Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 33

D D for nontaxable exchange. Rainman Corporation is considering the acquisition of Largo Company through the acquisition of Largo's common stock. Rainman Corporation will issue 20,000 shares of its $5 par common stock, with a fair value of $25 per share, in exchange for all 10,000 outstanding shares of Largo Company's voting common stock.

The acquisition meets the criteria for a tax-free exchange as to the seller. Because of this, Rainman Corporation will be limited for future tax returns to the book value of the depreciable assets. Rainman Corporation falls into the 30% tax bracket.

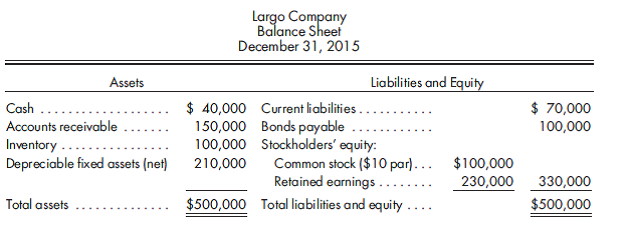

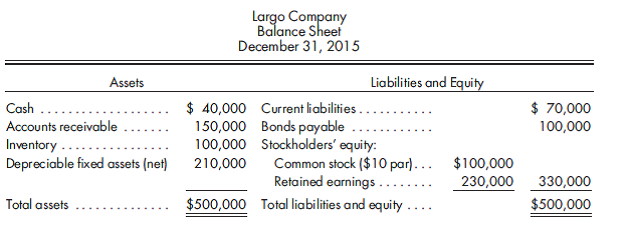

The appraisal of the assets of Largo Company shows that the inventory has a fair value of $120,000, and the depreciable fixed assets have a fair value of $270,000 and a 10-year life. Any remaining excess is attributed to goodwill. Largo Company has the following balance sheet just before the acquisition:

1. Record the acquisition of Largo Company by Rainman Corporation.

2. Prepare a value analysis and a determination and distribution of excess schedule.

3. Prepare the elimination entries that would be made on the consolidated worksheet on the date of acquisition.

The acquisition meets the criteria for a tax-free exchange as to the seller. Because of this, Rainman Corporation will be limited for future tax returns to the book value of the depreciable assets. Rainman Corporation falls into the 30% tax bracket.

The appraisal of the assets of Largo Company shows that the inventory has a fair value of $120,000, and the depreciable fixed assets have a fair value of $270,000 and a 10-year life. Any remaining excess is attributed to goodwill. Largo Company has the following balance sheet just before the acquisition:

1. Record the acquisition of Largo Company by Rainman Corporation.

2. Prepare a value analysis and a determination and distribution of excess schedule.

3. Prepare the elimination entries that would be made on the consolidated worksheet on the date of acquisition.

Explanation

Elimination entries :

a)Eliminate the b...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255