Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 2

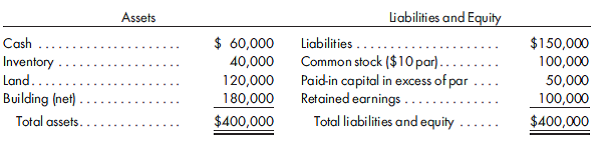

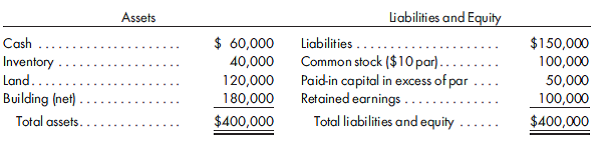

Cost method, worksheet, statements. Bell Corporation purchases all of the outstanding stock of Stockdon Corporation for $220,000 in cash on January 1, 2017. On the purchase date, Stockdon Corporation has the following condensed balance sheet:

Any excess of book value over cost is attributable to the building, which is currently overstated on Stockdon's books. All other assets and liabilities have book values equal to fair values. The building has an estimated 10-year life with no salvage value.

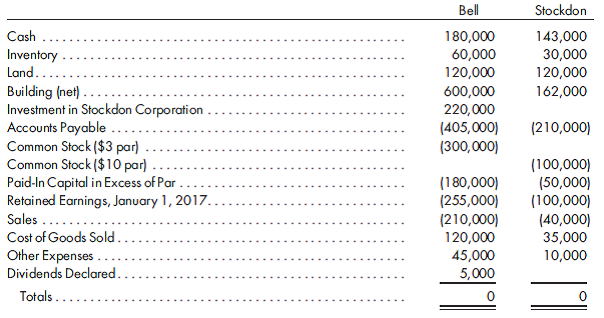

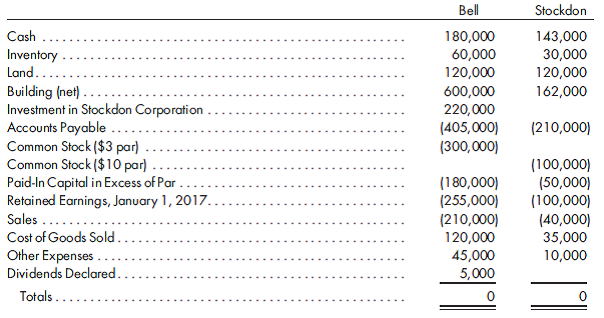

The trial balances of the two companies on December 31, 2017, appear as follows:

1. Prepare a determination and distribution of excess schedule for the investment. (A value analysis is not needed.)

2. Prepare the 2017 consolidated worksheet. Include columns for the eliminations and adjustments, the consolidated income statement, the controlling retained earnings, and the consolidated balance sheet.

3. Prepare the 2017 consolidated statements, including the income statement, retained earnings statement, and balance sheet.

Any excess of book value over cost is attributable to the building, which is currently overstated on Stockdon's books. All other assets and liabilities have book values equal to fair values. The building has an estimated 10-year life with no salvage value.

The trial balances of the two companies on December 31, 2017, appear as follows:

1. Prepare a determination and distribution of excess schedule for the investment. (A value analysis is not needed.)

2. Prepare the 2017 consolidated worksheet. Include columns for the eliminations and adjustments, the consolidated income statement, the controlling retained earnings, and the consolidated balance sheet.

3. Prepare the 2017 consolidated statements, including the income statement, retained earnings statement, and balance sheet.

Explanation

Determination and Distribution of Excess...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255