Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 34

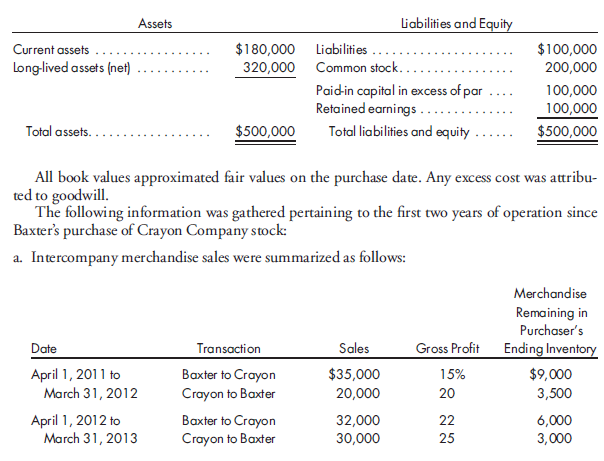

80%, cost, beginning and ending inventory. On April 1, 2011, Baxter Corporation purchased 80% of the outstanding stock of Crayon Company for $425,000. A condensed balance sheet of Crayon Company at the purchase date is shown on page 251.

b. On March 31, 2013, Baxter owed Crayon $10,000, and Crayon owed Baxter $5,000 as a result of the intercompany sales.

c. Baxter paid $25,000 in cash dividends on March 20, 2012 and 2013. Crayon paid its first cash dividend on March 10, 2013, giving each share of outstanding common stock a $0.15 cash dividend.

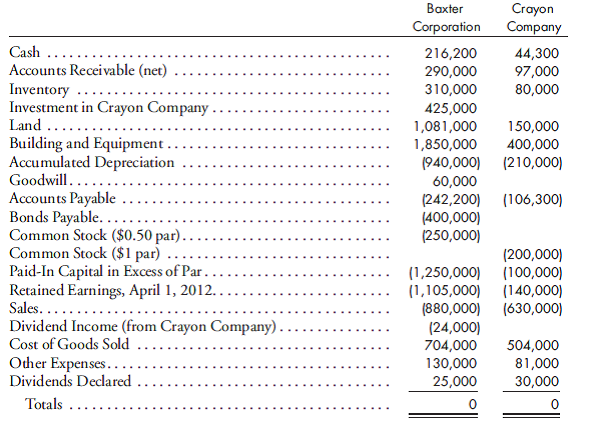

d. The trial balances of the two companies as of March 31, 2013, follow:

1. Prepare the worksheet necessary to produce the consolidated financial statements of Baxter Corporation and its subsidiary for the year ended March 31, 2013. Include the value analysis and a determination and distribution of excess schedule and the income distribution schedules.

2. Prepare the formal consolidated income statement for the fiscal year ending March 31, 2013.

b. On March 31, 2013, Baxter owed Crayon $10,000, and Crayon owed Baxter $5,000 as a result of the intercompany sales.

c. Baxter paid $25,000 in cash dividends on March 20, 2012 and 2013. Crayon paid its first cash dividend on March 10, 2013, giving each share of outstanding common stock a $0.15 cash dividend.

d. The trial balances of the two companies as of March 31, 2013, follow:

1. Prepare the worksheet necessary to produce the consolidated financial statements of Baxter Corporation and its subsidiary for the year ended March 31, 2013. Include the value analysis and a determination and distribution of excess schedule and the income distribution schedules.

2. Prepare the formal consolidated income statement for the fiscal year ending March 31, 2013.

Explanation

The calculated goodwill is

. ……(2)Now...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255