Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 21

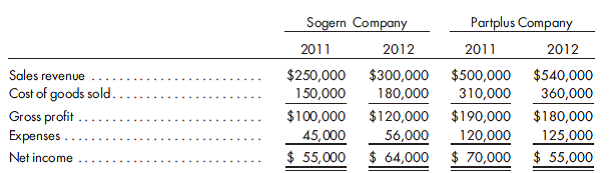

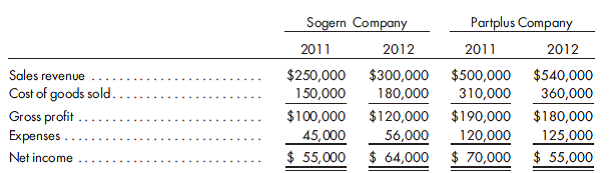

Gross profit: separate firms versus consolidated. Sogern is an 80%-owned subsidiary of Partplus Company. The two affiliates had the following separate income statements for 2011 and 2012 shown on page 247

Sogern sells at the same gross profit percentage to all customers. During 2011, Sogern sold goods to Partplus for the first time in the amount of $120,000. $30,000 of these sales remained in Partplus's ending inventory. During 2012, sales to Partplus by Sogern were $110,000, of which $2$0,000 sales were still in Partplus's December 31, 2012, inventory.

Prepare consolidated income statements including the distribution of income to the controlling and noncontrolling interests for 2011 and 2012.

Sogern sells at the same gross profit percentage to all customers. During 2011, Sogern sold goods to Partplus for the first time in the amount of $120,000. $30,000 of these sales remained in Partplus's ending inventory. During 2012, sales to Partplus by Sogern were $110,000, of which $2$0,000 sales were still in Partplus's December 31, 2012, inventory.

Prepare consolidated income statements including the distribution of income to the controlling and noncontrolling interests for 2011 and 2012.

Explanation

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255