Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 1

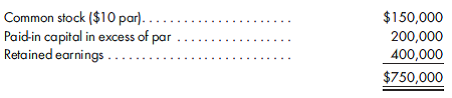

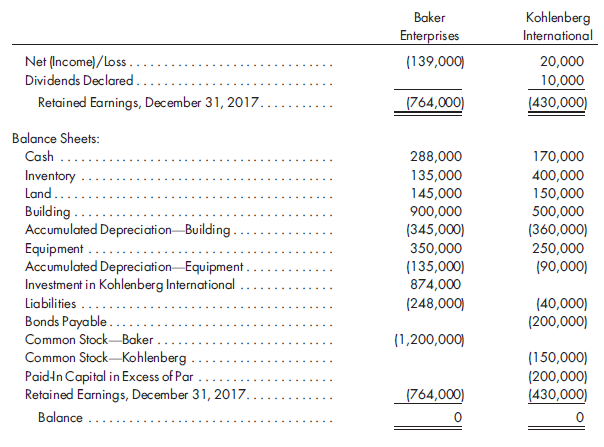

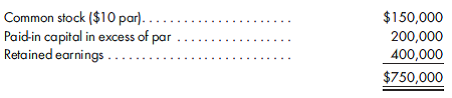

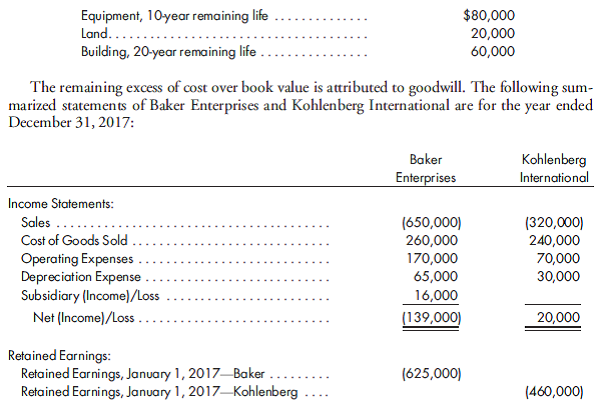

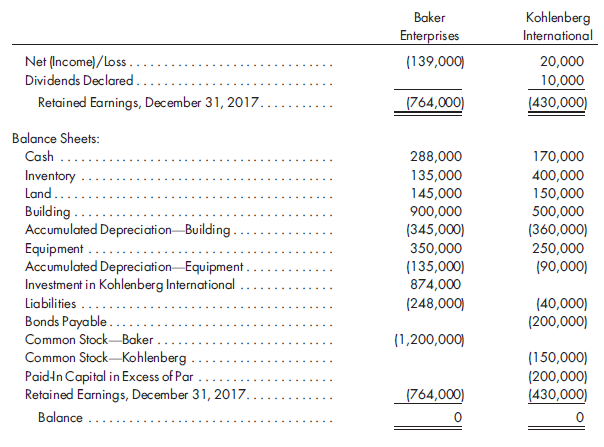

Equity method, later period, vertical worksheet, several excess adjustments. Baker Enterprises purchases an 80% interest in Kohlenberg International for $850,000 on January 1, 2015. The estimated fair value of the NCI is $190,000. On the purchase date, Kohlenberg International has the following stockholders' equity:

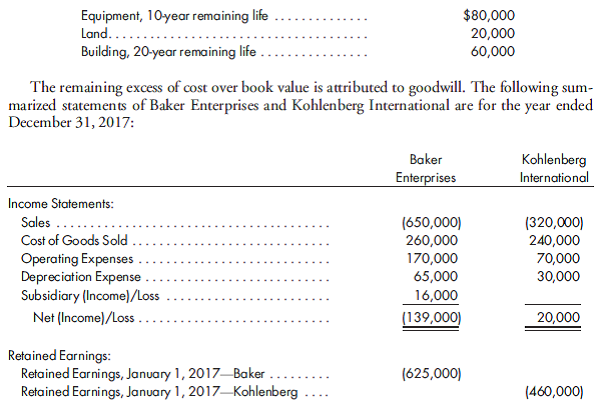

Also on the purchase date, it is determined that Kohlenberg International's assets are understated as follows:

Using the vertical format, prepare a consolidated worksheet for December 31, 2017. Precede the worksheet with a value analysis and a determination and distribution of excess schedule. Include income distribution schedules to allocate the consolidated net income to the noncontrolling and controlling interests.

Suggestion: Remember that all adjustments to retained earnings are to beginning retained earnings, and it is the beginning balance of the subsidiary retained earnings account that is subject to elimination. Carefully follow the ''carrydown'' procedure to calculate the ending retained earnings balances.

Also on the purchase date, it is determined that Kohlenberg International's assets are understated as follows:

Using the vertical format, prepare a consolidated worksheet for December 31, 2017. Precede the worksheet with a value analysis and a determination and distribution of excess schedule. Include income distribution schedules to allocate the consolidated net income to the noncontrolling and controlling interests.

Suggestion: Remember that all adjustments to retained earnings are to beginning retained earnings, and it is the beginning balance of the subsidiary retained earnings account that is subject to elimination. Carefully follow the ''carrydown'' procedure to calculate the ending retained earnings balances.

Explanation

Determination and Distribution of Exces...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255