Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 4

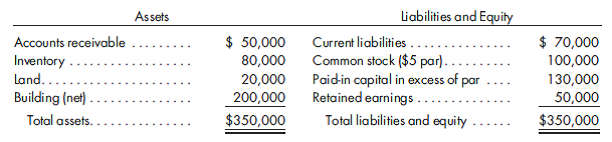

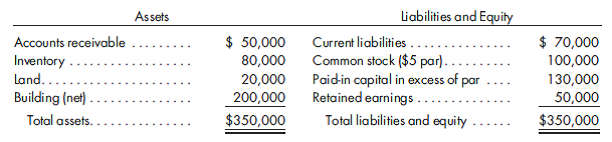

D D and income statement for nontaxable exchange. Lucy Company issues securities with a fair value of $468,000 for a 90% interest in Diamond Company on January 1, 2011, at which time Diamond Company has the following balance sheet:

It is believed that the inventory and the building are undervalued by $20,000 and $50,000, respectively. The building has a 10-year remaining life; the inventory on hand on January 1, 2011, is sold during the year. The deferred tax liability associated with the asset revaluations is to be reflected in the consolidated statements. Each company has an income tax rate of 30%. Any remaining excess is goodwill.

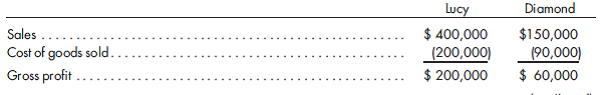

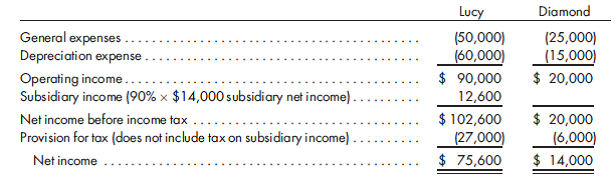

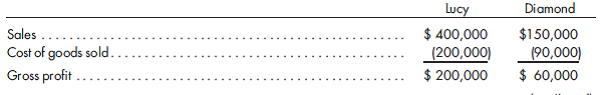

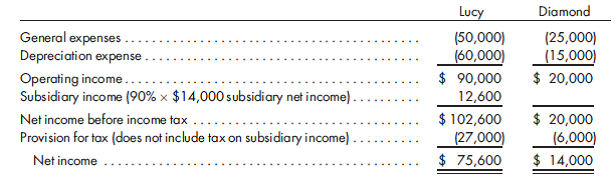

The separate income statements of the two companies prepared for 2011 are as follows:

1. Prepare a value analysis and a determination and distribution of excess schedule for the investment.

2. Prepare the 2011 consolidated income statement and its related income distribution schedules.

It is believed that the inventory and the building are undervalued by $20,000 and $50,000, respectively. The building has a 10-year remaining life; the inventory on hand on January 1, 2011, is sold during the year. The deferred tax liability associated with the asset revaluations is to be reflected in the consolidated statements. Each company has an income tax rate of 30%. Any remaining excess is goodwill.

The separate income statements of the two companies prepared for 2011 are as follows:

1. Prepare a value analysis and a determination and distribution of excess schedule for the investment.

2. Prepare the 2011 consolidated income statement and its related income distribution schedules.

Explanation

Determination and Distribution of Excess...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255