Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Edition 11ISBN: 978-0538480284 Exercise 2

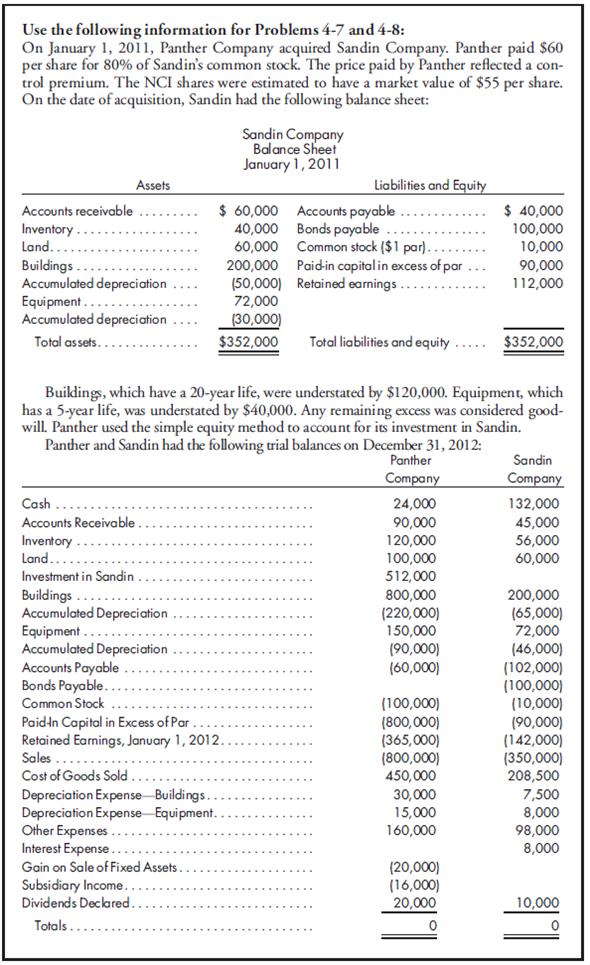

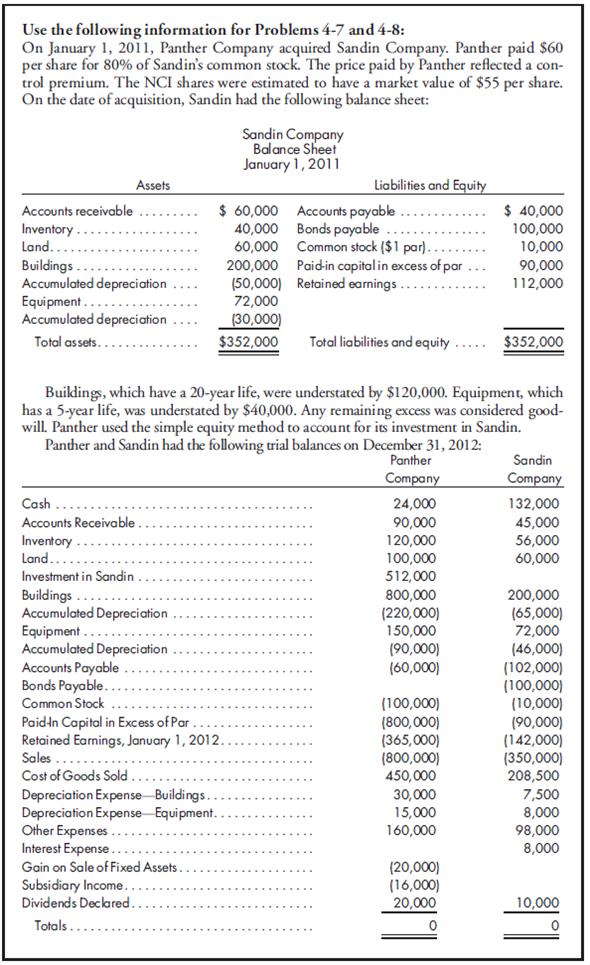

80%, equity, several excess distributions, fixed asset sale by parent and subsidiary. Refer to the preceding facts for Panther's acquisition of Sandin common stock. On January 1, 2012, Sandin held merchandise sold to it from Panther for $20,000. During 2012, Panther sold merchandise to Sandin for $100,000. On December 31, 2012, Sandin held $25,000 of this merchandise in its inventory. Panther has a gross profit of 30%. Sandin owed Panther $15,000 on December 31 as a result of this intercompany sale.

On January 1, 2011, Sandin sold equipment to Panther at a profit of $24,000. Panther also sold some fixed assets to nonaffiliates. Depreciation is computed over a 6-year life, using the straight-line method.

1. Prepare a value analysis and a determination and distribution of excess schedule for the investment in Sandin.

2. Complete a consolidated worksheet for Panther Company and its subsidiary Sandin Company as of December 31, 2012. Prepare supporting amortization and income distribution schedules.

On January 1, 2011, Sandin sold equipment to Panther at a profit of $24,000. Panther also sold some fixed assets to nonaffiliates. Depreciation is computed over a 6-year life, using the straight-line method.

1. Prepare a value analysis and a determination and distribution of excess schedule for the investment in Sandin.

2. Complete a consolidated worksheet for Panther Company and its subsidiary Sandin Company as of December 31, 2012. Prepare supporting amortization and income distribution schedules.

Explanation

Determination and Distribution of Excess...

Advanced Accounting 11th Edition by Paul Fischer,William Tayler, Rita Cheng

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255