Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 36

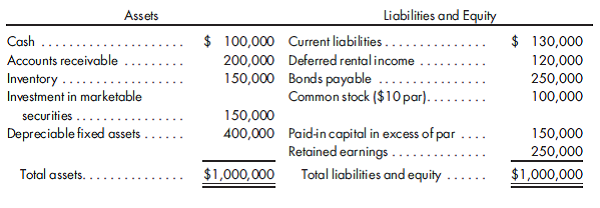

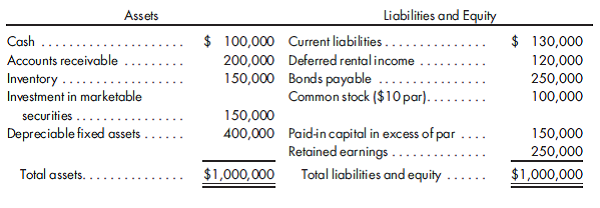

D D only, nontaxable exchange, tax loss carryover. On December 31, 2015, Bryant Company exchanges 10,000 of its $10 par value shares for a 90% interest in Jones Company. The purchase is recorded at the $72 per-share fair value of Bryant shares. Jones Company has the following balance sheet on the date of the purchase:

It is determined that the following fair values differ from book values for the assets of Jones Company:

Inventory.................................. $200,000

Depreciable fixed assets (net).................. 500,000 (20-year life)

Investment in marketable securities.............. 170,000

The purchase is a tax-free exchange to the seller, which means Bryant Company will use the book value of Jones's assets for tax purposes. Jones Company has $200,000 of tax loss carryovers. Bryant will be able to utilize $40,000 of the losses to offset taxes to be paid in 2016. The balance of the tax loss carryover will not be used within a year but is considered fully realizable in the future. The tax rate for both firms is 30%.

Record the investment and prepare a value analysis schedule and a determination and distribution of excess schedule.

Suggestion: Asset adjustments should be accompanied by the appropriate deferred tax liability.

It is determined that the following fair values differ from book values for the assets of Jones Company:

Inventory.................................. $200,000

Depreciable fixed assets (net).................. 500,000 (20-year life)

Investment in marketable securities.............. 170,000

The purchase is a tax-free exchange to the seller, which means Bryant Company will use the book value of Jones's assets for tax purposes. Jones Company has $200,000 of tax loss carryovers. Bryant will be able to utilize $40,000 of the losses to offset taxes to be paid in 2016. The balance of the tax loss carryover will not be used within a year but is considered fully realizable in the future. The tax rate for both firms is 30%.

Record the investment and prepare a value analysis schedule and a determination and distribution of excess schedule.

Suggestion: Asset adjustments should be accompanied by the appropriate deferred tax liability.

Explanation

1)Journal entry for recording investment...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255