Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 25

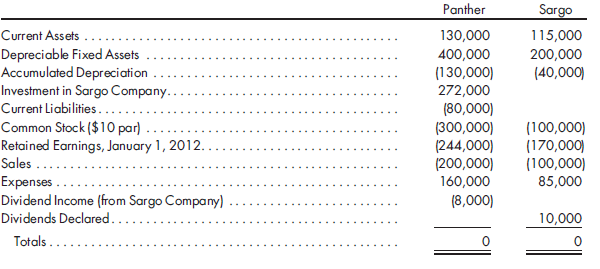

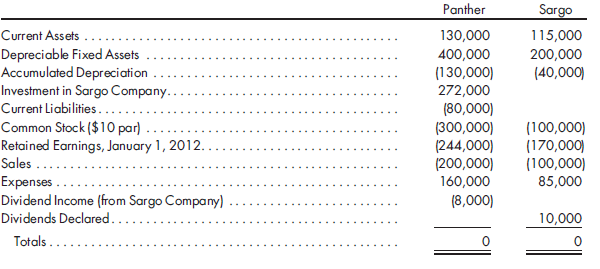

Cost method, second year, eliminations, income statement. The trial balances of Panther and Sargo companies of Exercise 7 for December 31, 2012, are presented as follows:

Panther Company continues to use the cost method.

1. Prepare all the eliminations and adjustments that would be made on the 2012 consolidated worksheet.

2. If you did not solve Exercise 4 or 6, prepare the 2012 consolidated income statement and its related income distribution schedules.

Reference:

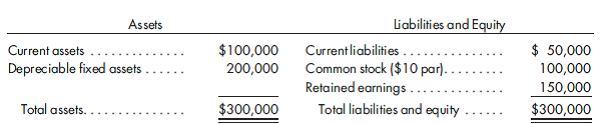

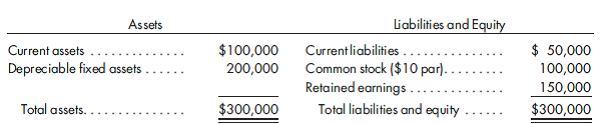

Cost method, first year, eliminations, statements. (Note: Read carefully, as this is not the same as Exercise 3 or 5.) Panther Company acquires an 80% interest in Sargo Company for $272,000 in cash on January 1, 2011, when Sargo Company has the following balance sheet:

The excess of the price paid over book value is attributable to the fixed assets, which have a fair value of $260,000, and to goodwill. The fixed assets have a 10-year remaining life. Panther Company uses the cost method to record its investment in Sargo Company.

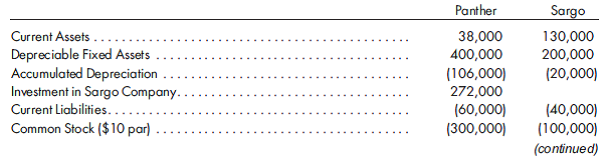

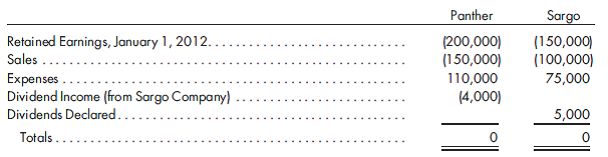

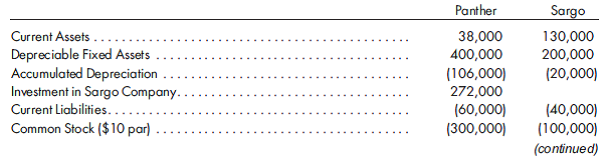

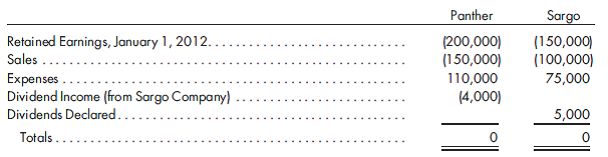

The following trial balances of the two companies are prepared on December 31, 2011:

1. If you did not solve Exercise 3 or 5, prepare a determination and distribution of excess schedule for the investment (a value analysis is not needed).

2. Prepare all the eliminations and adjustments that would be made on the 2011 consolidated worksheet.

3. If you did not solve Exercise 3 or 5, prepare the 2011 consolidated income statement and its related income distribution schedules.

4. If you did not solve Exercise 3 or 5, prepare the 2011 statement of retained earnings.

5. If you did not solve Exercise 3 or 5, prepare the 2011 consolidated balance sheet.

Panther Company continues to use the cost method.

1. Prepare all the eliminations and adjustments that would be made on the 2012 consolidated worksheet.

2. If you did not solve Exercise 4 or 6, prepare the 2012 consolidated income statement and its related income distribution schedules.

Reference:

Cost method, first year, eliminations, statements. (Note: Read carefully, as this is not the same as Exercise 3 or 5.) Panther Company acquires an 80% interest in Sargo Company for $272,000 in cash on January 1, 2011, when Sargo Company has the following balance sheet:

The excess of the price paid over book value is attributable to the fixed assets, which have a fair value of $260,000, and to goodwill. The fixed assets have a 10-year remaining life. Panther Company uses the cost method to record its investment in Sargo Company.

The following trial balances of the two companies are prepared on December 31, 2011:

1. If you did not solve Exercise 3 or 5, prepare a determination and distribution of excess schedule for the investment (a value analysis is not needed).

2. Prepare all the eliminations and adjustments that would be made on the 2011 consolidated worksheet.

3. If you did not solve Exercise 3 or 5, prepare the 2011 consolidated income statement and its related income distribution schedules.

4. If you did not solve Exercise 3 or 5, prepare the 2011 statement of retained earnings.

5. If you did not solve Exercise 3 or 5, prepare the 2011 consolidated balance sheet.

Explanation

1)Calculate P company portion in S compa...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255