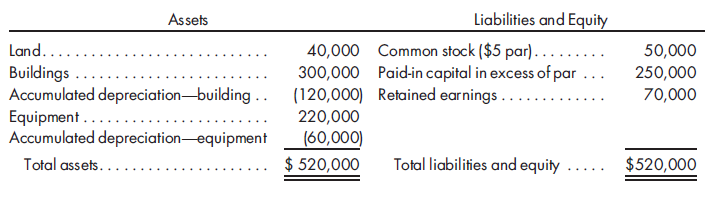

100% purchase, bargain, elimination entries only. On March 1, 2016, Carlson Enterprises purchases a 100% interest in Entro Corporation for $400,000. Entro Corporation has the following balance sheet on February 28, 2015:

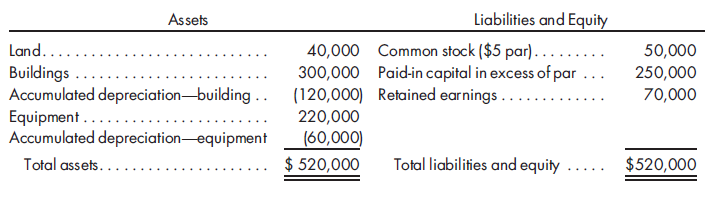

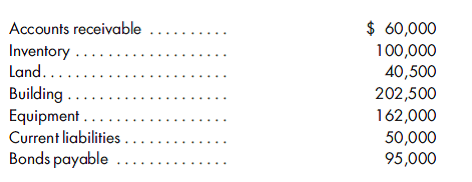

Carlson Enterprises receives an independent appraisal on the fair values of Entro Corporation's assets and liabilities. The controller has reviewed the following figures and accepts them as reasonable:

1. Record the investment in Entro Corporation.

2. Prepare the value analysis and the determination and distribution of excess schedule.

3. Prepare the elimination entries that would be made on a consolidated worksheet prepared on the date of acquisition.

Carlson Enterprises receives an independent appraisal on the fair values of Entro Corporation's assets and liabilities. The controller has reviewed the following figures and accepts them as reasonable:

1. Record the investment in Entro Corporation.

2. Prepare the value analysis and the determination and distribution of excess schedule.

3. Prepare the elimination entries that would be made on a consolidated worksheet prepared on the date of acquisition.

Explanation

Determination and Distribution of Exces...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255