Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 18

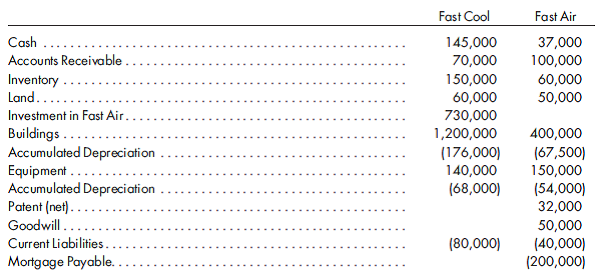

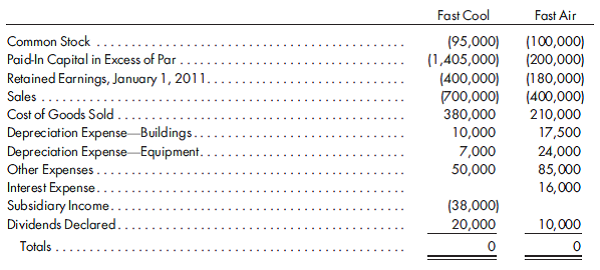

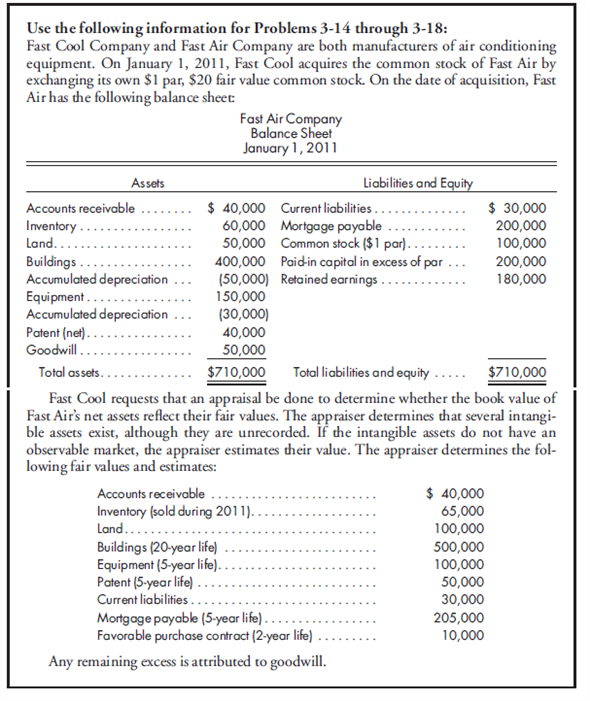

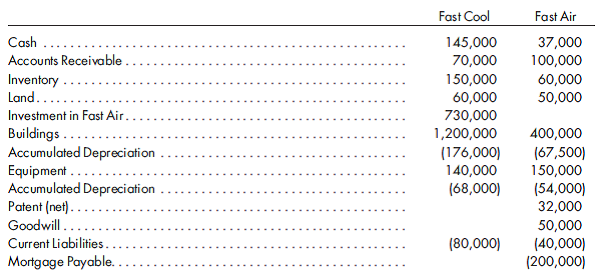

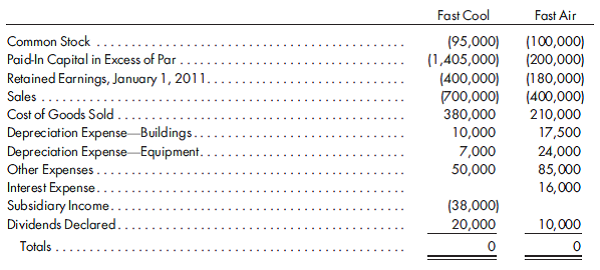

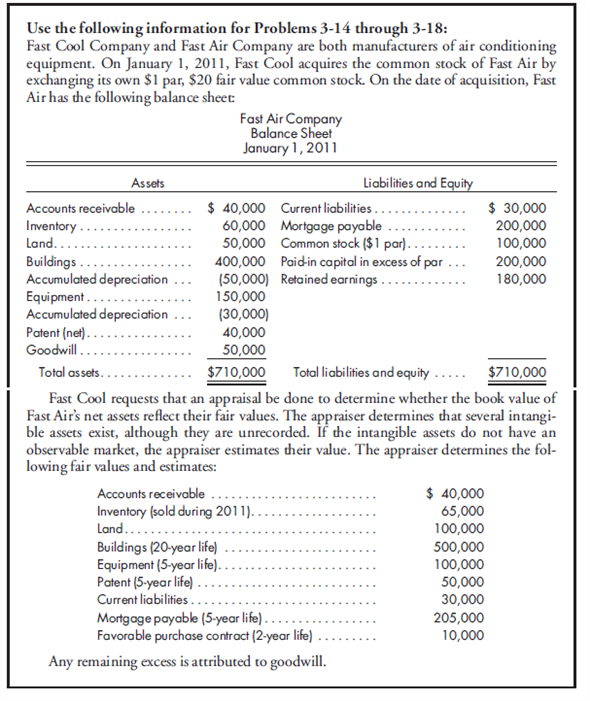

80%, first year, equity method, complicated excess. Refer to the preceding information for Fast Cool's acquisition of Fast Air's common stock. Assume Fast Cool issues 35,000 shares of its $20 fair value common stock for 80% of Fast Air's common stock. Fast Cool uses the simple equity method to account for its investment in Fast Air. Fast Cool and Fast Air have the following trial balances on December 31, 2011:

1. Prepare a value analysis and a determination and distribution of excess schedule for the investment in Fast Air.

2. Complete a consolidated worksheet for Fast Cool Company and its subsidiary Fast Air Company as of December 31, 2011. Prepare supporting amortization and income distribution schedules.

1. Prepare a value analysis and a determination and distribution of excess schedule for the investment in Fast Air.

2. Complete a consolidated worksheet for Fast Cool Company and its subsidiary Fast Air Company as of December 31, 2011. Prepare supporting amortization and income distribution schedules.

Explanation

Total amortization table

Calculate in...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255