Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 39

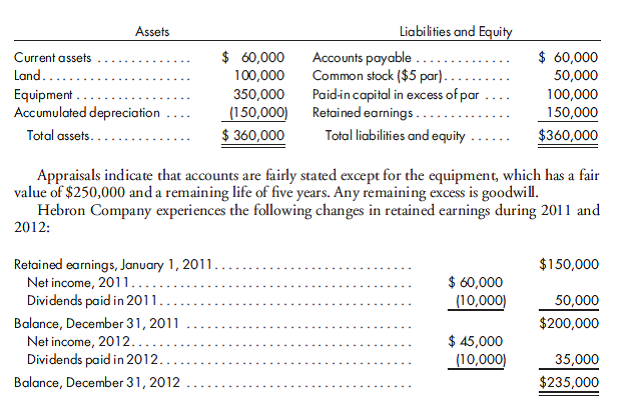

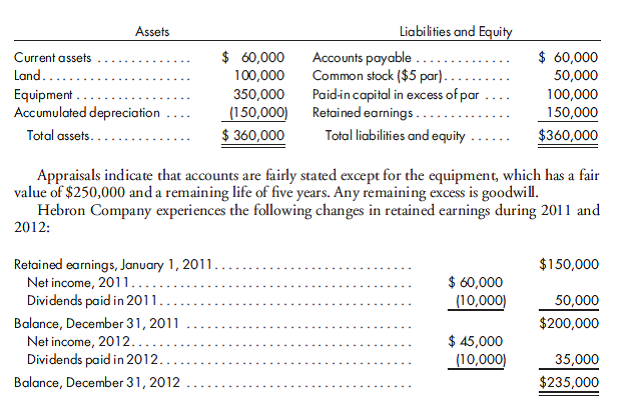

Compare alternative methods for recording income. Clark Company acquires an 80% interest in Hebron Company common stock for $400,000 cash on January 1, 2011. At that time, Hebron Company has the following balance sheet:

Prepare a determination and distribution of excess schedule for the investment in Hebron Company (a value analysis is not needed). Prepare journal entries that Clark Company would make on its books to record income earned and/or dividends received on its investment in Hebron Company during 2011 and 2012 under the following methods: simple equity, sophisticated equity, and cost.

Prepare a determination and distribution of excess schedule for the investment in Hebron Company (a value analysis is not needed). Prepare journal entries that Clark Company would make on its books to record income earned and/or dividends received on its investment in Hebron Company during 2011 and 2012 under the following methods: simple equity, sophisticated equity, and cost.

Explanation

The following are the adjustments:

It is...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255