Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 1

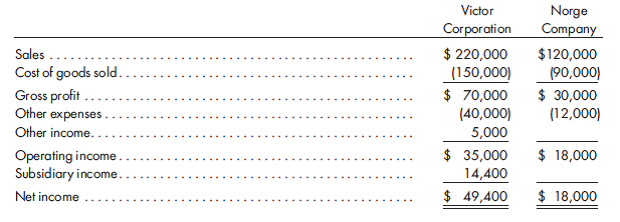

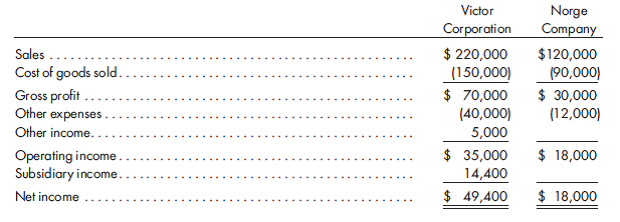

Distribution of income with inventory profits. Norge Company is an 80%-owned subsidiary of Victor Corporation. The separate income statements of the two companies for 2012 are as follows:

a. Norge Company sold $80,000 of goods to Victor Corporation. The gross profits on sales to Victor and to unrelated companies are equal and have not changed from the previous years.

b. Victor Corporation held $20,000 of the goods purchased from Norge Company in its beginning inventory and $30,000 of such goods in ending inventory.

c. Victor Corporation billed Norge Company $5,000 for computer services. The charge was expensed by Norge Company and treated as other income by Victor Corporation.

Prepare the consolidated income statement for 2012, including the distribution of the consolidated net income to the controlling and noncontrolling interests. The supporting income distribution schedules should be prepared as well.

a. Norge Company sold $80,000 of goods to Victor Corporation. The gross profits on sales to Victor and to unrelated companies are equal and have not changed from the previous years.

b. Victor Corporation held $20,000 of the goods purchased from Norge Company in its beginning inventory and $30,000 of such goods in ending inventory.

c. Victor Corporation billed Norge Company $5,000 for computer services. The charge was expensed by Norge Company and treated as other income by Victor Corporation.

Prepare the consolidated income statement for 2012, including the distribution of the consolidated net income to the controlling and noncontrolling interests. The supporting income distribution schedules should be prepared as well.

Explanation

• N Company is an 80% owned subsidiary o...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255