Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 16

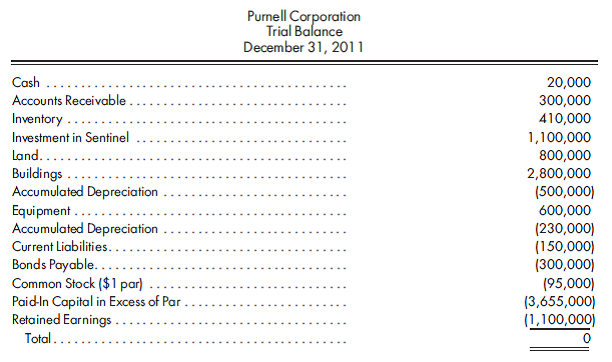

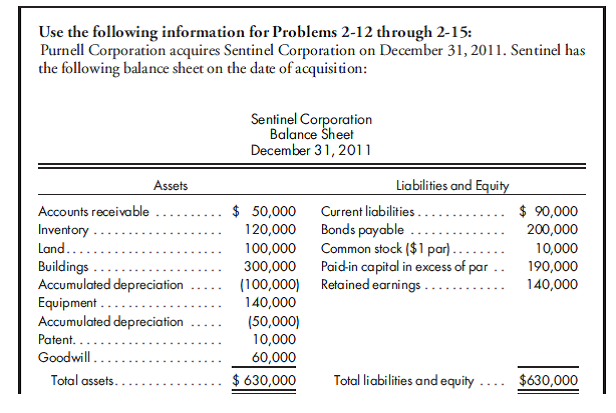

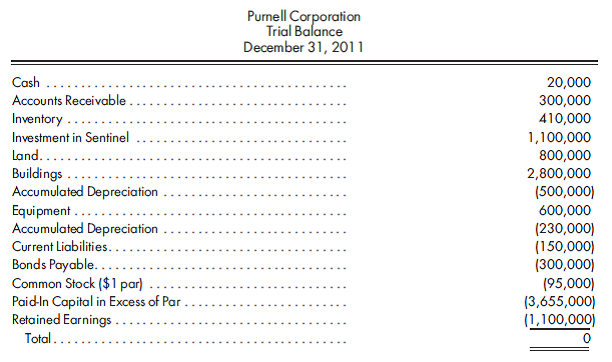

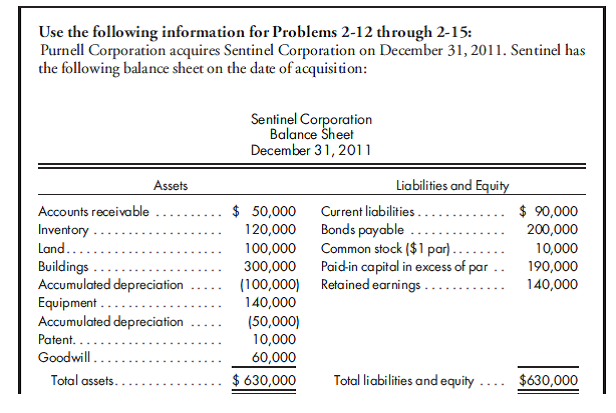

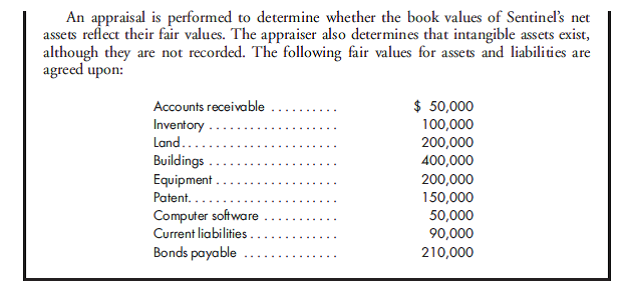

100% purchase, goodwill, several adjustments, worksheet. Use the preceding information for Purnell's purchase of Sentinel common stock. Assume Purnell exchanges 22,000 shares of its own stock for 100% of the common stock of Sentinel. The stock has a market value of $50 per share and a par value of $1. Purnell has the following trial balance immediately after the purchase:

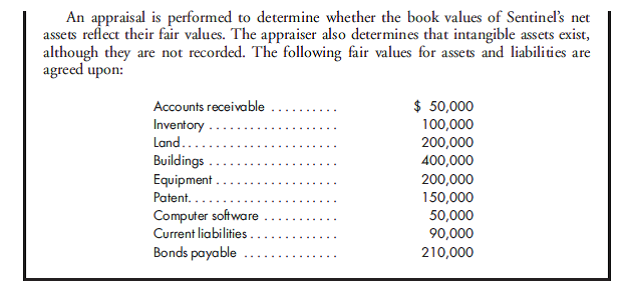

1. Prepare the value analysis schedule and the determination and distribution of excess schedule for the investment in Sentinel.

2. Complete a consolidated worksheet for Purnell Corporation and its subsidiary Sentinel Corporation as of December 31, 2011.

1. Prepare the value analysis schedule and the determination and distribution of excess schedule for the investment in Sentinel.

2. Complete a consolidated worksheet for Purnell Corporation and its subsidiary Sentinel Corporation as of December 31, 2011.

Explanation

PP Company purchased 100% shares of SC C...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255